Midday Macro - Bi-weekly Color – 4/12/2022

Overnight and Morning Market Recap:

Price Action and Headlines:

Equities are mixed, helped by a slightly weaker than expected inflation report but well off session highs as Putin says peace talks surrounding Ukraine are a “dead-end”

Treasuries are higher, with the curve significantly steepening as Fed hiking expectations are reduced due to Core CPI coming in below expectations, helping the front-end outperform

WTI is higher, significantly rising as the situation in Ukraine worsens, while China begins to show some signs of easing lockdown restrictions as traders turn to tomorrow's weekly inventory data

Narrative Analysis:

Equities are mixed, giving up post-CPI gains as headlines out of Russia showed peace talks have stalled. Today’s CPI data showed most of March’s inflationary gains came from the gas pump, with increases in the core rate decelerating. Elsewhere the NFIB Small Business Survey showed a further deterioration in sentiment as inflationary pressure continued to weigh on the outlook. Treasuries are receiving a relief rally after multiple down sessions, with the weaker than expected core rate helping the front-end reduce Fed rate hike expectations, steepening the curve notably. Oil is having a strong day thanks to the increased likelihood that energy sanctions are still coming as Putin steps away from peace talks. Finally, the dollar is higher, helped by Euro weakness, despite yields falling domestically post-CPI.

The Russell is outperforming the Nasdaq and S&P with Small-Cap, Growth, and Momentum, and Energy, Consumer Discretionary, and Technology sectors are outperforming.

S&P optionality strike levels have the Zero-Gamma Level at 4508 while the Call Wall is 4700. The negative gamma level in SPY & QQQ is quite large, which signals more elevated volatility, while the SPX level is less. Yesterday saw an increased put buying preference, driving the overall put position higher in size while material call buying remains absent. Put controlled markets are characterized by high volatility, as dealers must hedge in the market's prevailing direction.

S&P technical levels have support at 4415, then 4370, and resistance at 4445, then 4480 area. Today's low in the S&P overnight was the exact 50% retracement of the March melt-up, and now, after the post CPI rally, bulls want to see a close above the 50dma at 4420.

Treasuries are higher with the 10yr yield at 2.70%, lower by around 8bps on the session, while the 5s30s curve is steeper by 13.2bps to 15bps as traders gauged the CPI data to be supportive. The ten-year notably auction tailed, although there had been a significant move into the auction following the morning's inflation data, and there was a big drop in non-dealer participation

Deeper Dive:

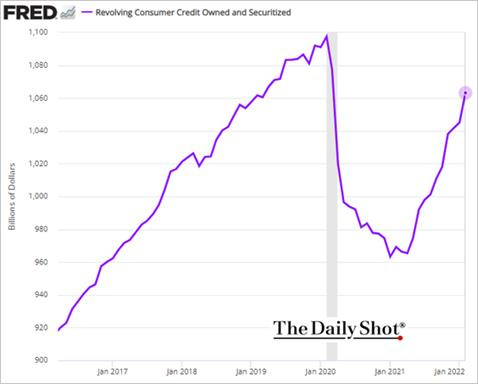

February’s significant jump in consumer credit, primarily driven by consumers tapping their credit cards, caught our eye and added to our belief that the household balance sheet, although currently strong, is increasingly coming under pressure from the ongoing inflationary pulse. As a result, not only is real disposable income being diminished, but savings levels are increasingly being taxed, and as a result, the consumer is starting to increase their level of debt to maintain purchasing power, an unsustainable situation that will lead to growing demand destruction later in the year.

Total consumer credit increased by $41.8 billion in February, up sharply from a rise of $8.9 billion in the prior month. Revolving credit, like credit cards, rose at a 20.7% rate in February after a 4% gain in the prior month. These increases occurred as mortgage and auto loan rates hit post-pandemic highs while the average credit card APR stands at 16.4%.

