MIDDAY MACRO - 1/4/2022

MIDDAY MACRO - DAILY COLOR – 1/4/2022

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are lower, but mixed as a significant rotation due to rising rates is causing sectorial performance to be highly varied with tech and growth baring the brunt of the selling while traditional cyclical sectors are higher

Treasuries are lower, again, following yesterday’s significant selling due to year-end/start technicals and changes to growth expectations and duration risk tolerance

WTI is higher, with OPEC+ staying its announced course, adding 400kb/d of supply in February, while analysts question how realistic those plans are given the existing member's production/capacity issues

Narrative Analysis:

The S&P is little changed on the day, hiding the somewhat drastic rotation occurring underneath the surface. The sudden rise in yields and steepening of the curve brought on by year-end/start technicals and/or changes in growth/Omicron and hence Fed policy outlook has duration-sensitive sectors under pressure again for a second day. Ten-year yields are approaching the highs seen in October, with front-end yields at post-pandemic highs. At the same time, inflation expectations have been stabilizing, driving real yields higher and helping the dollar rally, although still below its November highs and generally range-bound.

The S&P is outperforming the Russell and Nasdaq with High Dividend Yield, Value, and Small-Cap factors, and Financials, Energy, and Industrial sectors are all outperforming.

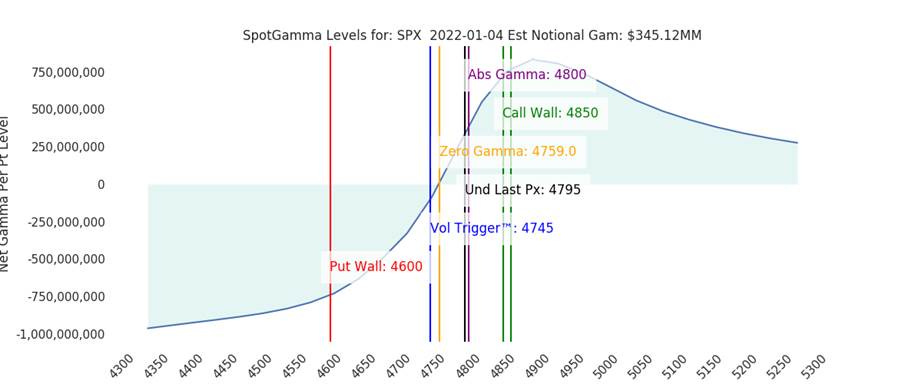

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4759 while the Call Wall is at 4850. A growing level of gamma in the S&P is reducing implied volatility but has yet to entice dealers to meaningfully buy back futures (vanna trade). Gamma turns more negative below 4745.

S&P technical levels have support at 4770, then 4745, and resistance is at 4815, then 4845. After the strong December rally, which peaked the Monday after X-mas, it is critical for bulls to hold above 4700. The S&P has consolidated since that post-X-mas day move higher and is still technically in a bullish formation.

Treasuries are lower, as the selling pressure, more acute in the long-end, has yet to meaningfully subside, moving the 10yr yield almost 20bps higher in 2 days while the 5s30s curve has steepened to 71bps. Whether this is more book-keeping technical selling or a meaningful shift in outlook is still a little unclear.

Econ Data:

The ISM Manufacturing PMI fell to 58.7 in December from 61.1 in November, below market forecasts of 60. The reading pointed to the weakest growth in factory activity since January, amid a slowdown in New Orders (60.4 vs. 61.5), although the Backlog of Orders did increase. There were significant drops in Supplier Deliveries (64.9 vs. 72.2) and Prices (68.2 vs. 82.4). Employment grew the most since April (54.2 vs. 53.3). Elsewhere, the inventory and import/export picture was mixed.

