MIDDAY MACRO - DAILY COLOR – 5/28/2021

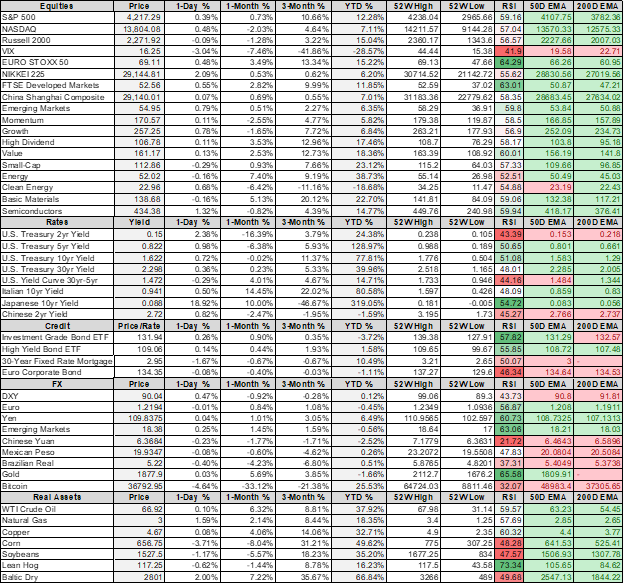

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities are mixed, with S&P and Nasdaq higher while Russell is under pressure

Treasuries higher following PCE data that was in line with expectation

WTI is flat, off of overnight highs on little new news

Price Action:

Nasdaq is benefiting from falling yields post-NY-data

Nasdaq outperforming S&P/Russell

Low Volatility and Growth factors outperforming

Industrials, Technology, and Real Estate sectors outperforming

Gamma gravity at 4200, Call Wall is at 4250, technical levels remain the same with support at 4180 while resistance is 4220

Major Asian indexes are mixed: Japan +2.1%. Hong Kong +0.1%. China -0.2%. India +0.7%.

European bourses are higher, at midday: London +0.1%. Paris +0.5%. Frankfurt +0.4%.

Treasuries higher with the curve bull steepening

5yr = 0.80%,10yr = 1.59%, 30yr = 2.27%

WTI flat at $66.90

Thirty-four million Americans are expected to take to the roads this holiday weekend in the US, facing gasoline prices at around $3.04/ gallon on average, the highest since 2014.

Copper flat, after rallying back from overnight lows at NY open to $4.66

Copper 3% rally yesterday was helped by a few factors; more positive U.S. infrastructure news, a strike by remote workers at BHP’s Escondida and Spence facility in Chile, and continued worries about Peruvian elections and a Chilean tax bill.

Aggs weaker with some consolidation occurring after yesterday’s gains

DXY slightly higher to 90.1 but giving back post data gains

Gold flat to $1895

Bitcoin lower by -5% to $36.7

Econ Data:

Personal Spending and PCE Prices: Personal income fell -13.1% in April as fiscal stimulus benefits dropped -41.6%. Wage and salaries rose 1% on the month and 8.8% at an annual rate over the last three months. The personal saving rate declined to 14.9% in April from 27.7% in March. Headline PCE prices rose 0.6%, while core PCE prices surged 0.7% MoM. Year-over-year core inflation jumped to 3.1% from 1.9%, and core prices are up 4.3% at an annual rate over the last three months.

It is important to highlight that these sizeable increases in PCE are not mainly due to base effects.

Univ. of Michigan Consumer Survey: Index of Consumer sentiment fell to 82.9 in May from 88.3 in April. The Current Economic Conditions and Consumer Expectations Indexes also fell. Record proportions of consumers reported higher prices across a wide range of discretionary purchases, including homes, vehicles, and household durables. The average change in May vastly exceeds all prior monthly changes.

As already being reported in parts of the housing market, rising prices are beginning to deter consumer activity and reduce confidence.

