MIDDAY MACRO - DAILY COLOR – 5/6/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities weaker post open but now positive on a sharp move higher

Treasuries again higher pushing up on their April highs

Agg complex higher overnight and maintaining levels post open

WTI weaker, hovering around yesterday afternoon’s lows

Price Action:

Mixed price action in equities

S&P outperforming Nasdaq/Russell

Low Volatility, High Dividend Yield, and Large Cap factors outperforming

Cons Staples, Industrial, and Financials sectors outperforming

Gamma wall at 4200 with support at 4150, 4130-40 continues to be technical support with resistance at 4190

Major Asian indexes higher: Japan +1.8%. Hong Kong +0.5%. China -0.2%. India +0.5%.

European bourses flat, at midday: London flat. Paris -0.1%. Frankfurt -0.1%.

Treasuries slightly higher and bull flattening

5yr = 0.79% and 10yr = 1.56%

WTI lower around 1% to $65

The new JCPOA deal looks to be its final innings

Copper hitting new highs again, consistently rallying overnight and post open

Aggs well bid again in overnight and maintaining levels post open

DXY came under pressure overnight, now around 91

Gold rallied post open, up 1.75% to $1,815

Bitcoin flat around to $57.2k

Analysis:

The S&P has been moving in a 100 point range since mid-April despite economic data and earnings superseding expectation, showing that positioning was extremely long entering this earning season.

Instead, new capital looks to be entering the Treasury space as future growth is being downgraded, allowing central bank accommodation expectations to be extended.

Lower yields are not benefiting growth and momentum as sector/factor rotation still favors value, large-cap, and dividend yield.

The “electrification” and “food security” baskets continue to outperform on the back of the historical general commodity rally being seen.

More and more reports are highlighting the ongoing grab for key resources currently occurring on top of the logistical and production issues already affecting prices.

WORTH A LOOK

Econ Data:

Productivity and Costs: Productivity rose 5.4% at an annual rate in the first quarter, a larger gain than the median consensus forecast. The pickup in productivity growth to the fastest growth rate since early 2010 is common in the early stages of economic recovery and underscores that the output gap is narrowing more quickly than the employment gap. It remains to be seen how much of the gain in productivity will be held on to as the more labor-intensive sectors of the economy fully reopen. Compensation per hour rose 5.1% in the first quarter but unit labor costs slipped 0.3%. Over the last year, labor costs have risen at a rapid rate of 5.8% but only by 1.6% when adjusted for productivity increases and this gain in costs has been largely matched by price increases. In the first quarter, price increases ran well ahead of unit labor costs, pointing to an improvement in underlying economy-wide profitability.

Policy Makers Rhetoric and Key Events:

Boston Fed President Eric Rosengren questioned whether the mortgage market still needs as much support as it’s been receiving in recent comments. That may seem like stating the obvious given the strength being seen in housing, however, it’s the closest the Fed has come to saying it out loud. And it raises the probability that when tapering does come, mortgage purchases will go first.

TECHNICALS / CHARTS

Despite improving initial claims and what looks to be a strong NFP print tomorrow, unemployment is still a problem. More than 16.5M Americans were receiving jobless benefits as of mid-April, including more than 12M Americans on the federal Pandemic Unemployment Assistance and Pandemic Emergency Unemployment Compensation programs. Last month's non-farm payrolls report also showed the U.S. economy is more than 8M jobs short of its pre-pandemic levels. Expect the Fed to continue to stress labor market weakness (allowing longer accommodation) even in the face of an improving NFP delta and higher stickier inflation.

OFF THE RADAR

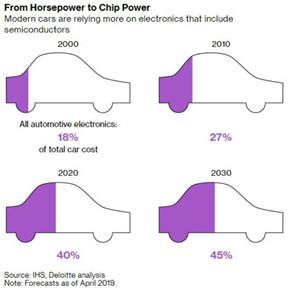

High Tech Features:

The chip shortage is forcing carmakers to dump high-tech features like satnavs, large displays, and intelligent mirrors to keep production moving.

