MIDDAY MACRO - DAILY COLOR – 5/13/2021

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities rallying after S&P bounced off long-term resistance as dip buyers came in

Treasuries are bull flattening, recovering some of their post-CPI losses

Ag complex under pressure following yesterday’s WASDE report

WTI significantly lower but within recent up-channel

Price Action:

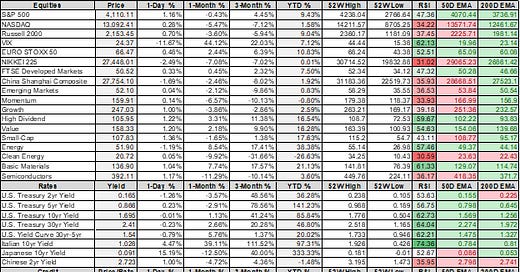

Equities

S&P outperforming Russell/Nasdaq

Small-Cap, Value, High Dividend factors outperforming

Technology, Cons. Discretionary, Industrials sectors outperforming

Call wall is back at 4150 with support at 4100, 4090 is technical support with resistance at 4125

Major Asian indexes lower: Japan -1%. Hong Kong -1.7%. China -1%. India closed.

European bourses rebounding from midday lows: London -0.6%. Paris +0.2%. Frankfurt +0.3%.

Treasuries bull flattening as long-end is outperforming

5yr = 0.83% and 10yr = 1.67%

WTI lower by 3% to $64.20

Copper slightly lower after post CPI data selling

Base metals held up well compared to other areas during Weds selling

Aggs significantly lower with corn down over 5% after WASDE report showed higher levels of planting

DXY maintaining postCPI level around 90.7

Gold is flat at $1825

Bitcoin lower by 9% to $49.9K after overnight weakness

Analysis:

Increasing inflation expectations have brought a more tidal approach to market price action as an increased focus on duration risk management is causing cross-asset correlation changes.

Markets are debating how damaging rising prices will be to growth as well as how to discount future cash flows.

There are three inflationary camps of investors emerging, driving this debate:

Skeptics that question the longevity of the inflationary pulse.

Reflationist that believe there will be a longer-lasting inflationary pulse, but it is not a structural change.

Inflationist that see a longer-term structural change occurring.

It is clear the Fed still believes the uptick is transitory but is becoming more mindful of the growing risk.

As a result, the Fed will now have to further emphasize their “maximum employment” mandate and focus on the shadow slack remaining in the economy (from missing participants), given its price-stability mandate will likely be met sooner than expected.

We saw precisely this from Clarida yesterday, who noted that the labor market recovery would take until late 2022 if the current pace of job creation held steady.

We believe that a wait-and-see approach is needed to determine if a more significant structural inflationary regime change occurs.

Recent weakness in the labor market will correct over the summer, while transitory inflationary pressures from shortages will subside to some degree.

More core inflationary pressures from housing and healthcare will take longer to take root.

Wage growth would also need to be more sustained to induce an inflationary wage-spiral feedback loop experienced in the 1970s.

Increases in productivity and business creations, as well as general labor shortages, support the potential for a longer-term cycle here, but it is still too early to tell.

Finally, both fiscal and monetary policy would need to expand the nation’s social welfare net further (also in the 1970s), which is certainly possible under the current administration.

Personnel is Policy: The replacement of Powell and Clarida would give us confidence that we are seeing a shift in policy that could allow a more sustained structural inflationary cycle.

WORTH A LOOK

Econ Data:

PPI: Final-demand PPI prices rose 0.6% in April, beating expectations for a 0.3%increase. Food prices rose 2.1%, and energy prices dropped 2.4%. Yearly PPI ended in April up 6.2%, versus 4.2% in March. Core final-demand PPI increased 0.7% in the month, also higher than forecasted, resulting in the year-over-year change in these prices, picking up to 4.6% in April from 3.1% in March. This report provides another elevated inflation reading and shows that core finished goods prices have risen at a 6.1% annualized rate over the last three months and by 4.6% over the previous year, which was the fastest rate in the nearly seven-year history of this measure. Price pressures are even more significant in the supply chain, with core intermediate prices for processed goods rising at a 36.4% rate over the last three months and by 14.1% over the previous year.

