MIDDAY MACRO - DAILY COLOR – 10/7/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are higher, supported by DC kicking the can, a more stable global energy outlook, and growing optimism around U.S./Chinese relations

Treasuries are lower, with the curve reversing much of yesterday’s flattening following better than expected U.S. jobless claims data this morning

WTI is higher, rallying almost $3 off overnight lows thanks to a more risk-on tone following yesterdays selloff due to Russian and U.S. inventory build developments

Analysis:

The S&P is bouncing nicely as several positive developments (DC, China, econ data…) helped it move through recent resistance levels and keep momentum at the NY-open while Treasuries lost their overnight gains as traders prepare for tomorrows job’s report.

The Russell is outperforming the S&P and Nasdaq with Small-Cap, Momentum, and Growth factors, and Materials, Consumer Discretionary, and Health Care sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4381 while the call wall is at 4500. S&P moved above the gamma flip line (4365) last night and is now even better supported by dealer hedging above 4400.

The technical levels have support at 4400, then 4360, and resistance at 4420, then 4470. 4hr RSI is very overbought, so breaking 4420 will be a challenge without a cool-down/consolidation.

Treasuries are lower, as the 5s30s curve is steeper by 0.8 bps, with better jobs data from Challenger Job Cuts and Jobless Claims this morning upping expectations for tomorrow's job report with a notable beat likely steepening the curve.

Several of the risks we highlighted yesterday are stabilizing (in the last 24 hours), and going into what we expect to be a solid jobs report tomorrow (+500k) gives us enough conviction to recommend a long position in the Russell 2000 as a general reopening/reflation trade into year-end.

Energy prices should stabilize here for a while (before winter fully hits), with Russia having significantly more capacity to offer Europe/U.K. (holding it back for political reasons, which look to be changing now), reducing pressure on international LNG and coal markets, and alleviating growth and inflation worries more generally. We are not out of the woods yet, especially regarding China and India, but again, we were looking for stabilization.

A future meeting between Xi and Biden was announced after a more productive meeting between the two sides finished this week in Zurich, and although not the micro or macro policy response we were looking for regarding the property sector and energy problems, it is helping spur a more risk-on tone in Chinese markets today with the Hang Seng up over 4%. There cannot be a meaningful rally in global risk assets without China participating.

Congress finally figured out a way to agree that they don’t agree by agreeing to kick the can down the road, which is what really sparked the current rally. Although we imagine more drama will be coming, the immediate time concerns that were increasing the odds of a more negative outcome for markets have dissipated.

Finally, regarding supply-side disruptions, a more positive weekly claims report coupled with the largest weekly drop in the Shanghai to Los Angeles freight benchmark since it went parabolic in April gives some relief to inflationary fears there. A notably positive jobs report tomorrow will reduce the wage-spiral inflationary fears we believe are overly high right now.

Putting the above developments together with the current price action in U.S. equities, which are now more supported by technicals and optionality, we expect a continuation of the current positive momentum in equities (helped further by tomorrow’s jobs report). The recovery is picking up so sentiment should improve.

As a result, we recommend a long position in the Russell 2000 ETF ($IWM) with an entry price of $224 and a target of $245 for a 5% position in our portfolio (which we will begin to build up over the next weeks). The Russell is currently in the middle of its range for the year. Despite the known inflationary/cost pressures (which we believe are priced in), we expect an outperformance of the index into year-end based on increased growth and earning expectations (as well as reduced cost pressures) for the 4th quarter and the first half of next year.

Econ Data:

According to a report from Challenger, Gray & Christmas, job cuts announced by U.S.-based employers rose 14% in September to 17,895 from the 24-year low of 15,723 cuts announced in August. This is a very low level on planned job cuts historically (despite the 18% increase), which are 84.9% lower than September 2020. A Challenger spokesperson noted that “Companies are in hiring and retention mode, and job seekers have a lot of power to make demands at the moment” and “Hiring announcements exploded in September, a month when many big-box retailers, shipping, and warehousing companies announce seasonal hiring plans... This year, many hiring announcements are for permanent workers rather than seasonal ones.”

