MIDDAY MACRO - DAILY COLOR – 12/7/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Narratives/Price Action:

Equities are higher, as yesterday’s relief rally continues and is now taking a more global hold, helped by more positive sentiment around China, Omicron, and a lack of hawkish Fed speak

Treasuries are lower, with the curve flattening to new recent lows as the belly is under pressure into today's 3yr auction and growing corporate supply

WTI is higher, as increasing views that Omicron is not a game-changer to international travel and growth (more generally), as well as growing geopolitical risks from Russia, has it well bid

Analysis:

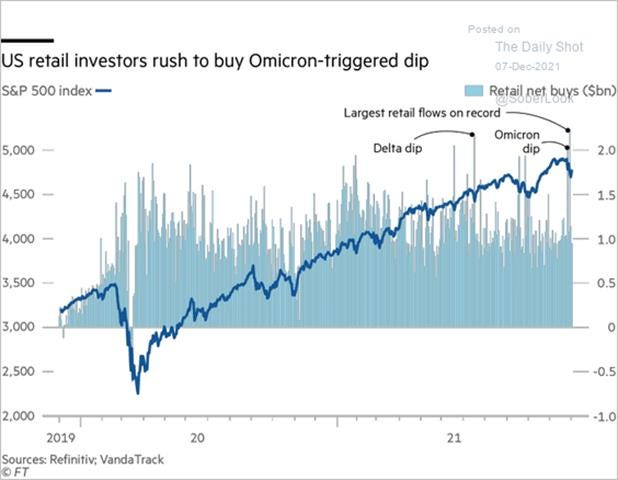

Equities continue their relief rally higher, more globally today, as fears over Omicron continue to subside, helping support re-open/reflation orientated sectors further while “oversold” tech names are receiving retail dip-buying support. Treasuries are under pressure again, although more so in the belly today, while the dollar was helped higher by better than expected improvement in the U.S. trade deficit.

The Nasdaq is outperforming the Russell and S&P with Momentum, Growth, and Small-Cap factors, and Technology, Energy, and Consumer Discretionary sectors all outperforming.

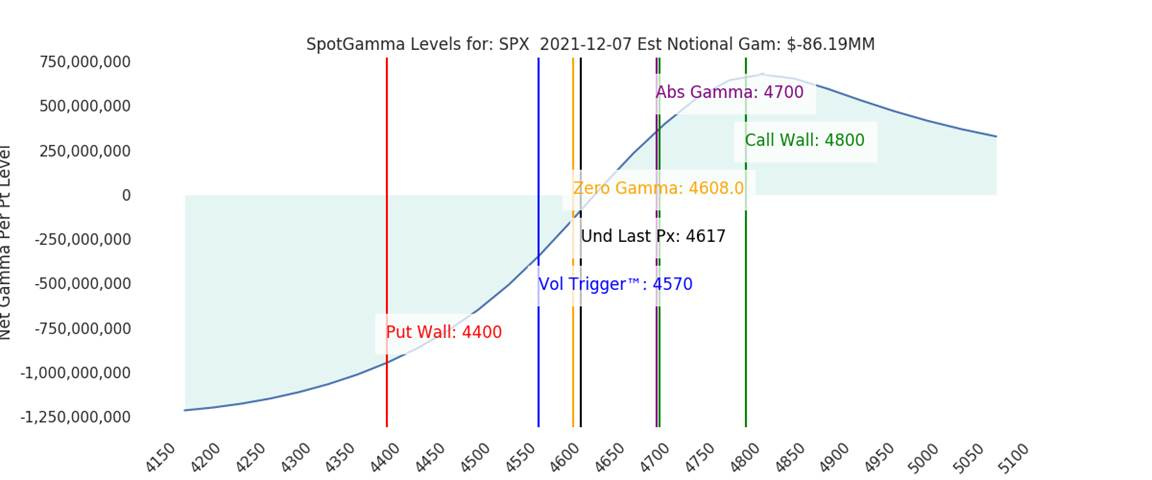

S&P optionality strike levels have the Zero-Gamma Level moved lower to 4608 while the Call Wall is at 4800. Positive gamma has increased while implied volatility is falling hard, helping a more vanna induced rally continue; however, there is strong resistance at 4700, and next week's FOMC meeting will floor how far implied volatility can fall.

