MIDDAY MACRO - DAILY COLOR – 12/3/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Narratives/Price Action:

Equities are lower, as markets are again focused on increasing case counts/Omicron and a more hawkish Fed despite solid domestic data

Treasuries are higher, with the curve slightly steeper as a weaker headline NFP helped the belly

WTI is lower, reversing an overnight rally as OPEC+ did not change plans to raise output in January but gave itself optionality based on Omicron developments which traders saw as supportive to prices initially

Analysis:

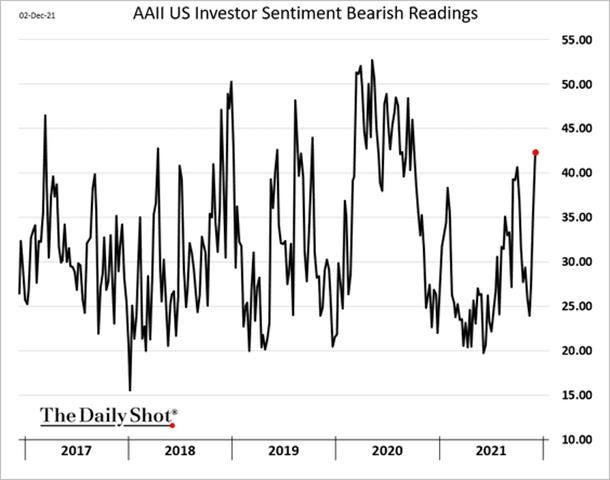

Equities are again under significant pressure, with the S&P now approaching recent lows despite a neutral jobs report and a better than expected Service PMI. Continual virus-related headlines and furtherer hawkish Fed commentary are driving volatility higher and reducing participation as market breadth continues to deteriorate. The risk-off tone has Treasuries rallying while the dollar is more neutral.

The S&P is outperforming the Russell and Nasdaq with High Dividend Yield, Value, Low Volatility factors, and Consumer Staples, Utilities, and Materials sectors all outperforming.

S&P optionality strike levels have the Zero-Gamma Level moved to 4610 while the Call Wall is higher at 4800. Traders used yesterday’s rally to add to put positions, increasing support in the 4400-4500 area. Gamma flips more positively above 4600 but increased implied vol today increases downward pressure (as we are currently seeing).

S&P technical levels have support at 4505, then 4490, and resistance is at 4545, then 4565. Not much support under recent lows until 4435. Bulls need to recapture 4545 to get things positive again.

Treasuries are higher, as the risk-off tone has traders looking for safety more generally while a quicker taper is reducing rate-hiking expectation, helping the belly, and moving the 5s30s curve slightly steeper by 1.5bps to 57bps. Next week brings 3, 10, and 30yr auction supply.

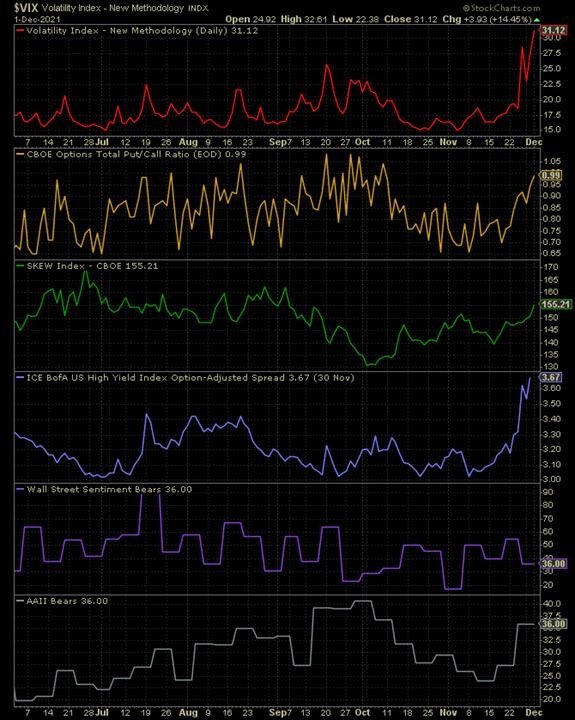

*Various measures of volatility and “fear” certainly picked up further this week

*The share of NYSE stocks closing above their 200-day moving average dipped below 50%.

