MIDDAY MACRO - DAILY COLOR – 6/25/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities are mixed, staying near highs on light news and volume

Treasuries are lower, with long-end under pressure

WTI is higher, pushing on the top of the week’s range

Price Action:

Equities generally quiet, with the Russell rebalancing occurring today

Russell outperforming S&P/Nasdaq

Small-Cap, Value, and High Dividend Yield factors outperforming

Financials, Consumer Discretionary, and Materials sectors outperforming

Zero Gamma Level is 4227 while Call Wall is 4275, technical levels have support at 4222 while resistance is at 4270, 4300

Major Asian indexes are higher: Japan +0.7%. Hong Kong +1.4%. China +1.2%. India +0.5%.

European bourses are lower, at midday, London flat. Paris -0.2%. Frankfurt -0.2%.

Treasuries lower with the curve steepening

5yr = 0.92%,10yr = 1.52%, 30yr = 2.14%

WTI higher by 0.7% to $73.40

Shrinking inventories and rising global crude prices could lead the Opec+ coalition to consider a 500K b/d production rise when it irons out its August output policy next week, group delegates said.

Copper lower by -0.6% to $4.27

Aggs are significantly lower

Supreme Court rules in favor of the small refineries requesting waivers from biofuel blending mandates sending soyoil tumbling, as well as soybeans and corn.

DXY slightly lower by -0.1% to 91.7

Gold higher by 0.3% to $1780

Bitcoin lower by -6% to $32.7K

Econ Data:

Income, Spending, and PCE Prices: Total Personal Income fell -2%, and Wages and Salary Income increased 0.8% in May. Government social benefits (including unemployment benefits and other pandemic relief payments) fell -11.8% on the month. Consumer spending was flat (lower -0.4% in real terms) while the personal savings rate declined to 12.4% from 14.5% in the previous month. Headline PCE prices rose 0.4%, and core PCE prices were up 0.5% month-on-month. Year-over-year core inflation jumped to 3.4% from 3.1%, with core prices now up 6.6% at an annual rate over the last three months.

Why it Matters: Annualizing the three-month growth we have seen in income, spending, and inflation is starting to become a scary exercise. Both labor income and real consumer have seen double-digit increases at 11.6% and 12.8% so far this quarter, respectively. As highlighted in previous daily’s, the Fed will need to raise its inflation forecasts for this year, a dovish development without a subsequent increase in tightening projections. Finally, the level of monthly inflation increases will likely start to subside. However, we are doubtful it can go negative given the ongoing supply-side disruptions and pent-up consumer demand.

University of Michigan Survey of Consumers: Consumer Sentiment rose to 85.5 in June (+3.3%) from 82.9 in May, below expectations of 86.5. Views on current conditions declined while future expectations increased. June’s gains were from households with incomes above $100K and mainly from views on future economic prospects. Future inflation expectations fell slightly to 4.2% in June from May's decade high of 4.6%. Consumers also believed that the price surges will mostly be temporary. Finally, the report noted, “it is likely that consumers will not reduce their savings and wealth to pre-pandemic levels, but maintain a higher level of precautionary funds.”

Why it Matters: Consumers are becoming more optimistic based on their future outlook but continue to see risks currently. Even as inflation expectation fell slightly, favorable price references are the most negative in a decade. Job and income prospects have improved but are not as favorable as prior to the pandemic. This mixed message between optimism and the need for “precautionary funds” gives us pause on being too bullish on consumer spending into the second half of the year.

Analysis:

Muted price action in equities today while the Treasury curve is steepening with 10yr and 30yr yields moving out of their multi-day range.

Yesterday infrastructure “deal” announcement failed to move rates showing there is still a high level of uncertainty over its likely passage.

The passage of a smaller bipartisan bill should support Treasuries, lowering yields, given it would reduce future debt supply instead of a more significant Democrat-only deal put through via a reconciliation package with harder to predict revenue-increasing methods.

Today’s long-end selling instead comes after PCE data improved the outlook for a steeper curve, one of the favorite reflationary trades.

The PCE data was in line with expectations and temporarily takes the pressure off the Fed, buying them more time to see if their transitory views come true.

As a result of monthly inflationary increases slowing, the worry the Fed will have to remove accommodation much more quickly is subsiding, allowing for the resumption of prior investment themes.

The multitude of Fed speakers this week also reinforced the message of patience and transitory inflation forces.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value Outperforming on the Week

Chinese Iron Ore Future Price: Iron Ore Higher on the Week

5yr-30yr Treasury Spread: Curve is Steeper on the Week

EUR/JPY FX Cross: Euro Higher on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Too Much: FedEx Sinks on Higher Spending, Labor Costs Amid Parcel Boom – Bloomberg

FedEx’s cost pressures, tied to surging package deliveries, are threatening profitability. Capital expenditures will jump more than 20% during the fiscal year 2022 as FedEx ramps up outlays to boost efficiency, including 16 automated facilities to be built before the end of the year. Labor constraints also have boosted costs and crimped on-time deliveries. The inability to hire team members, particularly package handlers, has driven wage rates higher and creates inefficiency in our networks,” Chief Operating Officer Raj Subramaniam said

Why it Matters:

FedEx’s recent earnings release is a great example of how the real supply-side constraints are hurting growth and profitability. It also highlights a disconnect between investor’s high expectations for profit growth and the challenges of growing revenue while defending margins in the current environment. This story will become more common as we enter the second half of the year and cost pressures compress margins and continue to cap growth before ultimately being passed on increasingly to end consumers.

