MIDDAY MACRO - DAILY COLOR – 10/27/2021

OVERNIGHT/MORNING RECAP & MARKET ANALYSIS

Narratives/Price Action:

Equities are mixed, with tech and growth outperforming small-caps and value despite continued generally positive earnings and domestic economic data

Treasuries are higher, as a global rally in (longer-dated) rates is underway thanks to budget cuts in the U.K. while traders await the deluge of central bank meetings coming this and next week

WTI is lower, after a weaker overnight session continued following larger than expected EIA inventory builds (and API yesterday) as traders increasingly focus on geopolitical developments and OPEC+ production quota compliance

Analysis:

The S&P is chopping around after reaching new ATHs yesterday, consolidating as more neutral technicals and optionality pushes against relatively positive earnings and economic data. However, a flatter Treasury curve and a stronger dollar continue to show growth fears remain. Tomorrow’s GDP and PCE inflation prints, as well as a slew of other data, will help shed light on how much drag occurred in the third quarter and whether things are improving now. Also, Apple, Amazon, and numerous other major corporate earning releases tomorrow will add color to supply-side outlooks and margin pressures.

The Nasdaq is outperforming the S&P and Russell with Growth, Low Volatility, and Momentum factors, and Consumer Discretionary, Technology, and Communications sectors all outperforming.

S&P optionality strike levels have the Zero-Gamma Level moved higher to 4498 while the Call Wall is at 4600. As long as the S&P holds 4500, positive gamma flows and lower implied volatility should boost markets. However, the index has strong dealer selling resistance as it approaches 4600, leaving us range-bound currently.

The technical levels have support at 4555, then 4505, and resistance at 4595, then 4615 for the S&P. S&P is in a basing/consolidation pattern, with support now at 4555. If this breaks, then the likely next level of support is closer to 4500.

Treasuries are higher, with the 5s30s curve flatter by 6.5bps. Positive price action in UK Gilts (thanks to budget cuts) set a more positive tone for govies overnight despite a significantly more hawkish Bank of Canada policy decision this morning.

*A Santa Rally has historically started early November, but continued uncertainties regarding the debt ceiling could weigh on sentiment as year-end approaches

*Have future expectations for profit margins fallen too far given what Q3 earnings are showing? GS’s Strong Balance Sheet index has certainly been outperforming this month

*Equity positioning increased notably in the last two weeks driven by discretionary investors while systemic strategy positioning fell slightly

*The Treasury nominal yield curve has been flattening while the real yield curve has steepened

Econ Data:

The S&P CoreLogic Case-Shiller Home Price Index increased 0.9% MoM in August, bringing the annual increase to 19.7%, slightly below the record 20% rate in the previous month and compared to forecasts of 20%. As has been the case for the last several months, price increases were strongest in the Southwest (+24.1%), but every region logged double-digit gains. Phoenix (33.3%), San Diego (26.2%), and Tampa (25.9%) saw the highest annual gains among the 20 cities in August. Elsewhere, the average prices of single-family houses with mortgages guaranteed by Fannie Mae and Freddie Mac advanced 18.5% from a year earlier in August.

Why it Matters: There was a very slight cooling in housing price appreciation in August (from record levels). "The U.S. housing market showed continuing strength in August. Every one of our city and composite indices stands at its all-time high, and year-over-year price growth continues to be very strong, although moderating somewhat from last month’s levels", says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI.

