Midday Macro - 4/7/2022

Color on Markets, Economy, Policy, and Geopolitics

Midday Macro - Bi-weekly Color – 4/7/2022

Overnight and Morning Market Recap:

Price Action and Headlines:

Equities are lower, with overnight strength reversing after a choppy NY open as markets weigh the potential for further Russian sanctions and what a faster-moving Fed means with eyes also turning to first-quarter earnings season starting next week

Treasuries are mixed, with the post-FOMC minutes curve steepening continuing as the long-end is under increasing pressure following the release of further QT details yesterday

WTI is lower, down for a second day following EIA inventory data yesterday showing a larger than expected build in crude stock while demand expectations weaken further as China’s lockdowns continue

Narrative Analysis:

Equities are lower for a third day, with yesterday’s March FOMC meeting minutes cementing expectations the Fed is serious about tightening policy. Furthermore, today’s ECB minutes also signaled a further intention to get more hawkish. Concerns over “slowflation” and wage-spiral continue to grow amongst the world’s two largest central banks. Elsewhere markets are awaiting the announcement of further sanctions on Russia while watching for an abatement in Covid case counts in China. The Treasury curve has reversed some of its recent flattening, as worries regarding long-end demand have materialized following the minutes, although there has hardly been a change in trend. Elsewhere, WTI oil prices are closer to $90 than $100 for the first time since the Ukrainian invasion as domestic inventory levels increased more than expected on the week. The dollar continues to rise, with the $DXY now close to 100 as the Euro and Yen and some commodity currencies have given back recent gains.

The S&P is outperforming the Nasdaq and Russell with Low Volatility, Value, and High Dividend Yield, and Healthcare, Consumer Staples, and Material sectors all outperforming.

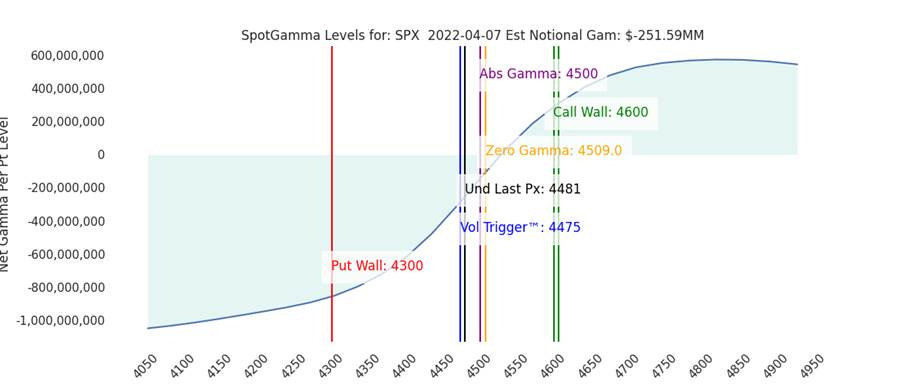

S&P optionality strike levels have the Zero-Gamma Level at 4509 while the Call Wall is 4600. Negative gamma shifted higher, increasing the expected level of volatility, with 4450 now support. Markets have built up enough implied volatility to have an increased vanna effect around 4400 or 4500. Put demand is still low at the index level while increasing for single names.

S&P technical levels have support at 4445, then 4415, and resistance is at 4465, then 4490 (200-dma area). The 200-dma area coupled with the psychologically important 4500 level is acting as strong resistance. This is a critical level, and recapturing it should support a further rally above 4600. Until 4500 clears, bulls are at risk.

Treasuries are lower with the 10yr yield at 2.64%, higher by around 4bps on the session, while the 5s30s curve is steeper by 7.3bps to 1.8bps

Deeper Dive:

Yesterday’s March FOMC Minutes reaffirmed what recent Fed speakers have jawboned; the Fed intends to tighten policy quickly. It is increasingly worried that continued high inflation will derail growth while future inflation expectations are becoming unanchored. We look to next week's inflation data to see if increases in core levels decrease while the headline index continues to rise at a faster monthly pace due to the effects of higher commodity prices. As a result of our belief that this decoupling between core and headline will increasingly occur moving forward, we think markets are now pricing an overly hawkish policy path and that demand destruction likely to occur over the summer will slow growth and inflation meaningfully enough in the second half of the year to allow the Fed to reduce its rate-hiking path. However, markets will have a rocky road to travel before then, likely leading to a retest of Q1 lows in stocks and a widening in credit spreads.

