MIDDAY MACRO - 12/6/2021

Daily Color on Markets, Policy, and Geopolitics

MIDDAY MACRO - DAILY COLOR – 12/6/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Narratives/Price Action:

Equities are higher, as Omicron fears have subsided slightly despite still rising Delta cases domestically as dip buyers are favoring reflationary/reopening sectors/factors

Treasuries are lower, with the curve slightly flatter but the entire yield curve generally higher by 6-7bps 5yrs and out

WTI is higher, helped by hospitalization rates still staying low in Omicron hit areas as fears over further pandemic induced lock-downs and travel bans are subsiding for now

Analysis:

Markets have a dip-buying risk-on feel thanks to Omicron fears subsiding while (soon to occur) defaults by Evergrande seem less problematic thanks to the PBOC cutting their RRR. Oil and commodities (more generally) are also gaining as the reflation trade looks to be basing and regaining some momentum. Treasuries are under pressure across the curve as a result of the more positive outlook, while the dollar remains near recent highs after a strong overnight session.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, High Dividend Yield, and Value factors, and Utilities, Consumer Staples, and Real Estate sectors are all outperforming.

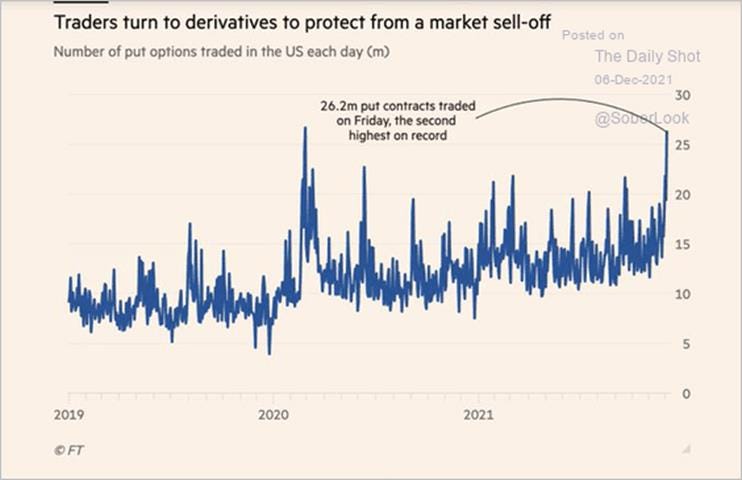

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4620 while the Call Wall is at 4800. Downside protection has gotten expensive, with high levels of put buying last week, leaving the market “over hedged” now and making it harder for it to crash. Above 4600, the dealer hedging reinforces a bullish feedback loop, but under 4500, the selling speeds up until next Friday’s December Opex, which will see a large amount of puts expire.

S&P technical levels have support at 4570, then 4530 (50-dma), and resistance is at 4590, then 4630. Momentum continues to become more positive after the end-of-day Friday bounce-off lows to close right above the 50-dma. Not much support below the 50-dma with the next big level around 4435.

Treasuries are lower, as the risk-on tone has the belly underperforming slightly, moving the 5s30s curve flatter by 0.5bps to 55bps. We have entered the pre-December FOMC meeting blackout period, and this week brings 3, 10, and 30yr auction supply.

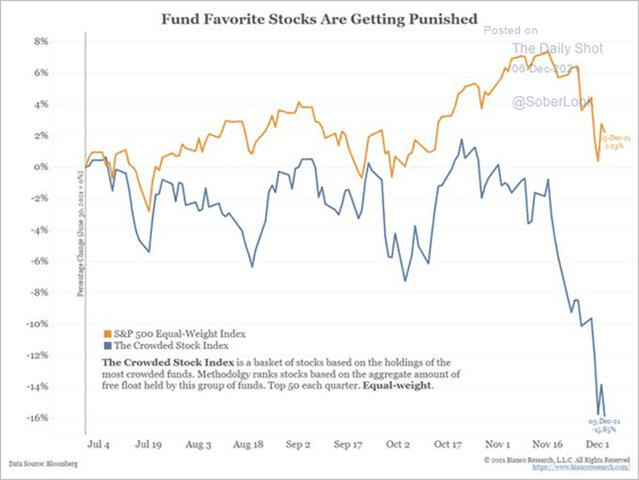

*Asset managers/hedge funds reduced their positions dramatically these last two weeks in the most popular “buy-side” held stocks

