MIDDAY MACRO - DAILY COLOR – 5/11/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

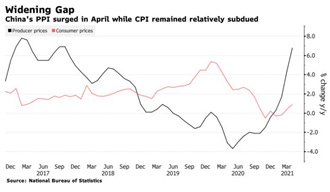

Equities significantly weaker across the board as stronger PPI data out of China further weighed on sentiment

Treasuries bear curve steepening as inflation fears outweigh flight to safety

WTI down slights as markets figure out pipeline shutdown consequences on demand

Price Action:

Equities broke through prior option and technical support levels overnight

S&P outperforming Nasdaq/Russell

Low Volatility, Growth, and Small-Cap factors outperforming

Consumer Staples, Financials, and Materials sectors outperforming

Call wall is at 4177with support at 4100 followed by 4150, 4120 is technical support with resistance at 4170

Major Asian indexes lower: Japan -3.1%. Hong Kong -2.2%. China +0.4%. India -0.7%.

European bourses lower, at midday: London -2.3%. Paris -2.1%. Frankfurt -2.3%.

Treasuries curve steepening as long-end under pressure

5yr = 0.80% and 10yr = 1.63%

WTI flat around $65 after overnight weakness reversed at NY open

Copper higher by 1% and consolidating around $4.75

Aggs higher after the NY open as traders await the WASDE report tomorrow

DXY briefly broke below 90 overnight but has been range-bound between 90.3-90 since NFP

Gold’s briefly dipped post open but has recovered to $1830

Bitcoin slightly higher to $56.2K after a weaker overnight

Analysis:

Today’s price action is undoubtedly more inflationary focused as a significant beat by Chinese PPI highlighted how the rally in commodities is hitting factory gate prices (and eventually exports), and NFIB and JOLTs data increased the probability that wages will rise.

The acceleration of the U.S. and Chinese growth, likely followed by Europe and eventually the rest of the world, is “currently” inflationary and will ultimately feed through into higher global levels of yields, starting with Treasuries.

Real yields will be pulled higher and tighten financial conditions.

Premium enjoyed by tech will continue to erode as growth is easier to come by.

The Fed’s wait-and-see stance will begin to change over the summer as it becomes clear we are out of the woods, and tapering talks start.

These factors, along with others (fully invested positioning, increasing geopolitical risks…), should all continue to weigh on equity indexes given their tech-heavy nature and support the rotation already underway into large-cap value and cashflow secure companies.

Our longer-term view is still a more stagflationary environment next year as future growth expectations fall heading into 2021

There will eventually be a re-rotation back into paying up for growth in the second half of 2021.

WORTH A LOOK

Econ Data:

JOLTs Job Openings: Job openings reached a record level of 8.1 million at the end of March, reflecting a widening gap between open positions and workers willing to take those roles. Available jobs rose by a seasonally adjusted 600,000 in March from February, exceeding the prior record of 7.6 million set in November 2018, the Labor Department said Tuesday. Data from job search site Indeed.com separately showed job posting continued to rise in April, ending the month 24% higher than February 2020’s pre-pandemic level. Many economists say a number of factors—including expanded unemployment benefits, fear of contracting Covid-19, and a lack of child care—are keeping workers from taking open jobs.

NFIB Small Business Optimism Index: Increased to 99.8 in April, an increase of 1.6 points from March, thanks to growth in sales. The Optimism Index has increased 4.8 points over the past three months since January but a record 44% of owners reported job openings that could not be filled. “Finding qualified employees remains the biggest challenge for small businesses and is slowing economic growth. Owners are raising compensation, offering bonuses and benefits to attract the right employees.” said NFIB Chief Economist Bill Dunkelberg. The percent of owners expecting better business conditions over the next six months fell seven points to a net negative 15%, surprisingly glum.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio

Chinese Iron Ore Future Price

5yr-30yr Treasury Spread

EUR/JPY FX Cross

Corn Technical Analysis:

Corn continues to rally, approaching recent highs. Its parabolic move in mid-April has consolidated into a rising pennant formation and although less bullish than a standard flag formation still indicates a bullish tilt to price action. Fundamentally there is still reason to believe the agriculture complex more generally will rise as China’s demand and weather/crop conditions in key regions like South America and Eastern Europe affecting supply globally have not materially changed. There is a risk that there will be higher acreage in the U.S. but this has yet to be seen. All in all the rally looks set to continue likely with less momentum.

