MIDDAY MACRO - DAILY COLOR – 5/10/2021

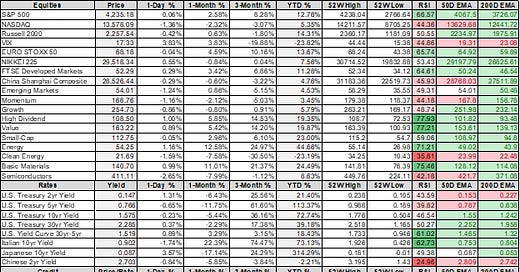

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities flat to weaker after a reversal in overnight price gains occurred at the NY open

Treasuries curve steepening again as the belly is well bid while the bond is under pressure

Copper gave up overnight gains as momentum was unsustainable

WTI recovering after NY open selling

Price Action:

Bull flag consolidation occurring after new highs in overnight turned into NY open selling

S&P outperforming Nasdaq/Russell

High Dividend Yield, Value, and Low Volatility factors outperforming

Industrials, Utilities, Healthcare sectors outperforming

Call wall is at 4250with support at 4200, 4190 is technical support with resistance at 4240

Major Asian indexes mixed: Japan +0.6%. Hong Kong -0.1%. China +0.3%. India +0.6%.

European bourses mixed, at midday: London +0.1%. Paris -0.2%. Frankfurt -0.2%

Treasuries curve steepening as the belly continues to outperform

5yr = 0.75% and 10yr = 1.57%

WTI lower around -0.3% to $64.7 after overnight rally reversed into NY open loses

Copper hit new highs overnight, up around 2.5% at one point, now down -0.6% post-NY open

Aggs lower post NY open but within recent ranges

DXY continues to drift lower, now around 90

Gold’s rally continues, up 0.5% to $1,840

Bitcoin slightly higher to $58.1k

Analysis:

Copper's major reversal from overnight highs (in line with other base metals outside iron ore) showed that momentum had become unsustainable even with the increased focus on the "electrification" theme by markets over the last few weeks.

Iron ore continues to rally, with futures in Singapore up 10% on the day, due to continued trade concerns between China and Australia.

Price action in Chinese commodity markets even caught the attention of regulators, who told brokers and banks Monday to tone down their bullish rhetoric as not to overheat the market.

Even as Treasury yields remain near the lows of their recent range, growth and momentum factors are underperforming, highlighting the divergence from past correlations between the two.

The rotation continues to favor inflationary defensive and cashflow yielding sectors

Increasing 2022 growth concerns have yet to entice investors to pay up for growth over value, will there be a 2021 2H rotation reversal?

Misunderstandingscontinue over last week's weaker-than-expected employment report.

Data misaligns with other labor data, hiring intention by firms, an economist's views on the effects of unemployment benefits.

This was likely a fluke report hurt by a number of unique factors.

WORTH A LOOK

Econ Data:

NY. Fed's Survey of Consumer Expectations: Median year-ahead inflation expectations increased to 3.4% in April from 3.2% in March, while remaining unchanged at 3.1% at the three-year horizon. The one-year ahead measure is now at its highest level since September 2013 despite inflation uncertainty falling. Interestingly, Rent growth expectations posted a fifth consecutive increase, rising to a new series high of 9.5 percent, while the one-year outlook for gas and medical care costs declined

Policy Makers Rhetoric and Key Events:

Chicago Fed President Evans said It will probably take "quite some time" for Federal Reserve officials to conclude the economy has made substantial progress following Friday's disappointing jobs report in an interview on CNBC Monday. "I think we are going to have to see more strong employment numbers, and we're going to have to see inflation, and it will be delicate. We'll see transitory inflation that's going to look like it's above 2%. Is it going to be relative prices, or is it something more sustainable?" Evans said. "So, I think it's going to take quite some time for us to actually see it in the data, assess it."

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio

Chinese Iron Ore Future Price

5yr-30yr Treasury Spread

EUR/JPY FX Cross

Despite the recent ransomware attack on Colonial Pipeline which drove a strong Sunday night open in futures, WTI prices came under pressure after the NY open. Taking a step back, WTI continues to move higher in a tighter up-channel since recent March lows with resistance looking to be around $66.50, then $68. Today’s lows pushed on the larger post-November up-channel but were able to bounce off that level. Given the number of factors pushing and pulling on price, it is likely we continue to consolidate in the current wedge pattern until ultimately breaking higher.

OFF THE RADAR

Longest Lead Times:

Longer lead times are one of the clearest indications of the supply-chain challenges that producers face.

