MIDDAY MACRO - DAILY COLOR – 4/30/2021

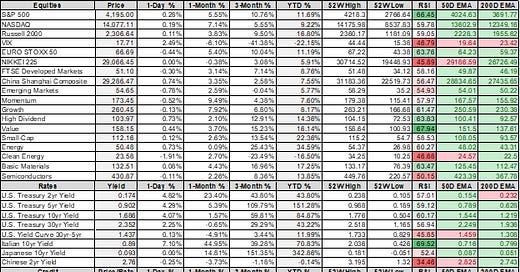

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities lower but staying in weekly range

Treasuries are flat, unphased by AM data

WTI lower, off $2 from yesterday’s high on changing Iranian deal timeframe

Price Action:

Slight risk-off tone to equities

Russell/Nasdaq outperforming S&P

Small-cap and Momentum factors outperforming

Gamma support at 4175 (after call buying on yesterdays dip) and resistance at 4225, 4170 technical support

Major Asian indexes lower; Japan -0.8%. Hong Kong -2.1%. China -0.8%. India -1.8%.

European bourses mixed at midday, London flat. Paris -0.1%. Frankfurt +0.4%.

Treasuries higher after open

5 yr = 0.86% and 10yr = 1.63%

WTI down around -2% to $63.70, weakening in the overnight

Iranian deal happening sooner than expected

Copper rallied overnight but down slightly after NY open

Aggs starting to gain some momentum again but mixed across crops

DXY higher overnight but accelerating post AM data, approaching 91

Gold flat at $1,770

Bitcoin rallying over 6% to $56.5k

Vaccination Data:

Average daily rate, U.S. vaccinations: 2.63mln

Total US vaccinations: 237mln

Average daily rate, global vaccinations: 19.7mln

Total global vaccinations: 1.1 billion across 174 countries

Countries with the highest incomes are getting vaccinated about 25 times faster than those with the lowest, Bloomberg’s Vaccine Tracker shows, and Africa, with 1 billion people, is trailing the rest of the world.

Analysis:

Equities continue to stay range-bound as a week of strong earnings and data fail to inspire the next leg higher and recent range holds.

Rates were not spooked by PCE data, which came mostly in line with expectations.

Employment cost beat may have weighed more on equities than rates.

Commodities continue to be mixed, with aggs and copper continue to drift move higher while oil gives back some weekly gains as the Iranian deal looks likely to come sooner than expected.

Bottom Line:

Data and earnings continue to point to a faster and stronger recovery in the U.S. with more persistent inflationary risks.

European GDP data weaker than expected giving pause to how quickly their catch up to U.S. growth can be.

Markets have been almost indifferent to any new economic and earning news this week, indicating a continued comfort with what is already priced in.

This widens the tail-risk more to the negative as a melt-up becomes harder (as we move towards more negative May seasonals and out of earnings season) verse an unforeseen shock spooking risk-assets lower, which increases on the geopolitical front in May.

WORTH WATCHING

Econ Data:

Personal Income MoM: Actual: 21.1%, Consensus: 20.3%, Previous: -7%

Personal Spending MoM: Actual: 4.2%, Consensus: 4.1%, Previous: -1%

Employment Cost Index QoQ: Actual: 0.9%, Consensus: 0.7%, Previous: 0.7%

PCE Price Index MoM: Actual: 0.5%, Previous: 0.2%

PCE Price Index YoY: Actual: 2.3%, Previous: 1.5%

Core PCE Index MoM: Actual: 0.4%, Consensus: 0.3%, Previous: 0.1%

Core PCE Index YoY: Actual: 1.8%, Consensus: 1.8%, Previous: 1.4%

Actual: 72.1, Consensus: 65.3, Previous: 66.3

Sentiment: Actual: 88.3, Previous: 84.9

Expectations: Actual: 82.7, Previous: 79.7

Current Conditions: Actual: 97.2, Previous: 93

Inflation Expectations: Actual: 3.4%, Previous: 3.1%

5-year Inflation Expectations: Actual: 2.7%, Previous: 2.8%

Events:

Fed Speakers: Kaplan

Baker-Hughes Rig Count

Misc:

What is a Jesus Coin, and Does it Foretell the End of Cryptocurrencies?

