MIDDAY MACRO - DAILY COLOR – 5/25/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities are lower after giving up overnight gains post-NY-open

Treasuries gaining post housing and consumer confidence data

WTI is consolidating after a multi-day rally

Price Action:

Equities were consolidating around key levels but now weaker on the session

S&P outperforming Nasdaq/Russell

Small-Cap, Momentum, and Growth factors outperforming

Consumer Discretionary, Industrials, and Communication sectors outperforming

Call Wall has shifter higher to 4250, technical support is at 4180 and resistance is 4220

Major Asian indexes are higher: Japan +0.7%. Hong Kong +1.8%. China +2.4%. India flat.

European bourses are higher, at midday: London flat. Paris +0.1%. Frankfurt +0.8%.

Treasuries higher with the curve bull flattening again as long-end continues to outperform

5yr = 0.79%,10yr = 1.58%, 30yr = 2.27%

WTI higher by 0.3% to $66.30

Copper lower at $4.52

Aggs under pressure again with corn heading to limit down

DXY slightly weaker to 89.7

Gold higher by 0.5% to $1895

Bitcoin lower by -6% to $37.8K

Econ Data:

Home Prices and New Home Sales: Home-price growth climbed in March to the highest level in more than 15 years, as strong demand continued to outweigh the housing supply. The Case-Shiller Index rose 13.2%, beating expectations of a 12.3% rise, up from a 12% annual rate the prior month. Sales of newly built homes fell -5.9% in April from March, worse than expected. “With demand in high gear and no respite in sight, home-price growth is likely to remain in double digits over the coming quarter,” said Selma Hepp, deputy chief economist for CoreLogic. Fast-rising home prices and the limited inventory are making homeownership less attainable for first-time buyers or those with limited budgets.

Consumer Confidence: U.S. consumer confidence fell slightly in May for the first time this year as Americans were less optimistic about future job and income prospects. While consumers’ outlook pulled back, the reading still hovered near pandemic-era highs. The group’s measure of economic expectations fell to 99.1, a three-month low, while a gauge of sentiment about current conditions rose to 144.3, a pandemic high. A measure of inflation expectations for the next year edged higher. Future expectations are cooling, and we look to be at peak optimism.

Policy Talk:

Chicago Fed President Evans: In a speech this morning Evans highlighted “the roles that resource pressures and inflation expectations might play in the path for inflation over the next few years.” He continues the Fed’s view that the current inflationary pressures are transitory; “it is important to emphasize that the recent increase in inflation does not appear to be the precursor of a persistent movement to undesirably high levels of inflation. I have not seen anything yet to persuade me to change my full support of our accommodative stance for monetary policy or our forward guidance about the path for policy.”

Analysis:

The positive correlation between bonds and equities continues today.

Equities look overextended tactically after a multi-day rally and are currently consolidating.

The S&P is being pulled towards 4200 due to the large gamma strike there.

Yesterday marked the lowest volume day of the year.

The Treasury curve continues to bull flatten, supporting financial conditions and the current outperformance of growth over value.

Although lower yields are supportive of equities, the flattening is indicative of lower growth expectations moving forward.

PCE data on Thursday will likely determine the direction of the next move in both equities and rates.

There would need to be a significant beat to rattle rate markets (and subsequently equities) given the parade of Fed speakers highlighting their belief that everything bad is transitory.

Today's data continues to support our view we are at peak growth outlook due to production/supply impairments increasingly causing the supply of goods and services to be unable to meet final demand.

Lack of inventory and high construction costs are impacting housing availability and affordability even with low financing costs.

Consumer confidence has likely peaked in the intermediate as future expectations fell while inflation concerns are rising.

This follows a separate survey published earlier this month by the University of Michigan that showed consumers expect a 4.6% increase in inflation over the next year, the highest reading in a decade.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth Outperforming on the Week

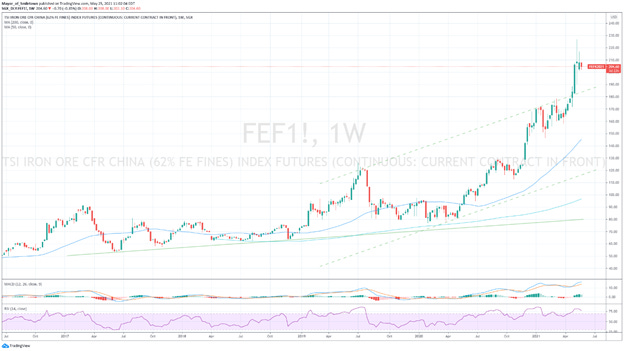

Chinese Iron Ore Future Price: Iron Ore Lower on the Week

5yr-30yr Treasury Spread: Curve is Flatter on the Week

EUR/JPY FX Cross: Euro Higher on the Week

HOUSE THEMES / ARTICLES

Digital Infrastructure Security and the “5th Dimension”

