MIDDAY MACRO - DAILY COLOR – 11/1/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

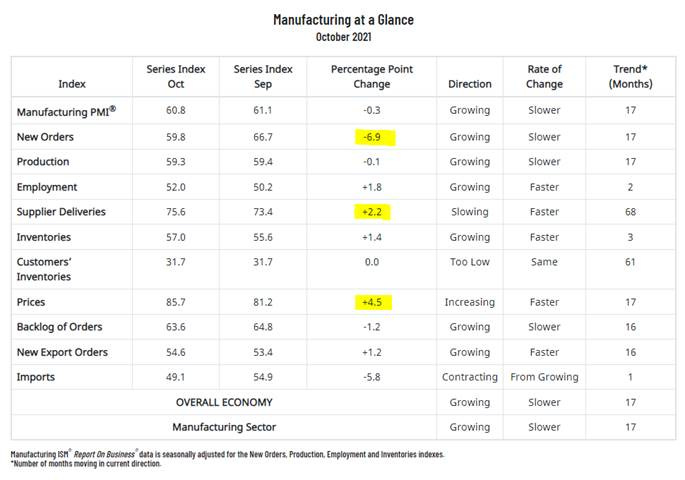

Equities are higher, with small-caps significantly outperforming despite today’s ISM manufacturing data showing no meaningful change in supply-side inflationary pressures last month

Treasuries are lower, with the long-end giving back some of last weeks gains as traders weigh the Fed’s coming tapering verse expectation for reduced Treasury issuance next year

WTI is higher, as traders look to this weeks OPEC+ meeting for signs of output increases despite nearly half of the members being unable to increase production, putting pressure on the Kingdom to add the extra needed barrels

Analysis:

The S&P hit new all-time highs overnight, but the real action is in the Russell, which has essentially done nothing since March and is now attempting to breakout. Today’s ISM manufacturing data showed no alleviation in the known shortages and price pressures and, when coupled with global PMIs released overnight, painted a more neutral growth reading. The Treasury curve is giving back some of last week’s flattening, and global rates generally are consolidating after last week's volatility.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Momentum, and High Dividend Yield factors, and Energy, Consumer Discretionary, and Communication sectors all outperforming.

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4529 while the Call Wall is at 4650. The move to new ATHs overnight helped build gamma levels a little further, but the 4600 level holds a significant amount of strikes, likely keeping trading contained until post-FOMC this week.

The technical levels have support at 4590, then 4575, and resistance at 4620, then 4660 for the S&P. The seasonal rally continues for the S&P with only one red day in the last thirteen. The current rally is intact as long as the S&P stays above the 4550 area, with 4700 being the ultimate target before strong resistance.

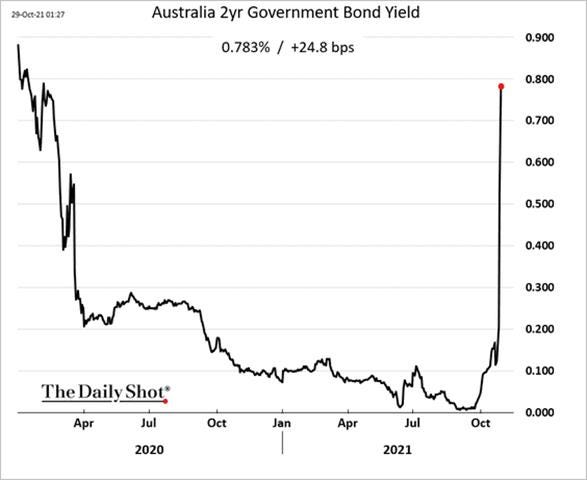

Treasuries are lower, with the 5s30s curve steeper by 1.5 bps currently. Last week’s global front-end carnage has stabilized as global Markit PMI’s overnight were somewhat mixed, and traders await the RBA, BoE, and Fed policy decisions later this week.

