MIDDAY MACRO - DAILY COLOR – 5/19/2021

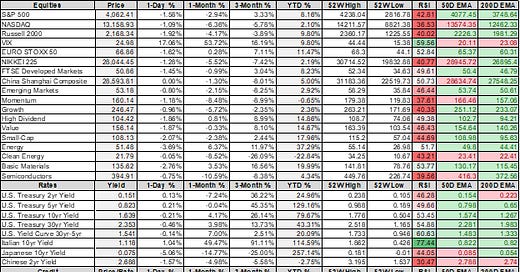

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities significantly weaker overnight but stabilizing post-open

VIX touched on 25

Treasuries curve bull flattening due to a flight to safety

WTI down over -5% with selling increasing post-N.Y. open

Price Action:

Equities have broken through critical levels and are attempting to base post-NY open

Nasdaq outperforming S&P/Russell

Growth, Momentum, and Low Volatility factors outperforming

Communications, Consumer Staples, and Utilities sectors outperforming

Call wall for the S&P is at 4125 with support at 4050, and technical support is at 4060 with resistance at 4130

Major Asian indexes lower: Japan -1.3%. Hong Kong closed. China -0.5%. India -0.6%.

European bourses lower, from midday lows: London -1.1%. Paris -1%. Frankfurt -1.3%.

Treasuries higher post-NY open after overnight weakness, long-end outperforming

5yr = 0.80% and 10yr = 1.62%

WTI lower by -5% to $62.2

Copper lower -3.8% to $4.54

Aggs lower with complex down between -1.5 to –3%

DXY bouncing around but slightly higher to 89.9

Gold higher to $1885

Bitcoin down now 15% (after being down over 20%) to $37K

The value of more than 7,000 tokens tracked by CoinGecko shrank more than $600 billion in the past week to $1.9 trillion.

Analysis:

The current pandemic recovery cycle continues to accelerate faster than markets expect, causing volatility as markets and the real economy react to the changing new realities.

Faster vaccination rollout and re-opening.

As a result, firms were not prepared and are now scrambling to restock inventories and hire labor.

Stronger/longer policy support has led to a stronger/quicker impact on main street.

Labor is hard to find as individuals are flush with cash, while easy financial conditions support rich financial asset valuations and housing price appreciation.

More extended production disruptions.

Transitory disruptions are turning out to be longer and more widespread.

Markets priced (to perfection) for one scenario continue to adjust to an evolving new one.

The changing view is now overly focused on the impact of higher and longer inflationary pressures from a lack of labor, materials, and logistical constraints.

These constraints will cap earnings and growth potential moving forward as it is not a lack of demand but instead a lack of supply (and the inflationary pressures growing as firms scramble to source needed inputs) that is the real problem.

The tail-risk is growing that the Fed is correct, and these inflationary pressures will subside as we may be at peak inflationary fear levels.

This is not our core view but needs to be acknowledged.

More specific to equity markets, the S&P has broken the critical support level of 4100 but is still in its longer overall post-pandemic uptrend after bouncing off support around 4050.

Gamma is now marked as negative across all indices, which infers that if markets decline, dealers will need to sell futures.

However, equity indexes are bouncing off the morning lows currently as dip buyers have emerged.

If the uptrend channel holds, the overall rally is still intact, but this was the second test in two weeks.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio:

Chinese Iron Ore Future Price:

5yr-30yr Treasury Spread:

EUR/JPY FX Cross:

Semiconductor Index:

Semiconductor stocks have been under pressure since the beginning of April and are now at the bottom of their 2021 range.

Although a number of specific stories have weighed on sentiment along with a general rotation away from growth and tech the long-term outlook for the industry still seems overly positive.

It has become clear just how important semiconductors are to our economy as shortages have now begun to weigh on the overall growth outlook.

Purely technically speaking this is a good place to enter longs on the $SOXX ETF with a stop at the uptrend support of around $385.

European Share Buybacks:

This year has seen a slew of companies in Europe putting forward share repurchase programs, including luxury house LVMH Moët Hennessy Louis Vuitton, personal care company L’Oréal and oil major Eni.

