MIDDAY MACRO - DAILY COLOR – 12/8/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Narratives/Price Action:

Equities are mixed, as positive news from Pfizer briefly sent the S&P to near recent highs, but a consolidation is now occurring there and in the Nasdaq, while the Russell continues to rally

Treasuries are lower, with the curve steepening significantly due to the underperformance of the long-end into today and tomorrow's supply

WTI is higher, as domestic inventory numbers weren’t as bearish as feared, while Europe's energy shortages continue as the weather worsens

Analysis:

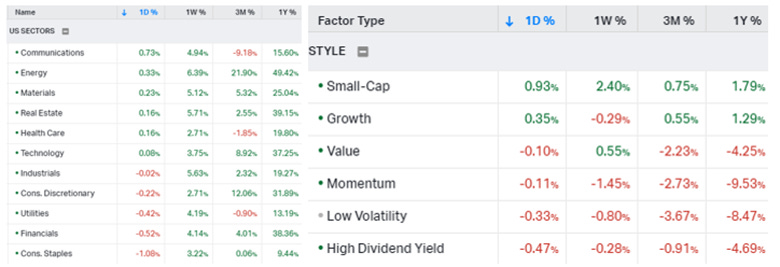

Equities are consolidating after a brief spike following Pfizer’s announcement about vaccine efficacy being strong against Omicron. The S&P has effectively retraced all its post-Thanksgiven losses in two days. Small caps continue to be the primary beneficiary of the improving Omicron sentiment and are notably higher today, while the Nasdaq is feeling some pressure from rising yields as the long-end of the Treasury curve is under pressure into today’s 10yr auction. The dollar is also lower due to Euro and Aussie strength.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Growth, and Value factors, and Communication, Energy, and Materials sectors all outperforming.

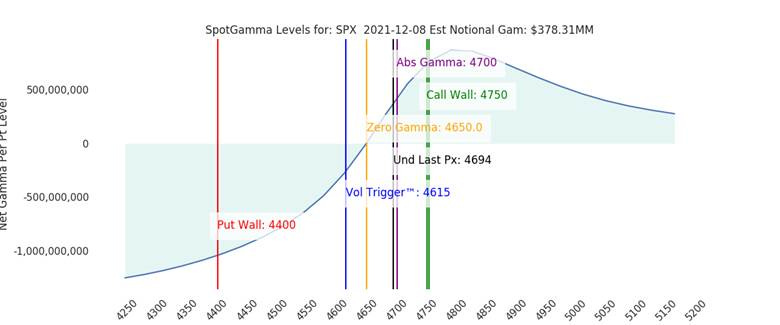

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4650 while the Call Wall is at 4800. After the recent rally, volatility expectations have fallen but will likely stay near current levels into next week's FOMC meeting and monthly OPEX.

S&P technical levels have support at 4670, then 4640, and resistance is at 4720. It would be bullish for the market to cool/consolidate today above the 4670 support level, with Friday’s CPI being a potential catalyst to move higher or lower.

Treasuries are lower, with the long-end being under the greatest pressure as an overnight rally reversed post-Pfizer headlines. The 5s30s curve is steeper by 5.5 bps to 60bps.

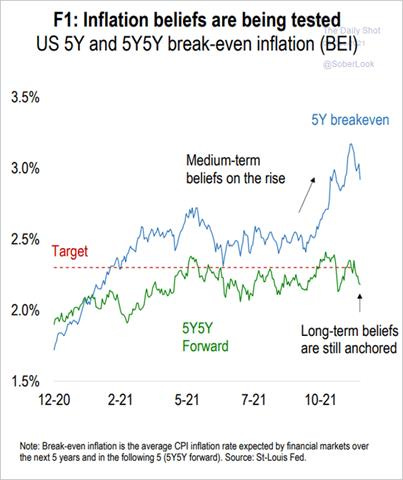

*Fed’s favorite measure of long-term inflation expectation remains well anchored

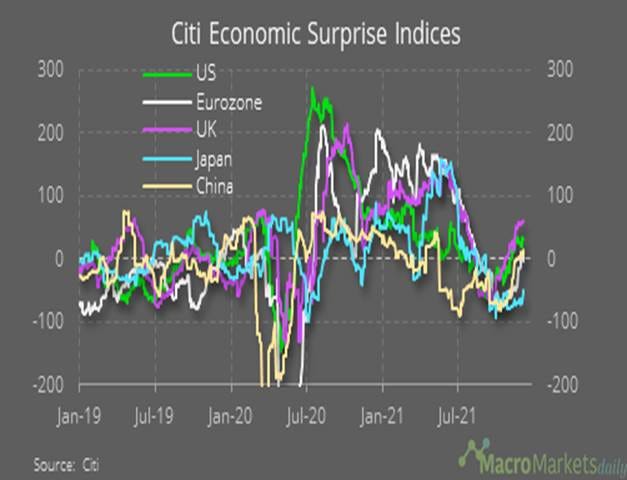

*Citi Surprise Indexes globally have been picking up as the 4th qtr continues to be stronger than expected

