Midday Macro - Bi-weekly Color – 3/30/2022

Overnight and Morning Market Recap:

Price Action and Headlines:

Equities are lower, but still near recent highs, with markets reassessing Ukrainian ceasefire hopes earlier in the week while rebalancing flows should increasingly materialize after a volatile quarter

Treasuries are higher, with a slight bull steepening occurring as rates generally continue a relief rally that started Sunday night and will likely continue into quarter-end

WTI is higher, reversing headline-driven selling yesterday, which took WTI back below $100 as worries again grow over European diesel supply and continued low inventories and high crack-spreads domestically

Narrative Analysis:

Markets are cooling slightly today with quarter-end fast approaching. Given 9 of the last 11 trading days saw the S&P close near highs of the day and the 4600 level on the S&P is a key resistance area, it is not surprising to see some consolidation. Recent ceasefire headlines out of Turkey are increasingly being discounted as Russia now pivots operations to secure the southeast of Ukraine. Treasuries are undergoing an overdue relief rally as quarter-end rebalancing flows will likely favor fixed income over equities. Oil is higher again as fundamentals continue to support the bull case despite continued lockdowns and demand destruction out of China. The dollar is weakening, with the $DXY back below 98, as the Euro and Yen have bounced off recent lows

The Nasdaq is outperforming the S&P and Russell with Low Volatility, High Dividend Yield, and Value factors, and Energy, Utilities, and Health Care sectors are outperforming.

S&P optionality strike levels have the Zero-Gamma Level at 4560 while the Call Wall is 4600. Volatility is expected to remain muted, with 4600 having strong gravity, given it is the largest open interest level for calls. As implied volatility continues to fall, it is becoming more of a drag on the S&P price action verse the catalyst it had been in the past weeks.

S&P technical levels have support at 4595, then 4565, and resistance is at 4620, then 4665. Dips are being quickly bought with strong support around 4595. However, a backtest to 4565 seems needed for a further move higher, given the overbought conditions. The risk of a quick 50-100 point correction on negative headlines is growing, given the length of the current rally.

Treasuries are higher with the 10yr yield at 2.35%, lower by around 4.8bps on the session, and back at overnight highs, continuing a multi-day rally into quarter-end, while the 5s30s curve is higher by 1.6bps to 2bps.

Deeper Dive:

Markets continue to go along with Powell and company's new aggressive inflation-stopping mantra as the best policy for greater economic growth in the near and medium-term. Powell has identified price stability as key for continued hiring and job growth as key to supporting consumption, recalibrating the markets to see further hawkishness as the best policy response given that inflation is the most significant risk to the economy. However, this doesn’t mean that tighter monetary policy won't eventually be bad for growth, but markets now see a Fed containing inflation as being more important, hence realigning equity and rate markets closer to more traditional relationships.

