Midday Macro - 4/5/2022

Color on Markets, Economy, Policy, and Geopolitics

Midday Macro - Bi-weekly Color – 4/5/2022

Overnight and Morning Market Recap:

Price Action and Headlines:

Equities are lower, with hawkish comments from Fed officials reversing yesterday's gains despite inline service sector data, while increased Russian sanctions are back in focus

Treasuries are lower, with the Fed all but certain to implement multiple 50bp hikes as it increasingly sees inflation derailing growth, moving 10yr yields back to recent highs while parts of the curve remain inverted

WTI is lower, but little changed and remains volatile as EZ sanctions on coal imports increase the likelihood that oil and natural gas sanctions may be next

Narrative Analysis:

Equities are lower, with tech underperforming as rising yields once again matter despite a future weaker growth outlook favoring the growth factor over value. The migration/evolution of doves to hawks continues at the Fed, with Brainard acknowledging that inflation is now the biggest risk, indicating she is in the middle of the pack regarding policy expectations. ISM service PMI held up as demand remains strong while firms continue to see capacity capped by shortages and logistical issues despite better labor availability. Treasuries did not like Fed official comments either, with overnight weakness increasing following Brainard and George's speech/interviews. Oil, although moving on headlines, is still hovering a little over $100 with uncertainty over sanctions and Iran negotiations continuing. At the same time, supply increases elsewhere look unlikely, while increased Chinese lock-downs chipping away at demand. The dollar, as expected, also received a bid following the more hawkish comments this AM, with the $DXY moving above 99.

The S&P is outperforming the Russell and Nasdaq with Low Volatility, High Dividend Yield, and Value, and Utilities, Healthcare, and Real Estate sectors are outperforming.

S&P optionality strike levels have the Zero-Gamma Level at 4543 while the Call Wall is 4600. Bulls retain the edge as long as the S&P remains above 4500. Resistance is at 4600, with support at 4550 & 4500. The VIX ground lower to 18.5 after yesterday’s rally but is now back above 20, but risk reversals are indicating put demand remains low.

S&P technical levels have support at 4545, then 4530, and resistance is at 4575, then 4590. April is the most bullish month of the year seasonally, particularly the first week, and it is off to a good start. The 200dma is at 4480, and after being higher than that for ten days, a fail below would indicate more losses are likely. Otherwise, things look to be consolidating as the impressive March run cools.

Treasuries are lower with the 10yr yield at 2.55%, higher by around 16bps on the session, while the 5s30s curve is lower by 1.5bps to -11bps

Deeper Dive:

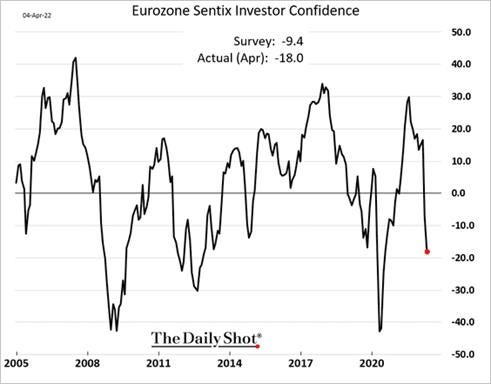

We see today’s European coal sanctions against Russia as opening up the door for further energy sanctions and increasing the recession risk that Europe currently faces. As a result, we want to be short European equities, which have recovered half their initial Ukraine invasion losses, mainly due to hopes that energy sanctions would not materialize. We see the European consumer’s end real disposable income continuing to fall due to increased inflationary pressures (specifically energy and food). At the same time, both consumer and business confidence should fall further, reducing overall activity more generally as the war to the east drags on longer than expected.

The atrocities being committed by Russia in Ukraine will likely only continue/worsen, and hence further sanctions, especially in the energy space, are likely. This, in turn, will increasingly act as a tax on economic activity in Europe, which is currently trying to stock up on natural gas and oil before prices rise further or the Russian supply is stopped. A shortage of diesel and increases in chemical and fertilizer prices are also impairing logistics and production of industrial and agricultural activity. The bottom line is things are not looking good.

*European economic activity is more sensitive to energy costs, and the probability of sanctions reducing Russian supply increases with every village Russia invades/leaves

We are opening a 5% short position in $VGK, Vanguards broad European ETF. Although certain countries are more susceptible to rising energy costs, and hence there will be varied negative growth shocks across the region, we see the general Eurozone as increasingly slowing over the rest of the year before a meaningful response from the ECB and fiscal authorities materializes. As a result, deteriorating earnings fundamentals should further decrease investor sentiment over the summer, likely giving us a significant pullback in the broader European equity index.

