MIDDAY MACRO - DAILY COLOR – 5/12/2021

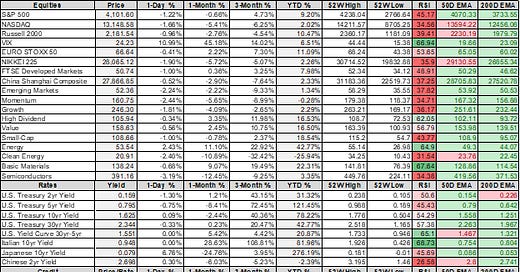

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities significantly weaker across the board again as CPI data continues inflationary fears

VIX front-month futures contract over 24

Treasuries curve is flattening with the belly underperforming

WTI higher with RBOB not far behind as gas shortages grow

Price Action:

Equities broke through prior option and technical support levels again following the CPI report and now look likely to fall further

S&P/Russell outperforming Nasdaq

High Dividend Yield, Value, Low Volatility factors outperforming

Energy and Financials sectors outperforming

Call wall is at 4150 than 4177 with support at 4100, 4040 is technical support with resistance at 4120

Major Asian indexes lower: Japan -1.6%. Hong Kong +0.8%. China +0.6%. India -1%.

European bourses lower, at midday: London +0.8%. Paris +0.1%. Frankfurt +0.3%.

Treasuries bear flattening as belly under pressure

5yr = 0.85% and 10yr = 1.68%

5-Year TIPs Breakeven rates top 2.8, highest level since 2005

WTI higher by 1.6% to $66.30 as markets further price in Colonial pipeline's disruption

Copper slightly lower after post CPI data selling

Aggs higher to flat, led by soybean complex, as traders await the WASDE report at noon

DXY breaking out of its recent range following CPI, now around 90.7

Gold is under pressure after post data volatility, currently at $1820

Bitcoin lower by 1% to $56.2K after overnight weakness

Analysis:

After two quarters of watching rising cost pressures seen in business surveys, ISM and PMI reports, global PPIs, and general commodity price increases, inflation is finally starting to reach the end consumer in a meaningful way.

The Fed will likely not be swayed to change their tune anytime soon, given the largest drivers of today's beat will be seen as "transitory" (factors such as used car prices) while rents, the most significant contributor, were more stable.

However, owner's equivalent rent is likely to increase moving forward.

Housing prices will continue to rise due to tight inventories, increased construction costs, and low land availability. At the same time, fiscal support to back-pay rents will finally allow rent rises to occur as landlords adjust to improved fundamentals.

Also, there is no immediate end to supply chain disruption, which has reduced the production and inventories of vehicles and numerous other things.

Finally, the national average price paid at the pump hit $3 for the first time since 2014, and while not part of core, it will help sway the American consumer's psyche that higher inflation is here.

Tomorrow's PPI will likely be an even greater beat over expectations as forecasters continue to struggle with modeling the unique dynamics at play.

Bear Flattening: This may break Treasuries into the next trading range as yields in the belly rise and price in less Fed accommodation while lower growth concerns reduce selling in the long-end comparatively.

It all comes down to real rates.

If breakevens can keep up with rising inflationary data, financial conditions may not restrictively tighten too quickly, and a stronger correction in risk assets may be avoided.

A rotation to more inflationary defensive sectors/firms will continue as duration risk and cash flow/earnings security concerns continue to outweigh growth factors allowing the headline index not to enter correction territory.

WORTH A LOOK

Econ Data:

CPI: The Core CPI surged beyond all expectations, higher by 0.9% on the month,pushing the annual rate to 3%. Headline CPI rose 0.8% on the month and 4.2% on a year-over-year basis. Used car prices jumped 10% on the month, having an outsized impact on the index. There is a clear impact from supply-chain issues on car prices and estimates have it raising core prices by 0.3% to 0.4% MoM. However, even excluding this effect the Core CPI advanced between 0.5% and 0.6% MoM. Along with the three deviation miss of the median expectation by forecasters for NFP we are clearly in a "data forecast fog".

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio

Chinese Iron Ore Future Price

5yr-30yr Treasury Spread

EUR/JPY FX Cross

The Breadth of Markets:

Recent weakness in equity market comes amid historic signs of broad-based strength in the S&P 500. The percentage of index members trading at a 52-week high hit a record of 45% on Monday according to data compiled by Bloomberg going back to 1990. The percentage of members trading above their 200-day moving average was at 92%, just below the record 97% reached late last month. U.S. equity funds have already attracted $170 billion of inflows so far this year, with their global equivalents seeing a breathtaking $456 billion of new money, according to the latest EPFR data.

