MIDDAY MACRO - DAILY COLOR – 6/21/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities are higher, with S&P recovering Friday’s losses and pushing back into its recent range

Treasuries weaker, with the curve steepening after overnight gains reverse

WTI is higher, with strong buying at the NY-open as the Iranian deal looks less likely

Price Action:

Russell and S&P are seeing solid gains as last week's reflationary trade death may have been overdone

Russell outperforming S&P/Nasdaq

Small-Cap, Value, and Low Volatility factors outperforming

Industrials, Materials, and Energy sectors outperforming

Zero Gamma Level is 4210 while Call Wall is 4300, technical levels have support at 4160 while resistance is at 4205, 4235

Major Asian indexes are lower: Japan -3.3%. Hong Kong -1%. China +0.1%. India +0.3%.

European bourses are higher, at midday, London +0.3%. Paris +0.3%. Frankfurt +0.4%.

Treasuries lower with the curve steeper

5yr = 0.91%,10yr = 1.48%, 30yr = 2.08%

WTI higher by 1.6% to $72.40

Copper higher by 0.5% to $4.17

Aggs are higher

DXY lower by -0.4% to 91.9

Gold higher by 0.7% to $1780

Bitcoin lower by -7% to $32.8K

Econ Data:

Chicago Fed National Activity Index: Led by improvements in production-related indicators, the CFNAI increased to +0.29 in May from –0.09 in April. Production, Employment, and Sales-related indicators made positive contributions to the index, while consumption-related indicators contracted over the period. Overall, 55 of the 85 individual indicators made positive contributions to the CFNAI. The index’s three-month moving average, CFNAI-MA3, rose to +0.81 in May from +0.17 in April

Why it Matters: The weakness in the consumption and housing sub-index came strictly from the personal consumption indicators, as housing indicators generally improved. Although the CFNAI aggregates all data points we have already seen, it summarizes our view that the lack of availability of goods and services is restraining consumption and growth.

Analysis:

It is unclear whether today’s price action is simply a tactical recovery bounce from an overextended rotation out of reflationary-themed trades last week or markets are again questioning the Fed’s path and whether inflation is truly transitory.

The VIX came close to 22 post-Asia open but is now falling to 18. At the same time, the S&P has re-entered its multi-week range, reducing concerns of a negative feedback loop starting from volatility and range-focused strategies.

A meaningful correction in the recent dollar strength is notably missing from today’s price action, highlighting a belief that real rates may continue to rise.

On the policy front, this week brings us Congressional testimony by Powell and numerous other Fed speakers.

This will help further expand the Fed's current outlook and whether they believe the post-FOMC price action properly reflects their intended message.

Also, this week brings 2-, 5-, and 7yr Treasury auctions, helping gauge where demand is for the “in play” belly of the curve.

There is a good amount of data this week as we receive Existing and New Home Sales, Markit PMI, Durable Goods, PCE, and Michigan Consumer Confidence data.

Friday’s PCE and Consumer Confidence data will shed further light on current and future inflation expectations, but a “shocking” beat will be unlikely with high expectations already priced in.

PMI service data on Wednesday will show whether supply-chain disruptions are further capping growth in the service sector, as we have seen in manufacturing.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value Outperforming on the Week

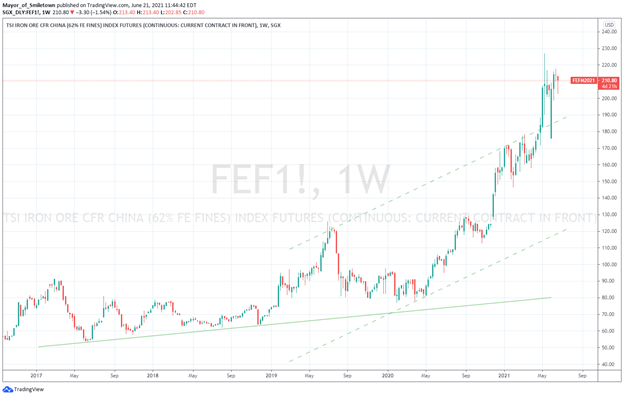

Chinese Iron Ore Future Price: Iron Ore Lower on the Week

5yr-30yr Treasury Spread: Curve is Steeper on the Week

EUR/JPY FX Cross: Euro Higher on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Not so Primetime: Amazon Prime Day Deals Expected to Disappoint Amid Cost Crunch - Bloomberg

Supply-chain disruptions have pushed up costs and made Amazon suppliers wary of selling too much during a profit-crushing sale. Many say they’re also holding back inventory in case shipping delays persist through the busy Christmas holiday shopping season. Amazon merchants are also grappling with tighter restrictions imposed this year on how much inventory they can push through its fulfillment centers, increasing shipping costs for merchants because they must send smaller loads more frequently.

Why it Matters:

Merchants have seen many cost increases this year (including a 50% price increase in advertising costs on top of the issues mentioned above) and are now clearly beginning to pass those on to end consumers. Softer discounts and on what is traditionally a big sales day shows a prioritization to defend margins and insecurity over abilities to maintain inventories into the holiday season later in the year.