Nissan is leaving navigation systems out of thousands of vehicles that typically would have them because of the shortages.

Ram no longer offers its 1500 pickups with a standard “intelligent” rearview mirror that monitors for blind spots.

Renault has stopped offering an oversized digital screen behind the steering wheel on its Arkana SUV -- also to save on chips.

Some companies are allocating scarce components to more profitable vehicles at the expense of others.

That rollback underscores the depth of the issues facing the industry.

Just last week, BMW AG, Honda Motor Co., and Ford Motor Co. all flagged worsening problems from chip shortages.

A failure to secure critical supplies is a massive short-term setback -- millions of vehicle sales will be lost this year and bodes ill for the future as competition from tech-savvy internet and consumer-electronics companies intensifies.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

Space Junk: Study calls on the U.S. to change how it buys space technology, reduce congestion in low orbits - SpaceNews

The Center for the Study of the Presidency & Congress (nonpartisan think tank) released a new report calling on the U.S. to accelerate the procurement of commercial space technologies and manage growing congestion in low-Earth orbit. The group called out DoD in a similar report back in 2019 for not opening-up opportunities for emerging commercial space companies and was especially critical of the national security space launch program. “If the Space Force does not address the underlying issue of acquisition reform, America will lose its competitive edge in space,” said the study.

Space, the final frontier, needs to be controlled by a U.S. led enterprise to ensure security back on earth. Identifying areas that need improvement regarding R&D, public/private partnerships, and management of space assets/junk, as this think tank’s report covers, is an important part of the process.

Twitter: Twitter hears from record respondents over world leader rules - Reuters

The company has received nearly 49,000 responses globally in 14 languages over questions regarding how to handle behavior by public figures. Its month-long survey asked questions like whether world leaders breaking Twitter's rules should face "greater or lesser" consequences than other users and whether it was ever appropriate for Twitter to permanently suspend the account of a current president or prime minister.

The ability to spread misinformation on private platforms continues to be a hot topic. Many of these companies seem to want to defer the decision as they weigh the pros and cons to their bottom-line of having more attention-grabbing content, even if it harms the general public.

Electrification

Space Investing: Space industry in midst of transformation following record private and public investments – SpaceNews

Space investment is “reaching near-manic levels” as private equity and growing demand in public markets (some through SPACS) drove $5.7 billion in investments for the first quarter of 2021, a 356% increase from $1.2 billion in the same period last year. That is not an all-time high, the third quarter of 2020 reached $3.4 billion without any SPAC activity, but is still a notable height given that 2019 averaged around $934 million per quarter.

The article identifies the current general investment wave and activity in SPACs in various parts of the “space business”. The “New Space” economy is likely to see significant further investment growth and given the importance, it has on the growing digitalization and electrification of the world is worth watching closely.

ENREA – Environment / Natural Resources / and Energy Advisory

Australia: Why This Climate-Laggard Nation Still Attracts Investments - BBG

Australia is falling behind other developed nations when it comes to climate change. Australia is the world’s third-biggest per-capita emitter given its resource-based economy, and has only pledged to cut greenhouse gases by between 26% and 28% by 2030. Australia isn’t paying the price for being a climate laggard though as some of the world’s biggest investors continue to hold Australian debt even as they pledge to shift money away from countries and assets that don’t align with a low-carbon world.

One of the most important problems ESG investing will have moving forward is finding the right supply and demand balance without driving valuations up to unsustainable levels. There are only so many “green” financial assets and considerably more capital that now wants to invest in it. If investors are forced into an unacceptable risk/reward scenario then capital will not be allocated efficiently.