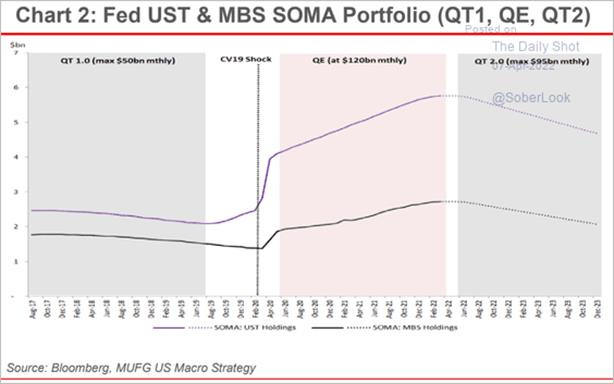

Minutes from the Fed’s March meeting showed many officials last month were prepared to raise rates by 50bps but opted for a smaller 25bps increase due to concerns from the fallout of Russia’s invasion of Ukraine. Given forecasts that next week’s CPI data does not meaningfully fall and the fact numerous Fed officials commented they supported a faster approach since the March meeting, it is now likely the Fed will raise rates by 50bps in the next two meetings while subsequently raising by 25bps every meeting after until Q1 ’23. At the same time, it will be reducing its Treasury holdings by $60 billion and MBS by $35 billion per month, with a short ramp-up period.

*The Fed’s quantitative tightening plans were the last piece of the puzzle regarding removing policy accommodations and aligned with market expectations

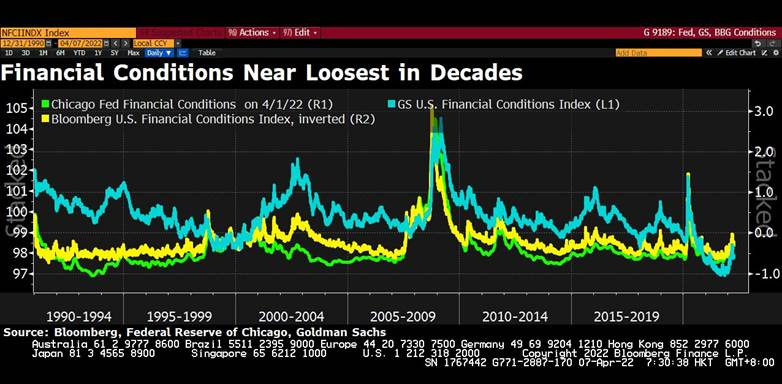

A widely noted recent OpEd by former NY Fed President Bill Dudley highlighted the challenges the markets face from the Fed implementing such an aggressive tightening regime. Dudley notes that to reign in inflation, the Fed will need to tighten financial conditions, effectively “pushing bond yields higher and stock prices lower,” considerably more than what has already occurred. To do this, the Fed “will have to shock markets to achieve the desired response.” We tend to agree, and given the level of tightening that is expected coupled with the negative macro backdrop, we are surprised risk assets continue to perform as well as they have.