OFF THE RADAR

China's 2020 Census:

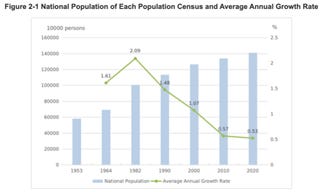

The nation's once-in-a-decade census, which was completed in December, showed its population increased to 1.41bn in 2020.

The official figures released on Tuesday showed the population grew just 5.4% from 1.34bn in 2010, the lowest rate of increase between censuses since the People's Republic of China began collecting data in 1953

Population by Regions: The population in the eastern region accounted for 39.9% of the total, that in the central areas accounted for 25.8%, that in the western region accounted for 27% percent and that in the northeast China accounted for 7%.

Sex Composition: Of the national population, 723.34 million persons, or 51.2% were males while 688.44 million persons or 48.8% were females.

Age Composition: The age group of 0 to 14 account for 18%; age group of 15 to 59 account for 63%; and in the age group of 60 and over account for 19%

60 and above were up by 5.5% since 2010 (19% from 13.3%)

Educational Attainment: There were 218.36 million persons with university education. Compared with 2010, the number of people with university education went up from 8,930 persons to 15,467 persons per 100,000 persons, the average years of schooling for people aged 15 and above increased from 9.08 years to 9.91 years, and the illiteracy rate dropped from 4.1% to 2.7%.

Urban and Rural Population: People living in urban areas account for 63.9%, while 36.1% live in rural areas.

Floating Population: Compared with 2010, the population who lived in places other than their household registration areas went up by 88.5%, the population who lived in places other than their household registration but still in the same city up by 192.6%, and the floating population up by 69.7%.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

Federal Cybersecurity: U.S. pipeline hack revives cybersecurity focus: Update - Argus

The pipeline attack highlights the need for the U.S. to set mandatory cybersecurity standards for oil and gas pipelines, U.S. Federal Energy Regulatory Commission chairman Richard Glick and commissioner Allison Clements. "Simply encouraging pipelines to adopt best practices voluntarily is an inadequate response to the ever-increasing number and sophistication of malevolent cyber actors."

Federal oversight of pipeline security resides primarily with the Transportation Security Administration (TSA), which employed roughly 50,000 airport screeners but just six full-time staff in its Pipeline Security Branch as of the fiscal year 2018. Critics argue TSA lacks the expertise, and pipeline operators have resisted mandatory cybersecurity rules because of concerns they could go out of date quickly. According to the Interstate Natural Gas Association of America, "government programs and standards must be nimble enough to adapt to continually evolving threats, leveraging public-private collaboration and two-way information sharing."

A.I. Ethics: Google Plans to Double A.I. Ethics Research Staff - WSJ

Vice President of Engineering Marian Croak said that Google would increase the size of the responsible A.I. team that she leads to 200 researchers. Additionally, she noted that Alphabet Chief Executive Sundar Pichai has committed to boosting the operating budget of a team tasked with evaluating code and product to avert harm, discrimination, and other problems with A.I.

A.I. governance will likely be a dog and pony show in the end. Corporations will be forced to publicly take a more ESG approach in their use of A.I. but ultimately are eager to monetize the benefits it brings. The real danger will be from hostile governments. The race to combine A.I. with quantum computing is the holy grail of cyber power, and once achieved, it will be so powerful it will fundamentally change everything.

Ransomware: Energy Tech Firm Hit in Ransomware Attack – WSJ

Volue AS A, a Norwegian company that provides technology to European energy and infrastructure firms, is working to restore critical software services to customers after a ransomware attack on May 4 and 5. Ransomware shut down Volue's applications providing infrastructure to water and wastewater facilities in 200 Norwegian municipalities, covering around 85% of the country's population. Seeking to prevent the ransomware from spreading to other computer systems, the company shut down all other applications that it hosts and quarantined around 200 employee devices.

Precise data on ransomware attacks are difficult to come by, partly due to the desire for secrecy among both perpetrators and victims. Ransomware victims paid hackers at least $350 million in cryptocurrency payments in 2020, a fourfold increase from the previous year, according to the blockchain analysis firm Chainalysis Inc. Other security experts and cybersecurity officials have estimated the overall toll on the U.S. economy registers in the billions annually.

Electrification

Semi Shortage: Worldwide chip shortage could last years, says Dell founder – TechRadar.com

The severity of the problem can be gauged because Dell, which is one of the biggest customers for semiconductor companies with a reported annual order volume of $70 billion, still had to pay a premium to meet its demands. "We are talking about components that are in the one-dollar range and are used practically everywhere (are hard to find)," said Michael Dell, adding, "but even newer technologies are not easy to come by."