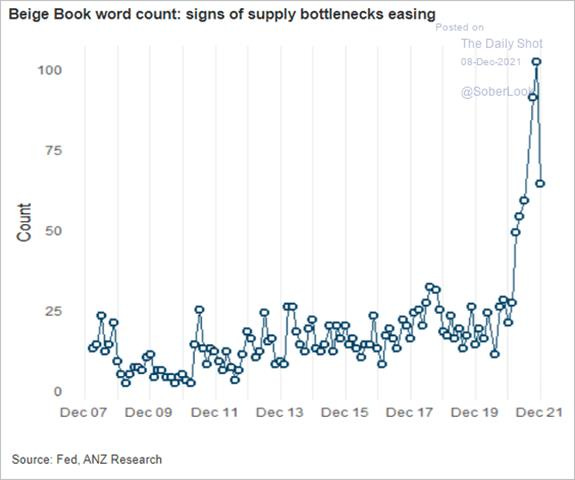

*There was a reduction in supply chain concerns in the Fed’s Beige Book

Econ Data:

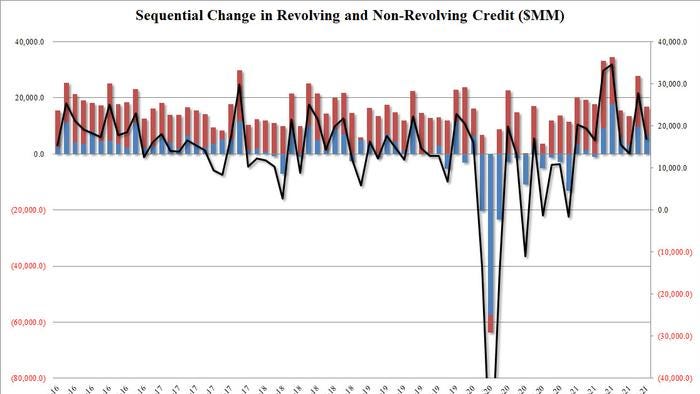

Consumer credit increased by $16.9 billion in October, following a downwardly revised $27.8 billion gain in September and below market expectations of an increase of $25 billion. Revolving credit increased by $6.6 billion, while non-revolving credit increased by $10.3 billion. That's an annual growth rate of 4.7% in October, down from a 7.7% gain in the prior month. Revolving credit, like credit cards, rose 7.8% after an 11.7% gain in September. Non-revolving credit, typically auto and student loans, rose 3.7% after a 6.5% growth rate in the prior month.

Why it Matters: There was a notable drop in the growth of consumer credit outstanding in October, both from drops in revolving and non-revolving. Declines in credit card debt (revolving debt) are not yet alarming but are worth watching. To keep it simple, the holiday season is usually when credit growth increases. However, given the strength seen over the summer, some slowing in credit growth may be warranted.

* Growth in consumer credit dropped notably in October, rising by just $16.9 billion, well below the six-month average of $23.5 billion.

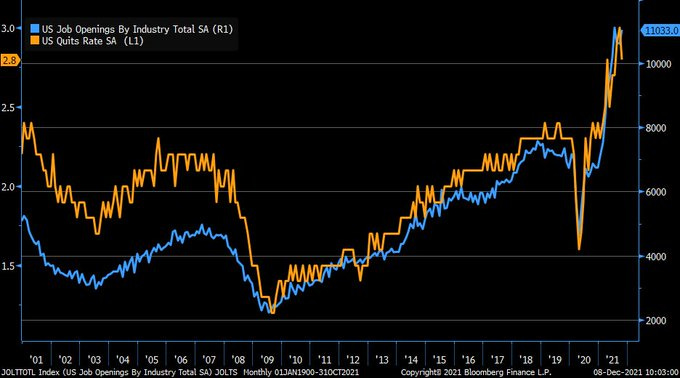

The number of job openings in the U.S. increased to 11 million in October, beating market expectations of 10.4 million. The largest increases were seen in accommodation and food services (+254K), nondurable goods manufacturing (+45K), and educational services (+42K). Job openings decreased in state and local government, excluding education (-115K). The number of hires was little changed at 6.5 million. Within separations, the quits rate decreased to 2.8%, following a series high of 3% in September. The layoffs and discharges rate was unchanged at 0.9%.