Teaser: Nope – we aren’t that lucky

A row has broken out over an image in new teaching materials to be used in Hong Kong’s schools that depicts Mickey Mouse and Goofy lookalikes in military uniforms, fighter planes dropping hamburgers instead of bombs, and evil versions of McDonald’s characters Ronald McDonald and Grimace.

If they only knew the real danger from McDonald’s is obesity and diabetes.

TECHNICALS / CHARTS

Big government is back (whether you like it or not). The Biden administration aims to expand the reach of the governments’ social safety net further into retirement security, healthcare, and income support, while also entering child-care, pre-school, and college support. They also want to renew the governments’ role in building infrastructure (while redefining what the definition of that is). Finally, Biden wants to give Washington a role in developing critical industries to combat foreign adversaries and fight climate change. A period of big fiscal ideas and spending has come. and monetary policy won’t get in the way, likely going hand-in-hand as new personnel is deployed at the Fed over the next few years.

The 0.6% quarter-on-quarter decline in gross domestic product followed a contraction of 0.7% in the final three months of 2020, plunging the single-currency zone into a technical recession. Much of Europe was subjected to varying levels of lockdown in the first three months of this year, shutting shops and limiting travel to contain the third wave of Covid-19 infections. Will the pickup in vaccinations and expectations for a large 2qtr bounce back help the trade idea that the EZ will quickly catch up to US growth and the better value is in European equities? Perhaps, but the EZ have been dragging their feet generally while the U.S. outlook continues to improve.

OFF THE RADAR

Don’t be a Chicken:

The popularity of chicken — from sandwiches and tenders to nuggets and wings — is fueling such demand for fried poultry that America is starting to run short.

Chicken, which is the most popular meat in the U.S., is finding a new level of demand after Popeyes introduced a sandwich in 2019 that went viral and sold out in weeks.

Poultry companies have been struggling to keep up with demand from quick-service restaurants.

KFC says it’s struggling to keep up with soaring demand for its new sandwich, while North Carolina-based chicken-and biscuits-chain Bojangles reported outages of tenders across its 750 locations.

Labor shortages are hampering production, and inventories of the meat in U.S. warehouses have tumbled.

Some food companies may be able to capitalize on the opportunity: To try to capture some of the red-hot demand, Beyond Meat Inc. is planning to start selling a plant-based chicken product this summer.

Early Retirement:

Soaring stocks and house prices plus the monotony of Zoom calls and the experience of living through a deadly pandemic are combining to nudge some who can afford it into early retirement.

About 2.7 million Americans age 55 or older are contemplating giving up work years earlier than they’d imagined because of the coronavirus, government data show.

The number of people expecting to work beyond 67 fell to a record 32.9% last month, according to a New York Federal Reserve survey.

Assets for Americans ages 55 to 69 rose by $4.2 trillion in 2020, including a $2.2 trillion increase in equities and mutual fund shares, the Fed calculates. Real estate assets soared by almost $750 billion.

Federal Reserve Chairman Jerome Powell this week noted a “significant number” of people saying they’ve retired as a reason companies are starting to report labor shortages.

Fields such as healthcare and education may be particularly hurt.

Almost a third of physicians are over 60, the Physicians Foundation estimates.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

Deepfakes: How to prepare your organization for a new type of threat - Accenture

Deepfake—a combination of the words ‘deep learning’ and ‘fake’—refers to an AI-based technology used to create or alter images, audio, and video resulting in synthetic content that appears authentic.

This can range from replicating a voice over the phone—to sound like a CEO or CFO asking for a money transfer—to portraying an accurate resemblance on video.

It can be altered in real-time or recorded media.

With the world more connected by digital media and the costs for creating deepfakes slumping dramatically, this emerging technology poses a serious risk.

Looking at the current trajectory of the technology, deepfake protocols will become part of every company’s security/incident response strategy in the near future.

Deepfake Satellite Images: Deepfake satellite imagery poses a not-so-distant threat, warn geographers - Verge

Geographers are concerned about the spread of fake, AI-generated satellite imagery.

Such pictures could mislead in a variety of ways: They could be used to create hoaxes about wildfires or floods, or to discredit stories based on real satellite imagery.

Electrification

Chinese Crypto Mining: Beijing starts inquiry into data center firms’ involvement in power-sapping cryptocurrency mining operations - SCMP

Beijing’s city authorities have started an inquiry into the involvement of the capital’s data center providers in cryptocurrency mining.