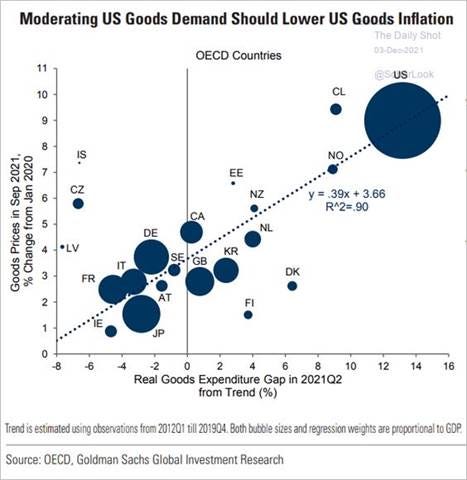

*Increases in goods prices given expenditure levels have significantly overshot historical norms in the U.S. and are likely to correct next year, becoming more of a deflationary force, according to GS

Markets continue to grapple with increased cases and a more hawkish Fed, but the fundamental economic backdrop is still improving, and consumer behavior despite growing uncertainty has yet to change materially, giving us hope that if technicals and optionality become more neutral and Omicron fear subsides, a more positive risk-on tone will emerge before the end of the month due to improving fundamentals and still highly accommodative financial conditions.

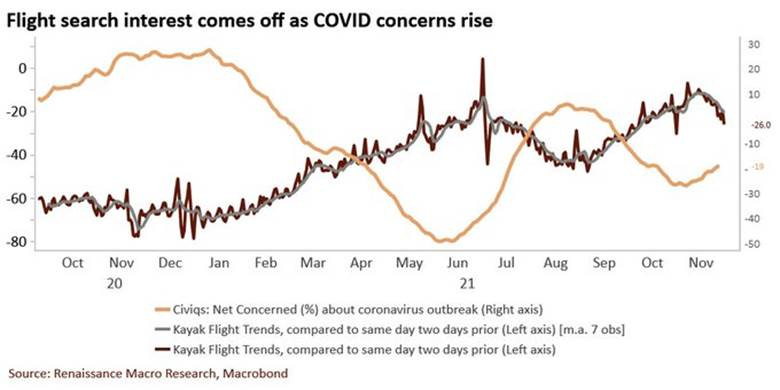

We still don’t know much about Omicron. However, increasing Delta case counts are certainly weighing on sentiment and, to a lesser degree, consumer activity, although it is still early in the wave cycle.

*“Public concerns about a coronavirus outbreak have picked up recently. Folks are staying away from certain activities as a result. Indeed, flight search interest, according to data from Kayak has been slipping.” – RenMac

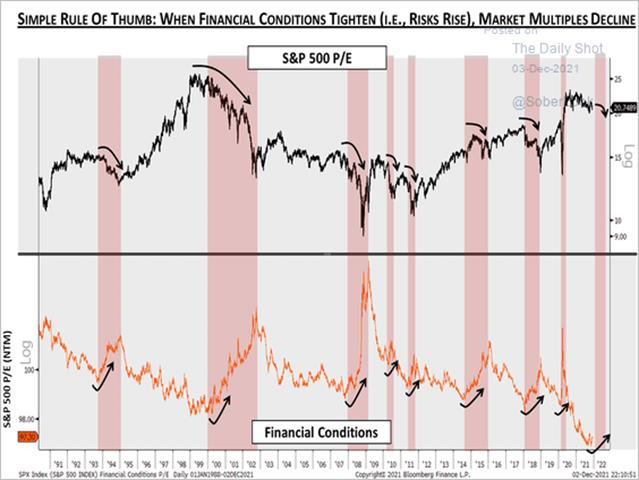

The Fed is now likely to increase the pace of tapering, but it will be sometime before financial conditions meaningfully tighten, which historically lead to declines in multiples, while earnings growth, although slowing and entering tough prior-year comparisons period in 2022, should still beat expectations in Q4.

*Financial conditions are unlikely to jump higher (tighten) in our view due to ample excess liquidity and negative real rates remaining for some time.

