MIDDAY MACRO - DAILY COLOR – 7/15/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, with the Nasdaq leading losses at the NY-open

Treasuries are mixed, with the long-end outperforming thanks to Powell’s dovish tone

WTI is lower, as an OPEC+ compromise yesterday finally gave some clarity to future supply from the cartel

Analysis:

Equity and Treasury markets are having muted reactions to this morning’s deluge of U.S. economic data as well as last night’s Chinese data, both continuing to stay in their current melt-up trend channels.

The Russell is outperforming the S&P and Nasdaq with Momentum, High Dividend Yield, and Value factors, and Financials, Industrials and Materials sectors all outperforming.

S&P optionality strike levels decreased with the zero gamma strike level moving lower to 4331 while the call wall remains at 4400; technical levels unchanged with support at 4350 and resistance at 4400.

The Treasury curve continues to flatten following the sell-off on Tuesday, with the long-end back to pre-auction levels.

Economic data domestically this morning, as well as last night out of China, did not ring any alarm bells, while Powell’s ongoing testimony before Congress is also helping support the grind higher in Treasuries.

Although the curve is flattening, which has been supportive of the “duration-traded” Nasdaq, today's “pullback” is likely healthy profit-taking and not a rotation back into reflationary-themed trades (which are outperforming today).

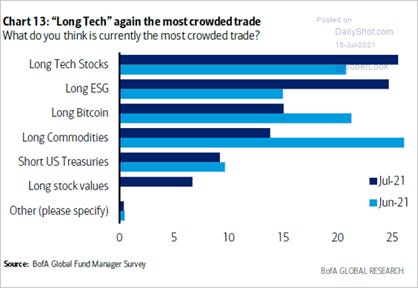

Even though we have advocated that being long Large Cap Growth has merit into a more stagflationary environment (which we expect next year), the recent rally needs to cool as BofA’s Global Fund Manager survey has “Long Tech” as the most crowded current trade.

Instead, with fiscal stimulus growing in focus and our belief that 3rd quarter growth will come in stronger than expected, we expect yields to slowly rise and value to outperform growth into the 4th quarter as the Fed proves its patience and the economy continues to run hot.

Views that Treasury yields will gradually rise over the 3rd quarter and, in turn, will increase real rates and alter equity factor and sector leadership are based on a few beliefs.

First, the often “non-economical acting” habitual buyers of Treasuries such as banks, pensions, and overseas accounts will begin to have different incentives and reduce purchases.

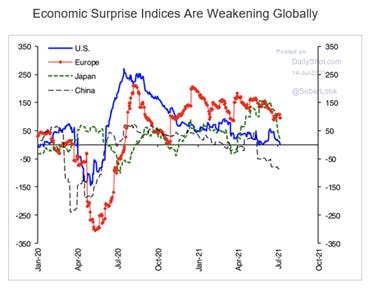

This requires excess liquidity to continue to decrease while loan demand increases, reducing bank purchases, while mandates are reached by pensions (increasing equity and alternative allocations), and growth catches up abroad (as delta cases fall and stimulus increasingly hits), reducing rate differentials.

Finally, domestically, supply-side disruptions need to improve, allowing transitory inflationary forces to be, well, transitory, uncapping growth potential as pent-up demand is further released and reducing Fed tightening fears.

We admit none of these things have yet to happen (and there is much more analysis to be given), and although short positioning has cleaned up slightly it is still a problem, but as always, we strive to skate to where the puck will be, not where it is.

Econ Data:

Import prices continued to rise in June, with the year-over-year increase now at 11.2%. Non-fuel import prices jumped 0.7% in June, beating forecasts and moving the year-over-year increase to 6.5%. There was a notable pick-up in the “Foods, Feed, and Beverages” category, increasing 1.9% on the month.

Why it Matters: Further evidence that inflationary pressures are not yet abating, even with the dollar strengthening over the quarter. Price increases in fuels, foods and materials categories will need to slow if the overall import price index is to decrease. We believe some of the recent pullbacks in the commodity complex might help a little here but have yet to see a meaningful change in trend.

Total Industrial Production rose 0.4% in June as a 0.1% decline in manufactured production was offset by gains in utilities and mining output, which increased 2.7% and 1.4%, respectively. Manufactured production was held back significantly by motor vehicle output, which declined -6.6% on the month due to the ongoing shortage of semiconductors. Overall capacity utilization increased slightly to 75.4%, with no change in manufacturing capacity.

Why it Matters: This report further showed that supply-side impairments continue to weigh on production and are capping growth. Material shortages continue to significantly hamper auto production in particular, which is now a notable drag on the headline index. However, excluding vehicles, production elsewhere has risen at 3.8% at an annual rate over the last three months. This shows demand continues to be strong and bodes well for tomorrow's retail sales report.

Headline general business condition in the NY region grew at the fastest pace on record in July’s Empire Manufacturing Survey. The headline general business conditions index shot up 26 points to 43.0. New orders and shipments increased robustly. Delivery times continued to lengthen substantially, and inventories expanded. Employment grew strongly, and the average workweek increased. Input prices continued to increase sharply, and selling prices rose at the fastest pace on record.