*Eurozone investor sentiment is increasingly deteriorating, and this is before earning report shows the full effects of lower demand and increasing costs

*The portfolio now has two short positions as we become increasingly defensive given a growing negative outlook on equities into year-end

Econ Data:

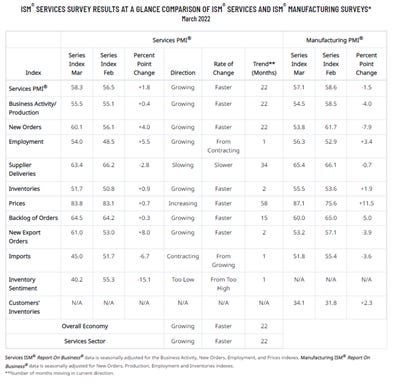

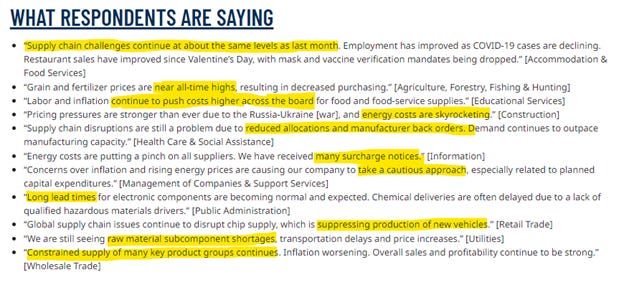

The ISM Services PMI increased to 58.3 in March from 56.5 in February, in line with market forecasts. Faster increases were seen for Business Activity (55.5 vs. 55.1) and New Orders (60.1 vs. 56.1), while Employment rebounded (54 vs. 48.5). Demand was also supported by a notable rise in New Export Orders (61 vs. 53) and a continued elevated level of Backlog of Orders (64.5 vs. 64.2). Supplier Delivery times decreased but remained elevated while price pressures increased slightly, still at highly elevated levels, showing a mixed story regarding supply-side impairment improvements. Inventories increased slightly, but Inventory Sentiment fell sharply as firms considered stock levels too low.

Why it Matters: There was an uptick in activity in the service sector in March, but respondents continue to have problems with capacity constraints, inflation, and logistical challenges. With demand continuing to be strong but future outlook becoming less clear, firms are now beginning to indicate a greater level of caution. This was worsened by increases in fuel and chemical costs brought on by the Ukrainian invasion. Interestingly there was a large change in imports and exports, with notable decreases and increases respectively, something we will be closely watching given the strength seen in exports lately and our concern for domestic demand weakening.

*Demand continues to be strong while supply-side improvements were more mixed with employment improving while price pressures remained high

*Respondent comments indicated that shortages and logistical issues remain, capping production capacity

Factory orders declined by -0.5% in February, the first decline since April 2021, and were in line with market forecasts. Orders for durable goods went down by -2.1%, mainly due to transportation equipment (-5.3%). Other decreases were also seen in orders for machinery (-2.9%) and computers and electronic products (-1.1%). On the other hand, orders for nondurable goods were up 1.2%. Excluding transportation, factory orders increased 0.4%. Shipments increased 0.6%, while unfilled orders increased 0.4%.

Why it Matters: After a relatively strong January, new orders were broadly lower in several key categories despite the bulk of the headline declines coming from weakness in nondefense aircraft and parts. Increases in unfilled orders, although weaker than January too, were still positive, showing demand is far from collapsing. This was also supported by continued growth in inventories and shipments. However, the broader decline in new orders, especially in categories like machinery and computer and electronic products, is worth watching. On the other side of this weakness were increases in orders for household appliances and furniture, contrasting slowing in housing-related purchases seen in other data and heard from industry insiders.

*February’s new factory orders decline of -0.5%, following a revised higher 1.5% increase in January, marked the first decline since April 2021 in new orders

Policy Talk:

Fed Governor Brainard gave prepared remarks at the Institute Research Conference at the Federal Reserve Bank of Minneapolis on how inflation is affecting households. She highlighted that maximum employment and stable, low inflation benefit all Americans but are particularly important for low- and moderate-income families. However, today’s inflation is far from low and is especially hurting households with more limited resources. She went on to explain that Fed is “only beginning to understand the ways in which inflation experiences vary from household to household, how this variation correlates with income and demographic information, and how these divergent inflation experiences change over time.” We highlight to show that given her ESG bias, she sees inflation as an increasing threat to a more inclusive economy. Turning to policy, she highlighted the FOMC “will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.” She expects the balance sheet to shrink considerably faster than in the previous cycle. Brainard’s comments suggest she is somewhere near the median estimate of seven rate increases this year but also prepared to go faster if inflation doesn’t subside. Clearly, the more historically dovish side of the table is increasingly making a case for how inflation is hurting lower-income households the most and pivoting to a more hawkish stance.