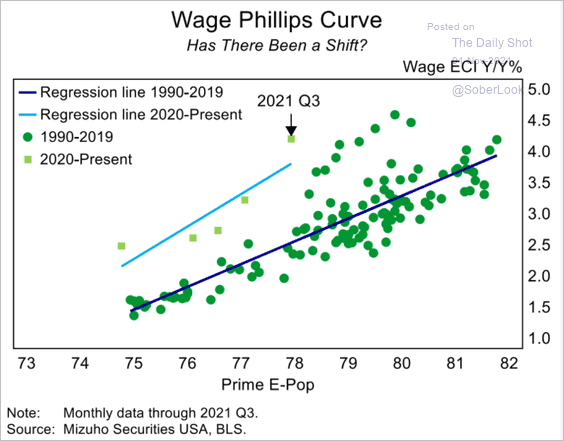

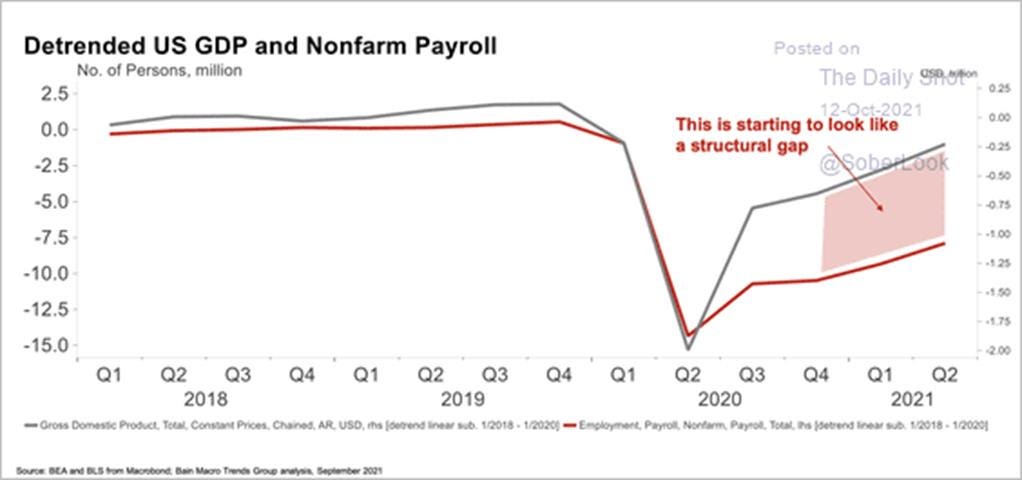

*The Employment Cost Index increased 1.3% in Q3, leaving many to wonder if there is a structural change occurring that will lead to more significant wage-spiral inflation

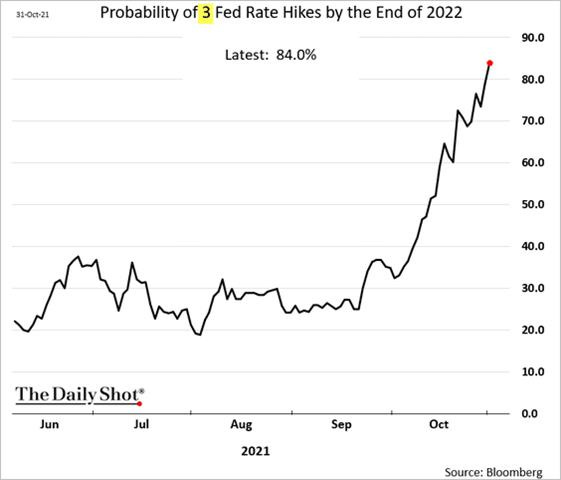

*Continued high inflationary pressures with no end in sight, coupled with central bank activity elsewhere, now have markets pricing in three 25bps Fed Funds rate increases in 2022