The Beijing Municipal Bureau of Economy and Information Technology released on Tuesday an “emergency notice”, asking data center operators to report their participation in cryptocurrency mining, the amount of power consumed by these enterprises in the past year, and its percentage amount to the total energy consumed by the data center.

China’s three main telecommunications network operators, all of which operate data centers, also received the notice, according to an unnamed official cited in a Reuters report.

The country, which is home to the world’s largest cryptocurrency farms, has pledged to halt the rise in its carbon emissions before 2030, and is committed to achieving carbon neutrality in 2060.

EV: GM to invest $1 billion in Mexico for electric vehicle production, angering UAW members - CNBC

The investment in its Ramos Arizpe production complex is the first major announcement by the automaker for EV production in Mexico following billions of dollars in confirmed investments in the U.S. and Canada.

The facility will begin producing at least one EV beginning in 2023, GM said.

The Ramos Arizpe plant is expected to be GM’s fifth manufacturing site in North America to produce electric vehicles following announcements for two plants in Michigan and others in Tennessee and Ontario, Canada.

China Macroprudential Policy

Shadow Banking: China’s Hidden Bank Assets Are Emerging from the Shadows - BBG

Over the last year, the country’s lenders wrote off big chunks of non-performing loans – around 3 trillion yuan ($463 billion)

But as the bad loans fall, banks including Bank of China Ltd. and Industrial and Commercial Bank of China Ltd., or ICBC, have been preparing to bring their off-balance sheet activities into the light, almost 8.5 trillion yuan ($1.3 trillion) of loan-like assets they're sitting on.

Beijing for the first time defined shadow banking activities and estimated that they totaled almost 85 trillion yuan at the end of 2019, equivalent to over a quarter of all banking assets and intertwined enough to endanger financial stability.

Banks could be left with over 3 trillion yuan of these assets on their books by the end of the year, the deadline for meeting the new rules, according to S&P Global Ratings.

Government Debt: China’s Sovereign Bonds Defy Expectations of April Reckoning - Caixin

Traders had been bracing for a seasonal increase in local bonds at a time when China’s commercial banks — the biggest buyers in the market — typically funnel funds to clients to meet tax payments.

The expectation among analysts was that the banks would offload sovereign notes so they could snap up the riskier but more lucrative munis.

Instead of surging higher, benchmark 10-year yields are comfortably below their half-year average and little changed from late March, thanks to a slowdown in debt issuance by municipal authorities.

“The closely-watched April tax period passed more smoothly than expected and didn’t cause a shortage of funds,” said Qi Sheng, an analyst at Founder Securities Co. in Beijing.

“Economic fundamentals haven’t changed, nor have the direction of central bank policy or credit risks.”

Qi said a downtrend in Chinese yields now looks “more clear than ever” — something which has implications for foreign investors, who’ve been piling into the nation’s sovereign bonds.

The 10-year yield touched a near three-month low of 3.15% on April 21 and is set to end the month little changed around 3.18%.

ENREA – Environment / Natural Resources / and Energy Advisory

Polish Coal: Polish coal mine closure timetable agreed - Argus

The Polish government and mining trade unions have reached an initial agreement on the schedule to end domestic coal mining by 2049.

The initial agreement following five months of negotiations is a major step but not a breakthrough for Poland's coal mining rescue and phase-out plan.

The approval of the EU's competition authorities is still needed before the plan can be finalized.

Environmental lobbies have criticized the plan for not committing to a quicker coal phase-out.

Big Oil: Exxon, Chevron Garner Huge Cash-Flow Boosts on Crude’s Rally - BBG

Rallying crude prices and demand for chemicals used in plastics more than offset losses from refining oil as the largest North American explorers disclosed first-quarter results on Friday.

Stocks lower on lack of buy-back guidance.

All the supermajors are making money again after crude’s 30% year-to-date rally to more than $65 a barrel, buoyed by rising energy demand as economies emerge from the pandemic and OPEC holds the line on big supply increases. BP Plc, Royal Dutch Shell Plc and Total SE all preceded their U.S. peers with bigger-than-expected profits.

ISIS: Total Suspends Mozambique LNG Temporarily on Security Threat - BBG

French energy giant Total SE suspended its $20 billion liquefied natural gas project in Mozambique indefinitely due to an escalation of violence in the area, including a March attack by Islamic State-linked militants.

