MIDDAY MACRO - DAILY COLOR – 10/8/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

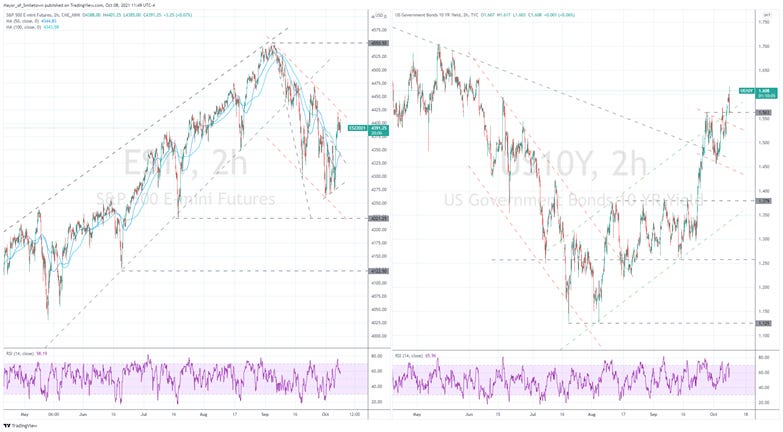

Equities are mixed, currently slightly lower but chopping around following weaker headline jobs numbers weakened positive momentum

Treasuries are lower, with yields breaking to new (recent) highs as the curve bear steepens

WTI is higher, touching on $80 (first time since November 2014) post-NY-open as higher inventory data this week failed to slow positive price momentum

Analysis:

The S&P is little changed on the day as a weaker than expected job report failed to stop the sell-off in Treasuries and the rise in oil, tightening financial conditions and raising inflationary concerns, all of which are increasingly becoming headwinds for equities.

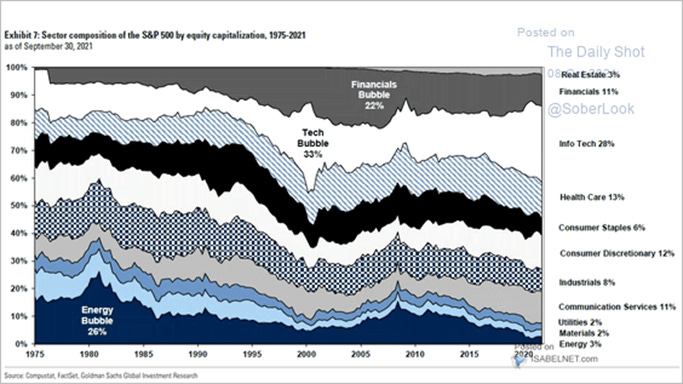

The S&P is outperforming the Russell and Nasdaq with Momentum, High Dividend Yield, and Value factors, and Energy, Financials, and Industrials sectors all outperforming.

S&P optionality strike levels have the zero gamma level at 4311 while the call wall is at 4500. 4400/4410 is the key area today, with support at 4380 and resistance at 4450.

The technical levels have support at 4380, then 4360, and resistance at 4420, then 4470. Mini-triangle is now forming post-NFP, with Friday afternoons historically seeing a rally (followed by a Monday sell-off)

Treasuries are lower, as the 5s30s curve is steeper by 1.8 bps, with 10yr yields breaking out above its two-week range and post-August up-channel to 1.60bps as rising energy prices are increasingly driving sentiment there.