Atlanta Fed’sBusiness Inflation Expectations: Firms’ year-ahead inflation expectations increased significantly to 2.8% on average from 2.4% in the prior month. Approximately one-quarter of firms expect labor costs to put significant upward influence on prices, while one-third expect nonlabor costs to do the same. About 40% of firms expect sales levels to put a moderate upward impact on prices over the next 12 months.

Policy Makers Rhetoric and Key Events:

Clarida on CPI: “I was surprised,” Richard Clarida, the Fed’s vice chairman, said of the 4.2% increase in consumer prices in April from a year earlier. “This number was well above what I and outside forecasters expected.” Mr. Clarida said he believes most of the recent acceleration in prices will prove transitory as the economy works through supply and demand mismatches that emerged during the pandemic. But he added that policymakers will be monitoring measures of long-term inflation expectations “very closely” and will act if they start to drift upward. He went on to further emphasize the need to focus on labor markets and said he was also surprised by last week’s weaker-than-expected jobs report.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio

Chinese Iron Ore Future Price

5yr-30yr Treasury Spread

EUR/JPY FX Cross

“Hard to Fill” vs. “Plan to Raise”

According to the NFIB survey, the share of firms having difficulty filling positions rose in April to a record high. While the share planning to raise compensation also rose, it remains lower than it was before the pandemic. Unless firms’ wage plans grow, the upcoming rise in inflation is likely to be transitory, as the Fed is claiming. However, numerous businesses have announced intentions to raise wages and offer hiring bonuses to attract workers. It is likely wages will rise given the strong correlation between “Hard to Fill” and “Plans to Raise” in the NFIB survey.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

Federal Cyber Upgrade: Biden orders federal cyber upgrade after barrage of hacks - Politco

President Joe Biden on Wednesday ordered a sweeping overhaul of the federal government’s approach to cybersecurity, from the software that agencies buy to the security measures that they use to block hackers. The executive order, which has been in development for months, addresses federal computer networks, not the critical infrastructure operated by private companies.

Biden’s executive order requires agencies to encrypt their data, update plans for securely using cloud hosting services and enable multi-factor authentication. It also creates a cyber incident review group, modeled on the National Transportation Safety Board that investigates aviation, railroad, and vehicle crashes, to improve the government’s response to cyberattacks.

Colonial: Colonial Pipeline Paid Hackers Nearly $5 Million in Ransom - BBG

Colonial Pipeline Co. paid nearly $5 million to Eastern European hackers on Friday, contradicting reports earlier this week that the company had no intention of paying an extortion fee to help restore the country’s largest fuel pipeline, according to two people familiar with the transaction.

The company paid the ransom in untraceable cryptocurrency within hours after the attack, underscoring the immense pressure faced to get gasoline and jet fuel flowing again. Once they received the payment, the hackers provided the operator with a decrypting tool to restore its disabled computer network. The tool was so slow that the company continued using its own backups to help restore the system, one of the people familiar with the company’s efforts said.

Electrification

Old Cars: Biggest Lithium Miner Gears Up to Tap Metal From Old Cars – BBG

Albemarle Corp. is making investments and partnering with automotive equipment manufacturers on the recycling effort, which it calls “critical” to its future growth. Thirteen years after the Tesla Roadster made its debut, a first generation of EVs is nearing retirement, making more battery packs available.

The commercial activity will be in the second half of the decade when regulatory mandates stipulate those batteries have to be recycled. In 2030, the world’s drivers and fleets are expected to buy almost 26 million electric vehicles a year, and junkyards will take in almost 1.7 million metric tons in scrapped batteries.

Environmental & Natural Resources

Rare Earth: GOP’s Barr Proposes Helping Coal Country With Rare Earth Mining - BBG

The measure would amend the so-called FAST act, a program that funds surface transportation infrastructure planning and investment. It would expand permitting to streamline and expedite the approval process for existing coal mines to extract and process the minerals the U.S. says are crucial for batteries and other green-energy infrastructure.

