MIDDAY MACRO - DAILY COLOR – 12/14/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are lower, with increasing worries over Covid, China, and how hawkish the Fed will be tomorrow (following a higher than expected PPI print today) continuing overnight pressure

Treasuries are flat, with the risk-off tone countering any tapering fears as a post PPI sell-off quickly reversed

WTI is lower, falling after an overnight strength reversed into the NY-open as OPEC left its oil demand and supply forecast unchanged for 2022, reducing expectations for any cuts to production increases while Iranian negotiations look to remain stalled

Narrative Analysis:

Continued uncertainty over the omicron variant and rising Delta cases, renewed concerns over Chinese developers, and the wait for critical central bank decisions this week are all weighing on sentiment today. Although the Fed will steal the show, the ECB and BoE will also have to justify keeping highly accommodative policies in place despite increasing inflationary pressures. As a result, equities and rates continue to coil in recent ranges until the future path of policy is clearer. The dollar remains near recent highs with rising real rates and the more risk-off tone supporting it.

The Russell is outperforming the S&P and Nasdaq with High Dividend Yield, Small Caps, and Value factors, and Financials, Energy, and Consumer Staples sectors all outperforming.

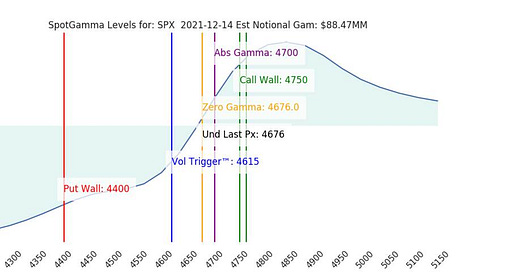

S&P optionality strike levels have the Zero-Gamma Level moved lower to 4676 while the Call Wall is at 4750. There is a negative gamma tilt in the Nasdaq and Russell while the S&P remains positive. A large volume of December puts, expiring Friday, has also developed for single stocks. Overall current positioning is quite negative, but that is heavily tied to the 12/17 expiration.

S&P technical levels have support at the current level of 4605, then 4590, and resistance is at 4635, then 4665. The 4hr RSI(5) has now reset and comparably oversold to where it was at the early December and October lows. The bulls must reclaim 4665 to keep direct upside in play, something we likely won’t see until post-FOMC results.

Treasuries are slightly lower, but quickly reversing more significant post-PPI weakness as the more risk-off tone has the curve little changed on the session. The 5s30s curve is little changed, sitting at 59bps.

*Majority of money managers now believe the Fed will end its taper in March

*Secular growth themes have been under increasing pressure since September

*Firms surveyed by Morgan Stanley have notably increased their expectation that supply conditions will improve moving forward since being asked last month

*Truly historic valuation gap between the U.S. and various other equity markets (by region) based on P/E

Equities are again under increasing pressure as fears over Omicron and the current Delta wave, renewed uncertainty in Chinese property developers, and of course, what the Fed will tell us tomorrow regarding not only increasing the tapering pace but also rate hikes next year has volatility increasing again, made worse by heavy levels of optionality expiring Friday and uninspiring technicals.

Until the market adopts a “learning to live with it” mentality, which means case count increases do not equate to lost economic activity due to lower levels of hospitalization or implementation of more restrictive policies, markets will be headline-driven, stuck in a broader and more choppy trading range regardless of any other positive developments.

*Rising case counts in South Africa due to Omicron has not led to a notable increase in deaths yet, as seen in past waves

Technicals are indicating this increased range-bound choppiness may already be occurring as Sunday nights attempt to reach a new ATHs quickly reversed, and the S&P has now retraced half of its gains since rallying off early December lows. While the S&P remains in its longer-term uptrend, its technicals are increasingly more negative below 4600, with the 50dma around 4580 being critical support.

*Technicals paint a mixed picture at current levels with no current clear tactical trend and the daily RSI in neutral territory

On a more positive note, the large level of December puts expiring this Friday are laying the grounds for a more bullish backdrop moving forward, assuming the Fed doesn’t scare markets with an overly hawkish posture. The growing level of negative put gamma could quickly reverse, leading to a large short (hedge) covering rally into year-end. This is what happened in 2018 when markets rallied 5% following the December OPEX, which saw the expiration of large amounts of put positions given the ongoing market sell-off to that point.

*December’s quad witching will remove a large amount of volatility-suppressing positive gamma, clearing the dealers’ sticky hedging, allowing for increased trading ranges

When we put it all together, the market is coiled up for a big move post-December FOMC decision. Clearly, an overly hawkish tilt has the potential to be the catalyst for the beginning of a more prolonged sell-off given technicals and optionality. A dovish message would do the reverse, and given the composition and size of Friday’s OPEX, it could finally start a more sustained year-end rally, all though we are increasingly running out of time. Either way, expect wider daily trading ranges for a while longer.

