MIDDAY MACRO - DAILY COLOR – 6/30/2021

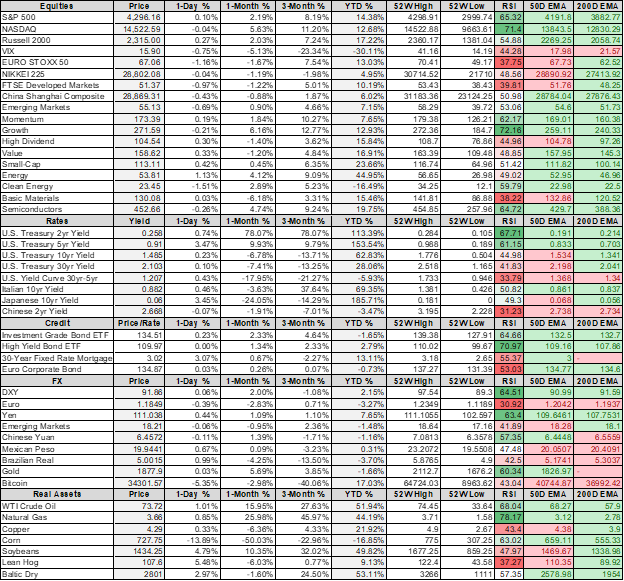

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are flat, as today's data and few new developments elsewhere keep traders patiently awaiting Friday's job report

Treasuries are higher, with the curve flattening into month-end

WTI is higher, but within its recent range as tomorrow’s OPEC+ meeting has the potential to change fundamentals materially

Analysis:

Equity markets are again quiet today, with more activity in the long-end of the Treasury curve as month-end buying activity has picked up from pensions and overseas buyers.

The Russell is outperforming the S&P and Nasdaq with High Dividend Yield, Value, and Momentum factors and Energy, Industrials, and Cons. Staples sectors outperforming.

Slight increase in S&P levels overnight with zero gamma strike moving higher to 4281 while the call wall continues to be at 4300; technical levels show support at 4265 and resistance at 4305.

5s30s Treasury curve spread has resumed its post-June FOMC meeting flattening and is now 57bps off its ’21 highs.

USDA grain stocks for corn and soybean came in below estimates, while wheat was above, nonetheless prices for all three are significantly higher following the release.

Traders saw risks tilted to significant increases in acreage, so even the slight miss was enough to propel prices higher.

Trader’s focus will now return to weather conditions, which have been growing dryer and hotter (not only domestically), and exports to China, which we expect to pick up again.

Today’s economic data again supported the continuation of our “real supply-side” disruption theme.

Chicago PMI highlighted increases in logistical bottlenecks, labor shortages, and increased input costs weighing on production activity.

Pending Homes data showed a tale of two cities, as sales of higher-priced homes increased while would-be first-time or lower-income buyers continue to be priced out.

Newly built home prices are on the rise while inventories continue to stay near historic lows.

Finally, ADP, the Voldemort of jobs data (we do not speak its name), did not solicit much price action but a separate private data report (by Kronos) points to the potential for an upside surprise even with “Bloomberg-sourced” expectations for NFP being a lofty 780K.

Econ Data:

Pending home sales increased an unexpectedly 8% in May (analysts expected a 1% decrease). This is the highest level of sales activity for May since 2005. “May’s strong increase in transactions, following April’s decline, as well as a sudden erosion in home affordability, was indeed a surprise,” said Lawrence Yun, NAR’s chief economist. “The housing market is attracting buyers due to the decline in mortgage rates, which fell below 3%, and from an uptick in listings.”

Why it Matters: Tight supply of existing homes has been a significant factor in limiting activity, but supply did rise slightly in May compared with April. However, sales of newly built homes in May, which are also measured by signed contracts, fell nearly 6% from April, as builders continued to raise prices.

The Chicago PMI fell to 66.1 in June from 75.2 in the prior month, which had been the highest reading since December 1983. Among the five main indicators, Order Backlogs saw the largest decline, with Supplier Deliveries posting the only gain. Supplier Deliveries rose 4.2 points to the highest level since March 1974 as logistical problems persisted. Employment slipped to the lowest level since January, with firms continuing to note difficulties in finding new staff. Prices paid at the factory gate surged to the highest level since December 1979.