Why it Matters: The record-high overall index level in the NY region was helped by increases in new orders, shipments, and inventories, provided well-rounded reading. There were slight decreases in prices paid and delivery times, showing some supply-side impairment abatement there. Firms remained optimistic about business conditions and hiring intentions, reflected in the future employment sub-index, reaching another record high.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week due to today’s pullback in the tech sector.

Chinese Iron Ore Future Price: Iron ore is higher on the week as lower supply is supporting prices.

5yr-30yr Treasury Spread: Curve is flatter on the week, as the long-end continues to outperform.

EUR/JPY FX Cross: Yen is higher on the week, indicating a more risk-off tone

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Summing It Up: Time Is Money for Companies Facing Transport Snarl -WSJ

The average price worldwide to ship a 40-foot container overseas is up 333% from a year earlier. However, for many businesses, shipping delays and long lead times amount to a bigger problem than rising transportation prices, as they mean lost sales. With demand as high/hot as it is currently, the ability to pass on cost increases is greater, but the ability to recoup lost sales is less likely.

Why it Matters:

Although not new to readers here, the article nicely summarizes the more significant problem of supply-side disruptions; lost revenue. This has led many firms to start to build greater inventory levels, increasing pressures on the supply chain and driving up costs further. It also leaves the risk of overestimating final demand and being left with depreciating inventory stocks. The bottom line is that just-in-time inventory management doesn’t work with the current delays in the system.

China Macroprudential and Political Tightening:

Balanced: China’s More Balanced Recovery Gives Support to Global Rebound – Bloomberg

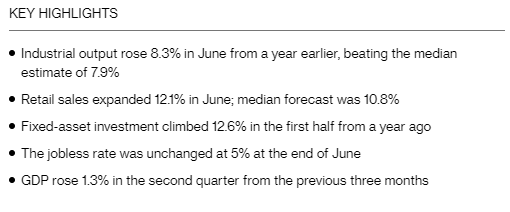

China’s economic rebound steadied in the second quarter and showed more balance as consumer spending picked up. A June pickup in retail sales and stronger investment by manufacturers fueled optimism that China’s growth is becoming more balanced.

Why it Matters:

The second-quarter data suggest Beijing will meet its growth target of more than 6% for the year. Following the more cautious tones out of officials and cuts by to RRR last week, last night's data was a welcome relief, given worries it would be much worse. It also was not strong enough to warrant further tightening, leaving open the likelihood that the PBOC has changed course to a more accommodative stance and municipalities will increase infrastructure spending.

LONGER-TERM THEMES:

Electrification Policy:

Russia Chinese Hackers: Microsoft links Serv-U zero-day attacks to Chinese hacking group – The Record

Microsoft said today that the recent wave of attacks that have targeted SolarWinds file transfer servers are the work of a Chinese hacking group the company has been tracking under the name of DEV-0322. These attacks also mark the second time that a Chinese hacking group has abused SolarWinds software to breach corporate and government networks.

Why it Matters:

Unlike Russia, which is actively engaged in state-sponsored hacking but does not control all groups operating within its borders, Beijing likely has a more substantial relationship with most hacker groups operating within its borders. On top of the multitude of other areas where the relationship between the U.S. and China has deteriorated, we must continue to watch developments in cyberspace

ESG Monetary and Fiscal Policy Expansion:

Digital Reality: ECB Starts Next Digital-Euro Stage With Investigation Phase - Bloomberg

The European Central Bank took a major step toward a digital euro on Wednesday, approving an “investigation phase” that could ultimately lead to a virtual currency being implemented around the middle of the decade. The next stage will last 24 months and will address key issues on design and distribution, the ECB said in a statement.

Why it Matters:

The stated goal by the ECB for a digital currency is to create a payment system that is fast, easy to use, and secure. The unofficial goal seems more akin to bypassing traditional banking channels to funnel social welfare benefits to individuals and have greater clarity on how those benefits are used. Commercial banks are fretting about what innovation would mean for them. One risk scenario is that customers shift their deposits to the perceived safety of the ECB in a crisis -- effectively a digital bank run.

Not To Be Left Out: Jerome Powell: CBDC Report Coming in Early September - Coindesk

In response to a question from ranking member Patrick McHenry (R-N.C.) during his semiannual Monetary Policy Testimony, Chairman Powell said a digital currency report would outline the benefits and risks of CBDCs and cryptocurrencies and stablecoins more broadly. In the hearing, Powell reiterated that stablecoins need regulation if they are going to play a significant part within U.S. payments networks.

Why it Matters:

Following efforts elsewhere (PBOC and ECB specifically), the Fed is researching the effects a digital currency would have on the existing system. As highlighted above, it would give greater flexibility to use 13-3 facilities to reach individuals during a crisis. It would also give greater control over the money multiplier. The Fed could directly offer individuals a savings rate of its choosing, rather than rely on banks, which offer savings rates often uncorrelated to Fed policy rates. Much more to say, and we expect an increase in activity globally here as more nations start the road towards digital currencies.