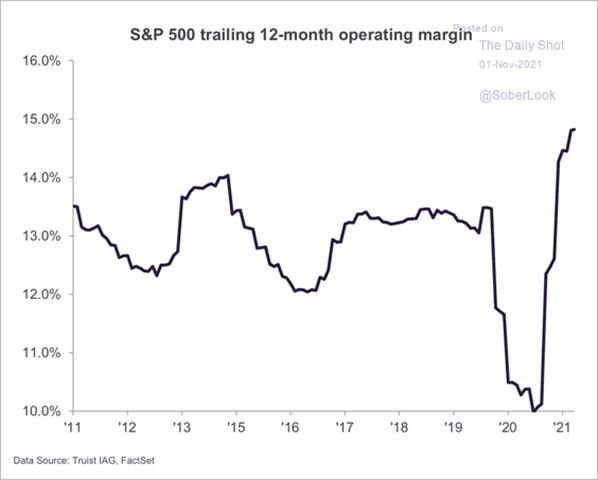

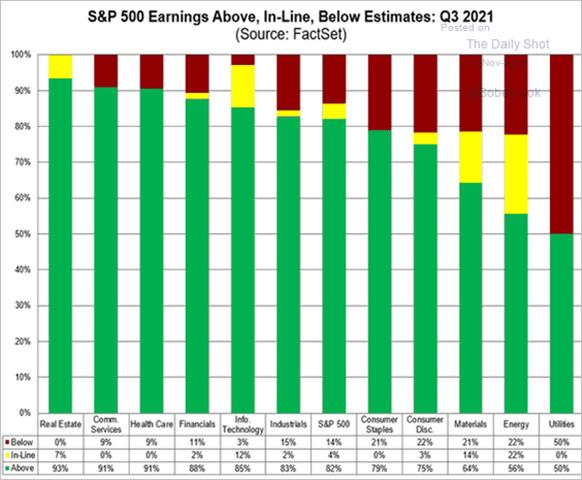

*Despite rising costs, companies have been able to maintain profit margins due to strong demand

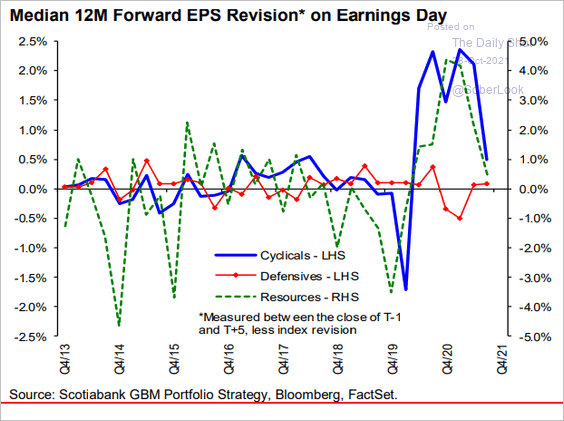

*However, positive forward EPS revisions have been much weaker, likely signaling concerns over how long profit margins can be defended

Following last week's slew of events/data, the S&P ended the month up almost 7%, the seventh-best October return since 1950, and now all eye’s shift to this week’s Fed meeting, further earnings reports, and key ISM and jobs data while markets continue to try and price future inflation given ongoing supply-side and energy uncertainties.

Last week brought us a lot of new information with the bulk of the S&P reporting earnings, key economic data further clarifying Q3’s weakness and ongoing inflationary pressures, as well as a potential path to end the D.C. infrastructure saga.

*Earnings generally continued to exceed expectations last week despite some big-name noise

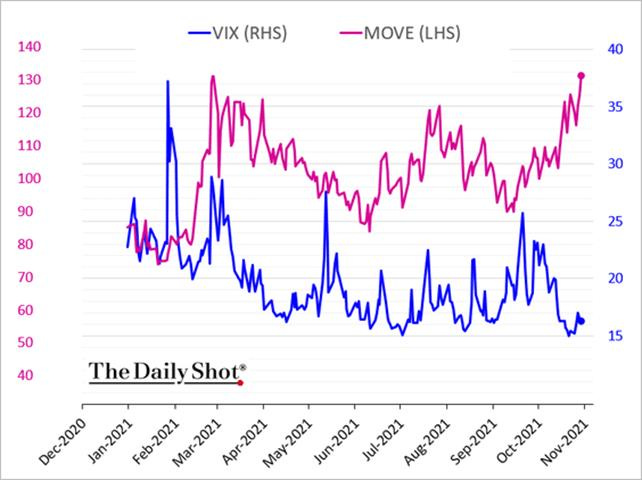

Looking abroad last week, we had three key (and more hawkish than expected) central bank meetings and a continuation of energy pricing volatility, helping flatten global bond curves and increase rate volatility. At the same time, equities melted up further, keeping with seasonal expectations.

