MIDDAY MACRO - DAILY COLOR – 4/27/2021

PRICE MATRIX

OVERNIGHT/MORNING RECAP / MARKET WRAP

Narratives:

Equities are mixed but generally lower after the open following a more positive overnight

Treasuries under some pressure but gaining off overnight lows

Agriculture complex lower after heavy buying in Asian session turned in to NY open selling

Price Action:

Equities mixed with small-caps slightly higher

Russell outperforming S&P/Nasdaq

Small-Cap and Dividend Yield factors outperforming

4200 Call wall, 4100 Support with little support after to 400

Major Asian Indexes mixed; Japan -0.5%. Hong Kong -0.2%. China flat. India +1.2%.

European bourses flat at midday, London -0.2%. Paris -0.2%. Frankfurt -0.3%.

Treasuries lower with slight bear steepening

2yr & 7yr FRN auctions on deck

5yr = 0.86% and 10yr = 1.58%

WTI up around 0.7% to around $62.40

RBOB outperforming, up 1.4%

Copper higher by 0.7%, but as high as 1.2% in the overnight

Aggs complex higher with corn leading at around +2%

Notably higher in overnight and under some pressure following NY open

DXY basing slightly around 90.85

Gold slightly higher at $1,783

Bitcoin higher by 2% to $55K after a roller coaster ride since the weekend

Vaccination Data:

Average daily rate, U.S. vaccinations: 2.74mln

Total US vaccinations: 231mln

Average daily rate, global vaccinations: 19.2mln

Total global vaccinations: 1.04 billion across 172 countries

The Biden administration said it would share as many as 60 million doses of the AstraZeneca vaccine with the rest of the world

Analysis:

A heavier feel to equities this AM as the melt-up waits for further earnings results and guidance to justify valuation/momentum

The recent rally in rates looks to be cooling and equities are starting to notice as small-cap and value have been outperforming

Bottom Line:

“Wait and See” mode in equities as the effects of supply chain disruptions and rising costs are being heavily discussed in earning call transcripts.

However: If companies keep beating forecasts at the current rate over the next couple of weeks, we could end up with growth for the quarter of as much as 40% from a year earlier due to the low base set last year, still an eye-popping number.

Corn hit a monthly return of 35% at its overnight high with most of the agg complex is not that far behind, leading one to question the longer-term effects of these increases on inflation generally and emerging markets particularly.

RSI is now above 80 and momentum has potentially faltered after todays NY open

WORTH WATCHING

Econ Data:

S&P Corelogic Case-Shiller Home Price Index:

MoM: Actual: 1.2%, Forecast: 0.8%, Previous: 0.9%

YoY: Actual: 11.9%, Forecast: 11.2%, Previous: 11.1%

MoM: Actual: 0.9%, Forecast: 0.8%, Previous: 1%

YoY: Actual: 12.2%, Forecast: 11.9%, Previous 12.1%

Conference Board’s Consumer Confidence:

Actual: 109.7, Previous: 90.4

Actual: 17, Forecast: 19, Previous: 17

Events:

April FOMC Meeting Begins

2-Year & 7-year Floating Rate Note Auctions

Misc:

Yeezy sneakers worn by Kanye West during his 2008 Grammy performance sold for $1.8 million—a new record and the first time a pair of sneakers hit seven figures.

Creation of First Human-Monkey Embryos Sparks Concern – You think?

TECHNICALS / CHARTS

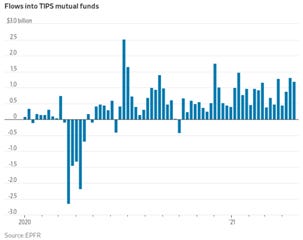

Investors poured a net $1.2 billion into mutual funds that buy Treasury inflation-protected securities in the week ended April 21, according to data from EPFR.

It was the 29th consecutive week of inflows into such funds, the longest streak since 2010.

The yield of 10-year TIPS was around negative 0.784% Monday, compared with negative 0.626% on March 31, according to Tradeweb.

Comments from CEOs and CFOs on earnings calls so far suggest that the risk of inflation is rising.

Reviews of transcripts looking for trends have overwhelmingly seen an increase so far in concerns about inflation mentioned.

