MIDDAY MACRO - 2/4/2022

Daily Color on Markets, Policy, and Geopolitics

MIDDAY MACRO - DAILY COLOR – 2/4/2022

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are higher, with post-Amazon earning index gains reversing in the AM before the jobs report, which then initially added to the volatility only to now see all indexes higher despite the rise in Treasury yields

Treasuries are lower, as the headline NFP number significantly beat expectations and increased Fed tightening expectations, flattening the curve and driving yields to new recent highs

WTI is higher, as traders shrug off OPEC+ production increase worries and focus on low inventories, tight balances, strong margins, and continued geopolitical risks

Narrative Analysis:

Equities are again chopping around but now higher, trying to recapture overnight highs as an earnings beat by Amazon helped reverse some of the Facebook-led selling yesterday after-hours. Still, bearish data/headlines in Europe reversed risk sentiment despite more positive action in Asia. With yields at recent highs, equities are cautiously rising with growth and more cyclical orientated sectors outperforming. Oil continues to drive higher, given fundamentals dictate new supply will be hard to find. The dollar is flat on the day despite the rise in yields due to the more hawkish message given by the BoE and ECB yesterday continuing to resonate.

The Nasdaq is outperforming the S&P and Russell with Growth, Momentum, and Value factors, and Consumer Discretionary, Energy, and Financials sectors all outperforming.

S&P optionality strike levels have the Zero-Gamma Level at 4557 while the Call Wall has fallen to 4700. Markets continue to have a negative gamma tilt which is driving the high level of volatility, as is the elevated level of options implied volatility. If markets can break 4525 (Vol Trigger level), the gamma-based resistance above is relatively light and could lead to the high level of puts being covered quickly and a rally to 4600.

S&P technical levels have support at 4450, then 4395, and resistance is at 4505, then 4530. The 200dma held around 4450, which is now crucial support and unlikely to hold if retested. Bulls will need to see 4530 recaptured to have any meaningful rally develop, or a more negative leaning range-bound chop will likely ensue into Wednesday’s CPI report.

Treasuries are lower, with the 10yr yield now at 1.92%, rising 9bps after the jobs reports, while the 5s30s curve is flatter by 4bps on the day to 44 bps.

After a week away, we come back to what continues to be a challenging macro backdrop with inflation and central bank tightening concerns back at the forefront. At the same time, earnings results have been mixed and underwhelming while economic data is increasingly being seen as “good is bad” (due to stronger data increasing the expected pace of tightening), keeping markets volatile as all eyes are on rising nominal and real rates as well as tightening financial conditions. In a little bit of a longer note, we lay out our belief that inflation and hence Fed tightening fears are increasingly becoming overdone

Inflation needs to fall for equities to resume any meaningful rally. In our eyes, it's just that simple. If next week's CPI is in line with the expected 0.5% monthly increase or less, the current narrative of an aggressive Fed hiking and QT cycle should begin to fade. Treasuries will settle into a new (higher) range but with reduced volatility, reducing cross-asset volatility and financial tightening fears, allowing both discretionary and systematic strategies to increase equity exposure that, when coupled with optionality positioning becoming more positive, should drive markets higher into the spring.

*Survey and positioning data vary, but seasonalities are becoming more supportive, and asset managers want to enter new positions once further clarity on inflation and Fed policy is established

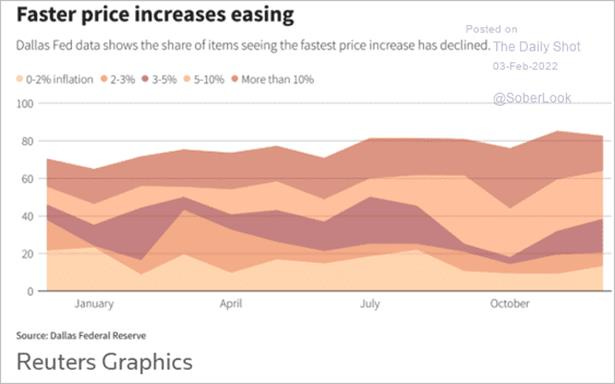

We believe the rate of increase in inflation has peaked, but price increases, although falling, remain more persistent due to prolonged supply-side disruption brought on again by Omicron and continued strong demand due to inventory restocking and the reopening. However, there are signs that both sides of the equation are changing. Omicron is fading fast, and production and logistics abroad, especially in China, have been less impacted than initially feared. At the same time, recent PMIs and regional Fed surveys, as well as wholesale and retail sales data, show demand easing back to more normal levels after the holiday ramp-up. As a result, price increases are starting to slow. Hence the trend is changing despite headline-grabbing rising wages and energy prices.