Barr’s legislation would have to get backing from Democrats but it comes amid a broader push in Congress to confront China on technology and innovation and reduce reliance on the country for critical materials. Coal production has slumped by more than half since peaking in 2008, and mining experts say the quickest route to domestic production of the critical rare-earth metals would be through existing facilities that won’t have to go through the rigorous approval process that new mines typically face

China Regulation: China to tighten environmental oversight - Argus

China’s Ministry of Ecology and Environment has issued a new draft regulation aimed at strengthening oversight on approvals of energy-consuming projects, in a sign of tightening environmental control that will have implications for the country’s refining sector. The MEE will require new, revamps and expansion projects to include assessments of the carbon emissions impact of projects, the first time it is requiring this. It will start with six energy-intensive industries including thermal power, petrochemicals, coal-to-chemicals, steel, non-ferrous metals smelting, and cement.

The MEE is facing increasing challenges supervising pollution control and is expected to act tough on local governments that fail to act. Its inspection last year revealed that several oil and petrochemical, as well as coal-to-gas projects, approved during 2016-20 did not meet environmental requirements as part of their EIA approvals.

Infrastructure

Deficit Financed: Republicans Reject Tax Increases After Biden Infrastructure Talks – WSJ

Republicans have called for raising unspecified fees on people who use the infrastructure, pushing a $568 billion proposal. The White House and many Democrats are opposed to raising user fees, and both sides have said they don’t want to borrow money to pay for new infrastructure investments. Mr. Biden later told reporters that he was encouraged by the meeting but said paying for infrastructure with user fees, as Republicans have suggested, would mean “the burden falls on working-class folks who are having trouble.”

Mr. McConnell has said Republicans could be willing to support as much as $800 billion in infrastructure spending, still far short of what Mr. Biden is seeking. Mr. Biden’s $2.3 trillion plan calls for funding over eight years, while the $568 billion in the Republican plan would be doled out over five years. Mr. McCarthy said he raised concerns to Mr. Biden about inflation and the labor shortage, which Republicans have pinned on Mr. Biden’s agenda.

China Macroprudential Policy

Bond Defaults: China Bond Defaults Racing to 100 Billion Yuan and It’s Only May - Caixin

Chinese corporations are defaulting on local bonds at the fastest pace on record, as authorities ramp up efforts to introduce more financial discipline and transparency in the world’s second-largest debt market. While 2021 is set to be the fourth straight year the 100 billion yuan level has been topped, it previously hadn’t happened before September.

The recent tumult surrounding bad debt manager China Huarong Asset Management Co. Ltd. raised fresh questions about support for central state-owned firms, even as the risk of contagion remains relatively contained. Increased financial discipline for companies and improved credit ratings serves Beijing’s longer-term goal of attracting more foreign cash to the country’s capital markets, especially from more stable sources like pension funds and insurers instead of hot money flows.

Property Tax: Beijing Sends Another Signal That Property Tax Reform Is on the Agenda - Caixin

On Tuesday, officials from the Ministry of Finance, the Ministry of Housing and Urban-Rural Development, the State Taxation Administration, and the national legislature’s budgetary affairs commission held a seminar to solicit opinions from experts and local government officials on piloting property tax reform, an official statement said. The seminar is a sign that work on the new property tax is accelerating, fiscal and tax experts told Caixin.

China does not have a national property tax levied on property ownership, which could generate billions of yuan in revenue for local governments. Instead, the country levies national taxes during the construction and transfer of properties. Debate on introducing such a tax has raged for years. Some analysts have said it would discourage property speculation as well as provide local governments with a stable source of revenue, encouraging them to improve public services.

Babies: China’s population outlook worrying as young people balk at high cost of having kids - SCMP

China’s young people are not surprised that their homeland has one of the world’s lowest fertility rates. In fact, most seem to empathize with the growing reluctance to have kids in China. Many believe that there is a general consensus among China’s millennials and Generation Z that having children will impose a strong financial burden under the country’s current public welfare conditions, and that having fewer or no children is necessary to maintain one’s quality of life.

China will need to continue to reform its Hukuo system if it wants to entice the younger generation to have children and keep a balanced demographic picture. Those having children continue to overwhelmingly have only one even though they are allowed two. In a public survey in November on Weibo, China’s leading social media platform asked, “How many children would you be willing to have if birth restrictions were fully liberalized?” Among the 284,000 people who voted, 150,000 said they would still have no kids, 85,000 said one child, 39,000 chose two, and about 10,000 said they would be willing to have three children or more.