*The market is significantly more “hedged,” but a break below 4500 on the S&P will see increased dealer selling to hedge those “hedges”

*The S&P has historically risen after the VIX hits the levels seen last week

*We are in uncharted territory with the removal of “extraordinary” accommodations from tapering flattening the yield curve to a degree normally only seen during rate-hiking cycles

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the week and on the day, with Mid-Cap Value outperforming on the day and Growth now down -2.5% in a week

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week and the day, with a top government think tank predicting GDP growth of 5.3% in 2022

5yr-30yr Treasury Spread: The curve is flatter on the week and today as the curve is generally shifting higher by 6bps today

EUR/JPY FX Cross: The Euro is stronger on the week and the day, with the risk-on tone helping the FX cross bounce off the bottom of its recent downtrend channel

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

China Macroprudential and Political Loosening:

Starting to Move: PBOC cut RRR by 50 basis points to release 1.2 trillion yuan long-term funding – Yuan Talks

The PBOC will cut the reserve requirement ratio (RRR) for commercial banks by 50 basis points, effective from December 15, which will release about 1.2 trillion yuan ($188 billion) of long-term funding, the PBOC said in a statement on Monday. This is the second time the central bank has reduced the RRR this year. The latest cut will lower financial institutions’ weighted average RRR ratio to 8.4% and reduce their funding costs by about 15 billion yuan a year.

Why it Matters:

The PBOC’s announcement of the RRR cut comes much earlier than expected, and it’s a broad-based cut, the scale stronger than the market thought, said Mao Lei, analysts at Guotai Junan Futures. Mao said that expectations for further monetary easing grow after the latest cut, and the market expects another RRR cut next year. Notably, “previous RRR cuts by the PBOC were mainly meant to increase liquidity and to lower funding costs, but this time the central bank said the RRR is also aimed to strengthen financial institutions’ capacity in capital allocation,” said Yan Yuejin, research director at the E-House China R&D Institute. Yan said that banks are likely to increase home mortgage loans against the backdrop of a cash crunch in the real estate sector.

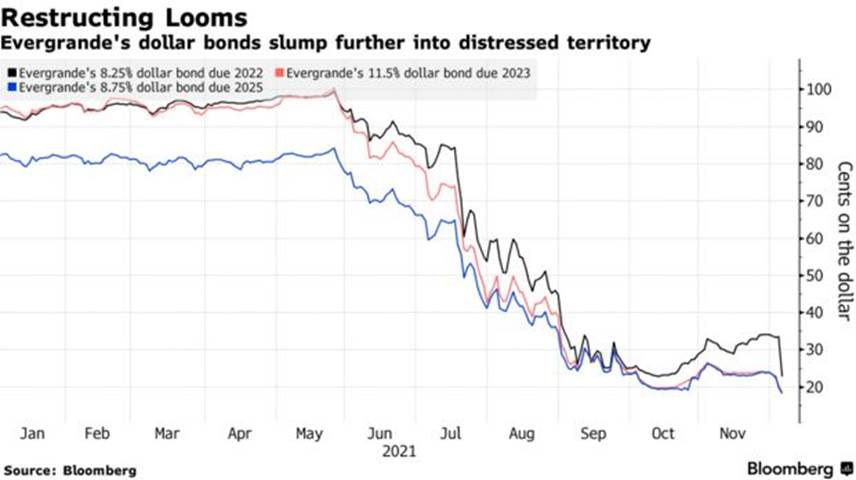

End Game: Evergrande to Include All Offshore Bonds in Restructuring – Bloomberg

China Evergrande Group is planning to include all its offshore public bonds and private debt obligations in a restructuring that may rank among China’s largest ever. Evergrande formally acknowledged the need to restructure its offshore debt for the first time on Friday. Grace periods for interest payments on two notes from Evergrande’s Scenery Journey unit end Monday and could mark the developer’s first default on public debts.