Technical and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the day and lower on the week. Large-Cap Value is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day and the week as a recent rally cools despite further policy support for growth coming due to lock-downs growing

5yr-30yr Treasury Spread: The curve is flatter on the day but slightly higher on the week, as hawkish remarks from Fed officials today are hitting the longer-end harder for once

EUR/JPY FX Cross: The Euro is higher on the day but lower on the week with rising energy prices pressuring the Yen after a bounce off lows last week has now faded

Other Charts:

At the end of Q1, the S&P Forward P/E was 19.5, still historically high, but thanks to strong earnings growth last year and the pullback in prices in Q1, the Forward P/E is now within one standard deviation of the 25-year average.

Not only did earnings grow an incredible 70% in 2021, but all sources were positive: Share count (-0.6% versus 0.3% average), Revenue increases (19% versus 3% average), but the vast majority of that growth came from Margin Gains (51.8% versus 2.8% average).

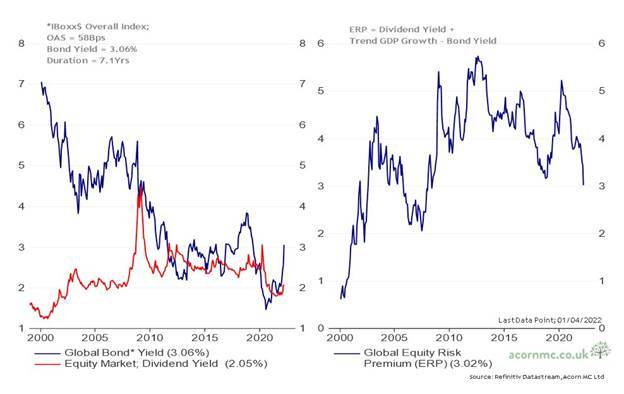

Global Equity Risk Premium is at its lowest level in years as investors are increasingly not being compensated for the risk they are taking

Bond markets were caught off guard by the Fed’s tighter policy pivot and failed to receive a lasting flight to safety bid due to the conflict in Ukraine, as it was seen as inflationary, leading government bonds to be having a tough Q1

The lack of past investment in commodity production continues to drive prices as inventory levels fall further while new supply/capacity is nowhere to be found

There has been a disconnect between financial condition easing and Fed rate hike expectations increasing. Will this continue?

Recent stabilization in the Russian Rubble is a combination of low liquidity, large current account inflows, and capital controls on outbound. It is unlikely this can continue.

Have we seen a peak in the size of central bank’s balance sheets? With QT around the corner, the now close to $27 trillion in holdings is likely to decline.

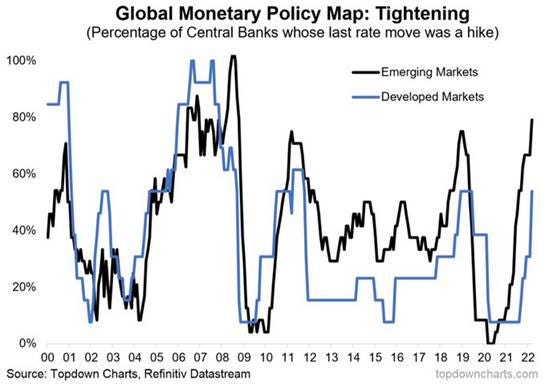

The percentage of central banks hiking continues to grow

Centraal Planbureau data showed overall global trade volumes hit a record level due to advanced economies having strong gains despite declines in trade volumes for China and emerging economies in January

Article by Macro Themes:

Medium-term Themes:

Real Supply-Side Improvements:

Near-Shoring: Supply-Chain Hell Ignites Economic Boom Along U.S.-Mexico Border – Bloomberg

China kept stealing U.S. market share from Mexico right up until Donald Trump took office in Washington. When he started slapping tariffs on Chinese-made products, Mexico suddenly looked pretty attractive again to executives. Then the pandemic came along and turbocharged the shift. The boom is so intense in Juarez that industrial real estate is suddenly getting tight: 98% of existing space is already leased, and the price has jumped more than 20% over the past year to about $5.25 per square foot, according to Jesse Melendez, a director at industrial real estate company Intermex.

