MIDDAY MACRO - DAILY COLOR – 6/1/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities are mixed, with S&P and Nasdaq quickly giving up overnight gains post-NY-open while Russell is rallying

Treasuries trending lower for a second day as month-end buying has turned into net selling

WTI is rallying, well bid on increased demand outlook while OPEC+ is sticking to its plan

Price Action:

Overnight gains reversed after NY-open with Nasdaq worst hit

Russell outperforming S&P/Nasdaq

Small-Cap, Momentum, and Value factors outperforming

Energy, Materials, and Industrials sectors outperforming

Gamma gravity continues to be 4200, Call Wall is at 4250, technical levels remain the same with support at 4185 while resistance is 4220

Major Asian indexes are mixed: Japan -0.2%. Hong Kong +1.2%. China +0.3%. India flat.

European bourses are higher, at midday: London +1%. Paris +0.8%. Frankfurt +1.5%.

Treasuries lower with the curve bear steepening

5yr = 0.82%,10yr = 1.64%, 30yr = 2.32%

WTI higher by over 2% to $67.80

Concerns over tighter COVID-19 related restrictions across parts of Asia appear to be secondary to a more positive demand story from the U.S. and parts of Europe, while OPEC+ did not announce any major policy shifts

Copper lower, now giving up NY-open gains to $4.66

BHP's Escondida and Spence copper mine strikes are now at their sixth day and providing an element of support to copper

Aggs rallying significantly higher with corn higher by close to 5%

A dryer weather outlook for the Midwest is giving the ag complex a boost today, but overall, U.S. corn and soybean crop conditions look good with limited problem areas

DXY lower to 89.7, approaching January lows.

Gold lower by -0.5% to $1895

Bitcoin higher by 2% to $36.7K

Econ Data:

ISM Manufacturing PMI: Headline PMI reached 61.2, an increase of 0.5 points from April and beating expectations of 60.9. The increase was driven by increases in Inventories, Supplier Deliveries, New Orders, and Backlogs categories, while Production and Employment both weakened notably. Record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices, and difficulties in transporting products continue to affect all segments of the manufacturing economy. Worker absenteeism, short-term shutdowns due to part shortages, and difficulties in filling open positions continue to be issues that limit manufacturing growth potential.

Why it Matters: More evidence that growth will be capped by prolonged supply disruptions and labor shortages, causing earning forecasts to fall in the second half of the year.

Policy Talk:

St. Louis Fed President Bullard: Bullard said that despite data showing nonfarm payrolls still 8m jobs short of pre-pandemic levels, other indicators were far closer to normal, matching anecdotal evidence of worker shortages. He added that he was “starting to advocate” for the Fed to look at other measures of job market tightness, particularly the unemployment to job opening ratio, which was at a low of 0.8 in February 2020, rose to 5 during the first lockdowns, and was back down to 1.2 in March 2021. Bullard said the Fed had already “achieved quite a bit” with respect to its employment goals, and the central bank may be waiting in vain for payrolls and labor force participation to recover fully since many of those workers were “marginally” attached to the worker force, and particularly the older ones may not return.

Why it Matters: Very important to see how the definition of “maximum employment” evolves as we determine how focused the Fed is on an “equitable” recovery in the face of increasing inflationary pressures.

Analysis:

Today is global Markit PMI data day, and it worth highlighting that many of the themes we have identified in the U.S. are playing out across the globe, continuing to show an increasing synchronization of global economic activity from both producers down to consumers that are now limiting growth potential.

Improving operating conditions and higher end-product demand continues to be accompanied by increasing input costs and supply chain disruptions:

Factory activity in China slowed slightly, with import orders contracting and raw material costs reaching an 11-year high.

Japan and South Korea saw moderation of activity in May as both countries experienced soaring input costs.

Eurozone manufacturers reported constraints on production from ongoing difficulties in sourcing inputs while deliveries from suppliers deteriorated at a severe and unprecedented rate during the month.

Today’s U.S. Markit PMI and ISM PMI continued to improve at the headline level but showed significant troubles underneath (as highlighted in the Econ Data section above) bringing question to the sustainability of the current growth levels being seen.