*Last month's large jump in revolving credit indicates that consumers may be increasingly using their credit cards to keep up with inflationary cost increases

Further, the perceptions of credit access compared to a year ago deteriorated in March, with more respondents finding it harder to obtain credit now than a year ago. Expectations about future credit availability deteriorated as well, according to the NY Fed’s recent Survey of Consumer Expectations. This leaves us wondering if consumers will have reduced access to credit, which will cost more, as their savings levels further normalize, ultimately reducing their ability to grow future real aggregate demand even if jobs levels hold up.

*Availability of credit is an important part of keeping the expansion cycle going and growing“harder” to get expectations are not a positive development

When looking at the current labor market, things are “tight,” and wage growth has certainly been historically strong. However, it is clear that inflation has been stronger with the current trend in real disposable personal income now below its longer-term trend. If increases in inflation slow and even start to decrease, the stickiness of wages means that the negative trend may reverse. Still, in the immediate, this loss of purchasing power will increasingly reduce end-demand and further weigh on consumer sentiment/confidence.

*The Atlanta Fed tracker shows that wages have increased by close to 6% annually, with those paid hourly increasing by even more. However, CPI was higher by 8.5% YoY as reported today

*As a result of the higher and persistent inflationary pressures, real disposable income continues to fall, well below the pre-pandemic trend, and as forecasted by Wells Fargo, will not catch up anytime soon

We question the ability of labor to continue to command “inflation offsetting” wage increases, pushing back on thoughts that we are entering a wage-spiral inflationary cycle. This means inflation is still cyclical and hasn’t morphed into a longer/larger structural pulse, but currently, this is bad for the consumer, given the loss of purchasing power. We believe the future ability of labor to garner higher compensation will likely decouple from the high levels of job openings. The recent NFIB small-business survey saw only marginal increases in compensation expectations despite skilled labor shortage issues remaining a critical issue. If demand falls in the second half of the year, the urgency to hire should drop as firms have already learned to do more with less on top of investing heavily in automation over the last two years. As a result, we question how essential/sticky the almost 11 million job openings in the country really are in the face of falling end demand.

*Firms expecting better business conditions over the next six months decreased to the lowest level on record, driven by falling sales expectations, but hiring and compensation plans increased? Something doesn’t make sense here

Finally, and well known at this point, is the continued deterioration in both business and consumer sentiment due to inflation. This increasingly clouds where end-demand and hence where production/service activity/capacity will go as current solid activity contrasts with growing negative sentiment. Further, uncertainty expressed regarding future inflation continues to increase, indicating not only is current inflation weighing on sentiment, but the uncertainty over where inflation is going has worsened. This was also echoed in today's NFIB survey, with the impact of inflation increasingly becoming the “most important business problem.” This leads us to believe that consumers and firms will increasingly pull back activity over the summer until there is greater clarity on when inflationary pressures will subside.

*Besides the general negative tilt occurring in most business/consumer confidence/sentiment surveys, it is becoming clear through the more microdata provided that future demand is increasingly falling due to higher prices

