MIDDAY MACRO - DAILY COLOR – 5/4/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities took a dip on geopolitical headlines after drifting sideways overnight, with selling intensifying after the open and key levels of support now broken

At the same time Treasuries are bid and were pushing up on April highs before comments from Yellen cooled buying there

Aggs rallied after the open but have given back some of their gains

WTI and copper, off morning highs, but moving higher

Price Action:

Significant risk-off tone in equities

S&P outperforming Russell/Nasdaq

Large-Cap Value and High, Dividend Yield factors outperforming

Energy, Materials, and Real Estate sectors outperforming

Gamma support now 4100 with resistance to 4200, 4130-40 new technical support

Major Asian indexes mixed: Japan closed. Hong Kong +0.9%. China closed. India -1%.

European bourses were higher, at midday: London +0.7%. Paris +0.5%. Frankfurt +0.3%.

Treasuries bull flattening

5yr = 0.80% and 10yr = 1.57%

April lows in yields were 5yr = 0.77, 10yr = 152%

WTI higher around 1.3% to $65.30, strong overnight rally

Copper flat, hanging in around all-time highs

Aggs opened notably higher but now giving back gains in some areas

DXY stronger overnight to around 91.25

Gold slightly higher to $1,795

Bitcoin lower by almost -5% to $55k

Vaccination Data:

Average daily rate, U.S. vaccinations: 2.29mln

Total US vaccinations: 247mln

Average daily rate, global vaccinations: 20.2mln

Total global vaccinations: 1.17 billion across 174 countries

The F.D.A. is set to authorize the Pfizer-BioNTech vaccine for those 12-15 years old by early next week.

Reaching Herd Immunity Is Unlikely in the U.S., Experts Now Believe - NYT

Analysis:

Equities broke well below their recent lows as the “sell in May and go away” didn’t wait long to strike.

The initial drop in stocks coincided with headlines that Chinese fighter jets were entering Taiwanese airspace, not something new or that warranted the type of price action it received.

More likely the “priced to perfection” view got shook and selling became self-fulfilling as key levels of support were broken as dealer hedging took hold.

Treasuries moved in line with the risk-off environment and are attempting to rise above April highs.

The absence of selling pressure in commodities shows the more longer-term fundamental stories and themes continue to support price action there.

Bottom Line:

It is getting harder to find anyone who is excited about equities which helps explain why today’s sell-off seemed to take on a life of its own without any real catalyst.

It no longer seems likely that there will be a final melt-up before the more seasonal sanguine summer months hit.

The market seems reluctant to acknowledge the higher level of earnings and economic growth expected for the second quarter with a view we are now entering the second stage of the recovery and the “free lunch” is over.

Any additional gains moving forward into the second quarter are simply losses for the second half.

Moving forward alpha will depend much more on the sector, factor, and risk selection.

“Two T’s” are driving equity sentiment: taxes and tapering, weighing on beta.

Still unlikely any pull-back will be sustained (over a -10% level) given how supportive financial conditions are.

It is more likely equities consolidate in a wider range as gamma and technical support/resistance levels widen.

The absence of selling pressure in the commodity complex shows the longer-term themes driving price action there have yet to materially change.

WORTH WATCHING

Econ Data:

Actual: -$74.4B, Previous: -$70.5B, Increase: +5.6%

MoM: Actual: 1.1%, Consensus: 1.3%, Previous: -0.5%

Events:

Fed Speakers: Kaplan, Kashkari, Daly

Total Vehicle Sales

API Inventories

TECHNICALS / CHARTS

WTI is slowly approaching its March high of around $68. Recent calls from sell-side research now have a growing number of year-end targets in the $70-80 level range. The chart itself is not very inspiring. After breaking out from the March-April bull flag correction, CL has stayed in a tighter up-trend channel. It is however now pushing up on resistance and will need to push through or risk becoming consolidated in an ascending wedge (with longer-term support as resistance), a bearish price action formation.

OFF THE RADAR

Vietnamese Equities:

Individual investors are piling into Vietnam stocks at an unprecedented pace, fueling Asia’s biggest rally and stoking speculation that foreign funds will return after fleeing the market over the past year.

The country’s benchmark VN Index soared 17% in the last three months.

Vietnam’s stocks have been climbing amid optimism its export-oriented economy can maintain momentum after being one of the few in Asia to expand last year.

Local investors have been driving the price action in anticipation of foreign flows picking up.

Plunging interest rates spurred ordinary Vietnamese to open nearly 400,000 new trading accounts in 2020, a record high.

Vietnam’s retail investors normally model much of their investment behavior around foreign investors when they look for which sectors to favor, according to SSI Securities JSC, the country’s second-largest brokerage.

Vietnam equity funds received record inflows in the third week of April even as emerging-market equity funds saw the biggest outflows since January, according to EPFR.

