MIDDAY MACRO - DAILY COLOR – 12/15/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are lower, with Retail Sales coming in weaker than expected and risk sentiment still being weighed on by Covid, China, and expectations for a hawkish Fed

Treasuries are flat, with the risk-off tone continuing to keep Treasuries in their recent range across the curve

WTI is lower, falling after new Covid restrictions were announced overnight but recovering now due to larger than expected inventory drawdowns were reported in the weekly EIA data

Narrative Analysis:

There is not much new to say as the world awaits Powell and company's FOMC meeting results. The main drivers (discussed yesterday) of the recent risk-off tone still control the day’s narrative. Today’s data was mixed, with the more critical retail sales being significantly weaker than expected, while there were some inflation/supply-chain moderations in import/export prices and the Empire State survey. Treasuries continue to be quickly bought on pullbacks, as evident again this morning, while the dollar continues to creep higher, helped by the general risk-soured mood.

The S&P is outperforming the Russell and Nasdaq with Low Volatility, High Dividend Yield, and Value factors, and Utilities, Health Care, and Consumer Staples sectors are all outperforming.

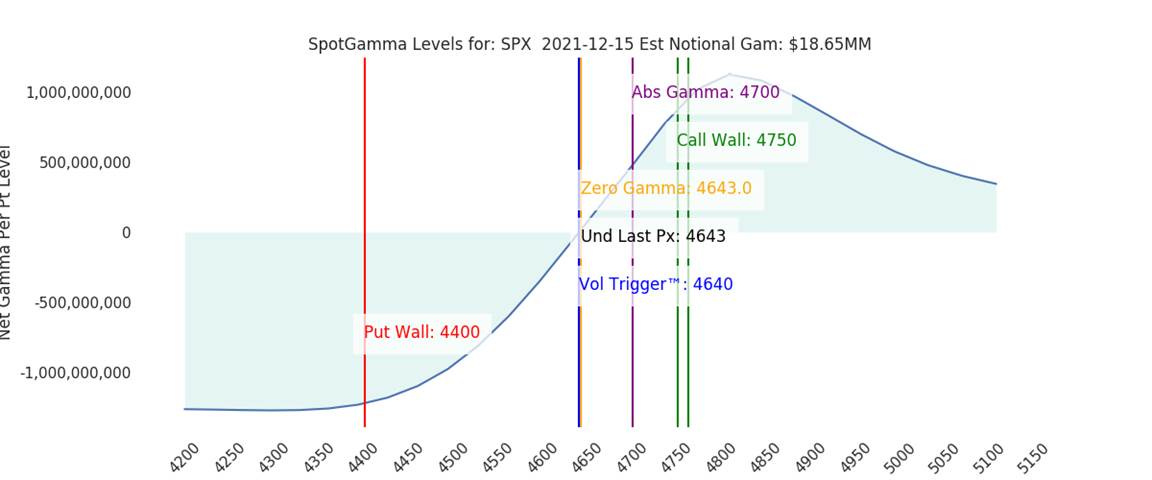

S&P optionality strike levels have the Zero-Gamma Level moved lower to 4643 while the Call Wall is at 4750. Gamma is flat in the S&P, while remaining sharply negative in Nasdaq and Russell. The S&P has support at 4600, with resistance at 4650 followed by 4700. A break of 4600 likely leads to a test of 4545.

S&P technical levels have support at current level of 4605, then 4590, and resistance is at 4635, then 4665. The S&P has received consistent support all year from the 50dma. Its recapture supported the early December rally, and it stopped eight other pullbacks this year except for September. Sitting at 4590, if it doesn’t hold post-FOMC significant downside opens up.

Treasuries are flat, with this morning's data and Ny-open selling quickly reversed with all eyes now awaiting the Fed’s dot plot. The 5s30s curve is little changed, sitting at 59bps.

The Fed will need to deliver a message of optionality today as they shift from pandemic relief to inflation risk management mode to ensure credibility is maintained while labor markets continue to normalize, effectively moving policy to a more neutral stance to restrain excess demand rather than an outright tightening path which would overly restrict activity to curb inflation. This will be a tough message to deliver, especially when their best tool to do so comes down to a few dots moving around.