Why it Matters: The last regional survey before tomorrow’s ISM Manufacturing PMI release showed that real supply-side disruptions have yet to abate meaningfully. It also showed that supply shortages impaired production. One of the special monthly questions asked was, “are rising prices going to have a material impact on your business thinking?”. The majority (82.1%) said their business decisions are impacted.

Policy Talk:

Federal Reserve Governor Christopher Waller said the better-than-expected performance of the U.S. economy warrants scaling back asset purchases sooner than expected and he favors starting with mortgage-backed securities. “I myself would like to see tapering over before we consider raising rates,” Waller said. “Therefore, if you think you may have to raise rates in late 2022 or early 2023, you pretty much want to get tapering done by the end of next year if possible.”

Why it Matters: The sequencing of events needing to occur to allow the Fed to taper has the potential to occur quicker than many expect. Waller’s comments echo other Fed officials who have been surprised not only by the speed of the recovery but also by the increases and stickiness in inflationary pressures. As a result, it is now increasingly possible to see a tapering announcement in the July or September meetings. We continue to believe the Fed will be patient and announce tapering in one of the final meetings of the year as the data is messy and they are not at their maximum employment goal, but the official rhetoric is undoubtedly changing.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth Outperforming on the Week

Chinese Iron Ore Future Price: Iron Ore Lower on the Week

5yr-30yr Treasury Spread: Curve is Flatter on the Week

EUR/JPY FX Cross: Yen Higher on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

Big Picture: China’s Economy Is Stabilizing and Improving, PBOC Says - Caixin

After record economic expansion in the first quarter, recent indicators show growth is stabilizing, but the PBOC’s recent statement highlighted they believe policy still needs to be kept stable. So far this year, the PBOC has kept its policy stance unchanged, taking a gradual approach to curbing credit growth and tackle financial risks while providing enough liquidity to the market to meet demand.

Why it Matters:

The PBOC is more focused on “external shocks,” signaling they are watching the Federal Reserve closely. If the Fed begins to tighten too quickly, the PBOC will likely increase the money supply, which they currently committed to growing the rate of nominal GDP growth. However, we continue to believe that inflationary pressures, mainly still in PPI, will now increase in CPI. This will force Beijing to choose between social stability objectives through tighter policy or a more robust economy through increased macro leverage levels, allowing greater bargaining/posturing powers on the international stage. We think they will choose the latter.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

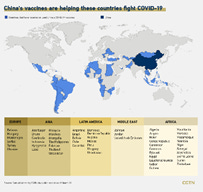

Vaccine Diplomacy: China welcomes Ukraine U-turn on Xinjiang human rights call - SCMP

Beijing warned Kiev it would block vaccine shipments if it did not withdraw from a joint statement urging a UN investigation into the treatment of Uygurs. Ukraine was one of more than 40 countries, including Canada, Australia, Britain, France, Germany, Japan, and the United States, that last week urged China to allow immediate access for independent observers to Xinjiang to check alleged mistreatment of Uygurs and members of other Muslim minority groups there.

Why it Matters:

There is an interesting dichotomy playing out regarding China’s vaccination diplomacy. Their vaccines are inferior, and countries that can choose western alternatives are doing so. Yet inaction by governments to source any vaccines leaves them politically vulnerable and giving China political leverage in places like Ukraine. It also shows that America’s global vaccination distribution efforts are still behind, as one would think that Ukraine would receive doses before others.

Electrification Policy:

Internet Everywhere: Elon Musk’s Starlink to Deliver Internet Nearly Worldwide Within Weeks - Bloomberg

SpaceX has launched more than 1,500 satellites so far and has Starlink operations in about a dozen countries, costing between $5 billion and $10 billion before cash flow is positive, according to Musk. Some $20 billion or $30 billion may be needed in the longer term to maintain Starlink’s competitive position, Musk further said. The service, which has more than 69,000 active users, may reach half a million in the next 12 months.

Why it Matters:

SpaceX aims to offer broadband to as much as 5% of the world’s population where conventional fiber and wireless networks can’t reach. Lower earth orbit internet also has significant military implications, ensuring battlefield connectivity. The Chinese are developing a competing network called SatNet. The goal of providing more robust internet to a broader range of places is core to our “electrification” theme, and we are watching developments regarding Starlink closely.

