MIDDAY MACRO - DAILY COLOR – 5/18/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities attempting to rally after overnight highs were lost into the N.Y. open

Treasuries curve steepening slightly after post housing data selling

WTI lost overnight gains post-N.Y. open

Price Action:

Equities are coiling into a tighter range

Russell/Nasdaq outperforming S&P

Momentum, Growth, and Small-Cap factors outperforming

Consumer Discretionary, Technology, and Health Care sectors outperforming

The call wall for the S&P is at 4200 with support at 4150, technical support is at 4125 with resistance at 4175

Major Asian indexes higher: Japan +2.09%. Hong Kong +1.58%. China +0.32%. India +1.20%.

European bourses higher from midday lows: London +0.42%. Paris +0.25%. Frankfurt +0.34%

Treasuries mixed but little changed as belly outperforming

5yr = 0.83% and 10yr = 1.65%

WTI lower by 0.6% to $65.9

Copper higher, by 0.5%, but off overnight highs

Aggs higher but mixed as corn is outperforming

DXY under pressure overnight to 90.25

Gold flat to $1865

Bitcoin falling over -3% to $42.7K

Econ Data:

Housing Starts: Housing starts fell -9.5% in April, a much weaker than expected reading. Building permits increased 0.3%, in line with expectations. The drop mainly came from single-family, which fell -13.1%. Single-family permits also declined -3.8%. The higher level of permits to starts points to an increase in starts over the summer. Logistical issues are currently keeping construction starts down, which jibes with growing concerns heard from homebuilders over the previous months and is in line with the general supply chain logistical troubles seen elsewhere. Another example of high demand not being met due to supply constraints.

Analysis:

Equities and Treasuries have been consolidating in a tighter range over the last two days with no new catalyst driving price action.

Option levels are creating a 50-point range between support and resistance for the S&P until Friday’s OpEx.

It is a relatively light data week, allowing the inflation fear frenzy that occurred last week to subside slightly.

Less Fed speakers this week, keeping policy expectations little changed.

The more interesting move (so far this week) has been the further depreciation of the Dollar.

DXY has dipped below 90, while the EURUSD cross is now above 1.22.

British Pound, Canadian Dollar, and a few other crosses are at pre-pandemic highs.

Yuan is also around recent highs despite growth expectations diverging and geopolitical risk worsening.

The current dollar weakness is a reflection of changes in growth and real rate expectations which are starting to favor the rest of the world over the U.S. (and not the main driver of cross-asset price action in itself).

A continuation in Dollar weakness will support the growing inflation narrative while also supporting dollar-sensitive trades which have recently picked up such as being long gold and potentially long emerging markets (although a lot to say about EM and for another time).

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio:

Chinese Iron Ore Future Price:

5yr-30yr Treasury Spread:

EUR/JPY FX Cross:

Corn Update:

Corn is attempting to rally again after a 14% correction from recent highs.

A bearish WASDE report, logistical disruptions, and weather improvements in Brazil weighed on sentiment as traders took profit.

China looks to have returned in size the last few days, and given their total April purchases were 109% higher than last year, expectations are for demand to remain high there.

Finally, although growing/planting conditions in the U.S. are currently supportive, they are mixed elsewhere, likely increasing future demand for U.S. corn as supply is constrained elsewhere.

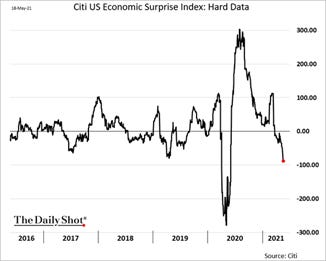

Citi Economic Surprise Index:

Recent misses by CPI, NFP, and Retail Sales are pushing down the Citi Economic Surprise Index for Hard Data.

In terms of economic indicators, hard data is made up of concrete results within a specific area of the economy that shows an output. By nature, these data sets are retrospective as they show real results over a period of time.

On the other hand, soft data sets are developed based on sentiments, such as the consumer confidence index or industry surveys.