HOUSE THEMES / ARTICLES

ENREA – Environment / Natural Resources / and Energy Advisory

Coolant Out: EPA Proposes Rules to Curb Coolant Emissions From Air Conditioners and Refrigerators - WSJ

The proposal would create a process for reducing the use of hydrofluorocarbons in cooling appliances, the first step toward meeting new mandates to cut their supply by 85% over 15 years, the EPA said.

The effort has bipartisan support and backing from the industry.

The Air-Conditioning, Heating and Refrigeration Institute, a trade group for equipment manufacturers, has said U.S. companies have spent billions of dollars developing alternative chemicals to sell globally, which would get a boost if the U.S. joins international efforts to eliminate hydrofluorocarbons, known as HFCs.

Coal Power: Tennessee Valley Authority plans to shut coal plants by 2035 - Reuters

A TVA official confirmed on Monday that it plans to shut by 2035 the remaining four coal plants: the Shawnee plant, in Kentucky, and the Cumberland, Gallatin, and Kingston plants in Tennessee.

"These assets will all have reached the end of their life cycle by then," said Scott Brooks, a TVA spokesman. The plants have a combined capacity of more than 6,000 megawatts.

Monetary Policy

Community Development: Community Development Speech by Chair Powell

“Long-standing racial disparities in unemployment were narrowing, and many who had struggled for years were finding jobs. It was not until the later years of that expansion that its benefits had started to reach those on the margins.”

“Our upcoming SHED report notes that 22 percent of parents were either not working or working less because of disruptions to childcare or in-person schooling. Black and Hispanic mothers—36 percent and 30 percent, respectively—were disproportionately affected.

In a similar vein, labor force participation declined around 4 percentage points for Black and Hispanic women compared to 1.6 percentage points for white women and about 2 percentage points for men overall.”

Speech emphasizes that theFed will look at employment recovery by region, urban vs. rural, educational levels, and of course in minority groups and by gender to determine when the economy is at “maximum” employment.

Fiscal Policy

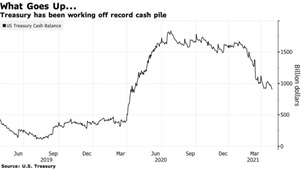

Debt Issuance: Treasury Quadruples Borrowing Estimates to Pay for Stimulus - BBG

The U.S. Treasury more than quadrupled its borrowing estimate for the quarter through June and expects to need some $1.3 trillion over the second half of the fiscal year to help pay for a raft of fresh pandemic relief spending.

Among the Treasury’s projections:

$463 billion in borrowing April through June.

$800 billion for the cash balance at the end of June to $800 billion.

That’s $300 billion more than previously seen.

$821 billion in borrowing for the three months through September.

$750 billion for the cash balance at the end of September.

Treasury said it assumed a cash balance of $450 billion at the end of the current debt-limit suspension period on July 31.

Officials built an assumption of an increase or suspension of the ceiling into their outlook for $750 billion in cash for the end of September.

Student Loans: Is the U.S. Student Loan Program Facing a $500 Billion Hole? One Banker Thinks So. – WSJ

According to a report produced by Jeff Courtney, a former JPMorgan exec, over three decades, Congress, various administrations and federal watchdogs had systematically made the student loan program look profitable when in fact defaults were becoming more likely.

The federal budget assumes the government will recover 96 cents of every dollar borrowers default on.

They told him that when borrowers default, the government often puts them into new loans. These pay off the old loans, and this is considered a recovery, even though in many cases the borrowers haven’t repaid anything and default on the new loans as well.

In reality, the government is likely to recover just 51% to 63% of defaulted amounts, according to Mr. Courtney’s forecast in a 144-page report of his findings.

New New Deal: Biden’s Great Economic Rebalancing – New Yorker

According to some commentators, President Joe Biden is turning out to be a quiet revolutionary. – BROAD article in the New Yorker on Biden and his fiscal policy plans.

The estimated price tag for Biden’s two policy initiatives is $4.1 trillion—$2.3 trillion for the American Jobs Plan and $1.8 trillion for the American Families Plan.

In 2017, according to the Congressional Budget Office, federal, state, and local governments spent about 2.3% of gross domestic production highways, mass transit, aviation, and water infrastructure.

That was the lowest level in decades.

Federal spending has also fallen short in supporting scientific research and innovation.

Biden is proposing to devote another hundred and eighty billion dollars to this area.

Infrastructure

Solar: Biden administration approves massive solar energy project in California – Axios

The Interior Department announced Monday that it has approved a massive solar energy project on California's public lands.

The $550 million project built on over 2,000 acres will produce enough energy to power nearly 90,000 homes.

Unclear where the panels will be made as imports from western China, a large/cheap producer, would put price concerns over human rights ones for the administration.