S&P technical levels have support at 4670, then 4640, and resistance is at 4720. 4hr RSI(5) is indicating extremely overbought conditions and will need to cool before a fresh leg higher can push the S&P to new ATHs. 4575-95 is the absolute max lowest bulls want to see on any pullback, or new lows will likely follow.

Treasuries are lower, as the continuation of the rally has yields generally higher but significantly more in the belly thanks to the coming 3yr auction supply and a heavier than expected corporate calendar. The 5s30s curve is flatter by 02.5bps to 54bps.

*December is historically a positive returns month, even more so after a negative November

*Retail buyers have been the main dip buyers, with the largest recent retail inflow on record

*China’s credit impulse has likely bottomed now that Beijing is changing its tune and seasonalities are becoming more supportive, helping create easier financial conditions domestically

We noted Friday that optionality and technicals indicated a high level of uncertainty, but solid underlying fundamentals and subsiding Omicron and Fed tightening fears would allow equities to rally into year-end. Well, optionality and technicals have become more positive while Omicron is being viewed more fairly, and Fed tightening fears have become more neutral, increasing our confidence that we are currently seeing the beginning of a Santa Clause rally.

Although this week has brought on a more risk-on relief rally after a -5% correction in the S&P, we still have many of the same uncertainties (and a few new ones), giving us caution in being too overly aggressive in chasing the current rally but also taking comfort that the market is better positioned to reach new ATHs and that last week’s negative sentiment was overblown.

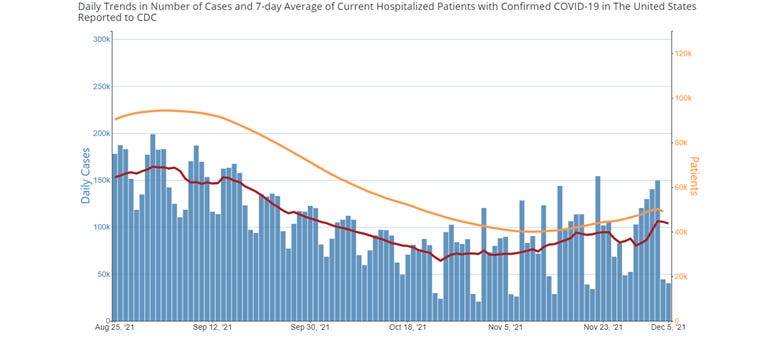

*Improvements in market volatility, momentum, and call/put ratio is helping the CNN Fear & Greed Index bounce these last two days

The Omicron strain looks to be the next logical evolution of the Covid virus, a milder yet more transmissible version, similar to what we have seen throughout history with other viruses (“antigenic drift”). As a result, we are less worried about it but await further information over the next few weeks. Elsewhere, the current Delta wave in Europe has not peaked meaningfully yet, and it is unclear what will ultimately occur in the U.S over this winter. However, as we have said before, we believe that the virus will always be with us (to some extent) and that each wave will have a decreasing effect on economic activity as we all learn to live with it, reducing our concerns around the current uptick (as it stands).

*Fortunately, although increasing, hospitalization rates are not rising in line with case counts, showing some herd immunity (resulting in less severe symptoms) is taking hold in the U.S.

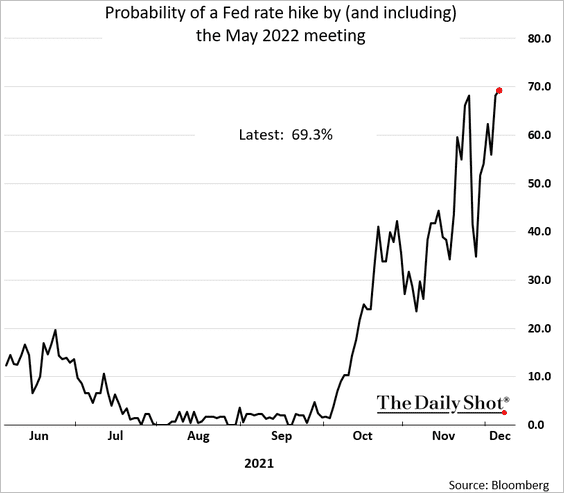

Turning to the Fed, we are currently in the pre-December FOMC-meeting blackout period, giving pause to the deluge of hawkish Fed speakers we had last week. While the more hawkish tilt towards a faster taper and bringing forward rate hikes tightened financial conditions (as best seen by the drop in equities and rising real rates), we still believe the Fed has a long road back to any “tight” policy stance.