Around 56 firms have released plans to buy their own shares so far in 2021, the most for the comparable period in three years, according to an analysis by Société Générale.

The pandemic may have accelerated the shift toward rewarding shareholders through buybacks, at least temporarily, according to analysts at the French bank.

We generally favor an overweight in European equities (EuroStoxx 50) as growth in economic activity and earnings catch up to the U.S.

HOUSE THEMES / ARTICLES

Environmental & Natural Resources

China’s Energy: Energy Giant Amps Up Strategy to Ditch Fossil Fuels, Boost Renewables - Caixin

China Southern Power Grid company, one of the country’s two main power distributors, aims to source two-thirds of its electricity from non-fossil fuels by 2030 under a plan that will also increase its renewable energy capacity by a factor of five. The plan means that 65% of the company’s electricity will come from renewable sources.

It comes as a succession of Chinese state-owned energy firms pledge to ditch fossil fuels and embrace renewables to realize Beijing’s bold climate commitments. In March, China’s main power distributor, State Grid Corp. of China, said it would significantly increase its wind, solar, nuclear, and hydropower capacity over the next 10 years. China’s energy sector is in the throes of a once-in-a-generation transition away from fossil fuels, spurred on by the country’s commitment to bringing its carbon dioxide emissions to a peak by 2030 and reducing them to net-zero by 2060.

Green Bonds: Banks Always Backed Fossil Fuel Over Green Projects—Until This Year - BBG

Green bonds and loans from the global banking sector exceed the value of fossil financing so far this year. Bloomberg data covering almost 140 financial-service institutions worldwide shows at least $203 billion in bonds and loans to renewable projects and other climate-friendly ventures through May 14, compared with $189 billion to businesses focused on hydrocarbons.

From a profit and loss standpoint, industry executives now have proof they can make money participating in the transition away from fossil fuels. Banks are earning fees of about 0.6% for underwriting green bonds and loans, six basis points more than similar deals for energy companies. Analysts at S&P Global cite estimates of $3 trillion in annual green investments, which means total investment in clean technologies and energy efficiency needs to increase by roughly a factor of five by the middle of the century, compared to 2015 levels.

Infrastructure

Hernando: I-40 bridge closure costs trucking millions daily with no end in sight -CCJ Digital

With the I-40 Hernando de Soto Bridge connecting Arkansas and Tennessee over the Mississippi River expected to be closed for the foreseeable future, the Arkansas Trucking Association estimates the closure will cost the trucking industry $2.4 million each day. “Using GPS data, we can discern that a previous 8-minute drive is now averaging 84 minutes." Arkansas Trucking Association President Shannon Newton

According to TDOT, the repair of the bridge will be done in two phases, and both phases will need to be completed before the bridge is reopened to traffic. The design of the second phase of the project is still in the works, TDOT said. Another example of how having reliable infrastructure matters and why it is likely bipartisan support for a physical infrastructure bill will materialize.

Logistical Bottlenecks

You’re Late: Shipments Delayed: Ocean Carrier Shipping Times Surge in Supply-Chain Crunch - WSJ

Only about 40% of container ships globally were on time arriving at ports in March, according to an analysis by Denmark-based Sea-Intelligence ApS, with average delays stretching to more than six days. The slowdowns improved from February but remained far behind reliability levels of the previous two years, when more than 70% of ships arrived on time.

The delays around the world, the result of a large-scale restocking by businesses as consumer demand improves, are tying up vessel capacity, adding to a shortage of sea containers needed to move goods, and sending shipping costs soaring as container freight rates rise at a historic pace.

Semiconductors: Chip Crisis in ‘Danger Zone’ as Wait Times Reach New Record - BBG

Chip lead times, the gap between ordering a chip and taking delivery, increased to 17 weeks in April, indicating users are getting more desperate to secure supply, according to research by Susquehanna Financial Group. That is the longest wait since the firm began tracking the data in 2017, in what it describes as the “danger zone.”