Why it Matters: There were a number of positive developments in today's manufacturing PMI report regarding improvements in the supply-side impairments we have been watching for so long. Manufacturing purchasing managers are reporting some easing in supply chain stresses and modestly easing in inflationary pressures. Timothy Fiore, the Chair of ISM Business Survey Committee, noted “The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment, with indications of improvements in labor resources and supplier delivery performance.” He reported panel sentiment remains strongly optimistic, with six positive growth comments for every cautious comment, down slightly from November. Respondents reported hiring was becoming less challenging, although turnover and backfill remained problematic. Finally, “inputs expressed as supplier deliveries, inventories, and imports — continued to constrain production expansion, but there are clear signs of improved delivery performance.” The bottom line is the report showed an improvement in disruptions but a weakening in demand. When looking at the New Orders/Inventory ratio, a good future predictor of overall index performance, headline readings will likely weaken further in the coming months.

*A slowing of production due to falling demand while supply-side impairments improved

*As always a mixed bag, depending on the respondent's industry, but generally sings of improving logistical backdrop and continued demand

The number of job openings decreased to 10.562 million in November from an upwardly revised 11.033 million in the previous month and below market expectations of 11.075 million. The largest declines were recorded in accommodation and food services (-261,000); construction (-110,000); and nondurable goods manufacturing (-66,000), while increases were reported for finance and insurance (+83,000) and federal government (+25,000). The number of job openings decreased in the South and Midwest regions. Meanwhile, the number of hires rose by 191,000 to 6.697 million, while total separations, including quits, layoffs and discharges, and other separations jumped by 382,000 to 6.273 million.

Why it Matters: Labor continues to flex its muscles, with the level of quits back at record highs. When coupled with the level of hires also staying relatively stable, the labor market remains very tight. We would expect this tightness to continue for sometime, with Omicron now decreasing the number of openings while also deterring workers from reentering front-line jobs. Diminishing savings, reduced childcare needs, and overall decreases in pandemic fear will all drive increasing amounts of participation into the summer. However, it will take time to determine the amount of structural change that occurred verse pandemic-induced reasons, keeping the Fed’s “full employment” mandate elusive for another two-quarters likely.

*Openings are off their record highs while quits have increased back to those ATH levels

*A record 4.5 million Americans quit their jobs in November

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the day and week as higher yields again have a rotation underway today, helping Mid-Cap Value be the best performing size/factor on the day

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and week as factory activity expanded in December and several cities saw home sales increase

5yr-30yr Treasury Spread: The curve is steeper on the day and week and today as the long-end is again under notable selling pressure

EUR/JPY FX Cross: The Euro is stronger on the day and week and the day as PMIs in both EZ and Japan stayed positive, but the outlook was weaker in Japan

*With real rates likely to rise this year, it will be harder for multiple expansions to occur as earnings growth slows

*Margin expansion was a significant contributor to EPS growth in 2021

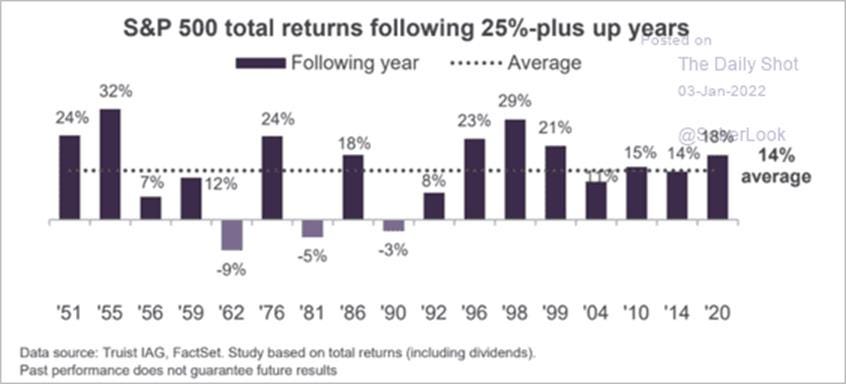

*On average, the S&P 500 has produced annual gains of 14% after rising more than 25% in a year

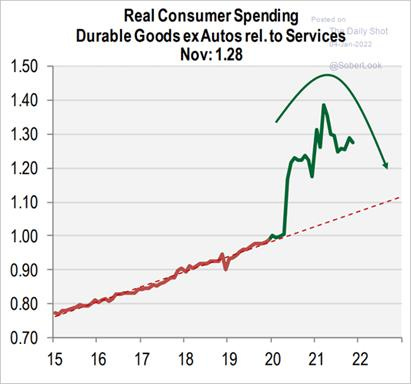

*Spending on goods verse services remains far above its typical relationship, as this reverses it should reduce some inflationary pressures

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Fewer: U.S., European Factories See Easing Supply Strains, but Omicron Threatens Setbacks – WSJ

According to recent IHS Markit PMI surveys of purchasing managers, there were some signs of a modest easing of bottlenecks in the final months of last year. In the U.S., input delivery delays improved the most since May, although they remained extensive. The rise in input costs also slowed to the softest pace in six months. European factories reported a second month of easing logjams.