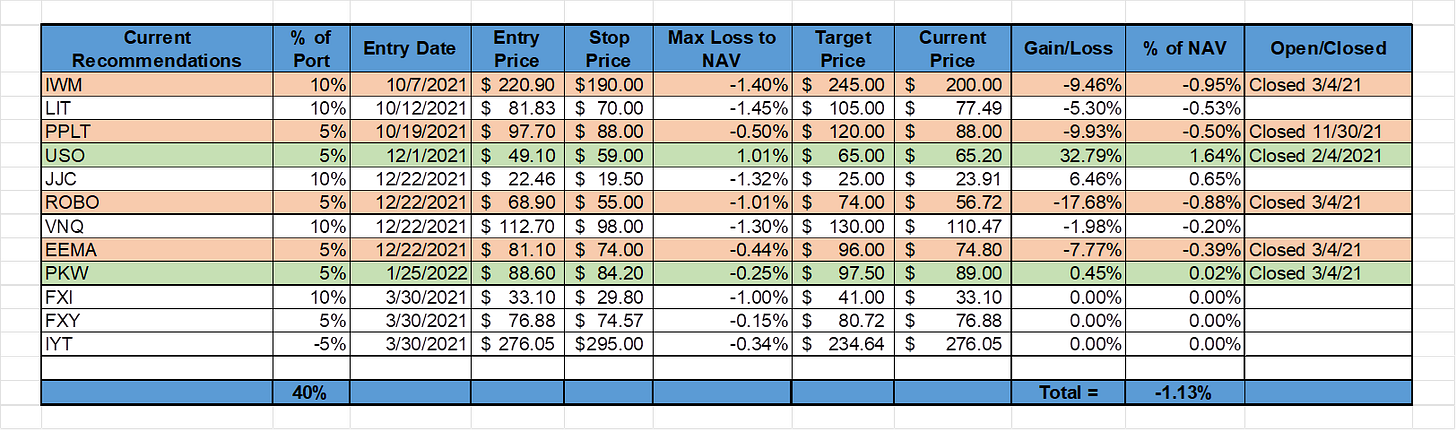

Markets are designed to inflict maximum pain on all those who participate in the aggregate. When participants become overly defensive and position to profit from declines, as we saw at the beginning of the first quarter this year, markets rally against all odds. Using that rationale and our belief in the overly optimistic outlook markets are currently pricing in for earnings growth moving forward domestically, as well as our more optimistic views on China and contrarian views on BoJ policy, we want to add three new positions to our portfolio.

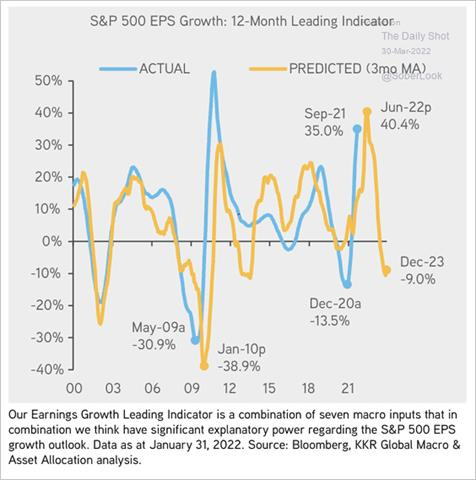

*KKR’s Global Macro team sees earnings growth going negative next year due to the persistence of inflation and the effects of tighter policy, and we tend to agree

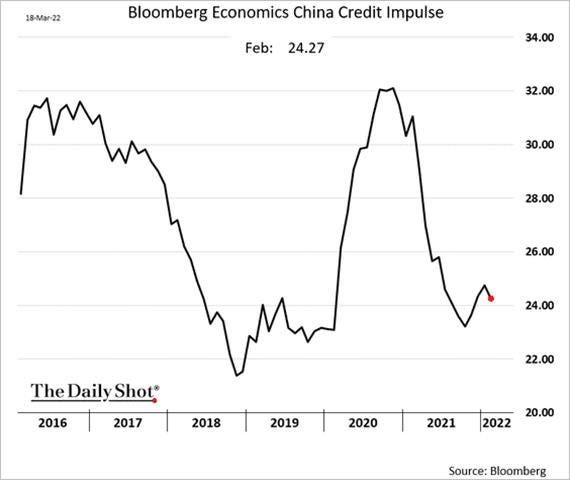

Although far from out of the woods, we are encouraged by many developments in China. Current Covid lockdowns and Beijing’s inability to fully evolve from their zero-covid policy way of thinking are again causing growth to be questioned. However, we see recent positive developments in the property sector, better-contained inflationary pressures, reduced common prosperity regulation threats, and a renewed emphasis on dual-circulation goals, increasing fiscal and monetary policy support for private sector growth as being positive for risk assets there. There’s more to say, specifically to the credit pulse and foreign flows, but generally, we expect fundamentals and liquidity conditions to allow the current rally underway to continue and not just be a short-covering dead-cat bounce.

*The most recent Chinese Beige Book indicated increases in loan demand, but the credit impulse is still weak with little real growth in borrowing activity. We believe this changes as the current Omciron wave passes and Beijing eases policy further

*Recent improvement in the property sector, whether the restructuring of existing or increased access to new loans as well as greater housing financing availability for consumers, encourages us that the worst is behind there

As a result, we are entering a 10% long position in iShares China Large-Cap ETF $FXI. The ETF tracks the results of an index composed of large Chinese companies that trade on the Hong Kong Stock Exchange. We don’t want specific sector exposure, especially in the more volatile tech sector. Instead, we seek broad exposure to what we believe will be a general recovery in Chinese equities as policy and economic fundamentals become more supportive moving forward.