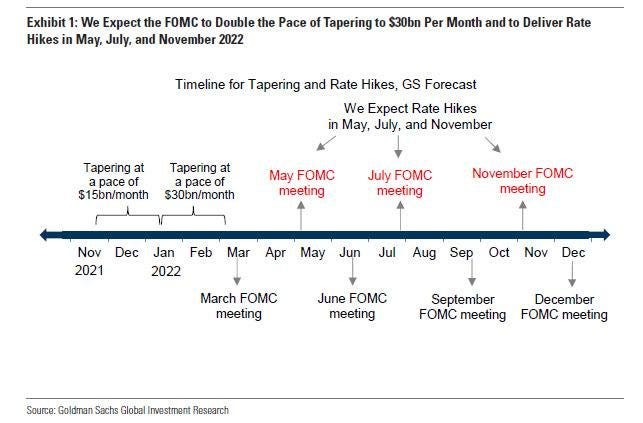

We expect several hawkish developments to come out of today's “reset” FOMC meeting:

The tapering process will be sped up with the FOMC increasing the pace of monthly reductions to $30bn a month, so it concludes by mid-March.

They will change the language around inflation in the statement with “transitory” being altered/morphed into something longer-lasting but not a structural change in nature.

Clarify that the Fed is not seeking to engineer even more of an inflation overshoot as part of its AIT policy goals and that inflation conditions for raising rates have been clearly met, while “full employment” has not.

The dots will hawkishly move as new economic projections show a lower path for unemployment and slightly higher 2022 inflation. However, there should be a greater dispersion in ’24 regarding UER and PCE while longer-run levels won’t change.

Fed fund expectation for 2022 moving clearly to two rate hikes with a skew to three-hikes rather than one. Moving out, a rate hiking schedule of 25bp a quarter through ‘23 and ‘24, taking the median projection to a neutral setting around 2.5 percent at end ‘24.

*Goldman, along with many sell-side shops, are now expecting three hikes in 2022

The above scenario/actions are what is already priced in. Hence, a more dovish tilt/interpretation is possible, and something we expect Powell will attempt to give markets given the increased level of uncertainty due to the current uptick in Delta cases and Omicron uncertainty, the distance to EPOP* and “full employment” (given the pace if November’s weak job gains continue), and continued belief that although longer-lasting, inflation is still a supply/demand imbalance caused by the pandemic and not the beginning of a wage-spiral cycle.

*At the risk of stating the obvious, a dovish tilt in any way could spur some “relief” buying by asset managers, although coming on year-end, this would likely materialize more forcefully in January.

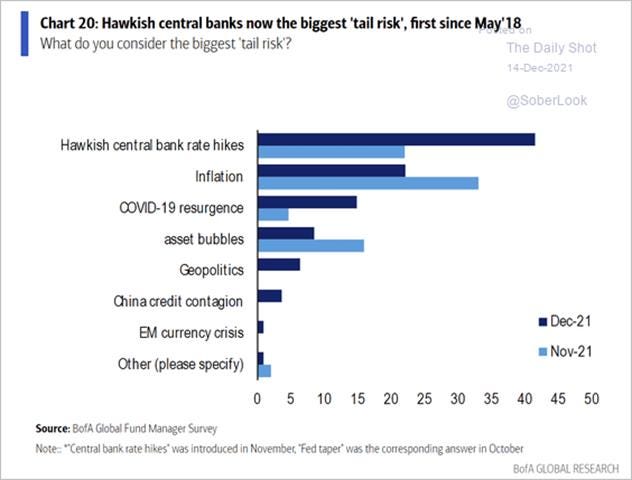

Stepping back, we continue to believe that the current growing risk-off narrative is wrong. The uptick in Delta cases and Omicron (more spready/less deadly) more generally is part of the natural evolution and flow of the pandemic. The Fed and other major central bankers still have a lot of tightening to do before financial conditions become meaningfully restrictive to risk assets. Finally, the economy continues to outperform expectations while firms look to be working through supply-side problems and passing on costs increases that should now start to more meaningfully abate.