*The sell-off in global shorter-term rates was significant last week, as best seen by the reversal in views on the RBA’s commitment to yield curve control

*There is a notable divergence between Treasury market volatility (echoing other rate markets) and equity volatility

Looking forward, we still have a positive outlook tactically into year-end on equities and small-caps in particular ($IWM long). However, we are more neutral long-term as rising costs will be harder to pass on as higher prices reduce demand. At the same time, productivity will improve as businesses are increasingly incentivized to invest in ways to lift output per employee due to shortages and rising wages, creating a glass half full-empty dichotomy for earnings growth in 2022.

*Post-pandemic, it is beginning to look like there is a structural shift occurring between the labor and capital relationship regarding productivity

Despite the weaker Q3 GDP print, the U.S. economy is doing well, and we still expect a strong holiday season of consumer activity. This will help support/improve investor sentiment and keep risk-asset momentum positive despite the persistence of labor and material shortages (again capping growth potential in Q4 but to a lesser degree) and maintaining inflationary pressures.

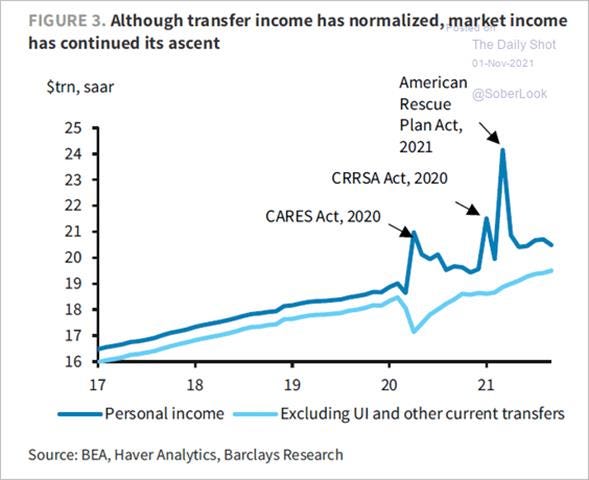

*U.S. households are in good shape with net worth and personal income continuing to grow despite drops in fiscal support

At the same time, the Fed will begin to tighten policy this week with the announcement of tapering, taking policy from highly accommodative to just accommodative. The ultimate pace of tightening will come down to labor developments and inflationary pressures in the first half of 2022, and we still believe the Fed will be highly patient, maintaining a transitory inflation tilt and targeting an EPOP that has not accounted for structural changes.

Finally, and putting the above together, we expect the strong equity performance in October to be followed by a further melt-up in November, supported by improving economic activity and supply-side disruptions abating slightly. We continue to see price increases in the global energy complex as the biggest threat to growth and risk sentiment, but given recent stabilizations have reduced our concerns there.

*Energy price drops in Europe, China, and elsewhere give us some comfort that the “tax” effect of higher energy costs on the consumer will be reduced over the winter

Econ Data:

The ISM Manufacturing PMI fell to 60.8 in October, from 61.1 in the previous month but was slightly higher than market expectations of 60.5. Production (59.3 vs. 59.4 in September) decreased slightly while New Order (59.8 vs. 66.7) growth eased to a 16-month low. This was supported by a drop in Backlog of Orders (63.8 vs. 64.8) and a decrease in Imports (49.1 vs. 54.9) to a now contractionary reading. Prices Paid (85.7 vs. 81.2) continued to rise at a faster rate. Meanwhile, the gauge for Employment (52 vs. 50.2) also increased at a faster rate. Finally, Inventories (57 vs. 55.6) continued to grow, with the sub-index rising to its highest levels since 1984.

