MIDDAY MACRO - DAILY COLOR – 1/25/2022

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are lower, reversing half of yesterday’s late-day gains overnight and increasingly after the NY open but now consolidating with Large-Cap Value and the Energy Sector outperforming

Treasuries are lower, with the curve little changed as today’s economic data was mixed and didn’t materially change uncertainty surrounding tomorrow’s FOMC meeting

WTI is higher, as supply constraints and continued geopolitical risk move back into the forefront after a more risk-off session yesterday

Narrative Analysis:

Equities are again in the red, but price action is more range-bound currently as the high levels of optionality and continued uncertainty regarding the Fed and geopolitics have the S&P giving up around half of yesterday's end-of-day gains but attempting to bounce again currently. There was a broader relief rally in Europe, while energy and commodities are generally higher on the day, indicating that fundamentals are conflicting with now oversold conditions in equities. Treasuries are slightly lower, with the curve little changed as traders await tomorrow's FOMC meeting results. The dollar has finally meaningfully strengthened, helped by the flight to safety, with the $DXY now above 96.

The S&P is outperforming the Russell and Nasdaq with High Dividend Yield, Value, and Low Volatility factors, and Energy, Financials, and Consumer Staples sectors all outperforming.

S&P optionality strike levels have the Zero-Gamma Level at 4595 while the Call Wall has risen to 4800. Yesterday’s reversal rally reduced negative gamma levels, but price action will remain choppy until implied volatility declines and puts are removed, which will not likely occur until post-FOMC tomorrow and some form of de-escalation in geopolitics. Dealer’s tail-risk hedges are also now becoming more supportive and reducing the need to sell futures. When coupled with the build in put positioning around current levels, the downward negative feedback loop is reduced.

S&P technical levels have support at 4280, then 4230, and resistance is at 4320, then 4380. The S&P is still in a relief bounce above 4280, but a close nearer to 4380 is critical to recapturing positive momentum. The 4280 level will be less likely to hold again if retested, and this opens up new lows if broken.

Treasuries are lower, with the 10yr yield now at 1.76%, while the 5s30s curve is little changed on the day at 0.56 bps. The $55 billion 5yr auction was uneventful at 1 pm today.

We continue to believe the current sell-off is overdone and are willing to dip our toes in the water a little even though the knife may still be falling. We believe that tomorrow's FOMC meeting will bring no hawkish surprises (reducing implied volatility) while the situation between Russia and Ukraine will drag on at its current level into February. This will allow fears over both too cool, markets to shift attention to earnings and the reopening, helping volatility drop and the major indexes to recover some of their current YTD losses.

We are adding a 5% long position in the Invesco Buy-Back Achievers ETF ($PKW) at $88.60. We see the future environment of greater regulatory scrutiny on mergers and acquisitions as well as the recent drop in equity valuations as compelling corporate treasuries to be more active in buying back stocks in the next few quarters (more than already expected).

*The recent pullback and significant corporate cash holdings, along with an increased reluctance to engage in big-ticket purchases, will help increase buybacks in ‘22

We also moved down our stops for our oil, robotics, REITs and Russell longs. With the VIX already in the mid-30s and optionality and short positioning becoming overly pessimistic, this is not a time to be selling. We would rather wait to see an actual tangible negative development from the Fed or Russia than sell on what we see as overly negative speculation.

*Markets have a December ’18 feel to them, with the VIX following a similar move higher to the 35ish levels, before equity indexes meaningfully rallied back

Instead, we believe tomorrow’s FOMC results will confirm that March will be a live meeting for only a 25bp hike, but the balance sheet policy is still being formulated. The Fed will reiterate they are effectively at “full employment” but acknowledge Omicron has slowed growth and continued to muddy the labor participation data. Further, we continue to see signs inflationary pressures have peaked and think this will allow for the Fed to guide towards only four rate hikes this year at most. This will also allow them to move back quantitative tightening plans into Q4, as tighter financial conditions are already doing some heavy lifting for them.