*Although off recent lows, financial conditions remain historically very easy. If inflation is now structurally entrenched in consumer thinking, financial conditions will have to move meaningfully tighter to slow real economic activity and re-anchor inflation expectations

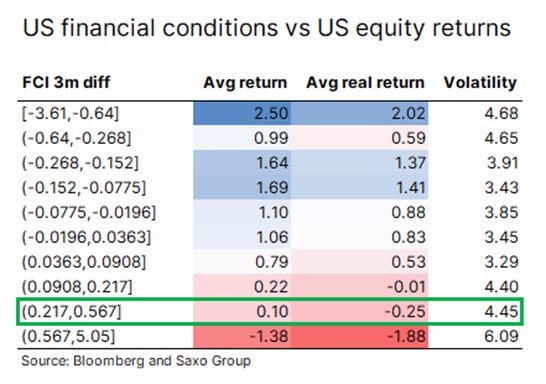

Combining what was communicated in the March minutes and through recent speeches and comments by Fed officials more generally coupled with Dudley’s beliefs of what the Fed needs to do to reign in inflation, it is clear that financial conditions may tighten very quickly as the Fed increasingly uses that channel to combat inflation. As with most things in markets, it is often the speed of change that is more important than the absolute level, and it is our belief the recent rally in risk assets, which has tactically eased financial conditions, will reverse in Q2.

*Fast changes in financial conditions correlate to monthly equity returns, with the above table showing that the recent 0.45 3-month increase in financial conditions has historically resulted in an average monthly return of 0.1% in stocks

The bottom line is that although currently strong, U.S. consumers and businesses will become increasingly defensive in the next two quarters as high levels of inflation persist, something current drops in sentiment/confidence surveys, especially regarding their future outlook, are forecasting. As a result, markets will increasingly question the ability of firms to pass on higher costs and defend margins as economic fundamentals weaken, reducing earnings growth expectations just as liquidity conditions are tightening and pressuring multiple expansion. At the same time, expectations will be for the Fed to continue on its aggressive tightening path, given the persistence of headline inflation. Coupled with the negative macro backdrop due to the war in Ukraine, Covid lockdowns in China, and other potential risks/drags it is becoming hard to make a bull case for risk assets.

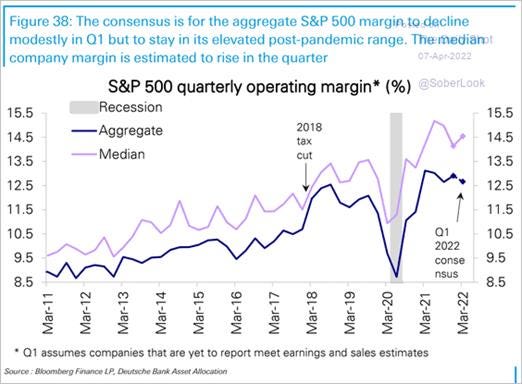

*Expectations are for Q1 margins to decline modestly but remain historically elevated. Moving forward, we believe these margins will come under increasing pressure as energy and wage pressures persist while end demand weakens

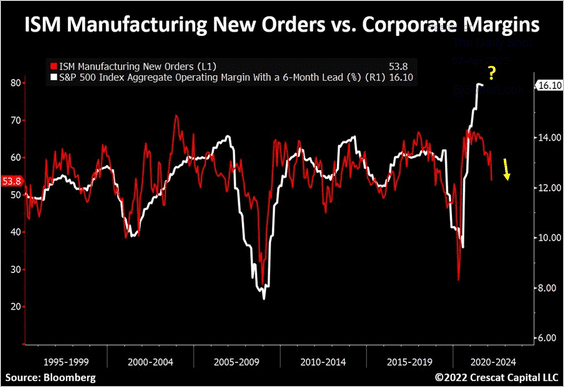

*Drops in new orders for manufactured goods, as seen in the ISM Manufacturing survey, have correlated with operating margins, and the recent drop is indicating that pressure should be coming

Policy Talk:

Philadelphia Fed President Harker gave prepared remarks at the Delaware State Chamber of Commerce yesterday, highlighting his outlook for the economy and policy. He noted that the economy has been strong with robust job creation and wage growth, likely leading the unemployment rate to fall further. However, he acknowledged that wage growth has not been keeping up with inflation while the participation rate was still below pre-pandemic levels. Further turning to inflation, he said that it is “running far too high, and I am acutely concerned about this.” He noted that the conflict in Ukraine would increase inflationary pressures through price increases in commodities. He highlighted that logistical impairments were gradually improving but remained problematic. He summarized his views here by saying, “The bottom line is that generous fiscal policies, supply chain disruptions, and accommodative monetary policy have pushed inflation far higher than I — and my colleagues on the FOMC — are comfortable with. I’m also worried that inflation expectations could become unmoored.” However, he believes inflation will taper back toward 4% by the end of the year and fall back in line with their target of 2% in the following two years. Harker concluded his prepared remarks by reviewing the housing market, similar to what he did in a speech last week. Turning to policy, he continues to expect “a series of deliberate, methodical hikes as the year continues and the data evolves… I also anticipate that we will begin to reduce our holdings of Treasury securities, agency debt, and mortgage-backed securities soon.” Harker is currently voting on monetary policy as an alternative member of the Federal Open Market Committee, in place of the Boston Fed, which is currently without a president.

San Francisco Federal Reserve Bank President Mary Daly gave a speech yesterday at the CFA Society in San Francisco, where she reiterated that she remains optimistic about the economy and believes the Fed can orchestrate a soft landing as it tightens policy to bring down inflation. “I feel that we’ll be able to get inflation moving down by the end of the year, and we’ll have a slower growth rate, but nothing that tips us into recession this year,” she said. She further said that while inflation is high now, she doesn’t see a repeat of the 1970s runaway inflation experience. But she added that it is critical for the central bank to act to get price pressures under control, saying, “I understand that inflation is as harmful as not having a job.” Daly isn’t a voting member of the rate-setting Federal Open Market Committee this year.

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the day and the week. Large-Cap Value is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day and the week despite steelmakers staging a strong rally and the best performers in A-share markets today as fiscal infrastructure expectations increase

5yr-30yr Treasury Spread: The curve is steeper on the day and the week, as the March FOMC minutes have cleared QT uncertainty and, for now, weighed more heavily on the long-end of the curve

EUR/JPY FX Cross: The Euro is higher on the day but lower on the week with today’s ECB minutes introducing “slowflation” expectations while the BoJ upgraded their inflation forecasts

Other Charts:

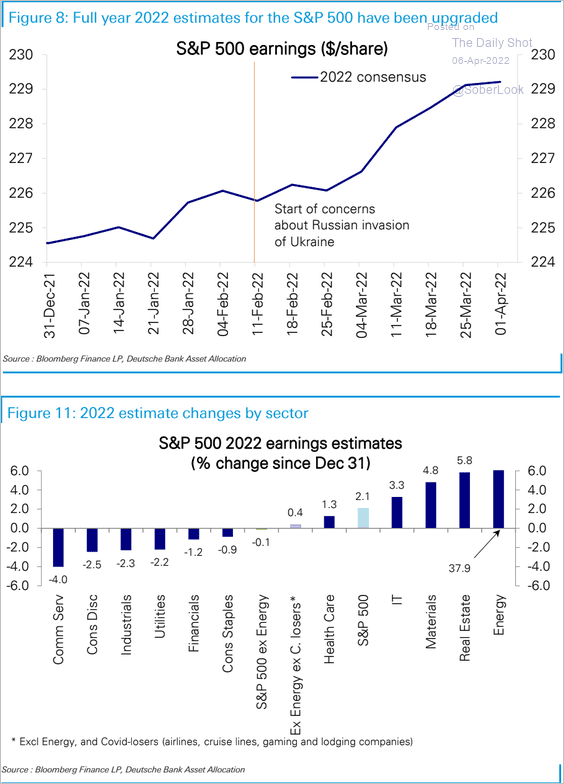

The S&P 500 2022 earnings expectations continue to rise despite growing uncertainty due to the war in Ukraine and a faster-moving Fed, primarily due to the Materials, Real Estate, and Energy sectors