Chinese Natural Gas: Sinopec to Plow Cash Into Natural Gas as Climate Targets Loom - Caixin

Sinopec aims to set up a new gas subsidiary and increase its overall gas trading volume to 100 billion cubic meters by 2025, up from 44.5 billion cubic meters last year. Under pressure from Beijing to reduce planet-warming carbon dioxide emissions, Chinese energy firms are increasingly pivoting toward tried-and-tested natural gas as well as dabbling in renewable sources.

Natural gas resources are still a weakness in China’s energy portfolio which will likely prompt not only further domestic development/exploration but larger overseas ventures, often in places, others think too un-economical or dangerous to go. The recent evacuation of a $20 billion natural gas project in Mozambique due to threats from Islamic terrorists may prove to be a good example of a situation that may be too dangerous for western companies while not for Chinese ones.

Monetary Policy

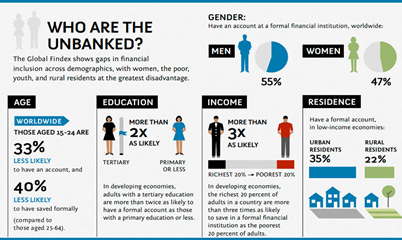

FinTech: Fed Weighs Handing Fintechs More Access to Its Payments System - BBG

The central bank invited the public to comment on proposed guidelines that would allow companies with “novel types of banking charters” to access accounts and services provided by the Fed, according to a statement Wednesday. Approval would give fintech access to one of the most efficient ways to send money in the U.S. For the Fed, it could also offer an easier way to move funds from government coffers to U.S. consumers, cutting out traditional banks in the process.

The Fed has been clear on its desire to directly access under-banked Americans (many of whom were identified during the crisis after being unreachable for pandemic aid). This has been a big push by several Fed members, especially Brainard. An increase in the abilities of non-traditional non-physical banking firms along with developments to allow 24/7 instant banking through Fedwire all increase the government’s ability to make direct payments and monitor the use of those payments to a larger percent of the population (think living wages).

CECL: With CECL in Force, Banks Remain Cautious on Loss Reserves – GARP

Banks ramped up loan-loss reserves at the onset of the pandemic because of the current expected credit losses (CECL) accounting standard that went into effect at the start of 2020. Although losses have been low so far, and the economy is improving as vaccinations accelerate, institutions remain cautious about releasing those reserves. Losses are still considered likely, and concerns about CECL’s methodology persist, limiting lending potential.

Worries persist that CECL presents a pro-cyclical risk, pushing banks to increase capital reserves when economic conditions make it most problematic. Flush with cash currently, commercial banks have been net buyers of Treasuries instead of lenders (for a number of reasons, not just CECL). Moving forward, as forbearance and deferment programs end, it will be worth watching where real credit losses end up and if CECL reserves can fall and be deployed through traditional banking activities.

Fiscal Policy

Trade Policy: US Trade Representative Katherine Tai says she expects to meet Chinese counterpart Liu He ‘in the near term’ - SCMP

USTRhead Tsai did not indicate a change in policy yet as she prepares to meet with her Chinese counterpart, Vice-Premier Liu He, “in the near term” for talks. “A lot of this is going to hinge on the conversations that we have with China, and our assessment of the effectiveness of the US-China trade and economic agreement,” she said.

The Biden administration is conducting a broad review of its trade policy with China as part of a larger assessment of the overall relationship with the country and is looking at whether Beijing has abided by the terms of the phase one trade agreement signed in January 2020. It is our view, and one the market seems reluctant to accept, that the relationship will continue to deteriorate and there will be no trade policy relief.

Eviction Moratorium: National Eviction Moratorium Thrown Out by Federal Judge – WSJ

A federal judge threw out a national eviction moratorium, saying the Covid-19 pandemic-relief measure exceeded the powers of the CDC. The decision is a blow to the Biden administration's plans to time the moratorium's expiration in June with the distribution of nearly $50 billion in rental assistance authorized by Congress. As of March, renters owed an estimated $52 billion collectively in back rent.