Why it Matters:

This is the near-shoring trend in action, one of the biggest economic transformations sparked by the pandemic. Shrink the length of the supply chain to keep production closer to its final destination and reduce the risk of some snag messing things up along the way. A shorter chain is a stronger chain, the thinking now goes, and there’s a growing sense that this new approach will remain in vogue in C-suites long after Covid fades.

China Macroprudential and Political Loosening:

Relaxing: Quzhou becomes first Chinese city to relax restrictions on both home purchases, resales – Yuan Talks

Quzhou in East China's Zhejiang province has become the first Chinese city to relax restrictions on both home purchases and home resales as local governments step up efforts to support the housing markets. Non-locals, those who don't have local household registrations or the so-called "Hukou," individual businesses or companies will no longer be subject to home purchase restrictions and will enjoy the same home-buying policy for locals.

Why it Matters:

More than 60 municipal authorities started easing property restrictions in the first quarter, according to a note on Sunday by the China Index Academy, one of the country’s biggest independent real estate research firms. The measures include reducing down payments, subsidizing house purchases, cutting mortgage interest rates, and giving financial support to developers. The China Index Academy said more jurisdictions would follow suit, saying “the overall policy relaxation has been intensified and accelerated.”

Longer-term Themes:

National Security Assets in a Multipolar World:

Critical Ingredients: The great medicines migration: How China controls key drug supplies – NikkeiAsia

China has become a major pharmaceutical player in recent decades as production has moved from West to East. This has included its emergence as the top producer of APIs. An API is a component of a drug that impacts health, for example, suppressing a disease or its symptoms. China has a huge production scale advantage, and for some APIs, Chinese companies have more than twice the capacity of their Indian counterparts, the second largest production country.

Why it Matters:

COVID-19 has brought to light just how much the global pharmaceutical supply chain depends on China, even for the most basic chemical building blocks. From the U.S. and European Union to India and Japan, governments are increasingly seeking ways to secure greater supply chain independence here. However, some countries are making promises about supply chain reshoring that they may find hard to keep. We highlight this as an important area to expect reshoring, but clearly, there will be challenges in doing so, likely increasing the cost of medicines.

Electrification and Digitalization Policy:

UK NFTs: NFTs to be launched by the Treasury later this year in crypto push – CityA.M.

John Glen, the economic secretary for the U.K.’s Treasury, confirmed that the Chancellor had asked the Royal Mint to issue NFTs later this year. Glen said that this signals a further move to create a welcoming environment for crypto assets in the U.K. “There is a genuine opportunity to build on our strengths in FinTech seize the capitalist energy, which has already made U.K. financial services what it is, and use it to unleash the potential of crypto technologies,” Glen commented.

Why it Matters:

The U.K.’s Treasury has confirmed its intention to recognize stablecoins, digital assets pegged to the price of real-world assets, as a valid form of currency. The government will also explore ways to make the U.K.’s tax system more competitive in order to encourage further development of the crypto-asset market in the U.K. “It is my ambition to make the U.K. a global hub for crypto asset technology, and the measures we’ve outlined today will help to ensure firms can invest, innovate and scale up in this country,” the Chancellor of the Exchequer Rishi Sunak said.

More Problems: Blockchains Have a ‘Bridge’ Problem, and Hackers Know It – Wired

This week, the cryptocurrency network Ronin disclosed a breach in which attackers stole $540 million worth of Ethereum and USDC stablecoin. The incident, which is one of the biggest heists in the history of cryptocurrency, specifically siphoned funds from a service known as the Ronin Bridge. Blockchain bridges are applications that allow people to move digital assets from one blockchain to another. Cryptocurrencies are typically siloed and can't interoperate, so “bridges” have become a crucial mechanism as bridge services “wrap” cryptocurrency to convert one type of coin into another.

Why it Matters:

Cryptocurrency platforms, and the decentralized finance movement in general, have been plagued by security issues as the underpinning technologies evolve and mature. And the services that are coalescing to form the backbone of this new financial ecosystem are experiencing a trial by fire as the cryptocurrency gold rush plays out. Bridge attacks may be the new cryptocurrency exchange hacks, but they prey on the same issues, with high-stakes platforms that store massive amounts of value being thrown together quickly to meet new demands.

Commodity Super Cycle Green.0:

Not So Fast: Ukraine War Drives Countries to Embrace Renewable Energy —but Not Yet – WSJ

Many countries are currently leaning even more on fossil fuels due to the war in Ukraine. They are in a race to lock up enough supply from non-Russian sources, including more coal, to ensure that they can heat homes, power factories, and transport goods over the next few years. At the same time, many, especially in Europe, are accelerating plans to switch to green energy such as wind and solar power. The goal is to meet climate targets as well as permanently reduce exposure to oil and gas supplies that are geopolitically volatile. Some are revisiting nuclear power.

