MIDDAY MACRO - DAILY COLOR – 12/9/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are lower, as a lack of any new positive catalysts have markets focusing on increasing Covid case counts causing the reopening trade to stall and Large-Cap Growth to outperform

Treasuries are higher, though little changed as yesterday’s better-than-expected 10yr auction has muted price action into today's 30yr

WTI is lower, falling from recent highs reached overnight as traders grapple with Russia tensions, increased supply on the margin, but also rising demand expectations despite the current Covid uptick in the U.S. and EZ.

Narrative Analysis:

Equities are under pressure as continued rises in Covid case counts both here and in Europe/U.K. have the re-opening trade (and small-caps) retracing some recent gains. Markets are waiting to see if increases in inflation are slowing with tomorrow’s CPI data likely being the next big catalyst for price action. Traders will extrapolate what any increase or slowing might mean for next week’s FOMC meeting’s SEP forecasts (for rate hikes in 2022), now that a faster taper looks to be a done deal. Treasuries are basing after notable recent weakness, while the dollar has retraced all of yesterday’s drop.

The S&P is outperforming the Nasdaq and Russell with High Dividend Yield, Low Volatility, and Value factors, and Health Care, Consumer Staples, and Utilities sectors all outperforming.

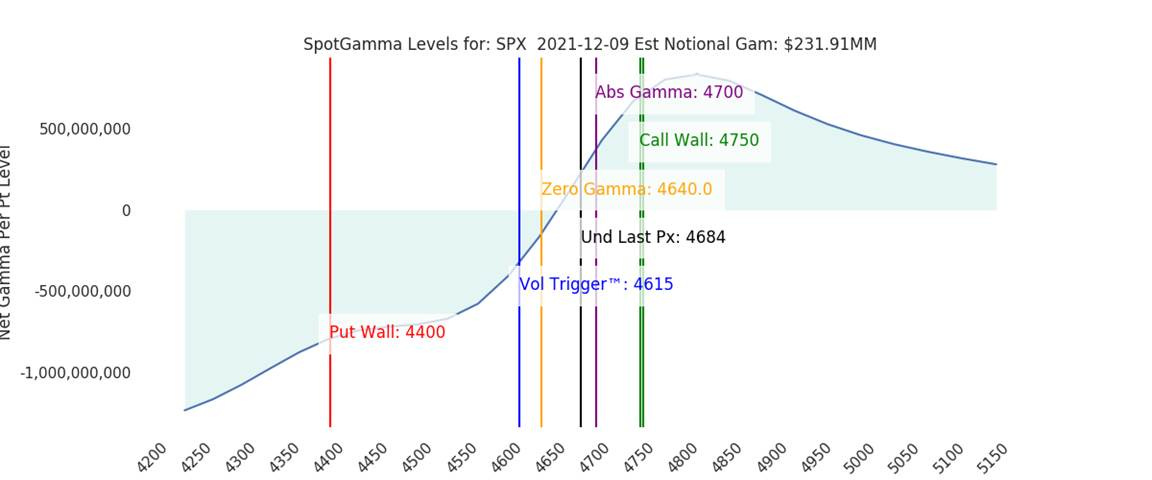

S&P optionality strike levels have the Zero-Gamma Level moved lower to 4640 while the Call Wall is at 4800. There continues to be strong resistance around 4700 due to positioning while support lies around 4680, then 4650. Put prices continue to decline sharply relative to calls, and implied vol past next week’s FOMC is also falling, indicating lower expectations for a policy surprise.

S&P technical levels have support at 4670, then 4640, and resistance is at 4720. The S&P continues to base in what now looks like a 40 point range (4670 to 4710). A triangle (coil) is forming with upside likely if 4675 holds, but tomorrow’s CPI print will likely be the next catalyst to break out above 4720 or retest 4640.

Treasuries are higher, reversing overnight weakness on the more risk-off tone today, with yesterday’s 10yr auction being well received given the sell-off into it. Today brings 30yr supply at 1 pm. The 5s30s curve is little changed, sitting at 61bps.

