MIDDAY MACRO - 1/19/2022

Daily Color on Markets, Policy, and Geopolitics

MIDDAY MACRO - DAILY COLOR – 1/19/2022

OVERNIGHT-MORNING RECAP / MARKET WRAP

Price Action and Headlines:

Equities are higher, as an overnight bounce is being maintained after post-open selling, but price action is uninspired, with some cyclical sectors and small caps negative on the day

Treasuries are higher, with the curve steeper as a relief rally also looks to be underway, similar to equities

WTI is higher, as the IEA increased its demand forecast while OPEC left theirs unchanged given the reduced effects Omicron has had on activity

Narrative Analysis:

Equities are mixed, with the Nasdaq outperforming after officially correcting -10% from November highs overnight. We still remain in a technical and optionally negative positioned down market with a lack of new data or news today keeping price action choppy but muted compared to earlier in the week. Housing starts and permits beat expectations but was regionally and type mixed. Rising oil prices failed to further weigh on Treasuries today, with WTI now cooling-off morning highs. The dollar is also cooling, but the $DXY is little changed on the day.

The Nasdaq is outperforming the S&P and Russell with Low Volatility, Growth, and Momentum factors, and Consumer Staples, Utilities, and Communication sectors all outperforming.

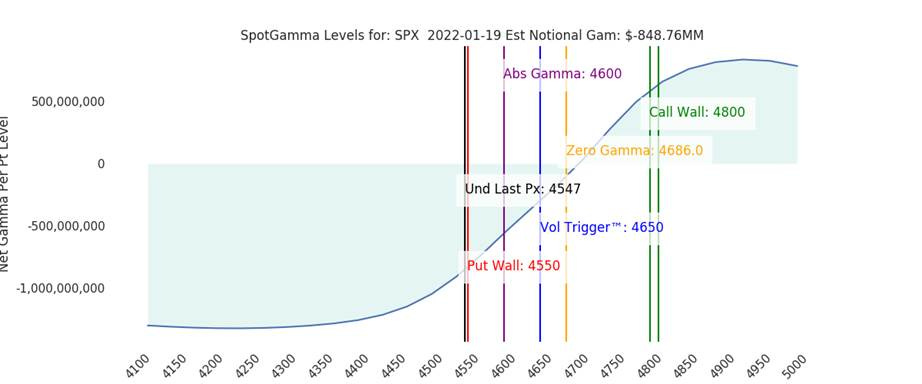

S&P optionality strike levels have the Zero-Gamma Level at 4683 while the Call Wall remains at 4800. The large negative gamma position in all indices implies that high volatility will continue, and large levels of strikes at 4600 will act as gravity to that level. Until the large level of put positions close/expire or implied vol drops, it will be hard for a sustained rally to occur.

S&P technical levels have support at 4565, then 4535, and resistance is at 4600, then 4620. Despite the overnight bounce and post-open recovery, the tactical level for bulls to regain control is 4620, and then the recapture of the 50dma around 4660 if a meaningful move is to persist, otherwise it is still a bear-controlled tape.

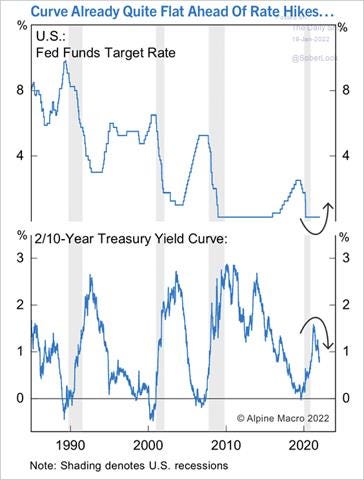

Treasuries are higher, with the 10yr yield hitting resistance at 1.90% overnight and now 6bps lower, while the 5s30s curve is steeper by 1bps to 0.54 bps. Today’s 20yr auction was decently received.