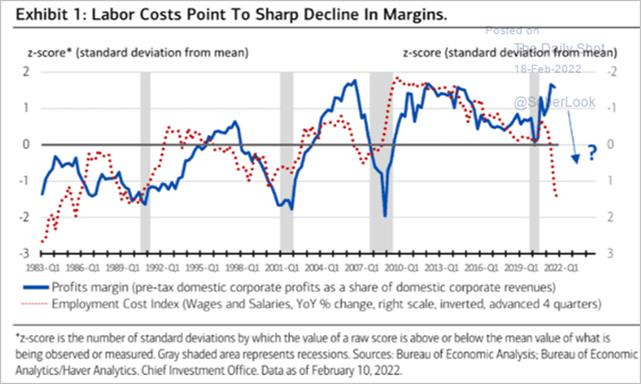

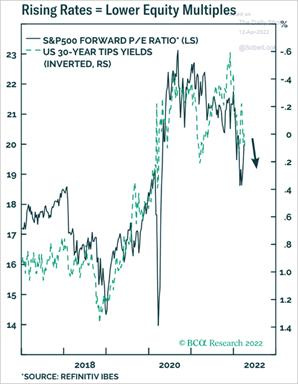

Putting it all together and it becomes hard to make a compelling case for stronger aggregate demand in the second half of the year. We are aware this is a consensus view, but when coupled with financial conditions that should increasingly tighten, primarily driven by higher real rates and lower levels of liquidity, it becomes harder to make a case for equities to meaningfully rally given the slowing in earnings growth and contraction of P/E multiples that should increasingly occur. There is a lot more to say here, but in the interest of keeping it concise, the consumer is looking less impressive moving into the second half of the year. Firms will increasingly pick up on this and adjust accordingly by reducing plans to expand capacity (reducing additional hiring and Capex). Coupled with a reduced ability to pass on cost increases due to weaker demand and it’s likely we have seen peak profit margins for some time.

*Strong demand has allowed cost increases to be passed on to end consumers. We question the ability of firms to continue to do this if demand increasingly weakens into year-end

Econ Data:

Headline consumer prices jumped 1.2% in March, the biggest monthly increase since September of 2005 and in line with forecasts. This moved the annual rate of inflation to 8.5%. Increases in the indexes for gasoline (18.3%), shelter (0.5%), and food (1%) were the largest contributors to the month. Excluding food and energy, the core CPI rose 0.3% MoM, below forecasts of 0.5%, moving the annual increase to 6.5%.

Why it Matters: The significant increases came from where you would expect, energy and food with shelter also rising but in line with last month's increase. Energy rose 11% on the month, something we think will be a negative contributor next month given the fall in gas prices likely to occur this month given the lower average oil price. “Food at home” prices rose 1.5% on the month, due to broad increases, while “food away from home” only increased 0.3%, showing an interesting growing divergence between what's occurring at the grocery store verse restaurants, something we thought the reopening and increased labor costs would have kept in line with each other but could be showing a weakening demand for leisure and hospitality. Turning to durables, there was a slowing in increases across a broad range of goods. Besides the eye-catching drop in used car prices, new vehicles and apparel price increases slowed. The shelter component saw monthly increases in rents little changed, and we believe increases there will begin to subside over the summer as purchasing activity cools and rental demand normalizes as labor has a better sense of where they need to be. Services for both medical care and transportation did show a notable pick-up in prices. People are finally going back to the doctor while airline fares drove transport costs higher as increased demand and higher fuel costs are prompting airlines to raise prices.

*“Dame más gasolina! Cómo le encanta la gasolina?” – Daddy Yankee = It was all about the increases in gasoline last month

*Energy continues to drive much of the annual headline increase, but increases in food and services picked up too last month

The NFIB Small Business Optimism Index declined to 93.2 in March, the lowest since April 2020, from 95.7 in February. The percentage of owners expecting better business conditions over the next six months decreased to -49%, the lowest level on record. Inflation is seen as the most important problem by 31% of business owners, the biggest share since the first quarter of 1981. Forty-seven percent of owners reported job openings that could not be filled, a slight decrease of one point from February. The net percent of owners raising average selling prices increased four points to a net 72%, the highest reading in the survey’s history. A net 49% reported raising compensation, down one point from January’s 48-year record high reading. A net 28% plan to raise compensation in the next three months, up two points from February. The net percent of owners reporting inventory increases fell five points to a net 0%.

Why it Matters: Increased worries around inflation continue to lead business optimism lower, with future sales expectations notably dropping last month, driving the percentage of firms expecting better business conditions over the next six months to a record low. The “frequency of reports” of positive profit trends was net negative -17%, with rising materials costs and weaker sales being the two most blamed reasons. Labor quality was the second top business problem after inflation, with many firms still unable to find qualified workers. Plans to raise compensation rose further, although, as seen elsewhere in the NFIB Job survey, plans for overall job openings and new hires were flat on the month. The difficulty in filling open positions is particularly acute in the transportation, construction, and manufacturing sectors, where many positions require skilled workers. The number of firms reporting “supply disruptions had a significant impact on their business” increased. As a result of lower expectations for sales, continued shortages of needed labor, and supply chain disruptions, firms reporting inventory increases fell, with 9% now viewing their inventory stock as too low.

