MIDDAY MACRO - DAILY COLOR – 10/4/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are lower, as continued inflationary concerns from supply-side impairments and rising energy costs are reducing growth and earnings outlook

Treasuries are flat, with higher energy/inflation pressures being balanced by a flight to safety bid

WTI is higher, with OPEC+ sticking to its 400k output hike in November, sending oil to its highest post-crisis levels

Analysis:

Renewed inflationary fears due to rising energy prices and continued supply-side disruptions along with continued uncertainty surrounding D.C. have equities back near their recent lows, while Treasuries are caught in the middle.

The Russell is outperforming the S&P and Nasdaq with High Dividend Yield Small-Cap, and Value factors, and Energy, Utilities, and Real Estate sectors all outperforming.

S&P optionality strike levels have the zero-gamma level at 4390 while the call wall is at 4500. The current sizeable negative gamma position continues to forecast large volatility swings. This should continue until/unless the S&P recovers 4380. The technical levels have support at 4270 and resistance at 4310, then 4360.

Treasuries are flat, as the 5s30s curve is slightly flattered by 0.5bps as increased inflationary pressures on yields to rise are being balanced by a flight to safety given the more negative macro backdrop.

The current energy crisis in China has the potential to increasingly weigh on global growth this winter as shortages of coal there coupled with shortages of natural gas in Europe will continue to increase electricity costs globally, acting as a tax on the consumer while also limiting production and earnings potential.

More than half of China’s provinces have been forced to limit electricity/energy usage due to shortages and self-imposed limits, including the largest industrial provinces.

These energy shortages are mainly due to coal shortages and self-imposed curtailments of energy use during a period of high and rising demand due to the re-opening of the domestic economy while export growth is surging, worsened by existing low (coal) inventories following a hot summer and lower than average hydroelectrical production.

Energy shortages have resulted from a few things; mine shutdowns (due to safety concerns) and import restriction (backlash over Australia’s “Origin-of-Covid” stance) are causing coal shortages, increasing prices, which is forcing utilities with fixed consumer prices to shutdown (vs. operate at losses), while emission targets were already forcing curbs and blackouts for energy-intense businesses.

Globally coal supply continues to be restrained from Covid-related shutdowns, diminishing current capacity and inventories, while structurally, there has been little new investment/production brought online for years, leaving China with few choices on where to source new supply.

As a result, there should continue to be a period of widespread energy shortages and price increases over this winter not only in China but globally which will act as a tax on consumers, not only increasing the direct costs for fuels and electricity but also pushing up the costs of all goods and services with firms now having to pass on their increased logistical costs too.

Finally, although the energy crisis in China (and Europe) are certainly negatives, we take comfort in two things; Beijing will increasingly stimulate their economy to compensate for the current drag on growth, and the global consumer is in a decent position to absorb the increased energy tax, of course, all bets are off if things worsen and fossil fuels continue to go parabolic in price.

Econ Data:

New orders for Durable Goods jumped 1.2% MoM in August, following an upwardly revised 0.7% rise in July and beating market forecasts of a 1% rise. The biggest increases were seen in orders for transportation equipment (5.4%), namely nondefense aircraft and parts (77.9%). On the other hand, decreases were seen in orders for machinery (-1%). Excluding transportation, factory orders edged up 0.5% MoM, while nondurable goods orders rose 0.6% MoM. Inventories increased 0.8%, the seven consecutive months of growth.

Why it Matters: Core factory orders (excluding transportation) have increased for 15 out of the last 16 months and are up 12.1% at an annual rate over the last three months. This lagged report on manufacturing activity combined with the more recent September ISM manufacturing survey last week shows the trend in core factory orders is still strong despite all the known problems.

TECHNICALS / CHARTS

FOUR KEY MACRO HOUSE CHARTS:

Growth/Value Ratio: Value is outperforming on the week, with the value factor higher again today as growth valuations are under greater pressure from rising yields

Chinese Iron Ore Future Price: Iron Ore futures are lower on the week, as last weeks bounce has faded due to continued power outages

5yr-30yr Treasury Spread: The curve is flatter on the week, slightly down today as a more risk-off tone is supporting long-end prices despite rising inflationary fears

EUR/JPY FX Cross: The euro is weaker on the week, but the pair is little changed despite the more risk-off tone in markets today

HOUSE THEMES / ARTICLES

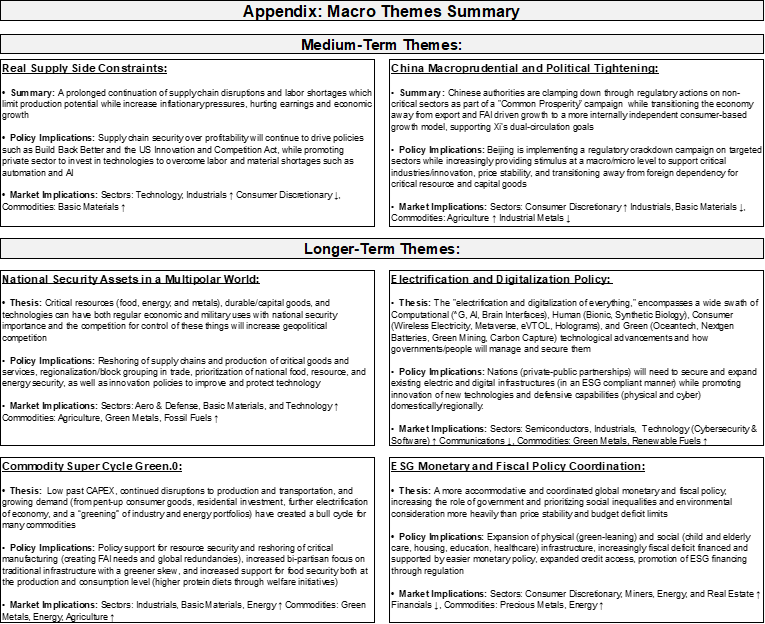

MEDIUM-TERM THEMES:

Real Supply Side Constraints:

Another One: Silicon’s 300% Surge Throws Another Price Shock at the World – Bloomberg

The shortage in silicon metal, sparked by a production cut in China, has sent prices up 300% in less than two months. The worsening situation has forced some companies to declare force majeure. The shortage is already hurting the solar industry, where a refined and purified form is used in photovoltaic panels. The price of solar-grade polysilicon jumped 13% on Wednesday, the highest since 2011, in the wake of the supply cuts. It’s up more than 400% since the start of June 2020.

Why it Matters:

The silicon shortages capture how the global energy crisis is cascading through economies in multiple ways. The slashing of output in China, the world’s biggest silicon producer, is the result of efforts to reduce power consumption. The bottom line, supply chain security will increasingly trump profitability.

China Macroprudential and Political Tightening:

Fencing: China Steps Up Efforts to Ring-Fence Evergrande, Not Save It – Bloomberg

Evergrande suspended its shares from trading in Hong Kong on Monday as the world’s most indebted real estate developer braced itself for the possible sale of its property management unit. Beijing has stepped up efforts to limit the fallout from Evergrande's anticipated massive restructuring, signaling it's willing to prop up healthy developers, homeowners, and the real estate market at the expense of global bondholders, who are likely to get a significant haircut.

Why it Matters:

Beyond the destabilizing effect the Evergrande sage has had on global risk sentiment, it is also a step backward in Beijing's attempt to internationalize/liberalize its financial markets. By not bailing out the property developer and punishing global investors, Beijing continues its Common Prosperity crackdown message of greed is bad. Not a message that entices the global investment community to see China as a replacement to the West.

Business Ethics: Chinese AI gets ethical guidelines for the first time, aligning with Beijing’s goal of reining in Big Tech – SCMP

China has revealed its first set of ethical guidelines governing artificial intelligence, placing emphasis on protecting user rights and preventing risks. Humans should have full decision-making power, the guidelines state, and have the right to choose whether to accept AI services, exit an interaction with an AI system or discontinue its operation at any time.

Why it Matters:

The goal is to “make sure that artificial intelligence is always under the control of humans,” the guidelines state (and you were worried). The document outlines six basic principles for AI systems, including ensuring that they are “controllable and trustworthy.” The other principles are improving human well-being, promoting fairness and justice, protecting privacy and safety, and raising ethical literacy. The Chinese are leading here as it is a forward-looking policy approach. It will be important to see further policy approaches from other nations now.

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Transition and Tensions: As Southeast Asia Racks Up Oil and Gas Deals, China Sits on the Sidelines – Caixin

During the second quarter of 2021, global upstream M&A in the oil and gas industry hit $33 billion, the highest quarterly value since the second quarter of 2019, with players from Southeast Asia highly active. China’s state-owned oil companies have been unusually quiet during this current boom. Analysts said that issues such as the transition to clean energy, tensions between China and the United States, increased wariness of overseas investments, and the need to coordinate existing overseas assets have all created uncertainties or headaches for the Chinese oil giants, making them extremely cautious about wading into the global market.

Why it Matters:

On top of troubles in their real estate sector, China's current energy crisis is reducing growth and increasing the potential for social unrest. Its lack of activity to secure new energy sources abroad is a direct consequence of Xi’s Dual-Circulation policy and a fear of further misinvestment, something the big three Oil SOEs suffered in their last wave of purchases between 2009 and 2013. The bottom line is that low investment elsewhere does not bode well for future energy security in the Middle Kingdom.

Electrification and Digitalization Policy:

All about the Money: The Facebook Whistleblower, Frances Haugen, Says She Wants to Fix the Company, Not Harm It – WSJ

Frances Haugen, a former product manager, hired to help protect against election interference on Facebook, said she had grown frustrated by what she saw as the company’s lack of openness about its platforms’ potential for harm and unwillingness to address its flaws. She is scheduled to testify before Congress on Tuesday. She has also sought federal whistleblower protection with the Securities and Exchange Commission.

Why it Matters:

The article expands on the most recent whistleblower occurrence at Facebook, who also did a 60-Minutes interview. As big-tech continues to be an underperformer, we want to highlight that it’s not only due to rising yields but a growing perception that these companies have abused their power and will now be increasingly regulated, something China and Europe are leading the U.S. in. We believe the valuations that big-tech has been rewarded with are not adequately accounting for this tectonic shift.

Commodity Super Cycle Green.0:

Gaining Traction: Hydrogen pipeline well below net-zero requirements: IEA – Argus

The current hydrogen project pipeline points to huge growth in low-carbon hydrogen production in this decade, but projects would need to be scaled up by a factor of nine to put the world on track to reach net-zero emissions by 2030 the IEA said.

Why it Matters:

The electrolyzer pipeline comprises 350 projects under development with a combined capacity of 54GW and another 40 early-stage projects with 35GW of capacity. To bridge the gap between announced projects and what is required to decarbonize, governments must support demand creation. They need to bring into force policy instruments such as carbon prices, auctions, quotas, mandates, and requirements in public procurement, the IEA said.

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.