MIDDAY MACRO - DAILY COLOR – 5/3/2021

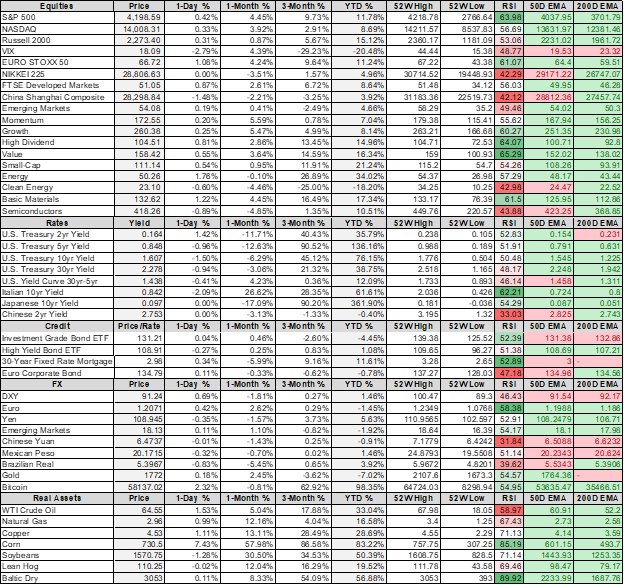

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities are off overnight highs post open as ISM Manufacturing came in weaker than expected

Treasuries got a bid pre-open but are now giving back AM gains

As yields fell, gold and silver also rallied, now pushing on recent highs

WTI and copper are also higher as commodities more general are bid higher

Price Action:

Mixed risk tone to equities

Russell outperforming S&P/Nasdaq

Small-cap and High Dividend Yield factors outperforming

Energy, Materials, and Healthcare sectors outperforming

Gamma support remains at 4175 and resistance at 4250, 4170 technical support

Major Asian indexes lower: Japan closed. Hong Kong -1.4%. China closed. India -0.1%.

European bourses higher, at midday: London closed. Paris flat. Frankfurt +0.3%.

Treasuries higher after open

5yr = 0.83% and 10yr = 1.60%

WTI higher around 1.5% to $64.60, strong NY AM rally

Copper rallying around 1% to new highs after a pulling back overnight

Aggs are pulling back from overnight highs notably

DXY higher overnight but accelerating post AM data, approaching 91

Gold up around 1.5% to $1,790

Bitcoin higher by 1.5% to $58.2k

Vaccination Data:

Average daily rate, U.S. vaccinations: 2.42mln

Total US vaccinations: 246mln

Average daily rate, global vaccinations: 21.1mln

Total global vaccinations: 1.16 billion across 174 countries

Analysis:

Equities continue to stay range-bound as another week of earnings and data will battle to convince markets whether valuations are fair.

Rates are giving back AM gains as rises in oil and other commodities as well as cost increases more apparent in today’s ISM and PMI data prints are making a case for yields to rise.

Bottom Line:

Slightly weaker data today with stronger inflationary pulses, bringing back into focus the key question of whether the current earnings outlook is too optimistic (given the coming margin pressures most firms will experience in the second half of the year).

We will continue to stay rangebound across equities and rates until a more concrete catalyst or consensus emerges.

Commodities look to be the clear winner in the current environment (over the last week or two) with “electrification” and “food security themes” continuing to work well.

WORTH WATCHING

Econ Data:

Actual: 60.5, Consensus: 60.6, Previous: 59.1

Actual: 0.2%, Consensus: 1.9%, Previous: -0.6%

Headline: Actual: 60.7, Consensus: 65, Previous: 64.7

New Orders: Actual: 64.3, Previous: 68

Prices: Actual 89.6, Previous: 85.6

Events:

Fed Speakers: Williams

Total Vehicle Sales

TECHNICALS / CHARTS

Copper is approaching its long-term upper channel’s resistance, at around $4.70 for the HG futures contract. It’s been in a tighter rising channel since mid-April, which has held nicely. Daily RSI is beginning to enter into overbought territory. It seems likely we push higher to the longer-term channel’s resistance level and then consolidates in a similar fashion to the March-April period, where prices pulled back 12%, but likely to a lesser extent given where mid-channel support lies.

OFF THE RADAR

Dressing Up Again, but More Casual:

Foot traffic to apparel stores has rebounded almost to pre-pandemic levels.