*Markets are pricing in no pause between the end of a faster tappering and the first-rate hike, something we see as too aggressive for a historically dovish Fed.

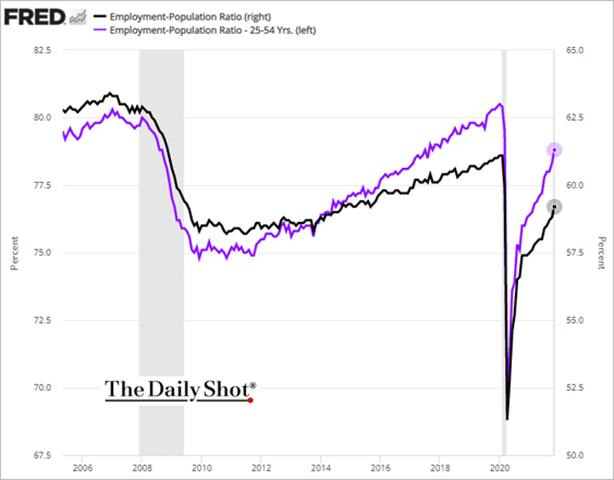

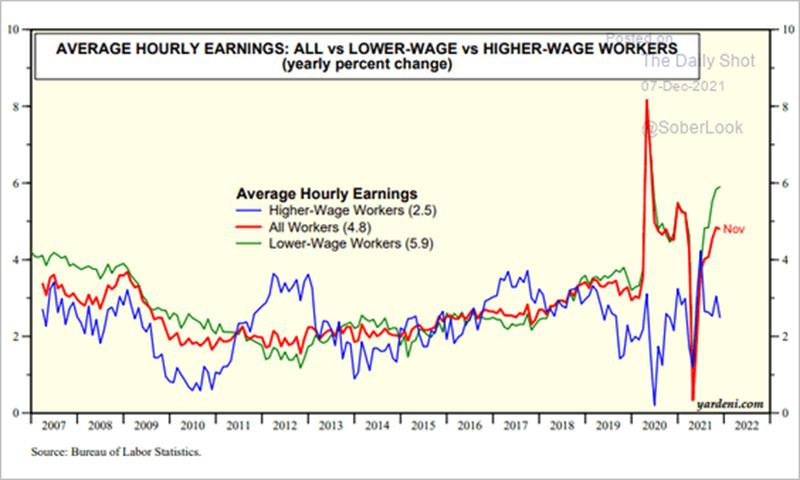

Inflation increases will slow in the first half of 2022, while more “inclusive” labor gains may not be “fully” achieved until mid-summer, capping how soon and fast rate hikes can occur in 2022 (despite markets increasingly pricing a rate hike in May). We expect (core) Fed members to communicate that the “maximum employment” level will still take time to be met following the December FOMC meeting, reducing rate hike expectations.

*The participation level of our economy may have been structurally reduced by the pandemic, making reaching pre-pandemic EPOP levels a more challenging task for the Fed

Supply-side-driven inflationary pressures are still marginally improving (despite headlines). Firms are evolving their supply-chain logistics to source needed goods and materials while labor is increasingly returning to needed areas. Although headlines still indicate shipping logjams and selective shortages, dwell times across logistical legs are falling, and price pressures and delivery times in business surveys are stabilizing.