*Yesterday’s ISM Service PMI results showed order backlogs and inventory shortages are improving as well as slightly reduced prices paid/received

*Citi’s Inflation surprise Index looks to have peaked as actual inflationary data is now coming in below expectations

The market is pricing in five to now almost six rate hikes this year, and a mid-summer start to balance sheet reduction based on what we see as peak inflationary fears. Hence, ceteris paribus, the risk-reward is that the Fed does not over-deliver/tighten due to the coming decrease in price increases and eventual deflationary pressures resuming further out due to longer-term structural factors (which we will discuss next week in greater depth).

*Sell-side analysts are wide-ranging in their rate hike expectations for 2022; 3 hikes - Barclays, 4 hikes – MS, Standard Charter, 5 hikes - Citi, Wells, DB, JPM, GS, Nomura, 6 hikes – BNP, 7 hikes - BofA

Looking across the pond quickly, the ECB and BoE both delivered more hawkish results than expected yesterday. In the case of the BoE, where a 25 basis-points hike was expected, the press release surprisingly showed that four of the nine members of the Monetary Policy Committee had dissented in favor of a 50 basis-points hike. Turning to the ECB, President Lagarde delivered a remarkably hawkish press conference, noting a growing concern regarding inflation and that the ECB would recalibrate policy at the March meeting, likely moving forward tapering and opening the door for a rate hike later this year.

*The market has been dramatically increasing its expectations for ECB rate hikes this year, now pricing in four, despite Lagarde commenting in December there may not be one

Bringing it all together, it is clear inflation pressures/worries have central bankers changing course meaningfully. The question is whether central banks believe financial conditions need to become punitive and aggressively shrink their balance sheets to tame inflation, or will front-end rates moving back to pre-pandemic levels (by next year) and improvements in supply-side fundamentals be enough to drive core inflation back towards 2-3% by year-end?

*The Fed’s CIE is now back above 2% but still well within acceptable levels

As we said, this depends on inflation falling and falling faster than is currently expected. We believe this will happen but acknowledge that we have yet to see the proof in the pudding meaningfully yet. We believe it is coming soon, though, and await February and March data to show us the supply and demand developments are increasingly reducing pricing pressures. Again the goal is to skate where the puck is going, which is why we are currently putting our view out there.

*The number of items increasing in the “fastest price increase” categories has begun to fall while the 0-2% increase group has increased

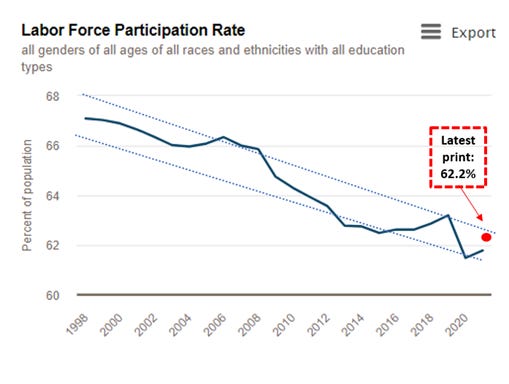

As a result of our views on inflation peaking and increasingly falling, we continue to believe that the Fed (and BoE and ECB) will not be overly aggressive and maintain our belief that we will see four rate hikes this year and a reduction in the balance sheet in the second half of the year. The pace of BS reduction will aim to achieve an end BS* target of around $6 trillion by the end of 2024, putting the pace of reduction around $100 billion a month. A lot can change, but given the financial tightening that has already occurred, “maximum employment” being achieved but EPOP still historically weak, and expectations inflation has peaked, we see the move to a more neutral policy position as being measured.

*We are not convinced that the Fed is happy with where the participation rate is despite Powell acknowledging the current labor market as tight and structural factors weighing on EPOP

Finally, we are closing our oil long expressed through the $USO Oil ETF, locking in a gain of 32.8%. We are not changing our bullish view on oil or commodities more generally, simply locking in profit after an impressive run.

Econ Data:

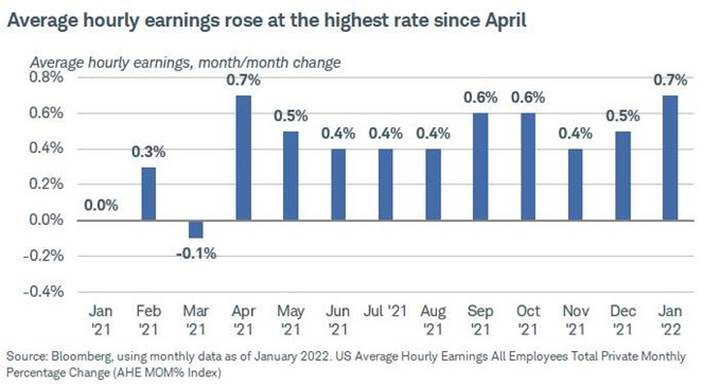

Non-farm Payrolls increased by 467K payrolls in January, better than market forecasts of 150K. The unemployment rate edged up to 4.0%, slightly above market expectations of 3.9%. Labor Force Participation Rate in the United States increased to 62.2% from 61.9% in December, the highest rate since March of 2020. Average hourly earnings increased by 0.7% over the month (above market expectation of 0.5%) or 5.7% YoY, the most since May 2020. The average workweek fell by 0.2 hours to 34.5 hours, the lowest since April of 2020.