Why it Matters: There are 0.67 unemployed workers per job opening (or ~1.5 job openings per unemployed), the largest imbalance since the JOLTS survey began in 2000. If every unemployed worker was matched to a job, there would be 3.6 million unfilled jobs leftover. On the one hand, a higher level of openings puts pressure on firms to raise wages to fill vacancies. On the other hand, the decreases in separations /quits levels show workers are less likely to leave a job.

*Job openings reversed higher in October to 11.03 million vs. 10.5 million estimate

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the week and today despite the Russell outperforming the Nasdaq as Small-Cap Growth is the best performing size/factor today

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week about cooling today after an impressive rally following positive commodity import data and continued belief the property sector will recover

5yr-30yr Treasury Spread: The curve is steeper on the week thanks to today’s move higher due to long-end weakness

EUR/JPY FX Cross: The Euro is stronger on the week and the day, with a notable move higher today against several crosses helped by more rational ECB rhetoric today

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Setback: Another lockdown at Ningbo has exporters on edge – Splash247

The district of Zhenhai has been put on a two-week lockdown after five people tested positive for Covid-19. Early indications are that the measures taken by local authorities have yet to harm productivity at the port. Ningbo is home to the world’s largest port – it was partially closed in the summer for a fortnight after another Covid-19 outbreak.

Why it Matters:

So far, no impact on port activity. Beijing’s strict zero-Covid policy has curbed local outbreaks with mass testing, snap lockdowns, vigilant surveillance, and extensive quarantines. However, the country has struggled over the past couple of months to stamp out the illness. Since October 17, China has reported at least one locally transmitted case every day. Beijing will have to end its zero-Covid policy at some point in the distant future, given the virus will always be with us, but that’s another story.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Reshoring: Yellen Says Supply-Chain Shift May Need Protectionist-Like Steps – Bloomberg

Treasury Secretary Janet Yellen said that U.S. reliance on foreign supply chains has proved a vulnerability and that the country needs to produce more critical goods domestically in order to protect both its economic and national security. “It’s possible that policies that people will describe as protectionist are going to be necessary in order to create the appropriate incentives to produce things at home,” Yellen said in an interview recorded on Monday for an online conference hosted by the Financial Times.

Why it Matters:

President Biden ordered a review of supply-chain vulnerabilities earlier this year that is focused on semiconductors, batteries, critical minerals, and pharmaceuticals. Yellen said the review is moving to a second phase that will examine supplies necessary for defense, food, public health, and communications technologies. None of this is new, and we highlight it to show that reshoring efforts continue, but the process will be slow.

Electrification and Digitalization Policy:

Partners: Biden’s cyber leaders go to Silicon Valley for more help fighting hackers - Politico

Homeland Security Secretary Alejandro Mayorkas, Cybersecurity and Infrastructure Security Agency Director Jen Easterly, National Cyber Director Chris Inglis, and other officials met with executives from 13 companies, including Google, networking vendor Juniper Networks and security firm Mandiant. They aimed to deepen relationships between government and industry that security professionals see as vital for protecting the nation’s critical infrastructure.

Why it Matters:

These partnerships could offer the Biden administration a new weapon against ransomware. A DHS official, who spoke anonymously in keeping with department policy, said the meeting was part of an effort to “get to the point where government and the private sector are working day in and day out on understanding, analyzing, and then mitigating the most urgent threats that we're seeing.” Officials also sought to ensure that corporate leaders viewed collaboration with the government as a priority and understood how it could benefit them and the entire technology ecosystem.

Legally: Rohingya sue Facebook for $150B, alleging role in violence – AP

Lawyers filed a class-action lawsuit Monday in California against Facebook parent Meta Platforms, saying Facebook’s arrival in Myanmar helped spread hate speech, misinformation, and incitement to violence that “amounted to a substantial cause, and eventual perpetuation of, the Rohingya genocide.” Years after coming under scrutiny for contributing to ethnic and religious violence in Myanmar, recently revealed internal Facebook documents show the company still has problems defining and moderating hate speech and misinformation on its platform in the country.