*The Fed will want to ease the pace of financial condition tightening that has occurred as they continue to believe inflation is transitory but prolonged by the continuation of the pandemic

We acknowledge that the situation regarding Russia and Ukraine is very volatile and that some level of incursion is highly likely. Russia is spending a great deal of money and political capital to move its military assets to the Ukrainian border, and it is unlikely to do that for nothing. However, as with its invasion of Crimea, we see very little real impact on global growth or U.S. risk assets in the long run if this were to happen. As a result, we would expect any further negative price impact to be short-lived (assuming it’s a small incursion).

*There have been no signs of de-escalation yet, and February will bring better weather conditions for Russia to move, so the geopolitical risk will remain high for a while longer

Putting it all together, we are buyers of this dip with the belief that the current Fed and Russia/Ukraine fears are overdone, and although financial conditions have tightened, there is still a supportive backdrop for earnings growth and hence equity performance. There may be a further drop, and a retesting of the recent lows and then a bounce would give us a stronger conviction that the low was in. Nevertheless, on a longer-term basis, we are at a good entry point for exposure to large-cap value stocks of companies with a history of buybacks.

*Despite growing losses, we believe a relief rally is coming and are moving down stops for now with expectations the passage of the FOMC tomorrow will help lower implied vol and support a bounce

OPERATIONS NOTE IN APPENDIX

Econ Data:

The Richmond Fed Manufacturing Index fell from 16 in December to 8 in January. Declines in the indexes for New Orders (6 vs. 17 in Dec) and employment measures were the main negative driver while Shipments (14 vs. 12) improved. There were also significant drops in Backlog of Orders (2 vs. 26) and Capacity Utilization (4 vs. 21). Inflationary pressures seen through Prices Paid (14.32 vs. 13.98) and Prices Received (11.27 vs. 8.26) also increased. Vendor Lead Times also worsened, showing little progress on the logistical front. Inventories and Capital Expenditures were mixed. Future expectations generally held up better then-current conditions but did deteriorate.

Why it Matters: This was not a very good report. Not only were there notable slowing in current conditions, but supply-side impairments also worsened, and inflationary pressure that has begun to weaken elsewhere increased in the fifth district. Employment hiring moderated while firms expected wages to increase further, with the wage index at the second-highest value on record. Even capital expenditures were mixed with FAI improving while IT spending dropped, made worse by future expectations decreasing for both

*The Richmond Survey tends to have a weaker correlation to the national PMI, still the drop in many of the underlying components was troubling

*Expectations held up better than Current Condition components as this report had widespread weakness

The Conference Board Consumer Confidence Index declined to 113.8 in January, after an increase to 115.2 in December. The Present Situation Index improved to 148.2 from 144.8 last month, and the Expectations Index declined to 90.8 from 95.4. Consumers’ optimism about the short-term business conditions outlook declined in January. Consumers were also less optimistic about the short-term labor market outlook.

Why it Matters: “The Present Situation Index improved, suggesting the economy entered the new year on solid footing… the proportion of consumers planning to purchase homes, automobiles, and major appliances over the next six months all increased… Meanwhile, concerns about inflation declined for the second straight month but remained elevated after hitting a 13-year high in November 2021. Concerns about the pandemic increased slightly amid the ongoing Omicron surge. Looking ahead, both confidence and consumer spending may continue to be challenged by rising prices and the ongoing pandemic.” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board

*Present Situation picked up slightly while Expectations were weaker

The S&P CoreLogic Case-Shiller 20-city home price index in the US rose 18.3% YoY in November, rising 1% MoM, the least since May but slightly above forecasts of 18%. Phoenix (32.2%), Tampa (29%), and Miami (26.6%) continued to record the highest annual increases. Prices were strongest in the South and Southeast (both 25%). The national index, covering all nine US census divisions, grew 18.8% YoY down from 19% in the previous month.

Why it Matters: The housing market remains hot but is finally showing some signs of cooling. Eleven of the 20 cities reported higher price increases in the year ending November 2021 versus the year ending October 2021, showing some slowing recently. As supply improves into the spring and mortgage rates increase, prices should moderate further but will likely still have historically strong increases in 2022.

The IHS Markit US Composite PMI slumped to 50.8 in January from 57 in the previous month. New orders continued to rise, albeit at the weakest rate since December 2020, while export order growth eased due to renewed restrictions in key export markets and raw material shortages. Employment only rose modestly; however, backlogs of work continued to increase. On the price front, input cost inflation softened to the lowest since last March, while the pace of selling price increases was the third-fastest on record. Finally, business confidence weakened due to concerns regarding further price rises and client responses to inflationary pressures.

