MIDDAY MACRO - DAILY COLOR – 11/30/2021

OVERNIGHT-MORNING RECAP / MARKET WRAP

Narratives/Price Action:

Equities are lower, as first comments from Moderna’s CEO regarding the need for new vaccines overnight and now Powell’s off cuff remarks that a faster taper pace may be warranted have every sector lower

Treasuries are mixed, with the front-end and belly flat/lower on the session (down post-Powell’s comments) while the long-end is rallying higher.

WTI is lower, as the overnight risk-off tone driven by increased pandemic fears hit oil hard as traders await OPEC+ meeting results tomorrow

Analysis:

The S&P is now close to -4% off recent highs (reached two weeks ago) as first comments that current vaccines may not work against Omicron by Moderna’s CEO and then a nod by Powell during a Senate Banking hearing that the pace of tapering may be increased have risk assets under significant pressure. The Treasury curve is predictably flattening while the dollar popped higher.

The S&P is outperforming the Nasdaq and Russell with Low Vol and Growth factors, and Real Estate, Utilities, and Health Care sectors are all outperforming.

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4635 while the Call Wall is at 4750. The 4600 level had significant support, and as we move further below it, dealers need to increase their negative gamma hedging. This, along with increases in implied vol, indicates that dealers are increasingly selling futures till the next level of support at 4550, or until the S&P is above 4600 again.

S&P technical levels have support at 4550-60, then 4485, and resistance at 4600, then 4635. The rejection of 4635 due to Powell's comments this morning was not a good sign. If a backtest of September highs (around 4550) is broken, the market will enter a deeper correction, which is looking increasingly likely.

Treasuries are higher, however, the front-end and belly are off overnight highs while the long-end is well bid, driving the 5s30s curve flatter by 8bps to recent lows of 62bps.

*Global value factor-related stocks continue to drop

*Treasury market implied volatility continues to rise

*Goldman’s global risk appetite index has fallen sharply due to renewed pandemic concerns

*As expected, CEOs talked the most about inflation and supply chain disruption in Q3 conference calls

Powell decided Omicron fears were not enough for markets to worry about today and hinted that the FOMC will be seriously considering speeding up the pace of tapering in the upcoming December FOMC meeting in comments made during Q&A at today’s Banking Oversight Committee hearing on the pandemic response, leading risk-assets and the belly of the Treasury curve to drop significantly and the dollar to jump higher.

Monetary policy is usually not discussed in Congressional hearings, so this was a complete slip up on Powell’s part, but yet here we are with all bets now off the table for any year-end rally given the dip buyers mantra that the Fed has the markets back now has to be seriously questioned.

*The S&P is now lower by around 80 points following Powell’s faster-tapering comments

Given the jump in the dollar and the pressure the precious metal complex had already been under, we were stopped out of our platinum long position on the move following Powell’s tapering comments for a loss of almost 10%, a disappointing turn of events given our belief that the long-term structural demand and supply story will eventually move prices higher.

*The technical breakout and fundamental story never gained traction as the combination of rising real rates, a stronger dollar, and now global growth worries have crashed platinum back down to recent lows

We now advise a significantly more defensive position and a cash overweight, the negative setup discussed last week and yesterday has only worsened. We also expect to be shortly stopped out of our Russell long as small-caps and value will continue to take the brunt of the sell-off.

The bottom line, things are changing quickly, and our core thesis that a more robust growth picture and a patient Fed would help melt-up equities into year-end a few weeks ago has fallen apart.

Econ Data:

The S&P CoreLogic Case-Shiller home price index rose 1% in September, slightly lower than the 1.2% rise in August. This moves the year-on-year increase to 19.5%. All 20 cities saw price increases in September, and all 20 cities stand at their all-time highs. The most significant increases were reported in Phoenix (33.1%), Tampa (27.7%), and Miami (25.2 percent).

Why it Matters: With everywhere in the country seeing record high prices, it looks like the pace of increases is at least slowing slightly. “If I had to choose only one word to describe September 2021’s housing price data, the word would be “deceleration.” Housing prices continued to show remarkable strength in September, though the pace of price increases declined slightly,” said Craig J. Lazzara, Managing Director at S&P DJI. As we have highlighted with other monthly housing data, supply-side impairments and land availability continue to keep inventories tight. A historically low mortgage rate, and now they fear that rates will rise, has maintained a firm bid and recently increased buying activity slightly. As a result, price increases are not likely to meaningfully subside for some time.