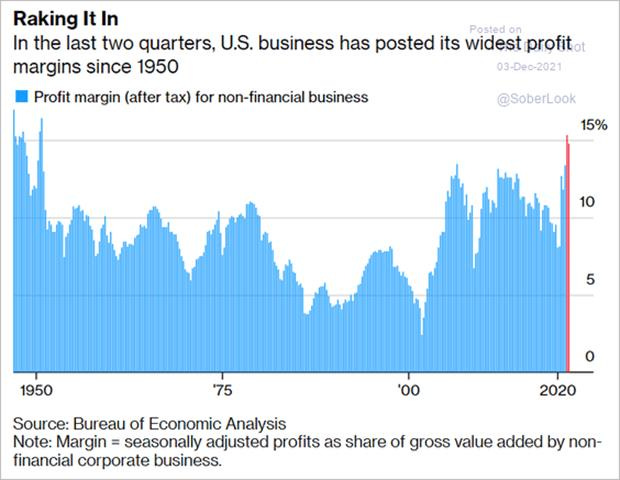

The Atlanta Fed’s GDPNow for Q4 has moved higher to 9.7%, with inflationary forces now likely to be 7%, creating a nominal GDP growth of 17% for the quarter. The economy is looking much more robust than expected (something we pointed out was potentially going to happen back in the fall), laying the foundations for corporate profits to surge given how successful firms have passed on cost increases(and despite the impressive gains in EPS so far this year).

*Quarterly comps will be increasingly harder in 2022, but Q4 is looking likely to beat expectations significantly

When we put it all together, technicals and optionality continue to indicate a high level of uncertainty, primarily around how consumers and the government will respond to the Delta uptick and potential risks Omicron poses as well as how fast the Fed will tighten policy. However, demand and activity remain strong in Q4, while downgrades to Q1 may be premature given what little we know about Omicron and how activity is adapting more efficiently to each wave.

*Increased uncertainty brings higher volatility, which in turn increases uncertainty

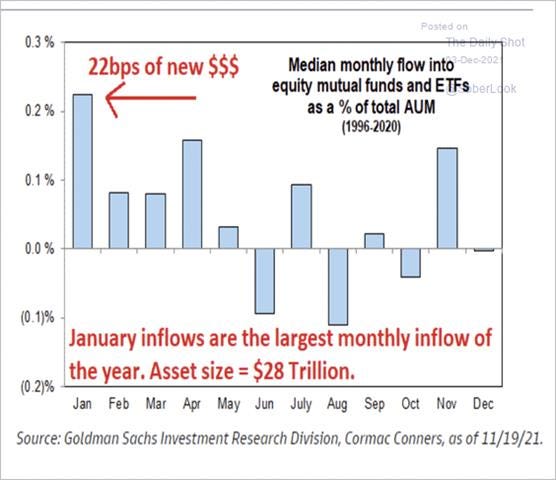

As a result, we are becoming more comfortable that the current wave of volatility and downward price pressure will subside into year-end as the market front-runs the inevitable decrease in case counts and realizes the increased tapering speed does not necessarily mean an increased rate of hikes that will overly tighten financial conditions in 2022. However, the knife is still falling which is why we continue to advise caution and building up cash.

*The Santa rally may be in trouble, but if markets get clarity on Omicron and tapering, January should see reduced uncertainty/volatility and the re-entry of various institutional participants that are currently net sellers

Econ Data:

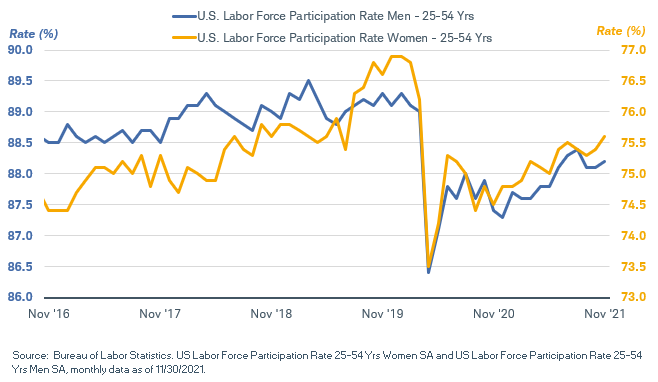

Non-Farm Payrolls increased by 210K jobs in November, the least since a 306K decline in December 2020 and well below market expectations of 550K. The seasonal factor was -568K in November, 179K larger than any previous November seasonal adjustment. The unemployment rate declined to 4.2% from 4.6% in October despite labor force participation, which is a key metric for labor supply, rising to 61.8% from 61.6% in October. The broader U6 underemployment rate dropped to 7.8% from 8.3% in October. The household measure of employment surged by 1.14 million. Average wages rose 4.8% from a year ago and at a 0.3% MoM pace, slightly lower than October.