We continue to highlight this developing dichotomy of improving demand and reduced supply as the main area where global policymakers underestimate the severity and longevity of the problems and hence the “stickiness” of the inflationary pulse that is occurring.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value Outperforming on the Week

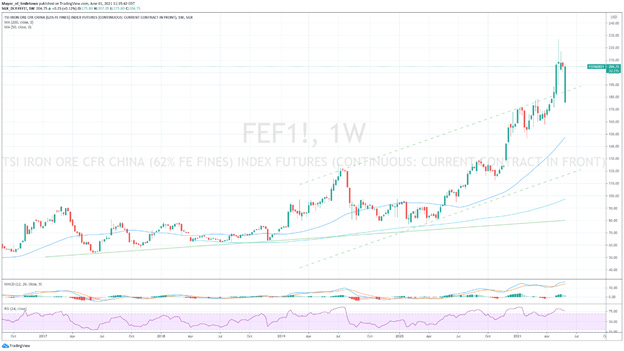

Chinese Iron Ore Future Price: Iron Ore Higher on the Week

5yr-30yr Treasury Spread: Curve is Steeper on the Week

EUR/JPY FX Cross: Euro Higher on the Week

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Automation: Warehouses Look to Robots to Fill Labor Gaps, Speed Deliveries – WSJ

There is a significant push toward automation occurring as businesses can’t hire warehouse workers fast enough to meet surging online demand. Logistics-automation companies say demand for their technology has grown during the pandemic as companies look for ways to cope with big swings in volume when workers are scarce and social distancing requirements limit building occupancy.

Why it Matters:

U.S. warehousing and storage companies added nearly 168,000 jobs between April 2020 and April of this year, a rise of 13.6%. There was a slight contraction last month, but logistical employers say they continue to see a shortage in labor availability and are increasing wages to find the needed workers. It’s a little ironic that generous fiscal stimulus benefits to support American labor (allowing workers to stay out of the workforce for longer and be more selective when reentering) are leading to a structural change to replace them with automation.

China Macroprudential and Political Tightening:

Yuan: China raises banks' FX requirements to rein in yuan – Nikkei Asia

The PBOC said it would raise the FX reserve requirement ratio for financial institutions to 7% from 5%, from June 15. Banks in China have about $1 trillion in foreign currency deposits, some of which are unconverted export receipts and investment flows. Analysts said the rise in FX reserves would force banks to freeze more of those dollars, slowing the yuan's pace of appreciation by deterring dollar inflows in the longer term.

Why it Matters:

The CCP uses FX policy in a weaponized way as it slowly liberalizes its financial markets and capital controls. Tactically, the PBoC is currently balancing the need to keep inflation low (by appreciating the yuan and making the imports of commodities cheaper) versus promoting export-oriented industries, which are hurt by a stronger yuan.

LONGER-TERM THEMES:

National Security Assets in a Unipolar to Multipolar World:

Space Budget: DoD agencies to invest more than $1 billion in low-Earth orbit space technologies – Space News

The Biden administration’s defense budget proposal for the fiscal year 2022 seeks more than $1.2 billion for military space systems in low-Earth orbit. The budget breakdown is $900 million Space Development Agency’s communications network in low-Earth orbit (LEO) known as the Transport Layer. The Missile Defense Agency is seeking about $300 million for space sensors, and the Defense Advanced Research Projects Agency is requesting $42 million to deploy experimental satellites in LEO under the Blackjack program.

Why it Matters:

Technologies developed by SDA, MDA, and DARPA are expected to transition into more extensive Space Force programs, which has their own budget for research, development, and procurement of new systems. Research and development by DARPA is a prime example of how the creation of dual-use technologies from civilian and military partnerships are critical to national security in a growing contested place, space.

Electrification, Digitalization, and Cyber Security:

Meat Hack: Meat Is Latest Cyber Victim as Hackers Hit Top Supplier JBS - BBG

JBS SA, The world’s biggest meat supplier, shut its North American and Australian computer networks after an organized assault on Sunday. The attack sidelined two shifts and halted processing at one of Canada’s largest meatpacking plants while the company canceled all beef and lamb kills across Australia.

Why it Matters:

We will continue to watch JBS shut down closely, given the importance of any supply shortages to global meat prices. More generally, hackers now seem to have the commodities industry in their crosshairs, with the JBS attack coming just three weeks after the biggest U.S. gasoline pipeline operator was targeted.

