MIDDAY MACRO - DAILY COLOR – 1/21/2022

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are lower, chopping around significantly on a large option expiration Friday with more defensive sectors/factors not surprisingly outperforming as worries over the Fed and geopolitics continue to drive sentiment

Treasuries are higher, with the flight to safety continuing as the Fed’s blackout period and little new economic data is keeping the narrative the same as yesterday

WTI is lower, as the risk-off tone and better than expected inventory builds are weighing on recent price increases from higher geopolitical risk premiums and the continued declines in Omicron cases increasing demand expectations

Narrative Analysis:

Equities are chopping around after falling to levels last seen in October after yesterday’s ugly close, where morning gains of over 2% in the Nasdaq turned into a -1% by the end of the day, a very telling sign of how poor sentiment currently is. Today’s large OPEX is adding to the volatility as dealers sell into any drops to hedge growing put positions. Treasuries continue to see a flight to safety bid as concerns over the situation in Russia/Ukraine are outweigh Fed tightening worries for now. Interestingly the dollar has yet to see a meaningful bid, which often occurs during bouts of risk aversion and remains rangebound. Elsewhere the commodity complex is not as troubling, with base metals and oil still generally rising due to optimism on Omicron and China.

The Russell is outperforming the S&P and Nasdaq with Small Caps, Low Volatility, and High Dividend Yield factors, and Real Estate, Consumer Staples, and Utilities sectors all outperforming.

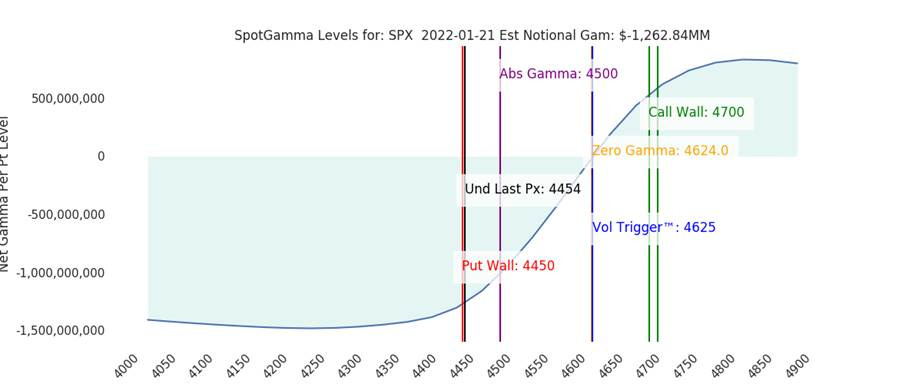

S&P optionality strike levels have the Zero-Gamma Level at 4624 while the Call Wall has fallen to 4700. The move lower yesterday has increased the negative gamma position significantly. 4500 is the major gamma strike currently on the board, but all strikes are very put-dominated. There is a historically high level of optionality expiring today, but a lot of put positions have been rolled forward, weighing on any chances of a meaningful rally. The market is currently very risky and fragile, where large flows that can shift prices rapidly.

S&P technical levels have support at 4430, then 4400, and resistance is at 4480, then 4540. The S&P recovered a drop below the 200dma overnight and post-NY open. If the current lows aren't maintained today, there is little resistance below, and the sell-off will significantly worsen.

Treasuries are higher, with the 10yr yield moving below its recent uptrend and now at 1.75%, while the 5s30s curve is little changed on the day at 0.53 bps.