This is in line with regional Fed surveys and the Beige Book which is showing record increases in input costs and output prices for both manufacturing and services sectors across the country.

OFF THE RADAR

Mothers in the Workforce:

Almost 1.5 million fewer moms of school-aged children were actively working than in February 2020, according to Misty Heggeness, principal economist and senior adviser at the Census Bureau.

Although men’s labor-force participation also fell to record lows last spring, women as a group have had more difficulty rebounding.

Factors including access to child care, a lack of attractive jobs, the demands of home and virtual schooling, and health concerns are likely affecting mothers’ employment.

The participation rates of women with children under the age of five have fluctuated the most

Since February of last year, participation rates for white women, including mothers, haven’t dropped more than 3.2 percentage points.

Rates for women of color—especially Black and Hispanic mothers with children under five—have at times fallen more.

Illegal Fishing and WTO:

The world’s most important trade negotiation this year centers on a deal aimed at saving the world’s fisheries.

Back in 2015, global leaders tasked the World Trade Organization with ending excessive and illegal fishing.

The idea was to eliminate government subsidies that incentivize companies to deplete the world’s fish stocks and threaten coastal economies.

A failure to conclude a fisheries deal would show that the WTO lacks credibility and is incapable of tackling the more pressing problems of the modern global trading system.

Okonjo-Iweala sees it as a way to signal to the world that the WTO is back.

China, India and other developing nations are more focused on carving out exemptions than agreeing to enforceable disciplines that would help foster the sustainability of the world’s fish stocks.

But there are two signals that may provide hope for advocates of a fisheries accord.

The first is the fact that the new director-general is both motivated to close the deal and willing to apply strong political pressure on trade ministers to get it across the finish line.

The second signal is the fact that President Joe Biden’s top trade official recently said one of her top goals is to use trade to help address environmental challenges.

In a speech in Washington this month, U.S. Trade Representative Katherine Tai specifically called WTO talks a “critical” tool for addressing the global problem of overfishing.

U.S. Population Growth:

The country’s overall population growth slowed to the lowest rate since the Great Depression, the Census Bureau said Monday.

Overall, the U.S. population grew 7.4% in the past decade, reaching 331,449,281 on April 1, 2020.

The census, because it is pegged to April 1, doesn’t reflect most of the coronavirus pandemic’s effects on the population.

Since then, the U.S. has seen half a million more deaths than in recent years, a birthrate that dropped to a record low and slowing immigration.

§ HOUSE THEMES / ARTICLES

Digital infrastructure security and the “5th Dimension”

NLP: Natural Language Processing Sharpens Its Focus on Financial Risk - GARP

The technology, which can enable machines to ingest and extract meaning from unstructured datasets hundreds of times faster than human readers, is getting a commercial boost from companies such as Amenity Analytics, Behavox, Eigen Technologies and Scienaptic.

Both open-source and proprietary advances in NLP technology facilitate a range of activities: text extraction and summation, voice surveillance of traders and other employees, compliance or fraud monitoring, sentiment analysis in social media and other communications, and analyses of CEO statements and Q&A sessions during earnings calls.

Uncharted territory fraught with abuses and privacy violations if used by the wrong actors.

“In other countries across the world, where many applicants are underbanked and do not have a historical credit record, NLP models can be applied to text messages to create signals that predict the borrower’s credit risk and allow you to underwrite loans in an effective way,”

Facial Recognition: China Technical Body Sets Plan to Bolster Facial Recognition Security - Caixin

China has released a detailed draft of national standards to regulate the use and protection on facial recognition data amid a heated debate surrounding the widespread use of surveillance technologies in public areas across the country.

After taking effect, it will become the country’s first set of national standards for the use and protection of facial recognition data.

The draft plan calls for increased security standards for storing facial recognition data and written permission from subjects before businesses can share captured data.

Top U.S. cybersecurity officials on Monday released an analysis of techniques they attribute to Russian hackers “to aid organizations in conducting their own investigations and securing their networks.”

The advisory includes signs of compromise and recommendations for defense, plus commentary on how tools and tactics have evolved.

