MIDDAY MACRO - DAILY COLOR – 10/6/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, retesting Monday’s lows overnight and completely reversing yesterday’s rally as the chop fest continues due to the standard barrage of concerns

Treasuries are mixed, with the belly flat while the long-end is well bid, flattening the curve meaningfully for the first time in over a week

WTI is lower, as headlines Russia would increase energy exports and a larger build in U.S. inventories helped reverse a multi-day rally

Analysis:

The S&P is currently attempting to bounce off its recent lows, which were retested overnight and at the NY-open, as yesterday’s rally quickly fell apart due to renewed fears over inflation pressures from global energy price increases and continued D.C. dysfunctionality, helping the Treasury curve flatten.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Volatility, and Momentum factors, and Consumer Discretionary, Consumer Staples, and Technology sectors are all outperforming.

S&P optionality strike levels have the zero gamma level at 4378 while the call wall is at 4500. The Volatility Trigger (aka gamma flip line) has moved lower to 4345 (from 4370), and a lot of gamma now sits at the 4350 level.

The technical levels have support at 4270, and resistance at 4310, then 4360. The current 4270-4360 is a textbook triangle formation (lower highs, higher lows, coiling) with the trend heading into the triangle down, making it a bearish pattern with a bias for a break lower.

Treasuries are mixed, as the 5s30s curve is flatter by 2.8bps, with the long-end get a further bid that started overnight despite better than expected ADP jobs data.

Markets continue to need clarity on several things before a more risk-on tone can emerge, keeping us from recommending long positions in the reflationary/re-opening trades we continue to believe will (eventually) outperform into year-end as the negative seasonal period ends.

First and foremost, energy markets globally need to settle as growth and inflation outlook has become unhinged due to the recent parabolic price increases there, dragging on investor sentiment due to the increased uncertainty.

At least for the U.K. and Europe, the good news is that Putin/Russia indicated this morning they are willing to increase supply, helping to stabilize/decrease prices there temporarily.

This also helps China and India by taking pressure off international LNG and coal markets due to the reduction in demand for alternative sources by the U.K. and EuroZone. However, China will still need to increase domestic production, while India will need to increase imports (likely from Australia) to increase their inventories.

Further focusing on China, Beijing needs to put the Evergrande/property-sector saga to bed through some form of final microprudential actions and increased macro-level stimulus support (increased liquidity injections as well as fiscal initiatives to support housing activity/prices). The uncertainty is becoming worse than a negative resolution.

Next, markets need to see an improvement in supply-side disruptions, and although we won’t get a clear single on the logistical side (instead, we will slowly see it through business surveys, shipping cost reductions, and individual company reports) a strong jobs report Friday should reduce concerns that labor shortages are causing a wage-spiral inflationary cycle (something less transitory than supply shortages).

Finally, we need the U.S. government to simply function, resolving the current debt-ceiling situation and passing the hard infrastructure bill while continuing the debate/downsizing of the social infrastructure bill, reducing the future pay-for drags while still providing a positive fiscal pulse.

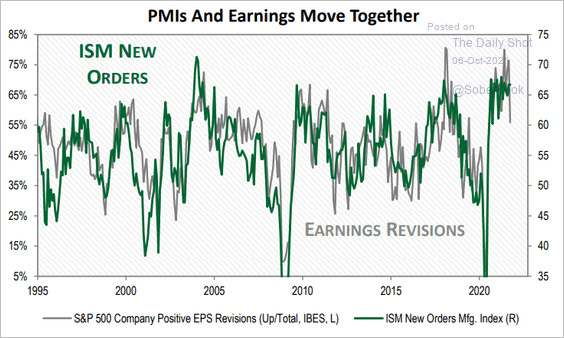

A stabilization in any of these things will allow market sentiment to improve as domestic and global economic data begins to rebound from the (global) re-opening occurring due to continuing declines in Delta while the Fed is effectively on auto-pilot with tapering, allowing economic growth to outperform (increasingly negative) expectations and the earnings outlook to improve for the first half of 2022.

