MIDDAY MACRO - DAILY COLOR – 12/1/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Narratives/Price Action:

Equities are higher, with markets globally reflecting a more risk-on tone, helping recent sectorial and factorial laggers outperform today as “comment” fears regarding Omicron and Fed policy have subsided

Treasuries are lower, with the curve little changed as the more risk-on tone overnight was furthered by more positive ISM data this AM, consolidating recent long-end gains

WTI is higher, as prominent sell-side research called the sell-off overdone and traders increasingly believe OPEC+ will balk at any production increases in December

Analysis:

Equities are shaking off yesterday’s worries with an almost complete reversal of yesterday's price action underway today, not only domestically but globally. The overnight rally got further support post-NY-open thanks to better than expected Manufacturing PMI data, showing some stabilization in supply-side troubles. Technicals and optionality are now working in favor of a further rally. Treasuries are under pressure, but the long-end is safely holding onto weekly gains, as is the dollar.

The Russell is outperforming the S&P and Nasdaq with Small-Cap and High Dividend Yield factors, and Energy, Materials, and Financials sectors all outperforming.

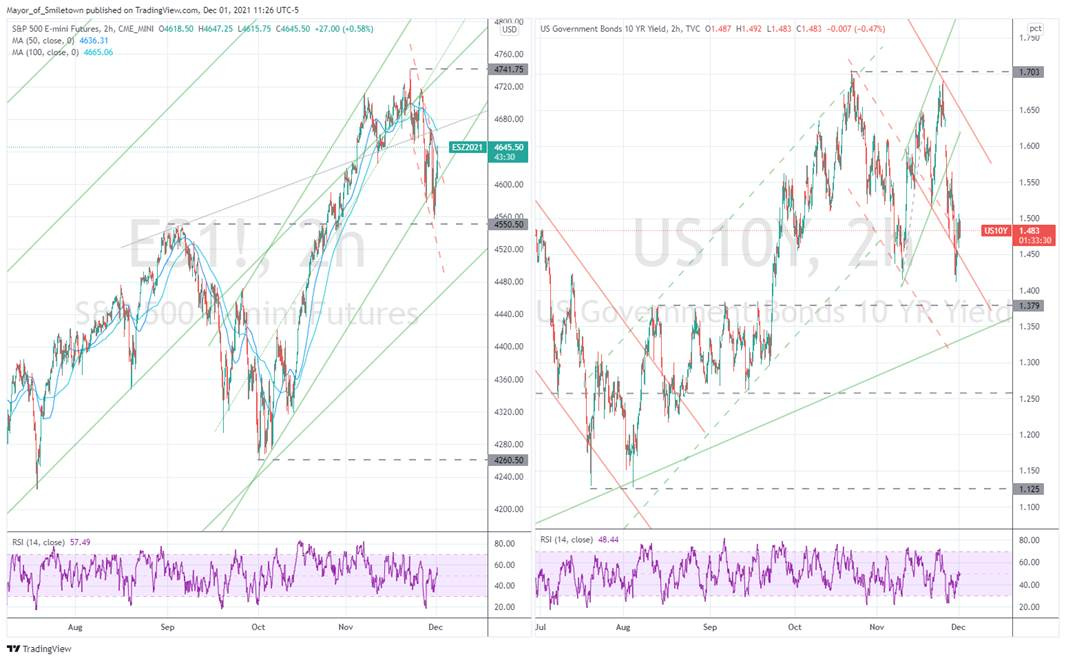

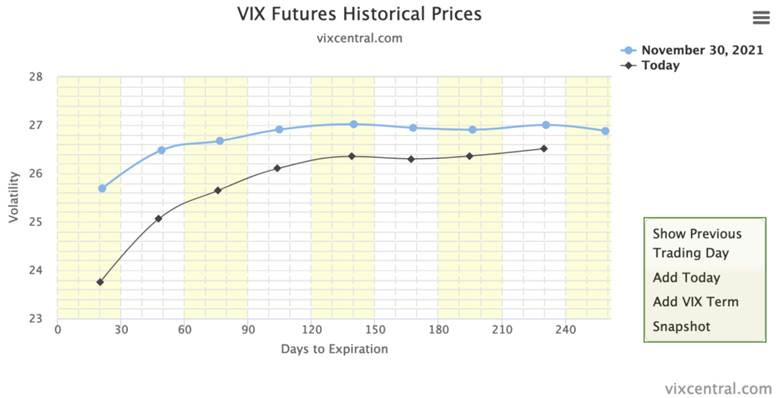

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4650 while the Call Wall is at 4750. Implied volatility is notably down this morning, showing the VIX complex is decompressing, a positive for equities. Gamma flips to a more positive position above 4640 which will act as resistance.