Analysis:

Equities are chopping around today in a tight range as this morning's data failed to provide a catalyst meaningfully lower or higher, instead mainly driving Treasuries to reverse yesterday’s weakness.

It has been a light volume week across assets, and Treasuries have been well anchored within their recent range.

This week's data reinforced our view that we are in a highly inflationary environment that will likely persist throughout the year.

The data received this week further emboldens our “sticky” inflationary view and continued concerns for growth due to production impairments:

Regional Fed Survey:

Richmond Fed Manufacturing: Record high Prices Paid, significant rises in Prices Received, and record Vendor Lead Time, confirming logistical bottlenecks are not easing.

Kansas Fed Manufacturing: Prices Paid and Prices Received hit new record highs for the second straight month.

Chicago PMI: Supplier deliveries rose to a 47-year high in May, with supply chain constraints remaining a severe problem. Prices paid fell from April’s 41-year high, however, respondents reported prices for commodities, such as steel, plastics, copper, or electronic components rose further.

Housing Prices: The Case-Shiller Index rose 13.2%, beating expectations.

Home-price growth is likely to remain in double digits over the coming quarter,” said Selma Hepp, economist for CoreLogic.

Durable Goods: Shortages of materials and delivery bottlenecks drove unfilled orders for durable goods to rise for a second month.

Consumer Confidence: Future expectations are cooling while a measure of inflation expectations for the next year rose.

University Michigan Survey: Median inflation expectations for the next year rose to 4.6%, with a record proportion of consumers reported higher prices across a wide range of goods

PCE: Core PCE prices and Wages are up 4.3% and 8.8%, respectively, at an annual rate over the last three months.

These increases in inflationary pressures and continued supply chain and production impairments continue to be due to:

Record levels of global monetary stimulus supporting financial and real asset price levels.

A historic level of U.S. fiscal stimulus transfer payments:

This created high levels of excess savings and increased aggregate consumer demand while also reducing labor availability.

There is now a higher level of revolving credit available for lower and middle-income consumers who paid down credit card balances, often with stimulus checks.

A global reopening that is unleashing pent-up consumer demand in a coordinated herd-like manner.

Consumer behavior has become increasingly synchronized as lock-downs and reopening’s created a coordinated demand cycle for the same goods and services simultaneously.

Accelerating wage growth has begun in earnest, increasing costs across most industries.

Accelerating rents and continued home price appreciation occurs as urban rent levels catch up to past suburban OER increases.

Bottom Line: The reasons for higher inflation have yet to subside materially. As a result, it continues to be our belief the market's acceptance of the Fed’s mantra that this will be “transitory” is incorrect.

We believe that more structural inflationary pressures will increase over the year, and so-called transitory ones will remain sticky.

We also believe that the market’s pricing of this risk continues to be wrong in rates and equities.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth Outperforming on the Week

Chinese Iron Ore Future Price: Iron Ore Higher on the Week

5yr-30yr Treasury Spread: Curve is Flatter on te Week

EUR/JPY FX Cross: Euro Higher on the Week

HOUSE THEMES / ARTICLES

Digital Infrastructure Security and the “5th Dimension”

Facial Data: Legality of collecting faces online challenged - BBC

Clearview AI, a US firm with a database of three billion facial images from the internet, faces a new legal challenge from privacy campaigners. Under GDPR rules, European citizens can ask the company if their faces are in its database and request that their biometric data is no longer included in searches. Five such requests were submitted by privacy campaigners.

Clearview AI is no stranger to controversy and has faced a flurry of legal challenges. Clearview said that national governments had expressed "a dire need for our technology" to help investigate crimes such as money laundering and human trafficking. However, "Just because something is online does not mean it is fair game to be appropriated by others in any way which they want to - neither morally nor legally," said Alan Dahi, data protection lawyer at NOYB. Expect more legal action and social debate here as people demand more security and ownership over their digital presence.