The advisory includes guidance for combatting specific hacking methods, including:

So-called Wellmess malware that appears to focus on gaining information related to Covid-19 vaccine development;

Exploitation of “zero-day” vulnerabilities, or freshly discovered weaknesses for which there aren’t yet patches, specifically related to virtual private networks commonly used during remote work.

Electrification

Food Robotics: Rockets Launch First-Ever Robot-Assisted Arena Food And Beverage Service - YouTube

The Houston Rockets and Toyota Center in partnership with Levy Restaurants have teamed up with Bear Robotics to launch the first-ever robot-assisted food and beverage service at a stadium or arena.

Self-Driving Cars: A City Tailor-Made for Self-Driving Cars? Toyota Is Building One - BBG

Toyota is building its sensor-laden “Woven City” from the ground up a two-hour drive outside of Tokyo.

When construction is completed in 2024, it will seek to offer a model of what urban centers around the world could look like in the age of autonomous transport.

Beyond futuristic mobility options, the city will also feature smart homes that take out trash and restock refrigerators automatically, according to Toyota.

The entire ecosystem will also be powered by hydrogen.

By 2040, a fleet of more than 30 million self-driving vehicles is estimated to be driving on roads globally.

Lyft: Lyft sells self-driving unit to Toyota’s Woven Planet for $550M – TechCrunch

Ride-hailing company Lyft has sold off its autonomous vehicle unit to Toyota’s Woven Planet Holdings subsidiary for $550 million, the latest in a string of acquisitions spurred by the cost and lengthy timelines to commercialize autonomous vehicle technology.

The Level 5 workforce, researchers from Toyota Research Institute and Woven Planet will be combined into one team of about 1,200 employees.

The company said the acquisition of Level 5 is a carve-out of Lyft’s self-driving division with a specific focus on accelerating the safety of automated driving technology and does not directly affect Toyota’s relationship with other partnerships such as AV startup Aurora.

China Macroprudential Policy

Rail Debt: As Debt Mounts, Beijing Puts Brakes on Two High-Speed Rail Projects - Caixin

Beijing has ordered a halt to work on two high-speed rail projects with total investment of 130 billion yuan ($20 billion) in Shandong and Shaanxi provinces, signaling concern over growing local government debt.

A person close to the Shandong rail system told Caixin that work on the Jinan-Zaozhuang line was halted partly because a section of the line was too similar to a stretch of the Beijing-to-Shanghai high-speed rail line that has operated for years.

ENREA – Environment / Natural Resources / and Energy Advisory

EU Emissions: EU emissions price rally 'fundamentally justified' - Argus

The EU ETS benchmark front-year product has made continuous month-on-month gains since November, almost doubling in value from €23.68/t of CO2 equivalent (CO2e) at the beginning of that month to an all-time high of €47.03/t CO2e on 22 April.

Some market observers have linked the rally to growing interest in carbon from speculative investors, sparking calls from some participants for regulatory intervention, such as additional position limits.

Investor activity does appear to have played a part in the recent rise in EUA prices, Ahrens and Azlen said, given that compliance demand will have dropped because of last year's Covid-driven fall in emissions.

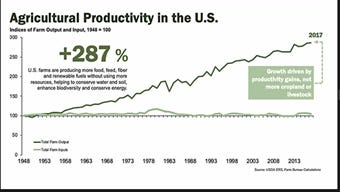

Farming: Agriculture remains a minimal contributor of greenhouse gas emissions - FarmWeek

According to the latest U.S. Environmental Protection Agency emissions report, agriculture remains a minimal contributor of greenhouse gas (GHG) emissions at 10%.

After factoring in land management and forestry practices, agriculture boasts net emissions of -2%.

Farmers are also providing more clean and renewable energy.

The use of ethanol and biodiesel in 2018 reduced GHG emissions by 71 million metric tons, equivalent to 17 million cars off the road.

IKEA: IKEA owner sets aside 4 bln euros for green power projects - Reuters

Ingka Group, the company that owns most Ikea stores, plans to invest $4.8B in green energy projects, including solar and wind farms in China, India, and Australia.

The investments, which will also finance electric car charging stations in Ikea parking lots, will be made by 2030.

The projects will help the world's largest furniture maker achieve its goal of becoming climate positive by the end of the decade, which would imply reducing carbon emissions to zero through the company's value chain, including the eventual disposal of the furniture.