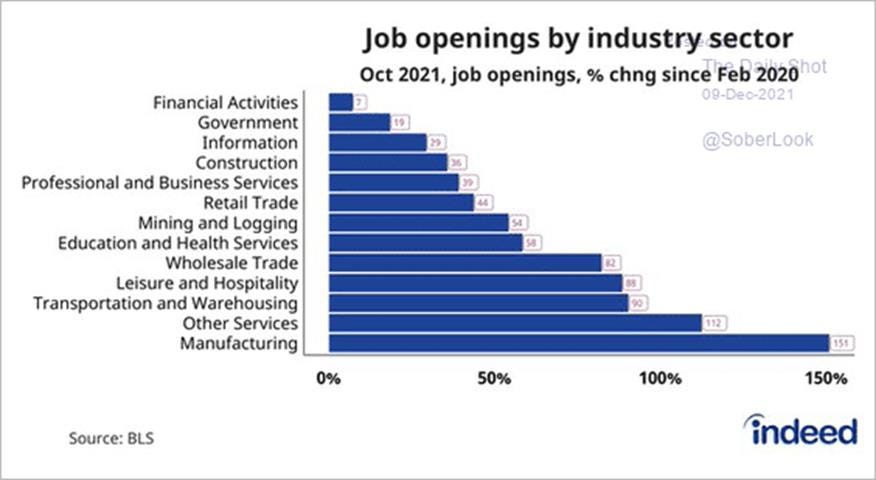

*U.S. manufacturing firms still have a lot of hiring to do

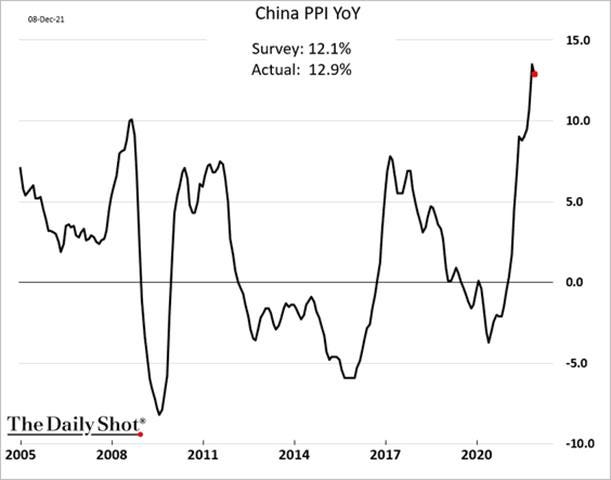

*China’s PPI may have peaked as Beijing’s effort to coerce lower prices and increase energy production may be beginning to reduce factory-gate pricing pressures