Visits were down 3.4% in the week beginning April 5, compared with the same week in 2019.

“The fact that sales came back so strongly, so quickly before offices reopened speaks to the need for people to dress up as they get out there and socialize,” said Michael Stitt, Haggar’s chief executive officer.

At Saks Fifth Avenue, sales of dresses, blouses, and sandals are exceeding levels not seen since spring 2019.

Other chains, including American Eagle Outfitters Inc. and The Buckle Inc., have also reported a return to pre-pandemic sales levels, and more retailers are expected to follow as they report earnings in coming weeks, according to UBS Group AG analyst Jay Sole.

Skewed Savings:

Households in wealthy countries have amassed an unprecedented pile of savings but it is unclear how much they will spend as the economy re-opens.

But the buildup in savings hasn’t been evenly spread.

Federal Reserve figures suggest that in the U.S., much of the accumulation has been in the bank accounts of the richest fifth of the population.

Of the $2 trillion increase in checking deposits between the final three months of 2019—the last quarter before the pandemic struck—and the final three months of 2020, roughly a third were accumulated by the richest 1% of households.

The buildup in U.S. savings also appears to have been skewed across age distribution.

People between ages 55 and 65 increased their checking deposits by $614 billion, while those 70 and over increased their holdings by $664 billion.

But for all adults under 40, the increase was a much more modest $245 billion.

Older and richer people tend to spend less and save more as a percentage of income, and the reverse is true for younger and poorer people.

If that pattern holds this year, a large chunk of the pandemic savings pool won’t be spent quickly.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

State Privacy Bills: States Push Internet Privacy Rules in Lieu of Federal Standards - WSJ

Consumer privacy legislation in Florida died Friday, the last day of this year’s legislative session.

The state Senate and House failed to reconcile competing bills that took different approaches to provisions such as whether individual residents could sue companies for misusing their personal information.

The so-called private right of action has emerged as the key issue for many state lawmakers attempting to write new internet privacy rules in lieu of a federal standard.

Many businesses have warned of a patchwork of privacy laws since California passed its landmark statute in 2018 and as elected officials in Washington, D.C. have clashed over a federal baseline.

Responding to divergent approaches could be complex for e-commerce.

ENREA – Environment / Natural Resources / and Energy Advisory

Chinese SOE Oil: China’s CNPC creates company for low-carbon initiatives - Argus

Chinese state-owned oil and gas producer CNPC has set up a firm targeting to expand its low-carbon business activities to support the country's peak emissions and carbon neutrality targets.

The new firm will take the role of industry investment, focusing on low-carbon business and other strategic emerging innovations, with an estimated registered capital of 10bn yuan ($1.55bn).

The natural gas sector is a key part of CNPC and PetroChina's efforts to achieve low-carbon development, targeting to raise their natural gas output to a 55pc share of the total production mix by 2025.

CNPC aims to achieve peak emissions by 2025 and net-zero emissions by 2050.

China Macroprudential Policy

Politburo: China’s Politburo targets economic risks to ensure post-pandemic recovery - SCMP

The Chinese political leadership has called for the country to double down on tackling its economic weaknesses, including uneven growth, deep-seated financial risks and technological challenges, to ensure that the post-coronavirus recovery continues.

Further regulation of internet platform firms, a continued crackdown on property speculation, more local responsibility for reducing financial risks and protection for the nation’s limited arable land were some of the key areas discussed at the meeting on Friday of the 25-member Politburo, the government’s main decision-making body headed by President Xi Jinping.

Growth: China Manufacturing Expansion Picks Up Speed, Caixin PMI Shows – Caixin

China’s manufacturing sector expanded at the fastest pace in four months in April, driven by rapid growth in new orders and new job creation, a Caixin-sponsored survey showed.

China’s GDP grew 18.3% year-on-year in the first quarter of 2021 on a low comparison base, accelerating from 6.5% growth in the previous quarter.

“Manufacturing demand and supply expanded significantly in April,” said Wang Zhe, a senior economist at Caixin Insight Group.

“Overseas demand remained solid and the job market recovered. Manufacturing growth remained strong as the post-epidemic economic recovery kept its momentum.”

The breakdown of the April PMI showed that total new orders rose at the quickest clip this year, supported by a further increase in new export orders. Manufacturing enterprises attributed the increase in the total to improved market conditions and greater customer demand.