Why it Matters: This was another report highlighting no meaningful improvements in the known supply-side disruptions/shortages. Timothy Fiore, Chair of ISM, summed it up by saying, “all segments of the manufacturing economy are impacted by record-long raw materials lead times, continued shortages of critical materials, rising commodities prices, and difficulties in transporting products. Global pandemic-related issues — worker absenteeism, short-term shutdowns due to parts shortages, difficulties in filling open positions, and overseas supply chain problems — continue to limit manufacturing growth potential. However, panel sentiment remains strongly optimistic, with four positive growth comments for every cautious comment. Panelists are fully focused on supply chain issues in order to respond to the ongoing high levels of demand.” One Chemical Producer firm simply responded, “business is getting stronger, but the supply chain is getting worse every day.”

*There was a significant decline in New Orders as higher prices and long wait times may be finally hurting demand

*Improvements in supply side-disruption may initially weigh on sub-indexes such as Supplier Deliveries and Prices Paid, hurting the headling number despite the positive developments

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Value is higher on the week, with the Russell 2000 significantly outperforming the Nasdaq today, helping value beat growth

Chinese Iron Ore Future Price: Iron Ore futures are flat on the week but weaker today as China’s PMIs were mixed but again showed power outages and reduced demand from the property sector are weighing on iron ore demand

5yr-30yr Treasury Spread: The curve is slightly steeper on the week but still near recent lows as fundamental views are little changed, with the front-end continuing to be weighed on by increasing rate hiking expectations.

EUR/JPY FX Cross: The Euro is higher on the week, but recovering from lows after Kishida and the LDP were able to maintain a majority in the lower house

ARTICLES BY MACRO THEMES

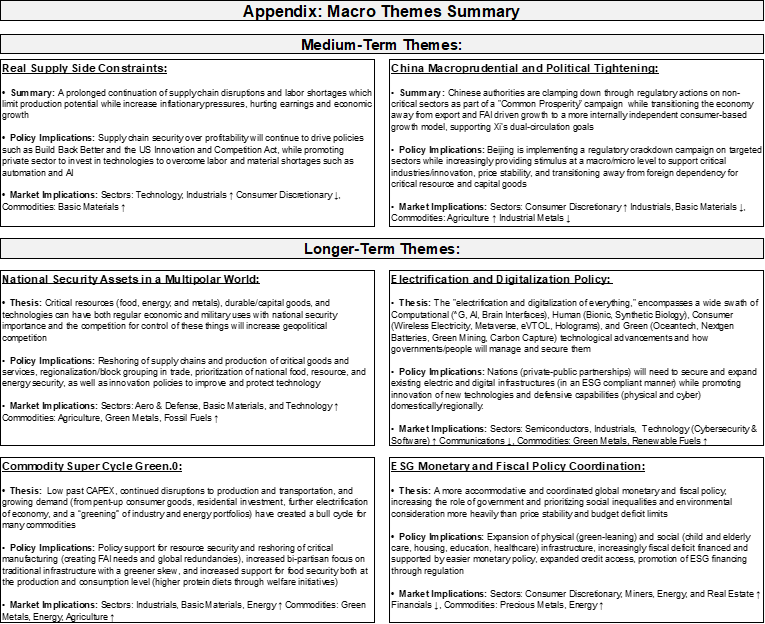

MEDIUM-TERM THEMES:

Real Supply-Side Constraints:

Covid-No-More: Covid-19 Cases Drop in Southeast Asia, Easing Supply-Chain Crunch – WSJ

Factories have reopened and production is steadily picking up in major manufacturing areas of Southeast Asia as Covid-19 cases have dropped in recent weeks, easing some of the supply-chain constraints that companies blame for lost sales. In Malaysia, Vietnam, Indonesia, and the Philippines, average daily confirmed cases are now at less than half the level they were at the start of September.

Why it Matters:

Southeast Asia isn’t out of the woods, and there could be risks for manufacturers in the region going forward. According to Our World in Data, a divergence in vaccine access means that some countries in the region, like Vietnam, Indonesia, and the Philippines, have fully vaccinated only about a quarter of their populations. By contrast, others like Malaysia, Singapore, and Cambodia, are at over 70%. Labor shortages will also take time to reverse more generally, with many migrant workers back home at more rural areas versus urban manufacturing centers.