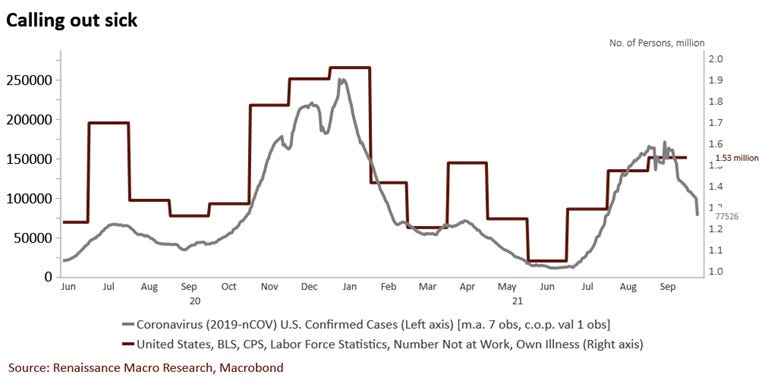

We underestimated the drag on the economy that this summer’s rise in Delta cases caused, something apparent in today's jobs data, leaving us with the important question; is the worst of Covid behind us? We believe it is, and today’s backward-looking jobs data captured the max-negative effect Delta had on the labor market.

Today’s jobs data makes sense; Delta cases only peaked at the beginning of September (keeping many out of front-line jobs), as a result, school openings did not go well (forcing those with childcare responsibilities to stay home), and although ending, those who received unemployment benefits still had excess savings, delaying their eventual re-entry into the workforce.

Stepping back and looking at other labor-focused data, we know there is a record amount of job openings (as seen in JOLTS), and business surveys are reporting high levels of hiring intentions (ISM, Fed regionals, and Challenger), giving us confidence that the recent drops in various consumer sentiment measures will reverse as Delta worries end and future financial outlook improves as expectations for wage increases buffer the negative effects of rising prices.

This positive labor backdrop coupled with still highly accommodative monetary policy, high levels of consumer net worth/excess savings (and available credit), positive business/Capex cycle, easing of supply-chain impairments, and finally, the general re-opening gaining further momentum continue to paint a supportive macro backdrop for risk-assets (despite rising yields and higher energy costs). As a result, today’s weaker jobs data is not a game-changer.

Econ Data:

The US economy added 194K jobs in September, the lowest so far this year and well below forecasts of 500K. Job gains occurred in leisure and hospitality (74K), professional and business services (60K), retail trade (56K), and transportation and warehousing (47K). Employment in public education declined over the month (-161K), and falls were also seen in health care (-18K). Private payrolls increased by 317K, the lowest in five months and below forecasts of 455K. The unemployment rate dropped to 4.8%, from 5.2% and below market expectations of 5.1%. The labor force participation rate was little changed at 61.6%, still 1.7 percentage points lower than it was pre-pandemic. Average hourly earnings rose by 0.6% MoM, above market estimates of 0.4%, giving it a year-on-year increase of 4.6%. NFP employment has increased by 17.4 million since the lows of April 2020 but is still 5 million, or 3.3%, below its pre-pandemic level.

Why it Matters: Well, we got this one wrong as we expected a significantly higher headline number and an improvement in the participation rate given what we saw elsewhere in labor market data. However, given the survey period was early September and much of the country was only starting to see Delta cases ease it makes sense and there should be a greater payback in October’s report. There was a significant drag from the government and educational sectors due to school re-opening troubles/uncertainties and seasonality adjustments (-160k). School closures and non-vax-related firings will keep muddying the water in October’s report on both the direct government educational hiring front and the ability of those with childcare responsibilities to return to the workforce elsewhere, but we expect this to be reduced. However, today’s jobs data was not bad enough to make a difference to the Fed’s tapering plans. Only if coupled with further weakness in October's report could they potentially reduce the monthly tapering amount (from $15bln to $10bln), but likely not delay the start time of December (given the persistence of inflationary pressures). Looking further out, the lower participation rate moves the Fed further from their rate hike goals/targets for maximum employment, as the EPOP has worsened, but there is still a lot of time for this to develop before the second half of next year. We also believe the Fed will increasingly have to explain the structural changes that are occurring to the labor force (early retirements, more gig-workers, and life/work balance changes) as the pre-pandemic EPOP/participation levels may now be unachievable.