*Before seasonal adjustment, the U.S. National Index posted a 1.0% month-over-month increase in September, while the 10-City and 20-City Composites both posted increases of 0.7% and 0.8%, respectively.

*Phoenix’s 33.1% increase led all cities for the 28th consecutive month

The Conference Board Consumer Confidence Index decreased to 109.5 in November, following an increase in October to 111.6. Present Situation Index fell to 142.5 from 145.5 last month, while the Expectations Index fell to 87.6 from 89.0. Consumers’ appraisal of current business conditions was less favorable, but their views on labor markets improved. Some other things worth highlighting:

17.0% of consumers said business conditions are “good,” down from 18.3%.

58.0% of consumers said jobs are “plentiful,” up from 54.8%.

24.1% of consumers expect business conditions will improve, up from 22.7%

17.9% of consumers expect their incomes to increase, down from 18.4%.

Why it Matters: Consumer confidence was unable to keep upward momentum as inflationary concerns weighed on sentiment. “Expectations about short-term growth prospects ticked up, but job and income prospects ticked down. Concerns about rising prices and, to a lesser degree, the Delta variant were the primary drivers of the slight decline in confidence. Meanwhile, the proportion of consumers planning to purchase homes, automobiles, and major appliances over the next six months decreased. The Conference Board expects this to be a good holiday season for retailers and confidence levels suggest the economic expansion will continue into early 2022. However, both confidence and spending will likely face headwinds from rising prices and a potential resurgence of COVID-19 in the coming months.” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board.

Policy Talk:

Chairman Powell released a short prepared testimony yesterday to the Senate Banking Committee. He and Treasury Secretary Yellen will be answering questions related to the pandemic response today (Senate) and tomorrow (House). The remarks initially focused on the effects of the virus over the summer and noted that economic activity picked up as cases subsided. He emphasized that there was still “ground to cover” in reaching maximum employment, which the virus still hampered. He highlighted that inflation was also a result of the pandemic and that it would subside next year, all be it at a slower than initially expected pace. Finally, he noted that the recent rise in Delta cases and the new threat from Omicron posed downside risks to the economy and increased the general level of uncertainty. The Q&A currently occurring elicited significant negative price action for equities when Powell noted that tapering might be sped up.

“The economic downturn has not fallen equally, and those least able to shoulder the burden have been the hardest hit. In particular, despite progress, joblessness continues to fall disproportionately on African Americans and Hispanics.”

“Most forecasters, including at the Fed, continue to expect that inflation will move down significantly over the next year as supply and demand imbalances abate. It is difficult to predict the persistence and effects of supply constraints, but it now appears that factors pushing inflation upward will linger well into next year.”

“The recent rise in Covid-19 cases and the emergence of the omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation. Greater concerns about the virus could reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.”

Why it Matters: Powell moved markets significantly lower shortly into the Q&A session when he said, “The economy is very strong and inflationary pressures are high, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner.” This negated Powell's concerted effort to emphasize that the pandemic was still very much affecting the economy and the labor market still had room for improvement in his prepared remarks. This more hawkish tilt couldn’t have come at a worse time for risk assets, given the current uncertainty regarding Omicron and case increases more generally. We are still leaning towards tapering not being changed given the uncertainties and belief inflationary pressures will start to subside, but we now have very low conviction in this view.

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the week, and today as again value and small-caps took the brunt of comments made overnight and then by Powell

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week and the day, with trader sentiment improving as more support is thrown at the housing sector by Beijing

5yr-30yr Treasury Spread: The curve is flatter on the week, and today, with the belly selling off sharply on Powell’s faster-tapering comments

EUR/JPY FX Cross: The Yen is stronger on the week and the day as the risk-off tone continues

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Improvements:

Clearing Up: ‘Container Dwell Fee’ Remains on Hold Until December 6 – Port of Los Angeles

After meetings today with U.S. Port Envoy John Porcari, ocean liner companies, and marine terminal operators, the two ports will delay the port fee to at earliest Dec. 6. Since the fee was announced on Oct. 25, the twin ports of Long Beach and Los Angeles have seen a combined decline of 37% in aging cargo on the docks. The executive directors of both ports will reassess fee implementation after another week of monitoring data.