S&P technical levels have support at 4600-05, then 4590, and resistance is at 4635, and then at 4665. Yesterday's end-of-day bounce of the 4550-60 area was a positive sign that kept the longer-term uptrend intact, with a move above 4665 fully reopening the way to new all-time highs.

Treasuries are lower, as yesterday's rally in the long-end has partially re-traced while the belly is back at Friday’s levels, leading the 5s30s curve slightly flatter by 1.5bps and staying near recent lows of 62bps.

*Volatility is falling today, and if the S&P can rise above 4640, gamma support would become increasingly positive, driving implied vol down further

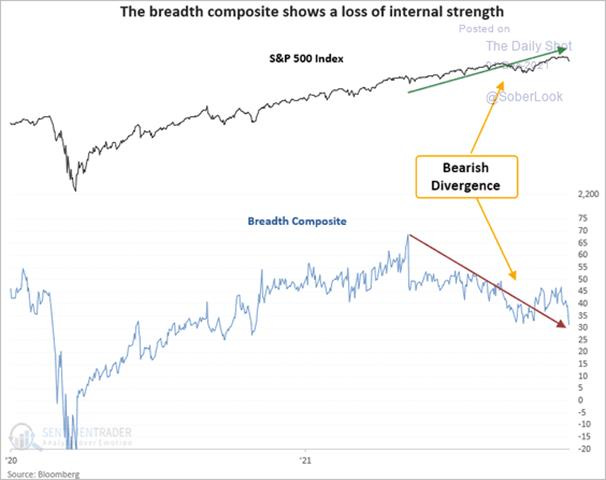

*The breadth of stocks driving index gains has fallen again after an uptrend post-September was broken in the recent sell-off

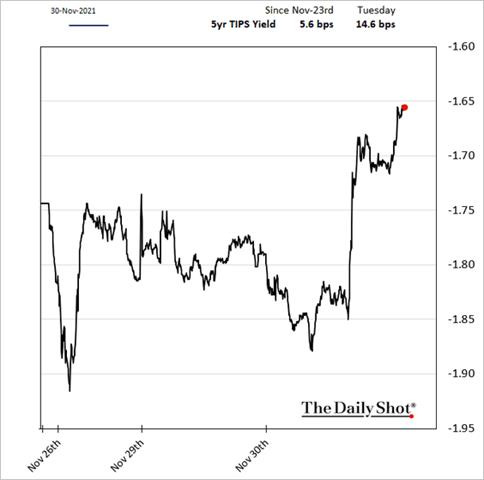

*5yr real rates rose close to 25bps yesterday following Powell’s faster taper comment

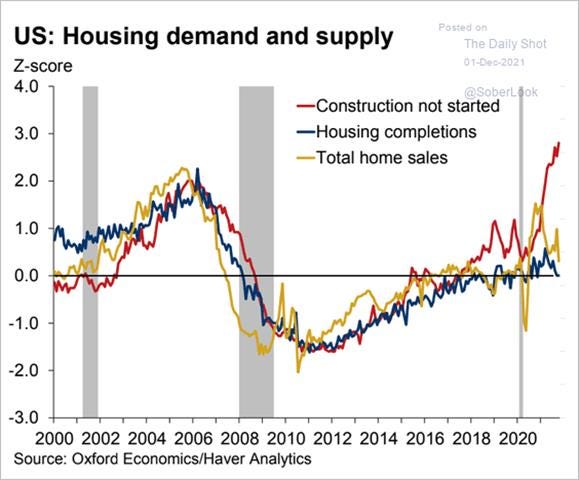

*Construction not started is 3 standard deviations above its average since 2000, showing a massive current backlog and increased supply coming next year

*Chicago PMI dropped more than expected yesterday due to decreases in New Orders, Order Backlogs, and Employment

We are adding a tactical long position in oil through the $USO ETF. We think the oil complex (both WTI and Brent) is now oversold on Omicron fears. We believe OPEC+ will limit supply, Iran negotiations will stall, and generally, expectations for surpluses next year and weaker demand do not justify the actual price drop.

The desire for producers to increase supply domestically and abroad (as either part of OPEC+ or elsewhere) has been significantly diminished due to the recent correction and higher volatility, and we expect OPEC+ not to increase future supply levels this week.