Fiscal Policy

Capital Gain Taxes: Biden Capital Gains Hike Would Hit Couples Earning $1 Million - BBG

Biden is set on Wednesday to unveil his “American Families Plan,” featuring major new social-spending measures that would be funded in part by higher taxes on the wealthy.

White House is planning to almost double the capital gains tax rate for wealthy individuals to 39.6%, compared with the 20% rate today.

Goldman Sachs Group Inc., drawing on Federal Reserve data, estimates that the wealthiest households now hold $1 trillion to $1.5 trillion in unrealized capital gains on equities.

That’s roughly 3% of U.S. stock market capitalization.

Goldman strategists led by David Kostin wrote in a note Friday: “In the three months prior to the last hike in the capital gains rate hike, in 2013, the wealthiest households sold 1% of their starting equity assets, which would equate to around $120 billion of selling in current terms,”

Monetary Policy

BoJ: Kuroda to Miss Price Goal as Japan’s Inflation Hunt Drags On - BBG

Bank of Japan Governor Haruhiko Kuroda will fail to reach his goal of stable 2% price growth during his term after what will have been more than a decade of stimulus to stoke inflation, according to the Bank of Japan’s latest forecasts.

The BOJ released the latest projections Tuesday after leaving unchanged its interest rate and asset purchase settings, as had been widely expected.

While the bank now sees stronger economic growth of 4% in the year started April and 2.4% the following year, it cut its inflation forecast for the current fiscal year to just 0.1%, citing cheaper mobile phone bills.

Logistical Bottlenecks

Suez: Suez effects to stretch into June, container shortage to worsen - SupplyChainDive

The loss in ocean capacity resulting from carrier schedule changes after the Suez Canal blockage is expected to stretch into June, according to an analysis of carrier schedules by Sea-Intelligence.

Sea-Intelligence CEO Alan Murphy said the impact will be felt in two waves — the first of which will be absorbed "quite quickly" and a second that will have a longer-term impact on the market.

The Port of Antwerp said the blockage is expected to result in delayed ship calls and general operational challenges "throughout Q2," according to a notice released on Friday.

German Manufacturers: German manufacturers’ optimism hit by supply chain disruption - FT

Almost half of German manufacturers reported disruption to their supplies of parts or materials in the past month, the highest level for 30 years, the survey by the Ifo Institute found.

In Germany the disruption, including shortages of semiconductors, plastics, rubber and metals, added to new coronavirus containment measures; as a result businesses’ confidence rose by a smaller than expected amount this month, Ifo discovered.

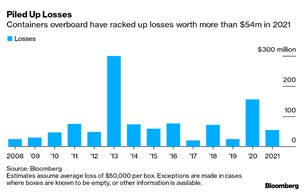

Losing Cargo: Shipping Containers Plunge Overboard as Supply Race Raises Risks - BBG

Shipping containers piled high on giant vessels are toppling over at an alarming rate, sending millions of dollars of cargo to the bottom of the ocean as pressure to speed deliveries raises the risk of safety errors.

The situation has grown more dangerous because of extra stress on supply chains since the pandemic.

More than 3,000 boxes dropped into the sea in 2020 and the number has already surpassed 1,000 so far this year.

The accidents are disrupting supply chains for hundreds of U.S. firms.

While the loss is minuscule compared with the 226 million container boxes shipped each year, it represents almost 60% of the monetary value of all container accidents.

Defining National Security Assets in a Dual Use Environment

Semiconductor: Tsinghua Sets Up School to Support Semiconductor Self-Sufficiency in China - Caixin

China’s Tsinghua University has set up the school of integrated circuits to nurture microchip professionals as Beijing seeks self-sufficiency in semiconductor production amid a tech war with Washington.

The new school aims to “achieve breakthroughs in chip technology” and “train much-needed high-level talent” that will help China attain global leadership in chip design and manufacturing.

Unipolar to Multipolar World

China and Sri Lanka Relations: As China’s defence minister heads for Sri Lanka, should India be worried? - SCMP

The Chinese Defense Minister Wei Fenghe’s visit to Sri Lanka on Tuesday is as much about boosting political and economic cooperationas it is about military links, experts say.