Commodity Super Cycle Green.0:

Green Gas: U.S. natural gas producers hope customers will pay more for 'green gas' – Reuters

EQT Corp, Chesapeake Energy, Cheniere Energy, and NextDecade Corp are among the companies considering low-carbon certifications for parts of their natural gas production. Gas certified as "responsibly produced" and contributing fewer emissions could get up to 5% above market prices, or up to 15-cents per thousand cubic feet (mcf), proponents say. Presently, there doesn’t seem to be much appetite from buyers to pay a premium for a still unclear “green” certified natural gas source.

Why it Matters:

There is still uncertainty over where the Biden administration and progressives generally stand on natural gas regarding their environmental goals. The transition to “greener” sourced gas could be a compromise, but we are too early to tell if there could be enough supply to make a meaningful difference. For example, gas produced from animal farms and landfills, called renewable natural gas, is selling at a premium to market rates, but supplies of the niche fuel are vastly more limited than conventional gas and very costly.

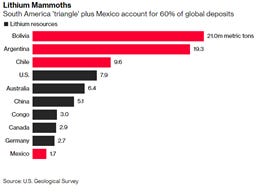

Che Battery: Lithium Nationalism Is Taking Root in Region With Most Resources - Bloomberg

Politicians in Latin America, a region that accounts for more than half the world’s lithium resources, are looking to increase the role of the state in the lithium industry that’s crucial for weaning the world off fossil fuels. In Chile, a process to rewrite the constitution is expected to include a debate over how to capture more of the sector’s profits, stricter licensing requirements, and the classification of water as a national asset for public use.

Why it Matters:

So far, no one in power is talking about expropriating assets in production, and much of the anti-investor rhetoric is coming from populist opposition groups. But critical minerals like lithium, cobalt, and even copper will increasingly be akin to fossil fuels, and their rise in importance will bring some level of political chaos as governments grapple with balancing populist opinion and private investment needs (similar to what oil often brought to developing nations in the past).

Coal Comeback: Billionaire Glasenberg’s Last Deal Says Coal Isn’t Dead Yet – Bloomberg

“The world has said we want to reduce the amount of thermal coal production, mining companies are definitely not investing in more thermal coal mines,” Glasenberg said at the Qatar Economic Forum last week. “What you are having is supply being disrupted, no new supply coming into the market. However, demand is still there.” A peak in demand isn’t expected until 2026, and in the meantime, the IEA forecasts demand will keep rising by about 0.5% a year. Consumption is expected to increase even faster in India, by an average of 3.1% a year.

Why it Matters:

Underinvestment by miners and a punitive regulatory and investor backdrop for multiple decades have now created a significant supply shortage globally for coal. Benchmark prices in Australia have rallied about 66% this year to more than $136 a ton, the highest since 2008. Shortages will likely continue, especially for China, given their boycott of Australian imports, increasing inflationary energy pressures.

ESG Monetary and Fiscal Policy Expansion:

More-atorium: Supreme Court Declines to Lift National Eviction Moratorium – WSJ

The Supreme Court rejected an emergency request by landlords and real-estate companies to clear the way for evictions after a federal judge in Washington ruled last month that the moratorium was legally unsupportable. The judge who issued that ruling stayed the effect of the decision while litigation continues.

Why it Matters:

We want to highlight two main points here. There are around 4.2 million Americans “very likely or somewhat likely” to face eviction or foreclosure in the next two months, according to Census Bureau data. How disruptive this will be to the real economy is unclear. Finally, SCOTUS has surprised pundits over several recent rulings, this being the latest. Justice Kavanaugh issued a one-paragraph concurrence explaining the moratorium would allow for “additional and more orderly distribution” of rental-assistance funds appropriated by Congress. It interesting to see a more moral take on the ruling verse a strict constitutional interpretation (ESG SCOTUS mission creep too?)

Try, Try Again: Biden Weighs New Executive Order Restraining Big Business - WSJ

President Biden's executive order, which could be signed as soon as next week, would direct regulators of industries from airlines to agriculture to rethink their rule-making process to inject more competition and give consumers, workers, and suppliers more rights to challenge large producers.

Why it Matters:

As we highlighted earlier in the week (in coverage of the Facebook antitrust court decision), this administration and Congress will likely change the rules of the game given the protection enjoyed by big-business currently. During his presidential campaign, Mr. Biden made it clear that he wanted the government to do more to limit business dominance over specific industries. We will keep watching developments here as the monopolistic concentration that has developed in various industries has supported earnings growth and inflationary pressures.