Why it Matters:

"In recent weeks, clearing our docks of imports and empties has been a top priority," Port of Los Angeles Executive Director Gene Seroka said in a statement. "As a result, we've seen a marked improvement of fluidity on our marine terminals, which allows more vessels to be processed." Major Ocean carriers originally commented that the problem was not at the port but with the rest of the inland supply chain. However, since the fee announcement, things have improved, showing the carrot and stick approach is working somewhat.

Pushy: Walmart CEO says Biden supply chain push is easing bottlenecks – Reuters

On Monday, Walmart Chief Executive Doug McMillon hailed the Biden administration's efforts to ease supply chain bottlenecks as the holiday season gets underway, noting the decision to extend port hours was having a positive impact on the flow of goods. "We are seeing progress. The port and transit delays are improving," McMillon told President Joe Biden during a White House meeting with CEOs to discuss supply chain issues.

Why it Matters:

"Because of what you all did to help with overnight hours, and because of the team's work to reroute to other ports, to extend our lead times, and have other creative solutions, we have seen an increase in throughput over the last four weeks of about 26% nationally in terms of getting containers through ports," McMillon said at the meeting with Biden. He also added that Walmart had noticed a 51% improvement in flow through Southern California ports, a big help for key holiday categories like toys. All signs things are improving on the logistical side.

China Macroprudential and Political Loosening:

Big Brother: Local Government Financing Vehicles Buy More Land to Fill Hole in Official Coffers – Caixin

As cash-strapped property firms became reluctant to bid for land, local government financing vehicles (LGFVs) have stepped in to help authorities make ends meet. LGFVs had bought more land-use rights nationwide starting the third quarter when the cash crunch at some private property developers worsened, and in some places, these vehicles became the major bidders.

Why it Matters:

In China, LGFVs are a group of state-owned enterprises generally used by their local government owners to fund infrastructure and public welfare projects. “LGFVs rarely showed up in the normal land auction market. They generally bid only when the market is quite sluggish, in a bid to shore up the local fiscal revenue,” Deng Haozhi, a real estate expert based in the southern city of Guangzhou, told Caixin. There are concerns that this is more of an optical event, meaning the local municipal seller does not fully realize the profits, than a sustainable solution. However, it is a sign that Beijing is making some efforts to stabilize property markets.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Vaccine Soft Power: China's Xi pledges another one billion COVID-19 vaccine doses for Africa - Reuters

China will deliver another 1 billion doses of COVID-19 vaccines to Africa and encourage Chinese companies to invest no less than $10 billion in the continent over the next three years, President Xi Jinping said on Monday. Xi said 600 million doses would be donations, and 400 million doses would be provided through other means such as joint production by Chinese companies and relevant African countries. China will also build ten health projects in Africa and send 1,500 health experts.

Why it Matters:

The announcement comes amid criticism of China's infrastructure-for-commodities deals that some experts say saddle countries with unsustainable debt. The Belt and Road Initiative, in which Chinese institutions finance major infrastructure in mainly developing nations, has slowed: Chinese bank financing for infrastructure projects in Africa fell from $11 billion in 2017 to $3.3 billion in 2020, according to a report by international law firm Baker McKenzie. There is also concern about how effective Chinese vaccines are, but given the lack of alternatives, many African nations are happy to receive the help.

Space Balls: Space Force official: Satellites in orbit have become pawns in geopolitical chess games – Space News

China and Russia for decades have watched the United States display its military power, much of it enabled by satellites in space. China’s recent demonstration of an orbital hypersonic weapon and Russia blowing up a satellite in orbit are expected countermoves, said Space Force deputy chief of operations Lt. Gen. B. Chance Saltzman. What is happening in space is a “natural consequence” of how military powers historically behave as they try to gain a leg up on adversaries, Saltzman said on Nov. 29 during a Mitchell Institute online event.

Why it Matters:

Military capabilities acquired by the United States, such as GPS-guided weapons and overhead sensors that detect missile launches, depend on satellites in orbit. In the event of a conflict, China or Russia have an incentive to develop space weapons that could serve as “first trike” capabilities to deny the U.S. these advantages, Saltzman explained. He highlighted the actions the U.S. and the international community could take to deter war from reaching space. However, we firmly believe that war in space is inevitable and will increasingly be the first-strike theater.