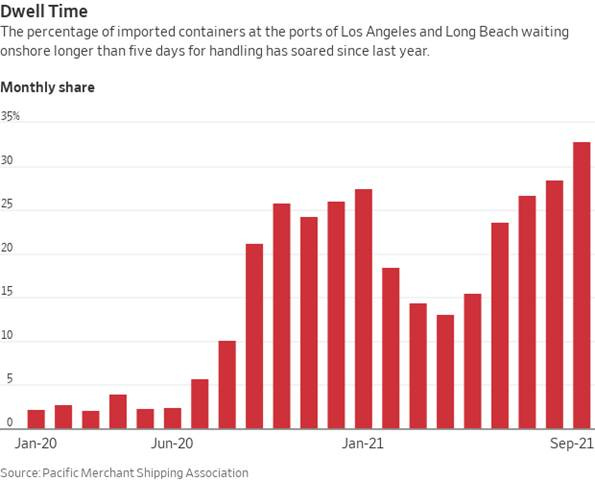

Another Fee: California Port Congestion Fees Divide Importers, Operators – WSJ

The ports of Los Angeles and Long Beach plan to begin charging the shipping lines starting Nov. 15 for containers that sit too long at marine terminals, a temporary fee officials say addresses a key part of the logjam that has tied up operations at the port complex and led to record numbers of ships waiting offshore to unload goods. The charges will apply to containers that wait nine days or more to move by truck and six days or more to move by rail, and they rise sharply.

Why it Matters:

Importers and freight forwarders say the fee would amount to a levy on them since they expect carriers to pass the charges along to them even though they have little control over when boxes are moved away from the ports. The bottom line is that this additional fee does not address the underlying problem and likely will only add further inflationary pressures to the end consumer.

China Macroprudential and Political Tightening:

Homeward Bound: Xi Hasn’t Left China in 21 Months. Covid May Be Only Part of the Reason - NYT

Xi Jinping’s lack of face time with world leaders signals a turn inward on domestic issues and a reluctance to compromise on the global stage. Beijing is preoccupied with protecting Mr. Xi’s health and internal political goals. As a result, face-to-face diplomacy is a lower priority than it was in Mr. Xi’s first years in office. To be clear, China is still active diplomatically, with Xi and others preferring digital meetings. However, there has been a significant step down in activity.

Why it Matters:

Mr. Xi’s recent absence from the global stage has complicated China’s ambition to position itself as an alternative to American leadership. Only five years ago, in a speech at the annual World Economic Forum in Davos, Switzerland, Xi cast himself as a guardian of a multinational order. It is challenging to play that role while hunkered down within China’s borders, which remain largely closed as protection against the pandemic. It also indicates Xi feels he has much stronger domestic support or control, and his behavior is in line with his “Dual Circulation” goals.

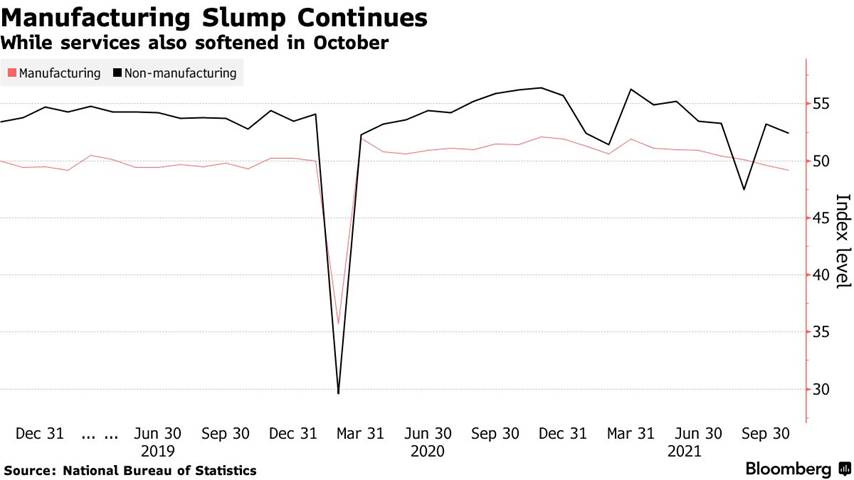

Still Weak: China’s Economy Weakens as Power Crunch, Covid Rules Hurt – Bloomberg

The official manufacturing purchasing managers’ index fell to 49.2, the Chinese National Bureau of Statistics said Sunday, the second month it was below the key 50-mark that signals a contraction in production. The non-manufacturing gauge, which measures activity in the construction and services sectors, dropped to 52.4, below the consensus forecast.