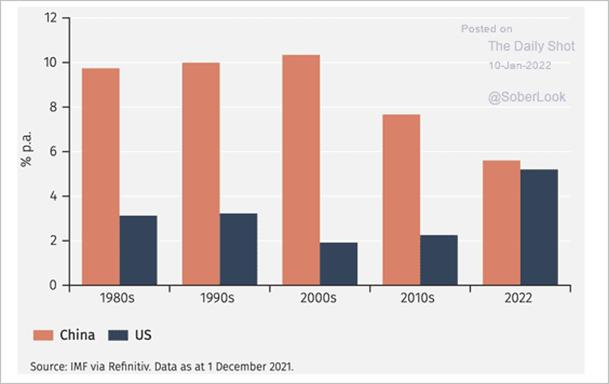

It is worth highlighting that things in China are slowly improving as Beijing increasingly commits to stabilizing growth in a crucial year of leadership transition. While the zero-Covid policy continues to cloud the domestic growth outlook given recent Omicron flare-ups, we are gaining conviction that China will become an increasingly positive pulse for global growth and markets in 2022.

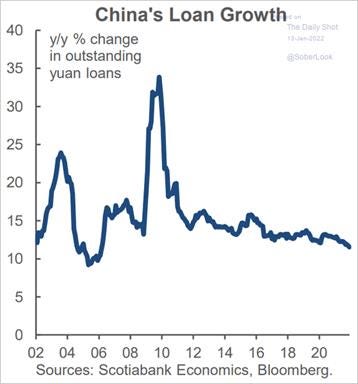

The PBoC further “pledged” to use more monetary policy tools to support the economy and drive credit expansion a day after cutting benchmark lending rates. Deputy Governor Liu Guoqiang said the PBoC would “open the monetary policy toolbox wider, maintain stable overall money supply and avoid a collapse in credit.” This more dovish signaling, the recent rate cut, and increased liquidity injections are the clearest signal that policy is meaningfully becoming more supportive.

*It is now likely the 1-year LPR rate will be lowered, with Goldman now expecting 50bps cuts to RRR in Q1 and potentially more after

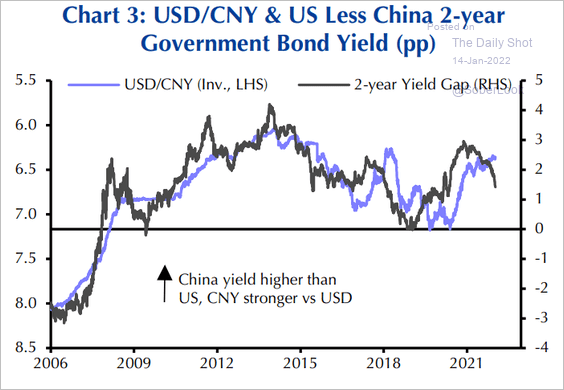

The PBoC also pledged to keep the yuan’s exchange rate stable, with PBoC governor Liu stating the PBoC will allow market demand and supply factors to play the determining role. This indicates that Beijing likely believes the yuan will depreciate, given falling rate differentials vs. the U.S., and this will be supportive of growth. It also means the FX channel will not be used to combat imported inflationary pressures or change dollar financing dynamics.

*With the yuan near multi-year highs, falling domestic yields, and hence rate differentials will likely put downward pressure on the USD/CNY cross

Stocks and bonds tied to property developers are bouncing today. Beijing is contemplating a package of policies to prevent a further deepening of the real estate crisis. Chinese regulators (The Ministry of Housing and Urban-Rural Development and China Banking and Insurance Regulatory) are considering lifting restrictions on developers’ access to cash from presold properties, improving cash inflows for developers that have seen many financing channels close or become too punitive.

*Land transactions have been increasing, but they have mostly been to local government financing vehicles, not property developers. As regulators make it easier for property developers to access capital/financing, we believe this will change

China’s state planner (NDRC) recently announced that given the greater uncertainty around Q1 growth (due to Omicron), it would be “moderately” front-loading its planned infrastructure investments for the year and push forward 102 mega projects as part of its 14th Five-Year plan. Elsewhere, the State Council recently committed to making high-speed railways cover 95% of cities and grow the digital economy to 10% of GDP (both by 2025).

*Greater state-sponsored construction projects will help alleviate the drag from private-sector developers currently occurring

Regarding sector-specific “Common Prosperity” crackdowns, there has been greater clarity for some sectors, with policies towards education/private tutoring, online gaming, and gambling/gaming laws at least now being (potentially) finalized. However, uncertainty over who may suffer Beijing's wrath is still weighing on business and investor sentiment. Due to uncertainty, the financial sector has also curtailed its lending activity, with most of last year's credit growth coming from the official sector.