Electrification and Digitalization Policy:

Property Bubble: Metaverse Real Estate Piles Up Record Sales in Sandbox and Other Virtual Realms – WSJ

A growing number of investment firms are acquiring digital land in worlds such as the Sandbox and Decentraland, where players simulate real-life pursuits, from shopping to attending a concert. They are betting that individuals and companies will spend money to use virtual homes and retail space and that the value of properties will increase as more people join the worlds.

Why it Matters:

The investments can be risky (to say the least). Unlike actual real estate, which tends to retain some value even during a market downturn, the value of virtual properties could fall to zero if the world they are in goes out of fashion and people stop visiting it. However, others argue this is the future. “This is like buying land in Manhattan 250 years ago as the city is being built,” said Andrew Kiguel, chief executive of Tokens.com.

Commodity Super Cycle Green.0:

Steps: EU green fuels talks slowed by detail – Argus

EU energy ministers will meet this week to try and clear stumbling blocks, notably over targeted levels, in legislation aimed at boosting uptake of renewable fuels, including sustainable aviation fuels (SAFs) and maritime fuels with a lower greenhouse gas intensity. Member states had aimed for a common position on the proposals before the end of this year, which would have allowed ministers to press the European Parliament to open talks for a final legal text. But energy ministers are now only expected to take note of their differences in early December.

Why it Matters:

The EU is likely to be the leader in setting green fuel standards given its more environmentally focused policy priorities/tilt. This leads us to believe they may set global standards simply from a first-mover perspective. There is a vast difference between targets and what can be done economically without undue punishment on end-users if current targets were enacted. As a result, compromises will likely ensue due to already high existing inflationary pressure, but we are still in very early innings here.

ESG Monetary and Fiscal Policy Expansion:

Labor!: Amazon ordered to redo union vote in Alabama - Axios

A U.S. National Labor Relations Board (NLRB) official on Monday called for a re-vote in a union election at an Amazon warehouse in Bessemer, Alabama. The move could set the stage for another organizing drive at the e-commerce giant, which has, so far, fought off unionizing efforts in the U.S. "Amazon's intimidation and interference prevented workers from having a fair say in whether they wanted a union in their workplace," Stuart Appelbaum, president of the Retail, Wholesale and Department Store Union, claimed.

Why it Matters:

We highlight this as a general nod to the growing power labor is getting with the current economic backdrop (labor shortages) and support the Biden Administration is willing to give labor generally and unions specifically. There has been a growing level of strikes, many of which have led to labor victories. The administration has increasingly signaled it is willing to take on big tech with key personnel picks such as FTC chair Lin Khan. We continue to watch Biden’s social justice and governance aspirations closely given the lofty levels Big Tech valuations have reached. Finally, the high level of Capex investment currently occurring, which should lead to future increases in productivity (as firms learn to do more with fewer workers), means that labor may be overplaying their hand in the long run.

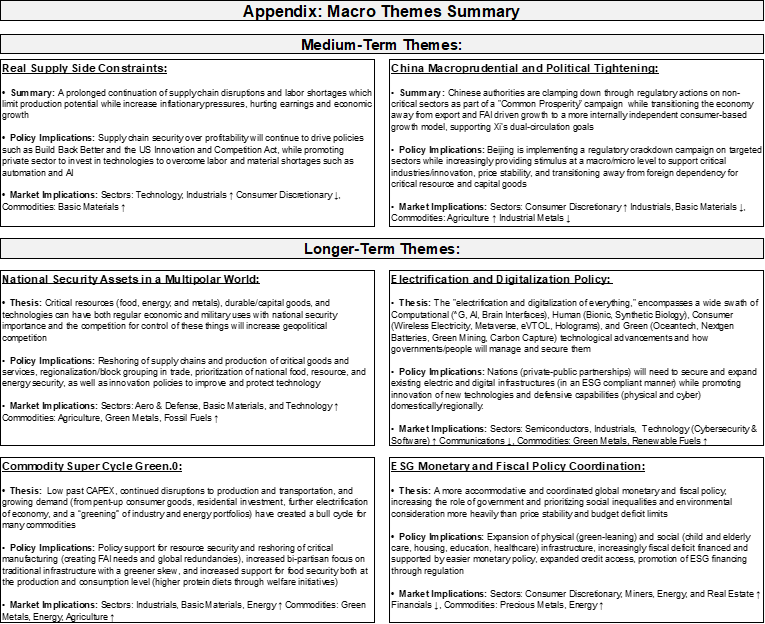

Current Macro Theme Summaries:

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.