MIDDAY MACRO - DAILY COLOR – 4/28/2021

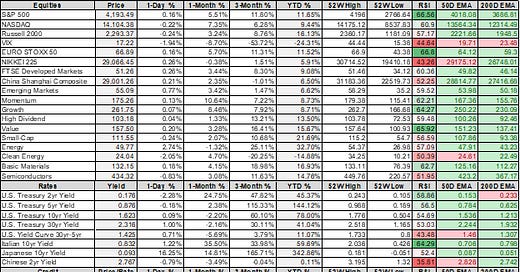

PRICE MATRIX

OVERNIGHT-MORNING RECAP / MARKET WRAP

Narratives:

Equities are mixed but generally flat

Treasuries flat after selling pressure yesterday

Energy complex gaining momentum

Agriculture complex corrected overnight but finding support at NY AM open

Price Action:

Equities mixed with Small-Caps under pressure after NY open

S&P/Nasdaq outperforming Russell

Value and Dividend Yield factors outperforming

4200 Call wall, Support moved higher to 4150

Major Asian Indexes higher; Japan +0.2%. Hong Kong +0.4%. China +0.4%. India +1.5%.

Multi-day rally in India as Covid fears subside and further policy support is priced in?

European bourses higher at midday, London +0.2%. Paris +0.5%. Frankfurt +0.4%.

Treasuries flat after long-end came under pressure yesterday afternoon

5 yr = 0.87% and 10yr = 1.63%

WTI up 1.3% to $63.70 after rallying yesterday post API Inventory data

Copper higher by 0.5%, higher at NY open after a weaker overnight

Aggs complex again attempting to rally after overnight pullback

DXY flat around 91

Gold slightly lower to $1,773

Bitcoin flat at $54.7K

Vaccination Data:

Average daily rate, U.S. vaccinations: 2.72mln

Total US vaccinations: 232mln

Average daily rate, global vaccinations: 19.8mln

Total global vaccinations: 1.06 billion across 172 countries

29% of Americans are fully vaccinated, and almost 43% have received 1+ dose.

Researchers' understanding of Covid-19 has come a long way since every Amazon package was treated like an Area 51 special delivery, and public health experts say it's rare for the virus to spread outdoors allowing CDS to change guidelines.

Analysis:

Equities are continuing to coil before likely making a last move higher before a more prolonged consolidation.

Rates have based from their recent lows and are breaking through down resistance

Commodities more generally cooled in the overnight but are again rising after the NY open

Bottom Line:

Today is being hyped as one of the most important trading days of the year so far but we aren’t biting.

FOMC should be a non-event (No SEP update) and Biden’s fiscal package is priced in as best it can be (given the uncertainty on how much tax increases will garner Dem Moderates support and likely division into two unique bills).

Instead, the bigger event this week will likely be Friday’s Personal Income and PCE data confirming higher MoM inflationary pressure on top of the YoY basing effect shock.

This along with expected blockbuster NFP data next week will help push rates higher, causing a pause in other risk-assets again eventually as the speed of yield rises throughout the second quarter are closely watched.

We still believe a further melt-up is possible in equities in the next few weeks.

The tail-risk continues to be an outperformance of growth and earnings driving a further melt-up in equities, catching markets too bearish even with positioning high (yes, I know that’s hard to believe at this point)

First-quarter earnings continue to beat expectations

U.S. economic data has been beating forecasts and is likely to continue given re-opening and pent-up demand

Foreign economic data has been mixed but generally positive

Highly accommodative fiscal and monetary policy

WORTH WATCHING

Econ Data:

Actual: -2.5%, Previous: 8.6%

International Trade: Actual: -$90.6bln, Previous: -$87.1, Deficit grew 4%

Retail Inventories: Actual: -1.4%, Previous: +0.1%

Wholesale Inventories: Actual: +1.4%, Previous: +0.6%

State Street Investor Confidence Index:

Actual: 93.9, Previous: 91.9

Atlanta Fed’s Survey of Business Uncertainty:

Sales Revenue Growth: Actual: 5.7%, Previous: 5.2%

Employment Growth: Actual: 2.6%, Previous 2.4%

Events:

April FOMC Meeting Ends, Chairman’s Press Conference

EIA Petroleum Inventories

TECHNICALS / CHARTS

The pace of growth in margin debt has hit levels synonymous with periods of equity weakness in the past. Strategist Stephen Suttmeier of BAML noted that the S&P 500 Index tends to struggle after the 12-month rate of change for margin debt peaks above 60% -- it's currently running at 72%. Margin debt hit a record $823 billion at the end of March, according to data compiled by FINRA. However the value of stocks has been rising too so at 1.7% of the total U.S. market cap, margin debt is actually below a recent peak of 2.2% in 2014.