*Government debt issuance has been primarily responsible for credit expansion as private lending has declined during the pandemic. However, this is likely to change as Beijing begins to pressure banks to do more and step back from “Common Prosperity” crackdowns

Finally, markets will need clarity on how long and severe Omicron continues to pressure mobility and consumer spending. We believe that Omicron will be less impactful to China’s domestic growth than previous waves, but this is the primary uncertainty still hanging over the growth outlook and hence financial markets and lending/borrowing activity.

*Omicron cases remain low, but every time one occurs, millions of people are restricted from going about their day-to-day activities, which chips away at growth

To summarize, we see positive developments in China on the policy front. Still, we continue to see overall sentiment weighed on by the uncertainty over the effects Omicron (and subsequent lockdowns) will have on economic activity. The coming Chinese New Year festivities and mass migration from urban to rural areas will show whether the Chinese consumer is ready to reengage or whether the zero-tolerance policy will continue to cap growth.

*China’s growth and Xi’s “Dual Circulation” goals depend on more robust domestic consumer spending. Will Beijing allow growth to slow to levels consistent with the U.S. in such an important political year?

Econ Data:

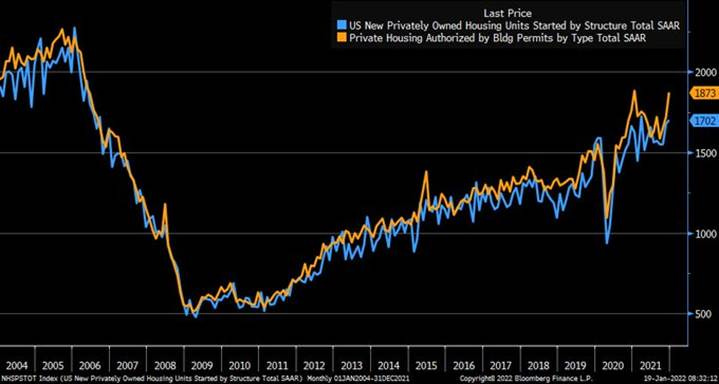

Housing starts in the US unexpectedly increased 1.4% MoM to 1.702 million (SAR) in December, the highest since March and beating the market forecast of 1.65 million. Starts for units in buildings with five units or more jumped 13.7% to 0.524 million, while the rate for single-family housing starts declined -2.3% to 1.172 million. Starts surged in the Midwest (36.5%) and the Northeast (20.2%) but fell in the South (-1.9%) and the West (-13.8%). Building permits jumped 9.1% to 1.873 million (SAR), the highest level since January ‘21 and well above market expectations of 1.701 million. This was primarily due to an increase in permits for multi-family properties in the Northeast. Housing completions fell -8.7% (vs. +13% in November), dragged down by a decrease of -34.4% in multi-family completions.

Why it Matters: Expectations are for homebuilding activity to slow in the first half of 2022 as rising mortgage rates, continued low availability/inventory, and the generally elevated levels of prices decrease demand. However, the above-expected activity in both starts and permits in December gives us some comfort that inventories will improve and price appreciation may begin to fall because activity remains strong. To be clear, we need to see a more meaningful surge in single-family activity, but the trend in multi-family is very positive. This, coupled with our expectations for continued supply-side impairment improvements as well as labor movement stabilization (reducing urban rental increases), means that shelter inflation will likely come off its historically high monthly gains currently being seen.

*Multifamily and activity in the Northeast and Midwest drove the better than expected level of starts in December

*Multi-family permits in the Northeast surged by 140k, excluding that permits were only up 1%

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the day and week, as tech/growth gets a relief bounce after recent underperformance. Large-Cap Growth is the best performing size/factor on the day.

Chinese Iron Ore Future Price: Iron Ore futures are higher on the day and week as positive announcements regarding the property sector and fiscal infrastructure investments have basic materials higher across the board in China

5yr-30yr Treasury Spread: The curve is steeper on the day butter flatter on the week as the belly outperfromance this morning was weakened by a solid 20yr auction

EUR/JPY FX Cross: The Euro is little changed on the day and weaker on the week as the risk-off tone is still supporting the Yen

Other Charts:

The VIX futures curve continues to flatten, although the front month is dropping slightly today

Analysts are expecting a low level of sales growth in Q4, with operating margins continuing to fall

The curve never really steepened following the start of the pandemic, and its current flattening trend is coming from a much lower starting point

The IEA became more bullish on oil prices continuing to rise as it flagged that OECD inventories were at 7-year lows last November

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

China Macroprudential and Political Loosening:

180: China Property Bond Crash Morphs Into Epic Rally on Easing Bets – Bloomberg

High yield dollar notes jumped as much as 10 cents on the dollar, and Chinese property stocks surged on Wednesday after reports that regulators may ease curbs on developers’ access to funds from presold homes.