Econ Data:

Producer prices for final demand increased 0.8% from a month earlier in November, the most since July and above market expectations of 0.5%. The final demand for goods index rose 1.2%, while the final demand for services moved up 0.7%. The index for final demand less foods, energy, and trade services or Core PPI moved up 0.7% in November, the largest rise since climbing 0.8% in July. Intermediate processed goods prices rose 1.5% and were up 1.2%, excluding food and energy. Year on year, producer inflation rose to a new recent high of 9.6%.

Why it Matters: The increases were broad-based, and even when removing food and energy were stronger than expected. The underlying data shows year-on-year gains in certain categories that haven’t been seen since the 1970s. In our attempt to find some signs of peaking price increase, it is worth noting that increases in Processed Goods and Intermediate Demand saw some deceleration across the board with the exception of Non-food Materials Less Energy, which should also cool slightly given decreases in commodity prices recently. Energy increases during the November period survey were also quite substantial, and this has notably reversed with the recent sell-off in the complex. Regarding more supply-side orientated inflationary measures, Transportation and Warehousing increased a notable 1.9%, showing no signs of demand abating there. When we step back, this was a troubling report regarding any future slowing of increases for CPI/PCE while also increasing the likely number of rate hikes the Fed will be forecasting/considering next year during today and tomorrow’s FOMC meeting.

*A large monthly increase in Final Demand for Services without any subsequent offsetting slowdown in Demand for Goods has year-on-year PPI increasing at a rate not seen since the 70s.

*Inflationary pressure is everywhere, with finished consumer goods increasing at the fastest rate since 1974

The NFIB Small Business Optimism Index increased 98.4 points in November from a 7-month low of 98.2 in October. Four of the 10 Index components improved, four declined, and two were unchanged. The NFIB Uncertainty Index decreased four points to 63. Owners expecting better business conditions over the next six months decreased to a net negative 38%, tied for the 48-year record low reading. A net negative 2% of all owners reported higher nominal sales in the past three months, up 2 points from October, while expectations for higher sales increased to a net 2%. The net percent of owners raising selling prices increased to a net 59%, the highest reading since October 1979. A net 44% of responding firms reported raising compensation, unchanged from October and a 48-year record high reading.

Why it Matters: Around half of responding business owners in the survey continue to report having job openings that are hard to fill, relatively unchanged from last month. When coupled with intentions to raise compensation being unchanged, we may have seen the worst of labor shortages. This is by far the “Selected Single Most Important Problem” facing respondents, so any improvement/stabilization there would support increases in general sentiment and reduce uncertainty. Regarding potential drivers of growth moving forward, both Inventory Satisfaction and Capital Expenditure continue to show continued demand. Firms desire to improve sales-to-inventory ratios and, at the same time, a steady/strong level of investment is being made now and planned for in the future to improve productivity.

*Small business owners continue to be challenged by labor shortages and supply-chain disruptions, causing a higher inflationary environment and increasing costs

*However, firms continue to have success increasing their selling prices with the highest amount doing so since the late 1970s

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the week, with a big move lower in the ratio today thanks to the Value factor higher by almost 1% while Growth is lower by almost the same amount. Mid-Cap Value is the best performing size/factor today

Chinese Iron Ore Future Price: Iron Ore futures are lower on week and day as property developers are again under pressure despite expectation for more FAI through fiscal measures in 2022

5yr-30yr Treasury Spread: The curve is flatter on the week and slightly higher today, but tomorrow FOMC decision will likely dictate where the trend goes from here

EUR/JPY FX Cross: The Yen is stronger on the week and today due to the more risk-off tone and despite PM Kishida spooking equities markets again with talks of reform

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

It’s On: UPS, Postal Service Step Up On-Time Holiday Deliveries, Data Show – WSJ

Delivery networks have mostly held up during the first major test of the peak shipping season, industry data show, as earlier shopping and increased in-store purchases have eased the usual late-year congestion. “In spite of labor shortages impacting parcel carriers’ ability to hire additional workers, they have held up the service levels,” ShipMatrix President Satish Jindel said. Other shipping consultants also have noted limited problems with the large carriers thus far.

Why it Matters:

On-time scores between Nov. 21 and Dec. 4 were 87.9% at FedEx, 96.1% at the Postal Service, and 96.4% at UPS, according to ShipMatrix. That compares with 94.9% at FedEx, 92.8% at the Postal Service, and 96.3% at UPS during a similar time frame last year. The carriers still have a critical two weeks leading up to Christmas to process and deliver hundreds of millions of parcels collectively, with some cutoffs already passed.

China Macroprudential and Political Loosening:

Boosting: China Seen Adding Fiscal Stimulus After Setting 2022 Targets – Bloomberg

At the end of their three-day annual Central Economic Work Conference, the Communist Party’s top decision-makers on Friday said the top priority for next year is “ensuring stability.” They also vowed to “front load” policies and keep the monetary stance flexible and appropriate. “Fiscal policy is expected to play the main role in supporting growth next year,” said Ding Shuang, chief economist for Greater China at Standard Chartered Plc, while housing policies will see “fine-tuning” rather than a significant shift, he added.