These data sets are future-focused, but they can often be considered less reliable when the sentiment doesn’t match the group’s eventual actions.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

User Data: Facebook Loses Bid to Block Ruling on EU-U.S. Data Flows - WSJ

Ireland’s High Court dismissed Friday all of Facebook’s procedural complaints about a preliminary decision on data flows that it received in August from the country’s Data Protection Commission. The preliminary decision, which the court stayed in September pending its decision, could, if finalized, force the social-media company to suspend sending personal information about E.U. users to Facebook’s servers in the U.S.

That ruling restricted how companies like Facebook could send personal information about Europeans to the U.S. because it found that Europeans had no effective way to challenge American government surveillance. E.U. regulators, in addition to Ireland, have started issuing orders to suspend some data transfers. In April, Portugal’s privacy regulator ordered the national statistics agency to stop sending census data to the U.S., where it was being processed by Cloudflare Inc.

Environmental & Natural Resources

IEA: Stop New Oil Investments to Hit Net-Zero Emissions, IEA Says – WSJ

A new report by IEA highlights the shifts required to ensure a path to “net-zero emissions by 2050, narrow but still achievable, is not lost,” said IEA Executive Director Fatih Birol. The IEA’s suggestions go far beyond what any of those companies have pledged so far, with many still dependent on income from oil and natural gas to fund their transition plans.

The IEA said investment in the global energy sector will need to more than double to $5 trillion by 2030 from its current level of $2 trillion to guarantee a reliable and economic supply of low-carbon energy. That will enable the quadrupling of the annual growth in solar and wind power by the end of the decade, according to the report, even after 2020’s record growth rate.

Sailing: Wind-assisted boxship project makes headway – Splash247.com

A new LNG-powered 2,500 teu boxship design featuring wind-assisted propulsion has been granted an approval in principle by the Paris-headquartered class society Bureau Veritas. It fosters six partially retractable Oceanwings installed on a vertical sliding mechanism which minimizes the impact on cargo operations while the vessel is in port, B.V. explained. The LNG engine is designed with pure gas four-stroke gensets offering possible upgrades to fuels such as ammonia or hydrogen.

B.V. said that on a typical transatlantic route of 4,000 nautical miles, the vessel will save on average 35% CO2-equivalent emissions compared to a conventional design, with a two-stroke engine, single shaft, and without wing-sails, at the same speed.

Monetary Policy

Hardest Hit: Pandemic Hit Less-Educated Workers Hardest, Fed Survey Shows – WSJ

The economic fallout from the coronavirus pandemic was concentrated among minorities, women, and workers who hadn’t finished high school, according to a new survey from the Federal Reserve.

Three-fourths of U.S. adults reported doing at least OK financially in November 2020, a share that was unchanged from previous years, the Fed said Monday. But that finding masked significant divergences in economic well-being between workers who retained their jobs and those who were laid off, households with more education and those with less, and those who have children versus those without.

Fiscal Policy

Child Tax Credit: Child Tax Credit Expansion Kicks In July 15 With Monthly Payments to Families – WSJ

The Internal Revenue Service will make its first batch of monthly payments to about 39 million families with children on July 15, delivering the child tax credit that Congress expanded in March. Tens of millions of households will receive up to $250 a month per child between age 6 and 17 and up to $300 per child under age 6.

The credit isn’t just larger. Congress made two other changes that effectively convert the credit into a near-universal child allowance. The credit fully refundable, which means that the entire amount can go to households that don’t make enough money to pay income taxes. In addition, Congress ordered the IRS to begin regular payments of the credit, turning the lump-sum refunds during tax season into a routine benefit for 2021.

E.Z. Tax: European Commission Mulls One System for Taxing Multinationals - BBG

The Commission will float new plans today to create one corporate tax system across the E.U. to put a stop to countries offering more favorable tax deals for multinational companies, according to draft plans we’ve seen. The approach would be a dramatic departure from how multinationals’ profits are currently taxed in the E.U., with much of a company’s profits assigned to jurisdictions where it holds intellectual property or undertakes important business functions.

The communication won’t include concrete proposals for now, pending a global deal on corporate taxation, due later this year.

Commodity Cycle

Copper Tax: Peru Leftist Copies Chile’s Proposal for Tax on Copper Boom - BBG

Pedro Castillo, who has vowed to nationalize a major gas field and capture more mineral profits to fund social spending, just added a tax on copper sales to his platform in a document he shared on Twitter late Sunday. In top producer Chile, the lower house of Congress earlier this month passed a system of progressive taxes on copper sales in what could become one of the heaviest levies in global mining.