Why it Matters:

A record-breaking rally in Chinese property bonds is highlighting the huge sums of money primed to flow into the distressed securities should Beijing dial back its industry crackdown. It’s still unclear whether Wednesday marks a turning point for the beaten-down sector, but traders are having a hard time turning down bets that things will improve.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Cloudy: The U.S. is examining Alibaba's cloud unit for national security risks - Reuters

The Biden administration is reviewing e-commerce giant Alibaba's cloud business to determine whether it poses a risk to U.S. national security, according to three people briefed on the matter, as the government ramps up scrutiny of Chinese technology companies' dealings with U.S. firms.

Why it Matters:

The focus of the probe is on how the company stores U.S. clients' data, including personal information and intellectual property, and whether the Chinese government could gain access to it, the people said. We continue to believe that “citizen” data is the ultimate national security asset, given how it can be used to manipulate and blackmail people.

Electrification and Digitalization Policy:

Green Minting: EU should ban energy-intensive mode of crypto mining, regulator says – FT

Erik Thedéen, vice-chair of the European Securities and Markets Authority, told the Financial Times that bitcoin mining had become a “national issue” for his native country Sweden and warned that cryptocurrencies posed a risk to meeting climate change goals in the Paris agreement. Thedéen said that European regulators should consider banning a mining method known as “proof of work” and instead nudge the industry towards the less energy-intensive “proof of stake” model to cut down on the sector’s vast power usage.

Why it Matters:

The two largest cryptocurrencies by volume, Bitcoin and Ether, rely on a proof of work model, requiring all participants on the blockchain digital ledger to verify transactions. Miners, who use sprawling data centers filled with fast computers to solve complex puzzles, are rewarded for recording transactions with newly minted coins. That requires significantly more energy than the proof of stake model, where the number of parties signing off trades is much smaller. Hence banning proof of work mining in Europe (as China did) could be a big disruptor to the crypto landscape.

More Needed: Biden to Expand National Security Agency Role in Government Cybersecurity – WSJ

President Biden expanded the NSA’s role in protecting the U.S. from cyberattacks on Wednesday by signing a memorandum that mandates baseline cybersecurity practices and standards, such as two-factor authentication and use of encryption, for so-called national security systems, which include the Defense Department and intelligence agencies and the federal contractors that support them. Additionally, Wednesday’s memorandum requires agencies to identify their national security systems and report to the NSA cyber incidents that involve them.

Why it Matters:

This new action aligns the cybersecurity standards imposed on national security agencies with those previously established for civilian agencies under an executive order Mr. Biden signed last May. Affected agencies will soon be expected to implement various cybersecurity protocols, including the use of certain cloud technologies and software that can detect security problems on a network.

Amateur: When It Comes to Health Care, AI Has a Long Way to Go - Wired

UK’s Alan Turing Institute report, published last year, said that AI had little impact on fighting the pandemic. Experts faced widespread problems accessing the health data needed to use the technology without bias. It followed two surveys that reviewed hundreds of studies and found that nearly all AI tools for detecting Covid-19 symptoms were flawed.

Why it Matters:

Many studies using samples of past medical data have reported that algorithms can be highly accurate at specific tasks, such as finding skin cancers or predicting patient outcomes. But many more ideas for AI health care have not progressed beyond initial proofs of concept. Researchers warn that, for now, many studies don’t use data of adequate quantity or quality to properly test AI applications.

Commodity Super Cycle Green.0:

Net-0: Exxon Sets a 2050 Goal for Net-Zero Greenhouse Gas Emissions - NYT

Exxon said it had identified 150 modifications of its exploration and production practices to help reach the goal of net-zero emissions by 2050, including electrification of operations with energy from renewable sources. Initial steps will include the elimination of the flaring and venting of methane, a byproduct of drilling that is a powerful greenhouse gas.

Why it Matters:

Exxon stopped short of embracing commitments to Scope 3 emissions (which result from the combustion of fuels by drivers and other customers, as well as other companies along Exxon’s supply chain), which will require immense efforts and something European companies have begun to plan for, including reforestation, the capture and removal of carbon from operations, and technological advances such as fuels made from recycled carbon.

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.