Data Privacy: Amazon devices will soon automatically share your Internet with neighbors – ATRS Technica

On June 8, Amazon will automatically enroll Alexa, Echo, or any other Amazon devices in Amazon Sidewalk. The new wireless mesh service will share a small slice of your Internet bandwidth with nearby neighbors who don’t have connectivity and help you to their bandwidth when you don’t have a connection.

Why it Matters:

Amazon has published a white paper detailing the technical underpinnings and service terms that it says will protect the privacy and security of this bold undertaking. To be fair, the paper is fairly comprehensive, and so far no one has pointed out specific flaws that undermine the encryption or other safeguards being put in place. But there are enough theoretical risks to give users pause and again question forced big tech changes to hardware usage.

Green Energy and Resource Transition:

Nat Gas: Battle Brews Over Banning Natural Gas to Homes – WSJ

Major cities, including San Francisco, Seattle, Denver, and New York have either enacted or proposed measures to ban or discourage the use of natural gas in new homes and buildings. The bans, in turn, have led Arizona, Texas, Oklahoma, Tennessee, Kansas, and Louisiana to enact laws outlawing such municipal prohibitions in their states before they can spread, arguing that they are overly restrictive and costly.

Why it Matters:

The outcome of the battle, largely among Democratic-led cities and Republican-run states, has the potential to reshape the future of the utility industry, and demand for natural gas, which the U.S. produces more of than any other country. Greater reliance on electricity raises the possibility that parts of the natural-gas delivery system will become stranded assets. However, an indiscriminate approach to widespread electrification could put a strain on the grid, resulting in either higher electricity prices or greater reliance on gas-fired power plants.

Commodity Super Cycle 3.0:

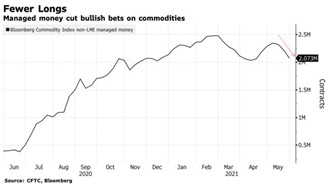

Spec Bets: Hedge Funds Keep Cutting Their Bullish Wagers on Commodities - BBG

Hedge-fund holdings this week in 20 of the 23 commodities tracked in the Bloomberg Commodity Index fell by the most since November, according to data from the U.S. Commodity Futures Trading Commission and ICE. There are a few outliers. Funds are showing more appetite for arabica coffee, the type favored by Starbucks Corp., and net-bullish positions are at the highest since November 2016 as drought continues to be a concern for top shippers in Brazil. Investors are also being lured back to gold as an inflation hedge, increasing net-long bets to the highest level in 20 weeks.

Why it Matters:

What the pullback in hedge fund positions in particular suggests is that any future price gains will depend more on actual supply and demand rather than speculative buying across raw materials.

Oil CAPEX: This Time Is Different: Outside OPEC+, Oil Growth Stalls - BBG

For the first time in decades, oil companies aren’t rushing to increase production to chase rising oil prices. Even the U.S. shale industry is resisting its traditional boom-and-bust cycle of spending.

Why it Matters:

There is now a big opportunity for OPEC+, specifically Saudi Arabia and Russia, to increase their production. Exxon’s board change and the ruling against Shell show traditional western big oil will not prioritize expanding production. As non-OPEC output fails to rebound as fast as many expected, OPEC+ is likely to continue adding more supply when it meets on June 1. However, with demand improving, the market will still be undersupplied in the second half of the year.

Iron-Ore CAPEX: Iron-Ore Miners Strive to Avoid Past Mistakes as Prices Boom - WSJ

Iron ore producers are split on CAPEX intentions. Chinese companies are pushing to build one of the world’s biggest mines in West Africa, while a clutch of smaller companies are developing new mines that are more flexible with price changes. BHP and Rio Tinto, the world’s two largest mining companies, say they aren’t interested in producing much more iron ore in Australia, accounting for more than half the world’s trade in the commodity.

Why it Matters:

Mindful of not repeating past mistakes, many aspiring iron-ore companies are targeting small projects that can start up quickly and be developed in stages. There are an estimated 20 new mines with a total annual capacity of 150 million tons starting this year, excluding any in China, a five-year high in capacity terms. Last year, just 5 million tons of capacity was added, down from 14 million tons in 2019.

Thank you for reading - Mike