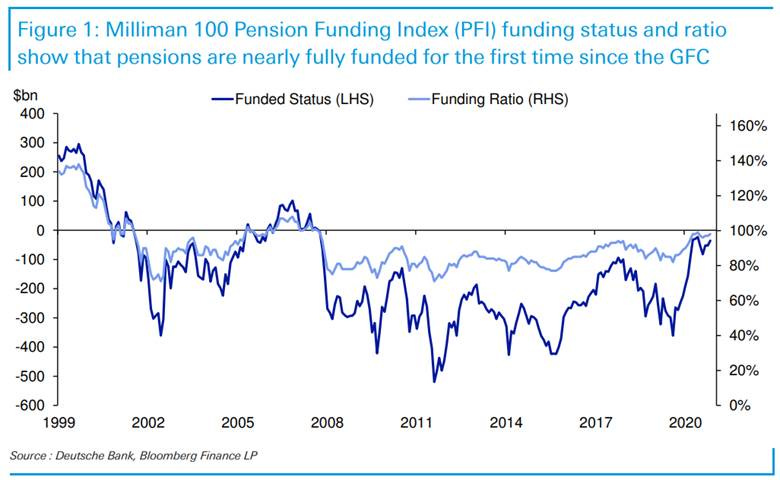

*It has been a long time since U.S. pensions were this well funded

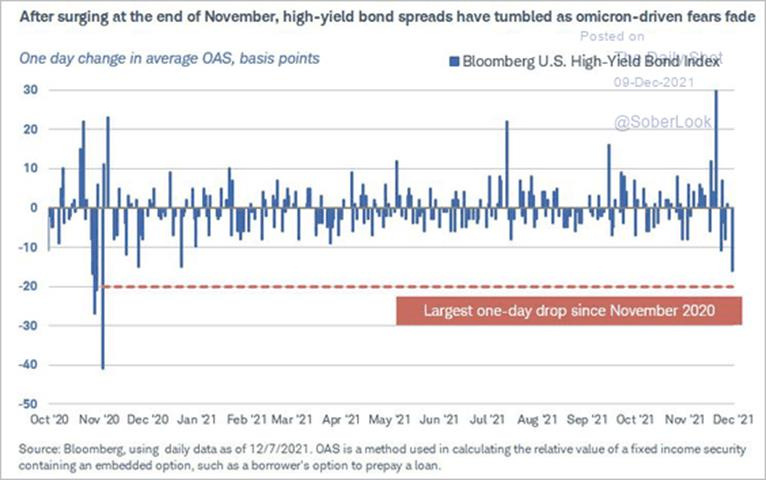

*High-yield bonds had a tough November but have now recovered much of the spread widening that occurred.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the week, but the ratio is little changed today despite Large-Cap Growth being the best performing size/factor today

Chinese Iron Ore Future Price: Iron Ore futures are higher but slightly lower today after China’s CPI and PPI mainly came in line with expectations reducing fears Beijing’s recent renewed interest in macro-policy support would be capped my inflationary pressures

5yr-30yr Treasury Spread: The curve is steeper on the week and slightly higher today but all eyes will be on the 30yr auction at 1 pm.

EUR/JPY FX Cross: The Euro is stronger on the week but weaker today due to the more risk-off feel as the Yen is stronger by 0.5% today

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Slow Progress: Glimmers of hope emerge in the supply chain nightmare - CNN

Epic port congestion is easing. Shipping prices are falling from sky-high levels. Deliveries are speeding up a bit. There are growing signs that the supply chain mess is finally starting to get cleaned up. "It is still going to take a long time for the supply chains across the country to be fully restored, but at least the first steps appear to be in place towards normalcy," Thomas Simons, an economist at Jefferies, wrote in a recent note to clients.

Why it Matters:

"We see the rapid decline in container vessels waiting to unload and falling global shipping prices as possibly leading to some easing in supply bottlenecks," Barclays economists wrote in a recent report, "which if continued, could downstream into other modes of transportation later." As traffic jams in one part of the supply chain improve, pressure will be taken off other areas. We continue to see signs this is slowly happening.

Fair Practice: Washington votes in favor of the Ocean Shipping Reform Act – Splash247

The House of Representatives on Wednesday passed the Ocean Shipping Reform Act (OSRA) in a 364-60 vote, a bill designed to strengthen shipping supply chains. “This legislation works to address unfair shipping practices by tackling the worst instances of abuse from bad actors in the shipping industry in an effort to boost our country’s global competitiveness,” Democrat representative Kurt Schrader said in a statement. It now needs to get the approval in the Senate to go to Biden.

Why it Matters:

John Butler, president, and CEO of the World Shipping Council, a liner lobbying group, said he was disappointed the bill had been passed without proper debate or committee process. Other parts of the American supply chain welcomed the bill’s passing. “Once passed, OSRA21 will reduce or eliminate carrier price gouging, epic freight costs, record delays – and other unfair and excessive punitive fees that only fuel inflationary pressures,” said Steve Lamar, president, and CEO of the American Apparel & Footwear Association.

China Macroprudential and Political Loosening:

Finally Happened: Fitch declares Evergrande and Kaisa to be in 'restricted default' - NikkeiAsia

Fitch Ratings declared China Evergrande Group and Kaisa Group Holdings to be in "restricted default" on Thursday, marking the first official recognition of default by Evergrande, the world's most indebted real estate company. The rating agency downgraded the Chinese developer, its central operating unit, and another subsidiary to "RD" from "C." Kaisa, while significantly smaller than Evergrande, has been China's next largest issuer of junk bonds and missed repayment of a $400 million bond on Tuesday with no grace period, resulting in technical default. Neither Moody's nor S&P Global Ratings have declared Evergrande or Kaisa to be in default.

Why it Matters:

PBOC Governor Yi Gang addressed Evergrande's plight in comments on Thursday by video to a financial forum held in Hong Kong, a rare direct company mention. "Evergrande's risk is a market incident," he said. It should be, he added, "treated in an appropriate manner according to established market mechanisms following the principle of law, and the rights of creditors and investors must be secured in accordance to the law." Yi insisted that developer troubles are "short term and individual" in nature rather than a threat to overall financial stability. Nonetheless, recent accommodative actions show a growing desire by Beijing to support the property market and developers.