Why it Matters: The slowdown in output growth was broad-based, with both manufacturing and service sector firms reporting near-stalled output as the steep spike in virus cases associated with the Omicron wave meant ongoing supply issues and labor shortages were exacerbated by renewed pandemic related containment measures. “However, output has been affected by Omicron much more than demand, with robust growth of new business inflows hinting that growth will pick up again once restrictions are relaxed. Furthermore, although supply chain delays continued to prove a persistent drag on the pace of economic growth, linked to port congestion and shipping shortages, the overall rate of supply chain deterioration has eased compared to that seen throughout much of the second half of last year,” said Chris Williamson, Chief Business Economist at IHS Markit

*U.S. private sector output growth slowed to an 18-month low in January, according to the latest flash PMI data

The Chicago Fed National Activity Index decreased to -0.15 in December from an upwardly revised +0.44 in November, suggesting there was a contraction in economic activity following a two-month period of expansion. Production-related indicators contributed –0.13 to the CFNAI in December, down from +0.25 in November, while the contribution of the personal consumption and housing category decreased to –0.19 from –0.02. The contribution of the sales, orders, and inventories category fell +0.03 in December from +0.05 in the previous month, and employment-related indicators contributed +0.13 to the index, down slightly from +0.16

Why it Matters: Two of the four broad categories of indicators used to construct the index made negative contributions in December, and all four categories deteriorated from November. Thirty-eight of the 85 individual indicators made positive contributions to the CFNAI in December, while 47 made negative contributions. This general summary of economic activity confirms that Omicron had a significant drag on activity in December and likely will also lead to a negative CFNAI print in January before activity begins to recover in February.

*Production and consumption activity notably declined in December as Omicron again limited consumer activity and production capacity

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the day and week, with the ratio now entering oversold conditions. Large-Cap Value is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and week again despite pressure on equities and other metals elsewhere in China

5yr-30yr Treasury Spread: The curve is unchanged on the day and steeper on the week as traders await tomorrow’s FOMC meeting results

EUR/JPY FX Cross: The Yen is higher on the day and the week as the risk-off tone and increased geopolitical risks weigh on the Euro

Other Charts:

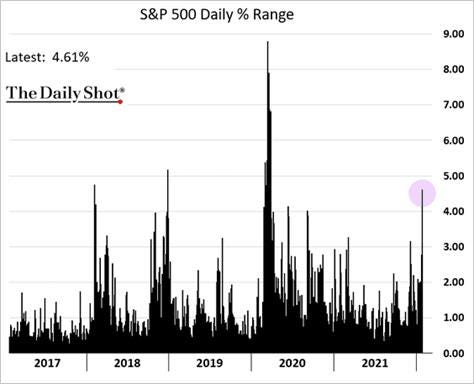

Big moves in markets are occurring as the S&P rose 4.6% in its intraday recovery bounce yesterday

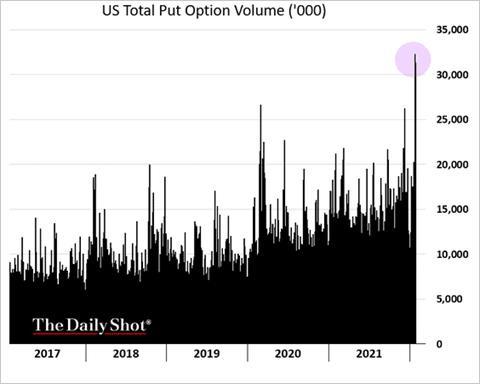

Demand for puts exploded, which is leaving dealers heavily negative gamma, increasing the volatility and intraday ranges but current levels are increasingly supported by tail-risk hedges

Growth slowed significantly in December due to Omicron, as clearly seen in yesterday’s Markit PMI data, with the service sector hit the hardest.

The slowing in the service sector is also clearly seen in the drop in spending on entertainment through higher frequency credit card data.

The increased volatility and move in markets has already tightened financial conditions considerably even while the Fed continues to expand its balance sheet.