Why it Matters:

Weaning Europe off Russian supplies remains a monumental and expensive task. Russia recently provided around 40% of the gas that Europe uses to heat homes and make electricity. Divorcing the European Union from Russian gas imports would require additional annual spending of at least €170 billion on renewable-energy production over six years or about 1.3% of the bloc’s gross domestic product, researchers at German insurer Allianz SE estimated. Even at that price, it rated renewables as the cheapest path to European energy self-reliance.

Financing: Global green finance rises over 100 fold in the past decade -study - Reuters

Global borrowing by issuing green bonds and loans, and equity funding through initial public offerings targeting green projects, swelled to $540.6 billion in 2021 from $5.2 billion in 2012, according to research done by TheCityUK and BNP Paribas. The data showed that green bonds accounted for 93.1% of total green finance globally between 2012 and 2021. China and the U.S. accounted for 13.6% and 11.6% of the green bond issuance between 2012 and 2021, the data showed.

Why it Matters:

The share of green finance in the total finance market was about 4% in 2021, compared with around 0.1% in 2012. The number of publicly-traded companies involved in green activities grew from 401 companies in 2012 to 669 in 2021, the data showed. We highlight this to show the divergence of growth in green financing verse the decline in the traditional fossil fuel industry financing levels.

Disruptive: Chipotle’s Push for Humane Chicken Delayed Amid Tight Supplies – Bloomberg

The burrito seller, which has long touted its “Food With Integrity” push for antibiotic-free meat and local ingredients, had planned to sell all third-party certified humane chicken by the end of 2021. But Chipotle says it was unable to take this step last year amid high demand and its stringent requirements for poultry. Chipotle’s chicken is already harder to source because the company buys antibiotic-free birds that are fed a vegetarian diet, a step above commodity chicken.

Why it Matters:

Restaurants are under growing pressure to show that the food they serve comes from sustainable sources, with animal welfare an important part of that equation. Increasing demand for chicken is also causing supply headaches across the country. Over the course of the pandemic, some cuts have been hard to get, and big companies are locking in inventory in advance. Given the current Bird Flu outbreak is the worst since 2015, sourcing chicken is likely to get even tougher.

ESG Monetary and Fiscal Policy Expansion:

Ordered: Biden Administration Orders 49 MPG Fuel-Economy Standard by 2026 – Bloomberg

The new fuel economy rules, issued Friday by the National Highway Traffic Safety Administration, require carmakers to heighten the fuel efficiency of their fleets by 8% annually for the 2024 and 2025 model years, and 10% for 2026, according to a senior administration official. The U.S. Environmental Protection Agency has separately issued greenhouse gas emission regulations that require automakers to achieve a vehicle mileage of 52 miles per gallon by 2026 across all models they make, up from 40 mpg this year.

Why it Matters:

The new rules come as the Biden administration is struggling to combat rising gasoline prices, with costs surging past $4 a gallon in the wake of Russia’s invasion of Ukraine. The average price on Thursday was $4.22 per gallon, according to the auto club AAA. “These new standards will mean fewer trips to the gas station, more cash in drivers’ pockets -- and less money handed over to petro-dictators,” Luke Tonachel, director for clean vehicles and fuels at the Natural Resources Defense Council, said. Still, many say the Biden Administration could have been more aggressive here.

Unlikely Alliance: Tribes, Industry Groups Reach Deal to Boost U.S. Hydroelectric Power - WSJ

After years of fighting, Native American tribes, environmentalists, and the hydroelectric power industry say they have reached a deal on a proposed legislative package that could boost clean energy as well as river conservation. The deal seeks to grant approvals to add hydroelectric power to some existing dams in as little as two years, while speeding the approval of off-river pumped-storage projects, which store surplus energy for later use, in as little as three years. Another key component would give tribes, instead of the Department of the Interior, the authority on the conditions put on permits for things like the protection of tribal cultural resources or fish passage.

Why it Matters:

Hydroelectric power makes up about 7% of the U.S. electricity mix. Around 281 hydro-generating facilities, making up roughly one-third of non-federally owned generation, are up for re-licensing by 2030. The re-licensing process usually takes more than seven years, and new projects take almost as long, a regulatory environment likened to nuclear power approvals. Regulators in many parts of the country want to speed the build-out of renewable energy in response to concerns about climate change, so improvements to the hydro process would be welcome.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.