MIDDAY MACRO - DAILY COLOR – 7/13/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, with the Nasdaq rallying and Russell notably lower after some initial confusion following the release of today’s inflation data

Treasuries are little changed, with the long-end being the benefactor of the sizeable beat in the data

WTI is higher, as uncertainty over an OPEC+ deal continues

Analysis:

Equity markets are mixed with the “Post-June-FOMC” trade back in vogue as today’s inflationary data increased cost/margin concerns while also moving forward Fed tightening expectations, propelling the Nasdaq higher and flattening the Treasury curve.

The Nasdaq is outperforming the S&P and Russell with Growth and Low Volatility factors, and Technology, Consumer Staples, and Communications sectors all outperforming.

S&P optionality strike levels decreased with zero gamma strike moving higher to 4312 while the call wall stayed at 4400; technical levels show support at 4350 and resistance at 4395.

Treasuries briefly all dipped following the data, but 10yr & 30yr recovered losses with 5yr yields higher on the day, flattening the curve.

It is undoubtedly a weird dichotomy when an almost 1% month-on-month increase in core inflation causes the long-end of the Treasury curve to rally at these nominal yield levels.

Today's price action is reflective of a market that believes the economy has seen peak growth but not peak inflation.

As a result, the Fed will tighten policy sooner and faster than expected into a more stagflationary environment (next year) than envisioned earlier this year when the “reflationary trade” was more consensus.

At the same time, uncertainty over the size of the infrastructure bill, the surge in the Delta variant, and increased geopolitical tensions are weighing on sentiment more generally.

Although we believe there are good reasons for stagflationary fears (which we have been highlighting for some time), we however take caution in discounting potential growth in the second half of this year too much.

Supply-side problems certainly remain, but firms seem to be successfully passing on cost increases to customers, who have yet to show any signs of decreased demand in the face of these increases, reducing earnings and valuation concerns and increasing demand (lost to lack of supply) moving forward.

More structural inflationary forces are only now gaining traction while key labor metrics are still well below the Fed’s targets, allowing the “transitory” and “mission not accomplished” patience stance to continue.

There will be a slowdown in cost-push and demand-pull inflationary forces moving into year-end before wage-spiral increases support a more structural cycle next year.

This supports our view that growth may run “hot enough” while inflationary increases “slow enough” in the second half of the year, allowing the reflationary-trade to have its day in the sun again as markets reassess growth and the Fed’s patience.

Econ Data:

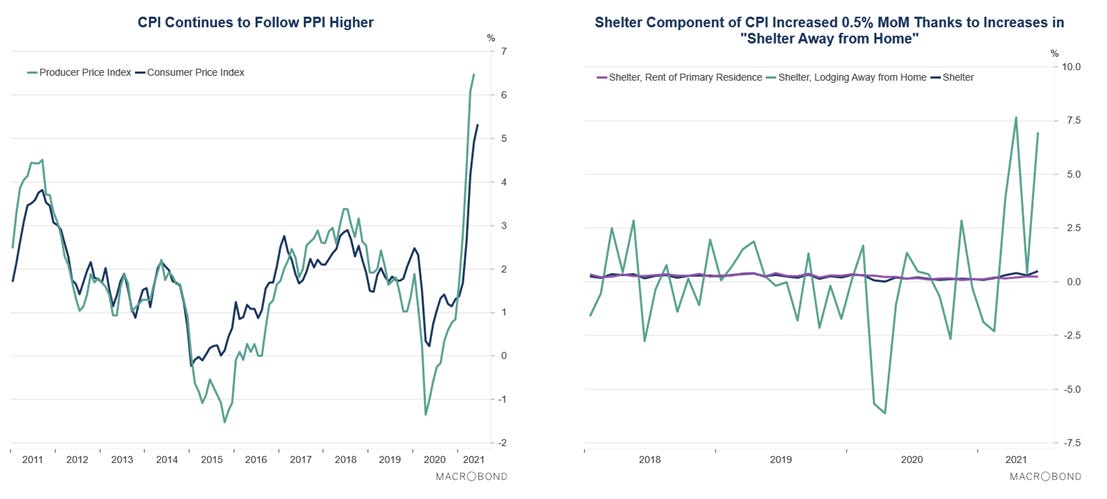

Inflation accelerated in June, with both core (4.5% YoY, 0.9% MoM) and headline (5.4% YoY, 0.9% MoM) beating expectations. Similar to last month, the areas affected by supply-side disruption and strong reopening demand were again drivers of the increase. The shelter component of CPI increased by 0.5%, largely thanks to "Lodging Away from Home" (+7% MoM), which the Fed would see as more transitory. However, Owner's Equivalent Rent continued to increase (+-0.32% MoM), which is more structural.

Why it Matters: There are no signs in June’s data that inflationary pressures from supply-side impairments are starting to subside. Further, in conjunction with other recent data, the consumer still has significant pent-up demand and is willing to pay up for things that they “missed” during the pandemic, as evident by the increases in prices for air travel, hotels, rental cars, entertainment and recreation. Bottom line, no change in the inflation picture from last month. We now look to tomorrow's PPI to see if input cost increases are slowing

Today's NFIB Small Business Report confirmed small businesses continue to struggle to find workers to fill open positions. Around 60% of firms hiring reported few or no "qualified" applicants for the positions they were trying to fill in June. A net 39% of firms reported raising compensation, a record high, while a net 26% plan to raise compensation in the next three months.