Fiscal Policy

Real-Estate Capital Gains: Biden Proposal Would Close Longtime Real-Estate Tax Loophole - WSJ

The current law allows investors to defer paying tax on real-estate gains if they reinvest the proceeds in other properties within six months of the sale.

The deals are known as 1031 exchanges, named for the section in the U.S. tax code.

The Biden proposal would abolish 1031 exchanges on real-estate profits of more than $500,000.

A U.S. congressional tax committee estimated that the 1031 tax break would save property investors more than $41 billion between 2020 and 2024

Infrastructure

Bipartisan?: Biden Open to Options on Spending as Congress Takes Over - BBG

While the “American Families Plan” that twins social spending with individual tax hikes is a non-starter for Republicans, parts of the infrastructure-focused “American Jobs Plan” have been embraced by the GOP.

Biden’s staff has held over 415 phone calls or meetings with lawmakers, chiefs of staff and staff directors on Capitol Hill regarding the American Jobs Plan.

They’ve hosted one meeting just for Republican lawmakers, and have done at least 24 briefings for both Democratic and Republican staff, according to a White House official.

Biden is deeply involved in the legislative strategy and is wooing lawmakers directly.

Aides who’ve worked with Biden highlight his attention to individual legislators’ personal politics and what motivates them.

Saudi Arabia’s Neom: Saudi Crown Prince’s Vision for Neom, a Desert City-State, Tests His Builders – WSJ

Neom has been mired in delays and hit by an exodus of employees who are straining under the weight of the prince’s ambitious vision.

Some Neom employees and Saudi officials say they are skeptical the plans are feasible.

The kingdom’s sovereign-wealth fund and finance ministry already have plowed more than $1 billion into initial infrastructure, master plans, consultants and employee wages—cash that some Saudi officials say they believe could have been put to better use elsewhere.

Total investment inflows to Saudi Arabia were about $5.4 billion last year, up almost a billion dollars over 2019, despite the pandemic, but lower than the $16 billion a year a decade ago.

Commodity Cycle

One Direction: The Price of the Stuff That Makes Everything Is Surging - BBG

From steel and copper to corn and lumber, commodities started 2021 with a bang, surging to levels not seen for years.

“The most important drivers supporting commodity prices are the global economic recovery and acceleration in the reopening phase,” said Giovanni Staunovo, commodity analyst at UBS Group AG.

Broad article on various parts of the commodity complex.

Mining Profits: Record Metals Prices Catapult Mining Profits Beyond Big Oil - BBG

In the corporate world, the top five iron ore mining companies are on track to deliver bottom-line profits of $65 billion combined this year, according to estimates compiled by Bloomberg.

That’s about 13% more than the five biggest international oil producers, flipping a decades-old hierarchy.

Iron ore is in a dream scenario: demand, especially from China, is rampant, while supply is constrained.

China, which accounts for about half of global steel production, is making a record amount of the metal, while industrial output is surging across the rest of the world as huge stimulus packages fuel a recovery from the pandemic.

At the same time, producers are struggling to keep mines running at full capacity.

Wheat: Canadian, Australian wheat output to fall from records - Argus

Wheat output in Canada and Australia is anticipated to fall from near-record levels of 2020-21 next year, as a return of drier conditions in both countries is expected to weigh on yields.

Logistical Bottlenecks

Trucking: Truckers Expect U.S. Transport Capacity Crunch to Persist – WSJ

Freight industry executives expect a squeeze on trucking capacity that has been driving up shipping costs for U.S. companies to persist through the rest of the year, as strong demand in a rebounding American economy collides with a shortfall in truck availability.

“There’s more freight than trucks, or maybe I should say, than drivers,” David Menzel, chief operating officer at freight broker Echo Global Logistics Inc., said in an earnings call Wednesday.

Semiconductors: TSMC says can catch up with auto chip demand by end June – Reuters

Speaking to CBS' 60 Minutes in comments broadcast on Sunday, TSMC Chairman Mark Liu said they first heard about the shortages in December and the following month began trying to squeeze out as many chips as possible for automakers.

"Today, we think we are two months ahead, that we can catch up the minimum requirement of our customers, before the end of June," he said.