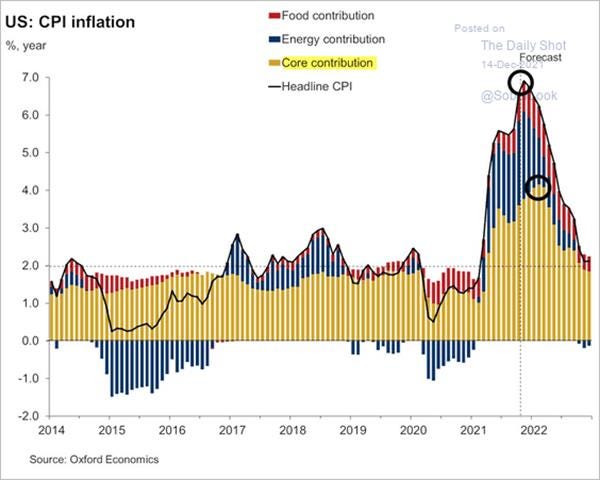

*Decreases in the headline and core inflation levels will reduce the current urgency to tighten policy in Q1, just as “transitory” is being retired now

However, and finally, as we highlighted yesterday, the current setup is not favorable for risk assets if we get a hawkish Fed today due to defensive positioning/optionality, neutral technicals, and uncertainty over future growth due to the current and coming uptick in Covid cases. Today’s retail sales data was a cautionary signal that end demand may finally be showing some exhaustion, bringing into question H1 ’22 growth again. However, at this point, bad news/data will increasingly be supportive of markets that continue to be on an “easy money” policy high as it reduces tightening expectations. Let’s get through today’s FOMC meeting results first, though.

Econ Data:

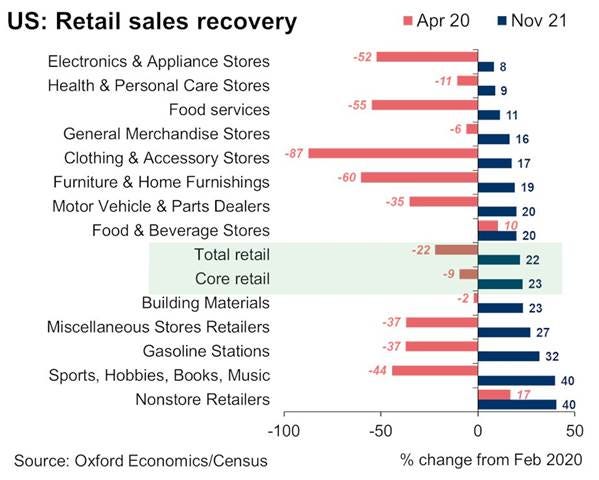

Retail sales increased by 0.3% from a month earlier in November after rising 1.8% in October and well below market expectations of 0.8%. Excluding gas and motor vehicles, sales increased 0.2%. The core retail sales, which correspond most closely with the consumer spending component of GDP, edged down -0.1%, missing expectations of a 0.7% increase. There were large decreases in Electronic & Appliance (-4.6 MoM) and Department Stores (-5.4%). Online sales were unchanged while Food Services & Drinking Places saw an increase of 1% MoM.

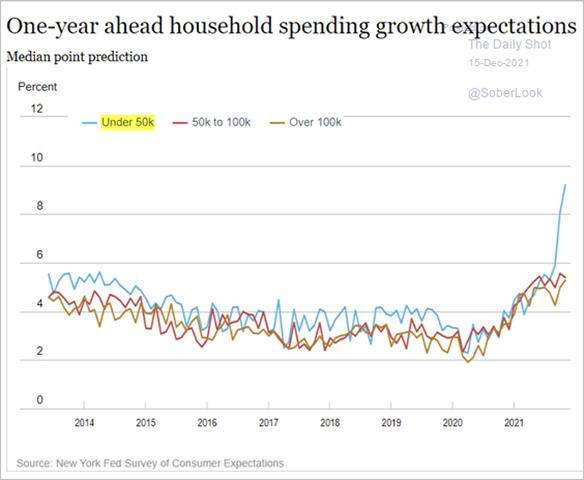

Why it Matters: A little bit of a mixed bag here, as it is possible, early shopping took away from November’s activity (as October was revised higher), but when adjusted for inflation, the drop is significant. It is also possible the effects of the higher inflation are finally causing end demand destruction, corresponding with what we are hearing in consumer survey reports. It's also likely continued shortages held back end sales, with a sharp drop in receipts at electronics and appliance stores, where shortages have been more acute. One month’s data does not make a trend, but this was an alarming slowdown in consumer activity given what was expected. On a happier note, it was good to see restaurants and bars have some growth, although the recent Delta uptick/Omicron concerns were not yet affecting what now looks like a slowing desire by consumers to go out.