Why it Matters: The big story for this report is the revisions. Summer levels were revised down while November and December saw significant increases. These changes put the longer-term NFP trend more in line with the Household survey, on which the unemployment rate is based. The BLS made these revisions to deal with pandemic distortions, raising concerns about interpreting the data. Nevertheless, January’s data moves us closer to the Fed’s “full employment” mandate on a headline basis. The UER only ticked up slightly despite a notable increase in the participation rate. Wage increases were more concentrated in higher earners. When coupled with the leisure and hospitality sector effectively matching the December hiring rate, the report reduced our labor shortage fears, and hence wage-spiral inflationary pressure concerns moving further out.

*Leisure and Hospitality continue to drive gains, but January’s breadth was weaker than Decembers

*Wage increases mainly came from higher-income jobs (those Wall St. raises/bonuses), with leisure and hospitality little changed

*Upward revisions to Non-Farm Payrolls helped that data series catch up to recent gains seen in the Household Survey but subtracted from gains seen over last summer

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the day and week, but the trend still favors value, although a weekly Doji star may have formed. Large-Cap Growth is the best performing size/factor on the day, mainly thanks to Amazon.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and week, breaking out this week as traders increasingly price in moved forward fiscal FAI

5yr-30yr Treasury Spread: The curve is flatter on the day and week as the better than expected jobs report put more significant pressure on the front and belly of the curve due to increased Fed tightening expectations

EUR/JPY FX Cross: The Euro is higher on the day and the week as Lagarde’s hawkish presser massively moved the Euro higher and increasingly led traders to believe the BoJ will be the last central bank buying

Other Charts:

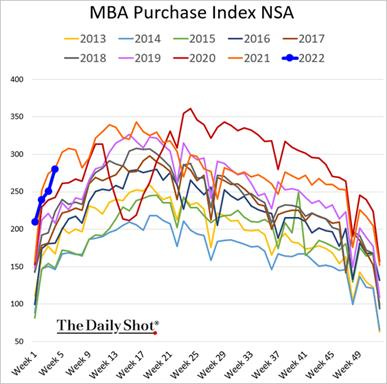

Mortgage demand remains strong despite the increase in rates and consumer sentiment surveys weakening

Housing inventory is slowly improving, with houses under construction or authorized to be at record highs

More inventory coupled with falling future interest in purchasing a home in 2022 should weigh on further price appreciation

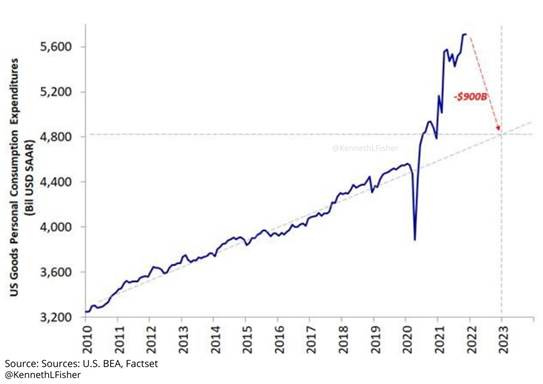

U.S. consumer activity has been running hot and will likely return to a more normal rate just as firms are increasing inventory stock

Although the $DXY has been appreciating, the breadth has been little changed with weakness in the Euro and Yen driving the index mainly higher

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

China Macroprudential and Political Loosening:

Three: To Achieve ‘Common Prosperity,’ Xi Jinping Seeks to Scale China’s ‘Three Big Mountains’ – WSJ

Chinese authorities have imposed measures aimed at taming the roaring housing market, imposed stringent restrictions on its once-booming tutoring industry, and laid out a plan to improve healthcare. Reducing costs in these three areas, or “three mountains,” is a core component of Xi’s “common prosperity” campaign. The rise in costs for these three areas is also being attributed to why birth rates are declining in China. The article lays out exactly how much costs have increased in these three areas in more detail.

Why it Matters:

The effort to tackle some of the country’s most intractable livelihood issues could, if successful, strengthen Mr. Xi’s widely expected bid to break with precedent and seek a third term later this year. Hence, we highlight this continued “crackdown” as a political objective and crucial in reversing the demographic decline currently occurring. Future growth is dependent on upward socio-economic mobility and increasing household formation, so in the long run, the “common prosperity” campaign is a pro-growth policy.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Addressing: House Expected to Pass $350 Billion Bill to Help U.S. Compete Globally – WSJ

The House is poised Friday to approve a sprawling $350 billion initiative to boost U.S. competitiveness with China and other rivals, but differences with the $250 billion Senate version signal struggles ahead in reaching a compromise. Both bills provide for substantial new federal incentives to help bring advanced semiconductor manufacturing back to the U.S. Compared with the Senate, the House version also targets more funding and related policy changes toward issues such as climate change, human rights, and domestic social inequality.

