MIDDAY MACRO - DAILY COLOR – 5/20/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP & MARKET WRAP

Narratives:

Equities rallying as S&P is breakthrough key gamma and technical resistance levels

Treasuries bull flattening continues post FOMC

WTI under some pressure again as Iran headlines weigh on price

Price Action:

Equities continue to recover from their sell-off earlier in the week

Nasdaq outperforming S&P/Russell

Momentum, Growth, and Low Volatility factors outperforming

Technology, Communication, and Utilities sectors outperforming

Gamma remains negative for S&P under 4130, with 420 major call wall and 4100 support, technical support is at 4060 with resistance at 4130

Major Asian indexes mixed: Japan +0.2%. Hong Kong -0.7%. China -0.1%. India -0.7%.

European bourses higher, at midday: London flat. Paris +0.6%. Frankfurt +0.5%.

Treasuries curve is bull flattening

5yr = 0.83%,10yr = 1.64%, 30yr = 2.34%

A more hawkish FOMC Minutes, amplified by Bostic and Bullard calls to be “nimble” on policy, have the belly underperforming on policy tightening and future growth concerns

WTI lower by -1% to $62.7

Iran president says a broad outline to ending sanctions has been reached

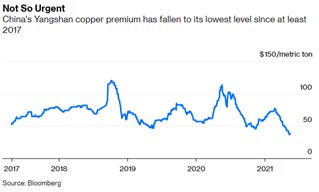

Copper lower -.3 % to $4.54

Demand is dropping as spot premiums over futures have dropped on the CME and in China while shortages in supply are also easing

Aggs mixed with corn outperforming (+1.6%)

DXY weaker to 89.8, giving up yesterdays gains

Gold flat to $1880

Bitcoin higher by 5% to $41k

Econ Data:

Philly Fed Manufacturing Survey: Headline Index was 31.5, coming in well below expectations of 43. The survey’s current indicators for general activity, new orders, and shipments declined from April’s readings. Additionally, employment increases were less widespread this month, while both price indexes reached long-term highs. The prices paid index hit its highest reading since March 1980. In this month’s special questions, the firms were asked to forecast the changes in the prices of their own products and for U.S. consumers over the next four quarters. Regarding their own prices, the firms’ median forecast was for an increase of 5%, an increase from 3% in February. The firms expect their employee compensation costs to rise 4% over the next year, an increase from 3% in the previous quarter. When asked about the rate of inflation for U.S. consumers over the next year, the firms’ median forecast was 4% percent, an increase from 3% in the previous quarter. These are large increases in inflation expectation over only one quarter.

Policy Talk:

Bullard: Expectations of a surge of job growth topping one million per month is “hyped up,” with a half-million jobs a month more realistic amid a potentially slow recovery of labor force participation, St. Louis Federal Reserve President James Bullard said on Wednesday. “I do think the labor market is tighter than is being represented” in part because some of the workers who left jobs at the onset of the pandemic are likely gone from the labor force for good, Bullard said, noting a rise in retirements. The Fed will need to overemphasize their “full employment” mandate as inflationary pressures move forward AIT progress.

Analysis:

The recent price action reinforces our view that equities and rates will be range-bound over the summer.

The debate between whether growth and earnings will be negatively affected by inflationary pressures will need more data points and a second-quarter earnings season to form a consensus.

The end of the summer will see the final stage of the reopening as stimulus checks end and schools reopen, increasing the availability of labor and ultimately production.

We will not have clarity on the future of fiscal and monetary policy till the fall.

We should see a bipartisan-supported traditional infrastructure bill over the summer. In contrast, we will likely not see a socially-focused infrastructure bill (as it is not bipartisan and provides more direct consumer supporting initiatives) until the fall, potentially part of the continuing resolution process.

Tapering talks will likely start in earnest at the September FOMC

The recent CPI and NFP (post-April's FOMC meeting) canceled each other out, leaving the Fed to debate which of the dual mandates to prioritize (hint* - it will employment) as they wait for more data to clarify the picture.

As a result, absent some outside shock, traditional asset classes will likely benefit from dip buying and rally selling in wider trading ranges while real assets catch up.

Commodities have yet to establish a range (given their parabolic ascent) and recent price action here suggests more consolidation may occur.

Real assets such as CRE and gold are beginning to react more forcefully to inflationary pressures and outperforming other risk assets (CRE) or breaking out of consolidations patterns (gold).