Until we see sentiment towards these major concerns change, negative optionality and technicals will keep the S&P choppy/volatile and range-bound (4270 – 4460), reducing investor participation (higher vol = less systematic buying). We see a break above 4460 as the signal for a continuation in the melt-up into year-end but continue to advocate dip-buying and rally-selling until then.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Growth is outperforming on the week, as the second day of outperformance have created a hammer formation, signaling a potential change in trend if it holds

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week, higher again today despite the more risk-off tone domestically

5yr-30yr Treasury Spread: The curve is flatter on the week, as today’s price action is flattening it by 3bps

EUR/JPY FX Cross: The euro is slightly higher on the week, however lower against the Yen by -0.5% today as increased energy import costs have yet to materially weaken the Yen

HOUSE THEMES / ARTICLES

MEDIUM-TERM THEMES:

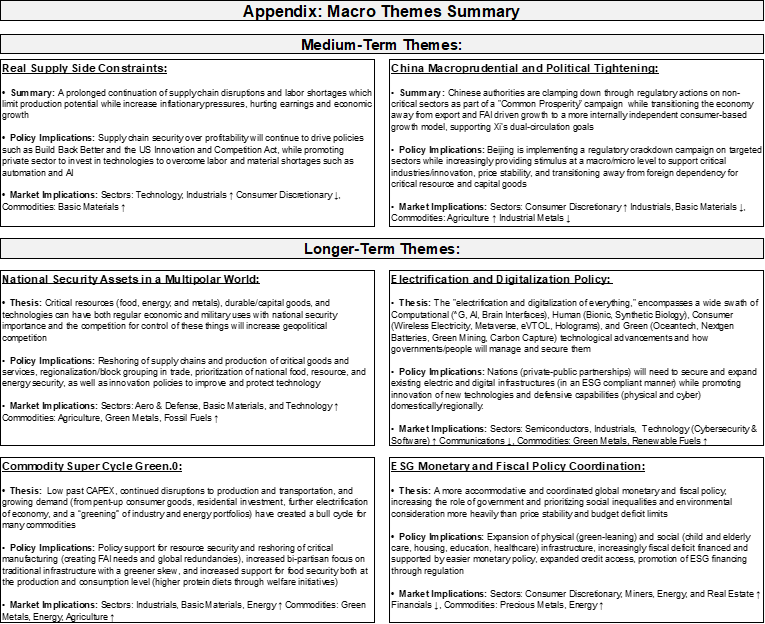

Real Supply Side Constraints:

Too Much Crap: U.S. Trade Deficit Widens to Record on Consumer-Goods Imports – Bloomberg

The U.S. trade deficit widened to a record in August, reflecting a pickup in the value of imports of consumer goods and industrial supplies. The gap in trade of goods and services increased 4.2% to $73.3 billion, from a revised $70.3 billion in July, according to Commerce Department data released Tuesday. The U.S. imported $3 billion more consumer goods during the month, mostly due to pharmaceuticals and toys, games, and sporting goods. Exports climbed 0.5% to $213.7 billion.

Why it Matters:

Incredible amounts of stuff coming in from abroad with no end in sight. Sadly even our surplus in services trade decreased to the smallest level since 2011. Travel imports, a measure of Americans traveling abroad, increased to $6.2 billion, a pandemic high though still half typical levels. What a world we have created where the U.S. can continue to grow its trade deficit (and federal deficit) by so much and the dollar appreciates.

Parts Needed: Toyota Outsells GM in the U.S. for Second Quarter in a Row – WSJ

For the second quarter in a row, Toyota has outsold General Motors in the U.S., illustrating how a continuing computer-chip shortage is upending the usual sales pecking order. GM has long led the U.S. market in sales, but a prolonged shortage of semiconductors has continued to have a disproportionate effect on GM, leading to widespread disruptions at its factories. GM sales dropped nearly 33% in the third quarter. By contrast, Toyota was up 1.4% from a year earlier.

Why it Matters:

Other car companies are also feeling the impact of the parts shortage, and the U.S. auto industry, as a whole, is expected to report its first quarterly sales decline for the year due to the computer-chip shortage. Many in the car business expect the challenges to persist well into next year as new supply-chain bottlenecks emerge in Southeast Asia and other parts of the semiconductor industry, dealers, analysts, and auto executives say. The shortages are also starting to wear on car shoppers, some of whom are so flustered by the challenges of purchasing a car right now that they are giving up until the situation improves.

China Macroprudential and Political Tightening:

DSL: China Fleshes Out Details on Sensitive Data Collection by Firms - Caixin

Chinese authorities have released new regulations to classify data based on the level of importance and risk to national security and overseas interests a month after the Data Security Law (DSL) took effect, in a move that could give much-needed clarity to foreign-listed companies and others required to transfer potentially sensitive information abroad. Industrial and telecoms data handled by companies in China will be categorized into “core data,” “important data,” and “ordinary data.”

