MIDDAY MACRO - DAILY COLOR – 6/29/2021

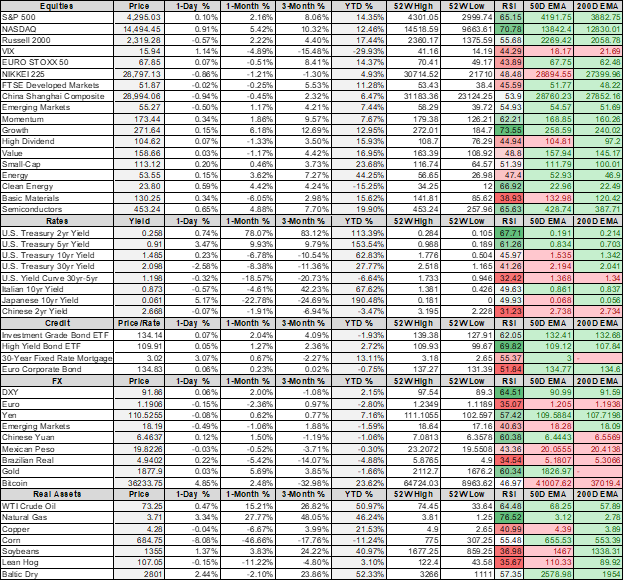

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities are slightly higher, with growing concern about the Delta variant weigh on sentiment

Treasuries are flat, with overnight losses reversing at the NY-open

WTI is higher, as traders await OPEC+ while gauging the impact of increasing global restrictions

Price Action:

Quiet price action as a $2 billion increase in bank dividends and a key antitrust case victory by Facebook balance out weakness in the re-opening basket

Russell outperforming S&P/Nasdaq

Momentum, Small-Cap, and Low Volatility factors outperforming

Energy, Consumer Discretionary, and Technology sectors outperforming

Zero Gamma Level is 4245 while Call Wall is 4300, technical levels have support at 4265 while resistance is at 4305

Major Asian indexes are lower: Japan -0.8%. Hong Kong -1.1%. China -0.9%. India -0.4%.

European bourses are higher, at midday, London +0.2%. Paris +0.4%. Frankfurt +0.9%.

Treasuries flat with the curve slightly flatter

5yr = 0.89%,10yr = 1.48%, 30yr = 2.10%

WTI higher by 0.6% to $73.30

The market will be in a deficit for the balance of the year, according to OPEC, with Q4 coming in short by roughly 2.2 mbd, so this week will be significant in gauging the cartel's stance on future production increases

Copper lower by -0.5% to $4.26

Aggs higher, but cooling off NY-open highs as dry conditions continue to be in focus

DXY slightly higher by 0.10% to 92

Gold lower by 1% to $1760

Bitcoin higher by 5% to $36.3K

Econ Data:

Case-Shiller and FHFA home price appreciation both beat expectations, increasing 14.6% and 15.7% YoY, respectively (13.3% and 14.4% in the previous month). Month on month gains between the two averaged 2%. Phoenix, San Diego, and Seattle reported the highest year-over-year gains that are now 20%+. “House prices recorded another monthly and annual record in April," said Dr. Lynn Fisher, FHFA's Deputy Director of the Division of Research and Statistics. “This unprecedented price growth persists due to strong demand, bolstered by still-low mortgage rates, and too few homes for sale."

Why it Matters: Annual housing price increases are at the same levels seen during the housing boom of 2005-06. There is also no immediate reprieve to the situation as a lack of land, labor, high input costs on top of historic low existing inventories will keep supply tight. This is becoming a significant problem for the Biden Administration as affordability is beginning to exclude a growing proportion of the population. Finally, the overheating of the housing market favors a heavier tapering of MBS when the time comes.

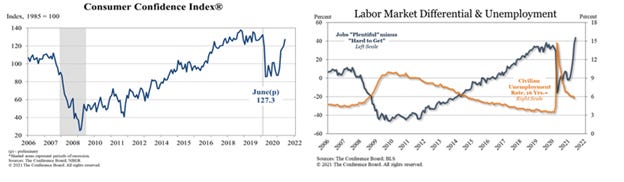

The Conference Board Consumer Confidence Index improved further in June, following gains in each of the previous four months. The Index now stands at 127.3, up from 120 in May. Both the “Present Situation” and “Expectation” indexes increased notably. Consumers’ assessment of current conditions improved as short-term optimism was supported by expectations that business conditions and financial prospects will continue improving in the months ahead.

