MIDDAY MACRO - DAILY COLOR – 5/7/2021

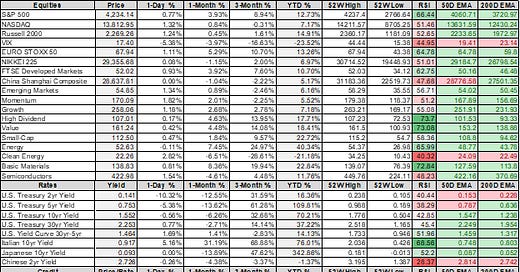

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities higher post NFP lead by growth and small-caps

Treasuries curve steepening after a brief rally post data fizzled out in the long-end

Copper going parabolic to new highs

WTI stronger at open after weaker overnight

Price Action:

Strong positive price reaction to data

Nasdaq/Russell outperforming S&P

Momentum, Growth, and Small Cap factors outperforming

Technology, Consumer Discretionary, and Healthcare sectors outperforming

Call wall stays at 4200 with support at 4175, 4190 is technical support with resistance at 4240

Major Asian indexes mixed: Japan +0.1%. Hong Kong +0.1%. China -0.7%. India +0.5%.

European bourses higher, at midday: London +0.7. Paris +0.3%. Frankfurt +1.3%.

Treasuries curve steepening as the belly's rally has been better sustained

5yr = 0.75% and 10yr = 1.56%

WTI higher around 1% to $64.80

Copper hitting new highs again, higher by over 3.5% in overnight and post open

Aggs higher but giving up some overnight gains

DXY came under significant pressure following NFP, now at 90.25

Gold higher by 1% to $1,835

Bitcoin higher by 2% to $57.2k

Analysis:

A lot of confusion on what drove the historic payroll miss, but price action tells us markets are now assigning a lower likelihood of summer taper talks while inflationary pressures continue to build.

Three main takeaways from NFP:

Companies are already seeing margin pressure from increased input and logistical costs and now look reluctant to raise wages to attract qualified labor even with strong demand drivers.

The view that stimulus/entitlement payments are holding back labor availability wasn't supported by the growth in low-wage (over higher-wage) hiring last month.

Have technological enhancements (implemented to overcome pandemic-induced problems such as labor shortages) now improved productivity enough to weaken labor demand structurally?

In the end, this jobs report points to a Fed that will continue to stay patient as it prioritizes its maximum employment mandate over price stability, allowing the economy to run hot (to the advantage of capital over labor).

WORTH A LOOK

Econ Data:

Nonfarm Payrolls: Nonfarm payrolls rose by much less than forecasts, increasing only 266,000 in April. In addition, total payroll gains in the prior two months were revised down by a net 78,000. This report is over 400,000 below the lowest projection in the survey of economists. The gains were almost entirely accounted for by the low-wage leisure and hospitality sector, making the surge in average hourly earnings of 0.7% hard to understand. The timing of the report and a reluctance of people to return to work (even with an increase in the participation rate to 61.7% from 61.5%) are being cited as potential reasons for the large miss, but this doesn't smell right.

Policy Makers Rhetoric and Key Events:

Cleveland Fed President Mester commented in a recent speech that "although the aggregate statistics do not show much acceleration in wages, our contacts say that they are beginning to respond to labor shortages by increasing their wage offers and by considering candidates they may have previously passed over because of minor criminal offenses or other reasons." She also commented that the Fed would not think that a healthy labor market suggests inflation is coming. These comments tell us a few things. One is that inflationary pressures from wage increases are likely to be only accelerating now. Second, the Fed has been wrong in the past on their Philip Curve views and will be wary of the sustainability of any wage pressures on overall inflation generally.

The Board of Governors released their bi-annual Financial Stability Report. It is worth a read as it summarizes vulnerabilities facing financial stability. They see asset valuations, borrowing levels by businesses and households, leverage in the financial system, and funding risk as their critical areas of concern. This report also details how near-term risks have changed since the November 2020 report. Despite substantial progress with vaccinations, perceived risks associated with the course of the pandemic and its effects on the U.S. and foreign economies remain relatively high.

TECHNICALS / CHARTS

Four charts will be included in this section every day to help monitor the macro picture and our specific themes: Growth/Value Ratio, Chinese Iron Ore Prices, 5-30s Treasury Spread, and Euro/Yen FX cross.