*$FXI remains in a downtrend after peaking in early 2021. We believe it will breakout in Q2, and our target of $41 looks for around a 25% return

Staying in Asia, we believe the Japanese Yen has been oversold. Fully understanding the BoJ will likely be the last central bank still operating in a highly accommodative policy stance, we still believe they, too, will begin to capitulate to a more neutral setting. The functionality of their bond market is becoming increasingly stressed, calling into question the sustainability of their ability to keep yield curve control policy going in its current form. We also believe that inflationary increases coming from higher energy costs will allow them to declare victory somewhat and gracefully change their tune. There is a lot to say here as well, but we want to jump on the recent selloff in the Yen by entering a 5% long position in the Invesco Currencyshares Japanese Yen Trust ETN, ticker $FXY.

*Admittedly, we may be catching a falling knife here, but we believe that the Yen has been oversold and will recover recent losses due to changes in BoJ policy expectations and flow changes following their quarter-end

Finally, we believe that the Fed will tighten to the point that they will reduce aggregate demand in the economy, something already increasingly occurring due to the persistence and strength of the current inflationary pulse. We worry this will be occurring toward the end of the year just as firms are sitting on more historically average (restocked) inventory levels. In turn, this may reduce the demand for and pricing power of logistical operators/providers right as their margins are increasingly under pressure due to higher fuel and labor costs. This, coupled with higher levels of Capex, should reduce earnings growth and shareholder capital availability. Admittedly we may be early on this call, given the current rally. Still, we believe we are entering the stage of the cycle where this sub-sector of industrials is likely to underperform.

*Transports are going to see increasing cost pressures erode earnings growth as the urgency of demand reduces their pricing power

*Our overweight in cash dominated the performance of our portfolio in Q1, reducing losses in the drawdown; however, if we had remained in all our positions, the portfolio would be up by 1.7%, not lower by -1.1%, teaching us that greater patience was warranted

As a quick update to our views regarding the war in Ukraine, we don’t see the result of the recent “peace talks” in Turkey as materially changing the current situation. Instead, Russia's pivot to focusing on the southeast part of Ukraine in the hopes of creating a Donbass-Crimea land bridge was likely the original plan, and leaving a theater of war that you were already losing is not a de-escalation. With that said, Kyiv remaining under Ukrainian control reduces the chances of maximum full-blocking sanctions against Russia, reducing the risk of further rises in energy costs.

Russia's recent diplomatic and military rhetoric is just a continuation of its broader (dis)information campaign to buy time against new sanctions. Putin's objectives remain the same, with close insiders not changing their message. As a result, positive headlines should be discounted as the issue of territorial integrity is still far from being resolved as experts warn that more intense fighting and a subsequent humanitarian crisis could transpire over the coming month.

*Images and reports from around Kyiv continue to show a Ukrainian counteroffensive pushing Russia back into a more entrenched defensive position

There are still no material concessions from either side, with demands for Ukrainian “neutrality” being a non-starter given Zelensky’s current Article-V-like security demands from Western countries. On the other side, moving back boundaries for Donbass is a non-starter for Russia. Further, any security guarantees by Russia will be discounted by the West, which sees Russia as the aggressor and is unable to provide such assurance.

*Russia will increasingly try and secure gains made in the southeast as operations elsewhere have stalled

Moving forward, we will be continuing to watch the rhetoric and actions out of China, with the EU-China summit commencing on April 1, for signs of which side they will prioritize. Russia will also have its “Conscript Day,” with the number of people reporting in as a good gauge of the support the “special operation” is receiving back home. Finally, we will want to see whether Western representatives are invited to any future peace talks in Turkey to gauge whether the Russians are actually capitulating. Something we don’t yet see as likely.

*EU officials will likely pressure Beijing to weaken its supportive stance toward Russia or face economic backlash from the union

Again the end goal of the West is for Russia to be bogged down in a proxy war of attrition in Ukraine, eventually leading to a humiliating loss for Putin that will expedite regime change. As a result, there is a long way to go in this conflict, and hence there will be new shocks and peaks throughout the summer. This means that the disruption of trade in commodities resulting in increased energy and food costs will increasingly weigh on global growth, especially in Europe and emerging markets.