While mining companies in Peru won’t be cheering additional taxes, that prospect would be preferable to the government expropriating assets, which was the initial fear when Castillo defied polls to win the first-round vote. In addition, he’s likely to face stiff opposition from a divided legislature.

Logistical Bottlenecks

Labor Mismatch: Manufacturing, competing with distribution, struggles to attract labor - SupplyChainDive

Between December 2020 and February 2021, The Manufacturing Institute and Deloitte surveyed more than 800 U.S. manufacturers and asked them about hiring. They found manufacturers are having trouble filling 46% of open positions due to a mismatch in skills, a 12%increase from 2018. "That's partially, we believe, because of the increase in demand for warehousing and distribution jobs," Paul Wellener, one of the report authors said.

One of the positions that manufacturers are having the hardest time filling is what the report referred to as "miscellaneous assemblers and fabricators," which are entry-level positions that actually don't require much training. Another issue the report found is that manufacturing apprenticeship programs are largely concentrated in the midwest, while the projected job openings for the industry over the next decade are expected to be concentrated elsewhere, specifically Texas and California.

Big Tech Regulation/Taxation

Chinese Apple: Censorship, Surveillance and Profits: A Hard Bargain for Apple in China - NYT

Apple will store the personal data of its Chinese customers on computer servers run by a state-owned Chinese firm as Apple has largely ceded control to the Chinese government. Chinese state employees physically manage the computers. Apple abandoned the encryption technology it used elsewhere after China would not allow it. And the digital keys that unlock information on those computers are stored in the data centers they’re meant to secure.

Mr. Cook often talks about Apple’s commitment to civil liberties and privacy. But to stay on the right side of Chinese regulators, his company has put the data of its Chinese customers at risk and has aided government censorship in the Chinese version of its App Store. After Chinese employees complained, it even dropped the “Designed by Apple in California” slogan from the backs of iPhones.

Defining National Security Assets in a Dual Use Environment

Reshoring: Covid Forced America to Make More Stuff. What Happens Now? - Wired

After a year filled with manufacturing scrambles, Armbrust American can produce 1 million masks a day and has supplied Texas public schools and the state of Illinois. It’s part of a mini industrial resurgence in response to the pandemic, as U.S. manufacturers sprang up or pivoted to meet new demand.

However, as supply chains normalize the threat of foreign (Chinese) competition weighs on domestic production again. The group says Chinese masks now sell for as little as a penny apiece in the U.S., despite raw materials costing at least three times that price. It predicts that half its collective production capacity will be lost within 60 days without federal intervention, such as the FDA reversing emergency authorizations of some overseas PPE, or requirements that federal PPE funding goes to US-made masks.

Unipolar to Multipolar World

Sanctions: U.S. will remove Xiaomi from blacklist, reversing jab by Trump - Reuters

The court filing said Xiaomi and the U.S. government would agree to resolve their ongoing litigation, bringing to an end a brief and controversial spat between the hardware company and Washington that had further soured Sino-U.S. ties. The department had designated the firm as having ties to China's military and placed it on a list that would restrict U.S. investment in the company.

In March, a federal judge temporarily blocked enforcement of the blacklisting, citing the U.S. government’s "deeply flawed" process for including it in the ban. The judge last week also suspended an investment ban imposed on Luokung Technology Corp, the Chinese mapping technology company. Soon after the victory, Reuters reported that other Chinese companies placed on the same blacklist were considering similar lawsuits. There are currently seven other Chinese companies under similar restrictions.

CPTPP: China Steps Up Efforts to Join Trade Pact Created to Exclude It - BBG

Officials from Australia, Malaysia, New Zealand, and possibly other nations have held technical talks with Chinese counterparts on details of the Comprehensive and Progressive Trans-Pacific Partnership. It’s not clear how far China has progressed in preparing an application, but the people see Beijing as seriously interested in joining, with multiple officials pointing to comments last year from President Xi Jinping as an indication of intent.

Many of the CPTPP nations are heavily dependent on trade with China, but China’s increasingly poor image in some nations may make it harder to agree on entry. Concerns over labor practices, state-owned companies, and its economic confrontation with America also loom as potential roadblocks for entry

Thank you for reading - Mike