*Despite a weaker November, retail sales remain 22% higher than what they were pre-pandemic

*By some estimates, about two-thirds of that increased spending reflects higher prices while one-third reflects increased purchases

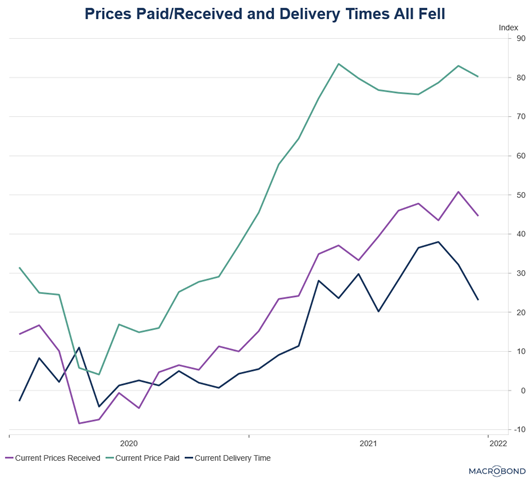

The New York Fed’s Empire State Manufacturing Index rose to 31.9 in December of from 30.9 in November, beating forecasts of 25. New Orders (27.1 vs. 28.8 in November) and Shipments (27.1 vs. 28.8) both decreased, but firms had a large increase in Unfilled Orders (19 vs. 12.7). Delivery Times fell notably (23.1 vs. 32.2), though less so than last month. Labor market indicators weakened with the Number of Employees (21.4 vs. 26) and Average Workweek (12.1 vs. 23.1) both falling. Both price indexes moved somewhat lower but remained near recent record highs. Looking ahead, firms remained optimistic that conditions would improve over the next six months (34.6, the same as in November), though optimism is lower than it was in the fall.

Why it Matters: There was some improvement in supply-side related sub-indexes as seen in a stabilization in prices paid/received while Delivery Times fell notably. Forward-looking indicators show firms expect prices paid to decrease while they will continue to be able to increase prices received. Although current employment indicators fell, future ones still indicate growth in the Number of Employees and Workweek. Finally, there has been no decrease in capital expenditure and technology spending intentions.

*Both current and future general activity indexes indicate “business activity continued to grow strongly” in early December

*Inflationary and logistical gauges showed some improvement

Prices for imports rose 0.7% in November, following a 1.5% increase in October. Both higher fuel and nonfuel prices contributed to the advance, with the price index for nonfuel imports advanced 0.5%. Import prices rose 11.7% YoY, the largest over-the-year increase since the index advanced 12.7% for the year ended September 2011. Export prices rose 1% in November, after increasing 1.6% in October. Exports increased 18.2% YoY, the largest over-the-year advance in the series, first published in September 1984.

Why it Matters: There was some decrease in the monthly increases in both imports and exports. There was a significant decrease in fuel imports thanks to more stable prices, although natural gas imports still contributed to a 2% monthly gain for the category. It's too early to tell, but October may have seen the most significant increases in monthly price increases.

*The overall monthly increase in import prices in November was half as much as October

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the week, and again today with the ratio lower by 0.75%. Large-Cap Value is the best performing size-factor style today

Chinese Iron Ore Future Price: Iron Ore futures are higher on week and day as positive industrial production data increased demand expectation while negative data elsewhere increased policy support expectations

5yr-30yr Treasury Spread: The curve is flatter on the week and but unchanged today as traders await the details of the December FOMC meeting

EUR/JPY FX Cross: The Euro is stronger on the week and today despite the more risk-off tone with the Tankan manufacturing survey unchanged while the outlook worsened

Other Charts:

*Increased uncertainty and high valuations are driving fund managers to increase cash holdings

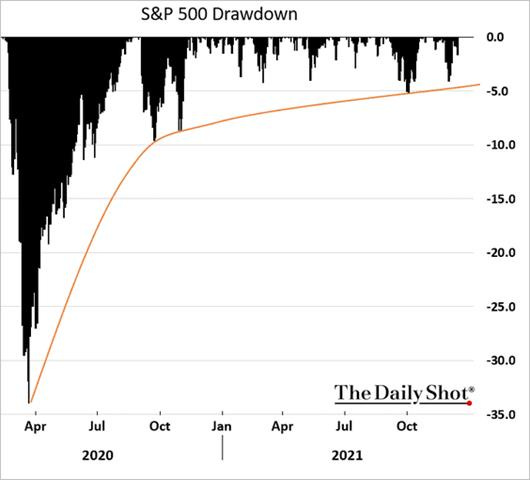

*Dipbuyers are not waiting long to jump in as drawdowns have been historically very shallow this year