OFF THE RADAR

The Fading American Dream:

In 2016, a group of US economists looked at data on U.S. households going back to 1940 and found generation by generation, were increasingly earning less than their parents.

The gap got most pronounced after 1980, their research showed.

Currently, the pandemic is making this generational inequality gap worse for American millennials.

“While the majority of Millennials are living with a significant other, the pandemic brought about a reversal of the previous multi-year downward trend in the percentage that live with their parents,” BofA Equities analysts wrote in its latest annual survey measuring this social trend.

“Our survey responses, which showed an uptick from April 2019 (9%) to April 2021 (14%) suggest that the pandemic set Millennials back by about five years in the trend of independence from their parents.”

BofA touched on some of the reasons for this trend:

Home prices are rising.

The labor market is uncertain, as is the income levels of this group.

The good news is they’re saving more money, and the urge to buy a house, and maybe start a family, is undiminished. Still, this cohort acknowledges, they won’t be able to leave mom and dad’s basement for the foreseeable future.

Credit Card Debt:

Americans are paying down their credit-card debt at levels not seen in years.

Large card issuers that cater to borrowers ranging from the affluent to the subprime say that overall card balances and thus the firms’ interest income are falling.

To make up for it, issuers are spending more on marketing and loosening their underwriting standards.

Discover Financial Services said on its earnings call last month that the share of card balances that were paid off at the end of the first quarter was at the highest level since 2000.

Capital One Financial said that nearly half of the credit-card balances it had at the beginning of March were paid off by the end of the month, which the company described as historically high.

Synchrony Financial, the largest issuer of store credit cards in the U.S., said payment rates have been higher than they averaged before the pandemic.

A year ago, lenders expected delinquencies to surge and many borrowers to turn to credit cards to make ends meet.

This never happened after the government stepped in, issuing stimulus checks, expanding unemployment benefits, and making it easy for borrowers to pause payments on many mortgages and student loans.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

Colonial Hack: What We Know About the Colonial Pipeline Cyberattack - NYT

Federal investigators said the attackers aimed at poorly protected corporate data rather than directly taking control of the pipeline. Colonial Pipeline stopped shipments apparently as a precaution to prevent the hackers from doing anything further, like turning off or damaging the system itself in the event they had stolen highly sensitive information from corporate computers.

The article identifies what the Colonial Pipeline is, why the Atlantic Coast is so dependent on one pipeline, and how serious the immediate and longer-term problems are. “The unfortunate truth is that infrastructure today is so vulnerable that just about anyone who wants to get in can get in,” said Dan Schiappa, chief product officer of Sophos, a British security software and hardware company. “Infrastructure is an easy — and lucrative — the target for attackers.”

Electrification

EV: China’s Tech Giants Bet $19 Billion on Global Electric Car Frenzy – Caixin

The size and speed of the move by China’s tech titans puts them ahead of many of their Western counterparts. Over the past three months, Huawei, smartphone giant Xiaomi Corp., Baidu, even Apple’s Taiwanese manufacturing partner Foxconn have joined the fray, forging tie-ups and unveiling their own car-making plans. Nowhere was that more on display than at last month’s Shanghai Auto Show, which has become one of the world’s premier events for showcasing the hottest new trends in the automotive sector.

The rise of smart vehicles and autonomous driving throws up a raft of possibilities for tech companies, not least access to data such as real-time insight into popular destinations and the routes taken to get there. On top of that, for some there’s the opportunity to charge for tech add-ons and system improvements, essentially treating the vehicle like a piece of computer hardware that constantly gets its software updated. There are also dual-use national security implications as vehicles become more self-reliant and capable of data gathering.