The appropriate level of Government reach during the pandemic will be debated for a long time moving forward. It should be seen as a positive that the checks and balances the three branches of government provide for each other are still very much functioning.

Primary dealers anticipate Treasury will be overfinanced in upcoming fiscal years and may need to consider coupon cuts either later this year or early next year. Primary dealers added that potential legislation associated with the American Jobs Plan and the American Families Plan introduced uncertainty to their financing outlooks. Treasury is expected to continue to gradually increase auction sizes over the calendar year and suggested that Treasury consider the higher-end of the previously announced $10-20 billion range of increases in TIPS gross issuance for CY2020 if demand remains robust.

TBAC minutes and chart-packs are some of the most underappreciated tidbits of government-produced market information. The quarterly refunding statement projects future federal financing needs. Expectations in the latest meeting show uncertainty over these needs due to the unknown ultimate size of the American Jobs Plan and other policy goals. Keep TBAC on your radar to get clarity on debt issuance.

China Macroprudential Policy

Middle Class: Shanghai’s dynamic art scene – Brookings

Among the many forces shaping China’s domestic transformation and its role on the world stage, none may prove more significant than the rapid emergence and explosive growth of the Chinese middle class. The increase in demand for art galleries and museums around the country is an interesting development given the CCP desire to repress outside thought and influence.

The middle class historically determines the legitimacy of political power in a nation. If the CCP wishes to remain in control it will need to compromise with the Chinese middle class on just how much authoritarian power and domestic/foreign exploitation it can enact moving forward. It will be the Chinese middle class that decides who controls China, not the CCP.

Defining National Security Assets in a Dual Use Environment

Semiconductors: US-China tech war: Beijing's secret chipmaking champions – Nikkie Asia

The equipment used to manufacture high-end computer chips is virtually an American global monopoly. 80% of the market in some chipmaking and design processes is in the hands of U.S. companies. It is a frustrating area of dependence for China, which imported $350 billion worth of semiconductors last year. Sanctions on Chinese chip makers spurred an aggressive effort by Beijing to identify and replace risky parts and suppliers. The result has been an unprecedented flourishing of chip-related companies within China.

The use of sanctions has a diminishing return. As the U.S. attempts to punish adversaries such as Russia, Iran, and now China, those countries become more self-sufficient. When future abuses warrant further retaliatory actions there are fewer tools to use. As a result, it is a tricky balancing act and may end up being counterproductive to our leadership in key areas as we force state subsidization of key industries.

Unipolar to Multipolar World

G7: U.S. Proposes G-7 Coordination to Counter China’s Might - BBG

Officials meeting on Tuesday spent some 90 minutes discussing ways in which China tries to get nations and individuals to do what it wants via the Belt and Road initiative or by leveling economic threats, according to a senior State Department official who spoke on condition of anonymity.

The biggest difference between the Trump and Biden administration in dealing with China is the more bilateral approach the current one is using. There are not many differences otherwise to the dismay of some market participants. Europe seems to be changing its stance on China significantly and given upcoming elections this new dynamic will be important to watch.

Europe and China Relations: European Union again drops plans for measures related to China’s Hong Kong actions – SCMP

For the second successive month, the EU drops plans for measures and statements related to Beijing’s tightening of control in Hong Kong, after failing to gain the endorsement of 27 member states. Twelve measures were laid out by the EU, including a “full review” of relations with Hong Kong and discussing with member states on the “implementation of their extradition treaties” with China. Others were coordinating the EU’s positions on Hong Kong with partners at the United Nations and Group of 7, scrutinizing the rule of law in the city and responding to extraterritorial application of the national security law against EU citizens.

China’s ability to influence Hungary’s vote is a good example of the dangers facing the EU and other multilateral organizations moving forward. China is more than happy to buy off or strong-arm other nations as it seeks to reset the global order and organizations that require super-majorities to dictate policy will be at the mercy of their weakest links.

Thank you for reading - Mike