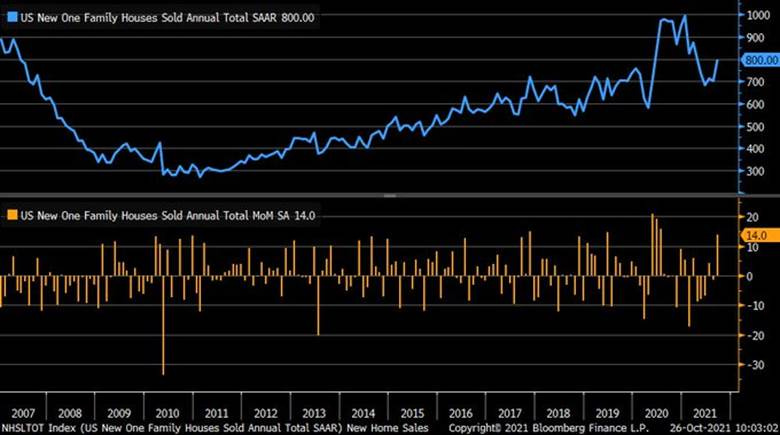

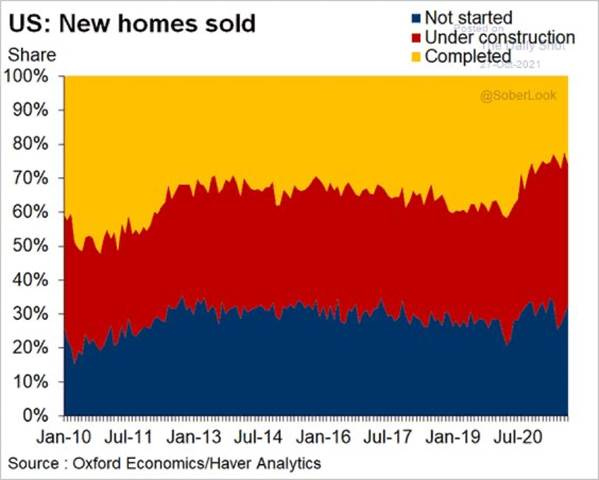

New Home Sales increased 14% in September to a seasonally adjusted annual rate of 800K, following a downwardly revised 702K in August and well above market forecasts of 760K. Increases were seen in the Northeast (32.3%), the South (17.5%), and the West (8.2%), while sales in the Midwest declined 1.5%. The median sales price increased to $408,800 from $344,400 a year earlier. There were 5.7 months of supply at the current sales rate. There were 379,000 new homes on the market, unchanged from in August. Houses under construction made up 62.5% of the inventory, with homes yet to be built accounting for about 28%.

Why it Matters: Continued strong demand and lower supply of existing homes for sale helped new home sales reach a six-month high. Sales continued to be concentrated in the $200,000-$749,000 price range. Sales in the under-$200,000 price bracket, the sought-after segment of the market, accounted for only 2% of transactions. About 74% of homes sold last month were either under construction or yet to be built. Because of strained supply chains, builders continue to be hamstrung by shortages of key inputs like copper and steel. Lumber for framing remains expensive (although significantly off highs), while household appliances remain scarce.

*The 14% MoM upside surprise in new single-family units sold in October beat significantly beat expectations of a 1% increase

*There was a tick higher in home sold not yet under construction

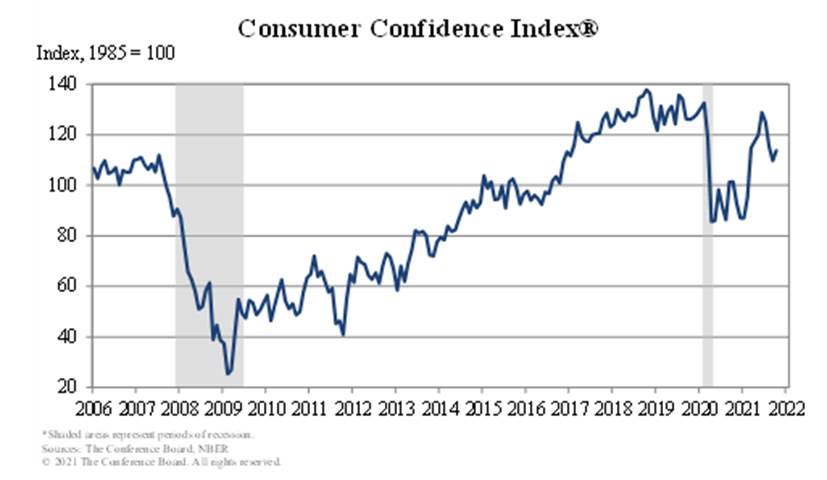

The Conference Board Consumer Confidence Index increased to 113.8 in October from 109.8 in September, following declines in the previous three months. The Present Situation Index rose to 147.4 from 144.3 last month, while the Expectations Index improved to 91.3 from 86.7.

