MIDDAY MACRO - 6/3/2021

Daily Color on Markets, Policy, and Geo-Politics

MIDDAY MACRO - DAILY COLOR – 6/3/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities are lower, falling overnight, but have recovered back into their recent range post-NY-open

Treasuries lower as global service PMI data highlighted increasing inflationary pressures

WTI is lower after EIA data reversed overnight and NY-open gains

Price Action:

Equities fell overnight but bounced back following positive U.S. econ data

S&P outperforming Nasdaq/Russell

High Dividend Yield, Value, and Low Volatility factors outperforming

Energy, Financials, and Consumer Staples sectors outperforming

Gamma gravity continues to be 4200 while Call Wall is at 4250, technical levels remain the same with support at 4170 while resistance is at 4195, 4220

Major Asian indexes are mixed: Japan +0.4%. Hong Kong -1.1%. China -0.4%. India +0.7%.

European bourses are lower, at midday: London -1.1%. Paris -0.5%. Frankfurt -0.7%.

Treasuries lower with the curve slightly bear steepening

5yr = 0.83%,10yr = 1.61%, 30yr = 2.29%

WTI flat to $69.10

EIA data, although inline with API yesterday, reversed gains leaving WTI little changed after overnight and AM gains

Copper lower by -3%to $4.45

There is little new news, and selling looks to be a reduction of positions by funds ahead of several developments

Aggs are lower across the complex

Weekly USDA export sale numbers will be published Friday due to the Memorial Day holiday

DXY higher, bouncing post data to 90.4

Gold lower by -2% to $1870

Bitcoin higher by 1.7% to $38.7K

Econ Data:

ISM Service PMI: Increased to 64 in May, from 62.7 in April, breaking a fresh record high and beating market forecasts of 63. However, the employment index declined to 55.3 from 57.2, which leaves the outlook for Friday's payrolls unclear following today’s better ADP and claims data. Prices paid increased to 80.6 from 76.8, which was the highest reading since July 2008. Supplier deliveries slowed to 70.4 from 66.1 in a worsening sign for supply chains. “Some capacity constraints, material shortages, weather-related delays, and challenges in logistics and employment resources continue,” says Anthony Nieves, Chair of the ISM.

Why it Matters: All the areas of concern (supply and labor shortages and logistical constraints) were again highlighted in today’s U.S. ISM Service data (and in other service PMI’s globally). This continues to show that rising headline prints in the data are not as rosy when dissected.

Analysis:

The positive correlation between equities and treasuries continues to be a concern of ours as the loss of diversification should reduce overall market risk tolerance and increase the risk of a negative feedback loop occurring if markets start to sell-off notably.

Range-bound yields have promoted range-bound equities.

The policy responses to the pandemic and the reopening of the economy increasingly make markets look like “it is (still) all one trade”.

As discussed yesterday, ample excess liquidity from Fed purchases and fiscal payments is acting to cap any sell-off in rates (keeping real-rates negative and financial conditions supportive for risk-assets).

When the Fed begins to commit to removing accommodation fully (likely this fall), there will be a rush for the door in both asset classes even if underlying economic fundamentals warrant the tightening.

As a result, the underlying risk in markets is much more significant than realized due to the benefits of multi-asset class diversification being significantly lower.

Although we believe there is still some time before the day of reckoning comes, this week’s data and comments from Fed officials make us believe the time to realign positioning for the next phase is quickly passing.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value Outperforming on the Week

Chinese Iron Ore Future Price: Iron Ore Higher on the Week

5yr-30yr Treasury Spread: Curve is Flatter on the Week

EUR/JPY FX Cross: Euro Lower on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

Real Estate: China Steps Up Pressure on Financial Institutions to Limit Property Lending - Caixin

Some medium to small regional banks are still growing their property loans book even while the big banks have reduced outstanding property loans as a proportion of total loans in compliance with a December order from the China Banking and Insurance Regulatory Commission's (CBIRC). In March, the CBIRC, the Ministry of Housing and Urban-Rural Development (MHURD), and the central bank ordered a nationwide inspection of business loans, targeting borrowers illicitly using individual or corporate business credit to speculate in the housing market.

Why it Matters:

In December, the central bank and the CBIRC capped the ratio of outstanding property loans to total loans at 40% for many of China’s larger financial institutions. As a result, all six large state-owned banks have reduced the ratios of property and mortgage loans. However, recent regulatory actions show that speculative capital is still seen as problematic for housing affordability, reinforcing Beijing growing focus on keeping consumer prices muted across a spectrum of areas.

LONGER-TERM THEMES:

National Security Assets in a Unipolar to Multipolar World:

Blacklist: Biden to Amend Trump’s China Blacklist, Target Key Industries - BBG

The amended order, which Biden is expected to sign later this week, will change the criteria for blacklisting entities to capture those that operate in the defense or surveillance technology sectors. The Trump order targeted companies owned, controlled, or otherwise affiliated with the Chinese military.

Why it Matters:

After two Chinese companies successfully challenged the order, Biden’s team said a revision of the policy was necessary to ensure it was legally sound and sustainable in the long term. By shifting responsibility to Treasury, the Biden team aims to solidify the legal standing for the penalties. There will likely be more activity here over the summer as Congress is in the process of finishing legislation focused on further restricting China’s access to western capital and IP.