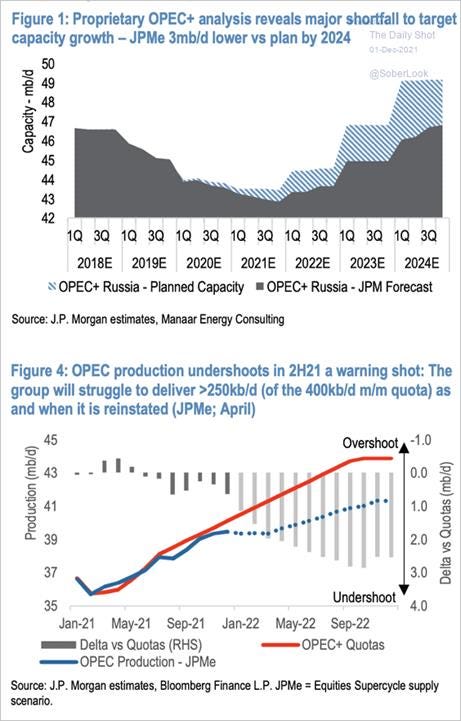

*Many analysts are questioning whether OPEC+ has as much spare capacity as it claims

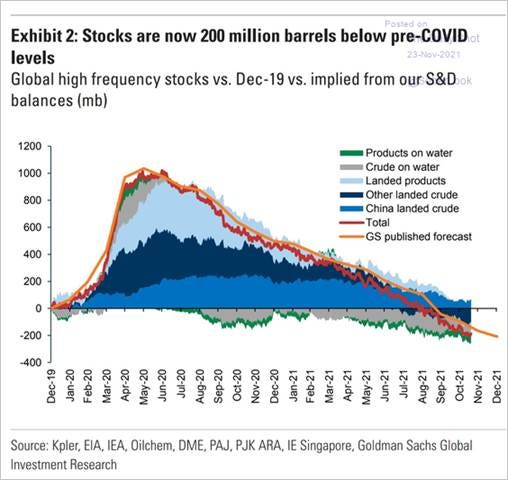

On the other side, demand is unlikely to fall as dramatically as feared from any uptick in the pandemic given the adaptability economies/consumers have shown in each past wave. Coupled with low global inventories and still tepid Capex activity (already known about), we (cautiously) echo calls from GS and other sell-side research that this drop was driven by fear and technicals/optionality in the market, not fundamental realities.

*Inventories remain tight, helping the futures curve remain in backwardation while expectations for surplus next year seem too rosy.

The bottom line, there is always a lot to say about oil. Although we follow the oil market closely, we are admittedly not experts (compared to those we follow), but with that said, we see the recent pullback as a good risk/reward opportunity. We enter $USO at $49.10, with a target of $57.50 and a stop of $46.25.

*$USO bounced nicely off the bottom of its yearly up-channel, giving confidence that our stop level is appropriate

Econ Data:

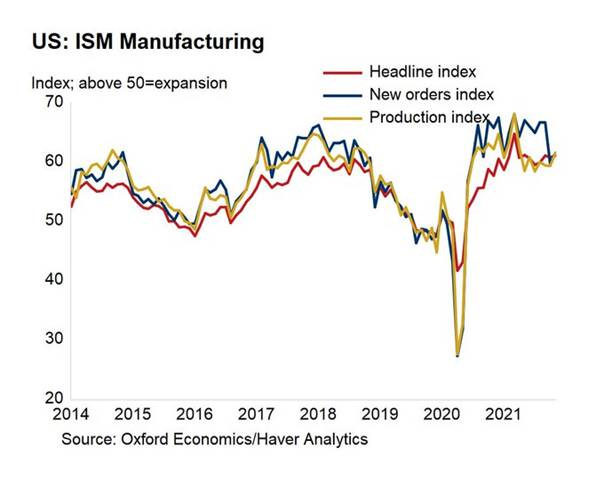

The ISM Manufacturing PMI increased to 61.1 in November, from 60.8 in the previous month and broadly in line with the market consensus of 61.0. Increases were seen in Production (61.5 vs. 59.3 in October), New Orders (61.5 vs. 59.8), and Employment (53.3 vs. 52.0), while the survey's measure of prices paid by manufacturers fell to a still-high 82.4 from 85.7 in the previous month. All of the six biggest manufacturing industries registered moderate to strong growth in November. Decreases in Backlog of Orders and New Export Orders as well as respondent comments showed demand increases were flattening though.

Why it Matters: The latest reading of sub-indexes showed some improvement in supply-side disruption while overall demand remained stable. Respondent comments, on the whole, also supported this assessment. “Meeting demand remains a challenge due to hiring difficulties and a clear cycle of labor turnover at all tiers. Panelists’ comments suggest month-over-month improvement on hiring, offset by backfilling required to address employee turnover. Indications that supplier delivery rates are improving were supported by the Supplier Deliveries sub-index softening. Transportation networks, a harbinger of future supplier delivery performance, are still performing erratically,” said Timothy Fiore, Chair of the Institute for Supply Management. The bottom line is this was a positive report. As we move forward, headline PMI prints will likely fall as supply-side related sub-indexes drop due to improvements in logistics, resolved labor issues, and fewer material shortages (hence lower inflation).