Why it Matters: Increases in short-term inflation expectations had little impact on consumers’ confidence or purchasing intentions. In fact, the proportion of consumers planning to purchase homes, automobiles, and major appliances all rose. Vacation intentions also rose, reflecting increases in spending on services and expectations that the economy is now fully open and the pandemic is over.

Policy Talk:

“It’s pretty clear to me we have had substantial further progress against our inflation goal,” Barkin said during an event at the Rotary Club of Atlanta. “I’m pretty optimistic about the labor market... If the labor market opens as I suggested it might, then I think we’re going to get there in relatively short order.” He noted 10-year TIPS breakeven gave him comfort that inflation expectations weren’t becoming unhinged but is watching other measures (of inflation expectations) closely.

Why it Matters: Barkin is a current FOMC voter and his comments, although more hawkish, keep him in the “extended” transitory camp. He believes that we are in a period more akin to the 1940s, where there was a significant level of pent-up post-war demand, but not in a roaring ’20s or stagflationary ’70s situation. Further evidence that Fed officials continue to jaw-bone the current inflationary pressures as under control, helping keep rates contained and risk-assets supported.

Analysis:

Markets are very quiet today as growing concerns over the Delta variant and renewed restrictions globally battle improving data in Europe and the U.S., as well as a few sector-specific favorable developments.

The S&P is likely to meet strong resistance at 4300, given positioning and technicals, so the pace of the melt-up should slow until a further catalyst occurs.

Treasuries are coiling into the jobs report as month-end buying, and a lack of supply has temporarily stabilized price action, tightening the current trading range.

Today’s U.S. housing and confidence data showed that inflationary forces are still abundant and likely to continue but not yet problematic to consumer behavior.

The monthly increase in housing prices reported today supports our view that more significant structural increases in Owner’s Equivalent Rent (the largest sub-components of core inflation) will continue to see strong growth into year-end.

Consumers noted no intention to lower purchases due to increasing prices in today's Conference Board Survey and continued to have a highly favorable outlook.

This does contrast to survey data we have seen elsewhere (Univ of Mich. Consumer Survey) showing some change in behavior and we continue to closely watch developments here.

Elsewhere, consumer confidence in the euro-area economy improved to the highest level in more than two decades.

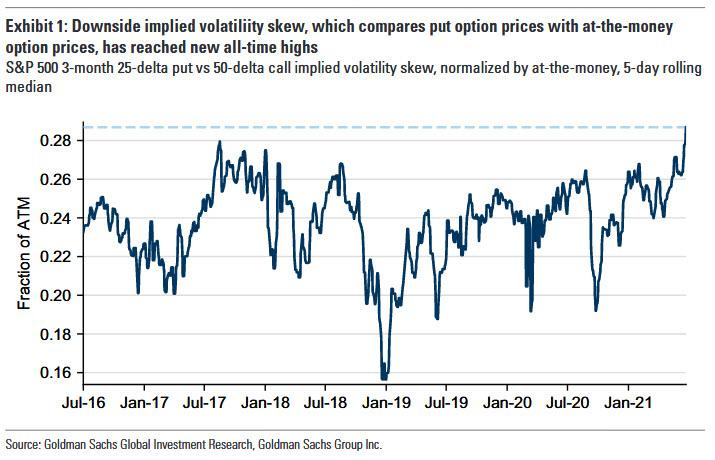

A recent report by Goldman highlighted that hedging tail risk (the chance of a drastic move lower) is becoming more expensive, indicating that traders are paying up for down-side hedges despite the market’s methodical grind higher. This indicates that:

If the market were to sell off, it would be significant, and equities would be increasingly correlated in a sell-off.

These findings reinforce our view that there is currently an unfavorable risk-return profile in entering new equity longs even with expectations for a further melt-up to continue.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth Outperforming on the Week

Chinese Iron Ore Future Price: Iron Ore Lower on the Week

5yr-30yr Treasury Spread: Curve is Flatter on the Week

EUR/JPY FX Cross: Yen Higher on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Fries are Extra: Stretched global supply chain means shortages on summer menus - Reuters

At least nine fast-food chains and restaurant companies (globally) surveyed by Reuters said some of their locations have been grappling with changing lists of brief shortages of key ingredients and products as supply bottlenecks plague eateries. For example, French fry shipments to South Korea's No. 1 fast-food chain, Lotteria was delayed due to a shortage of shipping containers and longer health-related customs checks

Why it Matters:

The problem is not typically a scarcity of the product itself. Rather, networks of cargo ships, trains, and trucks are buckling under the ongoing stress from the pandemic, and now, the re-opening of the economy. Current disruptions globally still have facilities closed and reduced labor at farms, factories, and warehouses, contributing to shortages of everything from meat and cooking oil to plastic and glass packaging.