Before Dell, CEOs of several other major semiconductor users such as Cisco, Qualcomm, and Micron had also expressed concern about the longevity of the crisis. Intel sees the crisis as an opportunity to correct an imbalance in the global semiconductor supply chain and plans to invest $20 billion in two new chip-making factories. The company has already started pumping money into upgrading its existing manufacturing facilities in the U.S.

Starlink: Elon Musk seeks NCC's approval to operate SpaceX Starlink satellite broadband in Nigeria - Vanguard

SpaceX has already entered into advanced discussions with the Nigerian Communications Commission, NCC, to ensure the move cascades into a successful technology transfer project. Nigeria is interested in making necessary efforts to drive the coverage of rural, unserved, and underserved areas of the country.

SpaceX's low orbiting constellation of satellites can provide low latency, high bandwidths internet to all corners of the world. Given the current breakdown of law and order in rural areas of Nigeria, the ability to better connect the population could help create stability and promote growth in the most populous country on the continent. This is also an area a U.S. company will be competing with the Chinese rival, creating another soft power capital battle in Africa.

Environmental & Natural Resources

SWF Investing: Sovereign Wealth Funds Invest In Climate Technology, Renewables

The custodians of national wealth invested $2.3 billion in 2020 in sectors important to combating climate change, including forestry, renewable energy, and so-called agritech, according to a report published Tuesday by the International Forum of Sovereign Wealth Funds, a network of sovereign funds from Abu Dhabi to Singapore. That's more than double the $1.1 billion invested in 2019, IFSWF data show. Only 30% of a group of 34 responding institutions had more than 10% of their portfolios invested in climate-related strategies.

Although $2 billion is only a fraction of assets managed by SWFs and they are far from trendsetters it is a significant increase. Sovereign investors are increasingly willing to invest in renewable energy assets because the technology has matured, and they have become profitable in the short- to medium-term. In addition, global electricity demand is increasing due to the energy transition and electrification of transport, which should send more capital into the sector and further drive down costs.

Ammonia: Japan's Kobelco to use ammonia for power generation - Argus

Japanese steel producer Kobe Steel is planning to co-fire ammonia at its 1,400MW coal-fired power plant in Kobe, aiming for a complete shift to the fuel as part of its strategy to achieve carbon neutrality by 2050, subject to verification and commercialization of cost-competitive, large-scale ammonia co-firing technology. A complete fuel shift to ammonia is planned before 2050, following a gradual increase in the co-firing rate.

New areas of industrial use of ammonia are emerging, which are becoming increasingly relevant in the context of increased attention to environmental protection and reduction of greenhouse gas emissions. Japan is considering replacing coal fuel for power plants with ammonia, and it is also emerging as a marine fuel. Ammonia as an energy source complies with the new IMO 2020 requirements that limit the sulfur content in bunker fuel and will reduce CO2 emissions to target environmental indicators.

Wind Farms: Wind Farm Off Massachusetts Coast Gets Final Federal Approval – WSJ

Vineyard Wind, a $2.8 billion project off the coast of Massachusetts, is likely to start construction within a year and operation in 2023, project leaders said. The Biden administration said Tuesday it had approved the project's construction and operations plans for as many as 84 turbines 12 miles off Nantucket, saying it could be a significant job creator and address climate change.

President Biden has made wind power a cornerstone of his plan to reduce greenhouse-gas emissions that contribute to climate change. Shortly after taking office in January, he signed an order directing the Interior Department to explore doubling U.S. offshore wind production by 2030, a boon to East Coast leaders vying to make their states new hubs in the growing renewable-power business. The decision could be a significant turning point for development that has languished in the U.S., while the same industry has flourished in Europe.

Commodity Cycle

Tin: Tin Prices Soar on Electronics Demand, Shipping Trouble – WSJ

High demand for consumer electronics and difficulties shipping metal out of Asia have created a shortage of tin, pushing prices for the metal close to record highs for the first time in a decade. "Demand is wild across the board," said Evan Morris, co-president of Nathan Trotter, adding that he has never experienced such acute shortages of tin. The Sadsburyville, the Pa.-based manufacturer of solder wire and other tin products, is racing to keep up with orders.

Tin's advance is one of the most significant moves in commodity markets, feeding expectations that inflation will accelerate. The market for tin tumbled in 2019 when a downturn in semiconductor sales knocked demand. Prices took another leg lower when lockdowns and the closure of factories hit sales of industrial commodities in early 2020. Fast forward a year, and the market is "probably the most squeezed it's ever been," said Charles Swindon, managing director of U.K.-based RJH Trading.