*Sadly, in the end, for markets, despite the humanitarian tragedy occurring, it does come down to oil and energy and the loss of supply from Russia weighing on global growth

Econ Data:

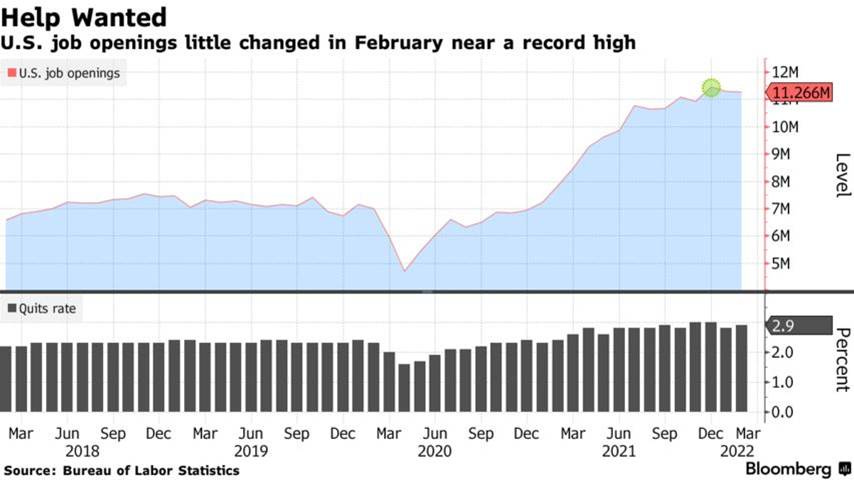

The number of job openings was 11.266 million in February, little changed from an upwardly revised 11.283 million in January and compared with market expectations of 11 million. Job openings increased in arts, entertainment, and recreation (+32K), educational services (+26K), and federal government (+23K) and decreased in finance and insurance (-63K) and in nondurable goods manufacturing (-39K). Job openings dropped in the Midwest region and increased in the West region. Meantime, 4.4 million Americans quit their jobs, with the quits rate rising to 2.9%, and there were 1.8 job openings for every unemployed person.

Why it Matters: The JOLTs data showed that businesses continue to struggle to attract and retain workers in a tight labor market. Fed Chair Powell cited the “job openings for every unemployed person” measure, previously around 1.7, as an example of a “very, very tight labor market -- tight to an unhealthy level, I would say.” The availability of workers is improving slowly, but clearly, there is a way to go still. About 2.8 million people weren’t working in early March because they either had or were caring for someone with Covid-19, down from 7.8 million in late January and early February, according to Census surveys. And the number of people who weren’t working because they were afraid of getting sick fell to 2.3 million from 3 million. The number of retirees is a whole other story, and this may be why reaching the pre-pandemic EPOP level is no longer possible in the medium term.

*Job openings look to be plateauing as a further increase would certainly signal a deeper problem structurally

The S&P CoreLogic Case-Shiller 20-city home price index rose 1.4% in January, leading to a 19.1% annual increase. The strength in home prices continues to be very broadly based. All 20 cities saw price increases in January, with prices in 16 cities accelerating relative to December’s report. The biggest gains were reported in Phoenix (32.6%), followed by Tampa (30.8%) and Miami (28.1%).

Why it Matter: After peaking in July and cooling off slightly in recent months, home price gains reaccelerated in January. Given low inventory levels, any declines in actual activity will have a reduced impact on price appreciation, masking any signs of demand destruction due to higher prices and mortgage rates. The housing picture is becoming a little more muddied with continued price increases are contrasted with the recent unexpectedly pending home sale declines in February, a fourth straight monthly decline due to inventory shortage restricting sales.

*Southern cities seem to have been the biggest benefiter from the work-from-home transition that moved many workers to warmer climates

*Housing price appreciation is becoming so unaffordable to first-time buyers that we increasingly expect DC policymakers to attempt to address the issue with new legislation

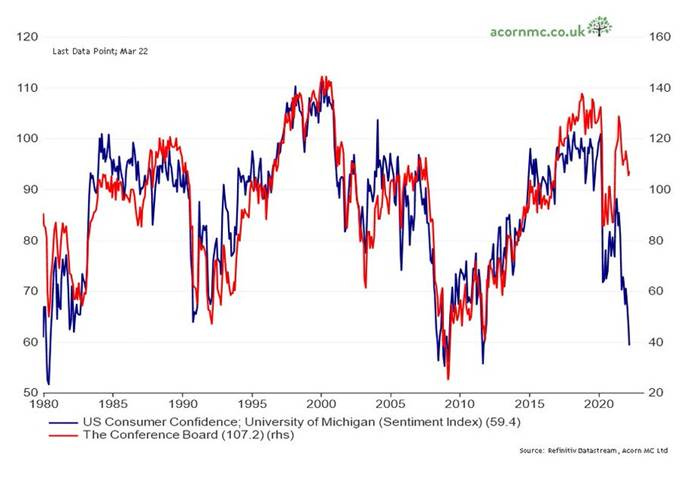

The Conference Board Consumer Confidence Index increased slightly to 107.2 in March, from 105.7 in February. The Present Situation Index improved to 153.0 from 143.0 last month. However, the Expectations Index (based on consumers’ short-term outlook for income, business, and labor market conditions) declined to 76.6 from 80.8. Consumers’ appraisal of current business conditions and labor markets improved. Consumers’ optimism about the short-term business conditions outlook declined while they were mixed about the short-term labor market outlook and short-term financial prospects.