Policy Talk:

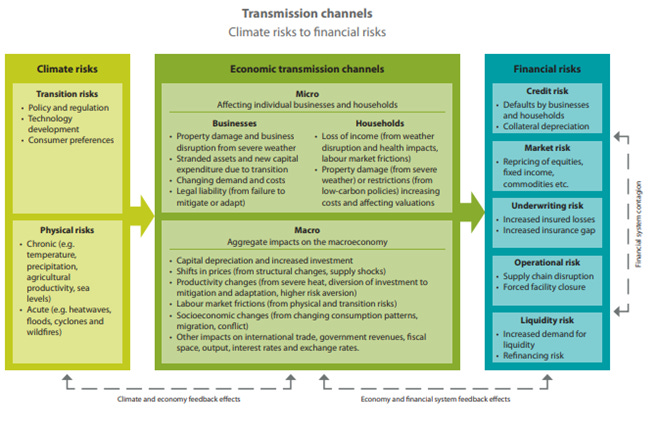

Governor Brainard gave a speech at the Federal Reserves Stress Testing Research Conference yesterday focused on climate scenario analysis, something regulators globally are increasingly using to assess risks to financial systems from climate change. Brainard highlights the continuing trend of increased costs associated with higher levels of frequency and severity of climate-related events as a reason the Fed needs to further its regulatory work here. She highlights that changing views on climate-related risks could occur quickly, causing sudden changes to asset prices, destabilizing the financial system. She notes that several countries have already made substantial progress on climate scenario analysis. The scenarios produced by the Network of Central Banks and Supervisors for Greening the Financial System (NGFS), with appropriate tailoring to local conditions, have been incorporated in climate change analysis by the ECB as well as by financial regulators in Canada, France, and the United Kingdom.

Why it Matters: Two main takeaways here, the Fed believes climate change provides real risks to the financial system, and second, there is a greater need for transparency by financial institutions on their exposures to these risks. Ultimately, Brainard anticipates it will be “helpful to provide supervisory guidance for large banking institutions in their efforts to appropriately measure, monitor, and manage material climate-related risks, following the lead of a number of other countries.” The bottom line, we are getting closer to seeing the codification of the management of climate change risk by financial institutions. This could ultimately skew the flow of capital away from high-risk areas/actors and toward more green-friendly initiatives — basically, another form of financial repression.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is higher on the week, as higher yields continue to weigh on growth despite both the Nasdaq and Russell being equally down currently

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week, up 1.4% today as a better risk-on tone is beginning to take hold in China more generally

5yr-30yr Treasury Spread: The curve is steeper on the week, higher by 2 bps today, as the long-end of the curve continues to come under pressure due to higher energy prices causing greater inflationary concerns and rising term premium demands

EUR/JPY FX Cross: The euro is higher on the week, as the Yen may be starting to increasingly price in higher energy imports and growing rate differentials

HOUSE THEMES / ARTICLES

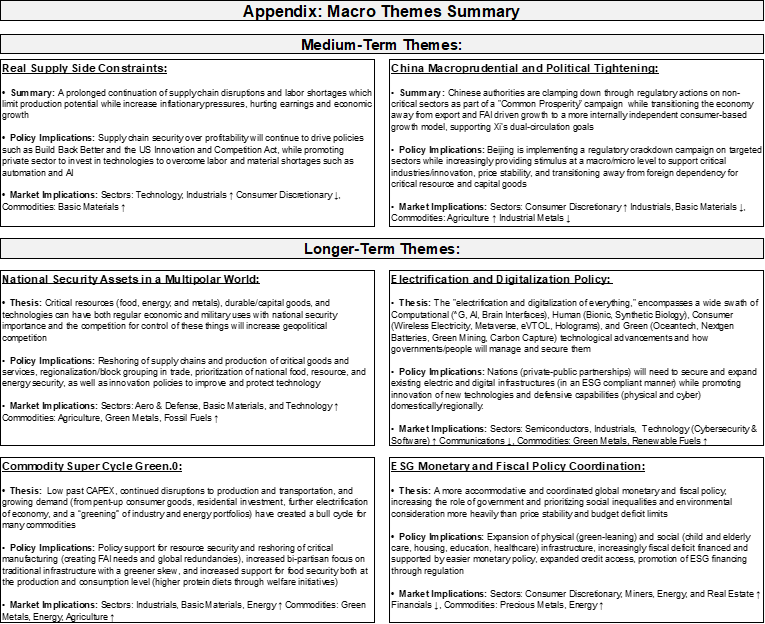

MEDIUM-TERM THEMES:

China Macroprudential and Political Tightening:

Expansionary: Caixin Services PMI Rebounds as Covid Outbreaks Fade - Caixin

The Caixin China General Services Business Activity Index, which gives an independent snapshot of operating conditions in the sector, rose to 53.4 in September from 46.7 the previous month. Input prices of services enterprises rose for the 15th straight month in September and at a faster pace than the previous month. The rising cost pressures were partly transmitted downstream to consumers as demand was not weak, with the gauge of prices charged returning to positive territory.

Why it Matters:

Service companies in China remained upbeat about the business outlook, with the measure of business expectations rising further into positive territory in September, though it remained below its long-term average. “Overall, because the impact of the pandemic was less severe in September than in the previous month, services quickly rebounded,” Wang Zhe, a senior economist at Caixin Insight Group, said. “By contrast, recovery in the manufacturing sector was limited, showing the economy still faced downward pressure.”

Pitmatic: Inner Mongolia Coal Mines Ordered to Boost Production by 55% - Caixin

Seventy-two coal mines in North China’s Inner Mongolia autonomous region have been told to boost their output by nearly 100 million tons from an urgent notice on Thursday, an increase of 55.11%, provided they “do so safely.” Under the directive, which comes as part of a broader drive to grow China's core coal capacity, mines were told to complete procedures for the increase by the end of the month. But it is unclear how long that will take to translate into actual output.

Why it Matters:

China is quickly pivoting to alleviate energy shortages. There have been changes to how coal companies handle long-term contracts (incentivizing producers with higher price capture), while imports have increased (Australia and Kazakhstan). However, due to multiple factors, including safety, environmental protection, and land approval, there is only so much more domestic production that can be quickly brought online. At the same time, the international market is already short inventory to import.

LONGER-TERM THEMES:

Commodity Super Cycle Green.0:

Doldrums: Europe’s electricity generation from wind blown off course - FT

The strength of the wind blowing across northern Europe has fallen by as much as 15 percent on average in places this year, according to data compiled by Vortex, an independent weather modeling group. The cause of the decrease is uncertain, say scientists, but one possible explanation is a phenomenon called global stilling. This is a decrease in average surface wind speed owing to climate change.

Why it Matters:

It is possible climate change is causing the poles to warm faster than the tropics in the lower atmosphere, weakening the mid-latitude north-south temperature difference and consequently reducing the thermal wind at low altitudes. If this is the case and worsens, the days of wind-generated power production will be much more challenged.

ESG Monetary and Fiscal Policy Expansion:

Holdouts: Ireland Signs On to Global Deal Seeking to Curb Tax Avoidance – WSJ

A global agreement to set a minimum 15% corporate tax rate cleared its last major hurdle Thursday after Ireland, a low-tax country that is the European headquarters for some of the largest U.S. tech companies, said it would join the overhaul effort. The change in Irish policy comes ahead of a Friday meeting of 140 governments and jurisdictions that have for years been negotiating a way of taxing international companies to limit avoidance and divide tax revenue in a way they say is fairer. The group seems likely to support a final agreement that would aim for implementation in 2023.

Why it Matters:

Ireland’s decision to raise its corporate tax rate from 12.5% after the agreement is implemented is a concession to key allies, particularly since U.S. companies (that rely on intellectual property) can concentrate their profits in Ireland rather than in the higher-tax countries where their consumers live, and that has been a source of frustration for other governments. Those benefits have been shrinking, and U.S. policymakers are watching closely to see what, if any, advantages will remain following the global tax agreement for companies putting profits or headquarters outside the country

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.