Banned Content: Russia gives Google 24 hours to delete banned content - Reuters

The watchdog, Roskomnadzor, said it had sent more than 26,000 calls to Google to remove illegal information, including videos containing information on drugs or violence and material from what it called extremist organizations. Roskomnadzor also accused Google of censorship for allegedly restricting YouTube access to Russian media outlets, including R.T. and Sputnik.

Navalny and his allies have used YouTube widely to air graft allegations against senior Russian officials and to organize their opposition activities. As seen even in America, political forces are spreading disinformation on the internet or trying to silence opposition with no end in sight.

Electrification & Digitalization

Quantum: Xanadu Lands $100 Million as Investments Pour Into Quantum Computing - WSJ

Xanadu is using particles of light, or photons, to represent qubits, which store data needed to make a calculation. A commercial-grade quantum computer has yet to be built, but companies such as Google and IBM have recently announced developments and set milestones for the technology in the next few years.

Last year, investors poured $557.5 million across 28 venture deals for quantum-computing companies based in the U.S. and Canada, according to PitchBook Data Inc. That was more than three times the $171.2 million reached in 2019, in nearly the same number of deals. This is the new nuclear arms race.

Energy and Resource Transition

Ammonia: Japan to back ammonia bunkering infrastructure building - Argus

Japan is considering providing support for the development of ammonia bunkering infrastructure as part of efforts to launch ammonia-fueled commercial ships by 2028 under Tokyo's roadmap to decarbonize by 2050. The transport ministry today proposed subsidizing the research and development (R&D) of hydrogen- and ammonia-fueled vessels using part of the government's ¥2 trillion ($18bn) green innovation fund earmarked to help achieve Japan's 2050 decarbonization goal.

The subsidy is expected to help enhance the international competitiveness of Japanese shipbuilders and ship equipment producers and promote the use of zero-emission vessels after 2030. Two main points to take away here. There will be competing technologies as we transition into a more carbon-neutral future. Governments will use their decarbonization goals to subsidize industry, which will be highly contentious at a WTO level.

Solar Costs: Solar Power's Decade of Falling Costs Is Thrown Into Reverse - Caixin

Solar module prices have risen 18% since the start of the year after falling by 90% over the previous decade. The reversal, fueled by a quadrupling in the cost of the key raw material polysilicon, threatens to delay projects and slow uptake of solar power. “The disruption to solar hasn’t been this bad in more than a decade,” said Jenny Chase, a lead solar analyst with clean energy research group BNEF.

Higher prices are affecting demand and may delay some large-scale projects. Longer-term, the shortages are spurring construction of new polysilicon factories, including an announcement this month of what would be the largest facility in the world in China. China is responsible for a large percentage of the world’s polysilicon production, much of which comes from Xinjiang. The U.S. and Western nations will need to increase production, likely needing government subsidization similar to what China did to grow its industry.

ESG Monetary Policy

United Front: Fiscal Multiplier at the Zero Bound: Evidence from Japan – FRBSF Economic Letters

Evidence from Japan suggests that, in a sustained zero-bound environment, an unexpected increase in government spending has much larger and more persistent effects on real GDP, and even more so when the economy is in a recession.

Any research connecting the monetary policy (maintaining rates at the ZLB) to the effectiveness of fiscal policy is worth highlighting. It is also interesting that Japan, which has failed to achieve its monetary goals (of increasing inflation) for multiple decades is used to study this relationship. The authors end by saying that evidence should be interpreted with caution and we agree.

Fiscal Policy Expansion

Climate: As hurricane season looms, Biden doubles funding to prepare for extreme weather – Washington Post

President Biden is allocating an additional $1B in funding to help U.S. communities prepare for extreme weather and allow NASA to collect better climate data. About 40% of the funding will go to disadvantaged areas most likely to be impacted by hurricanes and wildfires. The funding is double the amount previously allocated to FEMA's Building Resilient Infrastructure and Communities (BRIC) program.

“We’re going to spare no expense, no effort, to keep Americans safe and respond to crises when they arise. And they certainly will,” Biden said during an afternoon visit to the FEMA Headquarters. We believe the markets are still underestimating the degree that the Biden Administration will go to enact climate-related policies. Even with a larger infrastructure bill likely to include green initiatives, there will still be numerous executive orders and smaller actions that add up.