*Firms are increasingly becoming more negative on the future outlook as cost increases and shortages continue to weigh on sentiment while demand expectations are rolling over

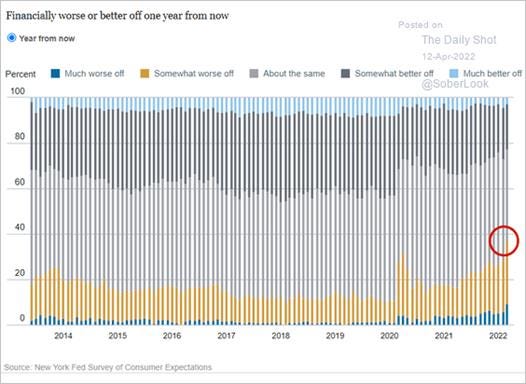

New York Fed’s Survey of Consumer Expectations showed another increase in short-term inflation expectations in March but a decline in medium-term inflation expectations. Short-term expectations increased to a new series high of 6.6% from 6.0% in February, while median three-year ahead inflation expectations decreased to 3.7% from 3.8%. The increase in short-term expectations was broad-based across age, education, and income groups. The median expected change in home prices one year ahead increased to 6.0% from 5.7%. Respondents note a more cautious tone towards labor expectations. The median one-year-ahead expected earnings growth remained unchanged at 3.0% in March for the third consecutive month, while the mean unemployment expectations increased by 1.7 percentage points to 36.2%, its highest level since February 2021. The median expected growth in household income fell by 0.2 percentage points in March to 3.0%, its lowest level since August 2021. The median year-ahead household spending growth expectations jumped by 1.3 percentage points to 7.7%, a new series high.

Why it Matters: Increased inflation expectations moved future spending expectations to a new series high. Labor market and income growth expectations receded somewhat, and respondents turned less optimistic about their year-ahead household's financial situation. The fact that long-term inflation expectations decreased somewhat should comfort Fed officials who are increasingly worried about a de-anchoring there. However, increases in short-term inflation expectations and annual median home price appreciation mean the consumer does not believe inflation is peaking yet.

*One year ahead inflation and home price expectations continue to rise while income and longer-term inflation expectations were little changed

*The percentage of Americans who expect to be worse off financially in a year has hit the highest level in a decade

Policy Talk:

Chicago Fed President Evans spoke at the Detroit Economic Club yesterday, saying that a half-percentage point increase in the Fed’s benchmark rate “is obviously worthy of consideration” when Fed officials next meet to decide policy in May. Evans has long been one of the most dovish Fed officials. “If you want to get to neutral by December, that would probably require something like nine hikes this year, and you’re not going to get that if you just do 25 at each meeting,” Evans said. “So, I can certainly see the case.” His lean towards a 50bp hike follows similar comments by Brainard, who gave a speech that mainly focused on identifying the adverse effects high levels of inflation have on lower-income households and is seen as closely aligned with Evans as far as dovish-tilt. Interestingly, Evans said the Fed needs to give themselves some time as rates approach neutral so they can analyze inflation pressures, presumably in 2023. This seems counter to recent talks/plans of raising rates quickly and again highlights our fear of the Fed making a policy error. Fed officials in March signaled they expect to lift rates to 1.9% by the end of 2022 and 2.8% by the end of next year, according to their median forecast. However, at this point, two 50bp hikes and subsequent 25bp hikes at each following meeting until year-end put the Fed Funds rate well above that level. Either the dots need to rise, or the jawboning needs to cool.