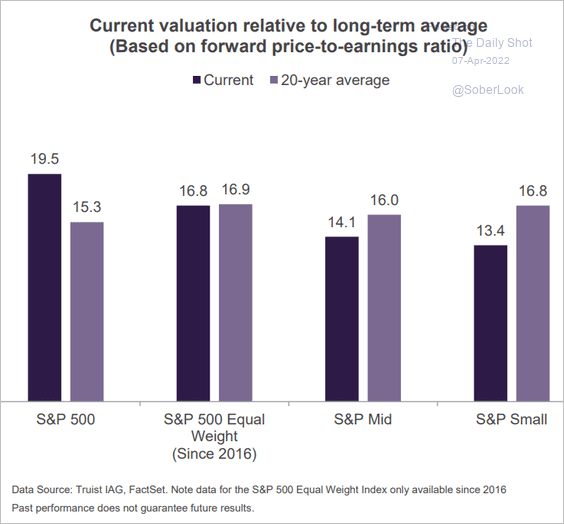

Although the S&P is still relatively expensive to its long-run average, mid and small-caps are now cheaper based on forward P/E ratios

The Treasury has lost a key buyer in the Fed, and markets will now have to absorb a larger share of additional float

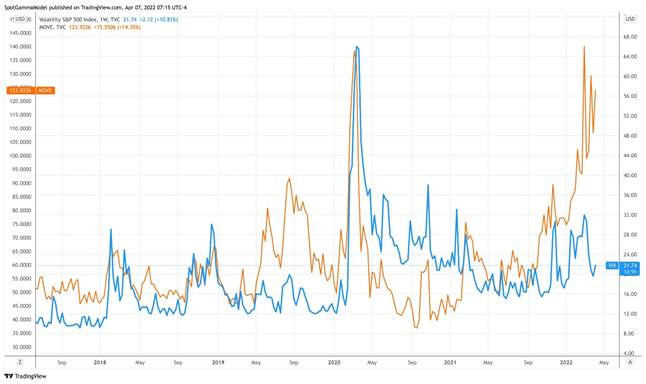

The MOVE Index, representing bond volatility, has become increasingly decoupled from the VIX

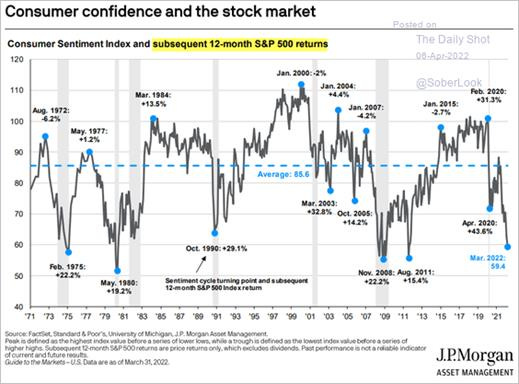

Peaks and bottoms in consumer confidence show some correlation to one-year ahead stock returns, although with highly varied results depending on the period

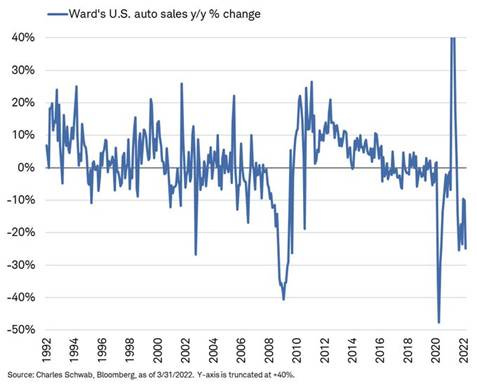

Auto Sales continue to contract with semiconductor shortages impacting available inventory, although price increases have stalled as demand is also falling

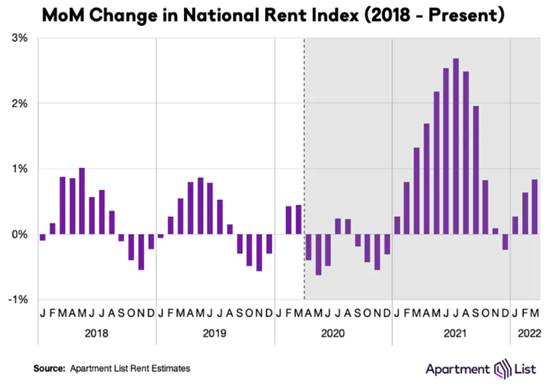

So far this year, rents are growing more slowly than they did in 2021 but have been reaccelerating after slowing in the winter, with a national index up by 0.8% for March