Why it Matters: Consumer confidence increased slightly in March after declines in February and January. “The Present Situation Index rose substantially, suggesting economic growth continued into late Q1. Expectations, on the other hand, weakened further with consumers citing rising prices, especially at the gas pump, and the war in Ukraine as factors. Meanwhile, purchasing intentions for big-ticket items like automobiles have softened somewhat over the past few months as expectations for interest rates have risen.” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. Inflation expectations over the next 12 months reached 7.9%, an all-time high.

*Growing divergence between the Present Situation and Expectations Indexes shows although the consumer remains positive, persistent inflation is increasingly weakening the future outlook

*Although trending in the same direction, the gap between the University of Michigan and the Confidence Board continues to grow

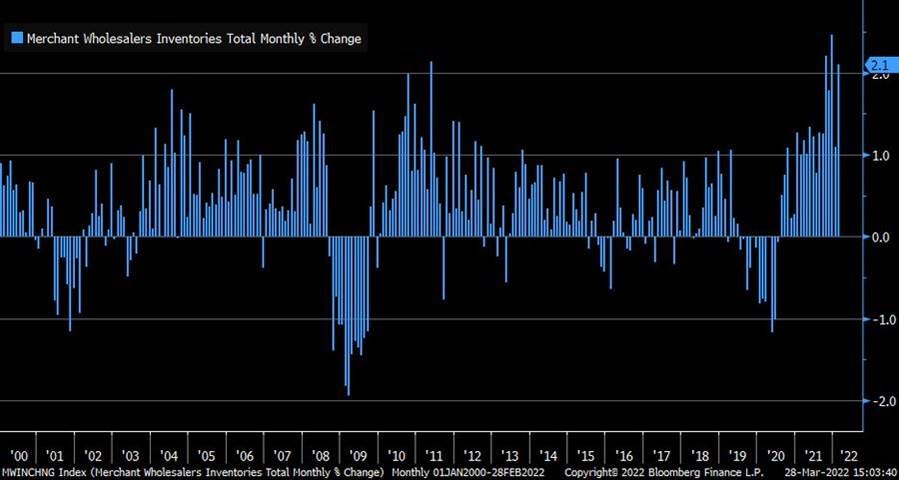

Wholesale inventories increased 2.1% to $814.8 billion in February, after an upwardly revised 1.1% increase in January. It was the 19th straight month of gains amid increases in inventories of both durable goods (1.7% vs. 1.1% in January) and nondurable ones (2.8% vs. 1.2%). On an annual basis, wholesale inventories are higher by 19.4%. Retail inventories excluding autos rose 1.2% in February, slowing from a downwardly revised 1.7% gain in January. On an annual basis, retail inventories are higher by 14.7 percent.

Why it Matters: There continues to be a very positive pulse to economic growth from inventory builds. The inventory to sales ratios remains well below historical norms indicating that monthly gains should continue. Supply chains are more mixed now, with numerous positive/negative developments indicating no material improvement or deterioration to what remains a still generally challenging environment. When coupled with continued strong demand and pricing power by end sellers, the urgency to hold appropriate inventory levels is still high, although off holiday levels.

*Monthly gains in inventory builds continue to be strong, with February being the 19th straight gain, showing how understocked wholesalers and retailers continue to be.