*Offical SEP dots, market-derived levels from futures, and actual rhetoric from Fed officials are becoming increasingly varied when forecasting where Fed Funds rates are going

Technicals and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the day but lower on the week. Small-Cap Growth is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are lower on the day and the week as traders continue to grapple with increased expectations for FAI verse reduced activity from growing levels of lockdowns

5yr-30yr Treasury Spread: The curve is steeper on the day and the week with today’s weaker than expected core inflation print reducing Fed hiking odds while long duration demand is still tepid

EUR/JPY FX Cross: The Euro is lower on the day but higher on the week with Putin declaring Ukraine peace negotiations effectively over for now

Other Charts:

As we often highlight, rising rates (real or nominal) put downward pressure on P/E multiples, which for many sectors/factors are still historically high

As real rates rise and excess liquidity subsides, it is worth looking at how various levels of “expensiveness” did during the 70s, assuming inflation remains persistent as it did then

Q1 saw a historically extreme drawdown in Treasuries and given our views on growth, inflation, and Fed policy are starting to question whether things are now overdone

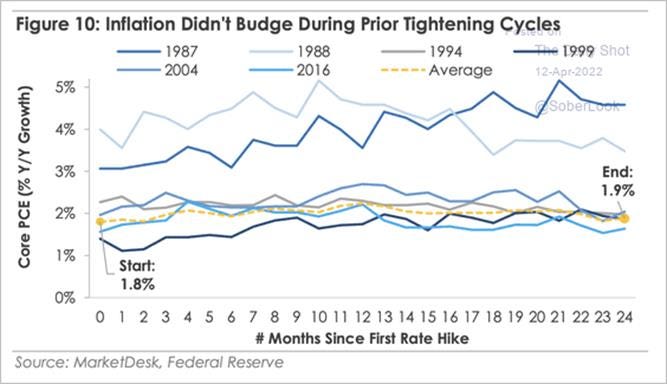

Following the 70s-early 80s, Fed tightening cycles have had little effect on inflation.

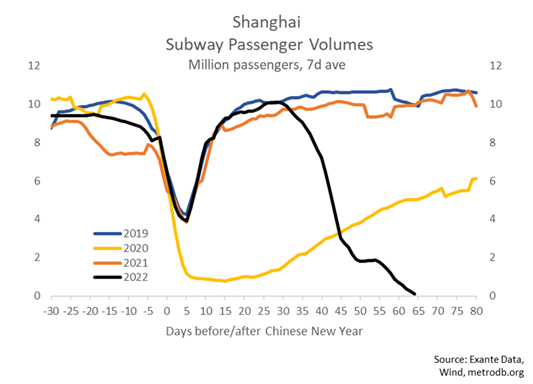

Growing Covid restrictions in China are back on market minds as falling consumer demand, and renewed supply chain concerns are adding to the recent general risk-off tone

Public transportation in Shanghai is basically non-existent as 25 million people continue to be locked into their dwellings

Although money supply growth was stronger last month in China, the private sector credit impulse continues to fall, showing much of the lending is Beijing directed and not organic

The dollar and euro continue to be the primary currency used in international payments despite increased talks of Renminbi and Rouble usage

Article by Macro Themes:

Medium-term Themes:

Real Supply-Side Improvements:

Labor Only: U.S. Supply-Chain Pressures Soar to a Record, Index Shows - Bloomberg

The Logistics Managers’ Index advanced for a third straight month in March, reaching 76.2 from 75.2 in February. Inventory levels dipped to 75.7 from February’s high of 80.2, though their costs rose to a record 91, according to the report. Warehouse capacity suffered “a rather precipitous drop” in March, pushing prices for storage space to an all-time peak of 90.5. “Continued inventory congestion has driven inventory costs, warehousing prices, and overall aggregate logistics costs to all-time high levels,” the report stated. “This is putting even more pressure on already-constrained capacity.”

Why it Matters:

In the survey results, transportation prices were little changed from a month earlier, utilization rose, and capacity edged higher. This is potentially not yet reflecting signs of weakness elsewhere in the second half of March that some analysts say portends a freight recession. While that’s possible, “there’s also a good chance it could lead to a moderation in prices that could end up being a relief in some sectors of the economy,” Zac Rogers, an assistant professor of supply-chain management at Colorado State who creates the report. So as always, it looks like demand is moderating, and things should improve, but logistical problems remain for another month.