*New Orders and Production marginally increased in November

*Some improvement in Deliveries and Prices continue to lead us to believe we have seen the worst of supply-side problems

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the week, but Value is higher on the day with Mid-Cap and Small-Cap Value factors outperforming Large-Cap Growth on the day

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week and the day, despite the Caixin Manufacturing PMI falling below 50

5yr-30yr Treasury Spread: The curve is flatter on the week, and today, with the belly continuing to underperform as Powell/Yellen are on their second day of the Senate Banking Committee Pandemic Response Hearings

EUR/JPY FX Cross: The Yen is stronger on the week and the day despite a more risk-on tone with the FX cross testing the lower levels of its recent down-channel

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

China Macroprudential and Political Loosening:

Warmer: China’s Frozen Factories Warm Up, a Little – WSJ

China’s official manufacturing purchasing managers index for November rose to 50.1, breaching the 50-point mark separating expansion from contraction for the first time since August. The production subindex jumped sharply, likely due to fewer power curbs as the fall’s electricity shortages ease. But new orders remain subdued. And the service sector decelerated further, with business activity expanding at the weakest pace since February, excluding the sharp drop in August when the country was combating a Delta variant outbreak.

Why it Matters:

The latest PMI data shows a weak recovery at best in early 2022, assuming exports continue to hold up. It also signals further significant policy support for the economy is warranted. The primary drag remains real estate, as it has been for months. The construction PMI ticked up, but that probably reflects the impact of a dramatic drop in costs as factories restarted, rather than a strong rebound in demand. Housing sales appear to have stabilized somewhat thanks to recent modest policy easing measures, mainly on mortgages, they have settled at a low level. The bottom line is that things look to be stabilizing but not accelerating.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

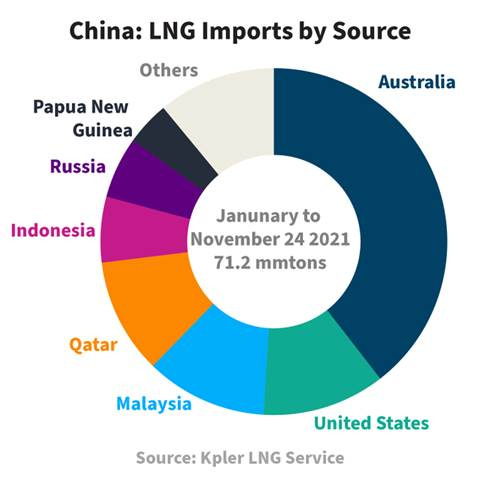

Gas Needed: China redraws seaborne LNG map, looks to America for supplies - Splash247

The United States is now China’s second-largest LNG supplier after Australia, having surpassed the likes of Qatar, Malaysia, and Indonesia. “China appears to be shoring up its energy requirements, signing up nearly a dozen long-term LNG contracts this year, with half of those being done in the fourth quarter. Although Australia looks set to be the biggest supplier of LNG to China this year, the US is moving up the ranks to take the second position, according to S&P Global Platts,” stated a new report from brokers Lorentzen & Stemoco today.

Why it Matters:

Earlier this year, China surpassed Japan to become the world’s largest importer of LNG, adding to a long list of commodities in which the People’s Republic is the number one buyer. China’s greater reliance on non-Asian providers of LNG this year has helped up tonne-mile demand by a massive 30% in 2021. Stepping back, China’s reliance on foreign commodities, with energy being the most important consideration, will limit their “Wolf Warrior” ambitions (in theory), including any plans for Taiwan.

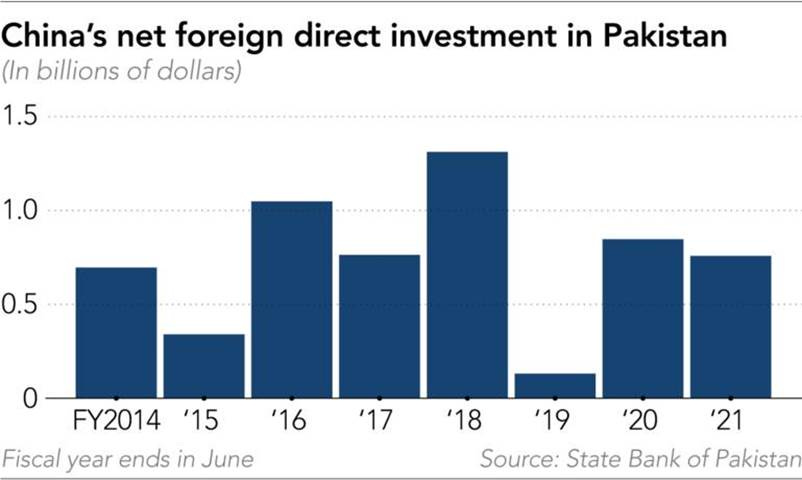

Bridge Over Troubled Waters: China-Pakistan Belt and Road Initiative hits buffers - NikkeiAsia