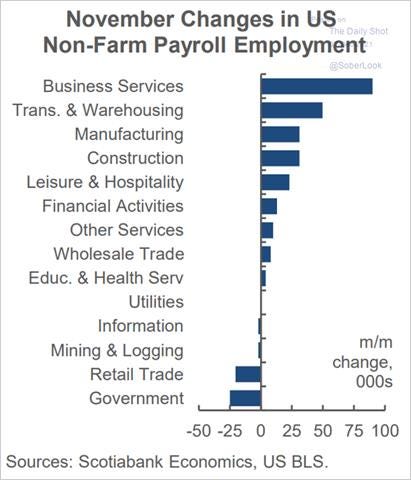

*Continued improvements in hiring in Transportation & Warehousing, Manufacturing, and Construction will help alleviate logistical, durable goods, and housing price pressures

Friday’s CPI should only show a marginal slowing in the monthly rate of increases, given the demand for pandemic-affected goods has not materially changed. At the same time, declines in energy costs are still too recent to work from headline to core. However, we continue to believe the worst of supply-side impairments/shortages are behind us, which will reduce inflationary pressures in the first half of 2022.

*Economists expect inflation to moderate but hold above 2% in 2022

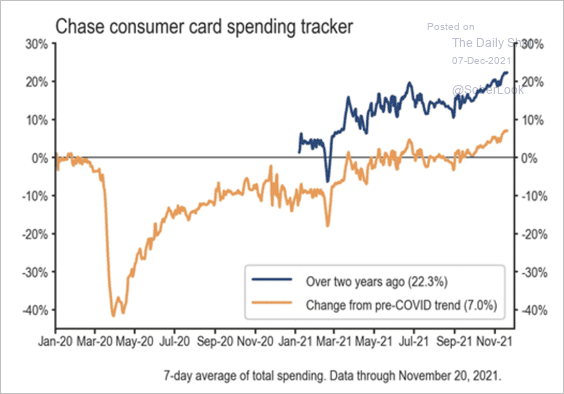

It is looking like Q4 will be peak growth as the first half of next year has greater headwinds (and uncertainties given Delta/Omicron). Still, consumers, especially lower-income ones, should continue to see supportive labor markets with rising wages, helping hold up aggregate demand, especially for services if the current Covid wave quickly subsides.

*Rising wages should continue to support consumer confidence in 2022 while reductions in inflationary pressures (specifically energy costs) lessen demand destruction

Coupled with continued high net household wealth levels and improving credit availability, improving availability of larger-ticket goods, less inflationary pressures generally, and a strong housing market, there should be no cliff effect on growth in H1 of ‘22 even if there is a greater fiscal drag.

*Despite Delta fears, D.C. uncertainty, higher inflation, and shortages, the U.S. consumer has been extremely resilient, and overall demand should remain strong well into 2022

Putting it all together (and really continuing our views from last Friday), we expect a further melt-up into year-end. Technicals and optionality for the S&P are increasingly more positive above 4600, but headline risk given continued uncertainties over Omicron/Delta and Fed intentions will likely keep volatility somewhat elevated. Finally, we note geopolitical macro headwinds from Russia (and China to a lesser extent) as well as D.C.’s “budgetary” abilities could quickly reduce risk appetite. The bottom line is to stay the course if you are already long equities but don’t chase rallies otherwise.

*Risks certainly remain, but the bounce-back rally over the last two days has reset optionality and technicals to a more positive tilt while buy-side deleveraging and increased downside protection put in place over the last two weeks have the S&P better positioned to melt up into year-end.

Econ Data:

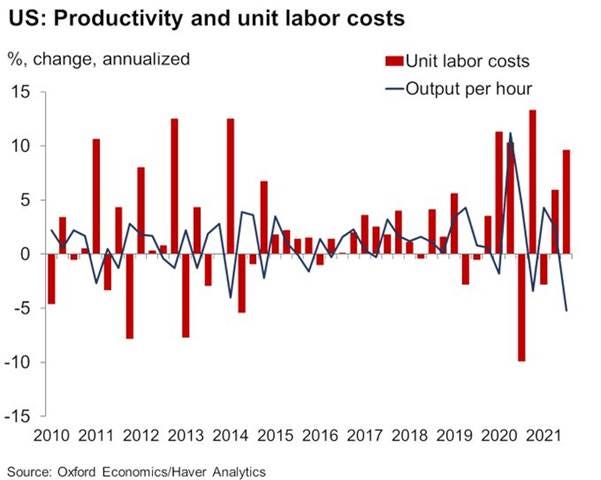

Nonfarm business sector labor productivity decreased -5.2% in the third quarter, as output increased 1.8% and hours worked increased 7.4%. From the third quarter of 2020 to the third quarter of 2021, nonfarm business sector labor productivity decreased -0.6%. Manufacturing sector labor productivity decreased -1.8% as output increased 5.1% and hours worked increased 7%. Unit labor costs increased at an annual rate of 9.6% in the third quarter, reflecting a 3.9% increase in hourly compensation and a -5.2% decrease in productivity.