The S&P continues to base this week in a bull flag with-in a flagpole pennant. A pennant is a type of continuation pattern, although this one comes with a relatively small flagpole from the 4,110 area, where support currently stands. With today’s FOMC and Biden’s speech, as well as the continuation of earnings this week and inflation data on Friday all possible catalysts the odds, are the S&P is setting up for one last move higher before seasonals become less supportive and rising rates again begin to weigh on risk sentiment.

OFF THE RADAR

ESG by the Numbers:

In 2020, ESG strategies broke several records:

Brought in record flows of $152 billion.

Reached record asset levels of $1.6 trillion.

Drove a record number of 196 product launches.

The percentage of institutional investors who implemented ESG rose by 18% between 2019 and 2021.

Fund selectors also reported higher levels of adoption, with the number implementing ESG rising from 65% to 77%

Globally, advisors report that 16% of client assets are invested in ESG

Measuring ESG has become a problem/concern.

60% of institutions and selectors rely on third-party ratings.

Around 30% of institutions and selectors rely on the company.

America’s Global Standing:

Between Jan. 20 and April 25, the percentage of respondents expressing favorable views of the U.S. rose in 13 out of 14 countries polled, according to a new survey by Morning Consult.

Favorable views about the United States improved strongly in Japan (up 19 percentage points, to 55 percent) and France (up 17 points, to 46 percent) after dipping below water following America’s Trump-fueled turmoil over the results of the November election.

China was the only country where positive views of the U.S. decreased among respondents.

The big picture: Biden's foreign policy of repairing alliances and pushing back against China may be having its intended effect.

Consumer Confidence:

Consumer confidence rose sharply for the second consecutive month in April, up 12.7 points to 121.7, following an 18.6 point increase in March.

Data is beginning to show more Americans are getting more comfortable with returning to regular pre-pandemic activities.

Morning Consult's "Tracking the Return to Normal" series reveals all-time highs in consumer comfort across activities including dining, entertainment, sports, and more.

60% of the public now feels comfortable dining out, a record high for the series that began record-keeping in March 2020.

17% say they will not be ready for two to three months and another 12% say it will be six months or more before they are comfortable dining in a restaurant.

53% of Americans feel comfortable going on vacation, a record since tracking began in April 2020.

Morning Consult's surveys on vaccine skepticism have declined for four straight weeks in the United States, progress has stalled, with 34% of respondents saying they won't get vaccinated.

HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

U.S. Government IT: Federal IT Experts Cite Host of Roadblocks to Tech Modernization - WSJ

U.S. lawmakers are pressing government agencies to update aging technology that hampers services and creates security risks.

The issue is more urgent during the Covid-19 pandemic as many federal operations shifted to remote work, said Sen. Maggie Hassan (D., N.H.)

The GAO estimates that software used across the government is about seven years old, on average. Some are much older, including:

A roughly 20-year-old Interior Department system that supports the operation of dams and power plants.

A 35-year-old Transportation Department system that holds sensitive aircraft information.

A nearly 50-year-old system used by the Education Department to store student-loan data.

Electrification

Batteries: Ford takes step towards making its own electric vehicle batteries - FT

Ford on Tuesday said it will beef up investment in batteries for electric vehicles after the pandemic, semiconductor shortages and a high-profile trade dispute highlighted the fragility of global supply chains.

Ford is centralizing its research and development for electric vehicle batteries in southeast Michigan and planned to open a $185m “learning lab” there late next year that will develop, test, and build battery cells and cell array.

The carmaker had planned to buy electric vehicle batteries from SKI, which had built a $2.6bn plant in Georgia, but in February the US International Trade Commission banned SKI from importing goods into the US for 10 years, finding that the company had stolen trade secrets from rival LG Chem and destroyed evidence to conceal the theft.

Satellites: Space race with Musk heats up as Eutelsat takes stake in OneWeb - FT

Eutelsat, the European satellite operator 20% owned by the French state, is paying $550m for a 24% stake in OneWeb, the space-based internet pioneer.

The deal brings into the fold one of the world’s largest fixed-satellite operators, with extensive commercial, government, and institutional customers, who could be tapped to buy the low-latency satellite services offered by OneWeb’s low-earth orbit fleet, people close to the deal said.

OneWeb and SpaceX’s Starlink are aiming to launch mega-constellations of low-earth orbit (Leo) satellites to deliver high-speed broadband from space.

China Macroprudential Policy

ENREA – Environment / Natural Resources / and Energy Advisory

China’s Energy Demand: China’s 2021 electricity use may rise by 7-8%

China's electricity consumption this year will increase by 7-8% from 2020 on stronger domestic activity, according to the latest forecast by the government-backed China Electricity Council.

China's non-fossil fuel installed power capacity could surpass that of coal-fired capacity this year for the first time, the CEC said.