Why it matters: Consumer confidence reversed a three-month downward trend in October as concerns about the spread of the Delta variant eased. Although short-term inflation concerns rose to a 13-year high, the impact on overall confidence was muted. The proportion of consumers planning to purchase homes, automobiles, and major appliances increased in October, a positive sign for the holiday season and 4th quarter growth. Nearly half of respondents (47.6%) said they intend to take a vacation within the next six months, the highest level since February 2020.

*Consumer’s assessment of labor markets slightly improved in October while business conditions weakened

*The labor differential (“jobs plentiful” – “jobs hard to get”) hit the highest level in over two decades, pointing to future improvements in labor markets

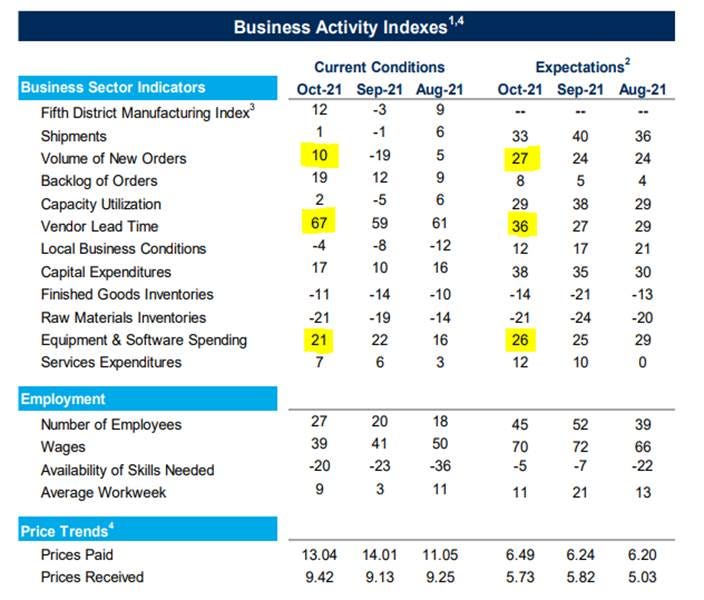

The Richmond Fed’s Manufacturing Index increased to 12 in October, rebounding from -3 in September (the lowest since May 2020). The improvement was driven by increases in New Orders (10 from -19) and Employment (27 from 20). Meanwhile, Backlogs of Work (19 from 12) continued to expand, while Vendor Lead Times lengthened to an all-time high (67 from 59). Manufacturers continued to have low inventories of both Finished Goods (-11 from -14) and Raw Materials (-21 from -19). Firms increased employment and wages in October but are still finding workers with the necessary skills difficult to hire. The average growth rate of prices paid decreased in October, while prices received increased. Finally, manufacturers were optimistic that conditions would improve in the coming months but expected inventories to remain low for some time.

Why it Matters: A nice bounce in manufacturing activity after a weak September reading shows that the effects of Delta are easing while supply-side problems remain. Although future expectations stayed positive, increases in expected Vendor Lead Times and a decrease in Capacity Utilization show a growing concern that shortages of materials and labor will persist. The future employment levels decreased on the aggregate but current and future capital expenditure plans increased. Finally, Prices Paid looks to be stabilizing while Prices Received increased, reducing margin pressure concerns.