Why it Matters: This is the largest decline in quarterly productivity since the second quarter of 1960. On a year-over-year basis, productivity fell -0.6%, which itself was the biggest decline since the second quarter of 1993. Again supply-side disruptions led to shortages of materials, capping production/capacity. Meanwhile, labor shortages increased the time worked by existing workers and the compensation they received. We see this drop in productivity reversing in the first half of 2022 as aggregate output becomes uncapped from improvements in the supply chain while labor shortages also abate. We also take comfort in the increased amount of Capex spending continuing to occur that will improve productivity over the long run.

*Our widely discussed supply-side disruptions are clearly seen in the historic quarterly drop in productivity as capped capacity and increasingly costly labor led to a yearly decline

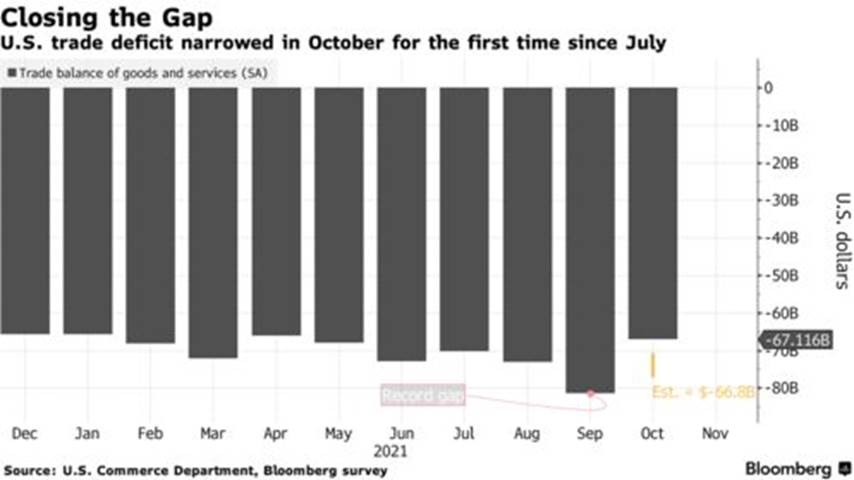

The gap in trade of goods and services shrank 17.6% to $67.1 billion, from a revised $81.4 billion in September. Imports to the U.S. increased by 0.9% MoM or $2.5 billion to a new record high of $290.7 billion in October. Exports from the U.S. increased by 8.1% MoM or $16.8 billion from a month earlier to $223.6 billion in October 2021, the highest level since the series began in 1950. The surge in exports were led by goods, which soared 11.1% to $158.7 billion, also a record high. Exports of industrial supplies and materials increased $6.4 billion, with crude oil shipments advancing $1.2 billion.

Why it Matters: The trade deficit saw the biggest percentage decline since April 2015. The goods deficit decreased $13.5 billion to $97.6 billion in October, adjusted for inflation. This is the smallest “real goods” deficit since last December, and if it continues to shrink, trade could positively contribute to gross domestic product this quarter. The trade gap has been a drag on GDP growth for five straight quarters. "We expect stronger export growth and moderation in import volumes to keep the deficit stable next year after reaching multiple record highs in 2021," said Mahir Rasheed, an economist at Oxford Economics in New York. Of course, we continue to see impaired supply chains and lean inventories supporting imports for some time, so any structural decreases in import demand should be gradual while a stronger dollar will weigh on exports somewhat.

*The value of goods and services exported rose 8.1% to $223.6 billion in October, the highest on record.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the week thanks to today's tech-heavy rally, with Small-Cap Growth outperforming on the day

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week and the day, with a notable rally overnight thanks to markets increasingly believing Beijing is changing its tune and becoming more macro supportive of the property market and economy.

