MIDDAY MACRO - DAILY COLOR – 7/12/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are generally higher, with the S&P melting up further into all-time highs while the Russell is in the red

Treasuries are lower, with overnight gains reversing at the NY-open

WTI is lower, but now recovering overnight loses

Analysis:

Equity markets are mixed with large-cap value leading gains while small-caps are in the red. Treasuries are weaker, with the curve slightly steepening.

The S&P is outperforming the Nasdaq and Russell with Momentum, Value, and High Dividend Yield factors, and Real Estate, Financials, and Consumer Discretionary sectors all outperforming.

S&P optionality strike levels increased with zero gamma strike moving higher to 4323 while the call wall increased to 4400; technical levels show support at 4343 and resistance at 4370.

Treasuries briefly rallied overnight but are back at Friday’s closing levels as traders await the results of today’s 3yr & 10yr auctions.

Friday’s rally is now Monday’s melt-up, after a brief cooling in the overnight session has reversed with little new news changing sentiment over the weekend.

Today’s price action is not a convincing continuation of the reflationary-themed price increases seen on Friday.

Although the Treasury curve is steepening, reflationary-themed commodities such as oil and copper as well as materials and industrials sectors are not outperforming today.

We will need further economic data (which we will receive this week) and clarity on earnings (which also starts this week) to determine how impactful supply-side disruptions have been before a resumption of the reflation trade can potentially re-start.

Not to be missed in the deluge of U.S. data this week is China’s GDP, Retail Sales, and Industrial Production data, out Wednesday night.

These data releases will garner extra attention following last week's PBOC pivot to a more cautionary stance as indicated by cuts to the required reserve ratios.

Last week’s RRR cuts will free $154 billion in available credit, and although not a game-changer, it should help reverse the recent slowing in China’s M2 growth.

We warn caution into these prints and although expectations are already low any notable miss lower could spook markets given the sensitivity we saw to the RRR cuts last week.

Econ Data:

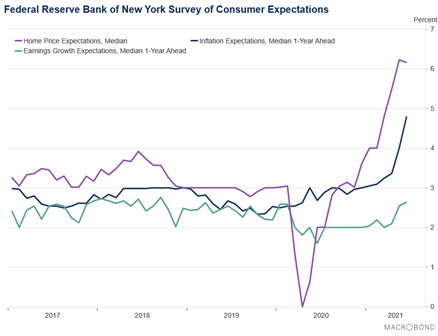

Consumers’ short-term inflation, income, and spending expectations continue to rise, according to the NY Fed’s Survey of Consumer Expectations. Inflation expectations increased 0.8% in June to 4.8%, reaching a new series’ high, and remained unchanged at 3.6% at the three-year horizon. Median one-year ahead expected earnings growth increased by 0.1% to 2.6% in June, the highest reading since the start of the pandemic. Households’ labor market expectations continued to improve with unemployment expectations and the perceived likelihood of job loss both reaching new series’ lows. Home price growth expectations remain elevated.

Why it Matters: The consumer is becoming more confident that their incomes will increase while job security will continue to improve. At the same time, they are expecting significant increases in inflation over the next year. The further increases in consumer confidence and acceptance of inflation continue to lay the foundation for stronger inflationary forces to become more persistent (as we move further into the wage-spiral part of the current inflationary cycle).

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week as the unwinding of the reflation trade may have been overdone.

Chinese Iron Ore Future Price: Iron ore is higher on the week, as China’s demand holds up despite worries over domestic growth.

5yr-30yr Treasury Spread: Treasury curve is little changed on the week, sitting at key support levels.

EUR/JPY FX Cross: Euro is higher on the week, indicating a more risk-on tone.

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Painting in the Red: Inflation Being Here to Stay Has PPG Preparing More Price Hikes - Bloomberg

PPG Industries Inc. is repeatedly raising prices of the paint and coatings it sells to customers across industries as inflation in raw material and logistics costs pressures the $40 billion business. “I’m not seeing this as transitory,” CEO Michael McGarry said. “This work-from-home phenomenon is going to lead to additional wage inflation because people are going to have the opportunities to figure out where they want to work.”