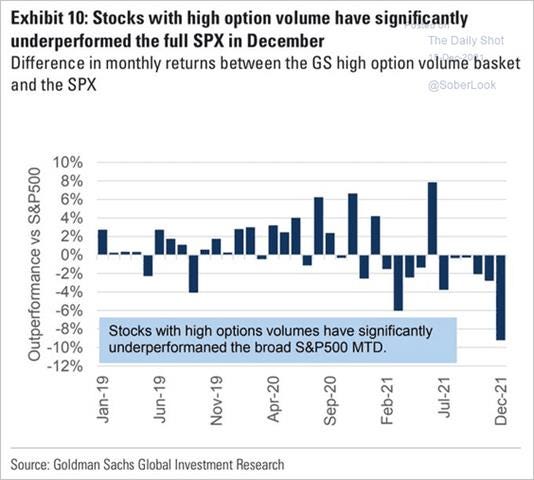

*The Reddit/Meme investors are increasingly becoming less active in driving price action

*Despite consumer confidence/sentiment continuing to be under pressure from inflationary concerns, intentions to spend are holding up

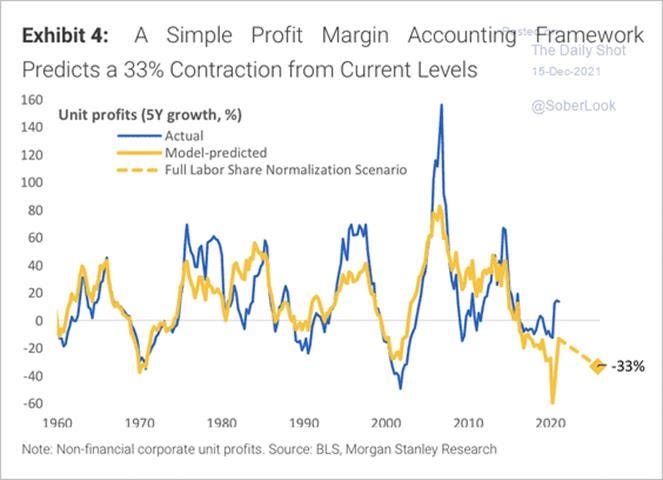

*Morgan Stanley expects profit margins to contract by 1/3

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Near-Shoring: Supply-Chain Hell Ignites Economic Boom Along the U.S.-Mexico Border - Bloomberg

For the multinationals that do business in the red-hot U.S. economy, near-shoring often means northern Mexico, where labor costs are cheap, the land is plentiful, and the border is just a short ride away. Other border cities such as Tijuana, along the west coast, and Reynosa, Matamoros, and Piedras Negras, far to the east, are undergoing similar industrial booms. The boom is so intense in Juarez that industrial real estate is suddenly getting tight: 98% of existing space is already leased, and the price has jumped more than 20% over the past year.

Why it Matters:

When China entered the World Trade Organization, many companies pulled out of Mexico and set up shop in China. China kept stealing U.S. market share from Mexico right up until Donald Trump took office in Washington. When he started slapping tariffs on Chinese-made products, Mexico suddenly looked pretty attractive again to executives. Recent supply chain problems brought on by the pandemic and more political pressure to near-shore as China's relations deteriorate continue this trend.

China Macroprudential and Political Loosening:

Snailed: China’s Economic Activity Slowed in November on Property Slump, Weak Consumption – WSJ