5yr-30yr Treasury Spread: The curve is flatter on the week and today by -3bps as the market continues to believe the Fed will tighten too quickly and need to cut rates in 2024

EUR/JPY FX Cross: The Euro is stronger on the week and the day, with the risk-on tone helping the FX cross to continue bouncing off the bottom of its recent downtrend channel

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

China Macroprudential and Political Loosening:

Helping Housing: China Shifts Toward Easing as Property Downturn Hits Growth – Bloomberg

President Xi Jinping oversaw a meeting of the Communist Party’s Politburo on Monday that concluded with a signal of an easing in curbs on real estate. Monday’s meeting of the Politburo will be followed by the Central Economic Work Conference sometime this month, which will flesh out economic policy plans for the next year. China will focus on stabilizing macroeconomic conditions, ensuring the economy grows in a reasonable range and that society remains orderly ahead of the party’s key 20th congress meeting later next year, the Politburo said.

Why it Matters:

Beijing didn’t simply cut the RRR level but also changed its rhetoric towards supporting the property sector and economy. The Politburo statement didn’t include the phrase “houses are for living in, not for speculation,” language used in July and an essay by Vice-Premier Liu He last month. The statement in July focused on the need to control housing prices, which was mostly missing from Monday’s announcement. As a result, shares of Chinese real-estate developers jumped Tuesday on the dovish signal from the central bank, with a Bloomberg gauge of developers rising 3.2% to its highest since late November. Evergrande’s shares surged as much as 8.3%.

Consolidating: China Creates New State-Owned Logistics Giant – Caixin

China Logistics Group, with registered capital of 30 billion yuan ($4.7 billion), was created through a combination of China Railway Materials Group and four subsidiaries of China Chengtong Holdings Group. The new logistics operator owns 120 railway lines for exclusive use, with routes connecting Asia and Europe. It also has 42 warehouses designated for future delivery, other storage facilities covering 4.95 million square meters, and a transportation network consisting of 3 million licensed vehicles in 30 Chinese provinces and all major continents.

Why it Matters:

Beijing has continued pushing mergers and restructuring of state-owned enterprises in several industries, including logistics and rare earth minerals. These state-backed firms will likely enjoy substantial subsidization allowing them to operate at losses to gain market share (something we have often seen) from other private or foreign firms. This is precisely what the Trump and now Biden administration has tried to stop with the initial and now potentially new trade deals.

Something is Missing: Evergrande bondholders yet to be paid as crucial debt deadline passes – FT

Some investors in China Evergrande say they have not received required bond payments after the expiry of a 30-day grace period on Monday, as the world’s most indebted developer edges closer to a formal default. The company, which has delayed several international bond payments over recent months after a liquidity crisis forced it to battle for its survival, had $82.5m in coupons due on Monday, days after it signaled the need to restructure its debt.

Why it Matter:

Remember when the global market really cared about Evergrande missing a bond payment? Well, that’s not the case anymore, with the missed deadlines this week potentially triggering an official default for Evergrande not hurting stock and bond performance. In fact, Evergrande’s stock rallied today due to changing posture from Beijing, as discussed above. The point is sentiment is changing toward the property sector in China, giving us comfort that we changed our medium-term theme on China’s Macroprudential policy from tightening to loosening at the right time.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Where are We?: China Increasingly Obscures True State of Its Economy to Outsiders – WSJ

China is increasingly obscuring the true state of its economy to outsiders. New data restrictions have made it harder for foreigners to get details on what’s happening inside China, including port activity, supplies, and political dissent cases. Companies and governments are left trying to figure out how to engage. A recent new data-security law has made it even harder for foreign companies and investors to get information, including about supplies and financial statements.

Why it Matters:

China’s increasing secrecy isn’t the result of any single policy, businesspeople and political analysts say, but rather a combination of factors: a response to the pandemic, growing concerns about data security, and a political environment in which the outside world is viewed with suspicion. Remember, the Chinese consumer is one of Beijing's ultimate assets, something it often uses to incentivize foreign firms to share critical IP and make investments domestically. By obscuring the current slowdown, Beijing hopes to continue to attract FDI based on promises to further “liberalize” its economy, but centralized control is only increasing, as are tensions/aggressions against foreigners.