Why it Matters:

The PMIs show the economy continues to be under pressure from both the supply and demand sides. Manufacturers are struggling with electricity shortages and rising costs, while consumer spending remains weak as the government’s Covid-zero approach means a tightening of restrictions around travel and social gatherings to contain frequent flare-ups of virus cases.

LONGER-TERM THEMES:

Electrification and Digitalization Policy:

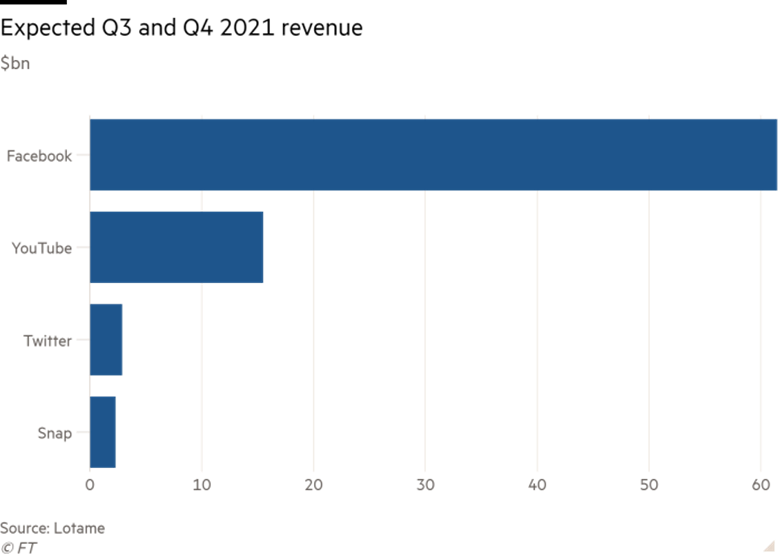

Cost of Privacy: Snap, Facebook, Twitter, and YouTube lose nearly $10bn after iPhone privacy changes – FT

Apple introduced its App Tracking Transparency policy in April, which forced apps to ask for permission before they tracked the behavior of users to serve them personalized ads. Most users have opted out, leaving advertisers in the dark about how to target them. Advertisers have responded by cutting back their spending at Snap, Facebook, Twitter, and YouTube and diverted their budgets elsewhere: particularly to Android phone users and Apple’s own growing ad business.

Why it Matters:

Lotame, an advertising technology company whose clients include The Weather Company and McClatchy, estimated that the four tech platforms lost 12 percent of revenue in the third and fourth quarters, or $9.85bn. Snap fared the worst as a percentage of its business because of its focus on smartphones, while Facebook lost the most in absolute terms because of its size. Apple, meanwhile, reported a “record” quarter for its advertising business on Thursday, as its services segment beat revenue estimates by $700m to reach $18.3bn.

Commodity Super Cycle Green.0:

Secured: China's Ganfeng closes Li hydroxide deal with Tesla – Argus

China's key lithium producer Ganfeng Lithium has signed a contract with US electric vehicle manufacturer Tesla for supplies of battery-grade lithium hydroxide. Ganfeng produced 15,000t of lithium carbonate, 27,000t of lithium hydroxide, and 1,600t of lithium metal in 2020, with plans to double its lithium hydroxide output in 2021. It has signed long-term supply contracts with critical consumers such as LG Chem, Volkswagen, and BMW.

Why it Matters:

The new contract will allow the company and its unit to provide products to Tesla for three years starting from 2022, and the sales amount and value of the contract are still pending Tesla’s purchase orders. Ganfeng has posted stellar earnings this year, with its third-quarter and nine-month net profits up 507% and 648% on an annual basis, respectively, thanks to rising lithium prices and robust demand. We highlight this deal to reinforce our $LIT long, which has a 4.5% holding of Gangfeng, and the general importance lithium will continue to play as a critical resource.