Growth/Value Ratio:

Chinese Iron Ore Future Price

5yr-30yr Treasury Spread

EUR/JPY FX Cross

SPECIAL SELECTION: Copper

The recent surge in copper looks to be driven mainly by political concerns and supply variables as opposed to the demand side, which is starting to fray, especially in China. that China's copper imports in April fell by about 12% from March levels and is up only 5% from the severely depressed year-ago benchmark. Looking at supply, Chilean and Peruvian production is below last year's levels while Brazil and India, both mining powerhouses, are dealing with Covid outbreaks. Various political developments are causing price tremors as well. Tax increases in Chile are likely while Peruvian elections are being watched closely. This leaves us to believe that although prices may continue to increase long-term this may be a good place to take some profits.

OFF THE RADAR

No Big Bankruptcies:

U.S. bankruptcy courts are in their longest quiet period since before the pandemic thanks to massive fiscal stimulus, a brightening economic outlook, and wide-open credit markets.

Zero firms with at least $50 million of liabilities have filed for bankruptcy since April 25.

That's the longest such stretch since September of 2019.

The pace of big bankruptcy filings had trended downward since the middle of last year when five or more new filings per week were typical.

The lull is likely no surprise to investors who specialize in betting on troubled companies.

According to data compiled by Bloomberg, the pile of bonds and loans trading at steep discounts (one proxy for corporate distress) has shrunk to below $100 billion from a pandemic high of close to $1 trillion.

China's Emissions:

China accounted for more greenhouse gas emissions than all developed nations combined in 2019, according to Rhodium Group.

The country accounted for 27% of the global total, with No. 2 U.S. at 11%.

China released 14.09 billion tons CO2 equivalent of seven heat-trapping gases, 30 million tons more than the OECD.

China releases far less per person than the U.S. and is a newcomer; the OECD has emitted four times as much since 1750.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the "5th Dimension"

Third-Party Problem: SecureLink: 51% of organizations experienced a third-party data breach – Venture Beat

Findings revealed that organizations are not taking the necessary steps to reduce third-party remote access risk and expose their networks to security and non-compliance risks. As a result, 44% of organizations have experienced a breach within the last 12 months, with 74% saying it was the result of giving too much-privileged access to third parties.

You are only as strong as your weakest link when it comes to cybersecurity as the U.S. government found out through the SolarWind hack. SecureLink's report sheds light on yet another avenue governments, businesses and individuals are at risk on the web.

Electrification

Battery Recycling: Battery recycling could cut raw material use by 12% - Argus

Demand for battery materials is set to increase sharply and outpace supply in the next 20 years, with electric vehicles and battery storage leading the change. But recycling and reusing batteries could cut demand for raw materials such as lithium and nickel by up to 12% by 2040, according to the International Energy Agency.

Increasing demand and prices will drive governments to implement more robust battery recycling programs. The rising costs of raw materials in batteries could remain a problem, with raw materials now accounting for 50-70% of battery costs, up from 40-50% five years ago, it estimates. Recycling could therefore play a crucial role in bridging the gap in metal supply.

Smaller Chips: IBM Creates First 2nm Chip - AnandTech

IBM's 2nm development will improve performance by 45% at the same power, or 75% energy at the same performance, compared to modern 7nm processors. IBM states that the technology can fit '50 billion transistors onto a chip the size of a fingernail'. IBM will be partnering with GlobalFoundaries, Intel, and Samsung to incorporate this new technology into their production chain.

Every decade is the decade that tests the limits of Moore's Law, and this decade is no different. Regarding America's role in the global chip industry, IBM is still one of the world's leading research centers on future semiconductor technology despite not having foundries of their own, showing the U.S. still leads in R&D and innovation in the semiconductor industry.

ENREA – Environment / Natural Resources / and Energy Advisory

Dirty Green: Lithium gold rush: Inside the not-so-green race to power electric vehicles - SeattleTimes

A lithium mine in Nevada is proving to be emblematic of a fundamental tension surfacing around the world: Electric cars and renewable energy may not be as green as they appear. Production of raw materials like lithium, cobalt, and nickel essential to these technologies is often ruinous to land, water, wildlife, and people.

This friction helps explain why a contest of sorts has emerged in recent months across the United States about how best to extract and produce the large amounts of lithium in ways that are much less destructive than mining has been done for decades. Some investors are backing alternatives, including a plan to extract lithium from briny water beneath California's largest lake, the Salton Sea, about 600 miles south of the Lithium Americas site. Necessary to watch developments here as ESG and regulatory standards may alter supply and production costs.

Forced Solar: Concerns over Xinjiang forced labor prompt transparency tool for solar sourcing – Supply Chain Dive

The Solar Energy Industries Association launched a traceability tool last week, aimed at helping manufacturers and importers of solar products identify the source of a solar product's material inputs and trace the movement of these inputs throughout the supply chain. The goal is for companies to implement the protocol's key principles and become better equipped to navigate U.S. import compliance obligations, the association said.