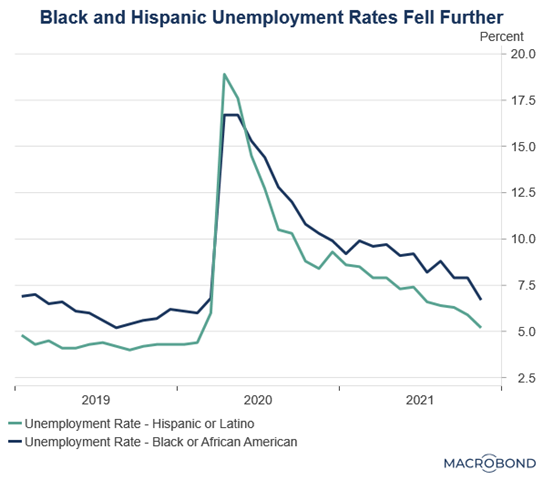

Why it Matters: Other than the headline miss for NFP, which was weighed on by seasonality and weak hospitality hiring, the report was generally positive and did not alter the Fed’s argument to increase the pace of tapering. The Feds preferred gauges of the labor market “maximum employment” saw improvements. The participation rate improved to the highest level of the year while minority unemployment dropped notably. Increases in the household survey were impressive. Although minor, the slightly lower increase in wages coupled with labor market developments/improvements seen elsewhere indicate that labor may be losing some bargaining power as firms fill needed positions or learn to operate around vacancies.

*The Prime Age Participation rate for both men and women up in November

*Increases in average hourly earnings continues to trend lower

*Further declines in minority unemployment move the Fed closer to a more inclusive economic recovery

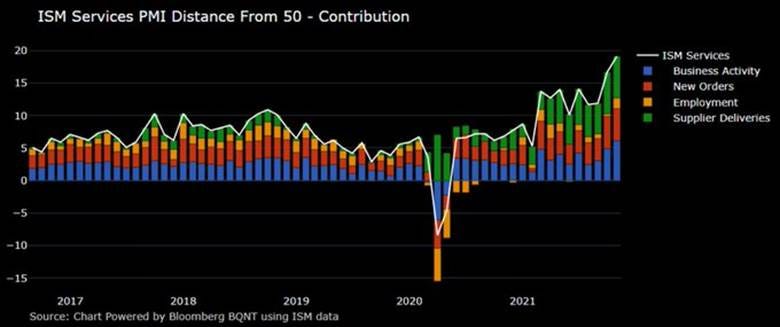

The ISM Non-Manufacturing PMI increased to 69.1 in November, from 66.7 in the previous month, easily beating market expectations of 65. Business Activity (74.6 vs. 69.8 in Oct), Employment (56.5 vs. 51.6), and Inventories (48.2 vs. 42.2) were the largest positive contributors. While the sub-index reading was unchanged from Sept, all 18 industries reported new orders growth in November. Supply-side sub-indexes such as Supplier Deliveries and Prices were unchanged and slightly lower, respectively.

Why it Matters: A solid increase in business activity helped headline service PMI beat expectations. Despite the headline increase, the marginal improvement in certain sub-indexes and comments from survey respondents indicated continued supply-side impairments to business. Several respondents noted they were evolving to overcome or better manage logistical issues. Improvements in the Employment sub-index and fewer comments regarding trouble finding skilled labor indicate stabilization there.

*Larger than expected increase thanks to a few sub-index contributions

*Increases in business activity showed firm’s production capacity was improving as material and labor shortages abated slightly

New orders for Durable goods rose 1% in October, following an upwardly revised 0.5% gain in September and beating market expectation of a 0.5% increase. Excluding transports, new orders increased 1.6% MoM as orders for transportation equipment fell -2.8% thanks to declines in “aircraft and parts,” and ships. Machinery orders fell -0.7% MoM due to less demand for construction equipment. Shipments increased 2% while Inventories increased 0.8%. The unfilled orders-to-shipments ratio was 6.76, down from 6.82 in September.

Why it Matters: There was a drag to the headline number from transports and defense but overall a positive report. There were notable increases in demand for communication equipment, motor vehicle parts, and “electrical equipment, appliances, and components.” Overall, demand continues to be strong.