China-Pakistan Economic Corridor is a $50 billion flagship BRI component that includes power plants, industrial clusters, and road and rail upgrades. About half the money pledged by China has already flowed in with investments and intergovernmental lending, pushing Pakistan's economic growth above 5% in 2017 and 2018. But locals have yet to benefit from Chinese largesse and are losing hope and increasingly resisting developments, with Islamabad also wary of the growing costs. Terror attacks on Chinese interests have also had a chilling effect on economic cooperation.

Why it Matters:

There has been a slowdown in FDI and trade between Pakistan and China. Chinese FDI in the quarter that ended in September was just $76.9 million compared to $154.9 million in the same quarter last year, and China's exports to Pakistan have been declining since a $15 billion peak in 2017. BRI projects have also stalled, with usually quiet rifts between the two sides becoming more evident. The article also clearly showed that locals near projects are very unhappy and are getting little benefits from them. We highlight this to point out further that the BRI soft power gains may be waining globally.

ESG Monetary and Fiscal Policy Expansion:

Top Reg: White House Considering Richard Cordray as Top Fed Banking Regulator – WSJ

According to people familiar with the matter, President Biden is considering Richard Cordray, the first director of the Consumer Financial Protection Bureau, to serve as the Federal Reserve’s top banking regulator. At the CFPB, Mr. Cordray brought significant changes to consumer finance, a corner of the financial industry that had previously escaped regulatory scrutiny. The agency tightened underwriting standards for mortgages, required more disclosure on credit-card rates and fees, and introduced federal oversight to payday lending.

Why it Matters:

Mr. Cordray’s nomination for the Fed post could hearten progressive Democrats who have called for the central bank to take a tougher approach to regulate big banks and addressing financial risks posed by climate change. However, Mr. Cordray would face a closer confirmation vote as Republicans are unlikely to support him given past conflicts when serving as head of the CFPB. According to Sherrod Brown, the Senate Banking Committee Chairman, there are still several other candidates on the table.

Comptrolled: Centrist Senate Democrats Signal Opposition to Biden Banking Nominee – WSJ

A group of moderate Senate Democrats has privately voiced their opposition to President Biden’s nomination of Saule Omarova to become head of the Office of the Comptroller of the Currency, the top banking regulator, likely scuttling the academic’s chances of confirmation. With Republicans unified in their opposition, Ms. Omarova would need approval from all Senate Democrats to win confirmation in the closely divided Senate.

Why it Matters:

Ms. Omarova’s past academic work calling for shrinking big banks and creating a much bigger role for the Federal Reserve in consumer banking has generated a backlash. Industry advocates and some Republicans have said she favors policies that would effectively nationalize lending and envisions an overly large role for the government that would crimp banks’ business. The White House has struggled to find a comptroller nominee who could win support from its Senate allies. Before nominating Ms. Omarova earlier this month, the White House considered at least three other individuals for the role but never nominated them.

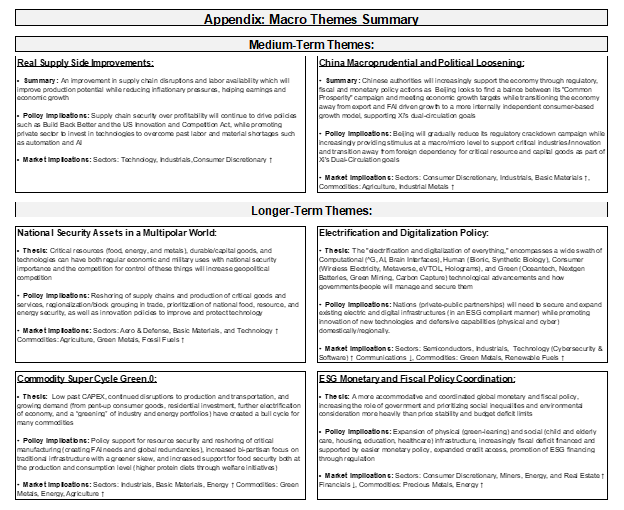

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.