Why it Matters:

The lawsuits say Facebook’s algorithms amplified hate speech against the Rohingya people, and the company didn’t spend enough money to hire moderators and fact-checkers who spoke the local languages or understood the political situation. The Rohingyas’ claims were fortified by the revelations in internal company documents that former Facebook employee and whistleblower Frances Haugen provided this fall to Congress and U.S. securities regulators. The documents could also serve to buttress potential legal action by other groups around the world harmed by hate speech and misinformation on Facebook’s platform.

Commodity Super Cycle Green.0:

Lower: U.S. seeks lower biofuel mandates in 2020-21 – Argus

In a move reflecting decreased demand for all fuel products last year due to the pandemic, the EPA has proposed retroactively decreasing renewable fuel blending mandates for 2020, marking a 14.7% drop from its final levels for that year that were set months before the pandemic began to spread in the US.

Why it Matters:

The release of the long-delayed proposal marks an initial attempt by the Biden administration to find a middle ground between the oil industry and agricultural interests that want to support biofuels production. "This proposal signals a possible end to the era of oil refinery waiver abuse, an embrace of new fuels, and biofuel market growth in 2022 — clear steps in the right direction," said Brooke Coleman, executive director of the Advanced Biofuels Business Council. "But if we're going to unleash the full potential of the RFS, the retroactive cuts need to stop."

ESG Monetary and Fiscal Policy Expansion:

Halted: Biden Vaccine Mandate for Federal Contractors Is Blocked Nationwide – Bloomberg

Led by Georgia, the seven states that challenged the mandate set to take effect on Jan. 4 are likely to succeed in their lawsuits against the administration’s order, U.S. District Court Judge R. Stan Baker of the Southern District of Georgia said in an order issued Tuesday. Baker’s order follows a Kentucky federal judge’s grant last week of a preliminary injunction in a lawsuit involving Kentucky, Tennessee, and Ohio.

Why it Matters:

The court found that the states could likely prove that Congress didn’t clearly authorize the President to issue the mandate and that it “goes far beyond addressing administrative and management issues in order to promote efficiency and economy in procurement and contracting.” Judge Baker, a 2017 nominee of President Donald Trump, said, instead, the executive order works as a “regulation of public health.” Although there is still more to come, this will reduce mandatory layoffs that may have occurred.

Too Far: Biden's pick to lead major banking regulator drops out - Axios

Saule Omarova, nominated by the Biden Administration to lead the Office of the Comptroller of the Currency, is dropping out of consideration for the post, according to a statement from Biden that accepted the withdrawal. The withdrawal means that the OCC, charged with overseeing lenders whose assets make up two-thirds of the banking system's total, will continue without a permanent head for the foreseeable future.

Why it Matters:

Rarely do banking trade groups publicly campaign against a regulator pick and do so with such a united front as they did with Omarova. Her withdrawal following opposition “exhibits the importance of community banks to Main Street communities and local economic growth,” the Independent Community Bankers of America said. The group, whose members mainly aren’t regulated by the OCC, also explained why it took the “rare step” of pushing back, namely, an academic paper in which Omarova floated that the government provides consumer banking services via the Fed.

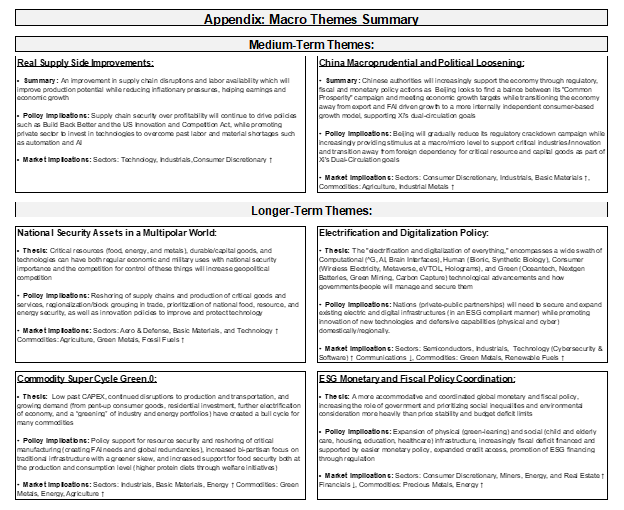

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.