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth Outperforming This Week

Chinese Iron Ore Future Price: Iron Ore Higher This Week

5yr-30yr Treasury Spread: Curve is Flatter This Week

EUR/JPY FX Cross: Euro Higher This Week

Emerging Markets:

Despite being an underperformer since March, the EEM ETF has matched the returns of the S&P (orange line) since the lows of last year.

As the dollar continues to weaken and growth/earnings expectation likely begins to fall in the U.S. (from what we consider peak levels currently) it may be time for emerging markets to get renewed interest/inflows and push higher.

Although each country has its own specific story the emerging market basket as a whole, represented by the EEM ETF, continues to consolidate in a bullish pennant formation with any multi-day breakout being a buy signal.

We highlight this now due to the belief that resistance may be breached soon and plan to do further research on flow and valuation dynamics to watch, as well as how to hedge China exposure, which we believe will be a drag on EM.

HOUSE THEMES / ARTICLES

Electrification

Crypto: China Hits Cryptocurrencies With Double Whammy - Caixin

The Inner Mongolia autonomous region, which recently started a campaign to stamp out cryptocurrency mining in a bid to cut carbon emissions, announced Tuesday it had set up a platform for residents to report on illegal projects. The same day, three financial self-regulatory bodies issued a joint notice banning financial institutions and payment companies from directly or indirectly providing cryptocurrency services to customers, including accepting the currency as payment.

China has long taken a negative view of cryptocurrencies amid concerns over the potential risks to the domestic financial system posed by a surge in speculation. In 2014, financial regulators banned financial and payments institutions from conducting Bitcoin-related business, including accepting it as payment. In September, the PBOC banned initial coin offerings and in February 2018, a PBOC-affiliated newspaper said the central bank would block access to domestic and foreign cryptocurrency exchanges.

Everything: The Electrification of Everything: What You Need to Know – WSJ

The “electrification of everything” most simply put, is that more of the energy we use will come from the electric socket. Instead of having fuels like natural gas or oil or gasoline flow directly into our homes, offices, manufacturing facilities, and cars, those fuels—and other sources of energy—will increasingly be converted to electricity first.

This will require investment in our grid. Over the past decade, the number of U.S. electricity outages has doubled. There is a long list of culprits from high winds toppling tree limbs to wildfires to ice storms to aggressive squirrels. The Biden administration recently said it plans $8 billion in new high-voltage transmission lines, along with other grid improvements. But more will be needed as well as microgrids as backup systems

Environmental & Natural Resources

Hydrogen: Hydrogen Gains a Toehold in Europe as a Cleaner Alternative to Gas and Coal - WSJ

Europe has made hydrogen a critical part of its plan to transition away from fossil fuels and slash net carbon emissions to zero by 2050. The European Union is aiming to have 40 gigawatts of green-hydrogen production capacity, enough to provide approximately 40% of France’s electricity consumption, according to the IEA, installed within its borders by 2030.

More hydrogen will need to be produced and it needs to be green—that is, made with renewable energy rather than fossil fuels. European companies also have to figure out how to safely store and move it. The article goes on to highlight the massive infrastructure build needed to support the transition, some of which is already underway.

Solar: As Banks Shun Coal, Vietnam Emerges an Unlikely Solar Champion - BBG

The Southeast Asian nation now ranks seventh in the world in terms of capacity, according to clean energy research group BloombergNEF, and in 2020 the only countries that installed more solar panels were the U.S. and China.

Foreign banks are limiting funding to fossil fuels projects, meaning Vietnamese utilities have struggled to get loans for new coal plants. At the same time, the plunging price of solar panels, many of which are assembled domestically, has created a cheap and convenient alternative.

Fiscal Policy

No Benefits for You: More Republican States Cut $300 Benefits, as Jobless Claims Fall - WSJ

This week Texas, Oklahoma, and Indiana joined the list of at least 21 states that are cutting off access to federal benefits early after a much weaker-than-expected April jobs report sparked concerns of labor shortages.

States have announced dates ranging from mid-June to mid-July for when they will stop processing pandemic-related benefits. That means nearly 3.5 million individuals could lose the $300 weekly benefits—which were set to expire in early September—beginning in mid-June, according to estimates by forecasting firm Oxford Economics.

Commodity Cycle

Copper: Copper’s Record-Breaking Rally May Be About to Take a Pause - BBG

There’s been a premium for cash metal over three-month forwards, with the spread hitting its second-highest level in six years in February but over the past month, it’s flipped to a $28 discount, the deepest we’ve seen in nearly a year. That suggests buyers are finally holding off from purchases.