Why it Matters:

One key difference between the House and Senate versions is how to use scientific research to counter overseas threats. The Senate focuses largely on encouraging private sectors cutting-edge technologies, such as artificial intelligence and quantum computing. The House, by contrast, wants to give more flexibility to federal science officials to decide which new ideas deserve to be jump-started. There is also a significant difference between strengthening supply chains and trade policy changes to counter overseas threats. We will be watching this closely as reconciliation debates begin.

By Sea: Russia tensions spur LNG tanker orders for Korean shipbuilders - NikkeiAsia

South Korea's top shipbuilders have received an influx of orders for liquefied natural gas tankers recently as European countries seek alternative LNG sources amid escalating tensions with Russia. This follows already increasing ship orders in South Korea, which jumped 2.3-fold from the previous year to $43.9 billion in 2021, according to government data. The number represents a 93% increase from 2019 and the highest level in eight years.

Why it Matters:

Europe mainly imports natural gas through a network of pipelines originating from Russia. Europe can circumvent Russia by importing natural gas from the Middle East or Southeast Asia, but doing so necessitates LNG tankers. As expected, European shippers have stepped up orders given these geopolitical circumstances, which will eventually reduce Russia’s leverage on the Eurozone.

Electrification and Digitalization Policy:

Review Board: Biden Administration Forms Cybersecurity Review Board to Probe Failures – WSJ

The new Cyber Safety Review Board is tasked with examining significant cybersecurity events that affect government, business, and critical infrastructure. It will publish reports on security findings and recommendations. The cyber board isn’t an independent agency (like the transportation board) and will reside within the Department of Homeland Security. It will have 15 members from the government and the public sector who don’t need to be confirmed by the Senate, and it lacks subpoena power.

Why it Matters:

Several government agencies, including the National Security Agency and other parts of DHS, have expansive cybersecurity missions that include protecting the federal government and assisting the private sector. Officials said the new board was necessary to combine the expertise of government officials and private-sector researchers to study high-profile cybersecurity episodes and share comprehensive findings with the public. The new board is currently investigating the vulnerabilities related to Log4j, which is being seen as a significant cybersecurity threat.

Commodity Super Cycle Green.0:

E.V. Sales Reach 'Inflection Point’ With Fast Growth in China and Europe - Bloomberg

In both European and Chinese auto markets, electric cars accounted for about 4% of new vehicle sales at the end of 2019. Last year, their proportion of all new car sales hit 15% in China and 20% in Europe. Consumer demand in China and Europe is now driving sales, not just public policy by governments trying to fight climate change.

Why it Matters:

Automakers and analysts often wonder when U.S. electric car sales might one day take off after years of slow growth. But in China and Europe, that moment may already have come. With sales above 10% and consumers actively demanding the product, it looks like critical mass is being reached to create an organically growing industry free of subsidization and government policy support.

ESG Monetary and Fiscal Policy Expansion:

Leasing: U.S. considering a hike to royalty rate for drillers at onshore auctions - Reuters

The Biden administration is considering raising the royalty rate that drilling companies must pay on oil and gas leases that it plans to sell in the first quarter, according to a draft notice posted but then removed from the U.S. Bureau of Land Management (BLM) website. The royalty rate for leases offered this quarter would be 18.75%, up from the 12.5% minimum rate required by law.

Why it Matters:

If the higher rate is finalized, the move would be in keeping with President Joe Biden's pledge to reform oil and gas leasing on federal lands as part of his climate change agenda. The administration is planning onshore lease sales in several states this quarter. After taking office, Biden had paused drilling auctions, but that effort failed after producing states sued.

Accounting: The U.S. Just Took a Step Closer to a Legal Climate Standard - Bloomberg

Late last week, the District Court in D.C. delivered a stunning and unexpected victory to climate advocates: It voided offshore oil and gas leases, recently sold by the federal government to energy companies, across 2,700 square miles of the Gulf of Mexico because the U.S. Department of Interior had not accurately calculated what effect the fossil fuels extracted from those wells would have on global greenhouse gas emissions.

Why it Matters:

A federal agency, or anybody subject to the National Environmental Policy Act, will now be evaluated on the climate implications a new project has more honestly, based on the precedent this ruling set. Every environmental impact statement from DOI now has to take the step of rigorously calculating downstream emissions. It does not stop the leasing of lands for fossil fuel extraction but increases the transparency of the effects of activity regarding carbon emissions.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.