Container Rates: A Summer of Sold-Out Ships Awaits as Sea Cargo Chaos Intensifies - BBG

After peaking in late 2020 and not budging much through the first quarter, the rate for a 40-foot container to Los Angeles from Shanghai hit $4,403 last week, the highest in Drewry World Container Index data going back to 2011.

Cargo shippers on less-traveled transatlantic routes are feeling the sting, too: Rotterdam to New York surged to a record $3,500.

Last year the spike in seaborne freight rates was initially viewed as a short-term reaction to a historic demand shock in the early stages of the pandemic.

Now, it appears that sustained high rates and stretched capacity may extend into a second year as the world’s economic recovery gathers steam.

Big Tech Regulation/Taxation

Epic Apple: Apple and ‘Fortnite’ Maker Epic Games to Square Off in Court - WSJ

Epic Games Inc. sued both Apple and Alphabet in August after the companies removed “Fortnite” from their mobile app stores.

Epic, a closely held company valued at nearly $29 billion as of last month, has asserted that Apple charges exorbitant fees to mobile software developers and runs the App Store in a way that stifles smaller businesses and prohibits fair competition.

Apple has said that Epic’s actions were a breach of contract and that the game company has engaged in a smear campaign.

Antitrust cases can be difficult for plaintiffs to win, legal experts say, and Epic’s lawsuit may hinge upon the court’s definition of a market in the digital age.

Epic says Apple is a monopoly in its App Store, while Apple says it is just one of many distribution channels in the larger market for videogames and other software.

Defining National Security Assets in a Dual Use Environment

EU and China Relations: EU Lists Dozens of Weak Points Where Industry’s Hostage to China - BBG

The EU is “highly dependent” on some 137 products -- 6% of its total imports by value -- mainly raw materials and chemicals used by energy-intensive industries but also including active pharmaceutical ingredients and other healthcare products, according to the paper seen by Bloomberg.

The analysis highlights in particular the EU’s tightrope relationship with China as it tries to keep global trade flowing while also protecting European companies against “unfair practices and foreign subsidies.”

The European Commission, the bloc’s executive arm, will next week propose new rules to levy fines and block deals to prevent companies owned by foreign states from buying European companies.

Unipolar to Multipolar World

Blinken on China: Secretary of State Antony Blinken on the threat posed by China – 60-Minutes

“It is the one country in the world that has the military, economic, diplomatic capacity to undermine or challenge the rules-based order that we-- we care so much about and are determined to defend. But I want to be very clear about something. And this is important. Our purpose is not to contain China, to hold it back, to keep it down. It is to uphold this rules-based order that China is posing a challenge to. Anyone who poses a challenge to that order, we're going to stand up and-- and defend it.” – Blinken

Australia and China Relations: Australia reviews Darwin Port lease to Chinese firm: media – Nikkei Asia

Defense officials are looking into whether the Landbridge Group, which is owned by Chinese billionaire Ye Cheng, should be forced to give up its ownership of Darwin Port on national security grounds.

Australia overhauled its foreign investment laws late last year, giving the government the retrospective power to impose new conditions or even force a divestment on deals that have already been approved.

The government has so far canceled four deals using the new law, two of which were Belt and Road initiatives struck by Victoria state with the Chinese government.

The other two deals were education agreements with Syria and Iran, also with Victoria state.

New Zealand and China Relations: New Zealand’s Ardern says differences with China becoming harder to reconcile - Reuters

Differences between New Zealand and its top trading partner China are becoming harder to reconcile as Beijing’s role in the world grows and changes, Prime Minister Jacinda Ardern said on Monday.

In a speech at the China Business Summit in Auckland, Ardern said there are things on which China and New Zealand "do not, cannot, and will not agree", but added these differences need not define their relationship.

The comments do not change New Zealand's overall shift to a more China-friendly, or at least a more neutral position than other western counterparts.

Ardern and Mahuta are selling the new stance as New Zealand advancing an ‘independent foreign policy that is not loyal to any major bloc.

India and EU Relations: EU and India set to revive talks on trade deal - FT

The EU and India plan to revive long-stalled talks on a comprehensive trade deal as they seek to deepen economic ties and respond to China’s rise.

The two sides could announce as soon as Saturday the relaunch of negotiations that were suspended in 2013 amid disagreements over tariff rules for car parts and free-movement rights for professionals.