Why it Matters:

The purchasing managers' surveys are consistent with slight improvements in other measures of supply chains. Costs for container transport have fallen steadily since early September. “While shortages remained significant, the end of the year brought with it some signs that cost pressures have eased,” said Siân Jones, senior economist at IHS Markit. “We’re seeing some tentative but very welcome signs that the supply chain crisis which has plagued production lines all across Europe is beginning to recede,” said Joe Hayes, an economist at IHS Markit.

China Macroprudential and Political Loosening:

Slight Improvement: China's Dec factory activity returns to growth, beats forecasts- Caixin PMI – Reuters

China's factory activity grew at its fastest pace in six months in December as the Caixin/Markit PMI rose to 50.9 from 50, driven by production hikes and easing price pressures, but a weaker job market and lower business confidence added uncertainty. The relative strength in the Caixin PMI tallies with an official survey released on Friday which showed China's factory activity edged up.

Why it Matters:

December saw a better headline PMI reading that showed production increases but a still unstable recovery due to Covid flare-ups (causing lockdowns) and weaker overseas demand. "Supply was strong and demand rebounded. With the easing of supply constraints, output expanded for the second month in a row and at a faster pace," said Wang Zhe, senior economist at Caixin Insight Group.

1/3: Asian Trade Pact Covering One-Third of Global Economy Takes Effect – Caixin

The Regional Comprehensive Economic Partnership (RCEP), inked in November 2020 after eight years of negotiation, went into force for China and the nine other countries that were first to ratify the agreement. China said it would fulfill its RCEP obligations by implementing agreements, expanding foreign trade, and reciprocal investment while strengthening supply chains, according to a statement released Saturday by the Ministry of Commerce.

Why it Matters:

Eventually, the deal is expected to remove 90% of the tariffs among the 15 countries and boost intraregional trade by $42 billion, or 2%, compared with the 2019 level. Japan is expected to be the biggest beneficiary of the deal, with the country’s exports expected to rise by about $20.2 billion, a UNCTAD study said, followed by China at $11.2 billion and South Korea at $6.7 billion.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

LNG Rescue: U.S. LNG Exports Top Rivals for First Time on Shale Revolution – Bloomberg

The U.S. was the world’s biggest exporter of liquefied natural gas last month for the first time ever. Output from American facilities edged above Qatar in December due largely to a jump in exports from the Sabine Pass and Freeport facilities, according to ship-tracking data compiled by Bloomberg. Cheniere Energy Inc. said last month that it achieved its first cargo from a new production unit at its Sabine Pass plant.

Why it Matters:

Overseas buyers purchased 13% of U.S. gas production in December, a seven-fold increase from five years earlier when most of the infrastructure required to ship the fuel out of the country didn’t yet exist. However, the ability to ramp up exports further will be constrained as existing infrastructure is stretched to capacity. It is also unlikely European buyers will pay the premiums they did if Russia begins to supply more gas through traditional means. Qatar is also building a large export facility.

Protectionism: Argentina Extends Export Ban on Popular Beef Cuts to Tame Local Prices - Bloomberg

Argentina extended an export ban on seven beef cuts until the end of 2023, doubling down on its unconventional approach to taming meat prices for local consumers. The government also prohibited exporters from shipping full cattle carcasses and half carcasses, among other categories, for the next two years. The move is the latest in a series of anti-market measures, with President Alberto Fernandez temporarily banning all meat exports last May, gradually easing some restrictions over time.