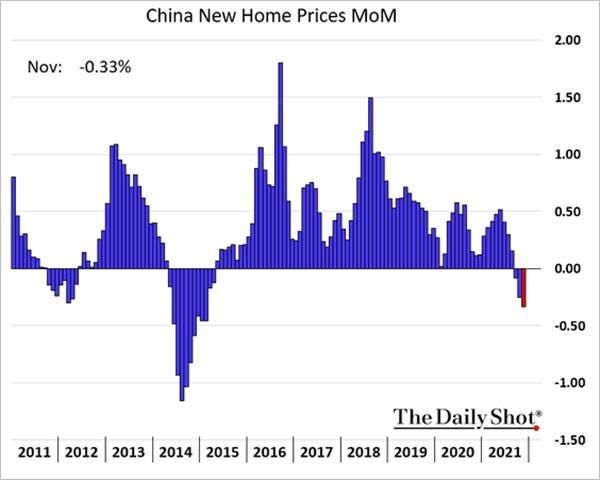

Leading indicators of consumption and investment activity weakened further from October, while factory production rose at a faster pace in November as a power crunch eased, according to China’s National Bureau of Statistics on Wednesday. New-home prices dropped 0.33% in November from October across 70 cities, the biggest month-over-month decline in about six years.

Why it Matters:

The latest economic data point to a further slowdown in China’s economy that began to sputter in the third quarter on the back of a power crunch that curbed factory output and sporadic Covid-19 outbreaks that hit consumption. China’s policymakers have signaled in recent weeks that they will pivot toward shoring up the economy, but the recent data shows Beijing is moving further away from its goal of a domestic consumption-driven economy.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Critical IT: Europe’s Cloud Project Launches Without U.S., Chinese Firms - Bloomberg

The EU published a list of the 39 companies signed up to become part of its Alliance for Industrial Data, Edge, and Cloud, which includes no American or Chinese companies at this stage after the region moves to lessen its reliance on U.S. technology firms. The EU is attempting to become a more significant player in the cloud space with so-called “mini clouds” that wouldn’t be housed in a centralized server farm.

Why it Matters:

The alliance is meant to bring various companies together to build new, secure European cloud and edge technologies. Some U.S. companies have applied to be part of the alliance but are undergoing eligibility checks, according to a person familiar with the plans. However, it is clear that the goal is to have an independent, homegrown data management/storage industry in Europe. This big data initiative, along with their bloc-wide semiconductor strategy (to ensure supply security), shows that critical technologies are increasingly seen as national security assets.

Block: Taiwan to restrict tech companies' sales of China assets - NikkeiAsia

Taiwan's Ministry of Economic Affairs said it is revising current regulations to require Taiwanese companies to seek approval if they plan to sell or dispose of any of their assets, plants, or subsidiaries in China to their Chinese counterparts or other local buyers, as such a move could involve the transfer of sensitive technologies. Current regulation only requires Taiwanese companies to notify authorities of such transactions.

Why it Matters:

Taiwan was already tightening its screening of Chinese investments in Taiwanese companies and taking other actions to protect sensitive technologies. On top of the new tech sales regulation, the Ministry of Justice and the Mainland Affairs Council is drafting new regulations to prevent professionals from leaking trade secrets and critical technologies to "foreign counterforces" in places like China, Hong Kong and Macao, in an elevating effort to discourage people from working for companies across the strait.

Electrification and Digitalization Policy:

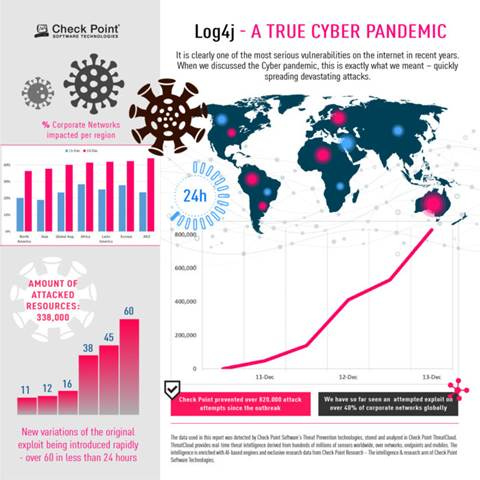

Cyber Pandemic: The Numbers Behind Log4j Vulnerability CVE-2021-44228 – Check Point

A recently discovered vulnerability in Log4j 2 is reportedly being exploited in an evolving way, putting widely used applications and cloud services at risk. The original vulnerability allowed for remote code execution against users with certain standard configurations, but patches have addressed this. However, attacks have continued to grow/evolve. Experts say it is one of the most severe vulnerabilities for the internet in recent years, and the potential for damage is incalculable.

Why it Matters:

Due to the complexity in patching it and easiness to exploit, this vulnerability will stay with us for years to come unless companies and services take immediate action to prevent the attacks on their products by implementing protection. Given the upcoming holiday seasons, when security teams may be slower to implement the protective measures, the threat grows. This acts precisely like a cyber pandemic, highly contagious, spreads rapidly, and has multiple variants, which force more ways to attack.