Why it Matters: Today’s NFIB report highlighted the increasing weight labor shortages are having on growth and the likelihood of further wage increases moving forward. While price increases in inputs and outputs are well underway, plans to increase compensation are only now starting to gain momentum. Many firms (in various business surveys) have noted they were reluctant to increase wages to attract or retain labor due to fears the surge in demand currently being experienced is temporary. However, this belief looks to be waning as demand has only increased and labor shortages are more clearly capping revenues.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is outperforming on the week as inflation data led traders to favor a more defensive growth position.

Chinese Iron Ore Future Price: Iron ore is higher on the week, as the growth outlook was helped by better than expected import/export data.

5yr-30yr Treasury Spread: Curve is flatter on the week, as 5yr yields rise following CPI data.

EUR/JPY FX Cross: Yen is higher on the week, indicating a more risk-off tone.

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Sea Sick: Shipping Chaos Here to Stay With Most Seafarers Unvaccinated - Bloomberg

Global vaccinations of seafarers are going too slowly to prevent outbreaks on ships from causing more trade disruptions, endangering maritime workers, and potentially slowing economies trying to pull out of pandemic slowdowns.

Why it Matters:

All signs now point to a worsening crisis on the oceans, just as the industry seemed to be emerging from months of port restrictions that hurt the ability of shipping firms to swap out crews and left hundreds of thousands stuck at sea for months.

China Macroprudential and Political Tightening:

Outbound: China’s Export Engine Accelerates, Defying Expectations – WSJ

China’s exports increased 32.2% from a year earlier in dollar terms, accelerating from a 27.9% gain in May, far stronger than expected. China’s imports, meanwhile, increased 36.7% in June from a year earlier, slower than May’s 51.1% YoY jump but also far better than economists’ forecast of a 25.5% gain. Taken together, the trade data expanded China’s trade surplus to $51.5 billion in June, from $45.5 billion in May, according to official data.

Why it Matters:

Lockdown measures introduced in late May to tame a flare-up in Covid-19 cases in the southern province of Guangdong, an economic and export stronghold, had economists worried about a prolonged impact on trade in Shenzhen’s Yantian port, one of the world’s busiest. Today’s trade data shows the impact of lockdowns there were less impactful than feared. Given concerns over China’s economy are growing, the increase in both exports and imports is a positive sign going into GDP, Retail Sales, and Industrial Production data tomorrow night.

LONGER-TERM THEMES:

Electrification Policy:

Stopping the “Scourge”: Easterly confirmed as CISA director as the agency grapples with ransomware crisis – The Record

Lawmakers confirmed Jen Easterly, a former NSA official, to helm CISA on a voice vote nearly a month after the Homeland Security Committee unanimously approved her nomination. “We’re now at a place where nation-states and non-nation state actors are leveraging cyberspace, largely with impunity, to threaten our privacy, our security, and our infrastructure,” Easterly said.

Why it Matters:

CISA has been without a permanent chief since former President Donald Trump fired Chris Krebs last November for refuting his conspiracy theories about the 2020 election. Established in late 2018, the agency is responsible for helping to protect the nation’s domestic networks and federal civilian systems, manage risks to the critical infrastructure, and secure U.S. elections, among other things. This responsibility is clearly more and more critical every day with the increased levels of attacks.

Commodity Super Cycle Green.0:

Arable Land: China’s Rich, Black-Soil Grain Fields Degraded by Over-Cultivation, White Paper Says - Caixin

Northeast China’s black soil, some of the most fertile in the world, has been significantly degenerated by over-cultivation in past decades. Irrational cultivation and tillage over the past 30 years, as well as climate change, have resulted in problems including erosion and declining fertility.

Why it Matters:

The northeast’s black soil zone covers 1.09 million square kilometers and accounts for a quarter of the country’s grain production. The over-cultivation of the land and the potential for future reduction in crop yield are important to watch. As long as China is dependent on crop imports from the U.S. (even with other sources likely to increase), there is a need for a more restrained Wolf Warrior diplomacy posture from Beijing.

ESG Monetary and Fiscal Policy Expansion:

Compromises: EU Delays Push for Digital Levy to Focus on Global Tax Deal - Bloomberg

The EU is delaying its push for a digital tax as negotiations continue on the more significant G20 broader minimum tax deal. Margrethe Vestager, the EU's technology chief, insisted that the EU would return to the digital levy plan in October after the final outcome of the global-tax pact is clear, which has components to end the digital levy.

Why it Matters:

Over the weekend, G-20 nations agreed on the outlines of a global corporate-tax agreement. Individual members will now have to approve the agreement through their respective governments. In Europe, the tax agreement doesn't have the backing of all EU nations, with Ireland, Hungary, and Estonia so far refusing to back it.