The slowing of growth in the global M2 money supply correlates strongly with financial conditions tightening but global central bank balance sheets are expected to still grow by $1 trillion in 2022.

The 5-year/5-year inflation breakeven rate, a Fed favorite to gauge inflation expectations, has dropped back to 2.0%.

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Easing: Omicron Slows Europe’s Economy but Supply-Chain Strains Ease – WSJ

Eurozone businesses reported that worker absences due to infection were a drag on activity in both services and manufacturing, but they also reported a further easing in supply-chain issues and a slowdown in the rate at which their raw material and input costs were rising. However, they raised their prices at the fastest pace on record, an indication that consumer-price inflation is set to remain high over the coming months.

Why it Matters:

Yesterday’s round of global PMIs showed a deceleration in global economic activity. However, the effects of Omicron are less pronounced on the supply side (verse service demand) as production shutdowns and logistical impairments have been less pronounced. “After a slowdown in growth, we expect economic activity to pick up later in the year,” said Rory Fennessy, an economist at Oxford Economics. “Ultimately, Omicron should not significantly alter the overall growth outlook for 2022.”

China Macroprudential and Political Loosening:

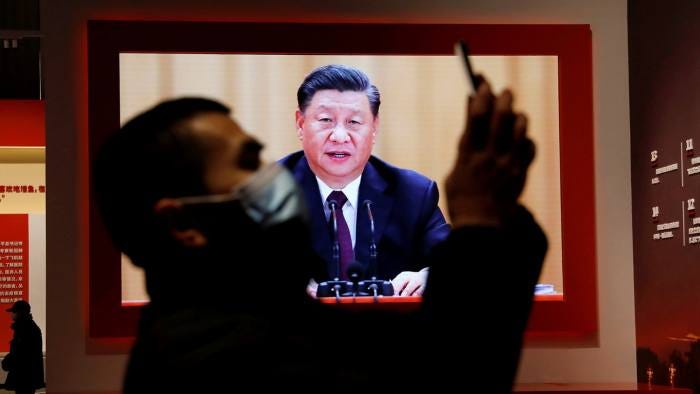

Cleaning Up: China launches internet ‘purification’ campaign for the lunar new year – FT

The Cyberspace Administration of China, the country’s top internet regulator, has instructed officials to sweep away “illegal content and information” and target celebrity fan groups, online abuse, money worship, child influencers, and the homepages of media sites. The edict is the latest step in Beijing’s clampdown on the entertainment industry as authorities purge content deemed immoral, unpatriotic, and non-mainstream from online culture.

Why it Matters:

President Xi Jinping has unleashed a broader effort to reshape Chinese social mores and culture, diminishing materialism and western influence in favor of a more nationalistic and homegrown approach. Many celebrities have found themselves blacklisted from television and online media, and China’s cyberspace regulator is eager to keep disgraced public figures from returning to the limelight.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Next-Gen: Japan steps up quantum push as U.S. and China forge ahead – NikkeiAsia

Japan will revamp its national quantum technology strategy, aiming to become self-sufficient in the area as the U.S. and China continue to make progress on mastering the critical next-generation technology. The current strategy focuses on basic research by such institutions as universities. Tokyo will now look beyond that and cultivate industry through such measures as support for startups.

Why it Matters:

The U.S. and China now hold a clear lead. "In quantum computing, quantum communication, and quantum sensing -- three consequential subfields within quantum information science (QIS) traditionally led by American researchers -- China is catching up and, in some cases, has already overtaken America," according to a December report from Harvard University's John F. Kennedy School of Government. The paper cites China's fast-growing number of patent filings in the field, which totaled 1,157 in 2018, compared with 363 in the U.S. and just 53 in Japan.

Electrification and Digitalization Policy:

Resiliency: SEC Looks to Bolster Market’s Cyber Defenses – WSJ

Mr. Gensler said the agency is considering extending a rule known as Regulation Systems Compliance and Integrity, or Reg SCI, to large financial firms it doesn’t currently cover, such as market makers and broker-dealers. The rule, which currently applies to stock exchanges, clearinghouses, and similar entities, requires firms to conduct testing for cybersecurity issues, back up their data, and have business continuity plans in the event of a breach.