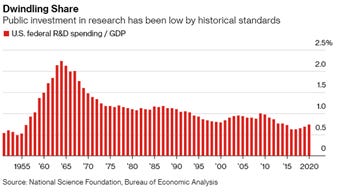

Competitive R&D: U.S. Plows Cash Into R&D as China Triggers a ‘Sputnik Moment’ - BBG

Federal money for research and development, as a share of the economy, has been at historically low levels. But President Joe Biden has made support for innovation a key part of his program, calling for increased funding to key industries like semiconductor manufacturing, cybersecurity, and electric vehicles. And Congress is moving toward a wide-ranging plan, with backing in both parties, that could inject about $190 billion into new and existing programs.

Why it Matters:

Officially named the Endless Frontier Act, it’s been combined with other proposals in an umbrella measure that’s become known in shorthand as the “China Bill.” On top of R&D support, the bill includes provisions dealing with national security concerns, stopping money laundering schemes and cyberattacks by entities on behalf of the government of China. There are also “Buy America” provisions for infrastructure projects. There is no other area in congress receiving as much bipartisan support which all but ensures a further deterioration in relations with Beijing.

Vaccine Soft Power: Bahrain, Facing a Covid Surge, Starts Giving Pfizer Boosters to Recipients of Chinese Vaccine - WSJ

Bahrain residents who are over 50, are obese, or have chronic illnesses now are being urged to get a Pfizer-BioNTech vaccine six months after their full Sinopharm vaccination. Bahrain’s health minister says the majority of the latest surge in cases is coming from unvaccinated people and that the Chinese vaccine is effective, but the country is giving its citizens the option to choose whether they want a Pfizer-BioNTech (which they are pushing on the most at risk) or the Chinese one.

Why it Matters:

China is certainly beating the U.S. in the sheer number of donated vaccines. The problem is they look to be significantly inferior to their western alternatives. In a separate, unpublished, real-world study of Sinopharm in Serbia, 29% of 150 participants were found to have zero antibodies against the virus three months after they received the first of two shots of the vaccine. This effort by China to increase its soft power among developing nations could backfire if vaccine recipients are back at risk a few months later.

Electrification, Digitalization, and Cyber Security:

Censorship: How censorship became the new crisis for social networks – Platformer

From India to Australia to Palestine, each day brings a new set of stories about outrage over content removals. In some cases, these removals are forced by the government. In others, platform policies put minority groups at a disadvantage, making it harder for their posts to be seen.

Why it Matters:

The article covers a long list of recent crackdowns, both by governments and platforms, showing the problem of censorship is worsening. This is important for a number of reasons that should already be familiar to all of us. Specifically, if social media continues to be manipulated, markets will have to reflect a greater level of (geo)political uncertainty.

Crypto Tax: Biden Targets Crypto Tax Evaders in Global Data-Sharing Pitch - BBG

The Treasury Department, in its “Greenbook” of revenue proposals released last Friday, proposed a requirement for cryptocurrency brokers, such as exchanges and hosted-wallet providers, to provide information to the IRS on foreign individuals indirectly holding accounts with them. Before the start of this year, the Treasury was already working on proposed regulations under existing law that would require cryptocurrency brokers to report certain information to the IRS, including the identities of their customers and the gross proceeds from sales.

Why it Matters:

The article highlights the proposal as a way for the Biden administration to strengthen tax enforcement. There may also be a cyber-security element. White House Press Secretary Jen Psaki said Wednesday that expanding the analysis of cryptocurrencies is one of the steps the administration is taking to help curb cyber-attacks. The bottom line is that crypto is being seen increasingly as a growing problem by governments, not a solution.

Ransomware: NYC’s Subway Operator and Martha’s Vineyard Ferry Latest to Report Cyberattacks – WSJ

On Wednesday, a ransomware attack disrupted ferry services in Massachusetts. New York’s Metropolitan Transportation Authority also revealed Wednesday that it had been hacked in April, although the attack didn’t disrupt operations, including the city’s subway system. San Diego-based Scripps Health said Tuesday that it is still recovering from a cyberattack it discovered on May 1. These are all on top of ransomware attacks on Colonial and JBS we already have discussed here.

Why it Matters:

Emboldened by recent successes, hackers have shifted their focus away from data-rich companies to providers of critical public needs such as hospitals, transportation, and food. Security professionals have warned that it is only likely to get worse. If the U.S. cannot operate on equal footing in cyber-space, it will likely apply force through more traditional means, increasing the risk that military actions against individual organizations and nation-state sponsors result from cyber-attacks.

Green Energy and Resource Transition:

Green Tariffs: EU Eyes First-of-a-Kind Border Levy in Climate Fight - BBG

The European Union plans to slap an import levy on steel, cement, and aluminum produced in countries with lower environmental standards. The planned measure is part of a broader package to be put forward on July 14 to align the EU economy with stricter emissions-reduction targets for 2030. The cost of emissions in the EU carbon market has soared 10-fold in the past four years as the bloc bolstered the program and vowed to step up climate action.

Why it Matters:

The problem with restricting non-environmental friendly sources of critical resources without first creating alternative sources or reducing demand is that it is highly inflationary. This inflation is most punitive to middle and lower-income people, the same group that the environmental policies are trying to help. Rising levels of inflation are ultimately destabilizing to growth as social unrest is highly correlated to inflation.