*Increases in New Orders and Employment helped the overall Richmond Manufacturing Index bounce off one-year lows in September

*Demand is expected to remain strong while future Capex and employment expectations diverged

New Orders for Durable Goods fell -0.4% in September, a smaller than expected decline. Excluding transportation, orders increased by 0.4%. The Capital Goods Orders and Shipments were stronger in September. Core Orders increased 0.8% while Core Shipments rose 1.4%, resulting in a Q3 annualized rate of 7.1% and 10.6%, respectively. Machinery orders were up 1.1% on the month. Elsewhere, Wholesale Inventories increased 1.1% last month while Retail Inventories fell -0.2%, however excluding autos, it was higher by 0.6%.

Why it Matters: New orders for US durable goods fell in September for the first time in five months, but the proxy for business investment (Non-Defense Ex-Aircraft Core Orders) continued to rise, accelerating to a three-month high. The implies the manufacturing sector still has an optimistic outlook on the economy. “Once you look past the headlines, the durable goods numbers were solid,” said Gus Faucher, chief economist at PNC Financial Services Group Inc. “I expect that supply chain issues will be worked out over the next six months or so. Demand for manufactured goods remains solid, and business investment will be a driver of economic growth in 2022.”

*Declines in shipments and new orders for motor vehicles and parts for a second straight month indicate supply-chain issues continued to weigh on production and sales there

TECHNICALS / CHARTS

Four Key Macro House Charts:

Growth/Value Ratio: Growth is higher on the week and the day (+1.5%), helped by big-tech earnings and lower yields - flatter curve

Chinese Iron Ore Future Price: Iron Ore futures are higher on the week, and the day, as the continued drop in coal prices, reducing steel production costs is balancing out demand destruction from needs to cut emissions

5yr-30yr Treasury Spread: The curve is flatter on the week, dropping 7.3bps today given expectations the Fed will now easily raise rates twice next year, hurting future growth prospects

EUR/JPY FX Cross: The Yen is higher on the week, and slightly higher today as traders perhaps see a more dovish ECB next week while awaiting results from the BoJ’s meeting tonight

ARTICLES BY MACRO THEMES

MEDIUM-TERM THEMES:

Real Supply-Side Constraints:

Teamsters Needed: The U.S. May Need Another 1 Million Truck Drivers Over the Next Decade - Bloomberg

According to the American Trucking Associations, the U.S. will need to recruit nearly 1 million truck drivers to replace retiring ones and keep up with high freight demand over the next decade. The nation’s trucking shortage already stands at a record 80k drivers, and that’s set to surpass 160k in 2030, the association said in a report.

Why it Matters:

There was no single cause identified in the report of the driver shortage, but some of the primary factors include:

The high average age of current drivers, which leads to a high number of retirements

Women make up only 7% of all drivers

The inability of some would-be and current drivers to pass a drug test

The federally mandated minimum age of 21 to drive commercially across state lines

The pandemic caused some drivers to leave the industry, plus truck driver training schools trained far fewer drivers than normal in 2020

Lifestyle issues, notably time away from home, especially in the longer-haul market

LONGER-TERM THEMES:

National Security Assets in a Multipolar World:

Friends Again?: Xi and Michel Agree to Hold China-EU Summit After Rift Over Xinjiang – Bloomberg

The European Union and China agreed to convene a summit, European Council chief Charles Michel said after speaking with Chinese President Xi Jinping, as the two sides aim to repair relations after a deep rift over alleged human rights abuses in Xinjiang. The disagreement has stalled the European Parliament’s approval of a landmark China investment pact spearheaded by Merkel.

Why it Matters:

Michel told Xi that the EU is seeking a more balanced economic relationship with China even as worries persist over the country’s human-rights record and its imposition of sanctions on European policymakers, an EU official said. According to Central China Television, Xi delivered a message to Michel that China and the EU need to resolve differences and enhance strategic communications to promote “healthy and stable” bilateral ties. Both sides are likely trying to balance out the need for economic cooperation verse a more confrontational geopolitical backdrop.