China Macroprudential and Political Tightening:

Junk: Chinese Junk Bonds Flash Warning Signs – WSJ

Last week, the yield on an ICE BofA index of Chinese junk bonds in dollars topped 10% for the first time since May 2020. Chinese junk bonds yield 5.36% over the global index. Apart from a brief period in March 2020, this spread hasn’t been above that level since early 2012, ICE BofA data shows.

Why it Matters:

Chinese junk bonds are underperforming regional peers this year while China’s largest distressed asset manager, China Huarong Asset Management, has shaken investor confidence by delaying the release of its financial results. Markets continue to price in Chinese policymakers that have become more tolerant of defaults. As a result, investors will likely be more selective in buying names “they know” and await further deleveraging more generally.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Changing the Numbers: Grains analyst missing as China shuts down information on failed crop – ABC Australia

Independent analysts who report on China's grains industry have reportedly been arrested, and their online businesses shut down to stop them from telling the truth about the country's below-average crop. "They don't want the whole world to know that they need grain, and they are in a bit of strife, so they very closely regulate the information that is released," an analyst from Australian firm Market Check commented.

Why it Matters:

Analysts have long known that Beijing manipulates its economic data. Unfortunately, this takes that problem to another level as the arrest of grain analysts shows the insecurity Beijing has around their domestic food supply situation. If China’s domestic crop failure is worse than reported, as it seems, then the recent pullback in the U.S. agriculture complex is likely to be short-lived. Even with favorable weather and output in the U.S., export demand from China should continue to be strong and support prices. Reliance on U.S. grains also limits Beijing’s “Wolf Warrior” stance and aggressions (in theory!).

Electrification Policy:

Still Need the Basics: Drought-stricken communities push back against data centers – NBC News

Many data center operations are drawn to water-starved regions in the West due to cheaper solar and wind energy availability. The number of large data centers has doubled since 2015, and due to cost benefits, their use of water is significant. The growth in the industry shows no signs of slowing and comes at a time of record temperatures and drought in the United States, particularly in the West.

Why it Matters:

As water becomes scarcer in certain regions due to climate change, choices on its use will have to be made. “The typical data center uses about 3-5 million gallons of water per day -- the same amount of water as a city of 30,000-50,000 people,” said Venkatesh Uddameri, professor and director of the Water Resources Center at Texas Tech University. Typically, the conflict for water is between agricultural uses and the needs of populations, but this is an example of how other interests are now in the mix. It is important to highlight that the continual electrification and digitalization of all things still rely on basic resources like water, which is now becoming less reliable.

Commodity Super Cycle Green.0:

Hydrogen Revolution: How Japan’s Big Bet on Hydrogen Could Revolutionize the Energy Market - WSJ

The Japanese government more than doubled its hydrogen-related R&D budget to nearly $300 million in the two years to 2019, a figure that doesn’t include the millions invested by private companies. Eventually, the government is expected to provide subsidies, as well as disincentives for carbon-emitting technologies. Japan’s industrial powerhouses are building ships, gas terminals, and other infrastructure to make hydrogen a big part of everyday life.

Why it Matters:

Hydrogen has key advantages. It can be used in modified versions of existing power plants and other machinery designed to run on coal, gas, or oil. That will help countries avoid scrapping billions of dollars of legacy assets to transition to a new energy future. Japan is a big enough player on the global stage to help push hydrogen into mainstream use globally. Another advantage is that hydrogen is a technology in which Japan can take the lead and reduce reliance on China (which has dominance in the solar industry).

Bread Basket: One of the Most Fertile Nations Wants to Feed the World - Bloomberg

On July 1, a new law will allow the buying and selling farmland for the first time in two decades. The government says the advent of a functioning market means one of the most fertile places on the planet is the first step toward bigger, more efficient farming by fostering investment. Productivity has been hampered to this point by leasing arrangements, which discourage investment, but now individuals can buy up to 100 hectares.

Why it Matters:

Ukraine has a potential arable land market of 40 million hectares. Farmers who own their own land have a better opportunity to diversify into higher-margin crops and get better access to finance. This development, over time, has the potential to increase the global supply of grains during a time when land resources around the world are diminishing. Some 12 million hectares are lost every year to desertification and drought alone, an area that could produce 20 million tons of grain.

ESG Monetary and Fiscal Policy Expansion:

First-Time Buyers: HUD Aims to Boost Homeownership for Buyers With High Student Loans – WSJ

The Federal Housing Administration is relaxing how it assesses student-loan debt when weighing eligibility for homebuying assistance as the Biden administration pushes to help lower-income borrowers and narrow a racial homeownership gap. Relaxing the way it factors in student debt will bring the FHA more in line with other government-backed mortgage programs, such as Fannie and Freddie, which also eased their criteria in recent years.

Why it Matters:

The changes should give recent graduates “burdened with significant debt loads” a better opportunity to buy a home. However, the effects are also likely to be damped in the short run by the red-hot housing market, which is favoring cash buyers for lower-median-priced homes. It is worth highlighting this development as another area the current Biden Administration is using its ability to regulate the financial system to alter the distribution of credit, potentially to those with riskier profiles.