Why it Matters:

The question for global markets is whether Beijing can coordinate a restructuring without upending the broader real estate sector, which accounts for nearly a quarter of economic output. Stepping back, Chinese borrowers have defaulted on a record $10.2 billion of offshore bonds in 2021, with real estate firms making up 36% of that total. That has pushed yields on an index of Chinese junk bonds, many of which come from property firms to near-record highs above 22%. It seems unlikely renewed panic will hit markets as real estate companies with poor management and high financial risk will be “phased out.” At the same time, policymakers will find ways to support the property market while Xi still looks to be fighting the “moral hazard” in markets that companies like Evergrande embody.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Consolidating: China Set to Create New State-Owned Rare-Earths Giant – WSJ

China has approved the creation of one of the world’s largest rare-earths companies to aim to maintain its dominance in the global supply chain of the strategic metals as tensions deepen with the U.S. The new firm will be called China Rare Earth Group and will be based in resource-rich Jiangxi province in southern China as soon as this month. The new entity would be created by merging rare-earths assets from some state firms, including China Minmetals Corp., Aluminum Corp. of China Ltd., and Ganzhou Rare Earth Group Co.

Why it Matters:

The effort to consolidate the country’s position in rare earths comes at a time of increased sensitivity in the West that China could use its dominance in the industry as a geopolitical weapon. Some analysts say China mines more than 70% of the world’s rare earths and are responsible for 90% of the complex process of turning them into magnets. A White House report has estimated that China controls 55% of the world’s rare-earth mining and 85% of the refining process. China has no intention to use rare earths as a countermeasure against any country, the state-run Global Times wrote earlier this year, though it added that it remains an option when “foreign companies hurt China’s interests.”

Electrification and Digitalization Policy:

Counter: U.S. Military Has Acted Against Ransomware Groups, General Acknowledges – NYT

The U.S. military has taken actions against ransomware groups as part of its surge against organizations launching attacks against American companies. The nation’s top cyber warrior General Nakasone said the first public acknowledgment of offensive measures against such organizations on Saturday. Cyber Command, the N.S.A., and other agencies have poured resources into gathering intelligence on the ransomware groups and sharing that better understanding across the government and international partners.

Why it Matters:

Government officials have disagreed about how effective the stepped-up actions against ransomware groups have been. National Security Council officials have said activities by Russian groups have declined. The F.B.I. has been skeptical. Some outside groups saw a lull but predicted the ransomware groups would rebrand and come back in force. Asked if the United States had gotten better at defending itself from ransomware groups, General Nakasone said the country was “on an upward trajectory.” But adversaries modify their operations and continue to try to attack, he said.

Ad Trends: Three tech giants control half of the advertising outside China - FT

Google’s parent company Alphabet, Facebook owner Meta and Amazon have doubled their share of ad revenues in the past five years, according to estimates from media buyers GroupM. The figures, which come at a time of heightened regulatory scrutiny of Big Tech, show digital defied the contraction in other advertising channels in 2020 and is expected to surge another 30.5% globally this year to $491bn, dwarfing other categories.

Why it Matters:

Online privacy concerns have done little to halt the digital marketing boom (so far), which has helped put global ad expenditure on track to rise this year more than previously expected. The report published on Monday showed the global ad industry overall, excluding US political advertising, was set to generate $763bn in revenues in 2021, a sharp year-on-year increase and also up 18.7% from 2019. The bottom line is that there has been no change in online ad behavior/revenue yet due to changes to privacy policies.

Commodity Super Cycle Green.0:

National Assets: Chile candidate vows to create state lithium firm – Argus

Chile's leading presidential candidate Gabriel Boric is pledging to create a state-owned lithium company, potentially diverting strategic growth away from private-sector producers, Chile's SQM, and US firm Albemarle. "Chile cannot again commit the historic mistake of privatizing resources, and for that, we will create the National Lithium Company, generating jobs in their reservoirs and a Chilean seal on the product," Boric said on social media today during a campaign visit in northern Chile's mining territory.

Why it Matters:

Critics of Boric's lithium proposal say the Chilean state already plays a role in the sector through state-owned copper mining company Codelco, which has undeveloped lithium licenses. Although the proposal was part of Boric's original platform along with other state-owned initiatives, the candidate has been moderating his proposals since last month's elections in an effort to win over centrist voters. The recent tweets suggest he is not backtracking as far as Chile's business community is hoping to see.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.