Wei will become the second senior Chinese official to have visited the country since the onset of the coronavirus pandemic when he arrives for the three-day visit, which follows a trip by China’s foreign policy chief Yang Jiechi in October 2020.

Wei is expected to hold talks with President Gotabaya Rajapaksa and Prime Minister Mahinda Rajapaksa and other senior officials.

Wei’s visit is likely to coincide with a ruling by Sri Lanka’s Supreme Court on Port City Colombo, a controversial Chinese-funded US$1.4 billion development project to be built on reclaimed land that opponents – who have lodged 19 petitions against it – say violates the country’s sovereignty, constitution and labor laws.

The project is the latest in a string of Chinese investments in the country that some believe are aimed at gaining influence among South Asian nations and luring them away from India’s orbit.

Japan and China Relations: Japan’s Suga voices ‘grave concerns’ over China’s maritime actions in call to India’s Modi - SCMP

Japanese Prime Minister Yoshihide Suga on Monday voiced “grave concerns” over China’s aggressive actions in surrounding waters in phone talks with Indian counterpart Narendra Modi.

Suga relayed Tokyo’s worries about Beijing’s “intensifying unilateral attempts to change the status quo” in the East and South China seas, including the recent introduction of a law allowing its coastguard to use weapons against ships it views as intruding into its territory, according to the Foreign Ministry.

The leaders affirmed the importance of Japan and India cooperating to realize a “free and open Indo-Pacific” region, the ministry said, along with other countries including the United States and Australia.

Suga also touched on bilateral cooperation in areas including cybersecurity, decarbonization, 5G networks and supply chain diversification, the ministry said

Beijing is embroiled in a number of territorial disputes, including in the East China Sea over the Japanese-administered Diaoyu Islands, which it claims. It has also continued the militarization of artificial islands in the disputed South China Sea despite an international ruling in 2016 against its claims.

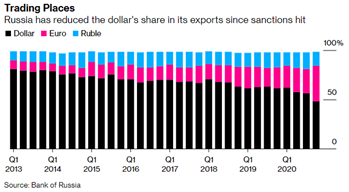

Russia and the USD: Russia Ditches the Dollar in More Than Half of Its Exports – BBG

The dollar share of Russian exports dropped below 50% for the first time on record in the fourth quarter following a multi-year Kremlin campaign to reduce the country’s vulnerability to U.S. assets.

Most of the slump in dollar use came from Russia’s trade with China, more than three-quarters of which is now conducted in euros, according to central bank data published on Monday.

The Euro’s share in total exports jumped more than 10 percentage points to 36%, the data show.

Chinese Defense Spending: China ups defense spending in 2020 but ‘economic growth cushions increase’ - SCMP

China again increased spending on its military last year, reflecting a global increase in defense expenditure in spite of the coronavirus pandemic, according to a Sweden-based research group.

In a report released on Monday, the Stockholm International Peace Research Institute (SIPRI) said China spent an estimated US$252 billion on its armed forces in 2020, 1.9% more than it outlaid the previous year.

The increase was lower than the 2.6% increase globally but the total was 41% higher than the budget announced by Chinese Ministry of Finance last year.

Defense spending around the world rose to US$1.981 trillion, with the five biggest spenders – the United States, China, India, Russia and Britain - together accounting for 62% of the global total, the group said.

Military spending by the US grew by 4.4% to a total of US$778 billion in 2020, or about 39% of the global total.

“The ongoing growth in Chinese spending is due in part to the country’s long-term military modernization and expansion plans, in line with a stated desire to catch up with other leading military powers,”

Russia and Eastern European Relations: Czechs Get Backing From East European Allies in Russia Spy Feud - BBG

The Czech Republic and Russia expelled a record number of each other’s diplomats in the past week after the government in Prague blamed Moscow’s agents for an explosion at an ammunitions warehouse that killed two Czechs and caused about $50 million of damage.

Several members of the European Union’s eastern wing also ousted Russian embassy staff in an act of solidarity, the prime ministers of Poland, Hungary and Slovakia jointly denounced what they called “illegal and violent actions carried out by the Russian intelligence operatives.”