*Factory Orders Ex-Transportation in the United States increased by 1.6% in October from a 0.7% increase in September

Policy Talk:

Several Fed officials expressed additional interest in increasing the pace of tapering recently following Powell’s nod to it at this week’s Congressional Covid response hearings.

On Thursday, Atlanta Fed President Raphael Bostic told the Reuters Next Conference it would be appropriate to end the central bank's bond-buying program by the end of March to allow the Fed to raise rates to deal with inflation.

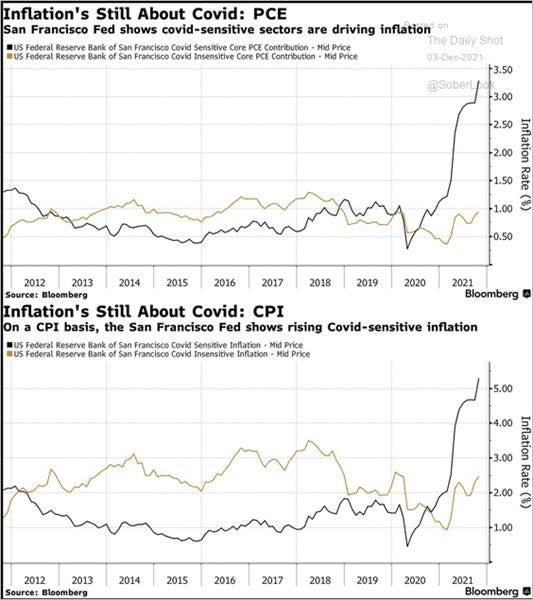

Fed Governor Randal Quarles said he was “certainly supportive” of ending the purchases sooner in his last public appearance. He further said it had become clear in recent weeks that inflation was no longer being driven “primarily by idiosyncratic price increases related to the reopening of the economy,” and the Fed needed to cool the economy until businesses create more capacity to meet higher demand.

Fed officials might need to start dialing down some of the extra accommodation they're "giving to the economy and start crafting a plan to, at least, you know, think about raising the interest rate," San Francisco Fed President Mary Daly said during a virtual event organized by the Peterson Institute for International Economics.

Speaking alongside Daly at the Peterson event, Richmond Fed President Thomas Barkin said it is important for the Fed to keep long-run inflation expectations anchored. "I do take seriously actual inflation and its impact, and that's why I'm supportive of normalizing policy as we're doing," he said.

Loretta Mester, the President of the Cleveland Fed, echoed Powell by saying she would support a quicker withdrawal of the Fed’s massive bond-buying program as a form of “insurance” that would give the central bank more flexibility to raise interest rates next year and that she believed vaccines would weaken the effects of Omicron.

Why it Matters: A faster pace of tapering looks like a done deal with it likely ending in March. In theory, this will increase rate hike optionality as the Fed becomes marginally less behind the curve, reducing the hiking pace they would need to tighten through that channel if inflationary pressure persisted. Coupled with today’s data, specifically improvements in the labor market from higher levels of participation and a more inclusive drop in the unemployment rate, the Fed is rightfully changing its need for “extraordinary measures” tune quickly. Stepping back and looking forward, we still believe that the Fed will remain patient with rate hikes, with two now being our base case in 2022. This is due to our belief that inflationary pressures have peaked and increased Covid cases will slow increases in the participation rate over the next several months. Labor data was “muddied” by the Delta uptick over the summer due to labor force participation being impaired (fear, childcare, retirement). We see this muddiness returning to a lesser extent as similar on the ground pandemic conditions return. As a result, the Fed will continue to differentiate a quicker taper from rate hikes, using slowing inflation and weak labor participation as reasons to spread out the pace of hikes in the middle to the end of 2022.

*Despite growing worries that there is a more structural tone to inflation forming, SF Fed’s research recently showed much of the rise is still from “Covid-sensitive” things

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is lower on the week and on the day, with Large-Cap Value outperforming on the day

Chinese Iron Ore Future Price: Iron Ore futures are slightly lower on the week and the day, as renewed worries about property developers have cooled the recent bounce

5yr-30yr Treasury Spread: The curve is flatter on the week but slightly steeper today as the belly benefited from the NFP miss

EUR/JPY FX Cross: The Yen is stronger on the week and the day, with the risk-off tone now moving the cross to the bottom of its recent channel

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Higher: China's Ningbo Zhoushan Port raises charges by 10%, other ports likely to follow suit – Yuan Talks

Due to an anti-trust investigation into China’s port operators launched in April 2017, the sector has maintained port charges steady even as costs increased due to epidemic prevention measures. The three-year scrutiny period is coming to an end, and now Chinese ports are going through the necessary procedures to raise port charges for unloading and loading by 10% and other service charges.