Electrification and Digitalization Policy:

Selective Buyers: Israel Tightens Rules on Cyber Exports After String of Scandals - Bloomberg

Israel said it would tighten supervision over the sale of cybersecurity exports, a decision that comes after a string of scandals involving foreign governments allegedly abusing technology developed by Israeli firms like NSO Group to spy on civilians. Countries will only be able to buy Israeli technology after signing a declaration that they will use it “for the investigation and prevention of terrorist acts and serious crimes only,” Israel’s Ministry of Defense said in a statement on Monday.

Why it Matters:

Foreign governments such as Mexico and Saudi Arabia have allegedly used NSO’s Pegasus software to hack the mobile phones of journalists and dissidents. Several U.S. State Department employees were also recently hacked with NSO spyware. The U.S. blacklisted NSO earlier this month. So bottom line, the story is still very much developing, and although this is a positive step in the right direction, it's doubtful Israel’s government will be able to monitor how tech from their national firms are used fully.

Commodity Super Cycle Green.0:

Not So Fast: The headline says ammonia – the detail says methanol – Splash247.com

To read the maritime headlines is to believe that shipping’s ‘White Knight’ is already here in the form of ammonia. True, ammonia has no carbon emissions when combusted, but there is a problem. Though the technology is emerging, a lack of supply of conventional, let alone renewable product means ammonia will need a support act. The article goes on to highlight a recent paper by Maersk on various fuel option scenarios that the shipping industry may take as it moves to a zero-carbon world.

Why it Matters:

Post-COP26, post-MEPC 77, shipping faces an inevitable but uncomfortable truth; the journey to a low carbon future has still only just started. What seems likely is that the market (shipowners, charterers, financiers) will move further and faster than the regulators. Using the most recent ship efficiency regulations as the spur, they will make operating inefficient, polluting ships unattractive enough to move the needle. However, the fuel of choice or the end state is still uncertain, and predicting it as new technologies and trends emerge may be premature.

Upgrading: ExxonMobil targets net-zero Permian ops by 2030 – Argus

Exxon said it would reach net-zero greenhouse gas (GHG) emissions in the region straddling New Mexico and Texas by electrifying operations, putting more investments in methane mitigation and detection technology, upgrading equipment, phasing out routine flaring, and buying offsets. By the end of 2021, the company plans to reduce flaring across its Permian operations by more than 75% from 2019 levels.

Why it Matters:

The plans are part of ExxonMobil's latest corporate-wide bid to reduce upstream greenhouse gas emissions intensity by 40-50% by 2030, compared with 2016 levels. Still, the company has drawn criticism that it is lagging behind its European rivals in tackling emissions. Think tank Carbon Tracker said ExxonMobil's recently unveiled plans only cover a fraction of total emissions and are inconsistent with the goals of the Paris climate agreement.

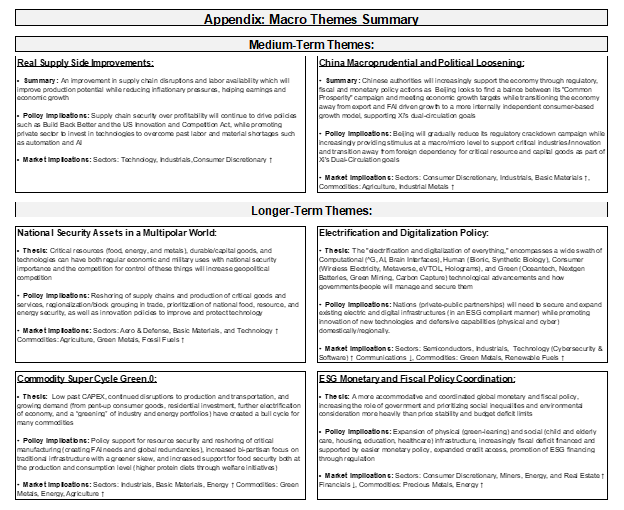

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.