The shortage of supply from copper mines is also starting to ease. At Freeport-McMoRan Inc.’s Grasberg in western New Guinea, years of work on extending the underground segment of the world’s second-largest copper pit is at last bearing fruit, with production this year forecast to hit its highest level in a decade and continue growing thereafter.

China Macroprudential Policy

Debt Bomb: China’s $2.14 Trillion of Bonds Coming Due Unnerves Foreign Investors - Caixin

Heavily indebted state-backed companies in China are starting to spook investors as they believe the Chinese government will no longer bail them out. Chinese companies’ debt servicing costs are climbing, with $2.14 trillion of bonds maturing by 2023, 60% more than the value of bonds that came due from 2018 to 2020.

Overseas investors are paying keen attention to trends in foreign currency-denominated debt, which makes up nearly 10% of the Chinese market. With $172 billion worth of such bonds maturing by 2023, foreign investors are increasingly nervous as defaults on those are increasing as well. The bond market may be dealt a shock if China’s implicit government guarantees are hastily reduced, similar to what happened with the GSEs during the GFC.

Defining National Security Assets in a Dual Use Environment

Semiconductors: US-China tech war: TSMC helps make breakthrough in semiconductor materials that could push back the ‘end’ of Moore’s Law - SCMP

Scientists and researchers from TSMC, Massachusetts Institute of Technology (MIT), and National Taiwan University (NTU) have shown in a paper, published in the scientific journal Nature, a process that uses the semi-metal bismuth to enable the manufacture of semiconductors below 1-nanometer. While today’s most advanced technologies can produce chips as small as 3nm, this latest breakthrough has the potential “to break the limits of Moore’s Law,” explained NTU professor Chih-I Wu, one of the 23 authors, in the announcement.

Jin Yufeng, a professor at Peking University’s School of Electronics Engineering and Computer Science, said during a recent chip exhibition in Chongqing that advanced packaging was China’s best shot to drive semiconductor development if it cannot secure advanced chipmaking equipment. The US is the current leader in third-generation semiconductor technology, making it wrong to expect China to take the lead.

Mars: Nelson uses Chinese Mars landing as a warning to Congress - SpaceNews

Nelson, in a statement, congratulated China for the successful Zhurong rover landing, hours after China released the first images from the rover.

However, he told House members that China's achievements on Mars should demonstrate that it is serious about sending humans to the moon, even though it's unclear exactly when China will attempt a human lunar landing. That milestone, he said, demonstrates "our need to get off our duff and get our Human Landing System program going vigorously."

Unipolar to Multipolar World

Three Seas Initiative: This Is How Europe Can Push Back Against China and Russia - BBG

Three Seas Initiative is an endeavor by 12 eastern members of the European Union to update the physical and digital links between the Baltic, Adriatic, and Black Seas. Though economically vibrant, most of this region still lags the rest of the bloc in infrastructure. Travel by road and rail takes two to four times longer on average than in the rest of the EU.

Projects include, for example, a port in Croatia that could welcome ships carrying liquefied natural gas and the pipelines that would bring this gas north to partner countries. The initiative’s other projects include roads, railways, river ports, bridges, and more. And of course lightning-fast fiber-optic cables, as well as what is needed to launch fifth-generation telecom networks.

Nord Stream: U.S. Calls Effort to Halt Nord Stream 2 Pipeline a Long Shot - BBG

In a report to Congress on Wednesday, the State Department said that Nord Stream 2 AG and its chief executive Matthias Warnig are engaged in sanctionable activity under U.S. law but that the administration will waive penalties for national security reasons.

Keeping the sanctions “would negatively impact U.S. relations with Germany, the EU, and other European allies and partners,” the administration said in the report to Congress. The administration added that close cooperation with those allies is needed to fight the Covid-19 pandemic and “counter malign behavior by Russia and China” and Iran.

FDI: US-China cross-border investment drops to the lowest level since 2009 - SCMP

Investment between the United States and China last year fell to the lowest level since 2009 amid the Covid-19 pandemic and rising geopolitical tensions. The investment between the two countries dropped to US$15.9 billion in 2020, falling to less than a quarter of US$70 billion invested during the 2016 peak, according to a report issued on Wednesday by Rhodium Group and the National Committee on US-China Relations.

Although the pandemic depressed the investments for the US businesses to expand in China the trend had been occurring since the Trade War heated up. Since the beginning of the trade war in 2018, China has also increasingly taken up policies to direct its economy in the opposite direction of globalization. The government doubled down on the country’s efforts to subsidize key tech industries to become less reliant on foreign countries.

Thank you for reading - Mike