The decision is a blow to Total, which bought an operating stake in the project for $3.9 billion in 2019, hoping to start exporting the super-chilled fuel by the end of 2024.

The first phase of the project is designed to produce over 13 million tons of LNG a year.

Fiscal Policy

Big Government: Behind Biden’s Big Spending Plans, the Waning Sway of Economic Caution - WSJ

Exiting the stage after a long run in power is a group of accomplished centrist economists who came of age during an inflation spiral in the 1970s and governed from the 1990s to the 2010s, with a mixed record of success and failure.

When Lawrence Summers criticized the Biden administration’s new economic policies in recent weeks as “being the least responsible in 40 years”, he was largely dismissed.

On Thursday Biden added another $1.8 trillion to his wish list, this time for family programs, adding up to $6 trillion in proposed or approved additional spending over a decade, a large chunk of it upfront.

The far-reaching economic agenda of today’s Democrats are driven in part by a sense that they were too focused on reducing budget deficits after the 2007-09 recession, which worked to their political disadvantage by holding back the recovery during the Obama administration.

Monetary Policy

PBOC Green: China’s Carbon Market Will Play Key Role in Climate Change Fight, PBOC Chief Says - Caixin

On April 15, the PBOC and IMF co-hosted the High-Level Seminar on Green Finance and Climate Policy.

PBOC Governor Yi Gang said that the central bank plans to launch tools supporting carbon emissions reduction and provide low-cost capital for carbon emissions reduction.

The PBOC is exploring the systematic inclusion of climate change factors in its stress tests for financial institutions.

It also plans to gradually incorporate climate change risks into its macroprudential policy framework.

The PBOC has made quarterly assessments of financial institutions’ green credit and green bonds while encouraging them to self-evaluate and manage their environmental and climatic risks.

It will also strengthen green finance support through commercial credit ratings, deposit insurance rates, collateral for open market operations, and more.

By the end of 2020, China’s green loan balance had reached $1.8 trillion and its green bond stock $125 billion, making them the largest and second-largest in the world, respectively.

Commodity Cycle

La Nina: La Nina Gives a Turbocharge Boost to Already High Food Prices - BBG

This year, the weather pattern has already made its mark in North and South America as well as Australia and Indonesia.

La Nina triggers atmospheric gyrations that cause water scarcity in some places and floods in others.

The prospect of drought across the U.S. — and difficult weather just about everywhere else — is roiling commodities markets.

The problem is already affecting winter wheat across the Great Plains and it could creep into the corn and soybean areas of the western Midwest as summer nears.

“The drought has been long enough out there, it is going to take a couple of years to get the reservoirs back to where they should be,” said Dale Mohler, a meteorologist at AccuWeather Inc.

Feed Stock: Feeding Chickens Is So Costly It’s Changing Global Trade Flows - BBG

As grain prices surge, American chicken giant Perdue Farms Inc. took the rare step of buying soybeans, an American staple, from rival Brazil.

BRF SA, Brazil’s top poultry producer, turned to neighbor Argentina for corn, while feed makers in China and the U.S. are buying wheat more commonly used for bread.

“The meat and chicken industries still have good margins, so higher prices are yet to curb their appetite,” said Brian Williams, a senior vice president at Macquarie Group Ltd. in New York.

High prices are starting to cut into margins for poultry and pig producers in Brazil, but prices aren’t yet high enough to curb demand, said Paulo Sousa, chief executive officer of Cargill Inc. in Brazil.

Feed makers and meatpackers could soon get some relief.

While U.S. acreage estimates disappointed the markets earlier this year, prices have surged since the survey was carried out and that will likely spur more plantings.

Logistical Bottlenecks

Capesize: Capes crack $40,000 mark – Splash247.com

Capesizes are commanding $40,000 a day, helping propel the Baltic Dry Index past the 3,000 mark for the first time in more than a decade.

Many analysts suggesting the floor of the sector has now hit new, sustainable levels.

Agricultural Exports: Ag industry’s letter to Buttigieg urges immediate action on export problem – Freight Waves

The U.S. agriculture industry is pressuring the Department of Transportation for immediate intervention in foreign-owned carriers’ denial of U.S. ag exports in favor of sending back empty containers to be filled with Chinese exports.