Nothing to See: Who’s watching? How governments used the pandemic to normalize surveillance - LAT

The technology-laden “smart city” being built on the southern coast of South Korea near Busan epitomizes the daily bargain for most of humanity: the relinquishing of personal data and privacy in exchange for convenience, order, and safety. The question facing citizens, governments, tech innovators, and rights groups is how to keep the same technology that drives the benefits of “smart city” living from jeopardizing civil freedoms. When the streets are watching, and the walls are listening, is what you’re getting in return worth it?

Why it Matters:

Some of the nations that pried most deeply into private lives to track infections managed to keep deaths low, curb the rampant spread, and prevent healthcare systems from being overwhelmed. But as the planet turns to the reality of living with the virus, the long tail of the pandemic will also include accounting and reckoning over the intrusive technology that was deployed. The same reckoning can be applied more generally to the soon-to-be smart cities. Long story short, smart cities are coming, and they will be driven by personal data, which will continue the ever-growing need for digitalization policy to balance the good and bad.

ESG Monetary and Fiscal Policy Expansion:

More Needed: U.S. invests nearly $9 bn to increase minority lending - Yahoo

The U.S. government will invest nearly $9 billion to increase lending to racial minorities and poorer individuals, the Treasury Department announced Tuesday. The funding announced by Yellen and Vice President Kamala Harris will be allocated through the Emergency Capital Investment Program and be directed to 186 banks and credit unions in 36 states, Guam and the District of Columbia, the Treasury said. Of the total $8.7 billion investment, $3.1 billion will go to institutions controlled by minorities, the release said.

Why it Matters:

The funding for the latest investment comes from federal pandemic response programs. As excess Covid relief money may be increasingly leftover, it will be interesting to see if more is moved to support ESG themed endeavors. We also highlight it in conjunction with continued Fed efforts to “strengthen” the Community Reinvestment Act, something Governor Brainard has championed for two years now. “As we as a nation struggle with racial injustice and a pandemic, it is more important than ever that we modernize the CRA to better address such challenges of our time.” - Brainard.

GSEing: Biden to Nominate Sandra Thompson to Lead Fannie and Freddie’s Overseer – WSJ

President Biden plans to nominate Sandra Thompson to become the permanent director of the Federal Housing Finance Agency, the White House said, tapping a career regulator to head the agency responsible for overseeing mortgage-finance giants Fannie Mae and Freddie Mac. While Ms. Thompson’s selection is unlikely to generate much industry opposition, she might encounter pushback from a few Republican lawmakers opposed to her decision to ease restrictions on Fannie and Freddie’s business activities that were implemented in the final days of the Trump administration.

Why it Matters:

The Biden administration has said it isn’t in any rush to return Fannie and Freddie to private hands, a reversal from the Trump administration, which pushed to put the companies on a path to exit conservatorship. The administration is instead expected to use Fannie and Freddie to support its general affordable-housing goals and a push to close a racial homeownership gap. The white homeownership rate is at roughly 72%, while the rate is 42% and 48% for Black and Latino borrowers, respectively, according to the Urban Institute.

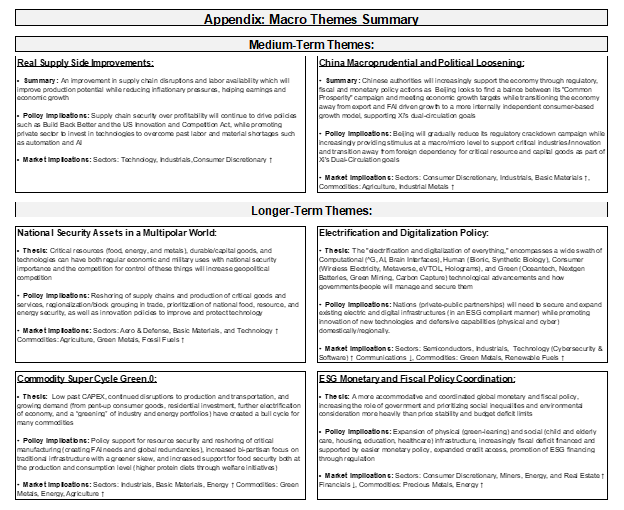

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.