Wait times of factories for production materials grew to 79 days in April, the longest in records dating back to 1987, according to the latest Institute for Supply Management data.

The average delivery time of supplies for maintenance, repair, and operations was also the longest in ISM data.

Such delays have inflated order backlogs to record levels and kept a lid on a breakout in production growth.

The ISM's monthly reports also provide a clear indication of a growing number of commodities in short supply.

In November, purchasing managers listed just 8 materials companies were struggling to get their hands on, five months later and it's expanded to 24.

Employment Cost Index:

The government's latest employment cost index, a quarterly measure of compensation, showed wages in the private sector climbed by 1.3% in the first quarter, the most in 18 years.

The ECI's (unlike average hourly earnings in the monthly jobs reports) worker-pay data isn't distorted by the compositional changes in employment that have been particularly severe amid the pandemic.

Despite an elevated unemployment rate, many firms have cited troubles finding qualified workers which may reflect lingering child care obligations and enhanced unemployment benefits.

As a result, some are offering incentives like signing bonuses and boosting wages to attract applicants.

Some 28% of small businesses reported raising compensation in the March survey by the National Federation of Independent Business.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the "5th Dimension"

Pentagon's Cloud: Pentagon Weighs Ending JEDI Cloud Project Amid Amazon Court Fight – WSJ

The JEDI Cloud Project, valued at up to $10 billion over 10 years, aims to allow the Pentagon to consolidate its current patchwork of data systems, give defense personnel better access to real-time information, and put the Defense Department on a stronger footing to develop artificial intelligence capabilities that are seen as vital in the future. However, Pentagon officials are considering pulling the plug on the star-crossed JEDI cloud-computing project, which has been mired in litigation from Amazon.com Inc. and faces continuing criticism from lawmakers.

The prospect of a lengthy litigation process from Amazon is bringing the future of the JEDI Cloud procurement into question. The fact that national security priorities are being held up by litigation from a private company shows the challenges the US faces in modernizing its defensive capabilities.

Electrification

Semiconductor Startups: Despite Chip Shortage, Chip Innovation Is Booming - NYT

The semiconductor field is entering a surprising new era of creativity, from industry giants to innovative startups seeing a spike in funding from venture capitalists that traditionally avoided chip makers. VC plowed more than $12 billion into 407 chip-related companies in 2020, according to CB Insights, more than double what the industry received in 2019 and eight times the total for 2016. Synopsys is tracking more than 200 startups designing chips for artificial intelligence, the technology powering everything from smart speakers to self-driving cars.

Although still a tiny fraction of VC investments, the recent growth in funding shows the importance of innovation in the semiconductor industry in enabling other technologies. Currently, markets are focused on supply chain security and production levels, but the true long-term concerns of investors will gravitate towards which companies and countries have an edge in innovation.

Environmental & Natural Resources

Transition: How an Oil Company Becomes a Renewables Company - BBG

This quarter's earnings season helped further elaborate on how many of the oil majors plan to transition further into low-carbon and renewable energy portfolios. Norway's state-owned oil producer, Equinor ASA, is taking the lead here as it posted more than $2.6 billion of earnings in the first quarter of 2021, 49% of which was from renewable energy. Equinor's capital gains in renewables came from "farm downs," i.e. the selling of assets at various stages of development to new owners.

Equinor's way to benefit from renewable-energy assets is, essentially, to put in the early work of developing them and then reap the cash benefits of selling them to others. For example, Equinor's US wind assets, recently sold, result from its success in the country's 2018 offshore lease auction, when it won stakes with a bid of $135 million. The company says BP paid $1.2 billion for those same assets in its latest earnings statement, netting the Norwegian company $1 billion on the deal.

China's Green Reg: China Watchdog's Latest Probe Uncovers Widespread Environmental Abuses - Caixin

China's top environmental watchdog found a string of violations during its latest round of inspections, including illegal mining, excessive development, and illicit trash incineration, illustrating the country's perennial struggle to crack down on ecological abuses. More than 2,200 people who had failed to comply with environmental laws were detained in the first round of inspections, with hundreds held to account, according to the report.

Xi pledged to further address environmental problems in the latest 14th Five-Year Plan as he remains under pressure from domestic and foreign interests to do so. The legitimacy and ruling ability of the CCP will be closely tied to their ability to create a more environmentally sustainable economy. The Chinese middle-class is demanding a healthier environment and international organizations and trading partners are also more focused on the issue making any crackdowns on environmental abuses worth watching closely.