Why it Matters:

Although this is not a meaningful macro issue in isolation, we highlight it as another example of governments using some form of protectionism/market intervention to fight inflation. Elsewhere this week, Indonesia is banning thermal coal exports in January to help supply local utilities that are grappling with shortages. In the U.S., Biden/Democrats are looking to use anti-monopoly regulations against the meat and poultry industry. We expect to see more government market intervention in various forms until energy and food inflation stabilize, given the political cost incumbent parties suffer.

Electrification and Digitalization Policy:

NFT Punks: How NFTs became a $40bn market in 2021 – FT

At the beginning of 2021, few people knew what non-fungible tokens (NFT) were. By the end of the year, nearly $41bn had been spent on NFTs, according to the latest data, making the market for digital artwork and collectibles almost as valuable as the global art market. Chainalysis found that NFTs have introduced a considerable number of retail investors to the crypto world, with small transactions of under $10,000 accounting for more than 75% of the market. But much like the market for cryptocurrencies, it remains dominated by a few prominent players, or “whales.”

Why it Matters:

The unregulated space is also plagued by fraud, scams, and market manipulation, mainly because the real-world identities of buyers and sellers are difficult, if not impossible, to discover. Researchers have also warned that the market is likely being inflated by wash trading — when a trader takes both sides of a trade to give the false impression of demand. It is also unclear where regulators will come down on NFTs, given they share similar characteristics with certain digital investment vehicles, and therefore, may be considered securities.

Shared Facts: A Former Facebook Executive Pushes to Open Social Media’s ‘Black Boxes’ – NYT

Washington is awash in proposals for reforming social media, but in a narrowly divided Congress, it’s little surprise that none have passed. The new Senate legislation, which was introduced by two Democrats, Chris Coons and Amy Klobuchar, and a Republican, Rob Portman, may have a path toward passage because it doesn’t require taking a side in that argument. It would require the companies to release internal data and assist independent researchers whose projects have been vetted by the National Science Foundation, an independent federal agency.

Why it Matters:

The article elaborates on how using something similar to a now-scrapped internal tool at Facebook called “open graph” would help policymakers better understand how social media companies impact the mental health/online safety of younger users and disinformation campaigns. "Increasing transparency around Big Tech practices will give policymakers the high-quality, well-vetted information we need to do our job most effectively," Senator Portman said.

Commodity Super Cycle Green.0:

Consensus: Battery costs rise as lithium demand outstrips supply - Nikkie

Benchmark prices of lithium carbonate ended 2021 at records, with other related commodities needed for battery production also rising significantly. The increase in prices is undermining the technological and efficiency gains of recent years. According to an S&P Global Market Intelligence report, supply is forecast to jump to 636,000 metric tons of lithium carbonate equivalent in 2022, up from an estimated 497,000 in 2021 -- but demand will jump even higher to 641,000 tons, from an estimated 504,000.

Why it Matters:

The pressure is on to secure new supplies of raw materials as the global car industry pivots away from the combustion engine to electric cars. This is causing carmakers to secure direct rights to extract lithium, improving their bargaining power with battery makers. However, China’s dominance in the battery market is weakening non-Chinese automakers' ability to control price increases. China accounts for over 65% of global battery production and over half of lithium chemical production, something that worries many in the car industry at a time of geopolitical tensions.

ESG Monetary and Fiscal Policy Expansion:

Nominate: White House Likely to Nominate Philip Jefferson for Fed Seat – Bloomberg

The White House is likely to nominate economist Philip Jefferson for a seat on the Federal Reserve’s board of governors, according to people familiar with the matter. With a doctorate in economics from the University of Virginia, Jefferson is the vice president for academic affairs, dean of faculty, and an economics professor at Davidson College. He has worked at the Federal Reserve twice before, serving as an economist in the board’s monetary affairs division and a research analyst before that.

Why it Matters:

President Biden has three more seats to fill on the board, including a new vice chair for supervision. Jefferson’s selection comes as the Fed faces criticism for the lack of diversity in its ranks, especially at the highest levels of leadership. Jefferson has authored and edited books and articles on poverty and has focused his teaching on inequality. We will be doing a deeper dive into Jefferson's past works, with the key question being his views on how damaging inflation is to lower-income given the greater clarity on his views regarding other policy objectives.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.