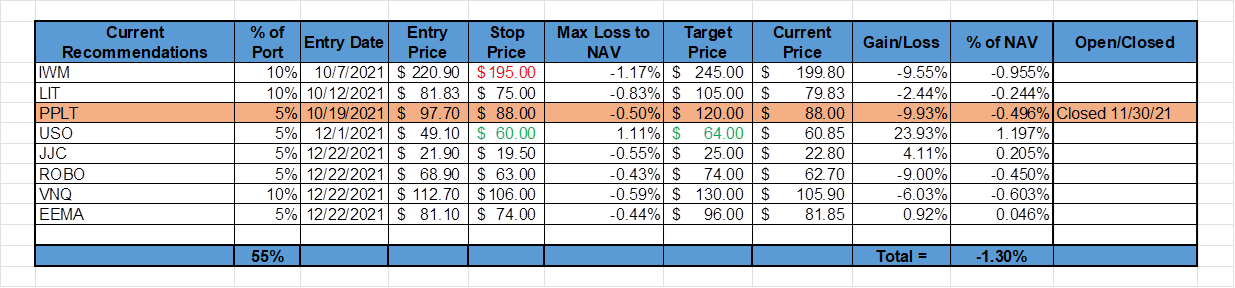

We are making a few updates to our portfolio target/stop price levels. Thanks to gains in oil, copper, and our Asian EM position, the portfolio is somewhat holding up during this current sell-off. The Russell long has been the worst performer, followed by our robotics ETF and REITs ETF. We still feel these positions are appropriate and instead look to weather the current storm based on the belief it has gotten ahead of the fundamentals and will correct following today’s OPEX and next week’s FOMC meeting.

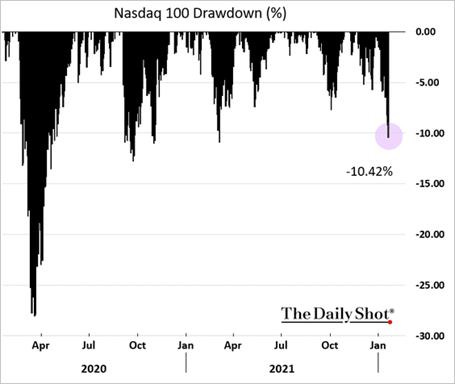

We continue to believe the current sell-off is overdone but fully acknowledge it could continue for some time until we get clarity from the Fed on tightening plans and a de-escalation in the current Russia/Ukraine situation. The passage of the large OPEX today will help remove some volatility but next week’s FOMC meeting is a more significant catalyst for whether dip buyers come in or we have a proper -10%+ correction in the S&P, something already achieved by the Nasdaq.

*We are now official in correction territory for the Nasdaq

As a result, we are lowering our Russell stop to allow a max loss of around -1.2% for the portfolio. We believe that OPEX today and no hawkish developments from next week's FOMC meeting will improve sentiment/volatility. As a result, we believe markets are near a tactical bottom in the current sell-off. This should benefit the Russell the most as cyclicals, value, and small-caps benefit from a proper reopening and falling inflation landscape moving forward while diminished Fed tightening fears reduce rises in real rates. (We also do not want to repeat our platinum trade which we sold at the bottom of its recent range, only to see it rally back since then)

*Momentum and RSI measures are showing very oversold conditions

We are also moving up our stop and target prices in our oil long expressed through the $USO ETF. This effectively locks in a 22% gain and allows for further gains if the geopolitical situation between Russia and the West deteriorates further. If that situation improves, we would expect a drop in oil prices as the geopolitical risk premium is reduced.

*The picture is still muddy, much like the Ukrainian landscape keeping Russian tanks from advancing, but we believe the likelihood of a large military escalation remains contained

The bottom line is that we continue to see very accommodative financial conditions for risk assets over this year and believe the Fed will not over tighten to materially change that backdrop as growth and inflation fall back towards longer-term trends. We believe that the Omicron slowdown in global growth will be short-lived, and the reopening will fully re-commence (for the last time). China’s macro policy is becoming more supportive. The current geopolitical worries will remain a concern, but markets will move on as we assume any incursion by Russia into Ukraine will be limited. As a result, we continue to have a high conviction that our macro themes (reopening, automation, electrification, appreciation of real assets) are all still intact and are comfortable continuing to hold longs there. Further, the current levels in equity markets are where we would initiate additional small/cautious longs if we didn’t already have our existing levels of risk on.

*Our overweight in cash, as well as longs in Oil, Copper, and EM, is buffering losses elsewhere

Econ Data:

The Conference Board Leading Economic Index increased by 0.8% in December to 120.8, following a 0.7% increase in November and a 0.7% increase in October.

Why it Matters: Despite a slowing due to Omicron and persistence of supply-side and inflationary concerns, the Conference Boards’ LEI did rise in December, and their economist remains optimistic on Q1 growth. The Conference Board forecasts GDP growth for Q1 2022 to slow to a relatively healthy 2.2 percent (annualized). Still, for all of 2022, we forecast the US economy will expand by a robust 3.5 percent—well above the pre-pandemic trend growth,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board.