Why it Matters:

Policymakers will start with “conventional” monetary and fiscal tools, such as cuts to bank reserve requirements and accelerated infrastructure spending, and could loosen curbs on the property sector and local government debt if conventional efforts don’t bear fruit, wrote Larry Hu, chief China economist at Macquarie Group, in a note. Beijing is also expected to guide banks to issue loans at a faster pace next year after it omitted references to efforts to control debt levels in the economy from its summary of the meeting.

LONGER-TERM THEMES:

Electrification and Digitalization Policy:

Censored: Tor’s main site blocked in Russia as censorship widens – Bleeping Computer

The Tor Project's main website, torproject.org, is actively blocked by Russia's largest internet service providers, and sources from the country claim that the government is getting ready to conduct an extensive block of the project. Russia is undergoing a coordinated action against Tor, orchestrated by Roskomnadzor, the Federal Service for Supervision of Communications, Information Technology and Mass Media. This blocking occurred simultaneously with the banning of six more VPN services in Russia, introducing multi-level anonymous Internet access hurdles to users in the country.

Why it Matters:

Tor is a software project that allows users to automatically encrypt and reroute their web requests through a network of Tor nodes for anonymous browsing. It is commonly used to protect one's identity from the internet and service providers, helps users hide their online trace, access shared information without fearing exposure, and bypass censorship. The actions by the Russian government are in perfect alignment with the overall strategy to gain complete control over what online resources its people are allowed to access. It is also happening at a time when Russia is potentially going to invade Ukraine and may want to block that on its own internet.

Commodity Super Cycle Green.0:

Follow the Money: This Was the Year Investors and Businesses Put Big Bets on Climate – WSJ

Investor demand for climate-friendly stocks has surged in the past couple of years. On the sidelines of the recent Glasgow climate summit, private investors were converging around new firms from a range of businesses that hope to profit from reducing emissions as investor demand for climate-friendly endeavors. Specialty funds aligned with environmental, social, and governance (ESG) principles hit a record of $51.1 billion in new money in 2020, more than twice as much new money as flowed into such vehicles a year earlier. Hedge funds and private-equity firms are also increasingly getting into the act.

Why it Matters:

The article recaps the increasing amount of capital going into ESG, primarily focusing on the E. Climate-conscious stakeholders are driving the demand, and there is no indication this trend will change anytime soon. Finally, even fossil fuel companies face increasing pressure from shareholders to diversify their energy portfolios towards greener pastures. This is all known, and we highlight the article as a summary of why we continue to believe in a green-orientated commodity supercycle.

Lost Gains: Supply chain woes dim 2022 outlook for US solar – Renewables Now

The U.S. solar industry/market is expected to grow 25% less than previously forecast during 2022, according to a new report by the Solar Energy Industries Association and Wood Mackenzie. "The U.S. solar market has never experienced this many opposing dynamics," said Michelle Davis, principal analyst at Wood Mackenzie. "On the one hand, supply chain constraints continue to escalate, putting gigawatts of projects at risk. On the other, the Build Back Better Act and extension of the investment tax credit would be a major market stimulant for this industry, establishing long-term certainty of continued growth."

Why it Matters:

Costs related to utility-scale solar projects had declined by 12% between Q1 2019 and Q1 2021, but the recent spike in the price of materials has erased two years' worth of cost declines. Despite the pressures, the U.S. installed solar capacity jumped 33% YoY to 5.4 GW, marking the most additions on record for Q3. America's total generating capability now consists of 1,200 GW, according to the Public Power Association.

ESG Monetary and Fiscal Policy Expansion:

Regulators, Mount Up: Janet Yellen Walks Political Tightrope to Deliver on Biden’s Climate Promises - WSJ

Facing pressure from congressional Democrats and a need to deliver on President Biden’s campaign promises, Treasury Secretary Janet Yellen is instructing financial regulators under her watch to take steps to reduce risks tied to climate change. “We’re not an environmental agency,” Ms. Yellen said in an interview with The Wall Street Journal on the Treasury Department’s role on climate issues. “But we can play and are trying to play a very significant role in contributing to our country and the globe in addressing this.”

Why it Matters:

Climate-focused regulation is coming. The Office of the Comptroller of the Currency, an arm of the Treasury, plans soon to issue a framework of its expectations for how large banks should be managing climate risk, with detailed guidance to follow next year. The Fed is working on so-called scenario analysis to model financial risks associated with climate change. The SEC plans to issue a rule proposal early next year to strengthen mandatory disclosures around climate-related risks. It has sent letters to dozens of publicly traded companies asking them to inform investors about how climate change might affect earnings.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.