MIDDAY MACRO - DAILY COLOR – 6/28/2021

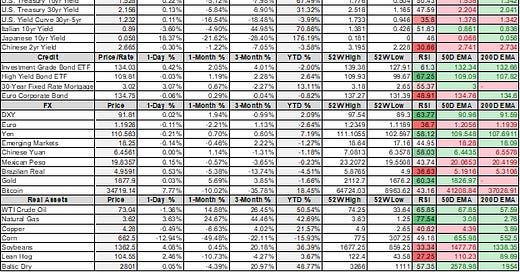

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities are mixed, with S&P flat while Nasdaq makes new highs

Treasuries are higher, with long-end recovering Friday afternoon loses

WTI is lower, after Iran related headlines over the weekend indicate a deal may be approaching

Price Action:

Equity rate sensitivity reflected in today’s price action with Nasdaq benefiting from flattening of Treasury curve

Nasdaq outperforming S&P/Russell

Growth, Low Volatility, Momentum factors outperforming

Technology, Utilities, and Consumer Staples sectors outperforming

Zero Gamma Level is 4241 while Call Wall is 4300, technical levels have support at 4252 while resistance is at 4305

Major Asian indexes are lower: Japan -0.1%. Hong Kong flat. China flat. India -0.3%.

European bourses are lower, at midday, London -0.5%. Paris -0.4%. Frankfurt -0.1%.

Treasuries higher with the curve flattening

5yr = 0.90%,10yr = 1.48%, 30yr = 2.10%

WTI lower by -1.3% to $73.10

Airstrikes in Iraq against Iranian Militias, the potential for further Iranian sanction relief, and the upcoming OPEC meeting give pause to the rally

Copper lower by -0.25% to $4.28

The Russian government is planning to impose new export taxes on steel, nickel, aluminum, and copper

Aggs higher, led by Soyoil and Corn

Relief rally from Friday’s strong post-SCOTUS-decision selling and dryer weather reports as traders await the NASS Stocks and Seeding Report on Wednesday

DXY flat to 91.8

Gold higher by 0.1% to $1780

Bitcoin higher by 8% to $34.7K

Econ Data:

Texas Manufacturing Survey Outlook decreased by 3.8 points from the previous month to 31.1 in June. Capacity Utilization and New Orders both jumped, showing healthy demand. Price and wage pressures accelerated further in June. The Raw Materials Prices and Wages and Benefits indexes both hit new all-time highs while the Finished Goods Prices index also pushed notably higher.

Why it Matters: It was encouraging to see production and demand pick-up even with supply-side disruption not abating, showing the versatility of firms to work around the current impediments. Outlook by firms improved but so did uncertainty. There was no relief yet in price and wage pressures.

Analysis:

Another day of strong positive correlation between equities and rates helping maintain our view that even with seasonality’s becoming negative, stocks will continue to melt up until yields meaningfully rise above their current ranges.

Month-end buying and low supply should keep yields contained until the end of the week.

Contained yields should support a slow grind higher in equities with implied volatility continuing to fall, and gamma pull continuing to rise.

This week's policy front is lighter than last week’s in terms of Fed speakers, and markets will be more focused on any new developments regarding infrastructure (although don’t expect much price action given the far-out impact it will have).

Powell, Williams, and Mester reset a more dovish tone last week, highlighting there is still work to be done (towards the full employment mandate as it’s getting harder to claim we aren’t meeting price objectives)

Friday’s Job’s report will again shed light on where we stand regarding that mandate, with moves in the participation rate and underlying gains by low-income and minority groups being more important than headline numbers or changes in wages.

The Fed’s focus will increasingly emphasize the need to see an “equitable recovery” in employment while inflation is in a “longer” than expected (but still) transitory period, allowing patience in keeping accommodation supportive.

Oil markets are cooling slightly, with front-month WTI futures a $1.50 off their overnight high after some initial confusion over how to interpret U.S.-Iranian developments over the weekend.

The Biden Administration is using “the carrot and stick” approach regarding their JCPOA 2.0 negotiations tactics.

Increased sanction relief (industry and Ayatollah focused) through diplomatic channels representing the “carrot” while military actions against Iran’s proxy forces in the region being the "stick.”

With prices at the pump rising into the driving season and no signs of increased production domestically, the Biden Administration is incentivized to make the deal and alleviate price pressures.

Will Putin do the dirty work and pressure OPEC+ (MBS specifically) to open the taps further as Russia has been critical of prices rising too far?

We caution against any new positioning in oil given the “fog of war” is relatively thick currently and watch for any response from Iran following this weekend's military provocation as well as general clarity from OPEC+ on its intentions at this week’s meeting.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth Outperforming on the Week

Chinese Iron Ore Future Price: Iron Ore Higher on the Week

5yr-30yr Treasury Spread: Curve is Flatter on the Week

EUR/JPY FX Cross: Yen Higher on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Xmas Early: This Shipping Dashboard Shows Why You Should Christmas Shop Early - Bloomberg

Shut-downs and congestion at ports across the world are now threatening holiday inventory restocking. Ships waiting to offload are parked outside ports from Singapore to Savannah, Georgia, and big European gateways for trade like Hamburg, Liverpool, and Rotterdam deal with bottlenecks and delays. Dozens of ships are queued up around Yantian, and, by one estimate, more than 400,000 20-foot containers were brought to a standstill.