Why it Matters:

The coming price hikes are causing concerns about further higher shipping costs, but analysts say the impact will be small. Due to the impact of the Omicron coronavirus variant and persistent port congestions across major economies, global shipping rates have recently resumed a climb after falling. In particular, routes to Southeast Asia reversed declines in November, with costs from China to West Coast in the US dropping to around $9k from a peak of nearly $20k but now higher to $11k.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Critical IP: Suspected Chinese hackers breach more US defense and tech firms – CNN

A suspected Chinese hacking campaign has breached four more US defense and technology companies in the last month, and hundreds more US organizations are running the type of vulnerable software that the attackers have exploited. Globally, at least 13 organizations total in sectors such as defense, health care, energy, and transportation are now confirmed to have been breached, cybersecurity firm Palo Alto Networks warned in a report published Thursday.

Why it Matters:

The hacking effort shares similarities with the techniques of a group Microsoft has identified as operating in China, Palo Alto Networks said. If Chinese involvement in the campaign is confirmed, it would add to multiple instances in recent years of alleged Chinese hackers seeking to burrow into the networks of US defense contractors. As a reminder, Beijing is actively trying to secure needed IP to further their “Dual Circulation” objectives and remove any foreign inputs into critical sectors.

Electrification and Digitalization Policy:

Section 230: Congress Takes Aim at the Algorithms – Wired

At a hearing on Wednesday, the House Energy and Commerce Committee discussed several proposals to strip tech companies of legal immunity for algorithmically recommended content. Currently, Section 230 of the Communications Decency Act generally prevents online platforms from being sued over user-generated content. The new bills would, in various ways, revise Section 230 so it doesn’t apply when algorithms are involved.

Why it Matters:

The goal of the new Section 230 bills is to give platforms a reason to change their business models. As Haugen put it in her Senate testimony in October, “If we reformed 230 to make Facebook responsible for the consequences of their intentional ranking decisions, I think they would get rid of engagement-based ranking.” For example, the Protecting Americans From Dangerous Algorithms Act, would take away Section 230 immunity for claims invoking certain civil rights and terrorism-related statutes if a platform “used an algorithm, model, or other computational processes to rank, order, promote, recommend, amplify, or similarly alter the delivery or display of information.”

No Skynet Please: The Department of Defense is issuing AI ethics guidelines for tech contractors – MIT Tech Review

In a bid to promote transparency, the Defense Innovation Unit, which awards DoD contracts to companies, has released what it calls “responsible artificial intelligence” guidelines that it will require third-party developers to use when building AI for the military, whether that AI is for an HR system or target recognition. The guidelines provide a step-by-step process for companies to follow during planning, development, and deployment. They include procedures for identifying who might use the technology, who might be harmed by it, what those harms might be, and how they might be avoided—both before the system is built and once it is up and running.

Why it Matters:

The work could change how the US government develops AI if other departments adopt or adapt the DoD’s guidelines. The Defense Innovation Unit has given the guidelines to NOAA and the Department of Transportation and is talking to ethics groups within the Department of Justice, the General Services Administration, and the IRS. We highlight this to show that western nations' development of AI may be weakened by ethical standards (although we believe this is the right approach), given China and others will not have such barriers.

Get it Now: Big Tech Privacy Moves Spur Companies to Amass Customer Data – WSJ

New privacy protections put in place by tech giants and governments threaten the flow of user data that companies rely on to target consumers with online ads. As a result, companies are taking matters into their own hands. Across nearly every sector, marketers are rushing to collect their own information on consumers, seeking to build millions of detailed customer profiles before the data becomes harder to obtain.

Why it Matters:

California’s Consumer Privacy Act and Europe’s General Data Protection Regulation have both made it more difficult for ad-tech firms and data brokers to collect information that brands can use, helping put the onus on companies to gather data themselves. Further, Apple’s new privacy policy, introduced in April, requires apps to ask users if they want to be tracked. According to Flurry, a mobile-app analytics provider, U.S. users opt in to being tracked only about 18% of the time they encounter the Apple privacy prompt. All this increases the cost e-commerce brands need to pay to identify a desirable audience.