*Inventory gains are an increasingly positive contributor to GDP growth

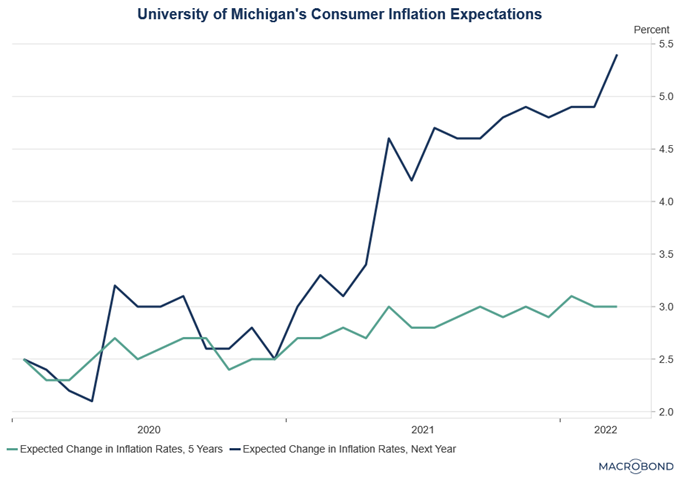

The University of Michigan consumer sentiment was revised slightly lower to 59.4 in March from a preliminary of 59.7, the lowest reading since August of 2011. The subindexes for both current conditions (67.2 vs. preliminary of 67.8) and expectations (54.3 vs. 54.4) were both revised down. The expected year-ahead inflation rate moved higher to 5.4%, the highest since November 1981, while the five-year ahead inflation rate expectation stayed at 3%.

Why it Matters: Inflation clearly continues to be the primary cause of the rising pessimism, seen more in this consumer survey than in the Conference Board’s one. More consumers mentioned reduced living standards due to rising inflation than any other time except during the two worst recessions in the past fifty years: from March 1979 to April 1981 and from May to October 2008. Also, half of all consumers unfavorably assessed current policies, more than three times the 16% who rated them favorably. So as we have highlighted in the past, there is more of a Republican partisan tilt to respondents, but even when accounting for the Fox News doom and gloom effect, the general U.S. consumer is growing more worried about the persistence of inflation and this will increasingly lead to reduced demand and more defensive behavior.

*Five-year ahead inflation expectations still remain only slightly higher than pre-pandemic levels, showing the Fed doesn’t have to overly tighten policy to re-anchor consumer expectations overly

*As we highlighted above, the gap between the CB Consumer Sentiment and Univ. of Michigan’s Consumer Confidence continues to widen, correlating closely to the 2s10s spread

Policy Talk:

NY Fed President Williams said last Friday in Q&A after prepared remarks given remotely to the Central Bank of Peru’s Centenary Conference that he was open to a 50bp hike in future meetings if the economy’s outlook called for it while stopping short of saying whether it was currently warranted. He noted that the Fed would be “steadily” moving rates higher, but there was still reason to be cautious and nimble. Williams highlighted that medium and longer-term inflation expectations have remained stable, and it was important to now normalize policy to ensure that anchoring remained. He highlighted that monetary policy is felt very broadly, and the Fed needs to be clear in communicating its plans, reducing volatility in markets, and not overly tightening financial conditions and negatively affecting the real economy. He believes the Fed has been successful so far at doing that. “While we’ve seen a shift in both current and expected monetary policy, we’ve seen very relatively small disruptions in global financial markets,” Williams said. I guess he missed the -20% pullback in the Nasdaq.

Philadelphia Fed President Harker gave prepared remarks in New York yesterday at a conference sponsored by the Center for Financial Stability. He expects a series of methodical increases in the fed funds rate this year in line with others. He noted that inflation is widespread, and even golf club membership fees increased, negatively affecting some of his contacts (yes, he actually said this). However, he highlighted that there are signs that supply chain constraints are finally easing. As a result of the tighter policy coming and commodity price pressures worsened by the war in Ukraine, he downgraded his growth outlook for the year but noted a high level of uncertainty. He spent a good amount of his speech on the housing market, identifying poor policies (regarding construction regulation) as exacerbating the lack of supply and problems with affordability. He believes the market is healthy and specifically talked to the forbearance situation as slowly improving after the CARES act moratorium ended. However, he highlighted that 1 million mortgages are seriously in delinquency. However, he noted, “most borrowers who remain seriously delinquent and not in loss mitigation never entered forbearance at all. Many were in nonpayment before the pandemic struck.” Finally, in a summary of his policy outlook, Harker said, “I don’t want to overdo it though and try just to stomp the brakes hard and have growth end. I think it will be a bumpy ride, and there may be some bumps where we get into a period of below-trend growth for a while, but I think we can pull this off.”