Russian Hackers: Russian Hackers Resume U.S. Cyber Offensive, Microsoft Says- BBG

The Russian hackers behind the SolarWinds campaign have escalated their attacks on U.S. federal agencies. The Cybersecurity and Infrastructure Security Agency at the DHS posted news of the breach to its website and encouraged users to review Microsoft’s reporting and “apply the necessary mitigations.”

The U.S. government said last month that SolarWinds was the work of SVR, the Russian foreign intelligence service. According to British intelligence, SVR spent much of the previous year hacking foreign governments for vaccine research. Cyber-attacks will eventually lead to retaliatory physical attacks, but we are not there yet.

Commodity Super Cycle:

Grain Inventory: Global Grain Supply Crunch Is Set to Get Worse, IGC Says - BBG

The International Grains Council cut its inventory estimate for the 2021-22 season to 595 million tons, the lowest in seven years, according to a report published Thursday. Rising animal-feed demand and a drought-stricken Brazilian corn crop are outweighing bumper harvests elsewhere, shrinking the world’s grain supply cushion for a fifth straight season.

The United Nations food-price index is at its highest level since 2014. Chicago grain futures have recently cooled from a rampant rally, but prices remain near multi-year highs. Good growing conditions are needed across the U.S. and Europe in the coming months to replenish silos. Always important to recognize increasing food inflation as it is often the primary cause for social unrest.

Energy and Resource Transition

Green Hydrogen: China’s Sinopec plans first green hydrogen project - Argus

The project, which will use wind and solar to produce 10,000 t/yr of green hydrogen for Sinopec's Zhongtian Hechuang coal-to-chemicals project in Ordos. The project will help Sinopec achieve its target to become the number one hydrogen company in China by 2025.

Sinopec has also announced a goal to reach carbon neutrality by 2050, 10 years ahead of the national target. The company this year announced several partnerships as part of its clean energy strategy, including with Chinese auto producer Great Wall, new energy vehicle manufacturer Nio and solar manufacturer Longi Green Energy Technology. With China’s environmental efforts increasingly being used to leverage geopolitical relationships, it is worth highlighting Sinopec’s activities.

Production, Inventory, and Logistical Bottlenecks

Retail Goods: Retailers Race to Keep Kayaks and TVs in Stock - WSJ

Total U.S. spending at stores, restaurants, and online jumped 10.7% to about $620 billion in March from February 2021 and stayed at that level in April. That means Americans spent more than $100 billion extra each month compared with March and April 2019.

Purchasing teams are dealing with the leanest levels of inventory relative to sales on record, along with strains on supply chains from factories to ports to warehouses. They risk potentially losing out on sales as consumers have historic levels of money to spend. This article highlights the main risk we see to the second half of the year, which is constraints to supply and production will cap economic and earnings growth.

China Macroprudential Policy

SOE Reform: State-Owned Capital Manager to Set Up Funds for SOE Reform - Caixin

Beijing-backed investment giant China Reform Holdings plans to set up a series of funds totaling 70 billion yuan ($11 billion) that will invest in SOEs to help drive corporate reform. Set up by the State Council in 2010, China Reform manages funds with a combined value of more than 800 billion yuan. Its major businesses include fund investment, asset management, and outbound investment. Last year, its net income surged 58% to 16 billion yuan.

The process of reforming SOEs can take on many forms, including helping them go public to achieve “mixed ownership,” which usually describes that a state firm receives investment from private players. This isn’t the first time that China Reform has set up funds for SOE reform. In 2019, the company and its partners created a fund with a fundraising target of 60 billion yuan to invest in a group of SOEs. Important to keep watching any SOE reform efforts as they present a complicated challenge to growth and international trade negotiations.

National Security Assets in a Dual Use Environment

Semiconductors: U.S. chip funding could result in seven to 10 new factories -officials - Reuters

U.S. Commerce Secretary Gina Raimondo said at an event outside a Micron Technology chip factory that she anticipated the government funding would generate "$150 billion-plus" in investment in chip production and research, including contributions from state and federal governments and private-sector firms. The current Chips for America Act, includes $39 billion in production and R&D incentives and $10.5 billion to implement programs including the National Semiconductor Technology Center, National Advanced Packaging Manufacturing Program and other R&D programs.