Commodity Super Cycle Green.0:

Investment Needed: The Scramble for EV Battery Metals Is Just Beginning – WSJ

Consulting firm Rystad Energy expects annual lithium demand from EVs and energy storage to rise by a factor of more than 20 times by 2030 compared with last year’s level. But a metals boom driven by decarbonization will be a more challenging one for the broader mining industry than the supercycle led by Chinese infrastructure growth that previously fueled commodity markets.

Why it Matters:

Today’s supplies of battery metals come with huge ESG and geopolitical challenges that are tough to reconcile with the environmental problem they are supposed to solve, not to mention Washington’s goal of lessening U.S. dependence on China. Furthermore, the wild card in this game is battery innovation, which could throw off today’s demand forecasts for lithium, cobalt, and nickel.

Green Vessel: Panama Canal announces greenhouse gas emissions fee – Splash247

Panama Canal Administrator Ricaurte Vásquez Morales announced the authority’s plan to implement a green vessel classification system that will include a new greenhouse gas emissions fee. Financial penalties for shipowners will increase based on the volume of emissions. The fee is intended to help make the canal’s operations carbon-neutral.

Why it Matters:

Under the new system, all ships over a certain length will be classified in levels depending on their energy efficiency. Three factors; the ship’s EEDI (Energy Efficient Design Index) score, its use of efficient operational measures such as bow thrusters, and its use of zero-carbon biofuels or carbon-neutral fuels, will determine a ship’s classification level. This will help move the shipping industry further towards blue and, ultimately, green fuels.

Greener Green: Ethanol Giant Bets on Low-Carbon Corn With Eye on Markets – Bloomberg

Top U.S. ethanol maker Poet LLC is looking to encourage greater production of climate-friendly grains in a bid to help farmers profit from an increasingly “green” energy economy. The company said it plans to use Gradable, a digital platform owned by agriculture-tech firm Farmers Business Network, at its 33 ethanol plants. The tool is able to rate grains used to make biofuel based on their so-called carbon intensity.

Why it Matters:

The idea is to spur more sustainable farming and help growers track their greenhouse-gas data, ultimately enabling them to get a premium for crops through low-carbon fuel markets. Programs already in California and spreading worldwide are expected to put a higher value on such fuel ingredients to encourage lower global warming emissions.

ESG Monetary and Fiscal Policy Expansion:

No Shutdown: Senate Approves Spending Bill Averting Government Shutdown – WSJ

Congress passed a short-term extension of government funding and sent the legislation to President Biden’s desk, averting a partial shutdown after resolving a standoff over vaccine rules. Republicans are planning to prompt additional votes in Congress to stop the private-employer vaccine rules, which have been challenged in court.

Why it Matters:

Extending current federal spending, set under the Trump administration, through mid-February will give lawmakers more time to negotiate and pass a new set of funding bills. Democrats and Republicans will now turn to several other must-pass items in the coming weeks, including raising the government’s borrowing limit and passing an annual defense policy bill.

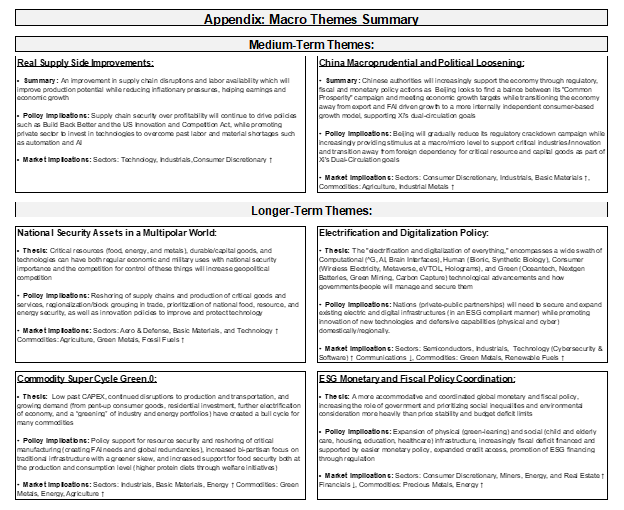

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.