Environmental & Natural Resources

EU Carbon Plans: Carbon Offsets Come Into Focus as Part of EU Green Overhaul - BBG

According to a group of climate policy experts, Europe could create a new carbon emissions-cutting market to attract billions of euros of investment and help set green standards globally. They suggest that the European Union could gradually open up voluntary carbon offsets -- tradeable credits generated for cuts in greenhouse gases that companies can use to justify their green claims.

The tool is growing increasingly popular with companies looking to slash emissions from their carbon accounts quickly and cheaply rather than invest in a structural change that takes time to take effect and cut emissions. To function correctly a carbon offsets market would need strong oversight to avoid greenwashing and strict quality controls could also prevent repeating past mistakes, which undermined public trust in offsets in the last decade.

U.S. and EU Cooperation: Kerry Signals U.S. Is Open to Coordinate Green Diplomacy With EU - BBG

Kerry spoke with European foreign affairs ministers during their meeting on Monday as the U.S. seeks to regain its position as a climate leader. A renewed green alliance with the 27-nation EU could help maintain momentum before key international climate summit in Glasgow in November.

The global summit is crucial because nations are expected to update their pledges under the 2015 Paris Agreement. Only a handful of new emission-reduction plans were submitted last year, including the EU committing to deepen its greenhouse gas-cut goal to at least 55% by 2030 from 1990 levels. Officials highlighted the need to make good on promises made by rich countries in 2009 to mobilize $100 billion a year to help developing nations in their green transition. Making the funding available is seen as key for the Glasgow summit to have a good chance of success.

Infrastructure

Colonial Hack: Colonial restoring branch lines after cyber attack - Argus

Colonial Pipeline began restarting branch lines in its system today but said it cannot yet restore flows along its main lines from the Gulf Coast to New York Harbor. Colonial said it restarted some of the 65 smaller lateral lines shut since last week between terminals and delivery points, and is in the process of restarting other branch lines. But the wide-diameter pipelines that stretch from Houston to Linden, New Jersey, feeding much of the east coast’s demand for gasoline, diesel, and jet fuel, remain offline. The company is developing a plan to restart the system fully, but that will happen “only when we believe it is safe to do so, and in fullcompliance with the approval of all federal regulations.”

The Administration is working with various parties to avoid supply disruption and the Dept of Transportation declared an emergency today waiving fuel transport rules but it's possible the main pipeline stays offline longer than anticipated. Outside of domestic supply disruptions, this attack also has the potential to derail JCPOA 2.0 negotiations if it turns out Iran had a hand in it (although the software used is currently being attributed to Russia), reducing future global oil supply as sanctions would be likely to remain. Finally, it also increases the likelihood of bipartisan support for Biden’s core infrastructure plan.

Resilient Ports Act: Bipartisan legislation introduced to improve resiliency of US ports – Splash247.com

Legislation has been introduced in the US Congress to help upgrade ports to meet the challenges of extreme weather events, flooding, and a rise in sea levels, and to increase funding for infrastructure projects at inland river ports. In addition to building resiliency, the bill would enable funding for port infrastructure projects that reduce the overall carbon footprint from port operations.

“Like so much of our nation’s infrastructure, our ports are years, even decades behind the times, which affects our global competitiveness in the maritime sector. This bipartisan legislation – which will help reduce carbon pollution and ensure our ports are resilient to events related to climate change – is a key part of the solution,” said Congressman DeFazio, sponsor of the bill. Look for national security concerns and cyber vulnerabilities to be added to this bill too.

Commodity Cycle

Commodity Price Pressure: China’s Surging Factory Prices Add to Global Inflation Risks - BBG

China’s factory-gate prices surged more than expected in April, fueled by rapid gains in commodity prices, adding to global inflation concerns. The producer price index rose 6.8% from a year earlier, its fastest pace since October 2017, following a 4.4% gain in March, the National Bureau of Statistics said Tuesday. The median forecast was for a 6.5% increase. Consumer prices increased 0.9% on year, slightly below the 1% gain projected by economists.