In a letter sent to Secretary Pete Buttigieg on Monday that was shared with American Shipper, almost 300 agriculture and forest product companies demanded the secretary intervene to protect U.S. exporters.

This letter is the latest in a series the agriculture industry has sent in an urgent plea to stop the denial of trade and increased demurrage costs.

President Biden and the Federal Maritime Commission have received similar letters.

Big Tech Regulation/Taxation

Apple and the EU: EU charges Apple with antitrust violations stemming from Spotify case - Axios

The Commission alleges that Apple also abused its power by limiting how app developers can inform users about cheaper subscription services.

Apple will have a chance to argue against the antitrust charge.

If found guilty, the company could face a fine of up to 10% of its annual revenue and will be required to change its business practices.

Big Money: Big Tech’s surging growth stuns Wall Street – FT

Big Tech this week reported a surge in growth and profits that stunned Wall Street, delivering powerful evidence that the digital dependence forced on a large part of the world’s population over the past year could have an enduring effect.

The combined revenue of Alphabet, Amazon, Apple, Facebook, and Microsoft, which jumped 41% in the first three months of this year, to $322bn.

After-tax earnings for the five soared by 105% from the previous year, to $75bn.

Defining National Security Assets in a Dual Use Environment

Water Supply: Taiwan looks to secure water supply amid chip growth - Argus

The Taiwanese government is implementing strategies to increase water supply over the next four years as the country's semiconductor manufacturers plan to build more water-intensive capacity to meet chip demand.

Taiwan is facing its worst drought in 56 years after no typhoon hit the island in 2020.

Reservoir levels in southern and western parts of the country have fallen below 20%.

The government has this month asked major industrial consumers in the western city of Hsinchu, including semiconductor manufacturers, to reduce their water usage by 13%.

Over the longer term, water consumption in the semiconductor industry in Taiwan is set to climb as the country's manufacturers respond to a structural rise in global demand.

Space Stations: China launches Tianhe space station core module into orbit - SpaceNews

China successfully launched a 22-metric-ton module, beginning an intense period of missions for constructing the nation’s own space station.

Tianhe, or “harmony of the heavens,” is now expected to raise its orbit to around 370 kilometers above the Earth.

China had expressed interest in joining the International Space Station project, but membership was effectively denied by U.S. policy towards China’s space programs.

Unipolar to Multipolar World

U.S. Vs. China: Biden Says Spending Program Will Give U.S. a Leg Up on China - NYT

President Biden justified his broad vision to remake the American economy as the necessary step to survive long-run competition with China.

His speech to Congress was laced with the themes of a new iteration of Cold War competition — more technological than military — without ever uttering the words “cold war.”

America now faces a far more capable technological competitor, a far more complex military standoff, and a starker ideological conflict.

“We’re at a great inflection point in history,” Mr. Biden said.

EU and Russian Relations: EU report takes aim at Russia over vaccine fake news – ABC News

Russia has launched a major campaign using ministries, companies, and pro-Kremlin media to promote the Sputnik V coronavirus vaccine and spread fake news that the West and the European Union are trying to undermine the shot, an EU agency said in a report Wednesday.

The European Medicines Agency, which regulates which vaccines and drugs can be put on the EU market, began a rolling review of Sputnik V last month but hasn't yet approved its use.

The EU's disinformation experts accused pro-Kremlin media outlets, including the official SputnikV Twitter account, of trying to “undermine public trust” in the EMA and “cast doubt on its procedures and political impartiality.”

Russia and India Relations: A message for US and China as India and Russia put two and two together – SCMP

The decision by India and Russia to hold a “two-plus-two” meeting of their foreign and defense ministers is meant not only to clear up misunderstandings in their bilateral relationship but to send a signal to both the United States and China.

New Delhi was keen to demonstrate that it retained its “strategic autonomy” in a signal to Washington.

The US has been trying to wean India off of Russian influence and has tried to discourage it from buying weapons from Moscow, its largest defense supplier, by threatening it with sanctions.

Moscow was keen to show Beijing that despite their relatively warm ties it planned to continue supplying advanced weaponry to New Delhi – a sore point for China which has spent much of the past year in a military stand-off with India over their disputed Himalayan border.

The Indian Prime Minister Narendra Modi tweeted on Wednesday after an “excellent” meeting with his “friend” the Russian President Vladimir Putin that they had decided on the two-plus-two meeting to add further momentum to “our strategic partnership”.