Hosers: Canada border officers mull strike at critical time for supply chain, ports - Freightwaves

Thousands of members of the Canada Border Services Agency are in the midst of voting on whether to authorize a strike, something that could roil the movement of billions of dollars of goods via its border with the U.S., airports, and shipping ports. Union members have been without a contract since 2018, and they’re seeking pay increases to match other Canadian law enforcement agencies and changes to working conditions.

Why it Matters:

The Port of Vancouver, Canada’s largest and busiest, has been handling an unprecedented level of container shipping in 2021 along with its competitors up and down the west coast. Vessels are waiting seven days on average for a berth. If the strike occurs, this will only further the current disruptions, adding additional cost pressures to the supply chain.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Space Friends: Military building an appetite for commercial space services - SpaceNews

The U.S. Space Force is eager to tap into the vibrant commercial market for space services enabled by increasingly capable small satellites and cheaper access to orbit. Commercial services, more generally, are of particular interest to the military and include imagery, analytics, weather data, and broadband from low-Earth orbit constellations. Buying commercial services means the Defense Department doesn’t have to finance the cost of building and operating a constellation and simply acquires the data.

Why it Matters:

The military’s modernization plans increasingly depend on technologies funded by the private sector. The Space Force is responsible for providing satellite-enabled capabilities to the entire Defense Department, and the acquisition of new space services will be a central piece of that effort. Along with other needs, imagery opens up a wide swath of investable themes from private companies in the aerospace and defense industry.

Electrification Policy:

Weakest Link: Hacker Lexicon: What Is a Supply Chain Attack? - Wired

By compromising a single supplier, spies or saboteurs can hijack its distribution systems to turn any application they sell, any software update they push out, even the physical equipment they ship to customers, into Trojan horses. The rise in supply chain attacks may be due in part to improved defenses against more rudimentary assaults.

Why it Matters:

The article highlights the growing vulnerability firms are experiencing through third-party software and hardware. This type of cyber threat occurred with the SolarWinds hack and is becoming more prevalent as hackers attack the weakest links in a firm's digital presence.

Trillion: Facebook Wins Dismissal of U.S., States' Monopoly Lawsuits - Bloomberg

U.S. District Judge Boasberg granted Facebook's request to dismiss two monopoly lawsuits filed last year by the U.S. Federal Trade Commission and state attorneys general led by New York, saying in his opinion that the FTC failed to meet the burden for establishing that Facebook has a monopoly in social networking.

Why it Matters:

With the ruling, Facebook has escaped, for now, the most significant regulatory threat to its business to emerge out of the broader crackdown on U.S. technology giants. The ruling also puts new emphasis on antitrust legislation advanced by the House Judiciary Committee last week that would make it easier for enforcers to challenge anticompetitive conduct by the biggest tech platforms. Meanwhile, elsewhere, Antitrust investigators at the U.S. Justice Department have stepped up scrutiny of Google's digital ad market practices.

Commodity Super Cycle Green.0:

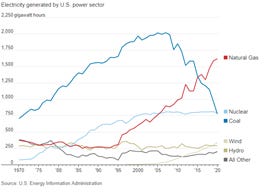

Progressive Gas: Democrats in Oil Country Worried by Party’s Natural-Gas Agenda – WSJ

Some moderates are distancing themselves from the progressive push to increase regulation of natural gas extraction. In January, four Texas House Democrats wrote to Mr. Biden asking him to abandon an executive order suspending new oil and gas leases on federal public lands and waters. Former Democratic Rep. Nick Rahall of West Virginia lost his seat in 2010 when the industry blamed him for not fighting harder against legislation to combat climate change. “If we ignore these people,” Mr. Rahall said, “we will never win states in the future like Pennsylvania, West Virginia, Ohio, even Indiana, Illinois.”

Why it Matters:

The more the progressives succeed in reducing natural gas from the countries energy portfolio, the more moderate Democrats in energy-producing states become vulnerable to losing seats crucial to the party’s hold on Congress. There is also no practical way to reduce natural gas use without increasing the cost of energy more generally, further hurting the political goals of the Biden Administration. We expect a compromise here, with any punitive regulation being sidelined until after the midterm election.