Why it Matters:

Regulators have recently stepped up scrutiny of how companies respond to attacks by hackers generally, and it is no surprise the SEC is looking at regulating additional critical entities. Kenneth Bentsen, president of SIFMA, said he welcomed Mr. Gensler’s remarks, adding that cybersecurity is already a top priority for the financial industry. On top of expanding Reg SCI firms, the SEC is considering how to ensure service providers (index providers, custodians, and data vendors) are held accountable for cyber security. We expect more rules to be coming soon.

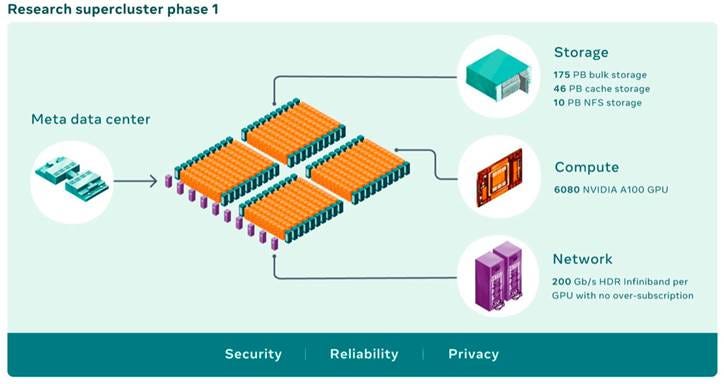

RSC: Meta has built an AI supercomputer it says will be world’s fastest by end of 2022 – The Verge

Meta says its new AI Research SuperCluster, or RSC, is already among the fastest machines of its type and, when complete in mid-2022, will be the world’s fastest. RSC will be used to train a range of systems across Meta’s businesses: from content moderation algorithms used to detect hate speech on Facebook and Instagram to augmented reality features that will one day be available in the company’s future AR hardware.

Why it Matters:

Rivals like Microsoft and Nvidia have already announced their own “AI supercomputers,” which are slightly different from what we think of as regular supercomputers. The article explains the two types of systems, known as high-performance computers (HPCs), that the industry is working on and the different potential uses. For Meta, that work means building moderation systems at a time when trust in the company is at an all-time low and means creating a new computing platform (Metaverse) that it can dominate in the face of rivals like Google, Microsoft, and Apple.

ESG Monetary and Fiscal Policy Expansion:

Data: Banks Handed New ESG Reporting Requirements by EU Watchdog - Bloomberg

The European Banking Authority has unveiled a new set of mandatory templates, tables, and instructions that banks will have to follow after a review of environmental, social, and governance (ESG) reports found “shortcomings.” The EBA reporting requirements, which still need to be approved by the European Commission, aim to provide comparability across bank books and show how the fallout from climate change could accelerate, worsening other risks.

Why it Matters:

The regulator said that the new rules give banks far less leeway to cherry-pick what to disclose or to use exaggerated language to describe what they’re doing. The EBA’s requirements form part of Europe’s broader climate agenda. The bloc last year became the first to force asset managers to document their ESG claims. This year, the EU will see the first reports from companies and the financial sector showing how well their businesses line up with a list of environmentally sustainable activities.

Exploiters: US antitrust head will look to block deals that ‘lessen competition’ - FT

Jonathan Kanter, in one of his first speeches as head of the justice department’s antitrust division, on Monday said his unit should, in most cases, seek to block tie-ups that were “likely to lessen competition” rather than pursue “complex settlements. . . [which] suffer from significant deficiencies”. Preserving existing competition could be more effective than predicting the effect of a divestiture, Kanter added. “That will often mean that we cannot accept anything less than an injunction blocking the merger — full stop.”

Why it Matters:

The justice department’s tougher stance on antitrust law enforcement comes as the administration seeks to crack down on anti-competitive conduct. The president appoints progressives who have historically called for stricter measures to critical competition roles. Given the pressures Biden is feeling on the inflation front, he will be using his newly created competition council to strengthen cooperation among antitrust agencies to win cases challenging anti-competitive behavior.

Midday Macro will be off for a week, returning next Thursday, 2/3/2022 as we take a potentially great or ill-timed vacation to the west coast depending on where markets go from here. - Mike

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.