Defining National Security Assets in a Dual Use Environment

Semiconductors: US-China tech war: Taiwan’s TSMC joins American chip coalition in another blow to China’s self-sufficiency drive - SCMP

The Semiconductors in America Coalition (SIAC), which includes 65 major players along the semiconductor value chain, announced its formation on Tuesday with the immediate purpose of pushing the American government to provide subsidies for chip manufacturing on US soil. It is dominated by American tech firms such as Apple, Microsoft, Google, and Intel, but also includes a number of Asian and European heavyweights in the semiconductor supply chain, such as TSMC and MediaTek from Taiwan, Samsung Electronics, and SK Hynix from South Korea as well as Holland’s ASML, the only supplier of the advanced photolithography equipment used to make high-end chips.

According to the coalition’s website, its mission is “to help bolster America’s economy, critical infrastructure, and national security by advancing semiconductor manufacturing and research in the US”. It called on US Congressional leaders to support US President Joe Biden’s CHIPS for America Act, which is aimed at bolstering America’s semiconductor industry by allocating a fund of US$50 billion. America has no choice but to subsidize its own semiconductor industry if it hopes to maintain an edge on China.

Semiconductors: Korea Unveils $450 Billion Push for Global Chipmaking Crown - BBG

Samsung Electronics Co. and SK Hynix Inc. will lead more than 510 trillion won of investment in semiconductor research and production in the years to 2030 under a national blueprint devised by President Moon Jae-in’s administration. They’ll be among 153 companies fueling the decade-long push, intended to safeguard the nation’s most economically crucial industry. Samsung and Hynix make the majority of the world’s memory chips, basic semiconductors that handle storage for all devices. But one area South Korea has been lagging in is the ability to produce advanced logic chips that handle complex calculations for tasks like AI and data processing.

Likening semiconductors to rice -- a global dietary staple -- the Korean ministry called them “strategic weapons” in a race for superior technology intensifying among not just firms but also nations. The Korean government will incentivize its domestic industry with tax breaks, lower interest rates, eased regulations, and reinforced infrastructure, hoping to see its chipmakers make up the distance from the global leaders, the ministry said. The government will also secure adequate water supply for the next 10 years in the targeted region and reinforce power supplies, both essential to advanced chipmaking factories.

Unipolar to Multipolar World

Afghanistan: China says extremism must not be allowed to return to Afghanistan – SCMP

“Both regional countries and the international community wish to see the future Afghan government pursue moderate Muslim policies and avoid extremist tendencies,” China’s Foreign Minister Wang Yi said in a meeting with the foreign ministers of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. Beijing would continue to play its part in the peace process, Wang said, adding that the Shanghai Cooperation Organisation – a security grouping led by China and Russia and including India, Pakistan, and Kazakhstan, Kyrgyzstan, Tajikistan, and Uzbekistan – could play a bigger role in it.

China stepped up its contact with the Taliban after former US President Donald Trump announced the troop withdrawal. In 2019, Beijing hosted representatives of the group to discuss their peace talks with the U.S. Pang said both China and India were keen to fill the gap left by the U.S., but Beijing was mindful of Afghanistan’s reputation as a “graveyard of empires” and would be reluctant to get too deeply involved. The suicide bomb in Quetta, Pakistan last month that killed five people at a luxury hotel hosting the Chinese ambassador highlighted security concerns in the region where Beijing has invested heavily via its Belt and Road Initiative.

Tariffs: U.S. Tariffs Drive Drop in Chinese Imports - WSJ

U.S. tariffs have led to a sharp decline in Chinese imports and significant changes in the types of goods Americans buy from China, new data show, with purchases of telecommunications gear, furniture, apparel, and other goods shifting to other countries. Vietnam has been an especially big beneficiary. It now ranks No. 6 globally for imports to the U.S., up from 12th as recently as 2018.

“If the goal was to reduce imports from China then it succeeded,” said Craig Allen, president of the U.S.-China Business Council, which represents U.S. companies that do business in China. “But if the goal was to increase manufacturing employment in the United States I don’t see any evidence that that’s happened. If the goal was to increase imports from other countries in Asia or increase manufacturing employment in Vietnam, it’s succeeded.” U.S. Trade representative Tsai commented that they are still reviewing the tariffs but will not be lifting them in the near term.

Thank you for reading - Mike