Supply chain transparency will be a growing theme as ESG concerns force firms to know everything about their inputs. Specific to solar, where China's share of the world's polysilicon production will increase to more than 80%, manufacturers and importers of panels will likely have to pay up to escape forced labor concerns in Xinjiang.

Monetary Policy

Green Union: Towards a green capital markets union for Europe – Christine Lagarde

"The green transition offers us a unique opportunity to build a truly European capital market that transcends national borders… We need to transform our economies as structural changes speed up around us. We must redirect activity towards the green and digital sectors as quickly as possible, which will help raise Europe's growth potential." – CL

Lagarde's speech calls for further integration of financial markets in the Eurozone to help meet climate, energy, and digital goals. She identifies the need for more robust capital markets to provide alternatives to the heavy level of bank borrowing occurring. This speech is very much in line with the "green" push occurring at the ECB while also promoting the internationalization of an E.U. debt market and further use of the common currency.

Logistical Bottlenecks

U.S. Ports: American ports fail to make the grade on efficiency – Splash247.com

No American boxport is among the top 50 most efficient globally, a new study reveals, in another damning indictment on the lagging state of U.S. maritime infrastructure. Released this week, the Container Port Performance Index 2020 (CPPI) ranks 351 of the world's container ports mainly based on dwell time, seen as a reflection of the ports' processes and infrastructure.

The Biden $17bn infrastructure improvements for ports and waterways cannot come soon enough. Analysis from Danish consultancy Sea-Intelligence in April spoke to that capacity issue, showing that North American ports are primarily to blame for the container imbalance plaguing the global container shipping industry. Clearly, improvement is needed.

China Macroprudential Policy

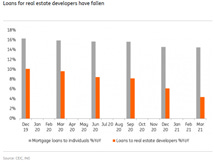

Leverage: China deleveraging spurred on by recovery - ING

After strong growth in the first quarter, the Chinese government has decided now is a good time to reduce leverage in the economy. This deleveraging reform is not to squeeze developers into an unsustainable operating situation but to downsize their books and debt ratios. Loan growth for property developers is much lower than the overall economic growth. This will help the overall debt ratio of China to fall as deleveraging reform will likely continue for the rest of the year.

The reforms show the Chinese government is optimistic enough about the economy to continue to push through reforms that all, though appropriate, will be a drag on growth in the short term. Stepping back, Xi will want a strong economy when now facing off against a more aligned Western economic adversary limiting just how fast and deep reforms in the real-estate sector can go.

Defining National Security Assets in a Dual Use Environment

HiSilicon is expected to be the biggest loser in the 5G smartphone chipset market in 2021 as U.S. company Qualcomm and Taiwan's MediaTek expand their presence, according to a new research note published by Counterpoint. The Chinese chip firm had 23% of the 5G phone chipset market in 2020, but it is expected to see that share shrink to less than 5% this year.

The decline of HiSilicon's business is a direct result of the U.S. government's tightened sanctions last summer, barring semiconductor companies from supplying Shenzhen-based Huawei with chips made using U.S. technology without prior approval, effectively severing the Chinese telecom giant's access to advanced semiconductors.

Unipolar to Multipolar World

Australian and Chinese Relations: China suspends economic dialogue with Australia - Argus

China's top economic planning agency the NDRC announced the suspension of the economics talks today. The decision adds to deteriorating trade relations between the two countries, which have all but halted Australia's thermal and coking coal shipments to China. Beijing has also imposed tighter restrictions on other Australian exports to China, including wine and barley. Iron ore, by far the largest trade item, and LNG has so far been largely unaffected by the tensions.

Futures prices for China's most heavily traded iron ore future contract were higher by nearly 7% yesterday as traders interpreted the suspension of economic dialogue as an escalation that may soon limit supply there. This further escalation supports our theme that the world is moving from a unipolar one to a more regionally based multipolar one, altering supply chains and international norms.

E.U. and China Relations: China hopeful E.U. investment deal can be ratified despite growing doubts over its future – SCMP

After the Comprehensive Agreement on Investment (CAI) was signed last year, relations between China and the E.U. have nosedived over human rights concerns in Xinjiang. In March, the E.U. joined the United States, Britain, and Canada in imposing sanctions on Chinese officials for human rights abuses in Xinjiang. Beijing has retaliated with sanctions on European officials and academics, hitting the chances of the European Parliament ratifying the deal.

Recent comments from E.U. Trade Chief Dombrovskis regarding the effects of human rights abuses and counter-sanctions by the Chinese indicated that there is growing opposition to ratifying the agreement. The E.U. is in the same situation as the rest of the western world is in when dealing with China, either "look the other way" for economic reasons or stand up for what is morally right.

Thank you for reading - Mike