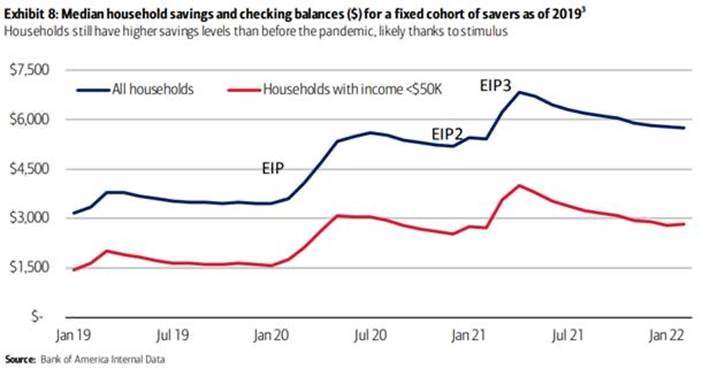

“All household savings balances are nearly two times their pre-pandemic levels. Low-income household savings levels are also about 2x pre-pandemic.” - BofA

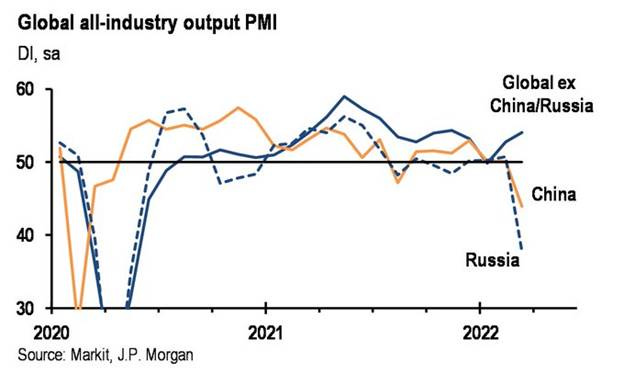

Excluding Russia and China, global PMIs are still in expansionary territory, but it may be too early to tell what

spillovereffects are coming from higher commodity costs

Article by Macro Themes:

Medium-term Themes:

China Macroprudential and Political Loosening:

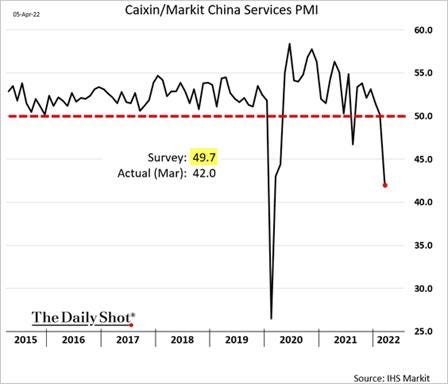

Two Years Later: China’s Services Sector Posts Steepest Decline Since Pandemic’s Start – WSJ

A gauge of services sector activity in China published Wednesday tumbled to its lowest level since February 2020, as dozens of provinces imposed strict anti-coronavirus restrictions that prevented people from moving around and weighed on consumer spending. The Caixin China services purchasing managers index dropped to 42.0 in March from 50.2 in February. Service-sector employment fell again, according to the index, while new orders and export demand also declined. Business confidence reached a 19-month low.

Why it Matters:

On Tuesday, the World Bank cut its forecast for economic growth in China this year to 5% from 5.4%, though it said growth could come in as low as 4% if the economic fallout from Russia’s invasion of Ukraine, higher interest rates in the U.S. or the pandemic proves worse than anticipated. Beijing has set a growth target of around 5.5% for the year. We believe that Beijing will increasingly look to stimulate demand through a number of fiscal measures as well as an easier monetary policy going in this falls communist party meeting.