ESG Monetary and Fiscal Policy Expansion:

Tariff-Busting: U.S., EU Eye Global Coalition to Fix Steel, Aluminum Markets – Bloomberg

The U.S. and the European Union clinched a tariff-busting trade accord over the weekend that they’ll try to leverage into a broader global arrangement that would penalize countries that don’t meet low-carbon targets for steel and aluminum exports. The U.S. agreed to remove the duties it placed on EU steel and aluminum exports up to a certain threshold. At the same time, the EU will also suspend its retaliatory duties, effectively ending punitive measures on as much as $10 billion of each other’s goods.

Why it Matters:

Von der Leyen said the deal would alleviate significant elements of the irritants to the U.S.-EU trade relationship and comes amid renewed “trust and communication” since Biden took office. It would also address the broader issue of low-cost steel and aluminum flooding the market as well as the environmental cost associated with the industry. It also comes about four months after the EU and U.S. reached a truce in an aircraft dispute over illegal subsidies given to Airbus and Boeing. The bottom line, as a counter to China, improving U.S. and EU trade relations are occurring.

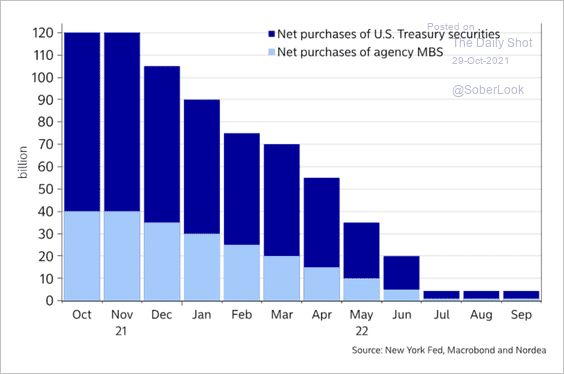

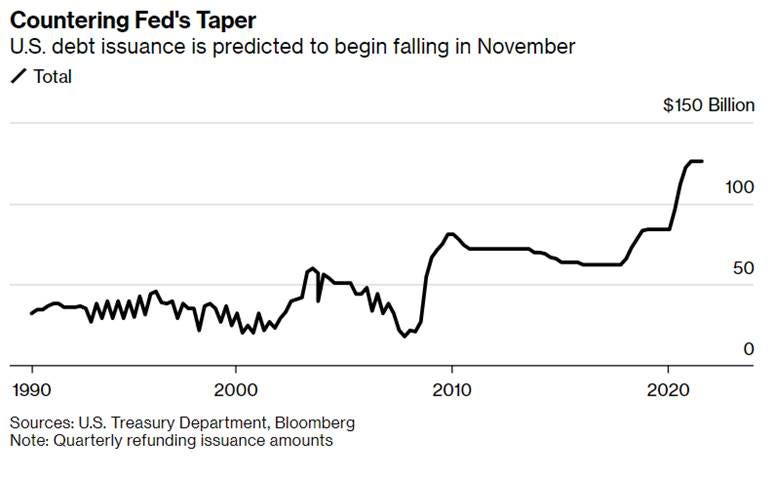

Contraction: Treasury’s Tapering Seen Outpacing Fed, With $1 Trillion in Cuts – Bloomberg

The Treasury Department, for the first time in more than five years, will likely unveil a scaling down of its behemoth quarterly sale of longer-term securities. Sales of regular coupon-bearing debt will be pared back by some $1 trillion by about the third quarter of 2022, according to a number of Wall Street banks. The reductions are expected to start with auctions at the so-called quarterly refunding next week, which is forecast to total less than the record $126 billion of the past three episodes.

Why it Matters:

The Treasury’s reduction in issuance of coupon-bearing debt will outweigh the Fed’s zeroing out of its quantitative-easing purchases of Treasuries. It’s a dynamic that hasn’t captured sufficient attention from investors, according to Wells Fargo analysts., and could help limit increases in borrowing costs as the central bank withdraws stimulus.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.