Global Tax: G7 is close to deal on taxation of world’s largest companies - FT

A G7 pact could be sealed as early as Friday after progress was made among top officials in recent days and would be a powerful force and prerequisite for a deal in the formal negotiations taking place at the OECD in Paris and directed by the wider G20.

An OECD agreement would lead to the largest shake-up in international corporate taxation for a century, severely curtailing the ability of companies to shift profits to low tax jurisdictions and ensuring that U.S. digital giants paid more tax in the countries where they made sales.

Commodity Cycle

Rodent Rage: Cannibal Mice Threaten Sydney Homes and Australian Farms - BBG

A mice plague is threatening Australia’s $51 billion agriculture industry, with some farmers are refraining from planting winter crops for fear of damage to freshly sown seeds and ripened grain. Farmers are actually just abandoning crops because they think “why am I going to plant this if it’s going to get eaten?”

The financial pain isn’t just confined to farms. Damage to machinery, storage vessels, homes, and the health of people have also been reported. The devastation could cost hundreds of millions of dollars and lost opportunity costs are hard to quantify.

Production, Inventory, and Logistical Bottlenecks

By Air: Air Cargo to Climb Into Mid-2022 Amid Shipping Delays, DHL Says - BBG

With thousands of passenger planes, which usually carry about half of the global air freight, still grounded, capacity constraints will continue to push up prices, according to Tim Scharwath, the chief executive officer of DHL Global Forwarding, Freight. Airfreight rates to North America from Hong Kong have risen as much as 24% this year after more than doubling in 2020.

Seafreight costs have surged, making air freight more competitive. The spot price for a 40-foot container to be shipped to Los Angeles from Shanghai has risen 34% this year, while rates for Shanghai-Rotterdam have surged 49%.

India Outsourcing: India’s Covid-19 Crisis Tests the World’s Back Offices – WSJ

India’s giant outsourcing firms face a two-front challenge: protecting the health of millions of employees as the nation suffers the world’s worst Covid-19 crisis and ensuring that their work continues as usual for the big Western companies on their client lists. Work capacity at Indian companies may have been down as much as 30% in recent weeks.

India’s I.T. and business-processing industry powers the back offices of corporate giants worldwide. It generates more than $180 billion in annual revenue and employs about 4.5 million people. It accounts for about one-fifth of India’s exports of goods and services. Another example of why companies will increasingly need to choose between supply chain security versus cost-efficiency moving forward.

Unipolar to Multipolar World

Phase One: China’s Progress on U.S. Trade Deal Promises Slows in April – BBG

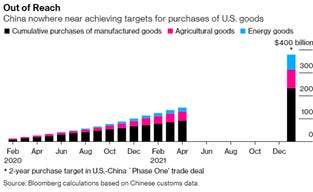

China bought $10.4 billion worth of manufactured, agricultural, and energy goods in April, taking the total in the 16 months since the trade deal was signed in January 2020 to $147 billion. That progress was at the slowest pace this year and reached 38.9% of the two-year target of $378 billion, compared to March’s 36.1%.

There’s no sign of when the two sides might next talk about the deal, although the U.S. side said it would meet with China to discuss it “soon”. There is unlikely to be a significant change in the Trade Deal given the Biden Administration has consistently kept up the pressure on China across multiple fronts.

JCPOA 2.0: Iran, IAEA agree on a one-month extension to monitoring deal - Argus

Iran has agreed to extend its nuclear monitoring deal with the IAEA by a month. The agreement, first struck in February, allows the agency's inspectors a degree of continued access to Iranian nuclear facilities giving some much-needed breathing room for talks to continue in Vienna over the U.S.' return to the 2015 Iran nuclear deal.

This should be seen as a positive sign for a deal completion occurring soon. The longer the negotiations carry on the more likely a geopolitical event might occur to derail them. Further, with Iranian elections approaching, an extension of more than a month would have left a critical domestic political issue in an unacceptable state of uncertainty.

Belarus чаму?: E.U. Leaders Agree on Broader Economic Sanctions - BBG

EU leaders tasked their ministers to ban overflight of E.U. airspace by Belarusian Airlines and prevent access to E.U. airports and avoid overflight of Belarus. Moreover, leaders vowed to add more Belarusian officials to an existing sanctions blacklist and adopt a broader set of punitive measures that would target companies and entire sectors of the country’s economy.

Extraordinary breach of international norms that will either embolden bad actors to now uses such tactics or will evoke such a punitive response that no individuals detainment would be worth it.

Thank you for reading - Mike