Chip shortages are rippling through industry after industry, preventing companies from shipping products from cars to game consoles and refrigerators. Automakers are now expected to lose out on $110 billion in sales this year, as Ford Motor Co., General Motors Co., and others have to idle factories for lack of essential components. That’s undercutting economic growth and employment, as well as raising fears of panic ordering that may lead to distortions in the future.

E-Commerce: Online Sales Party Starts Winding Down – WSJ

The Commerce Department on Tuesday reported that e-commerce sales were up 39% from a year earlier in the first quarter. That was the swiftest growth since the second quarter of last year when sales were up 44%. Before the Covid-19 crisis, e-commerce sales were growing at about a 15% rate.

There are signs that people’s zeal for shopping online has begun to slow. Recent earnings calls have highlighted a slowdown in online activity in the first quarter compared to the fourth. To a degree, those slower growth rates reflect the fact that the comparison periods include April 2020, when the Covid-19 crisis first set off the surge in online shopping.

China Macroprudential Policy

Pensions: China Promotes Private Retirement Savings to Shore Up Strained Pension System - Caixin

China will soon launch a new pilot program for private pension funds as part of efforts to overhaul its strained system for retirement savings. The country’s top insurance regulator proposed a new product after policymakers vowed to make private pension funds the crucial “third pillar” of the national pension system, as a number of officials and economists worry about the financial sustainability of the current state-dominated system, warning that it might soon run short of funds.

China will need to expand its social safety net and overcome its growing demographic troubles if it wants to transition to a more consumer-driven economy. This is a key area to watch as high levels of savings for medical and retirement hold back aggregate demand for consumer goods.

Defining National Security Assets in a Dual Use Environment

Semiconductors: Senate China Bill to Add $52 Billion for U.S. Chip Making - BBG

Funding to support the domestic semiconductor industry was authorized in the 2021 defense policy bill, but it didn’t actually provide the money, which this bill will. The Schumer-Young China bill would also authorize more than $100 billion over five years to enhance research and development of innovative technology and manufacturing at colleges, universities, and other institutions and create a new entity within the National Science Foundation to focus on technology.

The legislation’s path in the House is less certain. It’s unlikely the Senate version will simply be agreed upon. The bill includes funding to counter China’s dominance in 5G and requires CFIUS to review gifts and contracts to universities in an effort to stem China’s influence. The House will likely expand the bill here and also further focus/combine in a series of science and technology-focused education bills.

Unipolar to Multipolar World

China and Russia Relations: Xi and Putin to mark the expansion of China-Russia nuclear power project ahead of US talks - SCMP

Xi and Putin are meeting on Wednesday in a show of solidarity ahead of high-level talks between Washington and Moscow. During the talks by video link, Xi and Putin will watch the launch ceremony of an expanded China-Russia nuclear energy project, the Chinese foreign ministry said on Tuesday. It will mark the construction of four new reactors at two nuclear plants in China, in Liaoning and Jiangsu provinces, both of which use Russian technology, according to Chinese media reports.

The talks will be held a day before US Secretary of State Antony Blinken is due to meet Russian Foreign Minister Sergey Lavrov in Iceland for the highest-level in-person meeting between the two countries since US President Joe Biden took office. Yang Jin, an expert on Russian affairs with the Chinese Academy of Social Sciences, said Beijing and Moscow needed to present a united front against increasing Western pressure.

Trade War: China Extends Tariff Exemptions for Some U.S. Imports - Caixin

China said it will continue to allow a batch of 79 goods imported from the U.S., comprising certain raw materials and chemical and industrial products, to be exempt from retaliatory levies until the end of the year.

The Biden Administration has also been extending tariff exclusions on some Chinese goods. On March 10, the office of the U.S. Trade Representative announced that 99 categories of medical products including equipment, cleaning supplies, and personal protective equipment would continue to enjoy exemptions until Sept. 30. Neither of these actions represents a de-escalation but instead highlights the interconnected economical/trade relations both sides have with each other.

Thank you for reading - Mike