*The mix of inputs that dictate the Leading Economic Indicator remained positive in December

Existing home sales fell 4.6% to a seasonally adjusted annual rate of 6.18 million in December of 2021, the lowest in 4 months and below market forecasts of 6.44 million. Each of the four major US regions witnessed sales fall. Total housing inventory fell -18% to 910K units, an all-time low since January 1999, which is equivalent to 1.8 months of monthly sales pace. Properties typically remained on the market for 19 days in December, one day more than the 18 days seen in November, and down from 21 days in December 2020. The median existing-home price for all housing types was $358K, up 15.8% from last year.

Why it Matters: In 2021, existing-home sales totaled 6.12 million, an increase of 8.5% from the prior year and the highest annual level since 2006. "December saw sales retreat, but the pullback was more a sign of supply constraints than an indication of a weakened demand for housing. This year, consumers should prepare to endure some increases in mortgage rates. I also expect home prices to grow more moderately by 3% to 5% in 2022, and then similarly in 2023 as more supply reaches the market", said Lawrence Yun, NAR's chief economist.

*Low inventories are now the primary constraint to sales as demand continues to be strong despite lower affordability and higher mortgage rates

The Philadelphia Fed Manufacturing Index increased to 23.2 in January from a 1-year low of 15.4 in December and above market expectations of 20. Increases in New Orders (17.9 vs. 13.7 in Dec), Shipments (20.8 vs. 15.3), and Unfilled Orders (23.5 vs. 11.4) helped move the overall business condition index higher. Negative contributors were Inventory (3.1 vs. 13.2) and Employment measures. Logistical and inflation-related indicators were mixed with Delivery Times falling while Prices Paid increased and Prices Received fell. Six Month ahead outlook indicators for General Business Conditions (28.7 vs. 19) were higher, driven by increases in New Orders and Shipments. There was a significant jump in expectations for future Prices Paid (76.4 vs. 53.8) while Capital Expenditures (26.2 vs. 20) continued to rise at a strong pace.

Why it Matters: We were happily surprised to see the increase in the Philly Fed survey following the surprisingly negative Empire State survey. Increases in current and future expectations for new orders and shipments showed that Omicron was not diminishing demand. However, increases in current prices paid and future expectations do not bode well for the inflationary picture. Further, January’s special questions focused on expectations for changes in various input and labor costs for the coming year. Responses indicate an expected average increase of 8.9% for raw materials, followed by energy, intermediate goods, health benefits, and total compensation (wages plus benefits), which are all expected to increase 6.4% on average. In summary, no current or even expectation for reduced inflationary pressures in the Philly Fed region yet.

*Both current and future activity bounced off recent lows in January’s Philly Fed Manufacturing Survey

*Prices paid increased again while prices received took a turn lower, showing firms are experiencing increased margin pressures

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the day and week, with the ratio now falling below its recent downtrend. Small-Cap Value is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and week again as hopes for additional policy easing and property sector relief continue in China

5yr-30yr Treasury Spread: The curve is flatter on the day and the week pushing it further into the flattest levels seen post-pandemic as traders increasingly view Fed tightening as being restrictive to future growth

EUR/JPY FX Cross: The Euro is little changed on the day and weaker on the week as the risk-off tone supports the Yen

Other Charts:

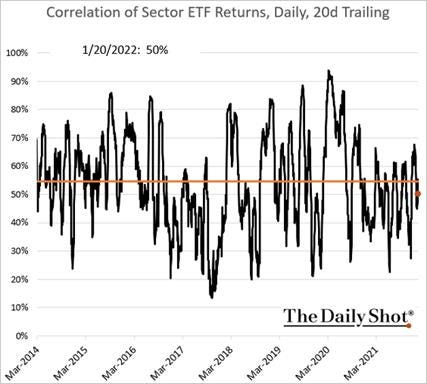

Sector correlation is still below historical averages, instead of increasing as it usually does during sharp sell-offs like the current one, a positive sign

Oxford Economics recovery tracker is showing a notable decline in economic activity at the end of Q4 and into Q1 due to Omicron but we believe this will be short-lived

Morgan Stanley estimates that Oil would need to be between $100-$110 to start to erode demand meaningfully, giving us caution that oil can rise much further on supply/demand dynamics alone