Infrastructure

Cybersecurity: Ransomware attack forces shutdown of major U.S. fuel pipeline - Axios

Colonial Pipeline, which carries 45% of the East Coast's fuel supplies, shut down 5,500 miles of its pipeline in response to the attack. The Department of Energy said it is coordinating with Colonial Pipeline, the energy industry, states, and interagency partners in responding to the incident.

This is a significant breach of critical infrastructure and comes on the heels of multiple other major cyberattacks on both US companies and the federal government. The Biden Administration will have to further focus on securing critical infrastructure from cyber-attacks, whether by state actors or rogue hackers. This will likely help encourage bipartisan support can put forth legislation to address the threat.

Commodity Cycle

OPEC Supply: Opec crude output rises on Iranian recovery - Argus

Opec crude production hit a three-month high of 24.96mn b/d, boosted by rising Iranian output. Iran overtook Kuwait to become Opec's fourth-largest producer and could raise its oil exports to 2.5mn b/d if sanctions are removed, which could happen within 6-8 weeks based on how current talks are going.

The higher production from Saudi Arabia and Iran will offset declines in north and west Africa. Overall Opec+ output, which includes nine non-Opec countries but excludes Opec members Iran, Libya, and Venezuela, increased by 260,000 b/d last month but remained below the group's collective April quota of 35.2mn b/d. There is also a belief that a larger amount of Iran's oil is currently on the black market and any additional legitimate supply will have less of an effect on prices.

Africa Agriculture: Africa's $31 Billion Farm Funding Gap in Focus for CDC Debt Deal - BBG

CDC Group, the UK government's development investment arm, is channeling $100 million to small-holder African farmers through export and trading company ETG and is seeking other partners to help it deploy more capital to the sector. As banks withdraw funding from agriculture because of regulatory challenges, and with some larger players defaulting, institutions such as CDC have a significant role to play in plugging the shortfall.

Appropriate interventions to address the funding shortfall, estimated annually at $23 billion to $31 billion, could increase the value of Africa's agricultural output to $880 billion a year by 2030, or more than triple the $280 billion in 2010, according to research compiled by CDC. Food security and its importance as a geopolitical tool will keep global interests focused on Africa and its untapped agricultural potential.

Defining National Security Assets in a Dual Use Environment

Chinese Lithium: Chinese Lithium Producer to Buy Out Mexican Sonora Project Owner - Caixin

Ganfeng Lithium will buy out Mexican miner Bacanora Lithium PLC in a deal valued at up to $264 million, becoming China's latest natural resource asset purchase to feed its booming demand for new-energy products. Bacanora's main asset is the Sonora project, which is among the world's largest for the mining of lithium clays with estimated reserves of 8.82 million tons of lithium carbonate equivalent.

Chinese companies continue to buy up key resource reserves across the globe. Increasing prices for almost all commodities in the Chinese domestic markets show that there continues to be a significant misalignment of supply and demand. Battery-grade lithium hydroxide is 68% higher on the year, while lithium carbonate had risen by an even stronger 72.8%.

Unipolar to Multipolar World

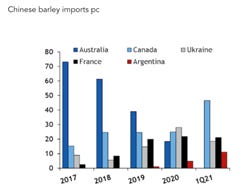

Food Security: China diversifies crop import origins - Argus

China, the world's largest grain buyer, has imported the highest level of barley and wheat since 2015. At the same time, corn imports rose to a record high. Chinese barley imports rose even though Australia, traditionally its largest barley supplier, was excluded entirely from the Chinese markets. Meanwhile, China has stepped up its wheat imports from Australia, exempt from the latest series of high tariffs.

China continues to pick and choose what it wants to import from Australia across the commodity complex based on the availability of alternative sources. This should be a clear warning to other trading partners, given China's willingness to use its economic might to weigh on any criticism of its activities.

Multilateralism: US, China take a less belligerent tone in remarks to UN Security Council - SCMP

Top diplomats from Beijing and Washington praised multilateralism at a UN Security Council meeting on Friday but in thinly veiled criticism accused each other of undermining it. It was the second meeting for Chinese Foreign Minister Wang and Blinken, and compared to Alaska, the UN meeting on Friday took on a more civil tone.

China is worried that the Biden administration's embrace of alliances and America's new-found emphasis on uniting the world's democracies pose a threat to its rise. President Joe Biden has said he will host a "democracy summit" of world leaders at the White House, clearly hoping to unite ideologically like-minded nations against China further. All this supports a further deterioration in Western-Chinese relations and a growing potential for further escalation in military action.

Thank you for reading - Mike