Why it Matters:

There are still numerous problems affecting the day-to-day logistical needs of the global supply chain. Constraints to capacity causing backlogs, shortages of containers, strained trucking capacity, insufficient warehouse space availability, and no meaningful end in sight. This all comes when firms find themselves with record-low inventories and, in some cases, historically high final demand. We believe this will continue to keep inflationary pressure from real supply-side disruptions elevated into next year and force the Fed to acknowledge the persistence of the problem has lasted longer than initially thought, increasing their inflation outlook forecasts.

Paying Up: Box rates up 332% year-on-year, schedule reliability hits dire new lows – Splash247.com

According to the latest data from Drewry, shippers might be paying 332% more per box than they were this time last year. Yet, they have to put up with the worst schedule reliability in the history of containerization.

Why it Matters:

As an add-on to the above-highlighted article, this article not only highlights the massive price increase in shipping costs but the fact that the reliability of delivery time is now deteriorating.

China Macroprudential and Political Tightening:

Standard Green: China, EU Set to Agree on Green Finance Definitions by Year-End, Official Says - Caixin

Experts from the two countries have agreed on a common taxonomy for environmentally sustainable investments in terms of types of projects and methodologies. In April, China released an updated list of industries and projects eligible to be funded by green bonds that excludes “the clean use of coal and other fossil energy,” which aims to make China’s green bond standards stricter and align them with global mainstream standards.

Why it Matters:

China is increasingly coordinating with other economies to attract overseas investments in domestic green projects, part of China’s broader efforts to meet its ambitious carbon neutrality goals. It is also part of the larger goal to attract foreign investors to shoulder some of the increasing NPL burdens and move away from dollar funding needs.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Semi No Full-Investment: China’s Chip Investment Moves Ahead Full Throttle - Caixin

According to a report published last week by U.S.-based law firm Katten and Chinese chip-industry monitor Ijiwei.com, some 164 Chinese firms received 40 billion yuan ($6.19 billion) in combined funding during the first five months of 2021. The companies mainly raised funds through government and venture capital investment, as well as through debt financing and IPOs, most notably on China’s two-year-old, tech-focused STAR Market.

Why it Matters:

The U.S.’s current chokehold on the Chinese semi-sector means it has no way of gaining access to critical American industrial technologies and products via curbs on the export of critical materials and technologies as well as scrutiny of Chinese acquisitions of U.S. companies. Hence, new investments cannot leverage many global innovations and effectively means the Chinese will have a long road to leadership despite growing levels of investment.

Electrification Policy:

Binance Ban: Financial watchdog bans crypto exchange Binance from the UK – FT

The UK’s financial watchdog has ordered Binance to stop all regulated activities in Britain and imposed stringent requirements in a rebuke of one of the world’s biggest cryptocurrency exchanges. The intervention by the Financial Conduct Authority in recent days is one of the most significant moves any global regulator has made against Binance, a sprawling digital asset firm with subsidiaries around the world.

Why it Matters:

The FCA’s decision not to approve Binance’s cryptocurrency dealer registration was based on a failure of the company’s controls and practices to prevent money laundering and the financing of terrorism. Separately, Japan’s financial watchdog issued a statement on June 25, saying that Binance isn’t registered to do business in the country. We believe this line of reasoning will be adopted by more and more governments moving forward, ultimately leading to a prolonged, more significant crackdown on the crypto space than many expect.

Edge AI: How AI Is Taking Over Our Gadgets – WSJ

In what is called "Edge AI, " AI computations are moving from data centers to devices, making everything from phones to tractors faster and more private. Edge AI has the potential to deliver on some of the long-delayed promises of AI, like more responsive smart assistants, better automotive safety systems, new kinds of robots, even autonomous military machines.

Why it Matters:

The article highlights how numerous “things” are beginning to rely less on cloud connection to centralized algorithms for AI reasoning. Down the road, Edge AI systems will start to learn on their own. That is, they'll become powerful enough to move beyond inference and gather data and use it to train their own algorithms. AI that can learn all by itself, without connection to a cloud superintelligence, might eventually raise legal and ethical challenges.

ESG Monetary and Fiscal Policy Expansion:

Bio Quotas: Oil Refiners Win Easier Biofuel Waivers at Supreme Court - Bloomberg

In a 6-3 decision, SCOTUS rejected arguments that the EPA's exemption power is limited to only a handful of refineries that have received uninterrupted annual waivers from the Renewable Fuel Standard. In his opinion for the court, Gorsuch noted the lack of clarity from the Renewable Fuel Standard law on the matter.

Why it Matters:

The Supreme Court precedent will give future administrations wide clearance to exempt oil refineries from annual blending quotas. It also provides the Biden administration with more options for addressing concerns that climbing compliance costs imperil some independent refiners. The EPA is now drafting a proposed slate of biofuel-blending quotas for 2021 and 2022 and said it was analyzing the opinion. the Renewable Fuel Standard law will also likely be rewritten given the court's decision was in response to the statute's unclear "text, structure, and history."