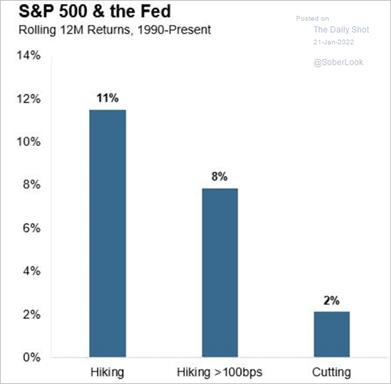

Markets tend to do better when the Fed is hiking, even when its greater than 1% a year which is why we think current Fed tightening fear’s are overdone

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Too Tailored: SCOTUS upholds stay on OSHA's vaccine mandate – SupplyChainDive

The U.S. Supreme Court issued a stay on the Occupational Safety and Health Administration's COVID-19 vaccination emergency temporary standard in a per curiam decision published Thursday. However, the court issued a separate per curiam opinion dissolving injunctions placed on a vaccination mandate for healthcare workers issued by the Centers for Medicare and Medicaid Services.

Why it Matters:

It is on employers to decide whether they want to have a vaccine mandate as there will be no uniformity from OSHA. On the margin, this helps supply chain functionality and manufacturing more general as non-vaxed workers can keep on doing their job. We don’t have a sense of which firms/industries were at risk of losing enough workers to lower output, but it is a notable development.

China Macroprudential and Political Loosening:

Disorderly: China Vows ‘No Mercy’ in Battle Against Corruption, Big Tech – Bloomberg

In a sweeping communique following the plenary session of the Chinese Communist Party’s top anti-graft group, the government said it would break the ties between money and power and tackle corruption in a range of industries. It also pledged to target political factions and interest groups within the party, the official Xinhua News Agency reported Thursday.

Why it Matters:

The comments suggest President Xi isn’t finished with his regulatory onslaught that upended industries from e-commerce to education and ride-hailing last year. As we highlighted in yesterday’s note, things on the ground are still two steps forward, one step back for improving market sentiment in China, but generally, an improving macro backdrop should prevail. We see the continued corruption crackdown as simply a consolidation of Xi’s tribe grabbing further power from other factions.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Onshoring: Intel to Invest at Least $20 Billion in New Chip Factories in Ohio – NYT

Intel said Friday that the new site near Columbus would initially have two chip factories and would directly employ 3,000 people while creating additional jobs in construction and at nearby businesses. The move is Intel’s first to a new state for manufacturing in more than 40 years.

Why it Matters:

Intel’s move has geopolitical implications, as well as significance for supply chains. Patrick Gelsinger, who became Intel’s chief executive last year, has rapidly increased the company’s investments in manufacturing to help reduce U.S. reliance on foreign chip makers while lobbying Congress to pass incentives aimed at increasing domestic chip production. Legislation passed by the Senate with bipartisan support last June would provide $52 billion in subsidies for the chip industry, including grants to companies that build new U.S. factories. The package has since stalled in the House, but it may pass in the coming months.

Electrification and Digitalization Policy:

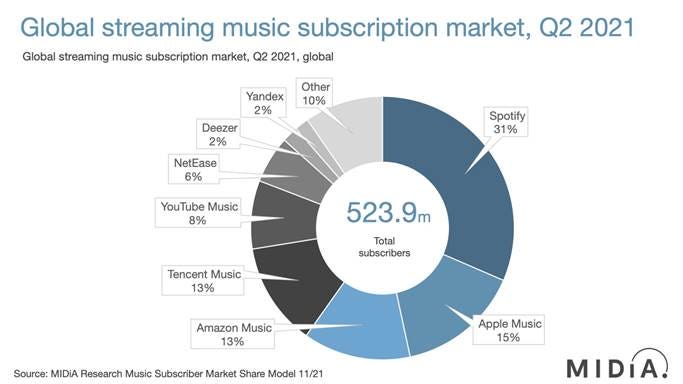

Music Share: Music subscriber market shares Q2 2021 - MIDiA

The global base of digital music subscribers continues to grow strongly, with 523.9 million music subscribers at the end of Q2 2021, which was up by 109.5 million (26.4%) from one year earlier. Crucially, this was faster growth than the prior year. Spotify has the highest market share (31%), but this was down from 33% in Q2 2020. Apple Music is a distant second with a 15% market share.

Why it Matters:

But the biggest subscriber growth came from emerging markets. The strong growth in subscribers holds an extra meaning going into 2022. The surge in non-DSP streaming in 2021 means that the streaming market is no longer dependent on the revenue contribution of maturing Western subscriber markets. This increases the diversification in how end-users receive music. This trend shows the further penetration of digitalization trends into non-western parts of the world.