Quandary: China’s Ties at Hamburg Port Spotlight Germany’s Economic Tradeoffs - Bloomberg

Cosco Shipping struck a deal last month to take a 35% stake in Hamburg’s Tollerort terminal, capable of handling the largest container vessels. Subject to final approvals, Tollerort will become a “preferred hub” in Europe for the Chinese container carrier to concentrate its cargo shipments. German trade with China was worth more than $200 billion in 2019, half of it passing through Hamburg.

Why it Matters:

Port operator Hamburg Hafen und Logistik says the deal offers long-term planning and job security. But it’s also stirring concerns about the city’s growing dependency on Beijing. In the first six months of 2021, seaborne container handling with China was more than four times the volume of that with the U.S., its No. 2 partner. The Eurozone will have to decide if it wants to stick to its Democratic principles or continue to engage in beneficial economic trade with China. Brussels, D.C., and Beijing are watching events in Berlin closely to see which way things go.

Banned: U.S. Bans China Telecom Over National Security Concerns – WSJ

The FCC said it was taking action against state-owned China Telecom Corp.’s U.S. business because the company was “subject to exploitation, influence, and control by the Chinese government.” The action follows a recommendation from executive branch agencies during the Trump administration last year. It extends from a broader effort to remove Chinese links to the U.S. telecommunications infrastructure that has targeted Huawei.

Why it Matters:

U.S. officials have long harbored fears about the potential for Chinese telecom companies to disrupt or spy on American networks. The FCC has been pushing small rural carriers who use Huawei equipment to replace their gear with that made by Western rivals, and Washington more broadly has sought to hobble Huawei’s 5G business, an effort that has had some success. Stepping back, at this point, every Chinese company and citizen is “subject to exploitation, influence, and control by the Chinese government,” so the general use of this reasoning could be increasingly used moving forward.

Electrification and Digitalization Policy:

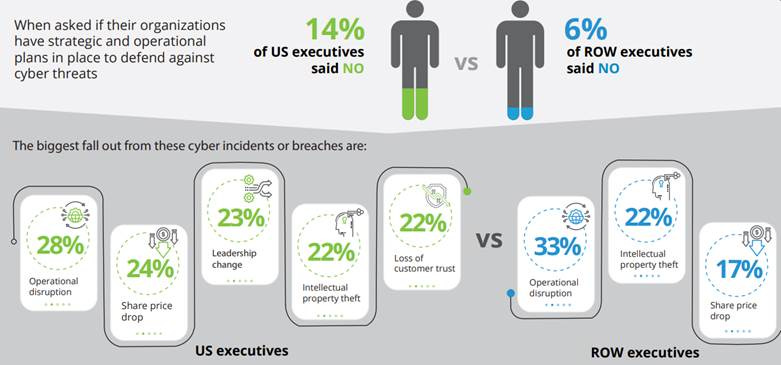

Consequences: Deloitte: 2021 Future of Cyber - Business Survey

Businesses are put through the wringer after a hack, according to a survey from consulting firm Deloitte of 577 C-suite executives worldwide. Among the repercussions companies said they experienced:

28% Operational disruptions

24% Stock price drop

23% A leadership change

22% Intellectual property theft

22% Loss of customer trust

Why it Matters:

Deloitte's survey shows cyber incidents are very much on the rise, and so are business preparations to handle them. Competition for cyber talent remains challenging, with U.S. executives twice as likely over the rest of the world to say it is difficult to recruit and retain cyber talent. Top concerns regarding cyber threats are split between unintended action by existing employees, ransomware and malware attacks, third-party and contractor risk, and Nation-state threats.