Current chip shortages are forcing the U.S. government and the semiconductor industry to reprioritize domestic production quickly as it is not enough to just lead in innovation. The United States had a 37% share of semiconductors and microelectronics production in 1990; today just 12% of semiconductors are manufactured in the United States. This is a highly supported bipartisan issue that enforces our beliefs that critical production will be increasingly be re-shored through private-public sector endeavors.

Science: Senate Is Poised To Approve A Major Science Funding Bill To Compete With China - NPR

The 1,445-page act would appropriate $52 billion for America's microchip industry (as we’ve highlighted on Midday Macro yesterday), tens of billions more for scientific research, and an overhaul of the National Science Foundation, adding a technology directorate. "The U.S. Innovation and Competition Act will be one of the most significant pieces of bipartisan legislation we pass in a very long time," Schumer said in the Senate on Thursday.

The Innovation and Competition Act of 2021 is part of a wave of recent China-related proposals in Congress. Anna Ashton of the U.S.-China Business Council has been tracking proposals aimed at China and the perceived challenge it poses to America. She said the last Congress considered more than 500 of them and the current Congress, which started in January, is on track to blow past that record. The bipartisan cooperation to confront China increases the possibility that a larger infrastructure bill can get done across party lines. Investing in physical and social infrastructure will ultimately fall under national security needs.

Unipolar to Multipolar World

Held in Brussels, the meeting between US Deputy Secretary of State Wendy Sherman and Stefano Sannino, the head of the European External Action Service, marked the resumption of a high-level US-EU strategic dialogue on China that was announced in October during the Trump administration. Among the areas of shared concern, the officials addressed were “human rights violations in Xinjiang and Tibet, the erosion of autonomy and democratic processes in Hong Kong, economic coercion, disinformation campaigns, and regional security issues, in particular the situation in the South China Sea,” according to a joint statement.

While Wednesday’s official joint statement ran the gamut on Western democracies’ grievances with Beijing’s behavior both within and beyond its borders, it included no concrete policy declarations. There was also no mention of any coordinated action about Beijing’s hosting of the 2022 Winter Olympics.

Open Skies: U.S. Won’t Rejoin Open Skies Treaty With Russia - WSJ

The 1992 Open Skies treaty was intended to lower the risk of conflict by allowing the post-Soviet Russian state and Western nations to conduct unarmed reconnaissance flights over each other’s territory. Under President Trump the U.S. left the treaty, alleging that Moscow had violated the accord by limiting access for Western flights over Russia while using its own flights over the U.S. to gather sensitive information on American infrastructure.

Biden had campaigned he would rejoin the treaty but has since backtracked on that. With the U.S. decision not to rejoin Open Skies, only the Obama-era New Start nuclear weapons treaty remains in place to regulate strategic competition between the U.S. and Russia. Given increased cyber-attacks, an emboldened Belarus, imprisonment of political opposition, and continued fighting in Ukraine; the U.S. and Russian relationships are at lows going into a meeting between President Biden and Putin. Separately, Open Skies has become less critical given satellite technology, so this is also the end of a policy that is less relevant.

Artemis: South Korea signs Artemis Accords; Brazil, New Zealand likely next – Space News

South Korea signed the Artemis Accords on May 27, becoming the 10th signatory to the pact that governs norms of behavior for those who want to participate in the NASA-led Artemis lunar exploration program. On the same day, South Korea and the United States signed an agreement on “civil global navigation satellite systems cooperation,” under which the U.S. will support South Korea in developing its own satellite navigation system.

Ten countries have signed onto the Artemis Accords, with two more expected to join. Although this accord is specific to lunar exploration, it is important to highlight that space alliances and cooperation will likely become more common as a growing number of nations put assets in space.

Thank you for reading - Mike