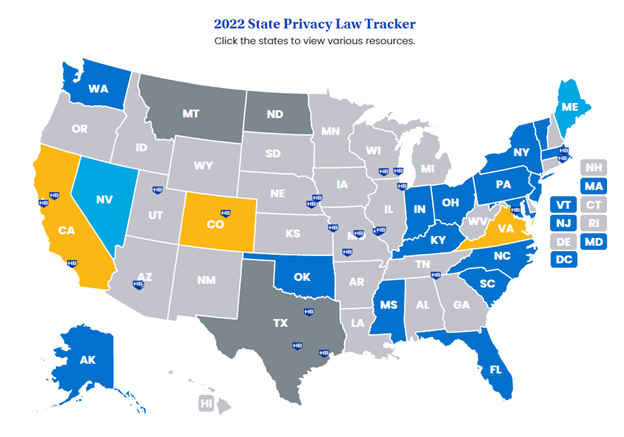

Tracking: A comprehensive resource for tracking U.S. state privacy legislation. - Husch Blackwell

Legislators in seven states, Alaska, Florida, Indiana, Kentucky, New Jersey, Pennsylvania, and Vermont, have proposed privacy laws so far this year. Law firm Husch Blackwell LLP is tracking the bills' progress, along with potential changes to existing laws in California, Virginia, and other states.

Why it Matters:

Changes to privacy rules will have significant effects on social media and online advertisers' business models. We highlight this tracker to help readers interested in monitoring those changes. We believe there is strong bipartisan support for differing reasons to continue to increase regulation on big-tech, and we see the privacy area as a critical area to watch.

Commodity Super Cycle Green.0:

Moving It: Liquid Hydrogen Wants a Clean Energy Future - Bloomberg

A pilot project is producing hydrogen from coal and biomass in Australia, with a future plan to capture associated carbon dioxide and store the emissions in the Bass Strait, off the country’s southeast coast. It will be transported to Kobe in Japan on the Suiso Frontier, the first ship ever designed to ferry this type of fuel.

Why it Matters:

For countries like Japan with little space for wind and solar equipment, new options to import carbon-free power are vital to achieving climate targets. Liquefying hydrogen is expensive, as it consumes more than 30% of the energy content of the fuel, according to the U.S. Department of Energy. Also, it takes two-and-a-half ships carrying liquefied hydrogen to move the same amount of energy as one vessel of the same volume carrying liquefied natural gas. Nevertheless, this first hydrogen shipment from Australia to Japan is a notable development.

Exponential: Carbon Offset Prices Could Increase Fifty-Fold by 2050 – Bloomberg

Prices for carbon offsets (verified emissions reductions equivalent to one ton of carbon each) could be as high as $120/ton or as low as $47/ton in 2050, according to research company BloombergNEF. The outcome will mostly depend on what types of supply are eligible to meet the rapidly expanding universe of sustainability goals, as well as who the primary customers are in the market, finds BNEF’s inaugural Long-Term Carbon Offset Outlook 2022.

Why it Matters:

In the report, BNEF models supply, demand, and prices for carbon offsets under three scenarios: a voluntary market scenario, an SBTI (Science Based Targets initiative) scenario, and a hybrid scenario. Offset prices range from $11-$215/ton in 2030, up from just $2.50 on average in 2020, before narrowing to $47-$120/ton in 2050. There is clearly a wide degree of uncertainty. Still, we do subscribe to the idea that offsets will be increasing in price initially until a more organic sustainable market can evolve.

ESG Monetary and Fiscal Policy Expansion:

Give me your: Biden Administration Makes Visa Changes to Retain Foreign STEM Students – WSJ

The Biden administration is making a series of policy changes aimed at easing the path for foreign students and professionals in the fields of science, technology, engineering, and math to remain in the U.S. on a long-term basis. Though the changes are technical, officials said they are necessary to make it easier for foreign STEM graduates to live and work in the U.S. rather than in other countries with friendlier immigration systems.

Why it Matters:

The most significant of the changes will expand the number of disciplines that international students can study to qualify to work in the U.S. on their student visas by 22 new eligible fields, including data science and financial analytics. It is unlikely that tweaking such visa policies will make a significant difference in attracting more international students. Broader changes, such as increasing the number of visas available or expanding visa eligibility, must be made by Congress, where any immigration legislation has become caught up in more significant political fights.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.