Back to FAI: China’s $2.3 Trillion Infrastructure Plan Puts America’s to Shame – Bloomberg

At Beijing’s behest, local governments have drawn up lists of thousands of “major projects,” which they’re being put under intense pressure to see through. Planned investment this year amounts to at least 14.8 trillion yuan ($2.3 trillion). Only about 30% of projects are traditional infrastructure projects, such as roads and rail. More than half are geared to support the manufacturing and service industries: factories, industrial parks, technology incubators, and even theme parks.

Why it Matters:

The change in emphasis reflects Beijing’s commitment to ensuring China retains its dominant share of global manufacturing, even as it shifts into more advanced areas such as electric vehicles and batteries, renewable energy, and microchips. It is also meant to ensure Beijing reaches its 5.5% growth target for the year. Finally, the desire to increase production in more advanced areas while promoting domestic consumerism is the goal of Xi’s dual circulation policy.

Longer-term Themes:

National Security Assets in a Multipolar World:

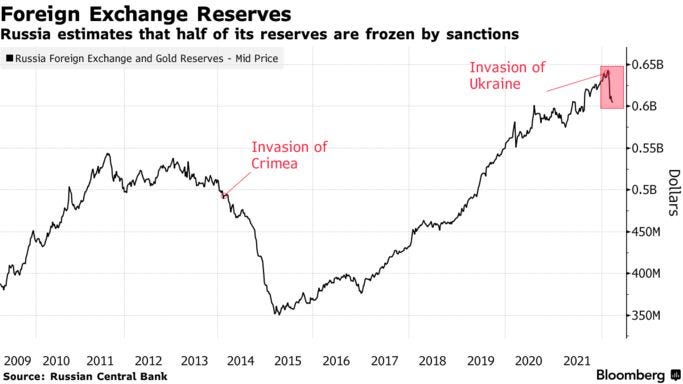

Needed: Russia Sidesteps Sanctions to Flood a Willing World With Energy – Bloomberg

Cargoes of Russian Sokol crude from the Far East have sold out for the next month, and several Chinese firms used local currency to buy Russian coal in March. Gas flows from Russia to Europe have, if anything, increased since the invasion on Feb. 24. None of these are subject to restrictions. Bloomberg Economics expects Russia will earn about $320 billion from energy exports this year, up by more than a third from 2021. The ruble has already rebounded to its pre-war price against the dollar.

Why it Matters:

Russia’s ability to keep the energy money flowing and boost its currency is frustrating western leaders while handing President Vladimir Putin a win at home, even with the country increasingly isolated and the Russian military pulling back from parts of Ukraine. “There is no doubt that the financial and other sanctions have weakened the Russian economy,” Patrick Honohan, a senior fellow at the Peterson Institute in Washington and former European Central Bank policymaker, wrote in a blog post on Wednesday. “But the sanctions fall short of crippling the economy, as long as they do not interrupt the flow of revenue from exports.” Commodity exports continue to be a critical national security asset enabling Putin to finance his war machine.

Electrification and Digitalization Policy:

Covert: U.S. Says It Secretly Removed Malware Worldwide, Pre-empting Russian Cyberattacks - NYT

The United States said on Wednesday that it had secretly removed malware from computer networks around the world in recent weeks, a step to pre-empt Russian cyberattacks and send a message to President Vladimir V. Putin of Russia. The move, made public by Attorney General Merrick B. Garland, comes as U.S. officials warn that Russia could try to strike critical American infrastructure, including financial firms, pipelines, and the electric grid, in response to the crushing sanctions that the United States has imposed on Moscow over the war in Ukraine.

Why it Matters:

The malware enabled the Russians to create “botnets,” networks of private computers that are infected with malicious software and controlled by the G.R.U., the intelligence arm of the Russian military. But it is unclear what the malware was intended to do since it could be used for everything from surveillance to destructive attacks. The article highlights other areas where the two sides of the current Ukraine war have been fighting it out digitally. The West may oppose direct physical conflict with Russia but is not hesitating to fight it out in cyberspace.