Commodity Super Cycle Green.0:

Green Skies: ADM Bets Big on Clean Jet Fuel as Airlines Aim to Cut Emissions - Bloomberg

Archer-Daniels-Midland Co. is making a major move into sustainable jet fuels and betting that airlines will remain under pressure to offset the gigantic carbon footprint of air travel. Demand for sustainable jet fuel is likely to jump to 3.6 billion gallons annually by 2030, or 3% of global jet fuel, up from less than 0.1% in 2019, according to a BloombergNEF report.

Why it Matters:

Demand for sustainable jet fuel is expected to boom in the coming years as the aviation industry, a major source of pollution, tries to reduce carbon emissions. Airlines are also under pressure to make quick progress toward lower emissions even though breakthrough technology like hydrogen-powered planes is years away. The alternatives are limited: sustainable aviation fuel is expensive and scarce, and purchasing carbon offsets has been criticized as ineffective.

Bigger Please: Tesla Supplier Shows Off More Powerful Battery – WSJ

Tesla supplier Panasonic Corp. said it has mostly solved the technical challenges with a larger lithium-ion battery that Elon Musk has called the lowest-cost way to power an electric car. Panasonic on Monday showed off for the first time its 4680 cylindrical battery, the largest it has supplied to Tesla. During its earnings call in October, Tesla said that it expected vehicles with battery packs composed of 4680 cells to be delivered next year.

Why it Matters:

Mr. Musk has said putting more energy capacity into each battery cell, along with other improvements, should help EVs boost their power and drive longer on a single charge. A related technology incorporated in the 4680 battery cells allows them to charge faster. However, Mr. Musk has also said that manufacturing the new battery on a large scale is a challenge Tesla and its partners haven’t fully overcome. “Prototype production is easy, but high-volume production is hard,” he said in July. Along with developments elsewhere, this is helping Tesla’s stock have a good week.

FYI - Midday Macro will be back 10/31/2021 as we join the 47.6% of Conference Board consumer respondents intending to take a vacation tomorrow

VIEWS EXPRESSED IN "CONTENT" ON THIS WEBSITE OR POSTED IN SOCIAL MEDIA AND OTHER PLATFORMS (COLLECTIVELY, "CONTENT DISTRIBUTION OUTLETS") ARE MY OWN. THE POSTS ARE NOT DIRECTED TO ANY INVESTORS OR POTENTIAL INVESTORS, AND DO NOT CONSTITUTE AN OFFER TO SELL -- OR A SOLICITATION OF AN OFFER TO BUY -- ANY SECURITIES, AND MAY NOT BE USED OR RELIED UPON IN EVALUATING THE MERITS OF ANY INVESTMENT.

THE CONTENT SHOULD NOT BE CONSTRUED AS OR RELIED UPON IN ANY MANNER AS INVESTMENT, LEGAL, TAX, OR OTHER ADVICE. YOU SHOULD CONSULT YOUR OWN ADVISERS AS TO LEGAL, BUSINESS, TAX, AND OTHER RELATED MATTERS CONCERNING ANY INVESTMENT. ANY PROJECTIONS, ESTIMATES, FORECASTS, TARGETS, PROSPECTS AND/OR OPINIONS EXPRESSED IN THESE MATERIALS ARE SUBJECT TO CHANGE WITHOUT NOTICE AND MAY DIFFER OR BE CONTRARY TO OPINIONS EXPRESSED BY OTHERS. ANY CHARTS PROVIDED HERE ARE FOR INFORMATIONAL PURPOSES ONLY, AND SHOULD NOT BE RELIED UPON WHEN MAKING ANY INVESTMENT DECISION. CERTAIN INFORMATION CONTAINED IN HERE HAS BEEN OBTAINED FROM THIRD-PARTY SOURCES. WHILE TAKEN FROM SOURCES BELIEVED TO BE RELIABLE, I HAVE NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND MAKES NO REPRESENTATIONS ABOUT THE ENDURING ACCURACY OF THE INFORMATION OR ITS APPROPRIATENESS FOR A GIVEN SITUATION.