Why it Matters:

With customers in the construction, consumer product, and industrial sectors, plus manufacturing facilities and affiliates in more than 70 countries, PPG has a wide window into how the global economy is functioning. So far, PPG has been successful at passing on higher costs in the U.S. and expects trends here to spread to other regions.

Air Time: Airfreight rates dropped 10% in June – Lloyd's Loading List

The Baltic Air Freight Indices decreased by 10% in June over the year-to-date high seen in May. Although the index was down in May, it was still 18% higher YoY, and over 88% higher than rates charged in May of 2019. Overall, demand was relatively flat in June over May, but this continues to differ by trade lane.

Why it Matters:

There were no signs of recovery in air freight capacity in June. Airlines are micromanaging their flights because cost pressures are everywhere and, in the case of cargo-only services by passenger airlines, the capacity out there is historically expensive to operate. As a result, although there was a decrease in rates in June, demand is still strong, and if rates continue to fall, capacity will be reduced, effectively flooring any price decreases.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Empire Strikes Back: Pentagon Sees China's Offensive Space Technology 'On the March' - Bloomberg

China is making sizable, long-term investments in weapons designed to jam or destroy satellites as the nation seeks to rapidly narrow the gap in space technology with the U.S., according to the top intelligence official for the Pentagon's Indo-Pacific command. Aside from destructive counter-space technologies, China is pursuing parallel programs for military and commercial communications satellites and owns and operates about 30 of those for civil, commercial, and military satellite communications.

Why it Matters:

China's threats to U.S. satellites as well as Russian advances in counter-space technologies, were among the primary justifications American officials cited for establishing the U.S. Space Force. The U.S. has a "substantial amount of activity going on on our side" as "we recognize the threat here," Rear Admiral Michael Studeman said. "It will be a game of measures and countermeasures and counter-countermeasures for some time to come." The U.S. has enjoyed space supremacy since the end of the Cold War, which has allowed our digitally connected world to proliferate. Now, this hegemony is being challenged, and we will be closely watching developments here.

Use it Or Lose it: The German ‘new space’ industry is booming. So why isn’t Berlin buying in? – Defense News

Germany risks losing new space companies to neighbors like Luxembourg and Switzerland if the government doesn’t start investing itself in “anchor contracts” or additional research grants. Defense projects are instead fighting for research dollars against the long-established automotive industry. Traditionally, even when Germany has allocated space contracts, they have all gone to the major prime contractors like Airbus, Thales, and OHB.

Why it Matters

Germany and Europe, in general, need a system change in investing in space based on the American model. Instead of developing and implementing space projects on their own, governments should purchase services and award more contracts to especially innovative ‘new space’ companies.

ESG Monetary and Fiscal Policy Expansion:

Greener Airs: Airlines to Be Charged More for Polluting in EU Green Push - Bloomberg

A proposal by the European Commission includes a gradual phase-out of emission allowances for airline carriers. The package will also introduce stricter demands on companies in the transport sector to use cleaner fuel. Cleaner fuels will also get preferential treatment under the EU's new energy taxation framework.

Why it Matters:

The EU aims to make its Green Deal and the ambitious environmental overhaul a new growth strategy as its economy recovers from the pandemic. The "deal" will also include proposals to increase the share of renewable energy, boost energy efficiency and toughen national emissions-reduction goals. It is important to watch any developments here as the European “Green Deal” will likely be a template for other nations to follow, including the U.S.

Developed No Further: Yellen Targets Curbs on Development Bank Support for Fossil Fuel - Bloomberg

U.S. Treasury Secretary Janet Yellen signaled she’ll prod multilateral development banks to rein in their lending for fossil fuels, part of a global effort to make the financial system greener. Yellen said she would convene the heads of such institutions “to articulate our expectations that the MDBs align their portfolios with the Paris Agreement and net-zero goals as urgently as possible.”

Why it Matters:

While the money development banks lend is small, those funds unlock much bigger money flows from commercial lenders, especially in developing nations. Since the beginning of the pandemic, development banks have extended $12 billion to clean energy projects and $3 billion to ones for polluting fuels like oil and natural gas, the International Institute for Sustainable Development said in March. For the first time ever in the research group’s rankings, no money went to support coal.