Logistical Bottlenecks

E-Commerce: How E-Commerce Fits into Retail's Post-Pandemic Future - HBR

Retailers made approximately $10 billion in e-commerce investments, acquisitions, and partnerships from May to July 2020. These investments spanned logistics capabilities to enable last-mile, asset-light approaches like ghost kitchens (restaurants with a space for kitchen equipment and facilities, but no dining area for walk-in customers) and dark stores (retail distribution centers that cater exclusively to online shopping), as well as product portfolio investments geared toward digital capabilities in A.I. and blockchain.

In early 2021, the EY Future Consumer Index surveyed thousands of consumers since the early days of the pandemic and found that 80% of U.S. consumers are still changing the way they shop. Sixty percent are currently visiting brick-and-mortar stores less than before the pandemic, and 43% shop more often online for products they would have previously bought in stores. One of the most significant effects of Covid-19 is the realization that geographical location has become less relevant so long as there's an internet connection.

China Macroprudential Policy

Price Controls: What Can China Do to Control Record Commodity Prices? - BBG

Beijing has historically used several ways to control price increases. Currently, policies on pollution and imports have only served to exacerbate supply constraints. Moving forward, China may use further financial trading restrictions like increasing margin requirements and narrowing trading bands to stop speculation. Beijing can also increase production as they are currently doing with thermal coal. They can also release stockpiles from state reserves. The nation holds stockpiles of materials like copper, agriculture products, and massive crude oil reserves, but the amounts are undisclosed.

The easiest way to reduce commodity prices is to reduce fiscal and monetary support, which might be precisely what China ends up doing. China has already trimmed this year's quota for the debt sales that typically fund infrastructure, and local governments have been slow off the mark in terms of new issuance. Finally, all of China's financial markets are watching for any indication that the PBOC will accelerate monetary tightening as the nation completes its recovery from the pandemic.

Defining National Security Assets in a Dual Use Environment

Chinese Semiconductors: China's top memory chip maker YMTC denies report that it has a secret plan to wean itself off U.S. technology - SCMP

Nikkei reported last week that Yangtze Memory Technologies Corp had launched a "massive review of its supply chain" to replace U.S. producers by setting up a task force of over 800 people. YMTC issued a statement on Monday evening saying it denied a "recent foreign media report" in an apparent reference to the Nikkei report. "YMTC is a globalized company with a commitment to integrating into the global semiconductor supply chain," the company said in the statement. The denial comes at a time when China is trying to cut its reliance on foreign technology, especially that supplied by U.S. companies.

The U.S. has placed sanctions on several Chinese tech firms, cutting off access to advanced U.S. technology. YMTC is not currently on any U.S. trade blacklist and is one of China's most advanced memory chip makers, capable of producing 128-layer NAND flash memory chips. President Xi visited the company in April 2018 and urged it to "climb to the peak of the world's memory chip technologies." This is a critical area in chips, and the U.S. has a shrinking time window as China prioritizes self-dependence here.

Unipolar to Multipolar World

Import Bans: China may target Australian LNG despite costly coal ban - Reuters

There is some concern that China may be taking some early action against LNG imports from Australia, with Bloomberg reporting on Monday that smaller LNG buyers in China have been told to avoid taking Australian cargoes. The unofficial ban only extends to second-tier LNG importers, not the state-owned majors, who account for almost 90% of China's imports.

It may be the case that authorities in Beijing are taking a calculated risk that they can afford to cut some purchases of Australian LNG as there are numerous other suppliers that can fill the gap, including the United States and Qatar. But it would also appear that a similar calculation on coal may have backfired, with China struggling to source sufficient imports and having to pay more for what it can get, leading to a squeeze on domestic supplies and prices.

5G Wars: China Threatens Retaliation Against Ericsson if Sweden Doesn't Drop Huawei 5G Ban - WSJ

Ericsson's participation in the next round of China's massive 5G build-out is linked to whether Stockholm changes its stance on Huawei, according to the Global Times, a Chinese Communist Party publication. Swedish regulators banned wireless carriers from using the Chinese company's 5G equipment in October, citing national-security concerns.

Another example of China using the lure/promise of access to its domestic markets to force foreign governments to look the other way when it breaks international norms. In March, Chinese media outlets and Communist Party-affiliated groups encouraged a purge of Swedish retailer H&M brand from much of the Chinese internet after the fashion brand said it was seeking to ensure that its cotton didn't come from Xinjiang. Xi knows the greatest leverage he has over foreign firms and their influence on governments is the Chinese consumer, continuing a fear and greed foreign diplomacy approach.

Thank you for reading - Mike