Too Strong: China Signals Discomfort Over Yuan Rally With Daily Fixing – Bloomberg

The PBOC signaled a limit to its tolerance for the yuan’s recent strength by setting its reference rate at a weaker-than-expected level on Thursday. The gap between the daily fixing set and the forecast in a Bloomberg survey of analysts and traders was the largest since mid-October. That was when yuan gains accelerated on strong trade data and hopes of easing tensions between China and the U.S.

Why it Matters:

This year, the yuan’s strength has been supported by solid inflows due to China’s robust exports and foreign investment in onshore bonds. The currency was more recently aided by bets that Beijing’s monetary stimulus will sustain the nation’s growth and that the new Covid variant will have a limited impact on the global recovery. However, “the weaker-than-expected fix is a reminder to markets that the currency is being watched, and the central bank wants to prevent appreciation bets from snowballing,” said Fiona Lim, a senior foreign-exchange strategist at Malayan Banking Berhad.

Get in Line: Beijing Reins In China’s Central Bank – WSJ

Earlier this week, pressured by senior leaders worried about plunging economic growth, the PBOC said it would ease banks’ reserve requirements, effectively making more cash available for bank lending. The move went against policy signals it had sent weeks earlier and came as the central bank and other financial institutions came under scrutiny by Beijing, part of Mr. Xi’s effort to curb capitalist forces in the economy.

Why it Matters:

Of all the financial institutions being scrutinized by Mr. Xi’s discipline inspectors, the PBOC is arguably the most consequential. The central bank oversees one of the world’s largest financial systems. In recent weeks, Communist Party discipline inspectors from China’s top anti-corruption agency have visited the central bank’s headquarters in central Beijing. Officials briefed on the matter said the inspectors asked questions, reviewed documents, and brought an unusually stern message: Beijing has little tolerance for any talk of central-bank independence; the monetary authority, just like any other part of the government, answers to the party.

Obscure Tap: China Reopens a Funding Spigot for Property Developers – WSJ

Property firms issued more than $38.6 billion in “supply chain asset-backed securities” bonds last year, according to Wind data, a huge jump from $12.4 billion in 2019. The actual totals are likely higher because some deals from developers weren’t classified as such. Regulators began curbing the issuance of these structured-finance products earlier this year as part of a wider effort to reduce developers’ leverage under a policy known as the “three red lines” that placed limits on their borrowing. However, given many real-estate firms’ liquidity challenges since the U.S. dollar junk-bond market seized up in recent months, Chinese financial watchdogs have started to loosen up and allow this form of financing again.

Why it Matters:

In China, supply chain asset-backed securities are created by bundling together developers’ payment obligations to their suppliers, which include sellers of building materials and contractors. In essence, property developers get suppliers to sell their account receivables, supplying cash upfront, typically paying them amounts that are less than what the developer owes them. The change by regulators to again accept this form of cash management tool further shows a pivot to become more supportive of the sector.

LONGER-TERM THEMES:

Electrification and Digitalization Policy:

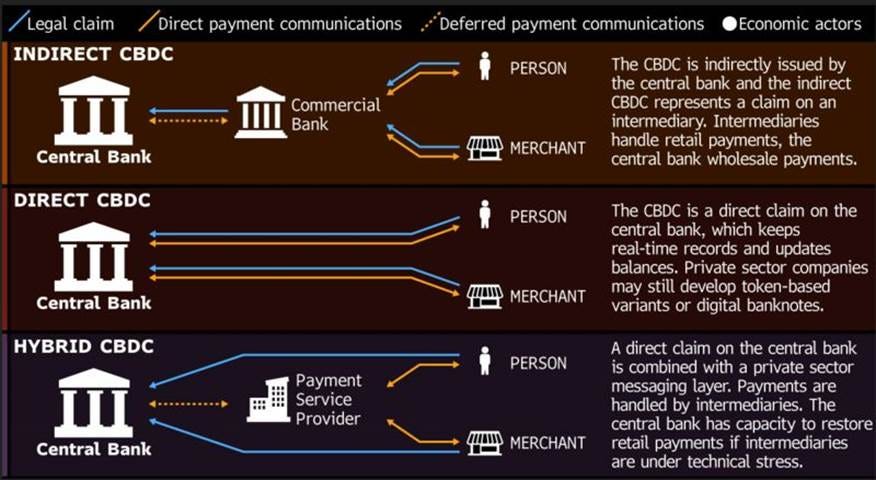

Tokenized: French, Swiss Central Banks Conduct Digital FX Experiment – Bloomberg

The Bank of France and the Swiss National Bank successfully tried foreign exchange transactions using digital currencies. Project Jura, which involved the Bank for International Settlements, UBS Group AG, Credit Suisse, Natixis SA, and others, also looked at issuing, transferring, and redeeming tokenized French commercial paper valued at 200,000 euros ($226,090) between French and Swiss financial institutions.

Why it Matters:

Monetary authorities around the world are studying how the advent of digital money might change the way the financial system operates. The People’s Bank of China could be the first major central bank to issue a digital version of its currency. In addition to issuing e-coins to the general public, central bank digital currencies used by financial institutions, also known as wholesale, could facilitate international payments.

ESG Monetary and Fiscal Policy Expansion:

Banned: House OKs a bill barring imports of goods produced by forced labor of Uyghurs in China – AP

The Uyghur Forced Labor Prevention Act would ban imports produced by ethnic Muslims in the internment camps in northwest China. The bill now heads to the Senate, but it's unclear when the chamber will take it up. The White House hasn't said whether the president backs the bill but added he shares concerns about forced labor in the Xinjiang region.

Why it Matters:

This is a rare instance of bipartisan support, with an overwhelming vote to pass of 428-1. More generally, opposition against China seems to be widely supported, with numerous other bills gaining broad support. Although the number often changes, GovTrack currently has 224 bills in Congress, including the Senate-passed U.S. Innovation and Competition Act, focused on China. "It is critical Congress pass strong, bipartisan legislation to address the generational threat posed by the Chinese Communist Party," said Representative Michael McCaul, the top Republican on the House Foreign Affairs Committee.

2030: The Seven Elements of the EU Green Deal You Should Care About - Bloomberg

The European Union has unveiled its blueprint for how the continent intends to meet stricter 2030 climate targets in what is being called the Fit for 55 package, the EU’s program to slash pollution by at least 55% from 1990 levels. While several years of negotiation are expected before the planned legislation comes into force, major changes are coming. The article highlights some of the most significant changes that may occur.

Why it Matters:

This will be the biggest overhaul of the EU’s Emissions Trading System to date, affecting everything from the price of flights to the cost of electricity bills. The shipping industry will be included in the Emissions Trading System for the first time, while airlines, already included, will eventually have to pay for all the pollution their planes produce. The EU is proposing that emissions from new cars fall by 55% from 2030 and drop to zero from 2035. The EU plans to introduce an import levy for steel, cement, and aluminum produced in other countries with lower environmental standards. There are many other proposed changes, including codifying renewable energy targets, and it is worth reading the Fit for 55 document.

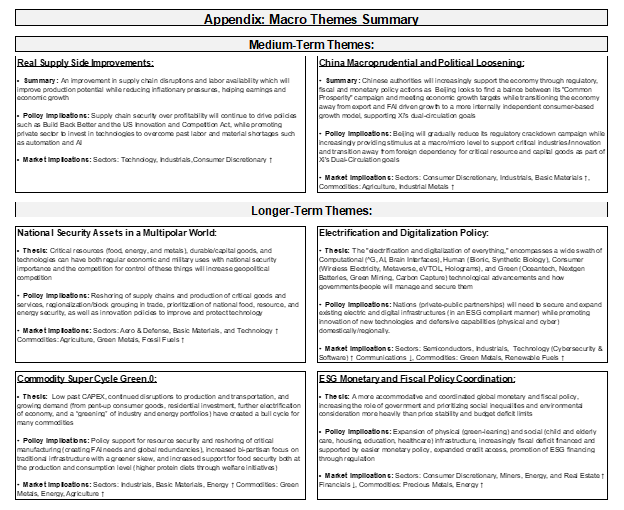

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.