Commodity Cycle

Iranian Oil: Iran sees 2.5mn b/d oil exports post-sanctions - Argus

Iran could raise its oil exports to 2.5mn b/d once US sanctions are lifted, vice-president Eshaq Jahangiri said, as talks in Vienna over both a return by the US to the 2015 nuclear deal and a lifting of sanctions on Tehran progress.

Iran's crude oil output dropped to multi-decade lows of below 2mn b/d mark following Washington's withdrawal from the Iran nuclear deal in mid-2018, with exports limited to at or around 500,000 b/d.

But Iran's production has staged something of a limited recovery since December, reaching 2.22mn b/d in March, according to Argus estimates.

Copper in China: Copper’s Surge Toward a Record High Is Hitting Chinese Industry - Caixin

Some Chinese manufacturers of electric wire have idled units and delayed deliveries or even defaulted on bank loans, according to a survey by the Shanghai Metals Market due to rising copper prices.

End-users such as power grids and property developers have also been pushing back delivery times, while producers of copper rods and pipes saw orders slump this week, said the researcher.

In a sign of potential future weakness in Chinese physical demand, the spot contract traded at a discount of as much as 215 yuan ($33) a ton to Shanghai futures’ prices this week, the widest in about 10 months.

China Macroprudential Policy

Regulators: China Beefs Up Antimonopoly Body Amid Regulatory Push – WSJ

Dong Hongxia will take on a new role as a third deputy director-general of the Antimonopoly Bureau, part of the powerful State Administration for Market Regulation, according to people familiar with the matter.

Ms. Dong, currently director of a division responsible for reviewing mergers, is an expert on antitrust issues and a frequent speaker at seminars and events.

The appointment, expected to take effect in the coming months, would mark the first time that the bureau has three deputy director-generals at once—a reflection of the agency’s growing clout, the people said.

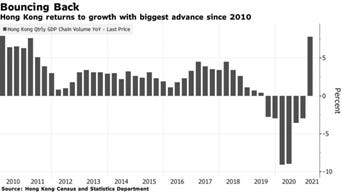

Hong Kong: Hong Kong’s Growth Surge Masks Uneven Recovery, Vaccine Risk - BBG

Hong Kong’s economy posted its fastest growth in more than a decade in the first quarter, though the recovery is an uneven one led mainly by exports and held back by weak consumer spending and a slow vaccine rollout.

Although retail sales by value gained in February for the first time since 2019, the growth rate unexpectedly slowed to 20.1% in March, according to government data released Tuesday, much lower than the 34% projected by economists.

Rental Market: Chinese pipeline of rental homes worth US$77 billion could create huge property asset management opportunities, firm says – SCMP

China is expected to build rental homes worth 500 billion yuan (US$77.2 billion) over the next five years, which could create massive opportunities in property asset management for the country’s leading developers.

If reforms to Hukou system can legitimize workers’ rights to housing further, either through renting or buying, then excess inventory can begin to be worked down and leverage and debt quality concerns can improve.

The real-estate sector can begin to be a driver of growth again, not an area of concern.

Unipolar to Multipolar World

Artic Activity: A more accessible Arctic becomes proving ground for US-China military jockeying - SCMP

Some 10,000 uniformed service members from the Army, Navy, Air Force, and Marines will participate in the Northern Edge training exercise aimed at countering China, Russia, and other potential adversaries that threaten the Arctic frontier and the broader Indo-Pacific region.

This comes as Beijing becomes an increasingly active great power competitor as global warming makes resources more accessible, opens new shipping lanes, and spurs military jockeying.

A big wake-up call for Arctic nations Canada, Norway, Iceland, Denmark, Sweden, Finland, the US, and Russia came in 2018 when China declared itself a “near-Arctic power” despite its location some 930 miles away.

Even as China refers to the Arctic as a “global commons”, internal documents suggest a more strategic outlook, analysts said, as Chinese scholars posit that controlling the region would afford Beijing a “three continents and two oceans’ geographical advantage” over the Northern Hemisphere.

In March, Beijing pledged to add a “Polar Silk Road” to its signature global infrastructure Belt and Road Initiative.

Philippine and China Relations: Duterte Says China a Benefactor, Denounces ‘Rude’ Remarks - BBG

Philippine President Rodrigo Duterte said China remains a benefactor, as the Southeast Asian nation seeks to increase vaccine delivery from the mainland amid brewing tensions in disputed waters.

Duterte made the comment hours after Philippine Foreign Affairs Secretary Teodoro Locsin, in a Twitter post, lashed at Beijing in an expletive-laced demand for China to remove ships from areas in the disputed South China Sea.

Locsin on Tuesday apologized to China’s Foreign Minister Wang Yi “for hurting his feelings.”