Earlier this year it forecast the share of non-fossil installed capacity to rise by 2.5% on the year to 47.3%.

One important factor in ensuring grid reliability of renewable energy is the ability to store energy because of the cyclical nature of renewables.

China's total installed energy capacity rose to 33.4GW at the end of 2020, a year-on-year increase of 136%, according to data from the China energy storage alliance.

Hydrogen: Japanese firms develop hydrogen engines for large ships - Argus

§ Japanese engine manufacturers have teamed up to attempt to develop hydrogen marine engines for large coastal and ocean-going ships by around 2025, as part of efforts to help the country's shipbuilders fast-track development of hydrogen-fuelled vessels.

§ Demand for hydrogen as a marine fuel is expected to expand as the international shipping industry strives to reduce its greenhouse gas emissions by at least 50% by 2050 compared with 2008 levels.

§ A number of countries, including Japan, have also toughened their greenhouse gas commitments to achieve decarbonization by 2050, prompting Japanese shipbuilders to speed up a shift to greener and zero-emissions vessels and tap decarbonization potential in competition against their Chinese and South Korean rivals.

Fiscal Policy

Biden’s Plan: Biden to Propose $1.8 Trillion Plan Aimed at Families, Tax Hikes for Wealthiest Americans - WSJ

President Biden plans to lay out a $1.8 trillion proposal that includes new spending on child care, education and paid leave, and extensions of some tax breaks.

The White House said the proposal includes $1 trillion in new spending over 10 years and $800 billion in tax cuts, largely extensions of breaks created or expanded in this year’s Covid-19 relief law.

The proposal would provide money to make child care more affordable for low- and middle-income families and boost federal funding to child-care providers.

It would establish a national paid-leave program for those needing time to care for a child or loved one or to recover from illness, among other reasons.

Mr. Biden’s plan stops short of making permanent the Covid-19 relief law’s temporary child tax credit expansion to $3,000 a child and $3,600 for those under age 6. Instead, he would extend that breakthrough 2025.

Restaurants: Restaurants Can Tap $29 Billion Covid-19 Aid Program Beginning May 3 - WSJ

The program, officially known as the Restaurant Revitalization Fund, is the first federal pandemic aid exclusively for restaurants, bars, and other food-service businesses.

It was authorized by Congress as part of its $1.9 trillion coronavirus-aid packages that became law last month.

Restaurants and bars reported sales of $659 billion last year, down by nearly a quarter from 2019, according to the National Restaurant Association.

More than 110,000 bars and restaurants closed at least temporarily, according to the trade group’s estimates.

Grant recipients are eligible to receive funding equivalent to their pandemic-related revenue loss, up to $10 million per business, according to the SBA website.

A single physical location can receive no more than $5 million.

Monetary Policy

Fed Repo: Demand Surges at Fed Reverse Repo Facility, Adding Wrinkle to FOMC Meeting – WSJ

Over recent days, firms eligible to participate in this tool and its 0% return have gone from ignoring it to pumping in cash.

The Federal Reserve Bank of New York took in $142.17 billion Tuesday and $101 billion Monday, in what were both overnight operations.

Demand has been inching up for the tool over recent weeks, but for much of the facility’s life, there has been zero usage.

Big Tech Regulation/Taxation

Ant: Ant IPO-Approval Process Under Investigation by Beijing - WSJ

The central-government investigation, which started early this year, focuses on regulators who greenlighted the initial public offering, local officials who advocated it, and big state firms that stood to gain from it.

The probe means uncertainty continues to loom over the future of Ant and controlling shareholder Mr. Ma.

The usually flamboyant entrepreneur has kept a low profile since the IPO was stopped last-minute in November.

He won’t be allowed to leave China until Ant completes a business overhaul ordered by regulators and the government’s investigation is over.

Logistical Bottlenecks

UPS: UPS expands weekend capacity, pricing to 'remain firm' - SupplyChainDive

UPS saw strong demand in Q1 with average daily volume increasing more than 14% YoY, according to its financial filings.

It expects a hot macro environment to carry this demand through 2021, though the company declined to provide financial guidance for the year.

Three main variables fuel UPS' optimism for the year, CFO Brian Newman said Tuesday:

Increased vaccine rollout,

Low inventory to sales ratio

Passage of the most recent stimulus measure in the U.S.

“Full-year retail sales are expected to grow nearly 12%”, Newman said

Carrier Construction: Yards max out slots for large-sized tonnage through to 2024 – Splash247.com

Data from brokers BRS shows that remarkably in just week 17 of the year, on a number of ships basis, total vessel ordering activity so far in 2021 already equates to 48% and 46% of the orders placed in 2020, and the average number of orders placed per year across 2016 to 20, respectively.

Alphatanker, a unit of BRS, is reporting today that it is now almost impossible for owners to order a large tanker in a Chinese yard for delivery before 2024.