China Macroprudential and Political Loosening:

Not so Zero: Shanghai eases COVID lockdown despite record infections – NikkeiAsia

The Shanghai government announced Monday that it would lift coronavirus lockdown restrictions in just over 40% of its neighborhoods. However, the city as a whole has continued to log record daily infections. Numerous companies producing a wide range of goods from electronics to other globally traded goods have halted production as activity in the city has effectively ground to a halt.

Why it Matters:

Social media shows a city on the edge. Residents yell from their balconies and demand food. Drones broadcast messages demanding they return inside. Thousands of people who have tested positive are crammed into isolation centers. Global supply chains are again under pressure. Altogether the Chinese Zero-Covid policy and lack of foreign-made vaccines are increasingly putting pressure on Xi into the all-important 20th Party Congress meeting later in the year.

Gaming Prosperity: China approves first batch of video games in 9 months - NikkeiAsia

China granted new video game licenses on Monday for the first time in nine months, but none of the 45 approved titles came from the big domestic leaders NetEase and Tencent Holdings. A senior executive from a top gaming company said it was no surprise that none of its titles received approval on Monday. "China froze new-game approvals in 2018, too, and when it resumed approvals after nine months, neither Tencent nor NetEase was on the first approval list," the executive told Nikkei Asia.

Why it Matters:

Beijing suspended approvals for new games in July, giving no reason or even an official acknowledgment of the decision. Thousands of small developers lost a critical revenue source, forcing some to tap overseas markets for survival. Before the July freeze, China's gaming regulator typically signed off on 80 to 100 new games a month. Chinese authorities last year also limited online players younger than 18 to just three specified hours a week. We see this as a slightly positive sign toward our theme that regulatory crackdowns are slowing as Beijing increasingly looks for ways to stimulate the economy. It's also nice an increasing amount of people in lockdown will have new games to play while waiting to be freed.

Longer-term Themes:

Electrification and Digitalization Policy:

Choices: Apple’s Tim Cook Warns Proposed Antitrust Laws Will Leave Users With Less Choice for Privacy – WSJ

The iPhone maker faces twin threats to its App Store business from Congress and the European Union, where lawmakers intend to loosen its grip on the app economy and make the iPhone more accessible to third-party developers as part of efforts to increase competition. Legislation in both jurisdictions would force Apple to allow third-party programs to be downloaded onto the iPhone outside of the company’s App Store, where it currently regulates the offerings and charges a commission of as much as 30% from in-app purchases. Apple has said this change would hurt user security and privacy.

Why it Matters:

The issue of user privacy is a favorite topic of Mr. Cook’s when he makes a rare public appearance, routinely calling it a “fundamental human right.” The company’s iPhone has been at the heart of multiple battles over privacy in recent years. “Apple believes in competition,” Mr. Cook said. “But if we are forced to let unvetted apps on to iPhone, the unintended consequences will be profound, and when we see that, we feel an obligation to speak up and ask policymakers to work with us to advance goals that I truly believe we share without undermining privacy in the process.”

ESG Monetary and Fiscal Policy Expansion:

Hello: Biden waiving ethanol rule in bid to lower gasoline prices – AP

President Joe Biden announced today he’ll suspend a federal rule and allow the sale of higher-ethanol gasoline this summer. Most gasoline sold in the U.S. is blended with 10% ethanol. The Environmental Protection Agency will issue an emergency waiver to allow the widespread sale of a 15% ethanol blend that is usually prohibited between June 1 and Sept. 15 because of concerns that it adds to smog in high temperatures.

Why it Matters:

Senior Biden administration officials said the action will save drivers an average of 10 cents per gallon but at just 2,300 gas stations. Those stations are mostly in the Midwest and the South, including Texas, according to industry groups. Administration officials said the EPA has determined that the “emergency” step of allowing more E15 gasoline sales for the summer is not likely to have a significant air quality impact.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE IN