With China being the world’s biggest exporter, its rising cost pressures for the nation’s factories pose another risk to global inflation as manufacturers start passing on higher prices to retailers. Surging factory prices are stemming from strong domestic demand for raw materials due to the continued momentum of infrastructure and property projects in China, as well as expectations of higher material prices globally thanks to the U.S. infrastructure building plan. This is likely to continue for the foreseeable future.

Logistical Bottlenecks

TC2 Route: Prolonged US pipeline closure the wildcard for product tanker owners – Spash247.com

Traders have booked at least six tankers to ship gasoline from Europe to the US. Although the product tanker market is oversupplied, it remains tight as non-eco MR spot rates for the TC2 route jumped by 90% on the news yesterday. Traders are also reportedly seeking vessels to ship gasoline that would otherwise have been shipped on the pipeline. Some tankers are also being secured to store gasoline at the US Gulf, in the event of a prolonged shutdown.

The federal government could opt to temporarily waive the Jones Act to increase the number of available tankers, resulting in some traders temporarily storing gasoline on tankers in the US Gulf Coast in the case of a multi-week or prolonged shortage. The US administration has already declared a state of emergency allowing for increased trucking of fuels in 17 states by permitting drivers to travel between fuel distributors and for longer hours. All in all, this could be a bigger deal than markets are expecting.

China Macroprudential Policy

Shaky Ground: Chinese Premier Li Keqiang warns of challenges over jobs, private sector, red tape - SCMP

Despite its outward confidence in being among the first countries to recover economically from the pandemic, Beijing recognizes that growth is on a weak footing and there are many challenges ahead. Li warned against complacency as he noted difficulties and challenges over employment, the private sector, and government inefficiency and red tape. “The foundation of our economic recovery is still shaky,” Li told the officials. “Small and medium enterprises, as well as self-employed businesses, are suffering from rising costs, which means there is heavy pressure on employment.”

China’s PPI is showing increasing inflationary pressures that Li is warning about. Bureaucracy and corruption are also stifling growth, highlighting key weaknesses that still exist in the capitalist-communist compromise Deng started many decades ago. Continuing to expand the CCPs legitimacy and power going into the 100th anniversary in 51 days is paramount for Xi so he will be eager to show progress in fighting inflation, corruption, and unnecessary bureaucracy but it looks like they think there is still much more to be done there.

Unipolar to Multipolar World

Taiwan and WHO: Taiwan fights to attend WHO meeting, but China says no - Reuters

The G7 has called for Chinese-claimed but democratically-ruled Taiwan to attend the WHO’s decision-making body, the World Health Assembly, which meets from May 24. Taiwan is locked out of most global organizations such as the WHO due to the objections of China, which considers the island one of its provinces, not a country.

While the WHO cooperates with Taiwan’s technical experts on COVID-19 it is up to member states whether to invite Taiwan to observe the WHO meeting, an invite China can easily get allied nations to block. Votes like this show where allegiances lie and should be watched to see how China’s influence is changing over the world.

Iraq the Peacemaker: Iraq Brings Saudi and Iran Closer as Biden Resets Policy - BBG

Iraq, the poster child of Middle East instability for two decades, is playing the role of peacemaker, brokering talks between Iran and Saudi Arabia and seeking to mediate an end to the war in Yemen. The Turks are also working on patching up relations with Egypt, Saudi Arabis, and UAE while Qatar’s ruler and Saudi Arabia’s crown prince met in Jeddah this week as they work to restore diplomatic ties.

It’s possible we could be looking at a very different Middle East from the past decade where statesmanship and de-escalation are replacing conflict and rivalry. Given the history it fair to be skeptical but any regional de-escalation would be a relief to the U.S. as it continues to pivot away from the region into the Indo-Pacific.

Thank you for reading - Mike