Overreach: Cyber experts warn against government overreach in defending against Russian threats – The Hill

Cyber executives testifying before the House Homeland Security Committee on Tuesday warned against the government taking an oversize role in defending the private sector against threats coming from Russia. The experts were largely supportive of recent government efforts to coordinate cybersecurity and said the focus should remain on guidance and information sharing rather than regulation.

Why it Matters:

U.S. critical infrastructure has been on high alert following the “Shields Up” guidance issued by the Cybersecurity & Infrastructure Security Agency (CISA), urging businesses to remain vigilant amid the war in Ukraine and harsh Western sanctions on Russia. Adam Meyers, senior vice president of intelligence at CrowdStrike, said CISA had done a “phenomenal job” of setting up information sharing systems, adding that fostering a collaborative environment between the government and the private sector is “absolutely critical.”

TRUST: Top US Lawmaker Proposes Sweeping Stablecoin Regulation Framework – CoinDesk

Sen. Patrick Toomey (R-Pa.), the ranking member of the Senate Banking Committee, announced the "Stablecoin Transparency of Reserves and Uniform Safe Transactions Act of 2022," dubbed the Stablecoin TRUST Act for short, as part of an effort to specify how the U.S.'s different regulatory agencies could approach companies issuing cryptocurrencies whose prices are pegged to the U.S. dollar or other assets.

Why it Matters:

As written, the discussion draft of the bill would define a "payment stablecoin," authorize the Office of the Comptroller of the Currency (OCC) to create a new license specific to stablecoin issuers, allow insured depository banks to issue payment stablecoins, and address state regulatory oversight of this segment of the crypto industry. Stablecoin issuers would have to choose between securing the OCC license, a state money transmitter license, or a traditional bank charter. These companies would be subject to a disclosure regime that would require them to secure regular attestations, detail redemption policies, and specify what actually backs the stablecoins they issue.

ESG Monetary and Fiscal Policy Expansion:

More Time: Biden Administration to Extend Student-Loan Payment Pause Through End of August – WSJ

The Biden administration is planning to extend until the end of August a pause on federal student-loan payments. Payments and interest accrual have been paused for borrowers with federal student loans since March 13, 2020, at the start of the pandemic. The pause is currently scheduled to expire on May 1, following a 90-day extension that was announced as cases of the Omicron variant of Covid-19 surged last December.

Why it Matters:

Legislative efforts to forgive student debt have sputtered in Congress, and progressive Democrats are ratcheting up pressure on Mr. Biden to take executive action, calling on him to cancel up to $50,000 in debt per borrower. About 40 million people owe around $1.6 trillion in federal student debt, a sum bigger than credit card or auto-debt, with federal loans making up more than 90% of outstanding student debt. Federal student-loan borrowers have been spared around $195 billion in loan payments since the government froze their payments in 2020, according to a March report by the Federal Reserve Bank of New York.

Stalled: Already Stalled In U.S., Global Minimum Tax Hits European Roadblock – WSJ

A global deal to introduce a minimum tax rate on company profits is stalled in both the U.S. and the European Union after Poland on Tuesday vetoed an EU agreement to implement the measure at the end of 2023. Poland’s veto came on Tuesday at the second meeting of EU finance ministers to discuss the issue. Malta, Estonia, and Sweden also had objected to the path to implementation proposed by the EU in March, but Tuesday said changes to the proposal had answered their concerns. Tax decisions in the EU require unanimity.

Why it Matters:

The deal to impose a 15% minimum tax on the profits of large corporations was agreed upon by 137 countries in 2021, paving the way for the most significant overhaul of international tax rules in a century. In the U.S., implementation of the minimum tax has been stalled in Congress for months. In Europe, efforts to get the EU’s 27 member states to enact the change have now also hit a roadblock. U.S. Treasury spokeswoman Alexandra LaManna said the agency remained confident that the EU “will ultimately meet that commitment” to implement the minimum tax.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE IN