Why it Matters: As was the case in August, the highest level of cuts came from the Health Care/Products sector in September, which announced 2,673 cuts. “Health Care is facing an enormous talent shortage, as burned-out medical and support staff walk away from stressed facilities and wages that may feel inadequate for the amount of work. Other systems are facing walk-outs or firings of unvaccinated staff, further broadening the worker shortage,” said Challenger. Elsewhere, Industrial Goods Manufacturers announced the second-most cuts in September with 2,328 and Warehousing followed with 1,936, both industries plagued by ongoing supply chain issues.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth/Value is little changed on the week, as the Small-Cap/Russell is outperforming on the day despite the Growth factor doing well too

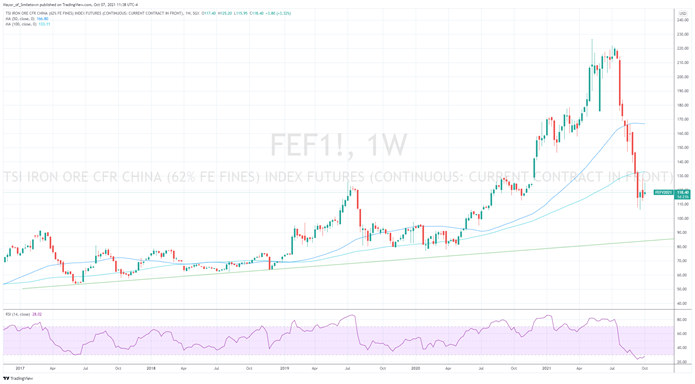

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week, slightly higher today

5yr-30yr Treasury Spread: The curve is unchanged on the week, as today's steepening has offset some of the prior flattenings earlier in the week

EUR/JPY FX Cross: The euro is higher on the week, and a more risk-on tone is helping it today despite the ECB forever bond-buying intentions that were leaked (although this just matches the BoJ)

HOUSE THEMES / ARTICLES

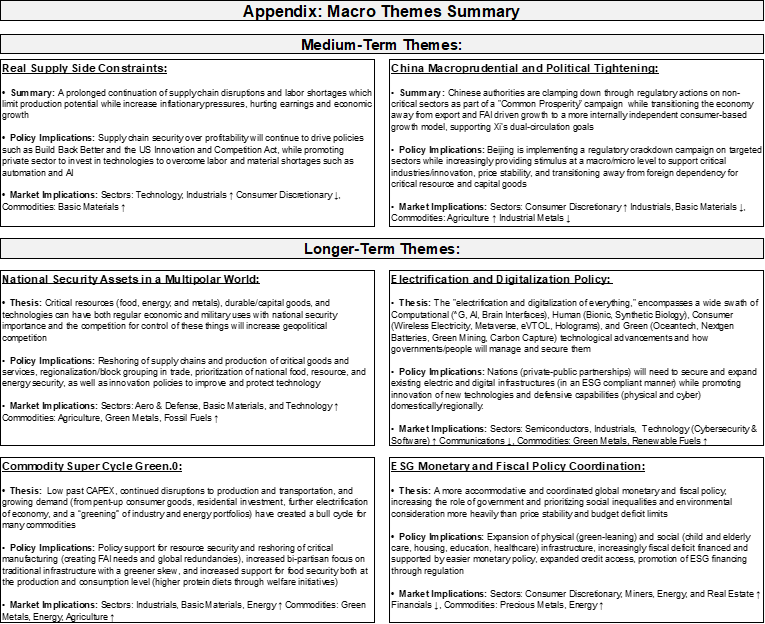

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Back to People: Airlines prepare to cut back ‘preighters’ on transatlantic – Lloyd’s Loading List

United Airlines will reduce the number of aircraft it operates in ‘preighter’ configuration to a bare minimum this autumn, having begun the process in July, as more and more of its fleet returns to flying scheduled passenger services, particularly on domestic and transatlantic routes. By early November, the transatlantic air transport market is expected to be completely open again, the US accepting vaccinated travelers from Europe. Right now, these schedules are at around 65% compared to pre-Covid levels

Why it Matters:

The airline industry's reduction in planes used for cargo is a vote of confidence, as they now prepare for a return to normality next year. However, it will continue price pressure on cargo rates as capacity falls. Although more pure freighters have entered the market, there is still not enough of them around the world to backfill the missing cargo capacity from the now leaving commercial airlines flying into Asia, either from Europe or from the US. It will take some time for this excess cargo backlog to be worked through, and until this happens, rate levels are expected to stay more or less where they are now.

Neverending Story: The Wait for Semiconductors Turns Ominous for Automakers - Bloomberg

The amount of time that automakers and other companies need to wait for chip orders to get filled hit a record 21.7 weeks in September, signaling that semiconductor shortages will continue to be a drag on growth for some time still. That wait has increased for nine months in a row, and automakers are projected to lose about $210 billion in sales. Key suppliers such as NXP Semiconductors NV, Texas Instruments Inc., Infineon Technologies AG, ON Semiconductor Corp., Microchip Technology Inc. all posted their highest lead times on record.