Why it Matters:

The draft rules are the latest step Beijing has taken to strengthen its data-related regulatory regime amid a tightening of control over the listing of companies on U.S. bourses to prevent sensitive information from falling into the hands of foreign governments and imposition of stricter controls on cross-border data flows. Given how much personal data China has stolen from other nations (both industrial/government and personal citizens data), it is not surprising to see how eager they are to secure their own data, knowing how valuable it is.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Не за что: Putin says Russia prepared to stabilize energy markets – FT

Russia is prepared to stabilize global energy markets after gas prices hit a new record on Thursday, Vladimir Putin said, hinting that Gazprom may increase supplies to help Europe stave off a growing energy crisis. Putin told officials on Wednesday that Gazprom was on course to set a new record for gas supplies to Europe this year and was exceeding its contractual obligations to send 40bn cubic meters of gas via Ukraine by “more than eight percent.”

Why it Matters:

Things were becoming downright scary in U.K. and European gas, coal, and electricity markets over the last few days. The parabolic rises, often over 20% a day, were destabilizing risk-assets in the region (due to increased growth and inflation uncertainties) and contributing to global concerns there would be widespread energy shortages this winter. This, of course, is still a risk, but Putin’s comments that Russia would increase natural gas supplies have temporarily paused the panic buying that was occurring. *As a reminder, Russia’s natural gas continues to be the nation’s ultimate national security asset against Europe.

Electrification and Digitalization Policy:

Blocking Moves: Singapore Set to Increase Control Over Online Content -WSJ

The country’s legislature approved a bill that targets foreign influence campaigns by giving Singapore’s government new powers over internet content, despite criticism that officials could use them to stifle dissent. The Foreign Interference (Countermeasures) Act would give Singapore’s Home Affairs Ministry new powers over social-media companies and others that host web content. The ministry could order the companies to hand over details about their users, block content judged to be a security risk, and remove apps.

Why it Matters:

Countries around the world are debating how to stop internet meddling by foreign governments, following cases such as Russia’s interference in the 2016 U.S. presidential election. Singapore, one of the world’s wealthiest democracies, will be a good bellwether to watch regarding the potential abuse of laws against “foreign influence” as there is little judicial oversight. However, given China’s interest in influencing the nation/region, it may be a necessary risk that will be adopted elsewhere.

Commodity Super Cycle Green.0:

Fuel or Food: An Ambitious Ethanol Plan Spurs Food Security Fears in India - Bloomberg

In June, Prime Minister Narendra Modi’s administration accelerated the nation’s ethanol goal by five years, seeking to double production and to have gasoline 20% blended with the spirit by 2025. To help meet the target, the government is offering financial assistance to biofuel producers and faster environmental clearances. The plan is also resulting in the diversion of food grains meant for the poor to companies at subsidized rates.

Why it Matters:

Even as many developed countries debate limiting policy support for grain-based biofuels amid reports of food-price increases and greenhouse gas emissions from deforestation, India believes there will be multifold benefits. The government argues that the new target will help the world’s third-largest oil consumer save $4 billion annually by cutting crude imports, reduce carbon emissions and boost farmers’ incomes. However, and this is applicable globally, price increases are bound to occur as more ethanol is produced without offsetting increases in the production of input crops, which is not occurring.

ESG Monetary and Fiscal Policy Expansion:

Definition of Stupidity: Democrats explore new options to raise debt ceiling amid deepening standoff with GOP – CNN

Democratic senators are scrambling to find a way to avert a potential debt default as soon as next week amid a high-stakes standoff with Republicans and are privately discussing whether it's possible to change Senate rules (getting rid of the filibuster) so the borrowing limit can be raised by a simple majority vote, according to multiple sources at closed-door sessions. There are also talks the White House can use administrative procedures to avoid default (invoking the 14thg Amendment). Likely it will be done through a reconciliation process.

Why it Matters:

Mind-numbing to watch this process (or lack of process) unfold. Instead of moving forward with a budget reconciliation process, Senator Schumer is again bringing a vote (cloture vote) to the floor that will fail today. As a result, Senate Democrats will likely (in the end) have to move a budget resolution, face a vote-a-rama, wait for the House to pass a reconciliation package, face another vote-a-rama, and then pass the legislation. And they need to do this faster than ever before by a huge margin. Eventually, markets will question their ability to do this and could violently sell-off.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.