Increasingly, Korean yards are in a similar situation, all of which has had the knock-on effect of increasing valuations for secondhand tonnage.

“While contracting an order book-to-fleet ratio remains at a historical low in the tanker segment, elevated contracting activity from other segments has reduced available capacity to build VLCCs for the upcoming years at a time when the sector needs to replace maturing vessels with more environmentally friendly designs,” Euronav stated in a release last week.

Defining National Security Assets in a Dual Use Environment

Marine Tech: Businessman to Admit Smuggling Marine Tech to China – WSJ

Under a plea agreement Mr. Qin reached with the U.S. attorney’s office in Boston, he is expected to plead guilty to counts of conspiring to commit export violations, visa fraud, lying to government agents, money laundering, and smuggling.

U.S. officials and court documents filed in the case describe Mr. Qin as a cog in Beijing’s grand plan to build an undersea drone armada—one built in part on acquiring advanced U.S. and allied technology.

In the Pacific, Indian and Arctic oceans, Beijing is deploying growing numbers of advanced sea drones, forming sensor networks that U.S. officials believe could track American submarines.

That could erode the U.S. Navy’s critical edge beneath the waves just as its surface ships are increasingly vulnerable to Chinese missiles.

Unipolar to Multipolar World

Quad Tres Supply Chain Security: Australia, Japan, and India Form Supply Chain Initiative to Counter China - BBG

Japan, India, and Australia’s trade ministers have met to officially launch the Supply Chain Resilience Initiative.

They also committed to holding investment promotion events to explore the possibility of diversification of their supply chains.

While China wasn’t specifically addressed in Tuesday’s statement, the ministers said that “some supply chains have been left vulnerable due to a range of factors,” while “the pandemic had revealed supply-chain vulnerabilities globally and in the region.”

Vaccine Soft Power: Vaccine Makers Warn Bottlenecks, Nationalism Threaten Production – BBG

Indian pharmaceutical executive Sai Prasad and other vaccine officials last week blamed the use of the U.S. Defense Production Act to protect American supplies on shortages in India.

They said it was aggravating a worldwide shortage of some of the more than 100 components needed to make those inoculations.

President Joe Biden’s administration said it will ship the critical items India needs to churn out vaccines as it desperately tries to douse the Covid wildfire that has engulfed the country and is smashing bleak global infection records.

Hong Kong to U.K.:Hong Kong residents buy US$1.3 billion worth of homes in London after the UK opened the path to citizenship in July - SCMP

Hong Kong residents bought 1,932 units or 4% of London homes worth £959 million (US$1.3 billion) since last July, estimates from Benham and Reeves show

Hongkongers accounted for 8.5% of home purchases by foreigners in prime central London last year, the second-largest group alongside the Chinese and Americans.

The UK government has made it easier for 3 million Hongkongers who qualify for a British National (Overseas) passport and their dependents to relocate to Britain and stay and work or study for extendable periods of 12 months, creating a path to citizenship.

An estimated 123,000 to 153,700 BN (O) passport holders in Hong Kong and their dependents are likely to come to the UK in the first year of the application and between 258,000 and 322,400 over five years are likely to purchase a home in the UK, according to the British government.

EU and China Relations: EU slams China’s ‘authoritarian shift’ and broken economic promises - Politico

Only four months after Beijing and Brussels concluded the principles of a landmark investment agreement, a high-level internal report seen by POLITICO shows the EU is now increasingly pessimistic about keeping business interests separate from political concerns over what it calls President Xi Jinping's "authoritarian shift."

The EU's "progress report" on China also slams Beijing for "little progress" on economic promises made by the Communist leadership, particularly in regard to opening up digital and agricultural markets, addressing steel overcapacity, and reining in industrial subsidies.

“The reality is that the EU and China have fundamental divergences, be it about their economic systems and managing globalization, democracy, and human rights, or on how to deal with third countries.

These differences are set to remain for the foreseeable future and must not be brushed under the carpet," European Commission President Ursula von der Leyen and Josep Borrell, the bloc's foreign policy chief, said in a letter outlining the report to the European Council comprising leaders of the 27 EU countries, on April 21.

EU CFIUS: EU Pushes Back on China With Powers to Thwart State-Backed Firms - BBG

The European Commission, the bloc’s executive arm, proposed new rules to levy fines and block deals, according to a draft obtained by Bloomberg.

While China isn’t specifically mentioned in the proposal, the move follows complaints from European businesses that the Asian nation’s firms get the support they can’t match.

It’s the next step in the EU’s efforts to ward off China, building on a push by member states to protect strategic companies from takeovers by non-European buyers.

The new rules would run in parallel with oversight on foreign direct investment, which European governments have been ratcheting up in the last few years to give them more power to stop deals over industries or sectors they view as crucial.