LONGER-TERM THEMES:

Electrification Policy:

Splits?: Big Tech edges closer to break up after deeply unhinged markup – The Verge

After nearly two years of investigations, the House Judiciary Committee met Wednesday to push forward on a package of bills targeting the power large tech companies hold over the market. The bills address fees for mergers, antitrust case rights, data portability, anti-discrimination, and platform access. The five bills are now heading to the House floor.

Why it Matters:

As the Nasdaq reaches new highs, driven by Big-Tech, it is important to watch how the regulatory and competitive landscape is changing. Apple’s clampdown on data sharing and efforts to reign in monopolistic behavior should all reduce earnings growth and force business models to change, which you have started to see. Although we still believe by big Tech will fare well in the upcoming more stagflationary environment, we caution the level multiples can grow to as earning growth slows.

Commodity Super Cycle Green.0:

Sea Floor: Environmental Investing Frenzy Stretches Meaning of ‘Green’ – WSJ’

Green investing has grown so fast that there is a flood of money chasing a limited number of viable companies that produce renewable energy, electric cars, and the like. Billions of dollars earmarked for sustainable investment are going to companies with questionable environmental credentials and, in some cases, huge business risks.

Why it Matters:

The article highlights several important themes. First, there is too much money chasing too few assets, driving valuations too high. This is best seen in the SPAC mania, where managers touted their ability to find hidden gems while mostly delivering overpriced turds. Second, the “Green Revolution” will be built on the back of environmental degradation as the needed resources are not easily sourced. This is highlighted in the article through the example of “clean” company endeavors that turned out to be anything but.

Nuts!: California’s Drought Is So Bad That Almond Farmers Are Ripping Out Trees - Bloomberg

California’s drought could have significant impacts on both the production and price of crops, according to an analysis by Gro Intelligence. Tree crops, like almonds, avocados, and citrus, are particularly vulnerable to dry conditions. It’s still too early to say with any certainty how much prices could increase, but avocados might be providing an early warning sign as they’re already up about 10% from last year.

Why it Matters:

Meteorologists have a saying: Drought begets drought. When land is dry, the sun’s energy is focused on heating the air instead of evaporating water. That raises temperatures, which leads to more dryness, which allows drought to spread even further. That’s why the brutally parched conditions of this year could spell additional trouble down the road, especially if next winter isn’t a wet one. As a result, we continue to expect price pressure on certain crops while also amplifying the need for water security in any infrastructure bills.

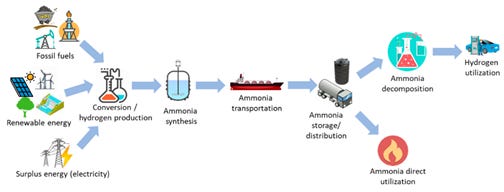

NH₄⁺: Japan to advance ammonia co-firing technology - Argus

Japan’s Trade and Industry Ministry has proposed a new target to finalize the development of a coal burner that can co-fire ammonia at an above-50% rate and of a fully ammonia-fired gas turbine by 2030. This will help Japanese firms tap the potential demand for ammonia as a co-firing fuel in Asia, where the EIA forecast coal-fired power capacity would account for 40% of total capacity in 2040.

Why it Matters:

Japan is taking the lead in developing ammonia and hydrogen energy technologies. The goal is to lower its own fossil fuel imports, become industry leaders and export the technology to the rest of the world. Eventually, the adoption of these technologies will reduce emissions, although currently, both are energy-intensive processes that draw mostly on traditional fossil fuels. It is important to keep watching Japan’s progress here given the support both technologies are getting from the government.

ESG Monetary and Fiscal Policy Expansion:

Deep Overhaul: EU Carbon Market Reform Set to Include One-Off Emissions Cap Cut - Bloomberg

The European Commission is currently designing the deepest overhaul of the bloc’s Emissions Trading System since the program’s inception in 2005 as part of a broader package of measures to be proposed on July 14. The cut in the pollution cap will be accompanied by an increase in the rate at which the annual emissions limit shrinks each year, likely from 2026.

Why it Matters:

The overhaul will increase the scarcity of permits and drive the cost of pollution higher, encouraging companies to shift away from fossil fuels. EU carbon prices jumped to a record 56.90 euros per metric ton last month, and some hedge funds predicted they could soar to as much as 100 euros later this year. These increases in prices may eventually be restrictive to growth as the region’s energy portfolio and industries can not transition fast enough into more carbon-neutral business models.

Frenemies: Biden agrees slimmed-down $1tn infrastructure deal with senators - FT

The agreement with a bipartisan group of senators fell short of the $2.3tn infrastructure spending plan announced in March and did not address the $1.8tn in social safety net spending that the US president proposed in April. Some Democrats and the White House hope to approve the rest of their economic agenda using their slim majorities in Congress, separate from the bipartisan infrastructure bill negotiated with Republicans.

Why it Matters:

We are not believers that this is a done deal. Opposition from both Republicans and Progressive Democrats came almost immediately following the announcement. Nancy Pelosi said the legislation would have to be linked to “social” infrastructure goals as well as tax increases. We continue to believe the disagreement over revenue-raising offsets will take the ultimate path of infrastructure through a reconciliation process, not a stand-alone bill, increasing the odds it is more extensive.