Technical and Charts:

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the day and lower on the week. Large-Cap Value is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and the week as a number of fiscal initiatives, better profit forecasts by key industries, and a property sector equity rally underway today, are supporting commodities

5yr-30yr Treasury Spread: The curve is slightly steeper on the day but flatter on the week, with a little bit of a relief rally occurring in the front-end into the month/quarter-end

EUR/JPY FX Cross: The Euro is lower on the day and higher on the week with the Yen bouncing after severe selling over the last week

Other Charts:

"For the S&P, the recent 10-day rally ranks in the 98th %ile of bear market rallies and in the 99.5th %ile of non-bear market rallies.” - BofA

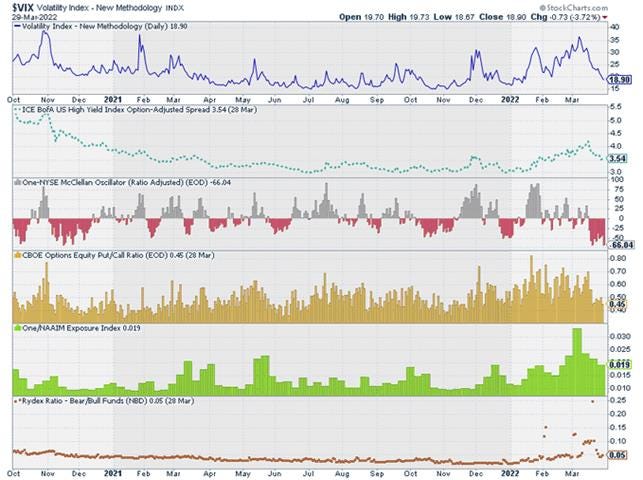

Volatility and risk sentiment measures show a significant improvement as the more positive risk appetite continues despite the ongoing Ukrainian war

Today's commodity price shock on consumers is similar to those during the 2008 and 1990 recessions but smaller than in the 1970s

Shutdowns/lockdowns due to Omicron are increasingly affecting port operations in China

Tender rejections are the best indicator of the real-time supply/demand of trucking. A high rejection rate means trucking companies have more options in freight to pick from. The index has been falling lately, showing less demand.

A recent Gallup poll confirmed what we see elsewhere; inflation worries continue to grow in the minds of Americans

The current market-derived expectations for Fed Funds is now at 3% by March 2023

Article by Macro Themes:

Medium-term Themes:

China Macroprudential and Political Loosening:

More, More: China’s PBOC Vows to Boost Confidence, Support Economy – Bloomberg

The People’s Bank of China reaffirmed it would step up the magnitude of monetary policy and make it more forward-looking, targeted, and autonomous, according to a statement Wednesday. The central bank will “further unclog the transmission mechanism of monetary policy” and expand the re-lending program for small and rural businesses, a meeting by the monetary policy committee chaired by Governor Yi Gang concluded, according to the statement.

Why it Matters:

The central bank kept key policy interest rates unchanged in March and hasn’t moved to reduce the amount of cash banks must hold in reserves, in spite of rising speculation after top financial leaders vowed to stabilize markets earlier this month. Hence all eyes are currently on the PBOC with today’s remarks came as China’s economic outlook worsened as fears mounted of an expanding lockdown in Shanghai and with Covid infections elsewhere continuing to rise. Economists have cut their growth forecasts for this year.

Longer-term Themes:

National Security Assets in a Multipolar World:

Safe?: Russia Built Parallel Payments System That Escaped Western Sanctions – WSJ

Western sanctions have disrupted nearly every part of Russia’s financial system, but there is one big exception. The domestic-payments system continued to work smoothly after Visa Inc., and Mastercard Inc. pulled out earlier this month. Behind the scenes, the cards don’t rely on the U.S. networks’ systems to process payments in Russia. For years, they have used a homegrown system overseen by Russia’s central bank.

Why it Matters:

The resilience of Russia’s payments system is a rare win for President Vladimir Putin in his financial war with the West. The National Payment Card System runs the financial plumbing that underpins card transactions in Russia, even for cards bearing Visa and Mastercard logos. The system was part of Moscow’s eight-year effort to insulate the Russian economy from Western financial pressure following the loss of access that occurred following the invasion of Crimea.

Electrification and Digitalization Policy:

It’s Coming: Antitrust Bill Targeting Amazon, Google, Apple Gets Support From DOJ – WSJ

The Justice Department Monday endorsed legislation forbidding large digital platforms such as Amazon and Google from favoring their own products and services over competitors’, marking the Biden administration’s first full-throated support of the antitrust measure. The letter expresses support for the American Innovation and Choice Online Act, which the Senate’s judiciary panel approved in January in a bipartisan vote, as well as similar legislation moving through the House.