Why it Matters:

Semiconductor shortages have hammered automakers just as the integration of new technology and the transition to electric vehicles become key competitive battlegrounds. Auto sales are down this quarter due to inventory shortages, not a lack of demand, although price increases are certainly starting to weaken consumer intentions. The bottom line is we are still not seeing any decrease in backlogs, and the drag on the auto industry will continue throughout 2022.

China Macroprudential and Political Tightening:

Dethawing?: Biden, Xi Plan Virtual Meeting Before End of Year, U.S. Says – Bloomberg

Plans for a meeting between Biden and Xi by the end of the year were announced on a conference call with reporters following about six hours of meetings Wednesday between White House National Security Adviser Jake Sullivan and a senior Chinese foreign policy adviser, Yang Jiechi, in Zurich. The details for the meeting between Biden and Xi, including the date, still need to be worked out. The two leaders last spoke on Sept. 9 and discussed what the White House described as guardrails to ensure that competition between the two countries doesn’t veer into conflict.

Why it Matters:

The meeting in Zurich had more meaningful and substantive discussions than previous meetings between Biden administration officials and their Chinese counterparts. The Biden administration this week also pledged to hold Beijing accountable on commitments made in the phase-one trade agreement with U.S. Trade Representative Katherine Tai set to meet with her counterpart, Vice Premier Liu He, as soon as this week. The bottom line, a slight de-escalation in relationships between the two sides despite recent increased military activity around Taiwan.

LONGER-TERM THEMES:

Electrification and Digitalization Policy:

Full Faith?: Anyone Seen Tether’s Billions? – Bloomberg

In July, Treasury Secretary Yellen summoned the chair of the Federal Reserve, the head of the Securities and Exchange Commission, and six other top officials for a meeting to discuss Tether, which is now so large it’s a potential threat to the U.S. financial system. Tether is what’s come to be known in financial circles as a stablecoin. Stable because one Tether is supposed to be backed by one dollar. There are now 69 billion Tethers in circulation, 48 billion of them issued this year. That means the company supposedly holds a corresponding $69 billion in real money to back the coins, an amount that would make it one of the 50 largest banks in the U.S., if it were a U.S. bank and not an unregulated offshore company.

Why it Matters:

Exactly how Tether is backed, or if it’s truly backed at all, has always been a mystery. For years a persistent group of critics has argued that, despite the company’s assurances, Tether Holdings doesn’t have enough assets to maintain the 1-to-1 exchange rate, meaning its coin is essentially a fraud. The officials who gathered in July at the Treasury Department continue to discuss regulating Tether like a bank, which would force Tethers leadership to show where the money is finally. Stepping back, although we are no crypto experts, something smells fishy here.

Commodity Super Cycle Green.0:

Getting Tight: Spot market growing for lithium amid tight supplies – Argus

While prices for hard rock lithium concentrate are driven by pricing trends in the downstream hydroxide and carbonate markets, rising volumes in the spot market are expected to influence term contract negotiations moving forward. The recent surge in downstream prices has had a significant impact on upstream prices, with some producers reducing the terms of their longer-term contracts and increasing spot market sales.

Why it Matters:

Lithium is set to join other industrial metals with a more liquid market for buying and selling beginning to develop. "We think this will be a very positive development for the overall market, increasing traded volumes, transparency and ultimately supporting the growth of the lithium raw material supply chain globally,” Pilbara Minerals CEO Ken Brinsden said.

* Lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price cif China, Japan & Korea, $/kg

ESG Monetary and Fiscal Policy Expansion:

A Rose by Any Other Name: ECB Said to Study New Bond-Buying Plan for When Crisis Tool Ends – Bloomberg

The European Central Bank is studying a new bond-buying program to prevent any market turmoil when emergency purchases get phased out next year, according to officials familiar with the matter. The plan would both replace the existing crisis tool and complement an older, open-ended quantitative-easing scheme that’s currently acquiring 20 billion euros ($23.1 billion) in debt every month

Why it Matters:

This “initiative” would act as an insurance measure in case the scheduled end in March of the 1.85 trillion-euro so-called Pandemic Emergency Purchase Program prompts a market selloff of bonds from highly indebted countries such as Italy, according to the officials. It also reinforces our view that the major central banks will never reduce their balance sheets and continue to expand their “mandates.” “We know that no one ever seizes power with the intention of relinquishing it” – Orwell

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.