Why it Matters:

The department’s letter throws its weight behind the view that the big-techs platform dominance gives them unchecked power to influence the fate of other businesses and that restricting the platforms’ conduct would carry significant benefits. The bills supplement existing antitrust laws by clarifying what kinds of conduct Congress views as anti-competitive and illegal, the letter adds, noting that “doing so would enhance the ability of the DOJ and the Federal Trade Commission to challenge that conduct.” This is in line with what is occurring across the pond in the Eurozone, as highlighted below, and will weigh on big-techs earning growth capabilities.

Gold Standard: New E.U. rules regulating U.S. tech giants likely to set the global standard - Reuters

Europe's antitrust chief Margrethe Vestager on Thursday won backing from European Union members and E.U. lawmakers for her proposal, the Digital Markets Act (DMA), to rein in the powers of the tech giants via legislation for the first time, rather than lengthy antitrust investigations. Under the DMA, the tech giants will have to make their messaging services interoperable and provide business users access to their data. Business users would be able to promote competing products and services on a platform and reach deals with customers off the platforms.

Why it Matters:

DMA indirectly places a premium on business models based on subscriptions or device-level monetization. This may lead to increased prices and vertical integration into hardware in the future by big-tech. "If it succeeds, the DMA will put pressure on monopoly rents of gatekeepers in tipped markets, thereby encouraging them to move towards more long-term innovation targets," said Nicolas Petit, professor of competition law at the European University Institute in Florence.

Trickbot: Secret World of Pro-Russia Hacking Group Exposed in Leak – WSJ

On Feb. 27, an anonymous researcher posted/leaked nearly two years of private chat messages, financial information, source code, and other technical details which belonged to Trickbot, the operators of the Conti ransomware. More than 200,000 messages exchanged by 450 Trickbot managers, staff, and business partners since June 2020 reveal a well-organized criminal syndicate with possible connections to Russian intelligence agencies. They show an organizational resilience that allowed the group to rapidly recover from counterattacks by international law-enforcement coalitions and grand ambitions to diversify and develop a cryptocurrency.

Why it Matters:

Trickbot is one of the most prolific and widely feared ransomware groups. Its Conti ransomware was by far the most used in 2021, according to cyber-threat researchers at Unit 42, a hacker hunting team at Palo Alto Networks. The gang is under pressure following the leak, indicating the leak disrupted the group’s operations, at least for now. “We’ve seen them try to reassemble a little bit, but they’re not rebuilding in any meaningful way,” according to Mr. Holden, the security analyst at Hold Security.

Commodity Super Cycle Green.0:

Powers: Biden to use Korean war-era powers to boost supply of EV battery minerals – FT

Biden will use a presidential determination as soon as this week to invoke the Defense Production Act to help increase the availability of lithium, nickel, cobalt, graphite, and manganese in the U.S. Under the terms of the DPA, an administration can compel companies to prioritize government contracts over private ones, send equipment to certain areas ahead of others, and provide loans and grants to encourage certain forms of manufacturing.

Why it Matters:

A person familiar with the White House’s plans said the administration was not contemplating making direct purchases of the minerals but would aim to make government funding available for feasibility studies, production at existing operations, and safety upgrades. The person said triggering the DPA would not allow mining companies to bypass or expedite any permitting or environmental review processes. The bottom line is that it shows the Biden Administration is aware of the problem but has yet to fully commit to fixing it, which would require changes to EPA regulations.

ESG Monetary and Fiscal Policy Expansion:

Too Rosey: US regulators take aim at bright forecasts from blank-cheque company sponsors – FT

The SEC is poised to advance sweeping reforms of special purpose acquisition companies, including stripping them of legal safeguards that have allowed sponsors to present rosy forecasts to potential investors. “Investors deserve the protections they receive from traditional IPOs, with respect to information asymmetries, fraud, and conflicts,” Gary Gensler, SEC chair, said in a statement. SEC commissioners would need to take a second vote after taking public comments in order to enact the proposed rules.

Why it Matters:

Spac forecasts, including revenue projections, would lose legal protection under the SEC’s new rules, opening the companies to potential lawsuits. If backed by the SEC, the guidance would also require additional disclosures on Spac mergers’ fairness to investors. Banks that work on the IPOs of Spacs would be required to underwrite the subsequent merger. Underwriters would also be potentially liable for misstatements in connection with the Spac merger. The SPAC mania was ridiculous and undermined confidence in markets. We applaud this effort, given the charlatans like Chamath that profited from it.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.